Blog

Product Updates

The latest updates and improvements to the Visible application.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Reporting

Product Updates

Q3 Product Webinar – Streamlining end of year reporting with Visible

Check out Visible’s recorded product webinar to learn about the most recent updates to Visible’s portfolio monitoring and reporting platform. The Visible team demonstrates how to leverage recent product changes to improve your portfolio reporting in Q4 and beyond.

Product webinar topics:

Common use cases for one-time Requests and how to set them up

Saving time by syncing company qualitative responses to Dashboards and One-Pagers

Exporting data to Google Sheets for external analysis and reporting

Embedding a dashboard in Notion to share with your team

Q&A

investors

Product Updates

What’s New in Visible for Investors — H1’ 2023

In the first half of 2023, Visible remained dedicated to helping our community of 350+ investors streamline the way they collect, analyze, and report on their portfolio data. We saw the slowdown in Venture Capital activity during the first part of the year translate into an increased need for accurate and up-to-date portfolio insights that can easily be shared internally and with stakeholders. Both Venture Capital investors and their Limited Partners are relying on data-informed insights more than ever before to guide their next steps.

To best support our investors, we focused on making updates to three core functions of our portfolio monitoring and reporting platform during the first half of 2023:

Keep reading to learn about some of the specific updates made to our platform during the last six months.

Changes to Getting Data into Visible

These product updates allow investors to more easily collect budget vs actuals KPI’s and send reminder emails to all their companies at once.

Send bulk one-off reminders to all companies (learn more)

Ask for up to six future and historical custom KPI’s (learn more)

View and edit company metrics in dynamic time periods

Changes to Visualizing, Analyzing, and Sharing Portfolio Insights

With these changes, users can more easily identify quick insights about their portfolio performance and share it with their team and LPs.

Extract quick insights about your portfolio with Portfolio Metric Dashboards (learn more)

Applying a custom dashboard template to all companies (learn more)

Build a flexible One Pager template for LP reporting (learn more)

Uplevel your data visualizations by adding color gradients to your charts (learn more)

Share your portfolio company dashboards via a link and choose to password-protect them (learn more)

Learn more about analyzing portfolio data with custom dashboards in Visible.

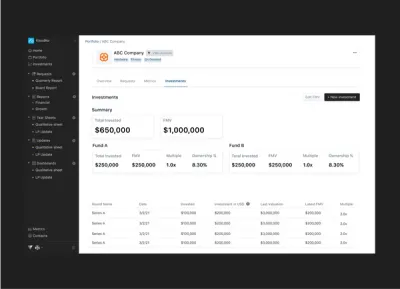

Changes to Investment Data Tracking

The following updates allow investors to track all their key investment data and fund metrics within Visible. This gives investors real-time control over updating, visualizing, and sharing their fund performance.

Convert Convertible Notes to equity with ease (learn more)

Track follow-on rounds you don’t participate in (learn more)

Choose a custom exchange rate for investment round details (learn more)

Capture all your core fund metrics in Visible (learn more)

Track and visualize IRR at the fund and company level (learn more)

Visualize auto-calculating fund metrics (learn more)

Ready to improve your firm’s portfolio monitoring and reporting processes?

founders

Product Updates

A Refreshed Look

We last updated our brand identity in October 2020. Since then, Visible founders have gone from sending 8,000 investor updates per month to over 75,000 — we also launched Visible Pitch Decks and Data Rooms.

We’ve learned first hand that building a startup is difficult. Most founders take a major risk to invest their time, money, and careers to build something. At Visible, we want to better celebrate the thousands of founders doing the difficult. We’ve been on the sidelines watching these founders grow while our own team, product, and organization has grown.

In order to reflect these efforts, we are excited to roll out our new brand direction that supports this new phase for Visible

Putting Visible Founders First

In order to put founders first with everything we do at Visible, we wanted to showcase their individual stories and experiences across our marketing efforts. You will notice individual founder headshots, stories, and quotes across the website.

Data and Stories to Help the Next Set of Founders

Thousands of founders use Visible every month to update their current investors, share their pitch decks, build their data rooms, and manage their fundraising efforts. In order to help the next generation of founders using Visible, we want to highlight the first-hand data and best practices we’ve uncovered.

Color, Gradients, and a New Font to Bring Life to Our Brand

While difficult, building a startup should be lively. In order to better recognize the highs of building a startup and align with our guiding principles we wanted to refresh our brand.

Logo

Our logo is staying and is the anchor to our brand. The Visible logomark is made from 3 overlapping, equilateral triangles. Each triangle is slightly transparent, allowing the mark to interact with other design elements. These triangles represent human relationships and the connection between founders and investors.

Brighter colors & gradients

Our black isn’t going away either, but are using the same color palette from our application to bridge the gap between our product and brand. You will see brighter, more vibrant colors in our product screens to bring those metrics to life. We have also added gradients across our website to enhance some elements like our product screens and call attention to our informational graphs.

Bridging the Product & Go to Market Gap

We wanted to bring the same sleek and modern feel from our product to our marketing efforts. In order to do so we’ve changed our serif font to a san serif font. Across our website, you will notice product screens that show our product in a more realistic approach.

investors

Product Updates

Reporting

Unlocking Venture Capital Portfolio Insights with Dashboards

If your portfolio data is patched together in an excel file with questionable version control or is buried in a slide deck prepared six months ago, your team is likely missing the opportunity to take action on important portfolio insights.

Up-to-date, accurate portfolio insights help venture capital investors:

Provide better portfolio support

Make data-driven investment decisions

Validate markups and markdowns during evaluation exercises or an audit

Demonstrate traction to LPs while fundraising for future funds

…but only if the insights are accessible.

Visible’s dashboards help venture capital investors visualize and explain the journey companies are on in a way that actually resonates.

Learn more about leveraging dashboards in Visible.

About the Guide

This guide demonstrates how venture capital investors can turn their portfolio data into actionable, accessible insights. The guide also includes examples of three different flexible dashboard types in Visible.

Topics covered include:

Portfolio data collection best practices

Creating dashboards for internal portfolio reviews (Flexible dashboards)

Identifying cross-portfolio insights (Portfolio metric dashboards)

Sharing portfolio insights with Limited Partners (One pagers)

Visible has helped over 350+ venture capital funds streamline the way they collect, analyze, and report on core metrics from their portfolio companies on a regular basis.

founders

Fundraising

Product Updates

Manage Every Part of Your Fundraising Funnel with Visible Data Rooms

Data rooms are the next step to help us on our mission of giving founders a better chance of success. Data rooms are the culmination of a fundraise, diligence, or M&A event. They combine all of the documents, data, and resources that an investor will use to evaluate a company.

With data rooms, you can now manage all parts of your fundraising funnel with Visible. Find investors with Connect, our free investor database. Track your conversations in our Fundraising CRM. Share your pitch deck with potential investors. And communicate with current and potential investors with Updates.

Learn more about Visible Data Rooms and how you can leverage them for your next raise below:

Organize and Structure Key Fundraising Documents

Build data rooms specific to your raise. Organize your data room with folders, upload files, and create pages directly in Visible.

Segment and Share Specific Folders

Securely share your data with investors. Segment their access by individual folders or give them access to the entire data room.

Understand How Investors Are Engaging with Your Data Rooms

View analytics to understand how individual investors are engaging with different documents and files in your data room.

Data rooms are enabled for all Visible users. Log into Visible below to get started on your first data room below:

Create a Data Room

Check out a few of our other resources to help get you started:

What should be in a data room?

How to write a cover letter for your data room

How to create a data room

How to share your data room

How to create a folder in your data room

How to view the analytics in your data room

Build and share your data room with Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

investors

Product Updates

Visible’s 2022 Year in Review

Visible is a founder-friendly portfolio monitoring and reporting solution used by VC’s around the world.

Thanks to the continued engagement from our investor community, the last twelve months at Visible have been full of growth. As a Visible user, you’ve helped bring more transparency to the Venture Capital industry through improved KPI tracking, accessing deeper portfolio insights, and by more regularly communicating with your companies, teammates, and LP’s.

Here are some 2022 highlights:

7k+ Requests completed by portfolio companies around the world

550+ LP Updates were sent to investors

800+ Investors deepened their VC expertise by engaging with our educational webinars

300+ VC firms verified their profiles in our Connect database

Biggest Product Updates of 2022

More Flexible & Scalable Dashboards

Portfolio Dashboard Templates – A more scalable way to visualize and extract insights from portfolio company data.

Flexible Dashboard Grids – Flexible widget sizing means you have more control over how you can display data visualizations for you and your team.

Intraportfolio Benchmarking and Insights – Compare individual company performance against portfolio quartiles using custom segments.

Improved Portfolio Request Experience

Request UI Overhaul – It’s now much easier to understand when your Request has been sent, % completion, and when the next scheduled reminder email will be sent.

Multiple File Uploads in Requests – Companies can upload multiple files into the same file block in a Request, saving them time each reporting cycle.

Export Request Summaries – Easily export and analyze Request responses in just a few clicks.

Re-open a Request – Mistakes happen. Re-opening a Request lets companies re-submit their data.

Advanced Investment Insights

Chart Investment and Fund Metrics – Chart and visualize key fund metrics such as TVPI, RVPI, DPI, and more.

Automatic SAFE Conversion & Token Support – Visible supports 6+ investment types.

Multiple Funds – Segment your investment data by fund in custom-built reports.

Interested in learning more about Visible’s portfolio monitoring solution for investors? Book a demo below.

Interested in learning more about Visible?

Meet with Our Team

Webinar Recap from 2022

More than seven thought leaders from around the world joined us to share their expertise in different topics related to improving the venture capital ecosystem. Check out the recordings and resources below.

ESG Best Practices with Tracy Barba ESG for VC –> Watch Here

Building Scalable Support with Jessica Lowenstein of K50 Ventures and Erica Amatori of Left Lane Capital – Watch Here

Benefits of a Hybrid SPV + Fund Strategy with Kingsley Advani of Allocations — Watch Here

LP Reporting Best Practices with Aduro Advisors — View the Report

SaaS Company Benchmarking with Christoph Janz of Point Nine Capital — Watch Here

Best practices for portfolio monitoring & reporting with Gale Wilkinson of VITALIZE Venture Capital — Watch Here

Interested in learning more about Visible?

Meet with Our Team

How to Partner with Visible in 2023

Increase your VC firm’s brand awareness by hosting your Update template in our public Update Library for investors.

Refer your investor friends to Visible and receive a $500 Amazon gift card.

Invite us to host a webinar for your portfolio companies on ‘Investing in Investor Updates’.

Verify your firm’s profile in our investor Connect Database.

To get started with any of the partnership opportunities above, send an email to belle@visible.vc.

Interested in learning more about Visible?

Meet with Our Team

founders

Product Updates

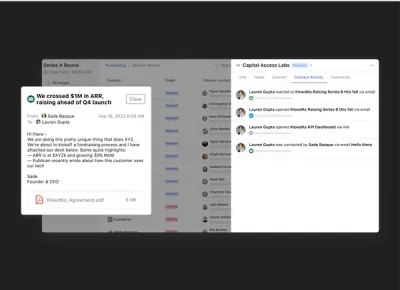

Level up Your Fundraising Process with Email Syncing

The Fundraising Funnel

Raising venture capital often mirrors a traditional B2B sales & marketing funnel. At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

Just as a sales & marketing team has dedicated tools, so should a founder that is raising venture capital. By having a CRM in place to track and monitor the status of a raise, founders will be able to spend more time on what matters most — building their business.

We’ve helped thousands of founders manage their raise with our Fundraising CRM. In order to help founders take their tracking to the next level, we are excited to announce our BCC email feature. Learn More

Tracking Conversations with BCC

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. Check out an example below:

This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Related Resource: 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

investors

Product Updates

Product update: Introducing Visible Portfolio Metric Dashboards

Understanding the performance and impact of your portfolio is critical for decision-making, follow-on investments, and raising future funds.

Available today, portfolio metric dashboards will give investors instant insights into portfolio company operational performance.

Visible will automatically provide investors the following:

Total – The total sum for a given metric included a time series trend chart

Minimum – The minimum value and respective company

Maximum – The maximum value and respective company

First Quartile 25%

Median Quartile 50%

Third Quartile 75%

Investors will also be able to view benchmark data for any current portfolio segments or for a particular period.

Quartiles

Investors can also select any portfolio company to quickly view their performance relative to the respective portfolios.

As always let us know if you have any questions or feedback!

Up & to the right,

Mike

investors

Product Updates

Product Update — Improve Your Fund Analytics with Multiple Funds

We’re excited to share that our Multiple Funds feature is now live. This means you can now drill into your investment data and fund analytics with even more precision than before.

Assign investments to different funds to view and compare individual fund analytics. Slice your data even further with custom segments. Answer questions like “How does the multiple for our SaaS companies from Fund I compare to the multiple for our SaaS companies in Fund II” in seconds.

Get started with Multiple Funds within your Visible account or schedule a call here to learn more.

founders

Fundraising

Product Updates

Introducing Decks — Manage Your Raise From Deck to Check

The pitch deck is the core marketing asset that jumpstarts any fundraising effort. It acts as the catalyst for connection, conversation, and relationship building.

How Pitch Deck Sharing Works

We talked to hundreds of founders, and three problems emerged around pitch deck sharing:

I’m not sure how prepared a potential investor is before heading into a meeting.

I’m under-networked. I share my deck to get meetings but want to understand who is engaged.

I iterate on my deck every hour. Sharing the latest version is a pain.

Introducing Visible Pitch Decks

Today, we are launching Decks. A dead-simple way to host and share a pitch deck on Visible. Decks are completely integrated with our fundraising crm and leading investor updates platform. You’ll be able to set customized sharing permissions, notifications when investors view your deck, upload new versions without clicking a button, and understand how potential investors have engaged with your content.

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck directly from Visible and completely integrated.

Want to see a Deck hosted on Visible in action? Take a look here.

Whether we are building fundraising automation with our Zapier Connection or crafting integrations with companies like ProfitWell, we are driven by giving founders a better chance of success. It is going to be a very fun fall 😉

Up & to the right,

Mike & The Visible Team

founders

Metrics and data

Product Updates

Unlock Your SaaS Metrics with Visible & ProfitWell

Keeping tabs on your SaaS metrics, like subscription growth, MRR movements, churn rates, etc., is vital to continued growth and improvement. We are excited to announce our direct integration with ProfitWell to do just that.

About ProfitWell

ProfitWell is a free tool that provides SaaS metrics insights, helps reduce churn and optimize pricing. Visualize your ProfitWell data directly in Visible, share it with your most important stakeholders, and combine it with other data sources to understand how your subscription growth is impacting your overall business.

ProfitWell + Visible

Our integration with ProfitWell allows you to sync 39 metrics to your Visible account (learn more about them here). Check out a few examples of different charts and data you can pull into Visible below:

With ProfitWell, you can bring in all of your recurring revenue movements — new, upgraded, downgraded, churned. If you’d prefer to not share such granular data with your investors (and potential investors), you can also pull in your current recurring revenue which may look something like this:Alternatively, you can also chart your customer count movements to get a look at how your customer base is growing.

How SaaS Metrics Help Fuel Growth

ProfitWell has taken an added focus on leveraging your current customer retention to fuel growth. As they put it, “Acquisition is the weakest growth lever. How do we know this? We studied the levers—acquisition, retention, and monetization—of 512 SaaS companies. We found that monetization and retention have much higher revenue impacts than acquisition when considering the same level of impact across each growth lever.”

Keep tabs on your retention directly in Visible. If you’d like to learn more, make sure to save a spot in our webinar with Patrick Campbell, CEO of ProfitWell, as we discuss all things churn and retention.

Learn more about connecting ProfitWell Don’t forget you can combine your ProfitWell data with any of our other integrations as well.

P.S. We are hosting a webinar with Patrick Campbell, the CEO of ProfitWell, on July 7th to discuss all things net revenue retention and churn. Save your spot here.

founders

Product Updates

Automate Your Fundraise with Zapier

Fundraising is a full-time job for startups. It’s a process most founders are running 24/7/365. The fundraising lifecycle typically has two parts:

Actively Raising: Founders are actively raising new capital for their business. Hopefully, they are using a process to build momentum (check out this First Round article for great tips).

Passively Fundraising: This is when founders are building relationships with future, upstream investors that might be a good fit for future funding events.

The Fundraising Process

We believe if founders run a great process when they are actively raising and build rapport with potential investors when they are passively raising they will raise faster, with better terms, and get back to building their business.

Over the last year, we’ve built and improved (with features like custom properties, update sends to potential investors, and Visible Connect) our Fundraising CRM with features to make a founder’s next raise as efficient as possible.

We are thrilled to announce our Zapier + Fundraising CRM integration. The integration will allow founders to fit fundraising into their daily workflow by using Zapier triggers to automatically add potential investors to their Visible Fundraising CRM.

Visible + Zapier Examples

Some examples of our favorite Zaps to get you started:

Send email to a potential investor –> Add to Visible Pipeline

Zapier Google Chrome Extension –> Add to Visible Pipeline

Slack message –> Add to Visible Pipeline

and more

Give Visible + Zapier a Free Try

Here are some templates to help get you started:

To learn more about getting your Zapier connection setup with our Fundraising CRM, check out this post.

If you have a Zap you’re using to automate your fundraise, we’d love to hear about it. Send a message to marketing at visible dot vc.

founders

Product Updates

Introducing the Founders Forward Podcast

Building a company is difficult. Being a founder can almost feel impossible. As Naval Ravikant, Founder of AngelList, wrote, “It’s never been easier to start a company. It’s never been harder to build one.”

Being a founder can be an incredibly lonely journey. There are very few people that truly know what it takes to build a company while being a strong leader. The best way to learn is from someone who has been there before. Being a founder can oftentimes be an “asymmetric experience.” As Seth Godin, business author, puts it:

“In these asymmetric situations, it’s unlikely that you’re going to outsmart the experienced folks who have seen it all before. It’s unlikely that you’ll outlast them either.

When you have to walk into one of these events, it pays to hire a local guide. Someone who knows as much as the other folks do, but who works for you instead.”

We are excited to launch the Founders Forward Podcast to do just that — enable founders to learn from their peers and leaders that have been there before. Every week our Founder, Mike Preuss, will interview a founder or startup leader that has a specific area of genius. We will cover everything from sleep and wellness to alternative forms of financing.

Why a podcast?

Our mission at Visible is to give startups a better chance to succeed. As we and our brand continue to evolve, so will our content. We want to give founders the absolute best resources they need to move forward. We will launch a new episode of the Founders Forward Podcast (paying homage to our original newsletter name) for the next 6 weeks. We will use this to elevate our other content and give founders digestible takeaways.

You can check out our first 3 episodes below (or listen on any podcast player):

Episode #1 — Lindsay Tjepkema, CEO and Founder of Casted

Episode #2 — Amanda Goetz, CEO and Founder of House of Wise

Episode #3 — Jeff Kahn, CEO and Founder of Rise Science

How can you help?

This is our first season and foray into podcasting so any feedback is very much welcome! If you have any suggestions, questions, or would like to recommend a guest, send us a message to foundersforward at visible dot vc.

To stay up-to-date with the Founders Forward Podcast subscribe to the Visible Weekly Newsletter below:

founders

Product Updates

Visible has a new look

Over the past twelve months, Visible has evolved from a tool to help founders write great investor updates to a platform to help founders Raise capital, Track key metrics, and Update investors.

We felt it was only fitting to evolve our brand just as we have evolved our product. We’re excited to share our new brand identity with you that pays homage to our past while letting us grow into our future.

Our mission hasn’t changed, we are still here to give founders a better chance of success.

We’ve updated our logo, wordmark, typeface, colors, and imagery across our marketing assets and app. Below we’ll get into why we ultimately made the change and how we went about accomplishing the overhaul this summer.

Why change?

Simply put, we love founders. We really started to feel this over the past two years after getting to work with over 4,300 founders across the globe. In our new brand identity, you’ll see that founders will be at the forefront of everything we do.

Why do we love founders? Because the odds are perpetually stacked against them but they always find a way to keep going. Being a founder is the toughest and oftentimes the loneliest job there is. Founders are forging new paths with future obstacles they can’t see paired with an environment that is ever-evolving.

So how does a founder navigate all of this? Withtrusted guides. Maybe that guide is a founder who has forged their own path or an investor who has seen others succeed (or fail) through similar obstacles. The guide could also be a significant other, an independent board member, or a close mentor.

One thing became clear to us, scaling a startup is a people and relationship driven endeavor. We hope thatVisible can act as a trusted guide and resource to founders. We also want Visible to act as a catalyst to help founders build relationships with other trusted guides to help take them on their journey. This is why we are updating our brand, to reflect our drive to serve founders first and the guides who support them.

Here are some of the tools & resources we’ve recently launched for founders to help them on their journey:

Visible Connect – A free investor database so founders can quickly find which potential investors they should be building relationships with.

176 editions of theFounders Forward – Our curated weekly newsletter that has gone out rain or shine every Thursday.

Visible for Investors – The most founder friendly tool an investor can use to engage with their portfolio.

We wrote 3,800 words in ourall encompassing startup fundraising guide to help founders who are fundraising for the first time.

The Visible Founder Community – This is currently in alpha with some of our customers. We just made a hire to take this to the next level. Stay tuned!

If you like getting into the details of how we went about deciding on the new brand and what it entails. Keep reading!

The Process

After we decided that we wanted to update our brand identity we dug into our design values & process, looked at the competitive landscape, talked to our customers, and even reviewed conversion data of our marketing funnel. To give an inside peek at some of our research and process:

Design Values

Empowerment – We want to make complex tasks simple, while also providing customers with all the valuable information they can get to improve their investor relationships.

Reliability – We want customers to trust Visible. They should not only trust that every investor update email is going to be sent but that our team is here when you need us.

Consistency – We need to be consistent in our communication and in our user experience. When we launch something new customers should feel like they know it by heart.

Competitors

We took a look at our customers and their brand identities. We wanted to make sure we could differentiate and stand out. We saw a lot of blue.

Mood Board

After we pulled all of our research together, we got started on a mood board. We knew that if we wanted to be a trusted guide for founders we need to convey trust, fearlessness, and experience. Here are some early mood boards:

Two ideas started to emerge that we liked:

The editorial feel our marketing site could have. Our articles and resources were read by more than 175k people in 2020. Let’s elevate the content with a more editorial and educational look.

Triangles vibed well with where we wanted to go. The glyphs above have a lot of parallel meanings to building a startup, it plays nicely with the V in Visible and also has elements of climbing a mountain.

Of course, we reviewed many iterations of our logo, typeface, and marketing site before landing on the final product.

The Logo

It is made of 3 overlapping, equilateral triangles. Each triangle is slightly transparent, allowing the mark to interact with other design elements.

The triangles represent human relationships, both the connection between each of us and the ever-shifting overlap across myriad networks. There’s also a resonance with the strength of triadic relationships in management and the value created between customers, founders, and VCs, as well as founders, VCs, and LPs.

The logomark also pays a nice tribute to our current logo which has an overlapping pie chart. The logo also makes your eyes go “up and to the right”, a common salutation for our content and represents the never ending journey for growth.

Typography

We found the need to have both serif and sans-serif typefaces in our updated brand style guide. With software interfaces at the core of our products, we found that sans-serif fonts offer the right combination of efficiency and legibility at all sizes.

We’re also introducing a beautiful new serif typeface that helps us express the quality and trustworthiness of the content we create and curate for founders. The serifs look great for headers and big and bold for things like inspiring quotes.

Imagery

We really wanted to bring our customers, founders, community – people! – to the forefront of our brand. Illustrations are trendy but can feel very abstract and lack relatable humanness. We found beauty and inspiration in seeing a diverse group of people doing incredible work.

We enjoy the stark contrast of a black and white photo but also how it plays nicely with vibrant headshots. Our logomark really pops across different media types from photos to videos.

Founders Forward –> The Visible Weekly

The Founders Forward is now The Visible Weekly and will also get a bit of a facelift. We decided it was better to support fewer brands and sunsetted the yellow branding and logo. If we want to better serve founders we felt that Visible should be the core focal point across all of our content.

Don’t worry… the newsletter isn’t going anywhere! It will still be curated by our team and produced once a week. If you haven’t subscribed you can do so here -> visible.vc/subscribe

Our App

In the immediate, our app will have the new logo, color palette, and showcase some of the new brand elements. Over time we’ll introduce more changes that further blend our brand identity into the product.

Thanks

Most importantly we’d like to thank you, our community, for your encouragement, feedback, and support to get us to this point. We are energized for the years to come and can’t wait to give you a better chance of success.

I personally want to thank the entire Visible team for their drive to better serve founders and our customers. The new brand was a total team effort and none of this would be possible without a team who isn’t scared to do the difficult.

Up & to the right,

Mike Preuss

Visible CEO & Co-founder

founders

Fundraising

Product Updates

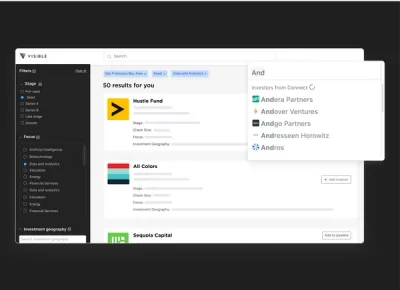

Visible Connect: Introducing Our Investor Database

TL;DR — We are excited to announce Visible Connect, our investor database. Visible Connect uses first hand data and directly integrates to our Fundraising CRM. You can give Visible Connect a try here.

Fundraising is a challenging, time consuming process for startups. One of those challenges is finding the right investors. Founders spend countless hours trying to understand:

Is this investor active? What deals have they done recently?

Will they lead? Take a board seat?

What geographies do they invest in? What stages? What verticals?

What size checks do they typically write?

Have they raised a new fund recently?

Do they have certain traction metrics or growth rates they like to see?

The current patchwork of data sources & resources lack the founder first mentality, can be cost prohibitive and lack insightful data for founders who are fundraising.

This isn’t a novel idea. Founder-friendly individuals who know the pain of fundraising consistently try to solve aspects of this problem with lists like Joe Floyd’s Emergence Enterprise CRM and Shai Goldman’s Sub $200M fund list. We believe these efforts should be coordinated and data aggregated for the benefit of founders everywhere.

Introducing Visible Connect

In the spirit of the Techstars #givefirst mentality, we are thrilled to announce Visible Connect. Our attempt at curating the best investor information in the world and opening it up as a resource for founders to derive investor insights and run more efficient fundraising processes.

Visible Connect allows founders to find active investors using the fields we have found most valuable, including:

Check size — minimum, max, and sweet spot

Investment Geography — where a firm generally invests

Board Seat — Determines the chances that an investment firm will take a board of directors seat in your startup/company.

Traction Metrics — Show what metrics the Investing firm looks for when deciding whether or not to invest in the given startup/company.

Verified — Shows whether or not the Investment Firm information was entered first-handed by a member of the firm or confirmed the data.

And more!

Visible Connect + Fundraising Pipelines

Once you filter and find investors for your startup, simply add them to your Fundraising Pipeline in Visible to track and manage your progress (You can learn more about our Fundraising CRM here).

We believe great outcomes happen when founders forge relationships with investors and potential investors. One of the benefits of the current system is that founders with options are forced to be thoughtful about who they reach out to. However, not all founders feel they have options. They need to know that they do.

We believe Connect is not a tool for founders to ‘spray and pray’ or spam investors with template cold emails. There will be no contact emails provided on the database for this reason.

We believe founders waste precious time trying to figure out investor fit and profile for their given stage when they could be spending that time building potentially fruitful relationships with the right investors. It should not be a core competency of a founder to understand all of the investment thesis for venture investors.

Connect Data Sources

We collect data in three principal ways:

Primary information – Direct attestations from venture capitalists, accelerators and other investment firms about their business

Secondary information – investor lists provided to us by venture capitalists (co-investors) or startup founders aggregated in the course of a fundraise or the ordinary course of business

Public information – third party data sources that are not labeled as proprietary or have terms of use associated. These sources may include: deal flow newsletters, public lists and databases, social media posts, journalistic articles, and more

We’d like to give special thanks to all the individuals who gave their time to build data sources used in the compilation of this ongoing project.

The AllRaise Airtable of investors. All Raise is on a mission to accelerate the success of female founders and funders to build a more prosperous, equitable future.

Data from the team at Diversity VC

The Southeast Capital Landscape built by Embarc Collective, Modern Capital, Launch Tennessee, and HQ1

Joe Floyd and the Enterprise Fundraising CRM

Shai Goldman and the Sub $200M VC fund list

Crunchbase Open Data Map API

NVCA’s membership database

The Fundery’s Essential VC Database for Women Entrepreneurs

Venturebeat’s NYC lead investor roster

This public airtable aggregating investors who invest in underrepresented founders (anyone know who we can give credit to?)

David Teten’s list of Revenue-based Investors (and Chris Harvey’s tweet about it)

Tech In Chicago’s list of Chicago VCs

Clay and Milk’s list of Midwestern VCs

Brian Folmer of XRC Labs

Nick Potts of Scriptdrop

Ideagist’s list of accelerators and incubators in California

Jason Corsello’s Future of Work Investors

Dan Primack’s Pro Rata Newsletter (We manually enter this data daily)

Evan Lonergan’s Excoastal (We manually enter this data weekly)

Austin Wood’s Tech Between the Coasts (We manually enter this data weekly)

We’re always looking to bring on more data sources, contributors and maintainers of the project. If you want to submit a data source or help contribute you can fill out this Airtable form.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial