Since the start of 2022, there have been major macroeconomic changes taking the startup world by storm. Rising inflation, paired with the tumultuous public markets (especially in the technology sector), has made its way downstream to startup fundraising. As the team at OpenView Ventures put it, “For operators, this has led to whiplash from grow at all costs to cut at all costs.”

We partnered with OpenView Ventures for the 2022 SaaS Benchmarks Survey. The main takeaway? Nearly every company is cutting spend, regardless of how much cash they have in the bank.

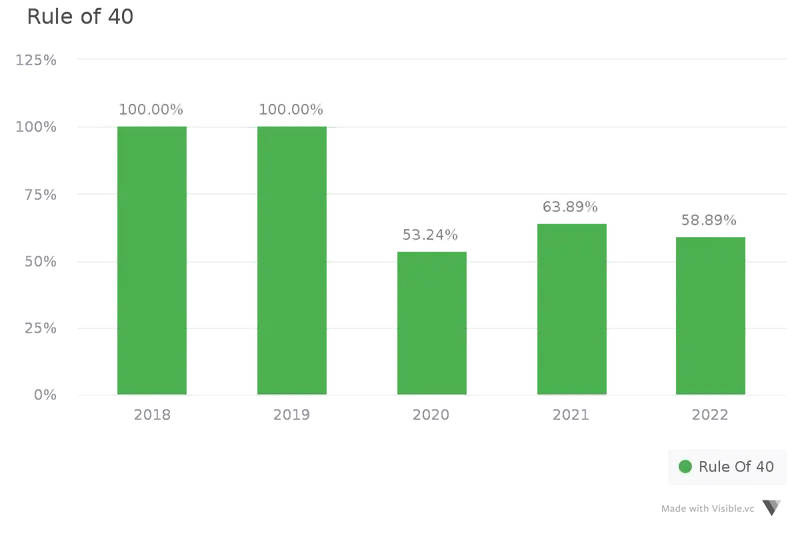

Valuations are also changing. In 2021, valuations were largely based on growth rates for the next 12 months. However, there has been a transition to public valuations being based on the “Rule of 40.” Put simply, the rule of 40 means a company’s YoY revenue growth % + profit margin % should exceed 40.

As the team at OpenView points out, “For companies with ARR below $10M, Rule of 40 can vary widely from quarter to quarter. Achieving 40 each quarter is not required. But, it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

Learn how you can calculate, and automate, the rule of 40 using Visible below:

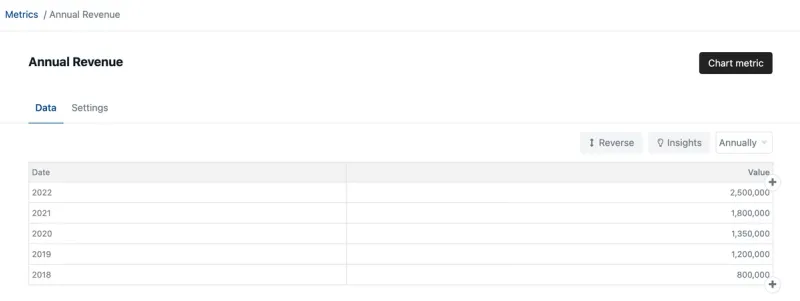

1. Track Revenue

First things first, to calculate the rule of 40 you need to know your revenue for multiple years (or periods). You can enter this into Visible manually or using 1 of our integrations (likely Google Sheets, Xero, or QuickBooks).

Once you have your revenue # in Visible, we’ll automatically calculate your growth % (more on this in step 3).

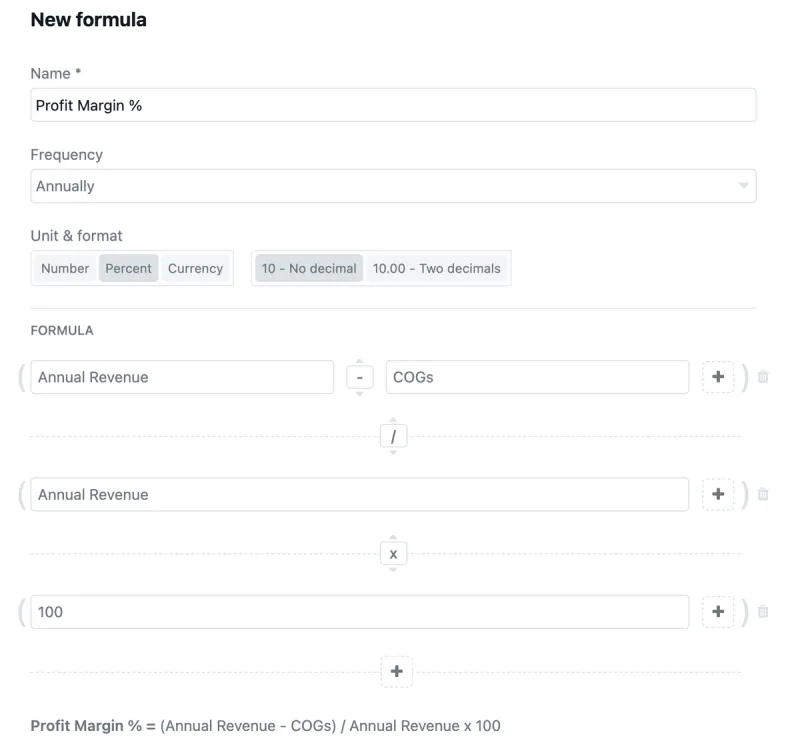

2. Track or Calculate Profit Margin %

Next, you’ll want to make sure you have the necessary metrics in Visible to track your profit margin %. If you are using one of our accounting integrations (like Xero or QBO), or tracking this in a Google Sheet, you’ll be able to automatically bring this in. If you’re starting from scratch, you’ll simply need your revenue and COGs (or Gross Profit).

Once you have your Revenue + COGs metrics in Visible, you’ll be able to calculate it using our formula builder. The formula for Profit Margin % is =

Profit Margin % = ((Revenue – COGs)/Revenue) x 100

Which will look like the following in Visible:

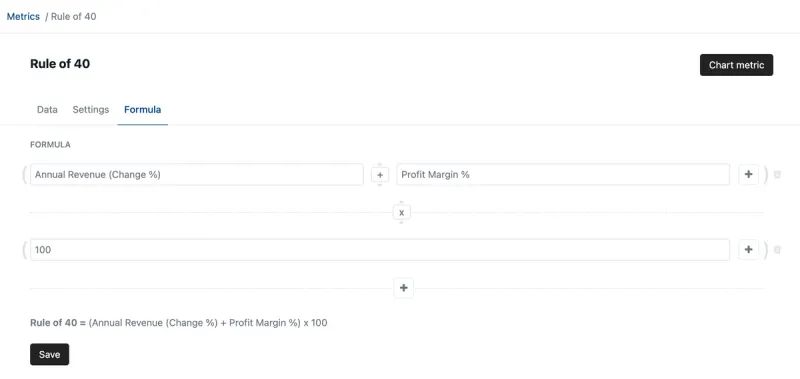

3. Calculate Rule of 40

Now that we have Revenue and our Profit Margin %, we just need to add the two together. We’ll create a new formula shown below (Note: we’ll want to make sure we are using the annual change % insight for Revenue — this is automatically calculated):

4. Chart & Share

Once your formula is set up, it will automatically be calculated as new data enters Visible. From here, you can chart and share your Rule of 40 using Updates and Dashboards — check out an example below:

Track your key metrics, update investors, and raise capital all from one platform. Give Visible a free try for 14 days here.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need