Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

The Founder’s Guide to San Antonio’s Top VC Firms and Startup Resources

Imagine San Antonio as a hidden oasis for startups, where the cost of living is low, the talent pool is deep, and the community rallies behind every bold idea. If you’re building a startup in San Antonio, you’re in the right place- the city’s vibrant tech ecosystem, supportive community, and growing investor network are creating new opportunities for ambitious entrepreneurs.

In this guide, we’ll introduce you to the top venture capital firms actively funding startups in San Antonio, along with practical insights on how to connect with investors, leverage local resources, and make the most of the city’s unique advantages.

Top VCs in San Antonio

Active Capital

About: Active Capital is a venture firm focused on leading seed rounds for B2B SaaS companies outside of Silicon Valley.

Sweetspot check size: $ 750K

Traction metrics requirements: Pre-Seed: Product built and in market with users. Pre-revenue is ok. Seed: $20k MRR and growing swiftly each month (flexible)

Thesis: Active Capital is a venture firm designed to lead seed rounds for B2B SaaS companies outside of Silicon Valley.

Texas Next Capital

About: Texas Next Capital is a private equity partnership of like-minded Texas leaders and investors dedicated to building the next generation.

Thesis: Texas Next brings together decades of Texas business influence, know-how and values from our partners and advisors to help portfolio companies succeed in Texas and the global economy.

Scaleworks

About: Scaleworks coined the term Venture Equity — and manages three funds totaling $150M to invest on the venture equity thesis. Essentially that means Scaleworks invests for controlling stakes in B2B SaaS companies and operates them for high–growth.

Thesis: Scaleworks invests in and operates SaaS companies.

Geekdom Fund

About: Geekdom Fund is a venture capital fund that invests in early stage tech startups led by the strongest founders. Our partners are in the trenches with our companies. From weekly calls to biannual deep dives, we are always looking for ways to help out our portfolio companies. Whether it be pitch meetings, talents referrals, or grant writings.

Thesis: Though we focus on B2B SaaS we are also very interested in backing teams working on big ideas that take longer to come to market but have huge potential such as Robotics, Exoskeletons, Autonomous Machines, Blockchain and others. We’re normally writing $50k-$500k checks into Pre-seed and Seed tech startups. We hope to support you in your A round, as well. We rarely do Series A investments for new companies.

Alamo Angels

Alamo Angels is a fund + angel community of 135+ investors that invests and supports early-stage companies.

Holt Ventures

About: Holt Ventures is the venture capital firm that invests in the construction technology sector, infrastructure, and manufa

cturing sectors.

The San Antonio Startup Ecosystem

San Antonio has seen a 20% surge in new tech startups, with the ecosystem attracting over $300 million in investments in the past year alone. This momentum is reflected in the city’s vibrant event calendar, with San Antonio Startup Week drawing record crowds and offering more than 90 sessions for founders and tech professionals. The average tech salary in the city has also jumped to $112,057, a 13.3% increase from the previous year, signaling strong demand for talent and a healthy job market for tech workers.

Key Growth Sectors

Cybersecurity: Bolstered by significant defense contracts and a strong military presence, San Antonio is often referred to as “Cyber City USA.”

Biosciences and Healthcare Innovation: Startups like Hera Biotech are revolutionizing diagnostics and drug discovery, while the city’s established healthcare infrastructure supports ongoing innovation.

Artificial Intelligence and Robotics: Companies such as Plus One Robotics and Darkhive are at the forefront of AI and robotics, attracting both talent and capital.

PropTech and HealthTech: Real estate and healthcare technology startups are gaining traction, with platforms like Developmate and LASO Health streamlining processes and improving access to services.

Notable Exits

San Antonio’s startup scene has produced several notable exits and high-growth companies, including Xenex (germ-zapping robots), 6Connex (virtual event platforms), and Plus One Robotics. These success stories are fueling further interest from both local and national investors.

Funding Volume and Capital Access

The city’s small business landscape is projected to grow by 25% by 2025, supported by $26.8 million in American Rescue Plan Act funding and new zero-interest loan programs. However, there remains an annual unmet capital demand of $8.3 billion, especially in underserved communities, highlighting the ongoing need for improved access to funding and coordinated stakeholder support.

Key Advantages of Building a Startup in San Antonio

Affordable Cost of Living

San Antonio offers a significantly lower cost of living compared to other major tech hubs like Austin, Dallas, or San Francisco. This affordability allows startups to stretch their runway further, attract top talent, and invest more in growth rather than overhead.

Diverse and Growing Talent Pool

With a 25% projected growth in software development roles through 2031 and a strong pipeline of graduates from local universities, San Antonio provides access to a skilled and diverse workforce. The city’s collaborative culture, exemplified by organizations like Geekdom and RealCo Accelerator, fosters mentorship and knowledge sharing.

Supportive Community and Ecosystem

San Antonio’s startup community is known for its collaborative spirit. Founders, investors, and established companies work together to build a supportive environment. Major events like San Antonio Startup Week, Tech Fuel pitch competitions, and ongoing workshops provide ample opportunities for networking, learning, and fundraising.

Strategic Location and Economic Stability

San Antonio’s central location in Texas, combined with its robust economic base (including military, healthcare, tourism, and education), provides stability and access to a wide range of customers and partners. The city’s population growth and economic resilience further enhance its appeal for startups looking to scale.

Local Resources and Programs for San Antonio Founders

San Antonio’s startup ecosystem boasts a robust network of accelerators, incubators, coworking spaces, and government-backed initiatives, all designed to support founders in launching, growing, and scaling their ventures. Here’s a closer look at the most impactful resources available to local entrepreneurs:

Accelerators and Incubators

Geekdom

Geekdom is San Antonio’s flagship startup incubator and coworking space, located in the heart of downtown. It offers affordable workspace, mentorship, and a collaborative community for early-stage founders. Geekdom’s Pre-Accelerator and Community Fund programs provide seed funding, business development workshops, and access to a network of experienced mentors and investors. Geekdom has played a pivotal role in launching companies like Plus One Robotics and FloatMe.

Founder Institute San Antonio

The Founder Institute is a global pre-seed accelerator with a San Antonio chapter. It offers a structured program for idea-stage founders, connecting them with local and international mentors, and helping them build fundable companies.

Coworking Spaces

Geekdom (also an incubator, as above)

Geekdom’s downtown campus is the city’s largest coworking space, offering flexible memberships, private offices, and a vibrant community of entrepreneurs, freelancers, and tech professionals.

Venture X San Antonio

Venture X provides modern coworking and private office solutions for startups and small businesses, with amenities like high-speed internet, meeting rooms, and networking events.

The Impact Guild

A coworking space focused on social impact, The Impact Guild offers workspace, community events, and resources for mission-driven entrepreneurs and nonprofits.

Government-Backed Funding Initiatives

State Small Business Credit Initiative (SSBCI)

Texas has received $472 million through the SSBCI, with $354.1 million allocated to the Loan Guarantee Program. This initiative is designed to increase access to capital for small businesses, especially those in underserved communities. San Antonio startups can leverage these funds for working capital, equipment, and expansion.

City of San Antonio ARPA Small Business Grants

The city has allocated $26.8 million from the American Rescue Plan Act (ARPA) to support local small businesses through grants and a zero-interest loan program, in partnership with organizations like LiftFund.

Additional Support Organizations and Programs

Alamo Angels

Alamo Angels is a network of accredited investors supporting early-stage companies in San Antonio through capital, mentorship, and networking opportunities. They host regular pitch events and educational workshops for founders.

UTSA Small Business Development Center (SBDC)

The SBDC at the University of Texas at San Antonio offers free business advising, training, and resources for startups and small businesses, helping with everything from business planning to accessing capital.

San Antonio Economic Development Department

The city’s Economic Development Department provides incentives, business support services, and connections to local resources for startups and growing companies.

Connect With Investors in San Antonio Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of San Antonio's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

founders

Fundraising

Orlando's Top Venture Capital Firms: A Founder's Guide to Funding

Raising capital in Orlando has never been more exciting—or more competitive. As the city’s tech and innovation scene continues to surge, founders are discovering a wealth of venture capital firms, accelerators, and networking opportunities. In this guide, you’ll find the most active Orlando-based investors, accelerators, incubators, and the key events and founder groups that can open doors to funding, mentorship, and lasting connections.

Top Orlando VCs

LEAD Sports

About: leAD Sports & Health Tech Partners sources, funds, and drives growth of early-stage sports & health tech startups globally. leAD works with groundbreaking solutions across the verticals of fan engagement, connected athletes, and health & well-being.

Sweetspot check size: $ 750K

Starter Studio

About: We are Central Florida’s only 501(c)3 nonprofit organization focused on accelerating tech and tech-enabled startups. We support founders through the early-stages of a startup, from validating their idea, developing an MVP or Prototype, building the infrastructure of a sustainable business, through first customer / first revenue, to preparing to meet with investors for pre-seed funding. We provide three world-class accelerator programs that offer tech founders the opportunity to learn the skills, competencies and business disciplines that help them address and mitigate the top 20 reasons 2 out of 3 tech startups fail in their first five years. The programs also provide founders with highly skilled coaches and subject matter experts, as well as personal introductions and connections into the broader tech ecosystem. We prepare pre-seed-ready starters to attract outside funding while also investing in eligible pre-seed-stage accelerator graduates through our own evergreen fund. StarterStudio is supported by donors and local governments as a stimulus to economic development and high-wage jobs.

Blackwood Holdings Group

About: Blackwood Holdings Group LLC is a multinational venture capital Firm with deep managerial and technical expertise capable of accelerating companies to market leadership. Blackwood, sponsors management buy-outs of privately owned businesses and subsidiaries or divisions of public companies with revenues between $5 million and $50 million. We seek investments in companies with solid fundamentals and provide financial transaction expertise which empowers management.

Penta Mezzanine Fund

About: Penta Mezzanine Fund is a private investment firm providing $2 to $15 million customized growth capital solutions to profitable, lower-middle-market companies nationwide. We look to invest our funds in established companies operated by experienced and proven management teams with a history of building enterprise value. Penta Mezzanine Fund was created by former industry executives and experienced investors who place a high value on their relationships with management teams.

Boxer Capital

About: Boxer Capital Management is a full life cycle investment firm, committed to fundamental, research-based investing in specialized and precision medicine companies across private and public markets.

Thesis: Innovation-focused investing in biotechnology companies that aim to drastically improve medicine.

Orlando Health Ventures

About: Orlando Health Ventures is advancing healthcare innovation by strategically investing in early stage companies and technologies that are transforming and disrupting the healthcare industry. Through a collaborative effort with our clinicians and leaders, Orlando Health Ventures sources, evaluates, and invests in innovative companies that demonstrate potential for a strong return on investment, high growth opportunity and that align with the mission of Orlando Health.

APC Holdings

About: APCH leads in alternative investments, specializing in private equity, private credit, infrastructure, and real estate. Our strategy integrates innovative financial approaches with a strong commitment to social impact, particularly empowering Minority Business Enterprises. Through strategic partnerships and demand-driven investments, we strive for strong returns while promoting sustainable growth and inclusivity in communities.

Top Accelerators and Incubators in Orlando

Orlando is home to a diverse range of accelerators and incubators, each offering unique programs, funding, and mentorship:

StarterStudio: Offers multiple accelerator tracks (Idea, Build, Seed) and provides funding, mentorship, and education for tech startups.

UCF Business Incubation Program: One of the largest university-affiliated incubators in the Southeast, supporting startups with office space, mentorship, and access to university resources.

VentureScaleUp: Focuses on high-growth, scalable startups, providing mentorship, workshops, and investor connections.

GuideWell Innovation: Specializes in healthtech, offering an 8-week accelerator with access to healthcare industry leaders and resources.

Burnout Game Ventures: Supports game development startups with funding, mentorship, and publishing support.

Goldstein Accelerator: Provides capital and mentorship for technology startups, with a focus on economic impact.

Rally: The Social Enterprise Accelerator: Supports social impact startups with a 16-week program, mentorship, and access to funding.

National Entrepreneur Center: Offers business support, training, and resources for entrepreneurs at all stages.

Prospera: Focused on Hispanic entrepreneurs, providing business assistance, training, and access to capital.

SBDC Central Florida: Offers free business consulting, training, and resources for small businesses and startups.

For a full list of 27+ accelerators and incubators in Orlando, see Starter Story’s 2025 Guide.

Key Events and Founder Groups in Orlando

Orlando’s startup ecosystem is vibrant and collaborative, offering founders a wealth of opportunities to connect, learn, and grow. Whether you’re seeking funding, mentorship, or peer support, the city’s events, accelerators, and founder groups are essential resources for any entrepreneur looking to scale a business in Central Florida.

Orlando Magic Venture Challenge: A high-profile pitch competition and showcase, the Orlando Magic Venture Challenge brings together early-stage startups, investors, and corporate partners. Winners receive funding, mentorship, and access to the Magic’s extensive business network. This event is a must for founders in sports, health, and entertainment tech.

StarterStudio Demo Days: StarterStudio, one of Orlando’s leading accelerators, hosts regular Demo Days where founders pitch to investors, mentors, and the broader community. These events are ideal for networking and gaining exposure to local VCs and angel investors.

UCF Business Incubation Program Showcases: The University of Central Florida’s incubator program regularly features pitch events and showcases, connecting founders with investors, advisors, and potential partners.

Orlando WEB3 Tech and Beer: A community of Web3 tech and data enthusiasts that are passionate about driving change and challenging the status quo through innovation.

Orlando Devs: A large community of software developers and tech professionals, offering meetups, hackathons, and online forums.

1 Million Cups Orlando: A weekly event where founders present their startups to a supportive audience and receive feedback and advice.

Synapse Orlando: A major annual innovation summit featuring panels, workshops, and networking with Florida’s top tech leaders.

Orlando Startup Weekend: A 54-hour event where founders, developers, and designers team up to launch new ventures.

The Pride Chamber: Orlando’s LGBTQ+ chamber of commerce, supporting LGBTQ+ entrepreneurs with networking, advocacy, and business resources.

NAWBO Orlando: The local chapter of the National Association of Women Business Owners, providing support, advocacy, and networking for women entrepreneurs.

Resource: For a comprehensive list of national and global startup events, see RocketDevs’ 56 Must-Attend 2025 Startup Events.

Connect With Investors in Orlando Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Orlando's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

investors

Customer Stories

Metrics and data

Case Study: Airtree Venture's Transformation with Visible

About Airtree Ventures

Airtree is a Sydney-based venture capital firm backing founders based in Australia and New Zealand building the iconic companies of tomorrow. The firm was founded in 2014 and is now deploying out of its 4th fund with $1.3 billion in assets under management. Their portfolio includes over 105+ portfolio companies and 250+ founders who have helped create over 17,000 jobs.

Airtree’s portfolio includes the region’s breakout technology companies, such as Canva, Go1, Employment Hero, Pet Circle, Immutable, and Linktree.

For this case study, we spoke to Dan Lombard who is the Data Lead at Airtree Ventures.

Related article: Airtree Ventures already returned its first fund thanks to Canva while maintaining the majority of its stake

Fragmented Systems and Processes Prior to Visible

Prior to the integration of Visible, Airtree relied heavily on a fragmented system of spreadsheets to manage their portfolio of 105+ companies. Each quarter, four employees were tasked with managing the relationships with the points of contact at 15 to 20 portfolio companies through manual outreach and communications. This reliance on spreadsheets resulted in inefficiencies and potential data loss, as spreadsheets are prone to break when modified.

Challenges With Data Accuracy and Scaling Manual Outreach to a Growing Portfolio

Before Visible, 80% of Airtree’s portfolio monitoring problem was having clean data and scaling outreach to their portfolio companies. They faced two primary challenges with their former system:

Operational Efficiency: Four team members spent significant time manually collecting data from over 100 companies every quarter. The Airtree team members were sending one-off email communications to each company and manually keeping track of who needed to be followed up with at each company which diverted resources from other critical projects they could be working on.

Data Integrity and Scalability: Frequent changes to the data in spreadsheets resulted in errors in the sheets and data loss, which caused frustration as there was no way of understanding which changes were made to the sheet and when. This process made it difficult to scale portfolio monitoring operations as Airtree grew.

Why Airtree Chose Visible as their Portfolio Monitoring Platform

Airtree chose Visible for its robust, scalable, and user-friendly platform. Key factors influencing their choice included:

Ease of Use and Customization: Visible's platform offered unparalleled customization and ease of use.

Support and Development: Visible’s team actively listened to feedback, offered best practices, and continuously invested in their product, ensuring a partnership that catered to Airtree’s evolving needs.

Automation and Integration: Visible excelled in automating portfolio monitoring and offered a frictionless experience for founders. Airtree leveraged the Visible API to seamlessly integrate data into their existing data warehouse system.

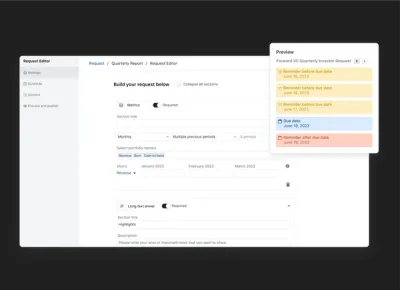

Airtree’s historical data collection process, previously led by four Airtree team members, is now a streamlined process led only by Dan, who leverages Visible Requests to collect data from their portfolio of 105+ companies. Visible Requests empowers Dan to send customized link-based data requests to each company, automate the email reminder process, and easily keep track of where companies are in the reporting process.

View an example Visible Request below.

Onboarded to Visible within 24 Hours

Visible provided Airtree with an efficient and supported onboarding. When asked about Airtree's onboarding with Visible Dan Lombard shared the following:

Visible stood out by enabling a swift and seamless transition that was operational in less than 24 hours, a stark contrast to other providers who estimated a quarter for full implementation. This rapid integration was facilitated by a comprehensive onboarding template provided by Visible.

Visible API & Airtree’s Data Infrastructure

With the implementation of Visible, Airtree wanted to take a more sophisticated approach to the way they handle their portfolio data with the goal of driving more valuable insights for their team. The approach needed to be automated, integrate with other data sources, and have a singular view accessible for the whole team. This was not possible when their data lived in disparate systems, files, and spreadsheets.

Dan Lombard has led the improvement of Airtree's data infrastructure. Now, data sources like Visible and Affinity are piped into Snowflake via recurring AWS Lambda jobs. Airtree leverages the Visible API daily. Dan mentioned that while Airtree collects data quarterly, a daily sync of the data is crucial because Airtree is always onboarding new companies, communicating with their founders, and uploading historical data.

“The Visible API gives us this level of daily fidelity and only takes the AWS Lambda job 5 minutes to populate an entire data architecture.”

- Dan Lombard, Data Lead at Airtree Ventures

Once the data is in their database, Snowflake handles the ETL and entity matching. Airtree then has Streamlit sit on top of Snowflake to query data, provision access, and build out new insights.

Advice for Other VC Firms Building Out Their Data Infrastructure

Don’t overcomplicate things to start. It is easy to get caught up in the bells and whistles. Dan recommends a bias towards simplicity. Start small and use it as a stepping stone as you build things out.

Conclusion

Airtree’s adoption of Visible transformed their portfolio management by automating key processes and centralizing data, thus enabling more strategic decision-making and efficient operations. The case of Airtree is a testament to how the right technological partnerships can profoundly impact business efficiency and data management.

founders

Fundraising

Maryland’s Top VCs and Resources for Startups

Maryland isn’t just the home of blue crabs and the Chesapeake Bay- it’s also a great place to launch and scale a startup. With billions in venture capital flowing through the state, a deep bench of tech talent, and direct access to federal agencies and world-class research institutions, Maryland founders are uniquely positioned to turn bold ideas into thriving businesses. But with so many funding options, accelerators, and networking events, where should you start? This guide will help you cut through the noise. You’ll discover Maryland’s top venture capital firms, insider tips for landing non-dilutive government grants, and the best events and accelerators to grow your network.

Top VCs in Maryland

New Markets Venture Partners

About: New Markets Venture Partners is an early and growth stage venture capital firm that invests in and helps build disruptive education, information technology and business services companies. We are one of the leading education technology-focused venture firms in the U.S. Each of our partners has many decades of investment and education experience. We maintain proprietary relationships with states, districts, universities and other centers of innovation that allow us to provide exceptional value to our portfolio companies. We help our portfolio companies succeed by adding value before, during, and after the investment process.

TDF Ventures

About: TDF Ventures is a venture capital firm that targets seed and Series A investments in technology companies.

Bonsal Capital

About: Bonsal Capital is a private investment company investing in technology and technology enabled services in education, healthcare and cyber security solutions.

Thesis: Bonsal Capital is a mission-driven partnership, and supporting education has been a core driver since our founding in 1999. With decades of experience in education as investors, practitioners, and volunteers, our principals have authentically grown a partnership that seeks founders and leaders who want to make a positive impact with a product and/or service, and who keep prospective scale and sustainability at the forefront. We support the growth of companies focused on tech-enabled services in education, and we have invested in and partnered with more than 20 such companies over the past two decades, providing human and financial capital, as well as other resources, that have made a positive impact on tens of millions of end users. We believe that, by fostering education, we can make the world a better place and feel good about our place in it.

Sterling Venture Partners

About: Sterling Partners is an investment management platform. We invest and manage across strategies and asset classes. We invest in companies in various stages of growth and across many industries, taking majority, minority, preferred equity, and even debt positions. We also invest in teams who bring their own experience and expertise and provide them with financial, strategic, and operational support. The people at Sterling believe in ideas and ideals, in people and partnerships that drive long-term success.

TCP Venture Capital

About: TCP Venture Capital is a Baltimore, Maryland-based early-stage technology focused venture capital firm. We partner with entrepreneurs to build great businesses. The Propel Baltimore Fund makes investments in early-stage technology companies willing to locate in Baltimore. The Fund addresses the critical need for more early-stage capital in Baltimore City, encourages more entrepreneurial activity in the City, creates more high-paying jobs, and helps to realize Baltimore City’s full potential as a destination for growing businesses.

Conscious Venture Lab

About: Conscious Venture Lab (CVL) is an early stage business accelerator with the goal of developing companies and leaders who embrace capitalism as a force for good in society. We work to help extraordinary entrepreneurs in their goal to build companies with societal purpose at their core; to give them all the tools and support they need to create engaged happy employees, loyal and joyful customers, deeply authentic partnerships, caring and safe communities and all manner of wealth for all their stakeholders.

Thesis: Conscious Venture Lab is an immersive 4-month, curriculum and mentor driven accelerator, We build companies focused on the power of purpose.

Camden Partners

About: Founded in 1995, Camden Partners is a growth equity firm that helps the management teams of enterprise software and technology-enabled companies scale their businesses. Camden has invested in 85 companies across six growth-equity funds and is known for providing creative and flexible growth capital. By focusing on the same strategy for over 25 years, the firm’s partners leverage deep domain expertise and a network of operating executives to help management teams grow revenue and cash flow. With initial equity checks between $5 million and $15 million, Camden is a preferred partner for owner-operators who are dilution sensitive.

Savano Capital Partners

Savano Capital Partners is a late stage venture fund investing in technology-driven businesses. About: We focus on investment opportunities in high-growth companies within the software, communications, e-commerce, technology-enabled services, healthcare and clean tech/alternative energy sectors. We partner with leading companies by providing liquidity to individual shareholders, such as former executives, angel investors and founders. The fund was founded by life-long venture capitalists and entrepreneurs who aim to work collaboratively with company management, venture investors and individual shareholders.

Early Light Ventures

About: The Early Light Ventures Fund is designed from the ground up to deliver incredible outcomes for the best founders in B2B SAAS.

ABS Capital

About: Since 1990, ABS Capital Partners has established a strong track record investing in later-stage growth companies in the business services, health care, media & communications, and software sectors. Opportunities and challenges change when companies enter the high growth phase. As a recognized leader in later-stage investing, they understand this point in a company's lifecycle.

Thesis: ABS Capital provides growth equity capital to B2B software and tech-enabled services businesses with strong technology and data underpinnings looking to scale with the right partners. Building businesses has been our passion for more than 30 years. Over that time, we have invested more than $2.5 billion in approximately 130 companies across eight funds. We bring our investing, operational, infrastructure, technology, and business development skills to amplify the success of growing businesses with data-driven business strategies, market research and analytics, and rolling up our sleeves to support talented management teams.

Boulder Ventures

About: Boulder Ventures was formed in 1995 to manage venture capital partnerships. They seek to realize superior returns from early-stage equity investment and active partnership with exceptional entrepreneurs to build market-leading technology companies. Boulder Ventures identifies exceptional entrepreneurs building market-leading technology companies and provides the funding, contacts and experience needed to succeed in today's highly competitive environment.

Tapping Into Government Contracts and Non-Dilutive Funding

Maryland is a national leader in winning federal research grants and government contracts, thanks to its proximity to Washington, D.C., a dense cluster of federal agencies, and a robust support ecosystem for startups. Here’s how founders can leverage these advantages:

SBIR/STTR Grants

The federal Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs provide non-dilutive funding (i.e., you don’t give up equity) to startups developing innovative technologies. Maryland amplifies these opportunities with state and local matching grants, technical assistance, and proposal labs.

TEDCO SBIR/STTR Proposal Lab: TEDCO, Maryland’s leading innovation agency, offers a comprehensive SBIR/STTR Proposal Lab that helps founders write, review, and win federal grants. The lab has helped Maryland startups secure over $28 million in SBIR/STTR funding from agencies like NSF, NIH, NASA, and the Air Force. The program is especially supportive of women-owned, disadvantaged, and rural businesses.

Montgomery County SBIR/STTR Matching Grant Program: If your startup is in Montgomery County and working in biotech, medicine, or life sciences, you may be eligible for a local matching grant—up to $25,000 for Phase I and $50,000 for Phase II awards, plus a “Phase 0” grant to help with application costs.

Maryland State Matching Grants: The state budget includes $1.3 million for SBIR/STTR matching grants and $500,000 for technical assistance in 2025, helping bridge the funding gap between federal grant phases and commercialization.

Maryland APEX Accelerator: Formerly known as PTAC, the Maryland APEX Accelerator provides free counseling, training, and bid-matching services to help startups compete for federal, state, and local contracts—including SBIR/STTR opportunities.

OST Global Solutions SBIR/STTR Lab: In partnership with TEDCO and SBDC, OST runs a proposal lab that has helped Maryland companies win up to $305,000 in Phase I non-dilutive funding.

Key Steps to Access SBIR/STTR and Government Contracts:

Register your business in SAM.gov and other required federal databases.

Identify relevant agencies (NSF, NIH, DoD, etc.) and open solicitations that match your technology.

Leverage Maryland’s proposal labs and technical assistance to strengthen your application.

Apply for state and local matching grants to maximize your non-dilutive funding.

Use bid-matching and counseling services (like Maryland APEX Accelerator) to find and compete for government contracts.

Tips for Startups in Health Tech, Cybersecurity, and Defense to Win Government Contracts

1. Understand the Procurement Landscape: Maryland’s proximity to federal agencies (NIH, FDA, DoD, NSA, NIST) gives startups a unique edge. Health tech, cybersecurity, and defense are priority sectors for both SBIR/STTR and direct government contracts.

2. Build Relationships and Network: Attend local government contracting events, SBIR/STTR workshops, and industry days. Maryland APEX Accelerator and TEDCO regularly host training and matchmaking events.

3. Get Certified and Registered: Register as a small business, women-owned, minority-owned, or veteran-owned business if eligible—these certifications can open set-aside contract opportunities.

4. Focus on Compliance and Security: For cybersecurity and defense, ensure your company meets federal security standards (such as NIST 800-171 or CMMC for DoD contracts).

5. Leverage Local Support: Use Maryland’s free counseling, proposal review, and bid-matching services to improve your proposals and find the right opportunities.

6. Start Small, Scale Up: Begin with smaller contracts or Phase I SBIR/STTR awards to build a track record, then pursue larger Phase II/III awards or direct procurement.

7. Highlight Maryland’s Ecosystem in Your Proposals: Federal reviewers value proximity to agencies, access to top research universities, and Maryland’s innovation infrastructure—emphasize these strengths in your applications.

Additional Non-Dilutive Funding and Support Programs in Maryland

TEDCO Seed Funds and Tech Commercialization Grants: Early-stage funding for tech startups.

Maryland Industrial Partnerships (MIPS): Grants for university-industry R&D collaborations.

Maryland Entrepreneur Hub: Centralized resource for all state and local funding programs.

Maryland Small Business Development Financing Authority (MSBDFA): Financing for minority- and women-owned businesses.

Networking and Community: Key Events and Resources for Maryland Founders

Top Startup Events, Accelerators, and Meetups in Maryland

Startup Grind Maryland: Startup Grind Maryland is one of the state’s most active entrepreneurial communities, hosting monthly events, fireside chats, and workshops that connect founders, investors, and mentors. Their annual Accelerator Demo Day, in partnership with BWTech and FounderTrac, is a must-attend for startups looking to pitch to investors and join a global network.

Maryland Entrepreneur Hub Events: The Maryland Entrepreneur Hub curates a comprehensive calendar of local startup events, pitch competitions, workshops, and meetups across the state. This is a go-to resource for discovering both in-person and virtual opportunities to connect with the Maryland startup ecosystem.

Accelerate Investor Conference (Arlington, VA): While technically in Virginia, this annual conference (November 5-6, 2025) is a major regional event for Maryland founders, attracting VCs, angel investors, and corporate partners from the entire DC-Maryland-Virginia (DMV) area.

Local Meetups and Pitch Nights: Regular meetups, such as those organized by Startup Grind, TEDCO, and local coworking spaces, offer founders the chance to network informally, share experiences, and find collaborators. Many of these events are listed on the Maryland Entrepreneur Hub and Eventbrite.

TEDCO’s Entrepreneur Expo: TEDCO, Maryland’s leading innovation agency, hosts an annual Entrepreneur Expo that brings together hundreds of founders, investors, and ecosystem partners for a day of networking, panels, and pitch competitions.

Maryland APEX Accelerator Workshops: For founders interested in government contracting, the Maryland APEX Accelerator (formerly PTAC) offers free workshops and matchmaking events to help startups connect with procurement officers and other small businesses.

How to Leverage These Events and Resources for Fundraising and Growth

Build Investor Relationships Early: Attend pitch nights, demo days, and investor panels not just to pitch, but to start building relationships with VCs and angels. Investors often fund founders they know and trust, so regular presence at these events increases your visibility and credibility.

Refine Your Pitch and Get Feedback: Use pitch competitions and accelerator demo days to practice and refine your pitch. The feedback from judges and peers is invaluable for improving your fundraising materials and approach.

Expand Your Network: Meetups and workshops are ideal for finding co-founders, advisors, and early hires. Don’t just focus on investors—building a strong support network is key to long-term growth.

Stay on Top of Trends and Opportunities: Conferences and expos feature panels on the latest industry trends, regulatory changes, and funding opportunities. Attending these sessions can help you spot new markets and adapt your strategy.

Access Non-Dilutive Funding and Support: Many events, especially those run by TEDCO and Maryland APEX Accelerator, offer information on grants, government contracts, and other non-dilutive funding sources. Take advantage of these resources to diversify your funding strategy.

Follow Up and Nurture Connections: After each event, promptly follow up with new contacts on LinkedIn or via email. Personalized follow-ups can turn a brief meeting into a lasting partnership or investment opportunity.

Join Accelerator and Incubator Programs: Accelerators like the Maryland Startup Accelerator and sector-specific programs in Baltimore provide structured mentorship, access to investors, and a community of peers—all of which can accelerate your fundraising and growth.

Connect With Investors in Maryland Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Maryland's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

investors

Metrics and data

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?

Everyone from Emerging Managers writing their first checks to established VC firms ask this question because they want to make sure they're monitoring their portfolio companies in the most effective way possible.

The Standard Metrics Value-Add Investors Should be Monitoring

It’s important to know which metrics are the best to collect from portfolio companies so that investors can extract the maximum amount of insight from the least number of metrics. This streamlined approach is easiest for founders and allows investors to get what they need to provide better support to their companies, inform future investment decisions, and have good records in place for LP reporting or fundraising.

Below we outline the six most common metrics investors collect from portfolio companies.

1) Revenue

Definition: Money generated from normal business operations for the reporting period; also known as ‘net sales’. We recommend excluding ‘other revenue’ from secondary activities and excluding cash from fundraising.

Revenue tells you how a company’s sales are performing.

This metric is a key indicator for how a business is doing. It can be analyzed to understand if new marketing strategies are working, how a change in pricing might affect the demand for a good or service, and the pace of growth in a market.

By asking for revenue from just ‘normal business operations’ you’re excluding money a company could also be making from secondary activities that are non-integral to their business. This helps keep the revenue data more precise, allows you to compare the metric more accurately across the portfolio, and will allow you to use it more accurately in other metric formulas such as Net Income.

Visible helps over 400+ VCs streamline the way they collect data from companies with Requests. Check out a Request example below.

2) Cash Balance

Definition: The amount of cash a company has in the bank at the end of a reporting period.

Cash Balance is an important indicator of ‘life expectancy’.

This metric is essential to track because it tells you about the financial stability and risk level of the company. There’s no bluffing with this Cash Balance metric. A company either has a healthy amount of cash in the bank at the end of its reporting or they don’t. Cash balance also gives you an idea of how soon a company will need to kick off its next round of financing.

3) Monthly Net Burn

Definition: The rate at which a company uses money taking income into account. The monthly burn rate will be positive for companies that are not yet profitable and negative for companies that are considered profitable. Net burn is usually reported as monthly and calculated by subtracting a company’s ending cash balance from its starting cash balance and dividing that by the number of months for the period. We recommend collecting this metric from companies on a quarterly basis but still asking for the monthly rate — this helps rule out any one-off variability.

Monthly Net Burn = (Starting cash balance – ending cash balance) / months

Monthly Net Burn is an indicator of operational efficiency.

This metric becomes even more relevant during market downturns when the focus shifts from growth at all costs to growth with operational efficiency. This is a good metric to benchmark and compare across all companies in your portfolio.

You can also use this metric to calculate a key metric, Cash Runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

4) Cash Runway

Definition: Cash runway is the number of months a business can survive before it runs out of cash. It can be calculated as:

Runway = Cash Balance / Monthly Net Burn

Cash runway tells you when a company will run out of cash.

This metric is essential because it determines when a company needs to kick off their next fundraising process, usually, it’s when they have 6-8 months of runway left. If you see one of your companies hit a cash runway of six months or less, you should be reaching out to see if they need support or guidance on their fundraising efforts.

While Runway is definitely considered a key metric, you don’t need to ask your companies for it since it can be calculated easily with other data you should already have on hand (Cash Balance & Monthly Net Burn Rate).

5) Net Income

Definition: Net income is a company’s total earnings (or profit) after all expenses have been subtracted. It is calculated by taking a company’s revenue and subtracting all expenses, including operational expenses, interest expenses, income taxes, and depreciation and amortization.

Net Income = Revenue – Total Expenses

Net Income is an indicator of profitability.

If net income is positive, meaning revenue is greater than a company’s total expenses, it is considered profitable. This is a metric that startups should have readily available since it’s the ‘bottom line’ of an Income Statement, making it very easy to report.

This metric can also be used in a formula to calculate Net Profit Margin, total expenses, and cash runway.

6) Total Headcount

This is the total number of full-time equivalent employees excluding contractors. Contractors are excluded because of the variability of the nature of contract work — a contractor may only work a few hours a month or they could work 20 hours per week. This variability will cause back-and-forth clarification between you and your companies which wastes time.

This metric gives you insight into company growth and operational changes.

This metric is important to track because it’s a reflection of decisions made by the leadership team. If there’s an increase in headcount, the leadership is investing in future growth, on the other side, if there’s a major decrease in total headcount it could be because the leadership team has decided to reduce burn by letting people go or employees are churning. All are post-signs of operational changes worth paying attention to.

Check out an Example Request in Visible.

Suggested Qualitative Questions to Ask Your Companies

While metrics are the best way to aggregate and compare insights across your portfolio, you may also be wondering which qualitative questions you should ask portfolio companies as well. Qualitative prompts can be a concise and valuable way for startups to share more narrative updates on company performance with their investors.

Below we outline the two most common qualitative questions investors ask portfolio companies as well as suggested descriptions.

1) Recent Updates & Wins

Description: Please use bullet points and share updates related to Sales, Product, Team, and Fundraising. This will be used for internal reporting and may also be shared with our Limited Partners.

We suggest asking companies for bullet points on these four categories because it’s a focused way for investors to understand the narrative context behind a company’s metrics.

With your companies’ permission, this narrative update can also serve as the foundation for your tear sheets for your LP reporting and your internal reporting.

2) Asks

Description: How can we best support you this quarter?

You can make your reporting processes more valuable for your portfolio companies by asking your companies if there are specific ways you can provide support to them in the next quarter.

Once you have responses from your portfolio companies, you can take action on their requests and you’ll be able to extract support themes to inform the way you provide scalable portfolio support.

Monitor Your Portfolio Companies Seamlessly With Visible

It’s important to know which are the most important metrics to collect to ensure your portfolio data collection processes are streamlined and valuable both for you and your companies. In this article, we highlighted Revenue, Net Income, Cash Balance, Runway, Net Burn Rate, and Total Headcount as the top metrics to collect from all your portfolio companies. With Visible, its also easy to ask for any custom metric and assign it just to specific companies.

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Book some time with our team to learn how Visible can automate your portfolio monitoring processes.

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform used by over 400+ VCs.

investors

Metrics and data

Portfolio Data Collection Tips for VCs

Getting regular, high-quality, and actionable data from portfolio companies is important. It allows investors to make better investment decisions, provide better support to companies, and share meaningful insights internally across the firm and with LPs.

This practice should also be highly valuable for founders. They should be able to share wins and challenges and seek support from their investors. The reporting process should only take companies 3 minutes to complete (if not, something may be wrong with how the investor is asking for structured data or the reporting company may not be as familiar with their key metrics as they should be).

Below are some best practices to make sure you get:

High response rates from companies

Structured data (comparing apples to apples)

Actionable insights

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

Set Reporting Expectations Early On

✔️ Tip: Set expectations during the onboarding process (if not sooner)

It’s way easier to set reporting expectations with companies early on (and with fewer companies) rather than changing your reporting requirements a few years into your relationship with portfolio companies.

Some investors choose to outline their reporting expectations in a side letter as a part of the investment documents.

It's recommended that investors also have a dedicated conversation around reporting expectations during the onboarding process.

Related Resource: A Guide to Onboarding New Companies to Your VC Firm

When and How Often to Collect Portfolio Data

✔️ Tip: Collect data at a predictable frequency

Set the expectation that you will be sending a Request for company data the same time every reporting cycle. Visible has data that shows that Mondays are great due dates and if you’re sending out quarterly Requests for data, we suggest giving your companies 2-4 weeks after quarter close to get their information back to you.

Don’t randomly switch between the 10th, the 30th, etc. This makes it difficult for founders to prioritize your reporting requirements and gives the impression that your due dates don’t really matter.

Visible makes scheduling data Requests and subsequent reminders a breeze for investors. Investors can select the due date, email notification dates, and customize the messages that will get sent out to portfolio companies.

✔️ Tip: Collect data at an appropriate frequency

We recommend the following cadences. This is 100% customizable as every fund is different.

Weekly – Companies in an accelerator program

Monthly – Pre-seed investments

Quarterly – Pre-seed, Seed, Series A, Series B + investments

What Data to Collect from Portfolio Companies

✔️ Tip: Less is more

Don’t send a Request asking for ‘nice to have’ metrics. Only ask for the information you really need and are going to use. We suggest starting small, getting a rhythm, and expanding the data as needed.

Metrics

✔️ Tip: Ask for only 5-15 metrics

Depending on how closely you work with companies, ask for 5-15 metrics and no more. If you’re not taking actionable next steps based on a metric (ex: reporting to LP’s, providing more hands-on support, informing investment decisions) then it's likely you don't need to be asking for it.

The most common metrics investors ask for include:

Revenue

Cash Balance

Cash Burn

Headcount

Runway

Related resource: Which Metrics Should I Be Collecting from Portfolio Companies

View examples of data Requests in Visible.

✔️ Tip: Use a metric description to reduce back-and-forth

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or the current month? Should it include financing? Be descriptive about what you want.

Qualitative Questions to Ask Portfolio Companies

✔️ Tip: Define what type of information you're looking for

As an investor, it's a great idea to give companies the opportunity to share support requests on a regular basis. Consider including a description to clarify what type of support your firm can provide companies.

Additionally, most investors also ask for companies to report narrative highlights and lowlights from the question. It's important to clarify what type of information you're actually looking for so companies are not wasting time sharing information an investor is not actually going to use.

Implementing a Portfolio Monitoring Platform

✔️ Tip: Notify your companies two weeks in advance

Introducing Your Companies to Visible

As the most founder-friendly solution on the market, we ensure that requesting data is a frictionless process for founders. This means founders don’t need to create an account in order for Investors to get value out of the platform (ie: No log-in required!).

Still, it's a great idea to give your companies notice about the adoption of Visible so they can keep an eye out for the first Request that will land in their inbox.

Feel free to use our Intro Copy Template to notify your companies about the adoption of Visible two weeks in advance of your first Request deadline.

Customize Your Domain

Investors can white-label the automatic emails that are sent from Visible so that the emails use their firm's domain. You can also customize the sender address to anyone at your firm.

Visible's Customer Support

All Visible customers get world-class support and a dedicated Investor Success Manager. We provide an efficient, hands-on onboarding experience, training for new team members, and support on an ongoing basis.

Visible is trusted by over 350+ VC funds around the world to help streamline their portfolio monitoring and reporting.

founders

Fundraising

From Seed to Scale: The Best Venture Capital Firms in New Jersey

New Jersey is rapidly emerging as a powerhouse for venture capital and startup innovation, offering a unique blend of strategic location, industry expertise, and a thriving entrepreneurial ecosystem. With its proximity to major financial centers like New York City and Philadelphia, New Jersey offers startups unparalleled access to investors, talent, and resources while maintaining a lower cost of operation compared to its neighboring states.

In this article, we’ll explore the top venture capital firms in New Jersey, along with other helpful resources for startups looking to take advantage of all that the city has to offer.

Top VCs in New Jersey

Edison Partners

About: Edison Partners is a growth equity firm that focuses on technology-enabled solutions in fintech, healthcare IT, and enterprise software.

Sweetspot check size: $ 10M

Newark Venture Partners

About: Newark Venture Partners is an early stage venture fund based in Newark, NJ.

Sweetspot check size: $ 2M

76ers Innovation Lab

About: The Sixers Innovation Lab supports rapidly growing, early-stage companies in the consumer product space and provides speed and flexibility, individualized, industry-leading consulting and investment opportunities to startups with potential. Selected companies receive access to industry experts, executives, and financiers, and third-party branding, marketing and legal services. Entrepreneur Seth Berger, Founder and former CEO of AND 1, an American footwear and clothing company, manages the Lab. For more information or to apply go to SixersInnovationLab.com

Johnson & Johnson Development Corporation

About: Backs ideas in pharmaceuticals, consumer and medical devices sectors, focusing on therapeutic areas having the greatest potential to improve the lives of patients and consumers.

Thesis: Johnson & Johnson Development Corporation, a venture capital subsidiary, finances technology companies focused on patient health.

Foundation Venture Capital Group

About: Foundation Venture Capital Group uses impact investing to provide pre-seed and seed funding to health-related start-up companies at Affiliated Organizations to help them advance toward and through commercialization. Our investments are made with the intention to generate positive, measurable social impact with any gains realized from the investments reinvested into furthering research and innovation at our Affiliated Organizations.

Jumpstart New Jersey Angel Network

About: JumpStart NJ invests in the Mid-Atlantic region, and beyond, with about a third of the investments in New Jersey-based ventures. JumpStart NJ members have diverse investment interests and preferences.

Thesis: Areas of interest include, but are not limited to- SaaS B2B, HealthTech, AgroTech, Medical Devices, Manufacturing, Alternative Energy, Shipping/Logistics Tech, Cybersecurity, Consumer Packaged Goods. Members have deep knowledge and experience in many areas; they invest not only their dollars but their expertise in helping young companies grow.

Creative Edge Ventures

About: Highly selective, early-stage deep-tech investments.

Honeywell Ventures

About: Honeywell is a Fortune 100 software-industrial company that delivers industry specific solutions

Syven Capital LP

About: Leveraging years of real-world operating experience, Syven Capital provides technology-driven companies with the growth capital, operational support, and strategic advice they need to realize sustainable, long-term growth.

Tech Council Ventures

About: Tech Council Ventures is a venture fund investing in early and expansion stage companies across all industries in the US Mid-Atlantic region. The fund invests $500K to $3M initially and provides additional support throughout the growth of the business. Tech Council Ventures’ principals all have 20+ years investing and building promising, rapid growth companies. The fund is affiliated with one of the largest and most active technology councils in the US, TechUnited:NJ, providing for its portfolio investments an unmatched network of customer, key team recruits, business partner and service provider connections.

Why New Jersey is a Thriving Hub for Startups

New Jersey’s strategic location, industry expertise, and supportive infrastructure make it an ideal environment for startups to thrive. With increasing investment in innovation and a focus on emerging technologies, the state is poised to remain a key player in the entrepreneurial landscape. Here’s why the Garden State is becoming a go-to destination for entrepreneurs:

Proximity to Major Financial Centers

New Jersey’s location is one of its greatest assets. Situated between New York City and Philadelphia, the state provides startups with unparalleled access to two of the largest financial and business hubs in the United States. This proximity allows entrepreneurs to tap into a vast network of investors, clients, and talent pools while benefiting from lower operational costs compared to these metropolitan areas.

Key Industries Driving Innovation

New Jersey’s startup ecosystem is particularly strong in several high-growth industries:

Biotech and Life Sciences: Home to major pharmaceutical companies like Johnson & Johnson and Merck, New Jersey has a well-established biotech and life sciences sector. The state also supports startups through initiatives like the Institute of Life Science Incubator at NJIT.

Fintech: With its proximity to Wall Street, New Jersey has become a hub for fintech innovation, supported by events like the New Jersey Big Data Alliance Symposium.

Healthcare and MedTech: The state’s focus on healthcare innovation is evident through programs like the NJEDA’s support for health-related startups.

SaaS and Technology: Cities like Newark and Princeton are emerging as tech hubs, with startups focusing on software solutions and AI-driven technologies.

Resource: A full list of Startup Incubators In New Jersey

Recent Trends in Startup Funding

New Jersey has seen a significant increase in startup funding, particularly in early-stage investments:

Seed and Series A Funding Growth: The state has attracted substantial venture capital, with firms like Edison Partners and Newark Venture Partners leading the way. These firms focus on early-stage and growth-stage companies, providing both funding and mentorship.

Government Support: The New Jersey Economic Development Authority (NJEDA) has launched several programs to support startups, including the Innovation Evergreen Fund and tax incentives for early-stage companies.

AI and Emerging Technologies: The launch of the NJ AI Hub in 2025 has positioned the state as a leader in artificial intelligence, attracting startups and investors in this cutting-edge field.

A Supportive Ecosystem

New Jersey’s startup ecosystem is bolstered by a network of accelerators, incubators, and co-working spaces:

Accelerators and Incubators: Programs like TechLaunch and Tigerlabs provide mentorship, funding, and networking opportunities for early-stage startups.

University Partnerships: Institutions like Princeton University and Rutgers University play a critical role in fostering innovation through research and technology transfer programs.

Networking Opportunities: Events like the NJEDA Founders & Funders All-Stars provide platforms for startups to connect with investors and industry leaders.

Resources for Startups in New Jersey

New Jersey offers diverse resources to support startup founders, from incubators and accelerators to co-working spaces and government-backed programs. These resources are designed to help entrepreneurs access funding, mentorship, and networking opportunities to grow their businesses.

Incubators and Accelerators

Incubators and accelerators in New Jersey provide startups with structured programs, mentorship, and access to funding. Here are some additional examples:

Merck Digital Sciences Studio (Newark): This accelerator supports startups in digital biopharma and drug discovery. It offers a 10-month program with direct funding and mentorship from industry leaders.

Rowan University’s Rohrer College of Business Incubator (Glassboro): This incubator focuses on early-stage ventures, offering office space, mentoring, and workshops to help startups refine their business models and scale.CleanTech Open Northeast: A five-month accelerator program for startups in clean energy and environmental technology. Participants receive funding, mentorship, and access to a large network of cleantech hubs.

Government and Nonprofit Support

New Jersey’s government and nonprofit organizations provide extensive support to startups through funding, mentorship, and other resources. Here are some additional programs and initiatives:

NJ Ignite: A program by the NJEDA that provides rent support grants for startups working in approved co-working spaces and incubators. This initiative helps reduce the financial burden of office space for early-stage companies.

AI Innovation Challenge: A grant program launched by the NJEDA to support startups in artificial intelligence. This initiative aims to position New Jersey as a leader in AI innovation.

Strategic Innovation Centers (SICs): These centers, developed in partnership with organizations like Nokia Bell Labs, provide physical spaces for startups to collaborate and innovate. SICs focus on fostering long-term economic growth through innovation.

New Jersey Business Action Center (NJBAC): NJBAC offers free, confidential assistance to startups, including help with navigating state regulations, accessing funding, and connecting with local resources.

CSIT Catalyst Seed Grant Program: Administered by the New Jersey Commission on Science, Innovation, and Technology, this program provides grants to startups in research and development, clean technology, and other innovative fields.

Connect With Investors in New Jersey Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of New Jersey's investors here.

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

investors

Customer Stories

Case Study: How Moxxie Ventures Uses Visible to Increase Operational Efficiency at Their VC Firm

About Moxxie

Moxxie was founded in 2019 by former Twitter executive Katie Stanton. Prior to starting Moxxie Katie worked at Google, in the Obama administration as a Special Advisor to the Office of Innovation, and co-founded the angel group #Angels. In 2021, Katie brought on Alex Roetter, whom she had worked with before at both Twitter and Google, as an equal partner in Moxxie’s second fund of $85M. Alex joined Moxxie with a wealth of operational and engineering experience from previously serving as the Senior VP of engineering at Twitter for 6 years as well as working as a software engineer at Google and various other early-stage startups.

Today, Moxxie has invested in over 60+ seed-stage companies in the consumer, enterprise, fintech, health tech, and climate sectors. The team at Moxxie is differentiated by their operational experience and focus on underrepresented founders. According to an article published in Forbes, out of the 27 investments from Moxxie’s first fund, 36% were founded by women, 40% by people of color, 8% by Black founders and 43% by immigrant founders. Learn more about Moxxie.

This Case Study was put together in collaboration with Alex Roetter, Managing Director and General Partner at Moxxie.

What Moxxie was doing prior to using Visible

In the early days at Moxxie, the team used a combination of check-in calls at varying frequencies, ad-hoc meetings, and texts to gather updates from their companies. Later on, they created a Google Group email alias where founders sent their updates so the communications were all stored in one inbox. The Moxxie team kept a summary of each company in a combined Google Document that was updated irregularly.

The portfolio monitoring challenges Moxxie was facing

The main issue with Moxxie’s ad-hoc method was that “...it was just all very manual. It was a mish-mash of documents and hard to maintain. We were inconsistent in how up-to-date we were on different companies,” shared Alex, Moxxie’s Managing Director. The manual effort required to stay on top of portfolio companies meant portfolio monitoring was “...falling to the wayside and we were not doing as good of a job [monitoring our companies] as we needed to be.”

“...it was just all very manual. It was a mish-mash of documents and hard to maintain. We were inconsistent in how up-to-date we were on different companies."

It’s common for investors to feel overwhelmed as they attempt to manually keep up to date on a growing number of portfolio companies despite recognizing the benefits of doing so.

Alex emphasized that the main reason Moxxie wanted to improve their portfolio monitoring was to ensure they were spending their time most effectively at their firm. It was hard to identify which companies needed their support and where Moxxie's time would be most valuably spent “...without having a regular heartbeat from [their] portfolio companies.”

The reasons Moxxie chose Visible

Moxxie’s founder Katie Stanton was told to check out Visible’s KPI tracking capabilities at the end of 2022 while she was attending the Equity Summit, an invitation-only gathering that brings together thought-leading LPs and GPs that drive industry change.

Alex from Moxxie reached out to Visible soon after the initial referral to schedule a demo. The demo confirmed that the Visible platform had exactly what Alex was looking for in a portfolio KPI tracking tool.

Moxxie's portfolio monitoring criteria included:

An automated way to send structured data requests to portfolio companies

A solution that wasn’t taxing on their founders

Allowed founders to share their data within seconds

Ability to see all their portfolio data in one clear place

Ability to easily build Tear Sheets for each company

Moxxie's onboarding experience with Visible

Moxxie’s onboarding took approximately 9 days to complete. When asked to share feedback on Visible’s onboarding process Alex shared “Everything was great. Whenever we had bulk data in a CSV that needed to be uploaded we shared it with Visible and it was uploaded within 24 hours.”

Check out additional Visible reviews on G2.

How Moxxie is leveraging Visible to streamline portfolio monitoring and reporting processes today

Today Moxxie doesn’t have to remember to check in with their companies or make guesses about their companies’ recent progress updates. Instead, Visible has enabled Moxxie to send automatic, recurring, structured data requests to their companies that can be completed without their founders ever having to log in or create an account. The Moxxie team is immediately notified when companies complete data Requests. From there, they are able to easily identify which companies need more support. This streamlined, founder-friendly process ensures the Moxxie team can continue to spend time on high-value fund operations, such as deal flow, while also efficiently monitoring and supporting current portfolio companies.

Taking a closer look at Moxxie’s use of the Visible platform, the team primarily uses four main features on Visible: Requests, Tear Sheets, Reports, and Updates.

Requests: Streamlining Moxxie’s portfolio KPI data collection process

Moxxie uses Visible’s Request feature to collect 5 metrics from companies on a regular basis. The firm collects data from early-stage companies on a monthly basis and on a quarterly basis for more mature companies in their portfolio.

The five metrics Moxxie collects include:

Revenue

Runway

Cash Spend

Cash Balance

Headcount

Moxxie also includes a qualitative text block in their Request that provides companies with an opportunity to add additional context to their metrics, share any additional updates, or ask Moxxie for support on specific items.

Alex shared that likes that the Visible platform sends him a notification each time a company submits a Request. He uses this as an opportunity to quickly identify any changes to the company’s performance. Alex shared “...anytime there’s something unexpected it’s a reminder to check in with the company.”

Reports: Building a custom investment data report before an annual meeting

Another key feature that Moxxie is utilizing is Visible’s report feature which allows Moxxie to pull together select metrics and investment data into a single table view. Moxxie has a fund summary for both Fund I and Fund II that includes: initial ownership %, total invested, total invested from a specific fund, and the initial valuation for each company.

Moxxie initially created this report to prepare for an annual meeting with LPs. They wanted to see the numbers across all their portfolio companies, be able to download the figures, and then compute averages.

Tear Sheets: Creating a clear overview of individual company performance

Moxxie utilizes Visible’s dashboard templates to create custom Tear Sheets for each of their companies. Moxxie’s Tear Sheets incorporate elements of their original investment memo coupled with dynamic metrics and qualitative updates that change over time.

Integrating company properties into Tear Sheets

The static information in Moxxie's Tear Sheets is pulled directly from companies' profiles in Visible.

The information that Moxxie includes in their Tear Sheets are:

Company website url

Latest valuation

Co-investors

Founders

Company summary

Why we invested

Status

Deal source

Initial ownership

Initial valuation

Investment date

Total invested

Sector

HQ location

Year founded

Integrated dynamic charts into Tear Sheets

Moxxie also incorporates data visualizations into their Tear Sheets which are automatically updated as companies submit new information to Visible. The dynamic information Moxxie includes in Tear sheets is:

Monthly KPI’s in a bar chart

Runway vs Headcount in a bar chart

Monthly spend vs cash balance in a bar chart

Revenue forecast vs actual in a bar chart

Update/progress since investment in a text widget

Key metrics in a text widget

Company-specific metrics in a text widget

View Tear Sheet examples from Visible.

Updates: Communicating portfolio performance with LPs on a quarterly basis

Moxxie also leverages Visible’s Updates feature to send outbound communication to their LPs and the wider Moxxie community on a quarterly basis. The firm uses Visible’s Update feature instead of its previous Google Group as a way to consolidate its tech stack. Alex shares that he finds the open rates and viewing analytics helpful so he can understand how LPs are engaging with their regular communications.

Conclusion

Moxxie chose to move forward with Visible’s founder-friendly portfolio monitoring solution after hearing about Visible’s KPI tracking capabilities through a credible referral. By adopting Visible, Moxxie’s ad-hoc, manual portfolio monitoring processes have been transformed into a streamlined cadence for collecting structured updates from their companies. The firm previously stored outdated company summaries in Google Documents and now the Moxxie team leverages neatly organized Tear Sheets that auto-update when companies share new information.

Over 400+ VC firms are using Visible to streamline their portfolio monitoring and reporting process.

founders

Fundraising

Melbourne's Top Venture Capital Firms: Your Guide to Funding and Resources