Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Product Updates

A Refreshed Look

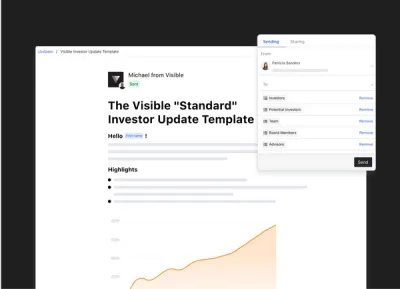

We last updated our brand identity in October 2020. Since then, Visible founders have gone from sending 8,000 investor updates per month to over 75,000 — we also launched Visible Pitch Decks and Data Rooms.

We’ve learned first hand that building a startup is difficult. Most founders take a major risk to invest their time, money, and careers to build something. At Visible, we want to better celebrate the thousands of founders doing the difficult. We’ve been on the sidelines watching these founders grow while our own team, product, and organization has grown.

In order to reflect these efforts, we are excited to roll out our new brand direction that supports this new phase for Visible

Putting Visible Founders First

In order to put founders first with everything we do at Visible, we wanted to showcase their individual stories and experiences across our marketing efforts. You will notice individual founder headshots, stories, and quotes across the website.

Data and Stories to Help the Next Set of Founders

Thousands of founders use Visible every month to update their current investors, share their pitch decks, build their data rooms, and manage their fundraising efforts. In order to help the next generation of founders using Visible, we want to highlight the first-hand data and best practices we’ve uncovered.

Color, Gradients, and a New Font to Bring Life to Our Brand

While difficult, building a startup should be lively. In order to better recognize the highs of building a startup and align with our guiding principles we wanted to refresh our brand.

Logo

Our logo is staying and is the anchor to our brand. The Visible logomark is made from 3 overlapping, equilateral triangles. Each triangle is slightly transparent, allowing the mark to interact with other design elements. These triangles represent human relationships and the connection between founders and investors.

Brighter colors & gradients

Our black isn’t going away either, but are using the same color palette from our application to bridge the gap between our product and brand. You will see brighter, more vibrant colors in our product screens to bring those metrics to life. We have also added gradients across our website to enhance some elements like our product screens and call attention to our informational graphs.

Bridging the Product & Go to Market Gap

We wanted to bring the same sleek and modern feel from our product to our marketing efforts. In order to do so we’ve changed our serif font to a san serif font. Across our website, you will notice product screens that show our product in a more realistic approach.

investors

Reporting

[Webinar Recording] VC Portfolio Data Collection Best Practices

Collecting updates from portfolio companies on a regular basis is an important part of running smooth operations at a VC firm. Well-organized, accurate, up-to-date portfolio data helps investors provide better support to companies, make data-informed investment decisions, streamline the audit process, demonstrate credibility during the fundraising process, and more.

However, collecting data from portfolio companies on a regular basis can also be a time-consuming, arduous process, especially if you’re not implementing best practices.

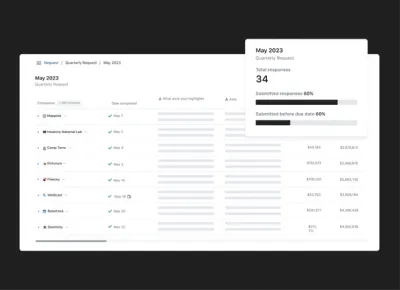

On Tuesday, June 20th Visible held a product webinar covering tips for streamlining the reporting process for you and your portfolio companies.

This webinar is designed for any VC looking to upskill their portfolio monitoring processes. Current Visible customers will benefit from a deep dive into recent product updates related to Visible’s Request feature.

Topics Discussed:

The top 6 most common metrics to collect from companies

How to collect budgets and actuals in Visible

Using formulas so you can ask for less data

[Product Walk-through] Highlighting recent product updates

Reviewing examples of different types of Portfolio requests

investors

Customer Stories

Reporting

Case Study: How Render Capital Uses Visible to Streamline Fund Reporting

Render Capital is a $30M early-stage VC fund with offices in Kentucky and Indiana. Led by Patrick Henshaw, Render has invested in 50+ companies as a part of its mission to create a robust and thriving regional economy where entrepreneurs see the Midwest and South as a place they can find appropriate risk capital necessary for them to start and grow.

For this case study, Visible interviewed Render Capital’s Operating Partner Mike Shepard.

Customer Story: How Render Capital Uses Visible to Streamline Fund Reporting

Watch the video below to learn why Render chose Visible to streamline their portfolio monitoring and reporting processes.

Prefer to read? Keep scrolling to read a paraphrased summary of Mike’s responses.

Q: How were you collecting data prior to using Visible?

Prior to Visible, Render was doing very little to collect data from companies because it was too time-consuming to do it via email and the process wasn’t very organized.

Q: What factors led you to choosing Visible?

We looked at other software to help with our fund management and the options seemed cumbersome, the relationships were tricky, and it seemed like it was actually going to be more work. I wanted to find a solution that let me pair our fund management alongside our own metrics so we could do our own reporting by creating dashboards and sharing those with LPs. We also liked that Visible helped collect reporting from our companies on a regular basis.

Q: What was the onboarding with Visible like?

I filled out a spreadsheet with our company and investment data. I prefer to be hands-on so the next step was just figuring out how to set up my own LP Update templates and reports. Visible was available to answer all my questions and the team was open to our feedback.

“It feels like we’re your only customer which is what you’re supposed to do.”

– Mike Shephard, Operating Partner at Render Capital

Q: What has been the result of using Visible

The results have been great. I created an LP Update template which we consider a marketing extension of our brand. To get this to look nice outside of Visible, in Excel, would have taken me a lot of time. I can use the template I created in Visible over and over again and it automatically updates. Our LPs are also really happy with the direction of our reporting and what we’re producing. We are getting our LPs the information that they want and need in a format that they can easily digest.

Over 350+ VC funds are using Visible to streamline their portfolio monitoring and reporting.

investors

Metrics and data

Customer Stories

Case Study: How The Artemis Fund Uses Visible to Create Annual Impact Reports

About The Artemis Fund

The Artemis Fund is on a mission to diversify the face of wealth. Founded in 2019 in Houston Texas, the firm is led by General Partners Diana Murakhovskaya, Leslie Goldman, and Stephanie Campbell. Their team of five invests at the seed stage and leverages their conviction that the future of financial services and commerce will be written by diverse entrepreneurs. The Artemis Fund has invested in 20 disruptive fintech, e-commerce tech, and care-tech companies founded and led by women.

The Artemis Fund joined Visible in April 2021 with the primary objective of streamlining the way they collect both core financial metrics and impact metrics from their growing portfolio. For two years in a row now, The Artemis Fund has turned their metrics into a data-driven impact report using Visible’s portfolio monitoring tools.

Unexpected Benefits of Creating Impact Reports

Juliette Richert from The Artemis Fund shared the objective of their impact reports has broadened over time — reaping more benefits than they originally intended.

Impact is integral to The Artemis Fund’s investment thesis so there was always a desire to measure their impact; however, the primary objective of publishing their first impact report in 2021 was for fundraising from future LPs. Needing data to back up the narrative of your portfolio’s performance to LP’s is something we commonly hear from investors using Visible.

Over time, the team at Artemis realized the companies they were investing in were having an outsized impact on the communities they are serving. Juliette shared their “portfolio companies are very focused on their end users.” The Artemis team worked with their founders to identify which impact metrics are most integral to their businesses and then Artemis began tracking them using Visible’s portfolio monitoring tools. This larger ripple effect is a major driver behind Artemis’ work and so the team was excited to have actual metrics to back up their investment strategy.

The Artemis Fund’s 2022 impact report clearly communciates their thesis and the narrative behind their portfolio companies’ performance, both of which are made more compelling because they’re backed up by data.

This year they distributed their impact report to their wider network. The unexpected result was that it has become a valuable marketing tool for their fund for not just potential investors but it’s helped attract more founders to their deal pipeline as well. Artemis’ report clearly demonstrates that they’re not just paying lip service to investing and supporting female founders — they’re actually executing against their values and have the data to prove it.

“Using Visible streamlines the way we collect and digest metrics, helping us understand the health of our portfolio and address potential issues proactively.”

— Juliette Richert, The Artemis Fund

Choosing Which Impact Metrics to Track

The first step of creating Artemis’ Impact Report was choosing which metrics to track from their portfolio companies and setting up a data Request in Visible.

Check out an Example Portfolio Data Request in Visible.

The Artemis Fund created 35+ custom metrics in Visible, some of which were collected from all companies, and the rest were assigned to specific companies based on the business model or sector.

Headcount Metrics

Artemis collects these metrics from all companies on an annual basis.

FTE Headcount

PTE/Contractor Headcount

Diverse Headcount #

Female Headcount #

Custom Impact Metrics

Artemis assigns these metrics to specific companies in VIsible and collects them on an annual basis. The list below is not comprehensive.

CO2 Saved (Assigned to portfolio company DressX)

Families Served (Assigned to portfolio company Hello Divorce)

Musicians Served (Assigned to portfolio company Green Room)

Financial Metrics

Artemis collects these metrics on a monthly basis from all companies. The list below is not comprehensive.

Cash Burn

Cash Balance

Revenue

Expected Runway

Total Funding

The Artemis Fund Collected Annual Impact Metrics with a 94% Response Rate Using Visible

Aggregating Impact Data into a Report

Next, The Artemis Fund aggregated their portfolio data within Visible using the Portfolio Metric Dashboard which provides quick insights such as the total, minimum, maximum, median for any metric.

The portfolio-wide metrics Artemis included in their report are Revenue & Capital for SMBs, Number of Families Served, and Number of Jobs created.

This year, instead of providing an overview of each company they chose to highlight specific companies in the form of a case study in their impact report. The result is a more digestible yet compelling report that certainly helps LPs and founders understand the type of companies Artemis’ chooses to back.

The entire compiled report is 17 slides. The Artemis Fund’s deck is hosted on Visible’s deck feature which allows them to distribute the deck via a shareable link and gives them control over their branding, email gating, password protection and more.

View the full impact report here.

Visible helps 350+ funds streamline the way they collect and analyze portfolio data.

investors

Metrics and data

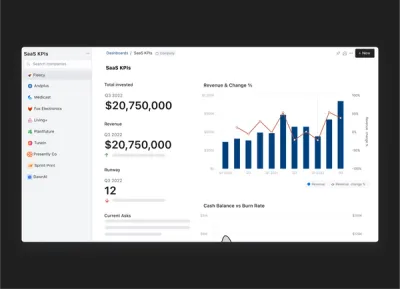

Venture Capital Metrics You Need to Know

The world of Venture Capital is full of jargon and acronyms that can make the industry seem intimidating. When it comes to Venture Capital metrics, it’s important to have at least a high-level understanding of what they mean so that you can contribute meaningfully to team discussions and evaluate investment performance accurately. This post breaks down common VC investment metrics that you’ll likely come across in venture.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

VC Fund Performance Metrics

Multiple on Invested Capital (MOIC): The current value of the fund as it relates to how much has been invested.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Distributions per Paid-in-Capital (DPI): The amount of money returned to Limited Partners, relative to how much capital Limited Partners have given the fund.

Residual Value per Paid-in-Capital (RVPI): The ratio of the current value of all remaining (non-exited) investments compared to the total capital contributed by Limited Partners to date.

Gross Total Value to Paid-in-Capital (TVPI): The overall value of the fund relative to the total amount of capital paid into the fund to date.

Internal Rate of Return (IRR): The expected annualized return a fund will generate based on a series of cash flows taking into consideration the time value of money. (Read more about IRR for VC’s)

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

You may also like → Venture Capital Metrics 101 (and why they matter to LP’s)

Fund Operations Metrics

Management Fees: A fee commonly paid annually by the fund to cover things like General Partner compensation, insurance, and travel. This is typically 2% of committed capital.

Escrow: Capital temporarily held by a third party until a particular condition has been met. Typically occurs as a part of paying distributions to Limited Partners.

Expenses: Money used to complete investments by the fund, such as legal costs, and other ongoing operational expenses of the fund, such as an annual audit.

Carried Interest: The amount of money returned to the General Partners of a fund after a liquidity event such as when a portfolio company gets acquired. Carried interest is typically 20% of profits, although it can vary depending on a GP’s track record and management fee.

Distributions: The transfer of cash or securities from a venture capital fund to its investors, called Limited Partners, after the fund exits its position in one of the companies. Typically 80% of distributions are returned to LPs. The timing of fund distributions varies from fund to fund.

You may also like → Venture Capital Fee Economics

Valuation Metrics

Fair Market Value (FMV): The value of an investment at a certain point in time. The most common trigger for a change in the FMV is when there is a company raises a subsequent priced round and a new company valuation is established.

Realized FMV: The value of an investment that has actually been realized through a liquidity event such as an acquisition.

Unrealized FMV: The perceived value of an investment that has not yet been realized through a liquidity event.

You may also like → 25 Limited Partners Backing Venture Capital Funds + What They Look For

Capital Metrics

Total Invested: The total amount of capital invested in portfolio companies. This includes initial capital and follow-on capital.

Committed Capital: The amount of money a Limited Partner promises to a venture capital fund.

Capital Called: The capital called from Limited Partners. Typically capital is called on an as needed basis before making a new investment.

Capital Remaining: Capital remaining in a fund that is yet to be invested into companies. Also referred to as ‘dry powder’ and unspent cash.

Uncalled Capital: Capital that has been committed by Limited Partners but not yet called by the fund.

Track & Visualize Your Fund Metrics in Visible

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Additional VC Metrics Supported in Visible

Visible auto-calculates common investment calculations so investors can more easily understand and communicate their fund performance.

Total Number of Investments: A sum total of investments made into individual companies.

Average Investment Amount: The average check size for all investments out of a fund.

Total Number of Exits: The number of companies that have exited the portfolio.

% of Fund Deployed: The ratio of capital deployed compared to the total committed fund size.

% of Fund Called: The ratio of capital called compared to the fund size.

Follow On Capital Deployed: The amount of capital deployed into existing companies in the portfolio.

Total Portfolio Company Capital Raised: The total amount a portfolio company has raised.

Follow on Capital Raised: The combined amount all companies in the fund have raised.

Visible supports over 30+ investment metrics and unlimited custom KPI’s for portfolio monitoring.

investors

Operations

Up-and-Coming Platform Managers Working in VC

Why It’s Important to Have a Platform Manager in VC

Platform managers are instrumental in the success of startups, which is why the role of platform managers within VC firms has become increasingly important and there has been a surge in hiring for this position. By providing guidance and support to portfolio companies, Platform Managers help founders navigate the challenges of building and scaling a startup. They offer advice and support on everything from product development and fundraising to talent acquisition and marketing. Platform managers act as a liaison between portfolio companies and the VC firm, helping founders access the resources and expertise they need to succeed.

Hiring a platform manager can also help VCs enhance their value proposition and differentiate themselves in an increasingly crowded market. Some other ways in which they can also add value to VC firms and their portfolio companies are:

Strategic Focus: A platform manager can help VCs develop a strategic focus for their investments by identifying areas where they can add value beyond just providing capital. The platform manager can work with portfolio companies to help them leverage the VC’s network, resources, and expertise to scale their businesses.

Portfolio Optimization: A platform manager can help VCs optimize their portfolio by identifying areas of overlap or synergy between portfolio companies. They can also help VCs identify potential acquisition targets and facilitate mergers and acquisitions.

Value Creation: A platform manager can help create value for portfolio companies by providing access to resources such as talent, capital, and strategic partnerships. This can help portfolio companies grow faster and more efficiently.

Brand Building: A platform manager can help VCs build their brand by creating and promoting events, content, and other initiatives that showcase the VC’s expertise and thought leadership in their respective domains.

Investor Relations: A platform manager can help VCs manage their relationships with investors by creating reports, organizing events, and providing regular updates on the performance of portfolio companies.

How to Succeed as a Platform Manager in VC

To succeed as a platform manager in VC, individuals must have a deep understanding of the startup ecosystem and the challenges that founders face. They must be able to build relationships with portfolio companies and act as a trusted advisor to founders.

Additionally, they must have strong analytical skills, as well as the ability to manage complex projects and navigate volatile market conditions. They must be able to analyze financial data and market trends to identify opportunities and make informed decisions. They must also have the ability to manage complex projects and navigate volatile market conditions.

To get into venture capital as a platform manager, individuals should focus on building a strong network in the startup ecosystem. They should attend industry events, participate in startup accelerators, and connect with successful founders and investors. It’s also important to gain relevant experience in areas such as product development, marketing, and finance.

It also helps to read industry blogs and publications to stay up to date on the latest trends and funding rounds.

Best Practices for Platform Management

Some best practices include, how to identify potential portfolio companies, how to add value to portfolio companies, and how to optimize the firm’s portfolio.

Identifying Potential Portfolio Companies

The first step in effective platform management is identifying potential portfolio companies that align with the VC firm’s investment focus and criteria. To do this, platform managers should:

Develop a deep understanding of the VC firm’s investment focus and criteria, including industry sectors, geographies, and stages of investment.

Network and stay up-to-date on industry trends and emerging technologies to identify potential investment opportunities.

Leverage the VC firm’s network to source and evaluate potential portfolio companies.

Conduct thorough due diligence on potential portfolio companies to ensure they meet the firm’s investment criteria and have strong growth potential.

Adding Value to Portfolio Companies

Once a portfolio company has been identified and invested in, platform managers can help add value to the company by providing access to resources and expertise that can help the company scale and succeed. To do this, platform managers should:

Work closely with portfolio company management teams to identify areas where the VC firm can provide value beyond just capital.

Provide access to the VC firm’s network of industry experts, potential customers, and strategic partners.

Help portfolio companies recruit top talent by providing access to the VC firm’s talent network and offering guidance on hiring best practices.

Help portfolio companies develop and execute growth strategies, including marketing and sales strategies, product development, and international expansion.

Optimizing the Firm’s Portfolio

Finally, platform managers should focus on optimizing the VC firm’s portfolio by identifying potential areas of overlap or synergy between portfolio companies and helping to facilitate mergers and acquisitions. To do this, platform managers should:

Conduct regular portfolio reviews to assess the performance of each portfolio company and identify areas where the VC firm can add value.

Identify potential acquisition targets that can help strengthen the VC firm’s portfolio and create synergies across portfolio companies.

Help facilitate mergers and acquisitions by providing guidance on deal structuring and negotiation.

Work closely with portfolio company management teams to identify opportunities for cross-collaboration and knowledge-sharing across the portfolio.

Resources for Platform Managers

VC Platform Jobs

VC Platform Global Community

Let’s Talk Ops

OpenLP resources across the venture ecosystem

Resources From the Visible Blog

How to Hire for Your First VC Platform Role

Defining Your VC Platform Approach Using the TOPSCAN Method

Guide: VC Portfolio Support Best Practices

How to Plan a Top-Tier CEO Summit

How to help your portfolio companies find talent

Up-and-Coming Platform Managers in VC

Meryl Breidbart | Director of Investment Operations | At One Ventures

How did you get into platform?

I started my career as a designer and founder of Chirps, so when I began at At One Ventures as an investor, I naturally gravitated to filling our platform holes. I started by organizing our first AGM and building some fund partnerships and from there, helped launch our platform and operations team, which now includes a VP of Talent, a VP of Marketing, and a Venture Partner with extensive commercialization experience.

What’s the focus of your firm’s post-investment support; what’s your specialty?

We know we can’t be excellent at everything, so we have decided to double down on a few areas: talent, marketing, fundraising support, and commercialization. I specifically focus on fundraising. I build pitch decks, run pitch practice sessions, and make introductions for our founders to our vast network of follow-on investors. In addition to this work, I also support our firm with internal operations – assisting with our fundraising efforts and making sure we run a tight ship.

What’s your favorite part of the role?

Working directly with our founders! I am an extrovert and get energy from talking to lots of different people. I enjoy reducing the amount of work our founders have to do and providing them with best practices and processes so that they can learn quickly.

Advice for first-time platform managers?

You can’t be all things to all people. Figure out 1-2 strategic goals for the first year of the role and make sure to prioritize those. Otherwise, you will find yourself being a recruiter for company A and a PR firm for company B, which will not scale and will not help you deepen expertise.

Mal Filipowska |Portfolio & Platform Manager | Seedstars

How did you get into platform?

For the first five years of my Venture Capital career, I was always on the investment side of the fund: sourcing deals, preparing investment memos etc. I executed over 30 transactions across Europe, MENA, and India. A big part of my role was building relationships with other VCs and sharing investment opportunities: that’s how I met Seedstars. I instantly fell in love with their investment thesis and commitment to empowering start-ups in emerging markets globally.It was mutual, and the Partners of Seedstars International Ventures invited me to join the team. The platform role was an obvious fit: it was 100% global (opposite to our Investment Managers, divided by regions). It allowed me to continue working with founders from diverse backgrounds from over 100+ start-ups in almost 40 different countries, be hands-on in supporting them in solving their most urgent challenges and have a tangible impact on their journey to success.

What’s the focus of your firm’s post-investment support; what’s your specialty?

As a global fund, we decided to focus on the most urgent and universal aspect of every start-up: growth. As we can read in the famous Paul Graham essay: “if you get growth, everything else tends to fall into place”.After we invest, our portfolio companies get lifetime access to the “Growth Track” – a tailored consultancy program for start-up teams. It is delivered by growth experts and helps our portfolio companies to develop a long-lasting and sustainable growth strategy. We host such a program twice a year, so portfolio companies can always bring their new employees for us to teach them the growth mindset & methodologies.

What’s your favorite part of the role?

My favorite part of the Platform role is how it fosters my professional growth within the Venture Capital industry. In the platform role, I am more exposed to the everyday challenges faced by founders, which enables me to actively participate in solving them together. There is no space for beautiful pitch decks or listening to what the VC wants to hear – we’re in the same boat now, so my entire focus is working towards a common goal. Personally, I find it very developing and satisfying.

Advice for first-time platform managers?

Take your time: Spend some time to dive deep into the role and understand the needs of your portfolio companies. By doing so, you’ll be better equipped to help them succeed.Find your niche: Focus on common challenges your portfolio companies face and become an expert in addressing them. This approach allows you to add “scalability” to your support and significantly impact the board.Stay connected to the investment side: Don’t lose touch with the investment aspect of venture capital. Participate in investment committees and the investment process to maintain a well-rounded perspective and contribute more effectively to your portfolio’s growth.Collaborate with the VC community: Each player contributes uniquely to the world of venture capital. Instead of competing, work alongside your co-investors, join forces with your co-investors, complement each other and build on each other’s strengths.Connect with founders personally: Meeting your founders in person and getting to know them as individuals will help build stronger relationships and foster a deeper understanding of their needs and motivations

Regan Gore | Community & Operations Associate | Eniac Ventures

How did you get into platform?

Prior to joining Eniac, I was in consulting and executive search, and then I taught first grade during COVID. I have honestly found so many overlaps between teaching and platform, and I think that experience helped me hit the ground running when I joined the VC world. I was really lucky to have a wonderful resource in Sam Gelt (a16z) who reached out to me after connecting in a Slack group and helped guide me in my VC job process. Through her and a few other mentors (huge shoutout to Mariana Consuegra (previously BCGDV), Kenyon Cory (Petal), and the Aspire to Her team), I was able to learn more about community and different roles that were community-focused, ultimately finding a path to VC. I have found that platform is a great way to connect with founders and be part of their journeys, especially at a seed firm where we can really provide help and value right away.

What’s your favorite part of the role?

My absolute favorite part of the role is getting to speak to so many interesting founders as well as connecting with phenomenal partners who can be great resources to our founders. Deepening those relationships every day drives so much of my work, and I love that each day is a little different!

Advice for first-time platform managers?

My best advice for first-time platform managers is to create your own cohort of founders in your portfolio who you trust + they trust you. I have found this small group has been a helpful sounding board to many ideas, they’ve given me very honest feedback on our platform offerings and have tested out ideas before I’ve brought them to the larger group, and they are great cheerleaders at events and in our slack group! I think a lot of first-time platform managers think that you have to have a “perfect” facade when talking to founders, but they are in the same boat as you, and the relationship is so much better when everyone is open and honest about where they are, what they are working on, and where they can use help.

Rachel Hodes | Director of Platform | NextView Ventures

How did you get into platform?

When I was a senior in college, I decided to take an internship at this relatively new, female-founded, D2C brand that had just closed its Series A. Taking the 1 train down to their chic Chinatown office, which one day became their flagship store, was always the highlight of my week. I remember feeling impressed and inspired by the creativity, collaboration, and community-building that went down in that millennial-pink wonderland, and I knew that this experience was the beginning of my addiction to all things startups. I spent the rest of my early to mid-twenties operating at various early-stage consumer and B2B companies. The “throw spaghetti at the wall to see what sticks” kind of days… *sigh* memories. But like most people, the pandemic forced me to pause, reevaluate my path forward, and be incredibly intentional about what I wanted to do next. I knew I was outgrowing those early-stage operating days but I also knew I wasn’t quite ready to quit startups cold turkey. During this transitional time, I learned about platform from a friend who was actually trying to hire me for a role at his boutique recruitment firm: “Your role here would be similar to that of a platform person’s role at a VC firm.” Oh really? Bet. I started doing my research and realized that platform encompasses all the things I love to do (content, community, operations, marketing, events, etc.) PLUS it directly supports startups and founders in a MAJOR way?! Sign me up. By some kind of kismet, stars aligning chance, my now mentor, Stephanie Manning Cohen (Operating Partner at Lerer Hippeau) had just messaged me on LinkedIn and was interested in chatting about an open platform role on her team. This particular position didn’t end up being the right fit, but Stephanie connected me to the partners at NextView, and it’s been a match made in seed-stage heaven ever since ❤️

What’s the focus of your firm’s post-investment support; what’s your specialty?

We focus on the four things that matter most at the seed stage: building a great product, getting great customers, hiring a great team, and not running out of money. I would say my specialty is bringing people together in a meaningful way, and I’m excited to explore that more with NextView’s founder initiatives this year. Stay tuned!

What’s your favorite part of the role?

Running the NextView accelerator program, hands-down. Bringing a group of early-stage entrepreneurs together and creating meaningful programming and memorable experiences that actually move the needle in propelling their businesses forwards?! There’s nothing more rewarding. It’s also pretty special to see lasting friendships evolve out of the programming you create. The startup founder journey can be a lonely one, and if I can help people feel a little less alone… that makes my heart and soul oh so happy.

Advice for first-time platform managers?

This role is inherently more fun because you’re doing all the things, but that variety of work also comes with its fair share of challenges. One day you’re working on a website redesign, the next day you’re working on an accelerator kickoff event, and the next day you’re working on establishing your firm’s Affinity foundations. Whatever major project you’re working on, you need at least one, if not two, point partners who can support you in driving towards decisions within the confines of those projects. Aim to divvy up your point partners based on the relevancy of the project at hand and meet with these partners on a regular basis as you’re moving through your work; get their take on things, ask them for advice, talk through your plan for prioritization, etc. The platform work we do on a daily basis is incredibly different than what the investment team is working on; it’s important that you have someone in your corner who has visibility into the work you’re doing and the progress you’re making. And trust me… it makes things a lot easier and more efficient when you’re getting the green light from one or two people vs the entire partnership 🙂

Jenna Borowski | Head of Platform | American Family Insurance Institute for Corporate & Social Impact

How did you get into platform?

I’ve long been passionate about the role business can play in making the world a better place so when I learned that American Family Insurance was building an Institute for Corporate and Social Impact, I was immediately intrigued. For those who are not familiar, the AmFam Institute’s mission is to close equity gaps in the US and we do that through both running a traditional venture capital fund and developing a portfolio of community partnerships and programs. My background was in communications, but I also had some experience within the startup community and the nonprofit, social impact space. After a lot of networking and a little luck, I took a role leading some of the Institute’s local partnerships and managing a community events space that catered to mission-driven organizations. As I was in on the ground floor of the Institute, I took the opportunity to learn as much as I could about the venture fund, intrigued by the innovation and potential for large-scale impact. This allowed me to dip my toe into platform by helping plan a few events and developing resources for our founders and in less than two years (with help from the pandemic unfortunately shutting down the event space), I made the jump to build out and manage our platform and portfolio services full-time.

What’s the focus of your firm’s post-investment support; what’s your specialty?

The AmFam Institute is focused on creating an inclusive community of high-performing, mission-driven founders who feel authentically supported and appreciated. We do our best to connect our founders to each other by hosting dinners when we’re attending large conferences and by hosting our annual founder summit, which is definitely my favorite event. Outside of gathering our founders together in person, we’ve put a big emphasis on supporting the health and well-being of our portfolio so we offer a coaching stipend, host monthly mastermind peer group sessions, and offer free drop-in coaching, all in hopes of preventing burnout and helping everyone feel supported because we know being a founder is often a really high-stress and isolating job. I also have to give a huge shoutout to our storytelling and social media team who amplify the work of our portfolio companies through video and social media. My specialty is definitely community building and events so I tend to focus on that, but the content creation is a really valuable part of our post-investment support.

What’s your favorite part of the role?

There are so many things I love about my role. From the creativity required and the continuous learning to the countless friends I’ve made within the platform community, there’s a lot to love. However, one of the simplest joys for me over the past year has been watching our community grow. It feels almost magical when I see two founders bond at an event or I hear that they’ve stayed in touch long after an introduction was made. It’s a lot of hard work to curate a space where those kinds of connections can form so it’s really rewarding to see it all come together and to know we’re (hopefully) helping them feel a little more connected and supported as they do the hard work of building these truly incredible, world-changing companies.

Advice for first-time platform managers?

Get connected and don’t be afraid to ask questions! My job got a lot easier when I joined platform groups like Let’s Talk Ops and VC Platform where there are hundreds of brilliant people willing to share their wisdom. It can be intimidating to ask a question when you’re still learning about venture, but there are so many people that enter platform roles without prior VC experience that most likely someone has the same question… or at least remembers having the same question when they started and is willing to jump in with an answer.

Cynthia Matar | Head of Platform and Communications | Swiftarc Ventures

How did you get into platform?

Interestingly enough, I started my career at the Firm as an intern for an analyst position. During my time as an intern/analyst, I discovered how much I enjoyed everything other than the financial/diligence part of the role. I thoroughly enjoyed speaking with founders and finding ways to help, building the firm’s brand and image, networking with investors for business development efforts, and planning and executing activation events. They didn’t quite know where to place me, but understood there was a need for the types of services I was offering. The team very quickly realized the one thing missing (an emerging role in the VC space at the time) was a Platform role/division that could manage all post-investment support and services. I worked my way up from Platform & Media Coordinator to Head of Platform during my time at the Firm and couldn’t be more proud of what we as a team have accomplished together.

What’s the focus of your firm’s post-investment support; what’s your specialty?

My specialty encompasses Public Relations, Internal & External Communications, Branding/Marketing, Investor Relations, Fundraising and Business Development, as well as Events & Networking. As an early-stage firm, a lot of effort is put into building the Firm’s image and network.

What’s your favorite part of the role?

My favorite part of the role is quite simply, the versatility of it all. No day looks the same, which makes the role so engaging and exciting to be a part of. I jokingly refer to Platform managers as the “Jack or Jane of all trades.” These are individuals who are able to wear multiple hats and offer a multitude of post-investment support and services. I love the collaboration that comes with the role – you find yourself working closely with everyone across the board (Senior Executives, Founders, Team Members, Stakeholders, and Investors). One of the most exciting parts I’ve had to play was launching each of the Firm’s funds with differing investment theses, PR and Marketing strategies, digital content, activation events, etc. You have a hand in everything, which gives you better insight into the moving parts of how the “engine” runs at a firm.

Advice for first-time platform managers?

My advice for first-time platform managers is to always be curious! Network with people across the industry, regardless of their roles – remember, you have a hand in it all. Share your thoughts, always. Your perspective is unique in that it offers an unbiased opinion and combines a variety of your experiences, making it refreshing to those who might have a standard set of questions or best practices they always use. Always be a student – your willingness to learn new approaches to apply across the firm is your superpower in this role.

Allie Mullen | Director of Platform | Wireframe Ventures

How did you get into platform?

I’ve spent my career as a startup operator, early employee, and wear-er of many hats. I love working with founders and I love building companies. I’ve always kept a pulse on VC and since I didn’t have a background in finance or consulting, I didn’t think there was an opportunity for me to break in. But as soon as I found out about Platform roles, I knew it was for me.

What’s the focus of your firm’s post-investment support; what’s your specialty?

Wireframe specializes in helping extraordinary early-stage founders on a mission to improve the health of people and the planet. Our team has deep industry expertise, having been founders and investors in climate, health, and bio for over a decade. I joined the team as a Platform team of one and built the function from the ground up, supporting the fund’s operations, marketing, community-building, events, and post-investment support.

What’s your favorite part of the role?

It sounds cliche, but I love that every day is different and that I get to work across so many different functions. I also love that this role is still relatively new to the industry and continues to evolve. As Platform leaders, we get to define what Platform means to our fund. There is still a lot of room and opportunity for innovation for what the future of Platform looks like. I am excited to be part of it and to continue to accelerate growth for our founders.

Advice for first-time platform managers?

Build relationships with other Platform leaders, especially those who have been in it for a while. Platform can be a lonely role, especially for those of us who are teams of one, so connecting with others early on can supercharge your success. Plus, Platform folks are usually pretty similar people and tend to get along well (type-A, social, creative, love a challenge, efficiency, and helping others).

Olivia Zdeb | Operations Manager | Hyde Park Venture Partners

How did you get into platform?

At first, I thought my journey to platform was random, but it turns out it’s a common path for many. I started my career in special recreation, then transitioned to Parks & Recreation for a neighboring Chicago municipality. With over 15 years of experience in events, program organization, marketing, and community engagement, it almost feels like I was training for this role all along. Leaving parks, finishing my master’s degree, and finding my dream job wouldn’t have been in my five-year plan before the pandemic. Taking the risk to leave my established career without a clear roadmap was worth it in the end.

What’s the focus of your firm’s post-investment support; what’s your specialty?

In addition to the financial support we provide, we also prioritize building strong relationships with our portfolio companies to better understand their needs and to provide them with tailored support to help them grow and succeed. HPVP operates on a true partnership model and focuses on companies rooted in the Midwest, Toronto, and Atlanta. This geographic focus allows us to provide dedicated attention and responsiveness to each of our portfolio companies. Our Platform team collaborates to provide impactful community-building events for our portfolio companies, offer problem-solving resources whenever teams ask for support, and offer personalized talent resources through our Talent Partner Jim Conti. As my role is still relatively new, my value-add continues to evolve with each new investment. With each new investment, I have the chance to establish a relationship with the founding team, understand their unique needs and challenges, and improve my ability to make a significant impactful in my role.

What’s your favorite part of the role?

I love the creative freedom this role provides. It’s rewarding to see my ideas come to life in the form of marketing campaigns and events that bring new value to our team and community. As a former government employee, I find it refreshing to be in a role with fewer restrictions. As HPVP’s first Operations Manager and the second member of the Platform team, my role has evolved and expanded beyond my initial responsibilities. It’s exciting to me that I can personally drive meaningful improvements for our HPVP team and our portfolio companies.

Advice for first-time platform managers?

As a first-time platform manager myself, I suggest joining or creating a community of like-minded platform professionals. We’re all learning and growing as we go, so it’s essential to have a support system. I’m an active member of the Let’s Talk Ops, VC Platform, and V2:VC communities. These communities are filled with kind, helpful, and creative individuals who share ideas, collaborate on events, and offer advice based on past experiences. One suggestion would be to take action and “just do it.” While researching the best software, vendor, or service can be helpful, it’s essential to remember that what works for one firm may not work for another. Instead, work within your current systems to maximize their capabilities. Then, identify the constraints that are limiting your next steps. This approach can help you identify the specific resources you need to take your firm to the next level.

Anna Jacobson | Operations & Data Partner | Operator Collective

Anna leads Operator Collective’s operations vertical, including data analytics, investment operations, internal operations, investor relations, fundraising operations, and fund administration. Prior to joining OpCo in 2020, Anna earned a Master’s in Information and Data Science from UC Berkeley, where she honed her data science expertise, concentrating on predictive analytics, machine learning, and data visualization. An engineer by training and experienced project manager, she is a cross-functional business leader, data strategist, and operations veteran who is passionate about combining technology with process and design to ensure outstanding collaboration across technical, business, and creative teams.

How did you get into platform?

Very organically! I had never heard the term before I started this job; it does not appear in my job description and even today we don’t call ourselves a Platform Team with a capital P. But most of the work that I do – whether in Operations or in Data – is deeply integrated with our platform functions, so much so that I do now consider myself to be someone who works in platform.

What’s the focus of your firm’s post-investment support; what’s your specialty?

In a word – connection. Our model is based on the power that is generated by making connections between our portfolio companies and our 200+ Operator LPs – exceptional tech executives – and their networks. My specialty is building and orchestrating the tools and processes that we use in each step of the connection process – to identify, facilitate, track, report, and everything in between.

What’s your favorite part of the role?

I love it all – from high-level strategic thinking to hands-on building to information design and communications – I find it all profoundly satisfying.

Advice for first-time platform managers?

Venture is a young industry and platform is an even younger function within venture. This means that practically every part of it is undefined and evolving. This can be a challenge – what exactly are we supposed to be doing?!? – but also an opportunity – we aren’t constrained by what has been done before! Seek allies to work through the challenges and be open and ready to seize on the opportunities.

Oleh Karizskyi| Head of Platform | Flyer One Ventures

How did you get into platform?

Initially, I joined Flyer One Ventures 2 years ago as a Growth/Operations Manager helping portfolio companies with growth, b2b sales, and performance marketing. We did not have a Platform Manager at that time. After 6 months, my team lead left the firm and I became a Band-Aid guy within the fund helping with partnerships and expanding perks, organizing webinars, creating a portal for portcos’ founders etc. Ultimately, the role transformed into Platform Manager combined with the firm’s Investment activity.

What’s the focus of your firm’s post-investment support; what’s your specialty?

Our fund’s structure is pretty unusual. The majority of our team consists of operators. We have 17 team members, and only 4 of them are in the investment team. We help portcos with hiring, marketing&branding, PR&communications, fundraising, operations, legal issues, and finance support. We have a startup atmosphere in our fund, thus we do not super restrict ourselves with responsibilities zones. One of the major trends inside our Platform is switching from a Hands-on approach towards scaling support by expanding our network of advisors. Personally, I combine fund & community operations (the latest tasks were the implementation of the founders’ request tracking system, arranging webinars for portcos and for the Ukrainian startup community, compiling an internal newsletter for the fund’s community etc), business development & networking, investment activity responsibilities such as startup due diligence, expanding our pipeline and helping portcos with fundraising. We also have a Head of Operations, her responsibilities overlap with mine, so we complement each other.

What’s your favorite part of the role?

Dynamism and helping founders. I do not get bored by doing the same duties, because they always change. Also, it is great to communicate with founders, find their pain points, and try to help them. It is crucial to show them that they are not alone in their journey.

Advice for first-time platform managers?

Define what are the pain points of your founders in terms of the fund’s Platform and their businesses, because it will be a waste of time creating value that is not requested. A person can do it by gathering the notes from the investment team that join the board meeting and 1:1 calls. Also, it is helpful to conduct a couple of interviews with founders to get to know founders better. But it shouldn’t be a surprise for first-time managers to find out that smth that was requested is now not needed 🙂 My personal insight was that founders do not share all pains. Such interviews can help founders to reveal their problems and create a comfortable atmosphere for future sharing.

Sophie Panarese | Head of Platform & Operations | 186 Ventures

How did you get into platform?

I began my career at Cambridge Associates learning the ins and outs of asset allocation, manager selection, and overall portfolio construction. While there, I had exposure to all asset classes including Venture Capital. It became immediately apparent to me that the entrepreneurial nature of early-stage VC was something that I wanted to explore one day. With this exciting new goal in my head, I realized that gaining hands-on operating experience would sharpen my Swiss army knife, so I joined the strategy team at HomeGoods where I spent a few years wearing a handful of hats. From there, I began networking and with a little bit of grit and a lot of luck, I’ve found myself at 186 Ventures leading our platform and operations efforts and couldn’t be happier.

What’s the focus of your firm’s post-investment support; what’s your specialty?

The entire team at 186 Ventures (3 of us) comes from operating backgrounds. We understand that the success of a company goes beyond the initial investment and requires ongoing guidance, strategic advice, and access to relevant networks. Our post-investment support is multifaceted and tailored to meet the specific needs of each portfolio company. We act as strategic partners, working closely with founders and their teams to understand their unique challenges, goals, and aspirations. By leveraging our industry knowledge, operational expertise, and network connections, we provide targeted guidance and insights to help companies overcome obstacles and seize growth opportunities.

What’s your favorite part of the role?

One of the most exhilarating and rewarding aspects of working in Platform is the opportunity to partner closely with founders who are on a mission to reshape the world as we know it. This is, by far, my favorite part of the role. Collaborating side-by-side with visionary founders who are driven by a deep sense of purpose and a desire to disrupt existing paradigms is truly incredible. These founders possess an unwavering commitment to making a meaningful impact, and being a (small) part of their journey is both inspiring and energizing.

Advice for first-time platform managers?

Be a lifelong student: The role of a platform manager is dynamic and ever-evolving. Stay open to learning new approaches and strategies that can be applied across your organization. So much of your role is connecting the dots and putting theory into action, so seek out mentors who you trust and who have faced similar challenges.

Prioritize user experience: As a platform manager, it’s crucial to prioritize the needs and experiences of your users (Founders, Ecosystem Operators, LPs, Vendors, fellow team members). Continuously seek feedback, understand their pain points, and iterate on your platform to enhance its usability and value. Platform can be defined as a product. By iterating on your product offering, and aligning your product goals with the goals of the investment team, you will play a huge role in differentiating your venture firm from others.

Julia Grassa | Head of Talent | Company Ventures

How did you get into platform?

My professional journey started in non-profit management, where I worked alongside Jewish communities, particularly with teenagers and young adults, to foster meaningful connections and witness their growth over time. Despite initially perceiving my transition to the tech industry as a major shift, I gradually realized that it was a natural fit for me. My initial role as the Community Manager for the Urban Tech Hub program, part of the Grand Central Tech Accelerator, involved establishing the program’s daily operations, yet I was drawn to community engagement as it aligned with my passion. Currently, I lead Talent initiatives and oversee key recruitment searches while facilitating synergistic opportunities between our portfolio companies and prospective candidates.

What’s your favorite part of the role?

Over the past 6.5 years, my role has evolved in tandem with the dynamic VC landscape, keeping me perpetually motivated and energized. There’s never a dull moment and that’s what keeps me motivated.

Advice for first-time platform managers?

I recommend starting by observing the firm’s operations, listening attentively to the founders’ needs, and refraining from impulsive action. As someone who is proactive by nature, I must remind myself to take a step back, breathe, and then proceed deliberately. As many platform professionals face burnout, similar to my experience in non-profit work, it’s essential to prioritize self-care for both the body and mind to excel in this role.

Kira Colburn | Head of Platform | Work-Bench

How did you get into platform?

I started my career at a tech PR agency, helping build narratives and stories for a handful of VC clients. After a few years, I realized agency life and working in-house as a VC Platform leader had a lot of similarities and decided to make the jump. In both worlds, days are filled with endless possibilities of things to do and projects to jump into, but instead of working with a variety of clients, I now get to work with our portfolio companies.

What’s the focus of your firm’s post-investment support; what’s your specialty?

I lean into my strengths coming from a PR background. To put it simply, “Head of Platform” at Work-Bench can be defined as strategy, planning, and execution between our community flywheels of content and events. This includes communications and marketing support for our firm (including writing our Enterprise Weekly Newsletter and managing our active blog) and for our portfolio (including helping them garner PR for their initial launches) as well as event planning to expand our growing community. While our investment team focuses on research and portfolio GTM strategy, my job as the firm’s community builder is to pull commonalities out of our portfolio and broader network, then plan workshops, meetups, blog posts, etc. around those commonalities.

What’s your favorite part of the role?

My favorite part of being in Platform is the opportunity to draw out stories within enterprise software. It’s no secret that the enterprise software industry is traditionally less sexy than consumer and even general tech. However, there is an interesting story behind every enterprise startup – you just have to dig a little. I love looking into the founder’s journey, where the startup idea percolated, from, how their product impacts the greater way something operates, or how their team is changing culture standards.

Advice for first-time platform managers?

Over my 5+ years working with and in a VC firm, the “Platform” role has always meant a mishmash of things – everything from portfolio GTM support and recruiting, to event and community planning, to content strategy and execution, to investor relations, to operations management and so much more. Really every and anything under the sun. My advice to first-time platform managers – and what’s going to be most impactful for your firm, and your portfolio companies, but also keep you sane – is to identify your superpower and double down on it. Give up the urge to boil the ocean and focus on a few key areas or projects that can move the needle in a tangible timeframe.

Sebastien Boucraut | Chief Scaling Officer | Breega

How did you get into platform?

Breega is a VC fund founded by Entrepreneurs for entrepreneurs. It was logical, right at the inception of Breega, to dedicate an operational team for the Start-ups.

What’s the focus of your firm’s post-investment support; what’s your specialty?

We focus on:

(i) setting up foundations per vertical with following expertises: Sales & Structure, Growth, Talent, Branding & Com

(ii) accompanying the Founders to review/crack an operational matter, such as GTM, Pricing Strategy, operational efficiency, Re-branding, Re-shape the organisation, the Roles & Responsibilities for a stronger performance

(iii) Mentoring & Coaching

What’s your favorite part of the role?

When we have a strong impact on the Start-up & its Founders and we are able to measure it.

Advice for first-time platform managers?

Be pragmatic, adapt to the structure and the DNA of the Start-ups & Founders, and always be honest to yourself on what you can and cannot provide.

Kayla Liederbach| Communications & Marketing Manager | Strut Consulting

How did you get into platform?

I got introduced to the wild world of VC platform when I was managing marketing at a VC-backed tech startup. One of our investors was a General Partner at a venture capital firm, and a mentor of mine. He asked me if I could help his firm put more intention and coordination behind the marketing efforts of its programs based around the world, and raise the visibility of the firm as the brand behind it all. This was nearly a decade ago when best practices for VC marketing weren’t widely known or shared. Over the years I have figured out what works—and just as importantly, what doesn’t work—when it comes to attracting founders and LPs by doing social media, content, newsletters, events, and PR for venture capital.

What’s the focus of your firm’s post-investment support; what’s your specialty?

At Strut, we are a consulting firm helping new and established fund managers navigate the complexities of VC fund management. Our expert team provides strategy, instills best practices, and delivers tactical support in Operations, CFO Services, Investor Relations, HR & Talent, Marketing & PR, and Events. My specialty is handling Marketing and PR for Strut Clients. I provide strategic guidance and tactical support based on their current needs—whether it’s writing punchy tweets or landing headlines in TechCrunch.

What’s your favorite part of the role?

My favorite part of my role is helping people tell their stories. I am a believer that every single person (or company) has an interesting story, but they don’t always know how to tell it. That’s where I can help by doing a deep dive and seeing what comes out. In life, I enjoy looking at patterns, and seeing the big picture. People who know me well have told me that I am a very entertaining and animated storyteller.

Advice for first-time platform managers?

When it comes to marketing, don’t try to do too many initiatives if you don’t have the bandwidth for it. VC firms often compare themselves against top players and want to do all the marketing initiatives they see the industry leaders are doing, like podcasts. But if you spread yourself too thin, you will burn out. Choose to do a few marketing initiatives that you know are working well and that you enjoy doing. If we aren’t enjoying ourselves, then what the heck are we even doing? 😉

Gil Birnboim | Head of Platform | UpWest

How did you get into platform?

During the last decade, I have gained valuable experience working closely with startups across various industries and domains, focusing on different aspects of ventures and the Tech ecosystem. Throughout my journey, I discovered that my true passion lies in empowering startup operations and sharing best practices to fuel the growth of founders and help set their companies up for success.

What’s the focus of your firm’s post-investment support; what’s your specialty?

UpWest is a Silicon Valley-based Seed fund purposefully designed to help Israeli startups break into the US market. We have backed over 90 companies and helped them grow through our hands-on approach. UpWest provides the essential ingredients for success: Seed funding, proximity and access to markets and capital, a supportive community of talented peers, and a workspace conducive to rapid development and deployment.

My specialty centers on creating a supportive community where founders thrive and leverage collective knowledge for success. By implementing a founder-first approach that is deeply focused on, and consistently influenced by the journey of entrepreneurs tackling similar fundamental market entry and growth challenges, I bring together our founders and facilitate various opportunities for them to connect, share their experiences, and support one another in overcoming challenges.

What’s your favorite part of the role?

The people! Working alongside inspiring, resilient, and ambitious individuals that are bringing disruptive ideas to life.

Advice for first-time platform managers?

My advice for a first-time platform manager is to embrace versatility and plan a roadmap for each area of responsibility. The platform landscape is expansive, so being able to switch between projects and tasks demands mental flexibility and self-discipline. It’s essential to connect with like-minded individuals and cultivate a supportive community for yourself. The opportunity to exchange perspectives, brainstorm ideas, and learn from others’ experiences is immensely valuable.

Adrienne Mangual | VP of Finance & Operations | The Artemis Fund

“We use Visible to connect monthly KPIs and annual impact metrics from our portfolio companies. In turn, we use monthly data to stay on top of performance and the annual impact data is used in our annual impact report. Examples of data collected include revenue dollars driven to small businesses, families served and jobs created. We strive to be a data-driven venture firm, and Visible allows us to do just that.”

More Platform Managers to Watch:

Eileen McMahon Coordinator of Operations at Prelude Ventures

Ellie Davis of TechNexus

Frances Choi Operations and Events at Kindred Ventures

Lu Yu at UpHonest Capital

Emma Sissman Director of Portfolio Acceleration at SJF Ventures

Kristin (Stannard) Kent Principal at Expa

Arnaud Hochart Growth Manager at Breega

Olivia O’Sullivan Head of Platform at Forum Ventures

Improve Post-Investment Operations with Visible

Over 400+ funds are using Visible to improve transparency across their funds through streamlined portfolio data collection, easy-to-build dashboards for Portfolio Reviews, and professional reporting.

Interested in learning more about Visible?

investors

Operations

Customer Stories

[Webinar Recording] Improving post-investment operations at your VC firm

Watch a recorded conversation with VC Ops experts about improving post-investment operations at your VC firm.

Collectively Kristen Ostro from Strut Consulting & Let’s Talk Ops and Lacey Behrens from 01 Advisors have been exposed to operations at dozens of top-tier VC’s. We’ve invited them to share their advice about implementing best-in-class operations at a venture firm.

This webinar is designed for anyone looking to improve operations at their Venture Capital firm.

Topics Discussed:

Tips for working with your fund admin

How Lacey runs Portfolio Review Meetings at 01 Advisors

How to tailor onboarding for portfolio companies

Tools that help improve post-investment operations

How to measure whether operational changes are working or not

Advice for first-time platform or VC operations hires

investors

Fundraising

25 Limited Partners Backing Venture Capital Funds + What They Look For

Where Do LPs Get The Capital They Deploy?

The National Venture Capital Association states that limited partners (LPs) are typically institutions or high-net-worth individuals, family offices, and sovereign wealth funds that have a substantial amount of liquid capital to invest. Some examples could include pension funds, endowments, foundations, and insurance companies.

In many cases, these investors allocate a portion of their capital to alternative asset classes, such as private equity or venture capital, as part of a broader investment strategy. The LPs then pool these funds together and invest them in venture capital firms as limited partners. It carries a higher risk compared to traditional assets such as stocks and bonds but also offers the potential for higher returns. Institutional LPs generally invest between $5 million to $50 million in a fund.

The venture capital firm, in turn, uses the capital to invest in early-stage or high-growth companies with the potential for significant returns. If the investments are successful, the venture capital firm will generate returns for its limited partners, who may then reinvest those returns into other funds or asset classes, or distribute them to their own investors or stakeholders.

How To Find LPs

Finding limited partners (LPs) for a venture capital fund can be a challenging and time-consuming process. Here are some general steps that can help:

Develop a target investor profile: Before starting your search for LPs, you need to understand the type of investors who are likely to be interested in your fund. Consider factors such as their investment preferences, geographic location, size of investment, and sector focus.

Network: Networking is a crucial part of the fundraising process. Attend industry conferences, join venture capital associations and groups, and seek out opportunities to meet potential LPs in person or online.

Leverage existing relationships: Reach out to your existing network of investors, entrepreneurs, and industry contacts to see if they can introduce you to potential LPs.

Work with placement agents: Placement agents are firms that specialize in helping venture capital firms raise capital from institutional investors. They can provide access to a broader range of LPs and can help you navigate the fundraising process.

Use online databases: As mentioned earlier, there are online databases like PitchBook, Preqin, and NVCA that offer information on LPs investing in venture capital firms. These databases can help you identify potential LPs and get a better understanding of their investment preferences and history.

Hire a professional investor relations team: Larger venture capital firms often have dedicated teams focused on investor relations. If you have the resources, hiring a professional investor relations team can help you navigate the fundraising process and build relationships with potential LPs.

LPs and VCs typically connect through one of two channels, either directly, due to prior collaboration at another fund or in an adjacent area of finance, or indirectly, via a warm introduction from a trusted source.

When VCs set out to establish a new fund, they often seek out an initial, strong LP known as an anchor. The anchor commits to the fund and helps the VC identify other potential investors. Depending on the network of the VC and their anchor, the fund’s investors can include family offices, high net-worth individuals, or even large institutional funds such as a fund of funds, CALPERS, or university endowments.

While VCs tend to be selective in choosing who they allow to invest in their fund, the process of selecting an anchor by well-connected or respected individuals is even more deliberate and cautious. Securing the right anchor for a fund is a crucial task for a venture firm to successfully raise their fund and set the stage for subsequent rounds in the future.

What Kind of Limited Partner To Target For Your First Fund

If you are building your first fund, you should look for LPs who are interested in investing in early-stage venture capital funds and have a history of investing in first-time funds. These LPs are typically high-net-worth individuals or family offices who are willing to take on higher risks for potentially higher returns.

Additionally, you may want to consider looking for LPs who have experience in the industry or sector you are targeting with your fund. They can provide valuable insights and connections that can help you identify and evaluate investment opportunities.

It’s also important to consider the size of the LPs you are targeting. While institutional investors can provide significant capital, they may also have more stringent investment criteria and require a proven track record. On the other hand, smaller family offices and high-net-worth individuals may be more flexible and willing to take a chance on a first-time fund.

Related Resource: Visible’s Guide to Fundraising for Emerging Managers

Criteria That LPs Use to Evaluate VC Firms

Limited partners (LPs) use various criteria to evaluate new venture capital firms that are raising either their first fund or subsequent ones.

Investment thesis: LPs want to see that the VC firm has a clear and well-defined investment thesis that fits their interests and investment strategy.

Team: LPs evaluate the experience, track record, and expertise of the VC firm’s founding team. They want to see that the team has relevant experience and a strong network in the industry.

Transparency: LPs expect transparency from the VC firm on their investment activities, portfolio performance, and other relevant information. Use our templates for Investors to create transparency by sending your LPs updates!

Differentiation: LPs look for a unique and differentiated value proposition of the VC firm that sets it apart from other firms in the market.

Network: LPs consider the firm’s network of industry contacts, co-investors, and advisors to gauge their potential deal flow and access to investment opportunities.

Deal flow: LPs assess the firm’s ability to source high-quality deals and their process for evaluating potential investments.

Due diligence: LPs want to see that the VC firm has a rigorous and disciplined process for conducting due diligence on potential investments.

Alignment of interests: LPs look for a firm that aligns its interests with those of the LPs, such as having a significant investment in the fund, a reasonable management fee structure, and a fair carried interest arrangement.

Related Resources: VCs can use Visible.vc to send their LPs updates as well! Check out our LP Update templates below.

Returns That LPs Expect

There are very complex agreements between venture capital LPs and venture firms/GPs, as you might imagine.

Based on research from Cambridge Associates, over the past ten years, the highest 25% of venture capital funds have yielded an average annual return between 15% and 27%. In contrast, the S&P 500 has only yielded an average of 9.9% per year over the same period.

Generally, top-tier venture LPs are looking for something north of a 3x net return on invested capital. This is for venture funds that usually have a formal 10-year lifespan. Top-tier venture LPs usually would rather have higher returns than faster returns, i.e. they don’t really care about IRR if they can get high overall returns.

Related Resource: What is IRR for VCs

3x net return on invested capital doesn’t sound like a lot for a financing industry that helps fund companies like Google and Facebook, but there are surprisingly few venture firms that can generate that level of overall return over time.

Related Resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

What is Included in Limited Partner Agreements

Extensive documentation of the terms of an investment in a venture fund is contained within the Limited Partnership Agreement (LPA). The LPA outlines several critical terms, including:

Management Fee: This fee is paid quarterly by Limited Partners (LPs), the investors, to the General Partner (GP), the venture capitalist, to manage the fund. The fee is typically 2% of the committed investment but decreases once the fund has invested in new companies, typically after five or six years. After the investment period, the fee declines annually based on a negotiated formula.

Carried Interest: The GP earns a fee, generally 20% of any profits on the fund after the LPs have received back their invested capital up to the point of liquidity event that made the carried interest possible. Once the GP has paid back the LPs all that they have invested up to that point, the GP gets 20% of distributions, and the LPs receive 80%. For a period, the GP may get more to “catch up” and receive their 20% carry.

Hurdle Rate: While popular with private equity (PE) funds, a hurdle rate is not typical with venture capital (VC) funds.

GP Clawback: If the GP receives more than 20% of the profits at the end of the fund, the GP agrees to pay back the LPs. This may happen if the GP receives their 20% early in the fund’s life based on early successes, but the LPs continue to invest, and the fund performs poorly, with no future distributions to bring the LPs to the point where they have all their invested capital back and 80% of any distributions above the return of capital.

Investment Period: This is the period that the GP/VC has to make new investments, usually five to six years. After this period, the GP can only make follow-on investments in existing portfolio companies and cannot invest in new companies.

Term: The term of a fund is generally ten years, with potential extensions of up to three years. The extensions may require LP approval or not. In theory, once the fund term is over, the fund should be fully liquidated, although provisions for a longer fund life may be necessary to take care of some lingering investments.

Key Man: Many funds identify one or a few key employees (VCs) whose leaving can trigger something – usually the end of the Investment Period. So if the super star VC of the firm leaves or dies, something happens. Likely, the Fund at that point can’t make any new investments unless the LPs vote that they can. There are many variations of this. A typical clause would be if 2 or 3 of 5 named partners leaves then this is triggered also.

GP Commitment: The GP has to commit at least 1% of the capital of the fund, with more being better, but 1% is standard.