14 Venture Capital Firms in Silicon Valley Driving Startup Growth

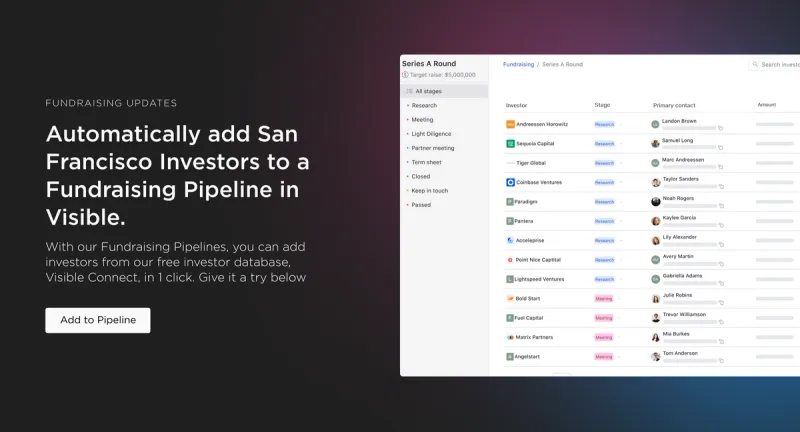

At Visible, we often compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of your funnel, you are adding potential investors via warm introductions and cold outreach

- In the middle of the funnel, you are nurturing potential investors with meetings, updates, pitch decks, and other materials

- At the bottom of the funnel, you are hopefully adding new investors to your cap table

Just as a traditional sales and marketing funnel starts by finding your ideal customer, the same idea is true with fundraising — you might consider location, check size, investment velocity, etc. If you are a founder in Silicon Valley, check out our list of investors in the area below.

1. Bessemer Venture Partners

Location: Redwood City, CA – San Francisco, CA

Focus: BVP invests in many focus areas. A few key areas include – SaaS, cloud, healthcare, vertical software, and marketplaces.

Related Resource: 32 Top VC Investors Actively Funding SaaS Startups

Stage: BVP invests across all stages. Typically writing checks anywhere between $100K and $50M.

As put by their team, “Bessemer Venture Partners helps entrepreneurs lay strong foundations to build and forge long-standing companies. With more than 135 IPOs and 200 portfolio companies in the enterprise, consumer and healthcare spaces, Bessemer supports founders and CEOs from their early days through every stage of growth.”

Notable investments:

- Twilio

- Shopify

- Yelp

- Twitch

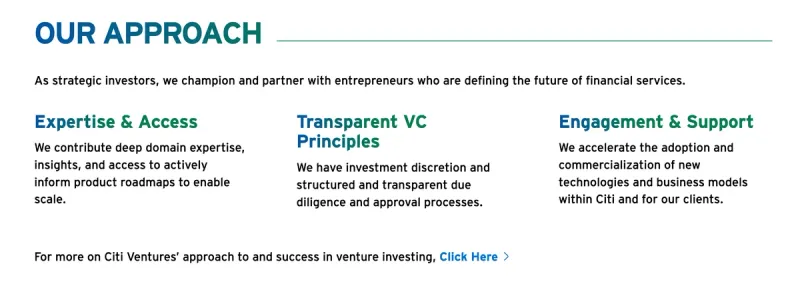

2. Citi Ventures

Location: Palo Alto, CA

Focus: Citi Ventures invests in 7 key focus areas:

- Fintech

- Data Analytics & Machine Learning

- Future of Commerce

- Security & Enterprise IT

- Customer Experience & Marketing

- Proptech

- DLT & Digital Assets

Related Resource: FinTech Venture Capital Investors to Know

Stage: Citi Ventures invests across all stages with a focus on Series B and later.

As put by their team, “Citi Ventures is committed to charting the unknown in a world of unprecedented change and disruption. We invest in innovative startups, and we work with our colleagues, clients, and the innovation ecosystem to experiment with next-generation technologies.”

Notable investments: Some of Citi Ventures’ most notable investments include:

- C2FO

- Docker

- Honey

3. Amplify Partners

Location: Menlo Park, CA – San Francisco, CA

Focus: Amplify Partners focuses on companies building developer tools & computer infrastructure, machine learning & artificial intelligence, data & analytics, and cybersecurity.

Related Resource: 15 Cybersecurity VCs You Should Know

Stage: As put by their team, “Amplify is an early, early stage investor: we meet many of our founders well before they start their companies, or even settle on a product idea.”

The Amplify team further goes on to state, “We believe that technical problems are best solved by the people who experience them firsthand. Our founders tackle what bothered them and their teams as practitioners. Empathy for your end user is much more powerful when you are your end user.

From the start, Amplify has been working with engineers, professors, researchers, and open source project creators to help turn their bold ideas into beloved products and companies. Long live the technical.”

Describe this venture capital firm and why they are a notable firm in Silicon Valley.

Notable investments:

- Datadog

- Gorgias

- Primer

4. Accel

Location: Palo Alto, CA – San Francisco, CA

Focus: Accel is industry agnostic in their investment focus.

Stage: Accel invest across all stages.

As put by their team, “Accel is a leading venture capital firm that invests in people and their companies from the earliest days through all phases of private company growth.”

Notable investments:

- 1Password

- Away

- Invision

5. UpHonest Capital

Location: Give the location of this firm.

Focus: List the industries of focus for this firm.

Stage: Give the funding stage(s) this firm invests in.

As put by their team, “UpHonest Capital is a sector agnostic early stage VC based in Silicon Valley. Our thesis is using our cross border network and information arbitrage to invest in tech driven founders in the U.S. and the next generation of high-impact Chinese and Chinese-American founders. We identify and invest in the next wave of early stage startups in consumer, enterprise and deeptech.”

Notable investments:

- Ironclad

- Substack

- Instacart

6. Designer Fund

Location: San Francisco, CA

Focus: Designer Fund is industry agnostic.

Stage: Designer Fund invest in early stage companies that “use design to improve health, sustainability, and prosperity for all people.”

As put by their team, “Designer Fund invests between $100K – $1M in tech startups that are design leaders including Stripe, Gusto, and Omada Health. Designer Fund specializes in helping design products and scale design teams through their community of designers from companies like Apple, Facebook, Google, Airbnb, Pinterest, and Dropbox.”

Notable investments: Some of Designer Fund’s most notable investments include:

- Framer

- Gusto

- Stripe

7. GSR Ventures

Location: Menlo Park, CA

Focus: GSR is focused on healthcare and healthtech companies.

Stage: GSR is focused on early stage companies.

As put by their team, “Founded in 2004, GSR Ventures is one of the world’s most successful early-stage venture firms, with over $3 billion under management. We are focused on early-stage digital health companies that leverage emerging technology to transform the healthcare landscape.”

Notable investments:

- Alpha

- Glimpse

- Nimble

8. GGV Capital

Location: Menlo Park, CA

Focus: GGV Capital is industry agnostic.

Stage: GGV Capital invest across multiple stages.

As put by their team, “GGV Capital is a global venture capital firm focused on multi-stage, sector-focused investments. Recognizing that the talent to build great companies can come from anywhere, the firm invests in founders building category-leading companies around the world. Founded in 2000 with roots in Singapore and Silicon Valley, GGV has expanded with additional offices in San Francisco, Shanghai, and Beijing.”

Notable investments:

- Airbnb

- Slack

- Opendoor

9. Expa

Location: San Francisco, CA

Focus: Expa is industry agnostic and focuses on “tech-enabled” companies

Stage: Expa invests in early-stage startups and also helps launch companies via their studio.

As put by their team, “We fund passionate founders that are building revolutionary, tech-enabled companies. We invest in startups at the earliest stages. Expa founders receive access to a global community of founders, startup resources, funding, and personalized support from our network of operators.”

Notable investments:

- Metabase

- Kit

- Clyde

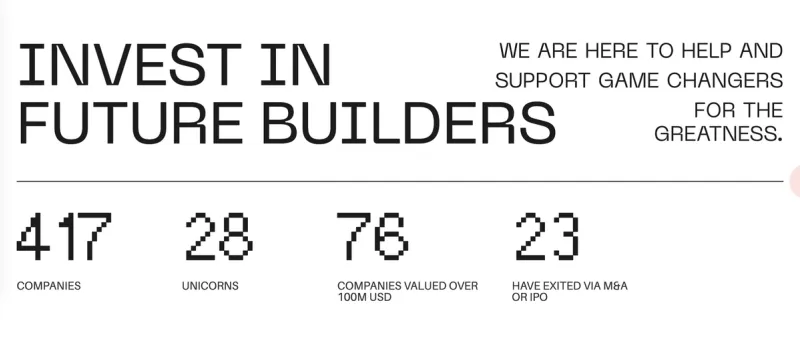

10. Artiman Ventures

Location: Palo Alto, CA

Focus: Artiman Ventures is industry agnostic

Stage: Artiman Ventures focuses early-stage investments

As put by their team, “Artiman is an early-stage sector agnostic venture fund with offices in Silicon Valley and Bangalore. We are seeking to invest in entrepreneurs building white space companies that have the potential to create or disrupt multi-billion dollar markets. As former entrepreneurs, we bring empathy, curiosity, passion, experience, and (occasionally) patience to the table. As investors, we bring capital plus access to a network that reflects the diversity of the firm and our portfolio. Artiman was founded in 2001 and has over $1 billion under management.”

Notable investments:

- Aditazz

- Airwide

- ApplyBoard

11. Sapphire Capital

Location: Menlo Park, CA – San Francisco, CA

Focus: Sapphire Ventures invest in many areas:

- AI/ML

- B2B SaaS

- Crypto

- Cybersecurity

- Data & Analytics

- DevOps

- Fintech

- Healthcare

- Vertical SaaS

Related Resource: 10 VC Firms Investing in Web3 Companies

Stage: Sapphire Ventures is focused on growth and expansion stage companies.

As put by their team, “Sapphire is a leading global technology-focused venture capital firm with more than $10.2 billion in AUM and team members across Austin, London, New York, Menlo Park and San Francisco. For more than two decades, Sapphire has partnered with visionary teams and venture funds to help scale companies of consequence. Since its founding, Sapphire has invested in more than 170 companies globally resulting in more than 30 Public Listings and 45 acquisitions.”

Notable investments:

- Box

- Chargebee

- DocuSign

12. Corner Ventures

Location: Palo Alto, CA

Focus: Corner Ventures is industry agnostic

Stage: Corner Ventures invest in growth stage companies.

As put by their team, “Corner Ventures is a venture capital firm investing in companies as they hit the inflection point of growth, supporting founders and companies as they transition from promising startups to category-defining leaders. Founded in 2004 as DAG Ventures, DAG Ventures was rebranded Corner Ventures in 2018 by its founders as the firm’s next chapter.”

Notable investments:

- Instawork

- Grubhub

- Yelp

13. K9 Ventures

Location: Palo Alto, CA

Focus: As put by their team, “We do not follow a sector strategy like other venture firms. Instead, we look for either core new technologies or radically new markets.”

Stage: K9 Ventures is focused on pre-seed and early-stage investments. K9 wants to be the first institutional check.

As put by their team, “K9 Ventures is a technology-focused Pre-Seed fund based in Palo Alto, California. We believe that extraordinary things are possible when great teams come together around technology. We primarily invest at the pre-seed stage, when the founding team is established and just starting to build the product, but we sometimes invest even earlier and engage with founders when they’re just thinking about the idea and haven’t yet incorporated their company.

K9 wants to be the first institutional/professional capital raised by the companies we invest in. This means we typically engage with companies either when they have raised no capital at all (preferred) or when they have raised only friends' and family money. If a company is going through an incubator/accelerator, then that’s probably already too late for K9 to engage.”

Notable investments:

- Twilio

- Lyft

- Card.io

14. Tribe Capital

Location: San Francisco

Focus: Tribe Capital is focus agnostic.

Stage: Tribe Capital is stage agnostic.

As put by their team, “Tribe Capital is a venture capital firm focused on capturing a perpetual edge in venture and crypto using data science. The team is made up of investors, engineers and scientists who use data to model venture-backed private companies. The San Francisco-based firm has approximately $1.5 billion in assets under management.”

Notable investments:

- Bolt

- Docker

- Kraken

Network with investors in Silicon Valley with Visible

As we mentioned at the beginning of this post, we often compare a venture fundraise to a traditional B2B sales and marketing funnel.

Just as sales and marketing teams have dedicated tools, shouldn’t a founder managing a fundraise and their current investors?

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.