Visible is a founder-friendly portfolio monitoring and reporting solution used by VC’s around the world.

Thanks to the continued engagement from our investor community, the last twelve months at Visible have been full of growth. As a Visible user, you’ve helped bring more transparency to the Venture Capital industry through improved KPI tracking, accessing deeper portfolio insights, and by more regularly communicating with your companies, teammates, and LP’s.

Here are some 2022 highlights:

- 7k+ Requests completed by portfolio companies around the world

- 550+ LP Updates were sent to investors

- 800+ Investors deepened their VC expertise by engaging with our educational webinars

- 300+ VC firms verified their profiles in our Connect database

Biggest Product Updates of 2022

More Flexible & Scalable Dashboards

- Portfolio Dashboard Templates – A more scalable way to visualize and extract insights from portfolio company data.

- Flexible Dashboard Grids – Flexible widget sizing means you have more control over how you can display data visualizations for you and your team.

- Intraportfolio Benchmarking and Insights – Compare individual company performance against portfolio quartiles using custom segments.

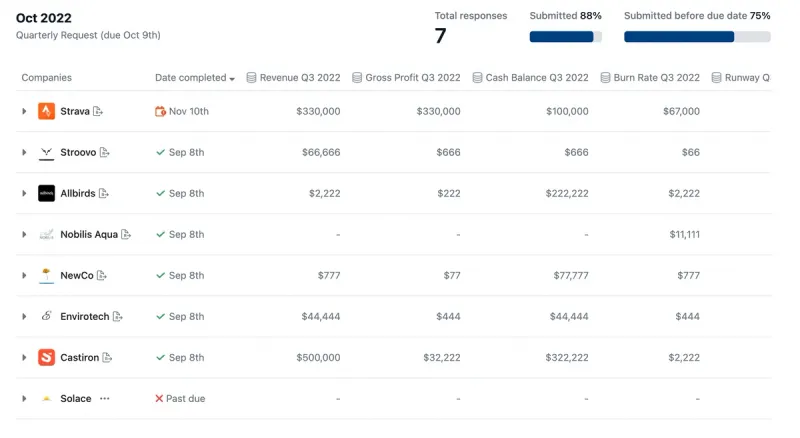

Improved Portfolio Request Experience

- Request UI Overhaul – It’s now much easier to understand when your Request has been sent, % completion, and when the next scheduled reminder email will be sent.

- Multiple File Uploads in Requests – Companies can upload multiple files into the same file block in a Request, saving them time each reporting cycle.

- Export Request Summaries – Easily export and analyze Request responses in just a few clicks.

- Re-open a Request – Mistakes happen. Re-opening a Request lets companies re-submit their data.

Advanced Investment Insights

- Chart Investment and Fund Metrics – Chart and visualize key fund metrics such as TVPI, RVPI, DPI, and more.

- Automatic SAFE Conversion & Token Support – Visible supports 6+ investment types.

- Multiple Funds – Segment your investment data by fund in custom-built reports.

Interested in learning more about Visible’s portfolio monitoring solution for investors? Book a demo below.

Interested in learning more about Visible?

Webinar Recap from 2022

More than seven thought leaders from around the world joined us to share their expertise in different topics related to improving the venture capital ecosystem. Check out the recordings and resources below.

ESG Best Practices with Tracy Barba ESG for VC –> Watch Here

Building Scalable Support with Jessica Lowenstein of K50 Ventures and Erica Amatori of Left Lane Capital – Watch Here

Benefits of a Hybrid SPV + Fund Strategy with Kingsley Advani of Allocations — Watch Here

LP Reporting Best Practices with Aduro Advisors — View the Report

SaaS Company Benchmarking with Christoph Janz of Point Nine Capital — Watch Here

Best practices for portfolio monitoring & reporting with Gale Wilkinson of VITALIZE Venture Capital — Watch Here

Interested in learning more about Visible?

How to Partner with Visible in 2023

- Increase your VC firm’s brand awareness by hosting your Update template in our public Update Library for investors.

- Refer your investor friends to Visible and receive a $500 Amazon gift card.

- Invite us to host a webinar for your portfolio companies on ‘Investing in Investor Updates’.

- Verify your firm’s profile in our investor Connect Database.

To get started with any of the partnership opportunities above, send an email to belle@visible.vc.

Interested in learning more about Visible?