If your portfolio data is patched together in an excel file with questionable version control or is buried in a slide deck prepared six months ago, your team is likely missing the opportunity to take action on important portfolio insights.

Up-to-date, accurate portfolio insights help venture capital investors:

- Provide better portfolio support

- Make data-driven investment decisions

- Validate markups and markdowns during evaluation exercises or an audit

- Demonstrate traction to LPs while fundraising for future funds

…but only if the insights are accessible.

Visible’s dashboards help venture capital investors visualize and explain the journey companies are on in a way that actually resonates.

Learn more about leveraging dashboards in Visible.

About the Guide

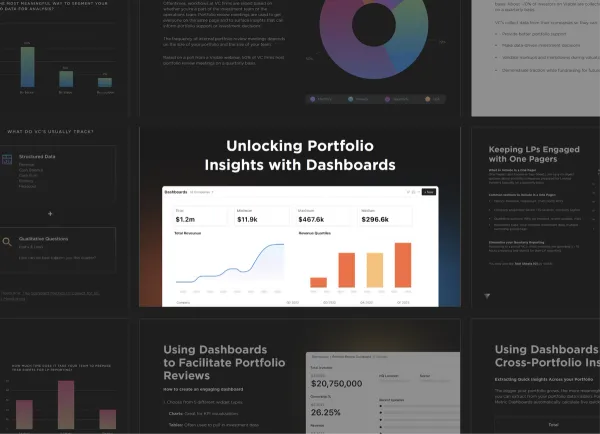

This guide demonstrates how venture capital investors can turn their portfolio data into actionable, accessible insights. The guide also includes examples of three different flexible dashboard types in Visible.

Topics covered include:

- Portfolio data collection best practices

- Creating dashboards for internal portfolio reviews (Flexible dashboards)

- Identifying cross-portfolio insights (Portfolio metric dashboards)

- Sharing portfolio insights with Limited Partners (One pagers)

Visible has helped over 350+ venture capital funds streamline the way they collect, analyze, and report on core metrics from their portfolio companies on a regular basis.