Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Operations

Metrics and data

Portfolio Management: What it is and How to Scale it at Your VC Firm

What is VC Portfolio Management?

Portfolio Management in Venture Capital is a process used by VC investors with the ultimate goal of protecting and increasing the value of their investments. Proper portfolio management is a cumulation of intelligent decision-making, information analysis, and resource commitment all aimed at achieving the value increase and stability in a range of investments.

Portfolio Management within the VC context generally consists of the following:

Market Research and Oversight

Venture capitalists need to be extremely savvy and up-to-date with the most relevant and real-time information about the industries they investment in. Typically, VC firms specialize in a particular type of investment (pre-seed, seed, later stage, etc) and sometimes they are industry specific (B2B Saas, B2C, EnviroTech, FemTech). Therefore, the portfolio that a VC is managing may encompass many different industries. Investors should aim to understand the most up-to-date research on how each industry and market is growing and changing. This helps investors make smart initial investment decisions, inform follow-up funding decisions, and appropriately advise on timely exit strategies.

Risk Profiling

VC investing is a risky business. However, a clear understanding of how long it will take to gain a return on an investment is critical for investors and goes hand in hand with market research when setting up a portfolio management strategy. VCs need to profile the level of risk of each investment with an informed understanding how long it will likely take to get their initial investment back (typically 3-7 years) and how likely they are to 10x their investment. The balance of quick return with high potential is critical to consider when managing new investments in a VC portfolio.

Exit Strategies

As a VC is first making an investment, they typically write into their investment strategy how they hope to exit the business. This plan includes identifying exit targets and appropriate negotiation engagements in best and worst-case scenarios for the business. Strategies might be mergers, acquisitions, buyouts, or public offerings. An ideal exit strategy is important to outline as a part of a portfolio management strategy. This helps investors better mitigate risk and understand the potential outcomes and value of a portfolio.

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

How Exactly Does Portfolio Management Work?

More experienced venture capitalists will use their past experiences to determine patterns in investment strategies and the most effective way to interpret different potential investment outcome scenarios. Ultimately, portfolio management in Venture Capital comes down to understanding the delicate balance of qualitative and quantitative information about the investments in a portfolio.

Portfolio management internally within a VC fund consists of market research and oversight, risk profiling, and formulating numerous potential exit strategies. In order to work through these steps, a VC will need updated information from their portfolio companies on a regular basis. VCs are looking for a mix of metrics and qualitative data from their portfolio.

If you’re a VC looking to streamline the way you collect data from your portfolio companies, check out What Metrics Should I Be Collecting from my Portfolio Companies.

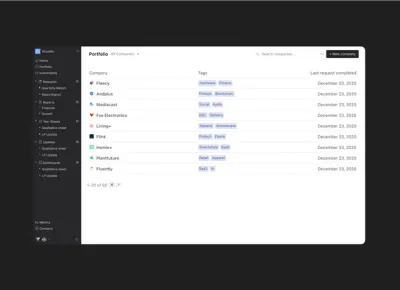

Collecting Portfolio Data in Visible

70% of the 350+ funds using Visible are requesting data from companies on a quarterly basis. Learn more about portfolio monitoring in Visible.

Check out an Example Request in Visible.

Portfolio Management Metrics

Of course, there are metrics that are commonly tracked amongst VC portfolio companies to help VCs stay on top of their portfolio performance. A couple of the key metrics and areas we generally see VCs focused on:

Financials and cash position

A VC wants the honest truth about how their companies are positioned financially. They will want to know metrics such as Cash Balance, Burn Rate, Runway, and Gross Profit. Investors may also ask for the forecast for these metrics. This information helps a VC determine whether they’re likely to reserve cash for a follow-up investment in a company and what a potential exit strategy might be.

Related Resources: Which Metrics Should I Collect from My Portfolio Companies?

True North KPIs

Depending on the type of business a company is operating, their ‘True North’ KPIs will differ. A company’s true north KPIs should be the key performance indicators that are guiding the business every single day. Beyond revenue goals, examples of other KPIs could be active users, a customer net promoter score, active customers, or average contract value. These KPIs will help a VC determine how the company is performing versus sector benchmarks.

Related Resources: Startup Metrics You Need to Monitor

Ownership and Cap Table Data

If a VC is looking to make a new investment, an important component they will consider for their portfolio management is how much ownership they will have in the company. A founder seeking investment should be transparent about what percent of the company is available in exchange for investment (if any) and how much is already taken. In addition to a clear ownership breakdown, a company should share information about its securities (stock options etc..). This information will be extremely relevant as the VC determines how to structure a potential investment deal.

Portfolio Management Qualitative Information

Collecting the metrics and quantitative data is only part of the portfolio management process. We also see investors collect a number of different qualitative fields to help them better understand how a company is performing. A couple of examples below:

Wins from the Previous Period

Founders shouldn’t be shy. Companies should be sure to highlight their most recent, and impressive wins as a company. This will energize and excite a VC who is determining which of their current companies they may want to make a follow-on investment into. Investors will also likely use this information when deciding whether to introduce a company to a potential follow-on investor. When investors make intros to other investors, they’re putting their social capital on the line. Companies who have instilled confidence in their current investors are more likely to get intros to follow on funders.

The VC Advantage

Venture capitalists take portfolio management so seriously because they of course want to see their portfolio investments succeed and make money. Therefore, outside of putting down the initial investment, venture capitalists usually incorporate many other touchpoints and opportunities to help their investments succeed. Outside of the fiscal advantage VC investments provide, a close relationship with investors and VCs can be a competitive advantage that makes or breaks a company.

Ultimately, VCs want to help their portfolio companies because it helps them. In addition to actively monitoring the metric performance of their portfolio, VCs want to offer assistance in any way that they can to give their investments a competitive advantage. These competitive advantage points are also a part of a successful portfolio management strategy. VCs help their portfolio companies in a variety of ways:

Taking action on metrics – As mentioned above, VCs are continuously monitoring their portfolio investments. VCs analyze their companies’ profits, customer churn, average deal size, and more. An informed VC can provide insights and advice to companies to help them improve their performance metrics. Drawing form experience managing other investments, they will have insight into what works and what to avoid or change in order to succeed.

Hiring decisions – VC partners are often ex-founders who have successfully built and exited one ore more companies. They are experienced in hiring founding teams and can help advise what roles are the most critical to higher first. Additionally, VCs networks are deep and wide. A founder may have the chance to hire a seasoned CFO or CMO through an intro from a VC. Hiring the right people is critical to the success of early stage companies and leaning on a VC partner to do so may allow a founder to access talent that wouldn’t have otherwise been interested in their company. (Relevant resource: 5 Ways to Help Your Portfolio Companies Find Talent)

Fundraising assistance – Fundraising is exhausting but necessary as companies aim to quickly scale their business. After partnering with a VC for an early round, investors want to ensure the right investment partners come onboard for later rounds. If a company is on track to succeed, leaning on existing VC relationships to find additional investors is a smart idea. An existing VC will want to work with other firms or angels they get along with or align with ideologically and will often go above and beyond to help you make new connections and raise a new round of funding. (Relevant resource: How to share your fundraising pipeline with your current investors)

Strategic product decisions – With a close eye on the market, a VC can be a good sounding board for what pivots or iterations to make to a company’s product. It’s easy for founders to get stuck in a silo, only focusing on the details of their product. A VC can provide helpful advice on what decisions to make that better keep in mind the market and competitors, even providing tough love on what product decisions might not be right.

Related Resources: How to Lead a Portfolio Review Meeting for VC’s

How Visible Can Help

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Visible helps investors streamline the way they collect data from their founders on a regular basis and provides data visualization and reporting tools.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.

investors

Metrics and data

Operations

Portfolio Monitoring Tips for Venture Capital Investors

What is Portfolio Monitoring

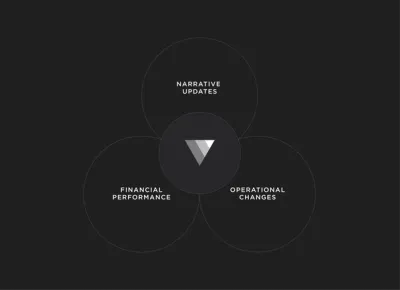

Portfolio monitoring in the context of Venture Capital is the process of tracking the performance of investments in a venture fund. The primary focus of portfolio monitoring is tracking the financial metrics of a company but it also includes monitoring key operational changes, fluctuations in companies’ valuations, and trends in the respective company’s market or industry.

We recently asked 50+ investors to choose their top three reasons for collecting structured data as a part of their portfolio monitoring processes.

You can find a summary of the results below —

Top three reasons investors take portfolio monitoring seriously:

Investors want to better understand how their companies are performing in general

Investors want to provide better support to companies

Investors need to provide updates to Limited Partners

How to Monitor Venture Capital Portfolio Companies

Investors struggle to monitor their portfolio companies effectively because if they hear from companies at all, it’s in a format that is unstructured and in a frequency that is unpredictable. This makes it extremely difficult for investors to have an accurate data set from which they can draw meaningful insights or share updates with their Limited Partners.

Investors who effectively monitor their portfolio companies have a process in place to collect structured updates from their companies on a regular basis — from day one. In the early days of a fund when there are typically less than 10 companies, this can look like sending an Excel file or Google Sheet template to portfolio companies via email and asking them to complete it and send it back.

It’s important to have a reporting process in place from day one because the more time that passes, the harder it can be to change portfolio company behavior when it comes to reporting.

As a fund’s portfolio grows, this process becomes cumbersome and investors often find they are wasting time chasing companies, trying to keep track of which companies have responded and which haven’t, and collating numerous templates into a master portfolio data file.

Visible helps over 400+ investors streamline the way they collect, analyze, and report on their portfolio data.

What Metrics to Track for VC Portfolio Companies

To monitor the performance of portfolio companies it’s crucial to track the right metrics across all your companies. The most common metrics to track include:

Revenue

Cash Balance

Monthly Net Burn Rate

Runway

Net Income

Headcount

Read more about which metrics to collect from portfolio companies and why.

Based on data from the 400+ funds using Visible, most investors are asking for their companies to report 8 metrics and 1-2 qualitative questions on a quarterly basis.

Learn more about VC Portfolio Data Collection Best Practices in our guide.

VC Portfolio Monitoring Template

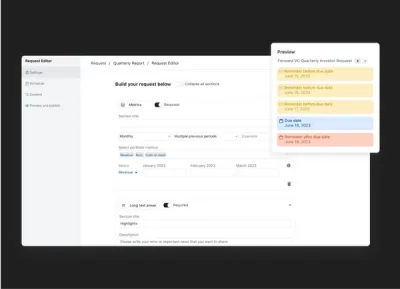

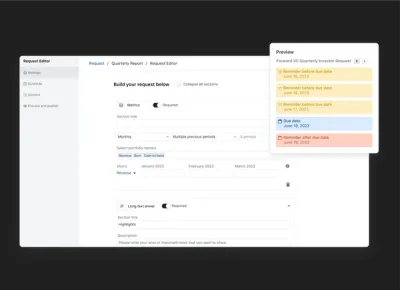

Visible provides investors with a streamlined, founder-friendly way to collect structured data from portfolio companies on a regular basis. The solution in Visible that empowers investors to easily collect KPIs is called a Request.

Visible allows investors to build custom data Requests that support:

Automated email reminders to reduce chasing companies

Assigning custom metrics to certain companies

Sending a Request to multiple points of contact

Asking for budget vs actuals

Secure linked-based forms for companies

Portfolio companies reporting in multiple currencies

Check out an Example Request in Visible.

Portfolio Monitoring Tips for Venture Capital Investors

Set expectations early on.

Consider outlining your reporting requirements in a side letter

Have a process in place to collect data from day one — it’s harder to change reporting behavior change later on

Incorporate reporting expectations into your onboarding process

Check out this Guide to Onboarding New Companies into Your VC Portfolio.

Communicate the why to portfolio companies.

Explain how responses will help inform portfolio support

Explain which data will be shared with LPs and which is just for internal processing

Explain how it will be used to inform follow on investment decisions

Make your data Requests founder-friendly.

Don’t ask for more than 5-8 metrics

Use metric definitions to reduce back-and-forth

Send your Request at the same time every period

Make sure you have the right points of contact at the company

Don’t make your companies create an account if they don’t want to

Turning Your Portfolio Data into Meaningful Insights

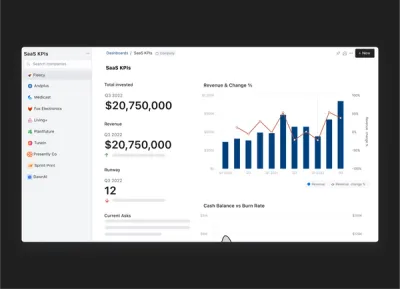

After going through the effort to collect structured data from portfolio companies the next important step is turning into important insights that can be shared with your team and eventually your Limited Partners.

Visible has a suite of tools to help with portfolio data analysis including

Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

Portfolio metric dashboards to help with cross-portfolio insights

Tools to slice and dice your portfolio data by custom segments

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting.

investors

Metrics and data

Customer Stories

Case Study: How The Artemis Fund Uses Visible to Create Annual Impact Reports

About The Artemis Fund

The Artemis Fund is on a mission to diversify the face of wealth. Founded in 2019 in Houston Texas, the firm is led by General Partners Diana Murakhovskaya, Leslie Goldman, and Stephanie Campbell. Their team of five invests at the seed stage and leverages their conviction that the future of financial services and commerce will be written by diverse entrepreneurs. The Artemis Fund has invested in 20 disruptive fintech, e-commerce tech, and care-tech companies founded and led by women.

The Artemis Fund joined Visible in April 2021 with the primary objective of streamlining the way they collect both core financial metrics and impact metrics from their growing portfolio. For two years in a row now, The Artemis Fund has turned their metrics into a data-driven impact report using Visible’s portfolio monitoring tools.

Unexpected Benefits of Creating Impact Reports

Juliette Richert from The Artemis Fund shared the objective of their impact reports has broadened over time — reaping more benefits than they originally intended.

Impact is integral to The Artemis Fund’s investment thesis so there was always a desire to measure their impact; however, the primary objective of publishing their first impact report in 2021 was for fundraising from future LPs. Needing data to back up the narrative of your portfolio’s performance to LP’s is something we commonly hear from investors using Visible.

Over time, the team at Artemis realized the companies they were investing in were having an outsized impact on the communities they are serving. Juliette shared their “portfolio companies are very focused on their end users.” The Artemis team worked with their founders to identify which impact metrics are most integral to their businesses and then Artemis began tracking them using Visible’s portfolio monitoring tools. This larger ripple effect is a major driver behind Artemis’ work and so the team was excited to have actual metrics to back up their investment strategy.

The Artemis Fund’s 2022 impact report clearly communciates their thesis and the narrative behind their portfolio companies’ performance, both of which are made more compelling because they’re backed up by data.

This year they distributed their impact report to their wider network. The unexpected result was that it has become a valuable marketing tool for their fund for not just potential investors but it’s helped attract more founders to their deal pipeline as well. Artemis’ report clearly demonstrates that they’re not just paying lip service to investing and supporting female founders — they’re actually executing against their values and have the data to prove it.

“Using Visible streamlines the way we collect and digest metrics, helping us understand the health of our portfolio and address potential issues proactively.”

— Juliette Richert, The Artemis Fund

Choosing Which Impact Metrics to Track

The first step of creating Artemis’ Impact Report was choosing which metrics to track from their portfolio companies and setting up a data Request in Visible.

Check out an Example Portfolio Data Request in Visible.

The Artemis Fund created 35+ custom metrics in Visible, some of which were collected from all companies, and the rest were assigned to specific companies based on the business model or sector.

Headcount Metrics

Artemis collects these metrics from all companies on an annual basis.

FTE Headcount

PTE/Contractor Headcount

Diverse Headcount #

Female Headcount #

Custom Impact Metrics

Artemis assigns these metrics to specific companies in VIsible and collects them on an annual basis. The list below is not comprehensive.

CO2 Saved (Assigned to portfolio company DressX)

Families Served (Assigned to portfolio company Hello Divorce)

Musicians Served (Assigned to portfolio company Green Room)

Financial Metrics

Artemis collects these metrics on a monthly basis from all companies. The list below is not comprehensive.

Cash Burn

Cash Balance

Revenue

Expected Runway

Total Funding

The Artemis Fund Collected Annual Impact Metrics with a 94% Response Rate Using Visible

Aggregating Impact Data into a Report

Next, The Artemis Fund aggregated their portfolio data within Visible using the Portfolio Metric Dashboard which provides quick insights such as the total, minimum, maximum, median for any metric.

The portfolio-wide metrics Artemis included in their report are Revenue & Capital for SMBs, Number of Families Served, and Number of Jobs created.

This year, instead of providing an overview of each company they chose to highlight specific companies in the form of a case study in their impact report. The result is a more digestible yet compelling report that certainly helps LPs and founders understand the type of companies Artemis’ chooses to back.

The entire compiled report is 17 slides. The Artemis Fund’s deck is hosted on Visible’s deck feature which allows them to distribute the deck via a shareable link and gives them control over their branding, email gating, password protection and more.

View the full impact report here.

Visible helps 350+ funds streamline the way they collect and analyze portfolio data.

investors

Metrics and data

Venture Capital Metrics You Need to Know

The world of Venture Capital is full of jargon and acronyms that can make the industry seem intimidating. When it comes to Venture Capital metrics, it’s important to have at least a high-level understanding of what they mean so that you can contribute meaningfully to team discussions and evaluate investment performance accurately. This post breaks down common VC investment metrics that you’ll likely come across in venture.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

VC Fund Performance Metrics

Multiple on Invested Capital (MOIC): The current value of the fund as it relates to how much has been invested.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Distributions per Paid-in-Capital (DPI): The amount of money returned to Limited Partners, relative to how much capital Limited Partners have given the fund.

Residual Value per Paid-in-Capital (RVPI): The ratio of the current value of all remaining (non-exited) investments compared to the total capital contributed by Limited Partners to date.

Gross Total Value to Paid-in-Capital (TVPI): The overall value of the fund relative to the total amount of capital paid into the fund to date.

Internal Rate of Return (IRR): The expected annualized return a fund will generate based on a series of cash flows taking into consideration the time value of money. (Read more about IRR for VC’s)

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

You may also like → Venture Capital Metrics 101 (and why they matter to LP’s)

Fund Operations Metrics

Management Fees: A fee commonly paid annually by the fund to cover things like General Partner compensation, insurance, and travel. This is typically 2% of committed capital.

Escrow: Capital temporarily held by a third party until a particular condition has been met. Typically occurs as a part of paying distributions to Limited Partners.

Expenses: Money used to complete investments by the fund, such as legal costs, and other ongoing operational expenses of the fund, such as an annual audit.

Carried Interest: The amount of money returned to the General Partners of a fund after a liquidity event such as when a portfolio company gets acquired. Carried interest is typically 20% of profits, although it can vary depending on a GP’s track record and management fee.

Distributions: The transfer of cash or securities from a venture capital fund to its investors, called Limited Partners, after the fund exits its position in one of the companies. Typically 80% of distributions are returned to LPs. The timing of fund distributions varies from fund to fund.

You may also like → Venture Capital Fee Economics

Valuation Metrics

Fair Market Value (FMV): The value of an investment at a certain point in time. The most common trigger for a change in the FMV is when there is a company raises a subsequent priced round and a new company valuation is established.

Realized FMV: The value of an investment that has actually been realized through a liquidity event such as an acquisition.

Unrealized FMV: The perceived value of an investment that has not yet been realized through a liquidity event.

You may also like → 25 Limited Partners Backing Venture Capital Funds + What They Look For

Capital Metrics

Total Invested: The total amount of capital invested in portfolio companies. This includes initial capital and follow-on capital.

Committed Capital: The amount of money a Limited Partner promises to a venture capital fund.

Capital Called: The capital called from Limited Partners. Typically capital is called on an as needed basis before making a new investment.

Capital Remaining: Capital remaining in a fund that is yet to be invested into companies. Also referred to as ‘dry powder’ and unspent cash.

Uncalled Capital: Capital that has been committed by Limited Partners but not yet called by the fund.

Track & Visualize Your Fund Metrics in Visible

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Additional VC Metrics Supported in Visible

Visible auto-calculates common investment calculations so investors can more easily understand and communicate their fund performance.

Total Number of Investments: A sum total of investments made into individual companies.

Average Investment Amount: The average check size for all investments out of a fund.

Total Number of Exits: The number of companies that have exited the portfolio.

% of Fund Deployed: The ratio of capital deployed compared to the total committed fund size.

% of Fund Called: The ratio of capital called compared to the fund size.

Follow On Capital Deployed: The amount of capital deployed into existing companies in the portfolio.

Total Portfolio Company Capital Raised: The total amount a portfolio company has raised.

Follow on Capital Raised: The combined amount all companies in the fund have raised.

Visible supports over 30+ investment metrics and unlimited custom KPI’s for portfolio monitoring.

investors

Reporting

Metrics and data

Flexible Dashboards for Venture Capital Investors (with examples)

As a venture capital investor, it’s critical to maintain accurate, up-to-date information about your portfolio companies and investment data. This helps investors make data-informed investment decisions, provide better portfolio support, fulfill audit requirements with relative ease, and not to mention, impress LPs.

What’s even better than just having your data well-organized and easy to find, is when investors can seamlessly turn that data into meaningful insights that are easy to share with internal team members and stakeholders.

Below we describe three different dashboard types supported in Visible that help investors surface and communicate important updates about their portfolio.

Flexible Dashboards for Internal Portfolio Reviews

Flexible dashboards in Visible allow investors to integrate metric data, investment data, and properties directly into a dashboard. The flexible grid layout means investors have control over how they want to visualize and communicate updates to their team.

Investors commonly use these dashboards to facilitate internal portfolio review meetings which keeps their team up to date and engaged about important updates across the portfolio.

View flexible dashboard examples in the guide below.

Fund Performance Dashboards for Communicating with LPs

Visible allows investors to track, visualize, and share key fund performance metrics. Investors can choose from 14+ different chart types and use custom colors to incorporate their branding into their dashboards.

The fund metrics supported in Visible include:

TVPI

DPI

RVPI

MOIC

IRR

Unrealized and realized FMV

Total Invested

Capital Called

and more.

Learn about the 30+ fund metrics supported in Visible.

Related resource: VC Fund Performance Metrics 101

View a Fund Performance Dashboard example in the guide below.

Portfolio Metric Dashboards for Cross-Portfolio Analysis

As a venture capital portfolio grows, it’s helpful for investors to be able to pull quick insights across all their companies. Visible’s Portfolio Metric Dashboards let investors compare performance across the entire portfolio for a single metric. This view can be filtered by a custom segment and time period. Visible also automatically calculates quick insights such as:

Total

Min

Max

Median

Quartiles

View a Portfolio Metric Dashboard in the guide below.

Visible’s dashboards give investors control over how they want to track and visualize their portfolio KPIs and investment data. Learn more about Visible.

founders

Fundraising

Metrics and data

[Webinar Recording] Using SaaS Metrics to Build Your Fundraising Narrative with Forum Ventures

Webinar Recap

Throughout a fundraise, founders are expected to share the data and financials that fuel their business. Jonah Midanik of Forum Ventures joined us on March 21st to discuss all things SaaS metrics and fundraising.

Watch Recording

A few things you can expect us to cover:

The SaaS metrics every founder should know

What metrics a founder should expect to share with potential investors

What metrics and financials a founder should expect to have prepared for due diligence

How early-stage founders should think about more “advanced” SaaS metrics

About Jonah

Jonah has spent the last twenty years at the intersection of marketing and technology as a serial entrepreneur in Canada. He has experienced several different lenses on the founder’s journey from bootstrapping his own startup, to launching new corporate divisions, and raising 8 figures of venture capital.

At Forum, in supporting hundreds of founders’ growth, Jonah has carved out a niche in the market of teaching founders how to build and deliver pitch decks and which metrics to include to convey traction to raise capital successfully.

investors

Metrics and data

Portfolio Monitoring for Corporate Venture Capital Investors

This article includes insights from a webinar Visible co-hosted with the corporate venture firm JLL Spark Global Ventures and Counter Club, a network of corporate venture capitalists brought together by common challenges and opportunities to share best practices. To learn more about Counter Club and watch the full webinar recording head to Counter Club’s registration page.

Corporate Venture Capital Overview

Corporate Venture Capital (CVC) is the practice of large firms investing in small early-stage startups and offering strategic value. They differ from traditional VC’s because they are not only motivated to make impressive returns for Limited Partners (LPs), but are also focused on protecting their corporate strategy and gaining a competitive advantage.

The Limited Partner for a CVC is usually the singular firm which means the capital source is highly concentrated. The parent corporation is often heavily involved in the day-to-day of a corporate venture. CVC teams are expected to know what’s going on in their portfolio at all times and be ready to share insights and regular reporting with their corporate partner.

What is Portfolio Monitoring?

Portfolio Monitoring is taking a holistic approach to understanding what is going on with your portfolio. It can be thought of in three categories: Qualitative Updates, Financial Performance, and Operations Changes.

Narrative Updates: Arguably the most important part is understanding the narrative behind changes going on with certain companies. For example, what’s going right for this company right now and what’s hard right now and why?

Financial Performance: Other aspects of portfolio monitoring is understanding the financial performance of a company and oftentimes comparing that versus what was forecasted. You’ll want to be able to understand the current value of a companies key performance indicators but also extract insights such as quarter-over-quarter and year-over-year growth.

Operational Changes: As a part of portfolio monitoring you’ll want to stay on top of any major operational changes a company undergoes. For example, major changes in total headcount or moving a company’s headquarter to a larger facility could explain the recent change in a company’s burn. Another operational change to monitor is when a company secures additional follow on investment or a change in their cap table.

Learn more about using Visible to monitor your portfolio companies.

Why is Portfolio Monitoring Important within the CVC Context?

Insight into your portfolio companies is critical within the CVC context. By knowing what’s going on with your portfolio companies you’ll be able to provide more impactful, relevant support to your companies. You’ll also be able to gain the confidence of your corporate partner by demonstrating your ability to monitor, manage, and share insights about your portfolio companies.

“Communication is the lifeblood of any relationship. If you’re delivering updates back to the corporate partner and they know exactly what’s going on, you’re more likely to continue to get funding and resources.”

– Mike Preuss, CEO Visible

Benefits of Portfolio Monitoring:

Being able to share meaningful insights with your corporate partner

Using data to drive future investment decisions

Helping portfolio companies succeed

Make introductions to talent, investors, customers

Provide relevant sector-specific expertise

Leverage intraportfolio knowledge to better understand technology trends

Staying organized with a central source of truth

Building more trust with the corporation

“I think what’s really important is having a central source of truth for all of our data whether that be portfolio companies, how much we invested and what was the price, all the information around the deal. Having that in a central location for all the team to look up is really important.”

– Mikey Kailis, Counterpart Ventures, Visible User

Portfolio Monitoring Best Practices

Oftentimes CVCs know they should be monitoring their portfolio companies but don’t know what best practices look like. Here are curated best practices based on Visible’s experience supporting over 400 investors.

Ask for only 5-10 metrics and 1-2 qualitative questions

Staying below 10 metrics reduces the time it takes founders to complete their reporting so they can get back to building their companies.

Most Common Metrics to Track

Revenue

Cash Balance

Monthly Net Burn*

Cash Runway*

Net Income

Total Headcount

*Both of these metrics can be calculated in Visible using formulas and don’t need to be requested.

For more details check out ‘”Which metrics should I be tracking for my portfolio companies”

Use Metric Descriptions

Using metric descriptions helps with data accuracy and can reduce back and forth between you and your companies. Visible’s customer sucess team can help you establish the best descriptions to include with your metrics.

Collect Data Quarterly

According to Visible’s user activity, 70% of investors are requesting updates from their portfolio companies on a regular basis. By establishing a quarterly frequency with your companies you’re getting them into a rhythm of reporting expectations only 4 times a year. It’s also becoming more common to request ESG or DEI information on an annual basis.

For more best practices such as high to get high response rates from companies check out ‘Portfolio Data Collection Tips from Visible’.

Check out an Example Request in Visible.

Providing Strategic Value to Portfolio Companies as a CVC

Corporate VC’s are uniquely positioned to provide strategic value to their portfolio companies. CVC’s are often investing in sectors in which they have deep sector expertise, relevant networks, and commercial experience. All of this can be extremely valuable to companies but only if you know what is going on with your companies and have developed enough rapport for companies to share where they need help.

By incorporating qualitative questions in your portfolio data Request in Visible such as ‘How can we specifically support you this quarter in terms of customer introductions, talent, or market expertise’, CVCs can unlock rich opportunities to deepen relationships with companies and provide strategic value.

The two metrics JLL collects and reports back to corporate JLL to demonstrate strategic value add are ARR and the number of customers.

“Visible helped us develop regular communication with our portfolio companies. It helps us understand where our portfolio companies are focused and how we can best align with them. Our investors also are able to look back at these updates to understand if companies are struggling at the moment and how we need to prioritize our support.” — Kelly Wong, JLL Spark

CVC Portfolio Reporting

You can share updates about your portfolio with your team and wider firm with Visible’s flexible dashboards, tear sheets, and LP Update features. Learn more.

Interested in exploring Visible for your Corporate Venture Capital fund?

founders

Metrics and data

Important Startup Financials to Win Investors

Accounting and finance are skills that every founder should hone. While you don’t need to be an expert, you should be comfortable with different financial statements and be able to answer questions from current and potential investors. Check out our quick breakdown of startup financials below:

What are startup financials?

Startup financials are the vitals behind how a company operates. Financials are the metrics and data that drive the different financial statements for a startup — income statement, balance sheet, cash flow, changes in equity, etc.

As we wrote in our post, Building A Startup Financial Model That Works, “The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.”

Why are startup financials important for pitch decks?

An investor’s job is to generate returns for their investors (AKA limited partners or LPs). In order to invest in the best companies, investors need to leverage data and their own insights to fund companies they believe have the opportunity to generate returns for their investors.

Related Resource: How To Build a Pitch Deck, Step by Step

Part of this process involves collecting financials and data. Different investors might look for different things when it comes to a company’s financials and metrics — inevitably, an investor will need to take a look under the hood to see how a company operates.

Learn more about the financials that VCs look for in a pitch deck below:

Essential startup financials to include in pitch decks

As we previously mentioned, different investors will look for different metrics and data when it comes to a pitch deck. In order to best help you prepare the metrics and data you need, we laid out the following common metrics that VCs might look for in a pitch deck below (as always, we recommend sharing what you believe is best for your business):

Related Resource: Tips for Creating an Investor Pitch Deck

Gross revenue

Gross revenue is the sum of all money generated by a company. This is important for a pitch deck because investors will want to understand how much revenue a business is generating. For companies that are pre-revenue, make sure you are targeting investors that invest in pre-revenue companies.

Cost of goods sold

As put by the team at Investopedia, “Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the goods. It excludes indirect expenses, such as distribution costs and sales force costs.”

Gross profit

As put by the team at Investopedia, “Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services.” This is important because investors want to understand how your business efficiently turns revenue into profit.

Operating expenses

Operating expenses are exactly what they sound like — the expenses a business incurs from normally operating. Operating expenses help investors understand how and where your business is spending money.

Net income

As put by the team at Investopedia, “Net income (NI), also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses.” Net income truly reflects the profitability of a company as it takes into account all of the expenses a business will face.

Related Resource: 18 Pitch Deck Examples for Any Startup

Understanding forecasting vs accounting

Over the course of building a startup, founders will inevitably have to understand different basic accounting, forecasting, and budgeting principles. Learn more about forecasting vs. accounting for your startup below:

Related Resource: 7 Essential Business Startup Resources

Financial forecasting

A financial forecast and financial model is a tool that founders can use to tell their startup’s story. As we wrote in our post, Building A Startup Financial Model That Works, “The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.”

Accounting

Basic accounting is a skill that every founder should be familiar with. Accounting is a realistic look at the financial performance of your business. It’s critical to have a grasp on all elements of your company’s books to ensure your company can grow and scale in an effective way and avoid costly financial errors down the line.

Related Resource: A User-Friendly Guide to Startup Accounting

Financial statements: your startup’s report cards

Having a grasp on your financials is a surefire way to clearly articulate your needs for capital and how you plan to spend any additional funding. Learn more about common financial statements for startups below:

Related Resource: 4 Types of Financial Statements Founders Need to Understand

Income statement

As put by the team at Harvard Business School, “An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time.”

Balance sheet

As put by the team at ProjectionHub, “A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup’s assets, liabilities, and owner’s equity. In other words, a balance sheet shows what a business owns, the amount that it owes, and the amount that the business owner may claim.”

Statement of cash flows

As put by the team at Accountancy Cloud, “A cash flow statement, or CFS, is a financial statement that accurately summarizes the total amount of cash that goes into and eventually leaves a startup business. Cash flow statements are designed to accurately measure if a startup is managing its cash wisely.”

Impress potential investors with Visible

With our suite of fundraising tools, you can easily find investors, share your pitch deck, and track your fundraising funnel. Learn more about our pitch deck sharing tool and give it a free try here.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital

founders

Metrics and data

How to Calculate the Rule of 40 Using Visible

Since the start of 2022, there have been major macroeconomic changes taking the startup world by storm. Rising inflation, paired with the tumultuous public markets (especially in the technology sector), has made its way downstream to startup fundraising. As the team at OpenView Ventures put it, “For operators, this has led to whiplash from grow at all costs to cut at all costs.”

We partnered with OpenView Ventures for the 2022 SaaS Benchmarks Survey. The main takeaway? Nearly every company is cutting spend, regardless of how much cash they have in the bank.

Valuations are also changing. In 2021, valuations were largely based on growth rates for the next 12 months. However, there has been a transition to public valuations being based on the “Rule of 40.” Put simply, the rule of 40 means a company’s YoY revenue growth % + profit margin % should exceed 40.

As the team at OpenView points out, “For companies with ARR below $10M, Rule of 40 can vary widely from quarter to quarter. Achieving 40 each quarter is not required. But, it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

Learn how you can calculate, and automate, the rule of 40 using Visible below:

1. Track Revenue

First things first, to calculate the rule of 40 you need to know your revenue for multiple years (or periods). You can enter this into Visible manually or using 1 of our integrations (likely Google Sheets, Xero, or QuickBooks).

Once you have your revenue # in Visible, we’ll automatically calculate your growth % (more on this in step 3).

2. Track or Calculate Profit Margin %

Next, you’ll want to make sure you have the necessary metrics in Visible to track your profit margin %. If you are using one of our accounting integrations (like Xero or QBO), or tracking this in a Google Sheet, you’ll be able to automatically bring this in. If you’re starting from scratch, you’ll simply need your revenue and COGs (or Gross Profit).

Once you have your Revenue + COGs metrics in Visible, you’ll be able to calculate it using our formula builder. The formula for Profit Margin % is =

Profit Margin % = ((Revenue – COGs)/Revenue) x 100

Which will look like the following in Visible:

3. Calculate Rule of 40

Now that we have Revenue and our Profit Margin %, we just need to add the two together. We’ll create a new formula shown below (Note: we’ll want to make sure we are using the annual change % insight for Revenue — this is automatically calculated):

4. Chart & Share

Once your formula is set up, it will automatically be calculated as new data enters Visible. From here, you can chart and share your Rule of 40 using Updates and Dashboards — check out an example below:

Track your key metrics, update investors, and raise capital all from one platform. Give Visible a free try for 14 days here.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

founders

Hiring & Talent

Metrics and data

Developing a Successful SaaS Sales Strategy

Founders are tasked with hundreds of responsibilities when starting a business. On top of hiring, financing, and building their product, early-stage founders are generally responsible for developing initial strategies — this includes the earliest sales and market strategies.

In this article, we will look to help you craft a successful SaaS sales strategy. We’ll highlight the elements you will want to think of when you start to build your sales motion. This will help your team to understand how to measure the number of potential customers in your pipeline and the growth potential you might see in your revenue numbers.

How are SaaS sales different from other types of sales?

Like any sales strategy, it is important to start with the basics when looking at a SaaS sales strategy. At the top of your funnel, you have marketing leads that likely find your brand via content, word of mouth, paid ads, your own product, etc.

From here, leads are moved through the funnel. In the middle, SaaS companies can leverage email campaigns, events, product demos, etc. to move leads to the bottom of their funnel. However, as the SaaS buying experience takes place fully online — sales and marketing organizations can be creative with their approach. The online experience allows companies to track more robust data than ever before. Additionally, SaaS products have turned into their own growth levers as well — the ability to manipulate pricing and plans has led to the ability for companies to leverage their own product for growth.

Related Resource: How SaaS Companies Can Best Leverage a Product-led Growth Strategy

The online presence and emergence of product-led growth have led to new sales strategies unique to SaaS companies. Learn more below:

3 Popular SaaS sales models

There are countless ways to structure your Saas sales strategy. For the sake of this post, we’ll focus on 3 of the most popular strategies. Learn more about the self-service model, transactional model, and enterprise sales model below:

Related Resource: The SaaS Business Model: How and Why it Works

Self-service model

The self-service model allows prospects to become customers without communicating with your team. As put by the team at ProductLed, “A SaaS self-serve model is exactly what it sounds like. Rather than rely on a dedicated Sales team to prospect, educate, and close sales, you design a system that allows customers to serve themselves. The quality of the product itself does all the selling.” This strategy is typically best for a strong and simple product that typically has a lower contract size.

Transactional sales model

The transactional model allows you to create income-generating actions where prospects have to become a customer at that point in time. This requires transactional sales models to have high-volume sales that can be supported by a strong sales and customer support team.

Enterprise sales model

The enterprise model is a strategy to sell more robust software packages to corporations – you will need baked-in features in a prepackaged manner to sell to a fellow business. Enterprise sales is the model that shares the most similarities with a traditional B2B sales funnel.

Inbound vs outbound sales

In a Saas sales funnel, you are constantly looking to consistently fill your sales funnel with fresh prospects. Once you have prospects you will look to find which prospects are worthy of being qualified and have a high likelihood of converting so you can spend your time communicating with those high-quality prospects.

There are two popular strategies for creating fresh prospects that would be defined as inbound and outbound sales strategies. Inbound sales is when you invest in marketing to create prospects reaching out to you – fresh prospects reaching out to your business to ask about your software product. As put by the team at HubSpot:

“Inbound sales organizations use a sales process that is personalized, helpful, and directly focused on prospects’ pain points throughout their buyer’s journey. During inbound sales, buyers move through three key phases: awareness, consideration, and decision (which we’ll discuss further below). While buyers go through these three phases, sales teams go through four different actions that will help them support qualified leads into becoming opportunities and eventually customers: identify, connect, explore, and advise.”

An inbound strategy typically works best for SaaS companies that need a greater volume of customers and can nurture them and move them through their funnel at scale (e.g. self-service model)

Outbound sales on the other hand are having members of your organization reach out to potential prospects to see if they would be interested in using your service. Outbound sales require highly targeted and proactive pushing of your messaging to customers.

Generally, outbound sales require dedicated team members to manually prospect and reach out to potential customers. This means that outbound sales organizations do not naturally scale as well as an inbound sales organizations and will likely require a higher contract value. An enterprise model would rely heavily on Outbound sales, while a self-service business model will rely heavily on Inbound sales.

The SaaS Sales Process

The best Saas sales strategy will be a hybrid of inbound and outbound sales, but all of them should include a sales funnel. This funnel should have stages that help to qualify your prospects. These stages should be:

Step 1: Lead generation

This activity is often times a marketing activity that gives you contact or business information to explore the fit further

Step 2: Prospecting

This is where you develop the bio of who is the contact you are reaching out to within the organization. It is always helpful to prospect for someone who can make a buying decision

Step 3: Qualifying

In this step, you need to understand whether the prospect has the resources to pay for your product and the problem that your product can solve. This step is often the time for you to ask questions of your prospects

Step 4: Demos and presenting

This is when you will share the features and capabilities of your product with the qualified prospect. You want to show them the different features and where they can get the most value.

Step 5: Closing the deal

After your demo or a presenting call, the prospect should be pushed to a point where they need to make a decision on whether to buy your product.

Step 6: Nurturing

Once someone becomes a customer, you need to make sure to nurture them and grow your product offering with their business. This is the most difficult stage. Make sure to share your new product releases, stay in tune with how they are using your product, and build relationships with your customers.

Cultivating a robust sales team

To create a sustaining sales team, it is important to hire talented and tenacious people to own your sales funnel. They will need to track conversion numbers, stay organized with their outreach to prospects, and grow your funnel over time.

There are three key roles within a Saas sales funnel. Those positions within your organization are:

Sales development representatives

(also known as business development representatives) These members of your team own lead generation, prospecting, and qualifying potential customers on your sales team. They get paid 40-60k/year depending on geographical location and experience. They should be tasked with outreach and drumming up new business.

Account executives

Account executives should focus on giving product demos, closing deals, and nurturing existing customers. They should be a bit more buttoned up in their approach and have a commission incentive associated with the # of accounts they manage.

Sales managers/VPs

Sales managers and Vice presidents of sales should take ownership of the data within your sales pipelines. Numbers like # of new leads, # of new qualified leads, # of new customers, # of churned customers, amount of new revenue, and lead to customer conversion %. Growing these sales numbers each quarter. Measuring these numbers weekly, monthly, and quarterly. Making them visible to the rest of the company regularly.

8 Key Elements of a successful SaaS sales strategy

One of the most important elements of building a successful business is having a like-minded team around you to support and work with you. Make sure to align with all your team members and hire people with good work ethics and similar values of your company. A good sales team should be competitive, goal-oriented, and metric-driven. The sales managers and VPs will be really crucial in shaping the team dynamics and culture of your business. Hire great people and the numbers will take care of themselves!

We’ve identified 8 elements of a successful sales strategy that every Saas sales strategy should include

1. Solidify your value proposition

It is so important to understand thoroughly and communicate your product’s core value proposition. If someone decides to buy your product, they should know how to use the product and how to get the most out of it.

2. Superb communication with prospects

Communication is of the utmost importance. Make sure your prospects understand your product and how it will help their business. Inform them of new product updates

3. Strategic trial periods

An effective strategy is to give potential customers a free trial of your product to understand your value proposition. You want to make sure not to make this trial period too short or too long. Make it strategic so the prospect will understand the value prop but also be encouraged to make a buying decision.

4. Track the right SaaS metrics

Tracking your core metrics is vital to success. See a few of those below:

Customer Acquisition Cost – the amount of money it takes to acquire a new customer

Customer Lifetime Value – the amount of value a customer provides your company over the course of their relationship with you as a customer.

Lead velocity rate – the growth percentage of qualified leads month over month. This will help you understand how quickly you are qualifying your leads

Related Resources: Our Ultimate Guide to SaaS Metrics & How To Calculate and Interpret Your SaaS Magic Number

5. Develop a sales playbook

Every successful sales management team should develop a playbook on how to deploy their resources and where each team member should spend their time. Playbooks are often thought of in sports terms, but they also work wonders in the business world. They will help you do things efficiently and effectively.

6. Set effective sales goals

How many new customers does your business hope to bring in next month? This is an important question and one your whole sales team should understand and work towards!

7. Utilize the right tools to enhance the process

Your team should have all the resources at their disposal to communicate effectively and track their metrics. As you build out your strategy and team, be sure to give them all possible resources at their disposal. There are tons of great tools out there for teams to make the most out of their time and have direct methods of communication with customers and one another.

8. Establish an effective customer support program

A huge part of an effective sales strategy is welcoming potential customers and making sure your existing customers are not forgotten about. When customers reach out, it is important to talk and listen to their issues. Understand what they are needing so your product can continue to evolve.

Make sure anyone getting introduced to your product will also have the information they need to use your product successfully. It might be helpful to include this member of your team in your sales meetings and keep them informed as to messaging and efforts for growth!

Generate support for your startup with Visible

Developing a successful SaaS sales strategy is not an easy task. It will take a hybrid approach of many of the elements listed in this article and will need attentive members of your team to nurture it and test new things. We created Visible to help founders have a better chance for success. Stay in the loop with the best resources to build and scale your startup with our newsletter, the Visible Weekly — subscribe here.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

investors

Metrics and data

Operations

How to Establish ESG Monitoring and Reporting Practices at Your VC Firm

As we invest in rapidly changing technologies that impact people and the planet, it’s of the utmost importance to consider the unintended consequences—even at the early stage. As the world felt the effects of several major crises in recent times, Environmental, Social, and Governance (ESG) principles have rightfully risen to the spotlight in the venture capital industry and now play a critical role in investment decision-making.

Investors hold a responsibility to guide their portfolio companies in ESG practices, not just because the world is watching—but because companies that are as concerned with their impact as they are with building their products are proven to perform better in the long run.

Visible recently hosted an ESG for Venture Capital webinar with Tracy Barba, Head of ESG at 500 Startups and Director at ESG4VC, where she answered the common questions about establishing ESG reporting practices at VC firms. We’ve shared answers to some of those questions below as well as guidance on using Visible for ESG portfolio monitoring.

What is ESG for Venture Capital?

ESG policies and practices help investors and companies manage their environmental, social, and governance risk and identify opportunities for value creation. VCs—including 500 Startups—are widely embracing the shift. In the 2020 ESG Annual Report spearheaded by Tracy Barba, 500 Startups said their policies include:

Environmental criteria to examine how a company performs as a steward of nature.

Social criteria to consider a company’s relationship with its employees, suppliers, customers, and communities where it operates.

Governance criteria to review a company’s leadership, shareholder rights, executive pay, audits, and internal controls.

VC firms can and should provide an ESG framework as startup companies grow. It’s never too early to care—as we’ve seen in the news, large tech companies have found themselves in legal and ethical trouble over issues that could have been resolved in the earlier stages.

In How Venture Capital Can Join the ESG Revolution, Stanford’s Social Innovation Review pointed out that eventually, ESG should not be understood as an “add-on” but a core value in a VC leading to better investments and companies. Ethical and legal considerations should not be ignored in the service of achieving rapid growth and swift time to market. As a VC firm, there is a risk in your ownership percentage if a portfolio company were to face legal battles, public scrutiny, and other risks that could have been prevented if they were identified earlier.

ESG as a term is often used interchangeably with impact investing. As Tracy Barba points out, impact investing is thinking about the end goal and the impact of the companies you’re investing in. Having a strategy around water or climate is an example of an impact strategy, so you’re filtering deals based on that. ESG is a screening for every company, regardless of the type, measuring their environmental, social, and governance criteria.

It’s hard for an early-stage company to know their impact, such as environmental waste, if they don’t have a product yet. That’s why it’s important to map ESG to relevant stages of a company’s development. At an early stage, the goal is to start to have a conversation. It’s much easier to think about how a company affects the environment from the beginning and address any issues upfront rather than fix or replace already-established processes in the future. At later stages, more detailed discussions will be appropriate.

Founders overwhelmingly do care and want to consider ESG, but many don’t know when or how to get started. As an investor, you can help them start to think through ESG by adding it as an agenda item on your monthly or quarterly check-ins. An example question is: “Are you tracking your carbon footprint?” Their answer might simply be “Yes”, or it might be, “No we aren’t, but we’d like to. How can we get started?”

Why is ESG Becoming More Common in Venture Capital?

There is a growing understanding that ESG policies help with customer loyalty, retaining talent, and attracting more investors. It’s beneficial if a company directs time and energy towards making sure they’re operating responsibly.

In venture capital, some topics are gaining momentum:

Diversity – there are demonstrated benefits to having culturally diverse teams and boards.

Gender equality – supporting more women and as founders and funders.

Data protection & privacy of users – startups are not exempt from laws such as the GDPR and CCPA which protect the personal data privacy of consumers.

Environmental impact trends – caring about carbon emissions, ethical sourcing of materials, waste management, etc.

It’s important to be mindful of regulations and how they can change over time. The Sustainable Finance Disclosure Regulation (SFDR) in Europe aims to prevent greenwashing and to increase transparency around sustainability claims (source: Eurosif). While the SEC currently only recommends ESG disclosure, it may also create firm rules in the future. Companies may start measuring and reporting their ESG progress in preparation for new regulations.

More than ever, founders care about being backed by VCs they align with. VCs can drive a positive shift by integrating ESG into their own operations. Showing that you care as an investor is integral in instilling ESG policies into your portfolio.

How To Monitor ESG Metrics Across your VC Portfolio

You can start tracking ESG metrics across your portfolio by sending them an annual questionnaire. 500 Startups, for example, collects their founder diversity info on a quarterly basis, measuring their progress over time and benchmarking to the VC industry.

Founders already get asked for a lot of information, so to encourage their participation in your ESG questionnaires, ask fewer questions and use simple yes/no answers whenever possible. With Visible, you can fully customize your ESG reporting questions using Requests.

Preview of an ESG Request in Visible below —

View best practices for collecting metrics with Visible below:

You can track answers and hold founders accountable for how they are going to implement best practices, how they are going to hire, etc.

ESG questionnaires are not meant to penalize startups, but to get a sense of where they currently are—they may only just be starting to think about tracking and monitoring their water usage or diversity, for example. Once they gain customers, the questions you ask them will grow more detailed.

If an early-stage company feels they do not have the resources or bandwidth to manage ESG concerns, you can help them get started by simply putting an employee manual or non-discrimination policy on the agenda for your next check-in. Remember, it’s going to be more expensive if they wait longer to implement those practices.

Tips for ESG Fund Reporting

External consultants can help VC firms evaluate their policies and processes across recruitment, HR, and deal flow, and recommend ways to improve. Since external consultants collect data across venture capital firms, they can educate them about best practices and compare how they are doing relative to the entire industry.

Tracy Barba, Head of ESG at 500 Startups, reported that working with external consultants like Diversity VC was helpful in providing them with an external validation point. This type of industry benchmarking is now growing as a field and becoming more common practice.

Resource: How to increase Diversity at your VC Fund

How to Incorporate ESG Into Your Portfolio Support

Now that you’ve gathered ESG data from your portfolio companies and identified opportunities for improvement, what’s next? VC firms can take the initiative to provide education, tools, training, and resources for their companies—whether in-house or through outside service providers and consultants.

500 Startups provides a vast array of ESG resources for their founders and the public, including webinars, which are available on their website: ESG for Early-Stage.

Resource: Portfolio Support Best Practices for Venture Capital Investors

Tracy Barba’s nonprofit ESG4VC aims to provide education, office hours, and research for venture capital firms to help establish standards and encourage movement in a positive direction across the industry.

It’s been said that we can’t fix what we can’t measure. When it comes to improving the impact business has on the environment, workers, and communities, investors can be proactive in incorporating ESG policies at the very early stages so that everyone can benefit.

View Examples of How to Request Metrics in Visible below:

founders

Metrics and data

7 Startup Growth Strategies

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Whether a venture-backed startup looking to attack a massive market or a bootstrapped business, startups are generally in pursuit of growth. One of the main competitive advantages of a startup is the ability to test new growth strategies and move quickly compared to its predecessors.

Related Resource: The Understandable Guide to Startup Funding Stages

Finding a growth strategy or channel can make or break a company. In order to best help you find and develop the growth channels that work best for your business, we’ve laid out a few key strategies below:

1. Develop a strong value proposition

First things first, you need to develop a strong value proposition. As put by the team at Investopedia, “A value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. A value proposition is part of a company’s overall marketing strategy. The value proposition provides a declaration of intent or a statement that introduces a company’s brand to consumers by telling them what the company stands for, how it operates, and why it deserves their business.”

This should be used at the backbone of your growth strategies and can be used to define your channels, messaging, and overall growth strategy. It is important to be thoughtful when laying out your value proposition — talk to customers, potential customers, and other stakeholders to help construct your value proposition.

Related Resource: How to Easily Achieve Product-Market Fit

2. Understand and embrace your target audience

After you’ve laid out your value proposition, you need to define the market and audience you would like to target. This is similar to creating your ideal customer profile.

As put by the team at Gartner, “The ideal customer profile (ICP) defines the firmographic, environmental and behavioral attributes of accounts that are expected to become a company’s most valuable customers. It is developed through both qualitative and quantitative analyses, and may optionally be informed by predictive analytics software.”

Related Resource: How to Write a Business Plan For Your Startup

Identify why a customer wants your product or service

If you’ve properly laid out your value proposition, this should be fairly easy. If you understand the value you are offering your customer, it should be straightforward why they would want to purchase your product or service.

Segment your overall market

For modeling purposes, you will likely start with your market as a whole. From here, it is important to narrow down your target and hone in on your specific segment in a market.

For example, if you are selling snowboards your total addressable market might be every outdoors person but you’d likely want to hone in your market to just anyone that has snowboarded in the last X years.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

Research the market

Once you’ve honed in on your market, you need to make sure you are an expert in all things related to the market. When reaching out to potential customers, chances are they will turn to you for best practices on the market and space. To go above and beyond, come equipped with the right knowledge.

Choose the segmented market

After researching and analyzing the different markets, make the choice. Pick your segmented market and make sure you have the messaging and product in place to win the market.

3. Research and analyze your top competitors

Inevitably, when speaking and targeting potential customers you will be compared to your competitors. In order to best combat any pushback, you need to come prepared. In order to best grow you need to understand how your product or service compares to competitors.

If you can understand your strong points (and weak points) in comparison to competitors you’ll be able to better tailor your messaging and campaigns.

4. Establish smart key performance indicators

As the old adage goes, “you can’t improve what you don’t measure.” When testing and finding growth strategies, it is important to have the right KPIs in place to track your performance.

Related Resource: Startup Metrics You Need to Monitor

Depending on the growth strategy or campaign will dictate what metric you should track. Check out a few examples below:

Return on investment (ROI)

One of the most common KPIs to track in relation to a growth strategy is return on investment. In order to continue investing in a growth strategy, you need to make sure it is generating returns.

As put by the team at Investopedia, “Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.”

Churn rate

On the flip side, growth can be fueled by improving your churn rate. If you’d like to grow your current customer base, focusing on churn rate is a surefire way. Learn more about tracking and improving your churn rate below:

Related Resource: Our Ultimate Guide to SaaS Metrics

Customer acquisition cost

As we wrote in our post, “Customer Acquisition Cost: A Critical Metrics for Founders,” customer acquisition cost is “The sum of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

By monitoring your customer acquisition costs, you’ll be able to determine what channels make the most sense for your business. A surefire way to fuel growth is by improving your CAC. For example, if you are running ads at a high cost that do not convert to customers, chances are you’d be better suited to reallocate those costs to a better converting channel with lower acquisition costs.

Customer lifetime value

As put by the team at NetSuite, “Customer lifetime value (CLV) is a measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client.”

By monitoring your customer lifetime value, you’ll be able to boost margins and warrant spending more on acquisition costs. Learn more about customer lifetime value below:

Related Resource: Defining Customer Lifetime Value for Startups: A Critical Metric

5. Scale wisely and effectively

In the early days of building a business, the old adage goes, “do things that don’t scale.” However, as you find your rhythm and have a valuable product with growth strategies that work, it is time to scale. During uncertain times, it is especially important to scale efficiently to work towards profitability.

Scaling involves taking your existing channels and growing them at scale (and ideally improving margins). This means making smart hires that will take certain areas of your business to the next level.

Related Resource: Scaling != Growth

6. Continuously review your business model

As you find the growth strategies and channels that work best, it is important to be consistently evaluating your business model. Markets and customer needs change quickly so it is important to make sure you are staying ahead of them.

This means that you are likely evaluating your different acquisition channels, your product, and your hiring plans. If you find your business is most capable of executing in a certain area (for example, product-led growth), you might want to consider hiring and building your product around product-led growth.

Related Resource: How to Write a Business Plan For Your Startup

7. Engage your investors to build relationships

Once you have found the growth strategies that work best for your business, you’ll need to make sure you have the resources in place to grow and scale. This is capital and talent.

One of the most common ways to source capital for a startup growth strategy is by raising venture capital. You’ll want to make sure that you are engaging with current and potential investors along the way to improve your odds of raising venture capital.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Grow your startup with Visible

Finding the right growth strategies for your business is only half the battle. Having the resources in place to track your key growth metrics will help you make informed decisions along the way.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

investors

Metrics and data

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?