The world of Venture Capital is full of jargon and acronyms that can make the industry seem intimidating. When it comes to Venture Capital metrics, it’s important to have at least a high-level understanding of what they mean so that you can contribute meaningfully to team discussions and evaluate investment performance accurately. This post breaks down common VC investment metrics that you’ll likely come across in venture.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

VC Fund Performance Metrics

Multiple on Invested Capital (MOIC): The current value of the fund as it relates to how much has been invested.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Distributions per Paid-in-Capital (DPI): The amount of money returned to Limited Partners, relative to how much capital Limited Partners have given the fund.

Residual Value per Paid-in-Capital (RVPI): The ratio of the current value of all remaining (non-exited) investments compared to the total capital contributed by Limited Partners to date.

Gross Total Value to Paid-in-Capital (TVPI): The overall value of the fund relative to the total amount of capital paid into the fund to date.

Internal Rate of Return (IRR): The expected annualized return a fund will generate based on a series of cash flows taking into consideration the time value of money. (Read more about IRR for VC’s)

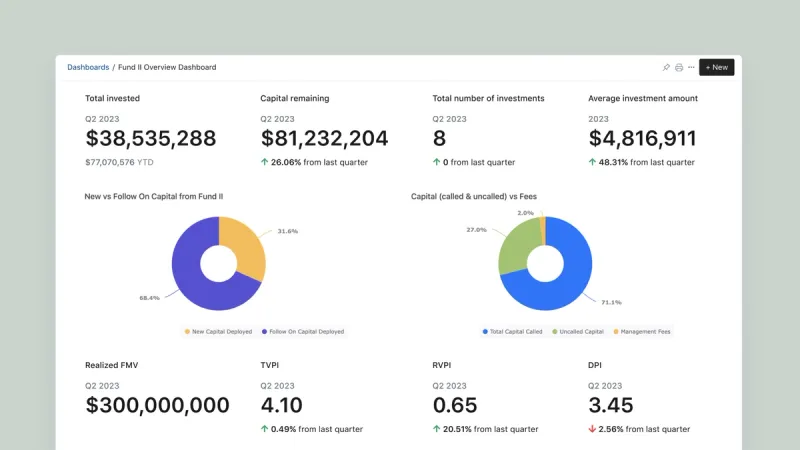

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

You may also like → Venture Capital Metrics 101 (and why they matter to LP’s)

Fund Operations Metrics

Management Fees: A fee commonly paid annually by the fund to cover things like General Partner compensation, insurance, and travel. This is typically 2% of committed capital.

Escrow: Capital temporarily held by a third party until a particular condition has been met. Typically occurs as a part of paying distributions to Limited Partners.

Expenses: Money used to complete investments by the fund, such as legal costs, and other ongoing operational expenses of the fund, such as an annual audit.

Carried Interest: The amount of money returned to the General Partners of a fund after a liquidity event such as when a portfolio company gets acquired. Carried interest is typically 20% of profits, although it can vary depending on a GP’s track record and management fee.

Distributions: The transfer of cash or securities from a venture capital fund to its investors, called Limited Partners, after the fund exits its position in one of the companies. Typically 80% of distributions are returned to LPs. The timing of fund distributions varies from fund to fund.

You may also like → Venture Capital Fee Economics

Valuation Metrics

Fair Market Value (FMV): The value of an investment at a certain point in time. The most common trigger for a change in the FMV is when there is a company raises a subsequent priced round and a new company valuation is established.

Realized FMV: The value of an investment that has actually been realized through a liquidity event such as an acquisition.

Unrealized FMV: The perceived value of an investment that has not yet been realized through a liquidity event.

You may also like → 25 Limited Partners Backing Venture Capital Funds + What They Look For

Capital Metrics

Total Invested: The total amount of capital invested in portfolio companies. This includes initial capital and follow-on capital.

Committed Capital: The amount of money a Limited Partner promises to a venture capital fund.

Capital Called: The capital called from Limited Partners. Typically capital is called on an as needed basis before making a new investment.

Capital Remaining: Capital remaining in a fund that is yet to be invested into companies. Also referred to as ‘dry powder’ and unspent cash.

Uncalled Capital: Capital that has been committed by Limited Partners but not yet called by the fund.

Track & Visualize Your Fund Metrics in Visible

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Additional VC Metrics Supported in Visible

Visible auto-calculates common investment calculations so investors can more easily understand and communicate their fund performance.

Total Number of Investments: A sum total of investments made into individual companies.

Average Investment Amount: The average check size for all investments out of a fund.

Total Number of Exits: The number of companies that have exited the portfolio.

% of Fund Deployed: The ratio of capital deployed compared to the total committed fund size.

% of Fund Called: The ratio of capital called compared to the fund size.

Follow On Capital Deployed: The amount of capital deployed into existing companies in the portfolio.

Total Portfolio Company Capital Raised: The total amount a portfolio company has raised.

Follow on Capital Raised: The combined amount all companies in the fund have raised.

Visible supports over 30+ investment metrics and unlimited custom KPI’s for portfolio monitoring.