Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Customer Stories

Metrics and data

Case Study: Airtree Venture's Transformation with Visible

About Airtree Ventures

Airtree is a Sydney-based venture capital firm backing founders based in Australia and New Zealand building the iconic companies of tomorrow. The firm was founded in 2014 and is now deploying out of its 4th fund with $1.3 billion in assets under management. Their portfolio includes over 105+ portfolio companies and 250+ founders who have helped create over 17,000 jobs.

Airtree’s portfolio includes the region’s breakout technology companies, such as Canva, Go1, Employment Hero, Pet Circle, Immutable, and Linktree.

For this case study, we spoke to Dan Lombard who is the Data Lead at Airtree Ventures.

Related article: Airtree Ventures already returned its first fund thanks to Canva while maintaining the majority of its stake

Fragmented Systems and Processes Prior to Visible

Prior to the integration of Visible, Airtree relied heavily on a fragmented system of spreadsheets to manage their portfolio of 105+ companies. Each quarter, four employees were tasked with managing the relationships with the points of contact at 15 to 20 portfolio companies through manual outreach and communications. This reliance on spreadsheets resulted in inefficiencies and potential data loss, as spreadsheets are prone to break when modified.

Challenges With Data Accuracy and Scaling Manual Outreach to a Growing Portfolio

Before Visible, 80% of Airtree’s portfolio monitoring problem was having clean data and scaling outreach to their portfolio companies. They faced two primary challenges with their former system:

Operational Efficiency: Four team members spent significant time manually collecting data from over 100 companies every quarter. The Airtree team members were sending one-off email communications to each company and manually keeping track of who needed to be followed up with at each company which diverted resources from other critical projects they could be working on.

Data Integrity and Scalability: Frequent changes to the data in spreadsheets resulted in errors in the sheets and data loss, which caused frustration as there was no way of understanding which changes were made to the sheet and when. This process made it difficult to scale portfolio monitoring operations as Airtree grew.

Why Airtree Chose Visible as their Portfolio Monitoring Platform

Airtree chose Visible for its robust, scalable, and user-friendly platform. Key factors influencing their choice included:

Ease of Use and Customization: Visible's platform offered unparalleled customization and ease of use.

Support and Development: Visible’s team actively listened to feedback, offered best practices, and continuously invested in their product, ensuring a partnership that catered to Airtree’s evolving needs.

Automation and Integration: Visible excelled in automating portfolio monitoring and offered a frictionless experience for founders. Airtree leveraged the Visible API to seamlessly integrate data into their existing data warehouse system.

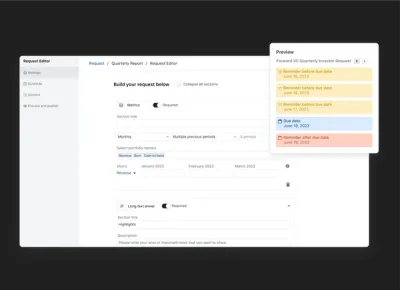

Airtree’s historical data collection process, previously led by four Airtree team members, is now a streamlined process led only by Dan, who leverages Visible Requests to collect data from their portfolio of 105+ companies. Visible Requests empowers Dan to send customized link-based data requests to each company, automate the email reminder process, and easily keep track of where companies are in the reporting process.

View an example Visible Request below.

Onboarded to Visible within 24 Hours

Visible provided Airtree with an efficient and supported onboarding. When asked about Airtree's onboarding with Visible Dan Lombard shared the following:

Visible stood out by enabling a swift and seamless transition that was operational in less than 24 hours, a stark contrast to other providers who estimated a quarter for full implementation. This rapid integration was facilitated by a comprehensive onboarding template provided by Visible.

Visible API & Airtree’s Data Infrastructure

With the implementation of Visible, Airtree wanted to take a more sophisticated approach to the way they handle their portfolio data with the goal of driving more valuable insights for their team. The approach needed to be automated, integrate with other data sources, and have a singular view accessible for the whole team. This was not possible when their data lived in disparate systems, files, and spreadsheets.

Dan Lombard has led the improvement of Airtree's data infrastructure. Now, data sources like Visible and Affinity are piped into Snowflake via recurring AWS Lambda jobs. Airtree leverages the Visible API daily. Dan mentioned that while Airtree collects data quarterly, a daily sync of the data is crucial because Airtree is always onboarding new companies, communicating with their founders, and uploading historical data.

“The Visible API gives us this level of daily fidelity and only takes the AWS Lambda job 5 minutes to populate an entire data architecture.”

- Dan Lombard, Data Lead at Airtree Ventures

Once the data is in their database, Snowflake handles the ETL and entity matching. Airtree then has Streamlit sit on top of Snowflake to query data, provision access, and build out new insights.

Advice for Other VC Firms Building Out Their Data Infrastructure

Don’t overcomplicate things to start. It is easy to get caught up in the bells and whistles. Dan recommends a bias towards simplicity. Start small and use it as a stepping stone as you build things out.

Conclusion

Airtree’s adoption of Visible transformed their portfolio management by automating key processes and centralizing data, thus enabling more strategic decision-making and efficient operations. The case of Airtree is a testament to how the right technological partnerships can profoundly impact business efficiency and data management.

investors

Metrics and data

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?

Everyone from Emerging Managers writing their first checks to established VC firms ask this question because they want to make sure they're monitoring their portfolio companies in the most effective way possible.

The Standard Metrics Value-Add Investors Should be Monitoring

It’s important to know which metrics are the best to collect from portfolio companies so that investors can extract the maximum amount of insight from the least number of metrics. This streamlined approach is easiest for founders and allows investors to get what they need to provide better support to their companies, inform future investment decisions, and have good records in place for LP reporting or fundraising.

Below we outline the six most common metrics investors collect from portfolio companies.

1) Revenue

Definition: Money generated from normal business operations for the reporting period; also known as ‘net sales’. We recommend excluding ‘other revenue’ from secondary activities and excluding cash from fundraising.

Revenue tells you how a company’s sales are performing.

This metric is a key indicator for how a business is doing. It can be analyzed to understand if new marketing strategies are working, how a change in pricing might affect the demand for a good or service, and the pace of growth in a market.

By asking for revenue from just ‘normal business operations’ you’re excluding money a company could also be making from secondary activities that are non-integral to their business. This helps keep the revenue data more precise, allows you to compare the metric more accurately across the portfolio, and will allow you to use it more accurately in other metric formulas such as Net Income.

Visible helps over 400+ VCs streamline the way they collect data from companies with Requests. Check out a Request example below.

2) Cash Balance

Definition: The amount of cash a company has in the bank at the end of a reporting period.

Cash Balance is an important indicator of ‘life expectancy’.

This metric is essential to track because it tells you about the financial stability and risk level of the company. There’s no bluffing with this Cash Balance metric. A company either has a healthy amount of cash in the bank at the end of its reporting or they don’t. Cash balance also gives you an idea of how soon a company will need to kick off its next round of financing.

3) Monthly Net Burn

Definition: The rate at which a company uses money taking income into account. The monthly burn rate will be positive for companies that are not yet profitable and negative for companies that are considered profitable. Net burn is usually reported as monthly and calculated by subtracting a company’s ending cash balance from its starting cash balance and dividing that by the number of months for the period. We recommend collecting this metric from companies on a quarterly basis but still asking for the monthly rate — this helps rule out any one-off variability.

Monthly Net Burn = (Starting cash balance – ending cash balance) / months

Monthly Net Burn is an indicator of operational efficiency.

This metric becomes even more relevant during market downturns when the focus shifts from growth at all costs to growth with operational efficiency. This is a good metric to benchmark and compare across all companies in your portfolio.

You can also use this metric to calculate a key metric, Cash Runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

4) Cash Runway

Definition: Cash runway is the number of months a business can survive before it runs out of cash. It can be calculated as:

Runway = Cash Balance / Monthly Net Burn

Cash runway tells you when a company will run out of cash.

This metric is essential because it determines when a company needs to kick off their next fundraising process, usually, it’s when they have 6-8 months of runway left. If you see one of your companies hit a cash runway of six months or less, you should be reaching out to see if they need support or guidance on their fundraising efforts.

While Runway is definitely considered a key metric, you don’t need to ask your companies for it since it can be calculated easily with other data you should already have on hand (Cash Balance & Monthly Net Burn Rate).

5) Net Income

Definition: Net income is a company’s total earnings (or profit) after all expenses have been subtracted. It is calculated by taking a company’s revenue and subtracting all expenses, including operational expenses, interest expenses, income taxes, and depreciation and amortization.

Net Income = Revenue – Total Expenses

Net Income is an indicator of profitability.

If net income is positive, meaning revenue is greater than a company’s total expenses, it is considered profitable. This is a metric that startups should have readily available since it’s the ‘bottom line’ of an Income Statement, making it very easy to report.

This metric can also be used in a formula to calculate Net Profit Margin, total expenses, and cash runway.

6) Total Headcount

This is the total number of full-time equivalent employees excluding contractors. Contractors are excluded because of the variability of the nature of contract work — a contractor may only work a few hours a month or they could work 20 hours per week. This variability will cause back-and-forth clarification between you and your companies which wastes time.

This metric gives you insight into company growth and operational changes.

This metric is important to track because it’s a reflection of decisions made by the leadership team. If there’s an increase in headcount, the leadership is investing in future growth, on the other side, if there’s a major decrease in total headcount it could be because the leadership team has decided to reduce burn by letting people go or employees are churning. All are post-signs of operational changes worth paying attention to.

Check out an Example Request in Visible.

Suggested Qualitative Questions to Ask Your Companies

While metrics are the best way to aggregate and compare insights across your portfolio, you may also be wondering which qualitative questions you should ask portfolio companies as well. Qualitative prompts can be a concise and valuable way for startups to share more narrative updates on company performance with their investors.

Below we outline the two most common qualitative questions investors ask portfolio companies as well as suggested descriptions.

1) Recent Updates & Wins

Description: Please use bullet points and share updates related to Sales, Product, Team, and Fundraising. This will be used for internal reporting and may also be shared with our Limited Partners.

We suggest asking companies for bullet points on these four categories because it’s a focused way for investors to understand the narrative context behind a company’s metrics.

With your companies’ permission, this narrative update can also serve as the foundation for your tear sheets for your LP reporting and your internal reporting.

2) Asks

Description: How can we best support you this quarter?

You can make your reporting processes more valuable for your portfolio companies by asking your companies if there are specific ways you can provide support to them in the next quarter.

Once you have responses from your portfolio companies, you can take action on their requests and you’ll be able to extract support themes to inform the way you provide scalable portfolio support.

Monitor Your Portfolio Companies Seamlessly With Visible

It’s important to know which are the most important metrics to collect to ensure your portfolio data collection processes are streamlined and valuable both for you and your companies. In this article, we highlighted Revenue, Net Income, Cash Balance, Runway, Net Burn Rate, and Total Headcount as the top metrics to collect from all your portfolio companies. With Visible, its also easy to ask for any custom metric and assign it just to specific companies.

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Book some time with our team to learn how Visible can automate your portfolio monitoring processes.

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform used by over 400+ VCs.

investors

Metrics and data

Portfolio Data Collection Tips for VCs

Getting regular, high-quality, and actionable data from portfolio companies is important. It allows investors to make better investment decisions, provide better support to companies, and share meaningful insights internally across the firm and with LPs.

This practice should also be highly valuable for founders. They should be able to share wins and challenges and seek support from their investors. The reporting process should only take companies 3 minutes to complete (if not, something may be wrong with how the investor is asking for structured data or the reporting company may not be as familiar with their key metrics as they should be).

Below are some best practices to make sure you get:

High response rates from companies

Structured data (comparing apples to apples)

Actionable insights

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

Set Reporting Expectations Early On

✔️ Tip: Set expectations during the onboarding process (if not sooner)

It’s way easier to set reporting expectations with companies early on (and with fewer companies) rather than changing your reporting requirements a few years into your relationship with portfolio companies.

Some investors choose to outline their reporting expectations in a side letter as a part of the investment documents.

It's recommended that investors also have a dedicated conversation around reporting expectations during the onboarding process.

Related Resource: A Guide to Onboarding New Companies to Your VC Firm

When and How Often to Collect Portfolio Data

✔️ Tip: Collect data at a predictable frequency

Set the expectation that you will be sending a Request for company data the same time every reporting cycle. Visible has data that shows that Mondays are great due dates and if you’re sending out quarterly Requests for data, we suggest giving your companies 2-4 weeks after quarter close to get their information back to you.

Don’t randomly switch between the 10th, the 30th, etc. This makes it difficult for founders to prioritize your reporting requirements and gives the impression that your due dates don’t really matter.

Visible makes scheduling data Requests and subsequent reminders a breeze for investors. Investors can select the due date, email notification dates, and customize the messages that will get sent out to portfolio companies.

✔️ Tip: Collect data at an appropriate frequency

We recommend the following cadences. This is 100% customizable as every fund is different.

Weekly – Companies in an accelerator program

Monthly – Pre-seed investments

Quarterly – Pre-seed, Seed, Series A, Series B + investments

What Data to Collect from Portfolio Companies

✔️ Tip: Less is more

Don’t send a Request asking for ‘nice to have’ metrics. Only ask for the information you really need and are going to use. We suggest starting small, getting a rhythm, and expanding the data as needed.

Metrics

✔️ Tip: Ask for only 5-15 metrics

Depending on how closely you work with companies, ask for 5-15 metrics and no more. If you’re not taking actionable next steps based on a metric (ex: reporting to LP’s, providing more hands-on support, informing investment decisions) then it's likely you don't need to be asking for it.

The most common metrics investors ask for include:

Revenue

Cash Balance

Cash Burn

Headcount

Runway

Related resource: Which Metrics Should I Be Collecting from Portfolio Companies

View examples of data Requests in Visible.

✔️ Tip: Use a metric description to reduce back-and-forth

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or the current month? Should it include financing? Be descriptive about what you want.

Qualitative Questions to Ask Portfolio Companies

✔️ Tip: Define what type of information you're looking for

As an investor, it's a great idea to give companies the opportunity to share support requests on a regular basis. Consider including a description to clarify what type of support your firm can provide companies.

Additionally, most investors also ask for companies to report narrative highlights and lowlights from the question. It's important to clarify what type of information you're actually looking for so companies are not wasting time sharing information an investor is not actually going to use.

Implementing a Portfolio Monitoring Platform

✔️ Tip: Notify your companies two weeks in advance

Introducing Your Companies to Visible

As the most founder-friendly solution on the market, we ensure that requesting data is a frictionless process for founders. This means founders don’t need to create an account in order for Investors to get value out of the platform (ie: No log-in required!).

Still, it's a great idea to give your companies notice about the adoption of Visible so they can keep an eye out for the first Request that will land in their inbox.

Feel free to use our Intro Copy Template to notify your companies about the adoption of Visible two weeks in advance of your first Request deadline.

Customize Your Domain

Investors can white-label the automatic emails that are sent from Visible so that the emails use their firm's domain. You can also customize the sender address to anyone at your firm.

Visible's Customer Support

All Visible customers get world-class support and a dedicated Investor Success Manager. We provide an efficient, hands-on onboarding experience, training for new team members, and support on an ongoing basis.

Visible is trusted by over 350+ VC funds around the world to help streamline their portfolio monitoring and reporting.

founders

Metrics and data

How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

Managing a high burn rate can be a make-or-break factor for startups. Without effective cost control, even promising ventures can quickly deplete their cash reserves, jeopardizing their long-term sustainability. Understanding what constitutes a healthy burn rate and how it affects your company’s financial runway is critical. In this article, we’ll explore eight actionable strategies for reducing burn rate, from cutting non-essential expenses to optimizing marketing efforts and leveraging automation. By implementing these techniques, you can extend your financial runway and ensure your startup maintains momentum on the path to growth.

Related resouce: Burn Rate: What It Is and How to Calculate It

What Is a Healthy Burn Rate?

A healthy burn rate for a startup is the rate at which it spends its cash reserves before generating positive cash flow, tailored to its specific stage, industry, and growth objectives. Early-stage startups often experience higher burn rates due to investments in product development and market penetration, while later-stage companies typically aim for more controlled spending as they approach profitability.

Industry norms also play a significant role. For instance, technology startups may have higher burn rates compared to service-based businesses, reflecting the capital-intensive nature of tech ventures.

Market conditions further influence what constitutes a healthy burn rate. Investors might tolerate higher burn rates in bullish markets with abundant funding to accelerate growth. In contrast, during tighter financial climates, a lower burn rate becomes crucial for sustainability.

Ultimately, a healthy burn rate aligns with the startup's strategic goals, ensuring sufficient runway to achieve key milestones without compromising financial stability. Regular financial assessments are essential to maintaining this balance, allowing startups to adapt their spending in response to evolving internal and external factors.

How Does Burn Rate Impact a Company's Runway and Sustainability?

A company’s burn rate determines its financial runway- the time it can continue operating before exhausting its cash reserves. The higher the burn rate, the shorter the runway, which puts pressure on the company to either increase revenue, secure additional funding, or cut costs to avoid running out of cash.

Managing burn rate is crucial for long-term sustainability. A balanced burn rate allows startups to achieve key milestones, such as product development or market fit, without facing financial distress. Conversely, an unchecked burn rate can force premature fundraising or lead to insolvency. By aligning spending with strategic goals and maintaining adequate cash reserves, startups can extend their runway, weather market fluctuations, and position themselves for sustainable growth.

Related resource: How to Calculate Runway & Burn Rate

8 Strategies for Managing and Reducing Burn Rate

Controlling your burn rate is essential to ensure your startup's financial health and longevity. By implementing effective cost-saving measures, you can extend your runway, reduce financial stress, and create a more sustainable path to growth. The following eight strategies offer practical ways to manage spending, improve efficiency, and optimize your operations without compromising your momentum or key objectives.

Related resource: The Standard Metrics to Collect for VC Portfolio Monitoring

1. Assess and Cut Non-Essential Expenses Through Regular Financial Audits

Conducting regular financial audits helps startups identify non-essential expenses and eliminate wasteful spending. By systematically reviewing all outgoing costs, you can spot inefficiencies, redundant services, and underutilized resources that drain your cash reserves.

For example, subscriptions to no longer-used software tools, unnecessary office perks, or overlapping vendor services can add up over time. Financial audits clarify where your money is going and help you make data-driven decisions to cut or reallocate funds. Implementing these audits quarterly or bi-annually ensures that spending aligns with business priorities, keeping your burn rate in check while maintaining operational efficiency.

2. Optimize Marketing Efforts by Focusing on Lower-Cost Channels With Long-Term Benefits

Startups can reduce burn rate by prioritizing cost-effective marketing channels that provide sustained returns. Instead of investing heavily in paid ads, consider channels like content marketing, SEO, and email marketing, which offer long-term visibility without continuous spending. High-quality blog posts, guides, listicles, and case studies can drive organic traffic over time, building brand authority and attracting leads.

Leverage social media marketing to engage with your audience directly. Platforms like LinkedIn, Twitter, Instagram, Quora, and Reddit allow you to share valuable content and connect with potential customers without significant ad spend. Additionally, referral programs and word-of-mouth marketing can generate new business through existing customers.

By focusing on these lower-cost, high-ROI strategies, you create sustainable growth and reduce dependency on expensive, short-term campaigns, helping maintain a healthy burn rate.

3. Outsource Non-Essential Tasks

Outsourcing non-essential tasks can significantly reduce overhead and operational costs for startups. Functions such as administrative work, customer support, bookkeeping, and IT maintenance can often be delegated to external agencies or freelancers. This approach allows you to avoid the expenses associated with full-time hires, such as salaries, benefits, and office space.

By outsourcing, startups can also gain access to specialized skills and expertise without investing in extensive training or long-term commitments. This flexibility helps you scale operations up or down based on demand. Additionally, outsourcing enables your core team to focus on strategic priorities, like product development and customer acquisition, driving growth while keeping your burn rate manageable.

4. Delay Non-Essential Investments

Prioritizing critical expenditures and delaying non-essential investments is a key strategy for managing your startup's burn rate. Focus on spending that directly supports product development, customer acquisition, and achieving key milestones. Investments in office upgrades, non-essential software, or secondary product features can often be postponed until your financial position is more secure.

This approach helps preserve cash reserves and extends your runway, giving you more time to reach profitability or secure additional funding. Regularly assess potential investments through the lens of immediate impact and long-term value. By distinguishing between “must-have” and “nice-to-have” expenditures, you ensure that every dollar spent contributes to your startup’s core objectives.

5. Leverage Technology for Automation

Leveraging automation and AI technology helps streamline operations, reduce labor-intensive tasks, and lower your startup's burn rate. Automation tools can handle repetitive processes like data entry, invoicing, customer onboarding, and email follow-ups. AI-powered solutions take this a step further by optimizing tasks such as customer support, marketing, and analytics through intelligent decision-making and data processing.

For example, CRM platforms can personalize customer interactions and automate follow-ups, while AI writing tools can generate blog posts, social media content, and email campaigns quickly and efficiently. Chatbots powered by AI can handle complex customer inquiries, providing immediate responses and reducing the need for additional support staff. Additionally, Analytics platforms can offer actionable insights to enhance business strategies and improve operational efficiency.

By integrating automation and AI, startups can increase efficiency, minimize human error, and free up team members to focus on strategic tasks. This not only reduces operational costs but also enhances productivity and competitiveness, helping maintain a lean and sustainable burn rate.

6. Establish Approval Policies for Purchases to Prevent Unnecessary Spending

Implementing strict purchase approval policies helps maintain financial discipline by ensuring every expenditure is justified and aligned with your startup’s goals. Without a clear process, impulse spending or redundant purchases can quickly inflate your burn rate. Approval workflows require team members to submit purchase requests for review, giving managers or finance leads the opportunity to evaluate the necessity and impact of each expense.

These policies can be tailored to your startup’s needs- for example, setting thresholds where low-cost items need minimal approval while larger purchases require multiple sign-offs. Using expense management software can streamline this process by providing transparency and real-time tracking of purchases.

7. Increase Your Cash Reserves

Building and maintaining healthy cash reserves is essential for safeguarding your startup against cash flow challenges. A solid financial buffer provides flexibility during market downturns, unexpected expenses, or periods of slow revenue growth. Here are a few strategies to help increase your cash reserves:

Monitor and Cut Unnecessary Expenses: Conduct regular financial audits to identify and reduce non-essential spending. Redirect those savings directly into your cash reserves.

Negotiate Payment Terms: Work with suppliers and vendors to extend payment terms, allowing you to hold onto cash longer. Also, encourage clients to pay promptly or offer discounts for early payments to improve cash flow.

Secure Recurring Revenue: Focus on building subscription-based or retainer models to ensure a steady income stream, reducing the risk of cash flow disruptions.

Allocate a Portion of Profits: When your business is generating a profit, allocate a percentage directly to your reserves to steadily build a financial cushion.

Consider Bridge Financing: Short-term financing options like lines of credit can serve as a backup to protect against cash shortages, though they should be used cautiously.

8. Consider External Funding Options Carefully

When exploring external funding, it's crucial to evaluate options that align with your startup’s long-term objectives and financial stability. While venture capital, angel investments, loans, and grants can provide the necessary capital to extend your runway, each option comes with its own implications.

Equity financing, such as venture capital or angel investment, dilutes ownership but can provide significant capital and strategic support. Ensure potential investors share your vision and growth goals to avoid conflicts down the road. In contrast, debt financing (like loans or lines of credit) allows you to retain ownership but requires regular repayments, which can strain cash flow if not managed carefully.

Evaluate funding sources based on their impact on your burn rate, control, and repayment terms. Consider alternative options like revenue-based financing, where repayments scale with your income, or government grants, which don’t require repayment but may have specific conditions.

Support Your Funding Efforts With Visible

Reducing your burn rate is crucial for extending your financial runway and ensuring long-term sustainability. By cutting non-essential expenses, optimizing marketing, leveraging automation, and carefully managing investments and funding, your startup can operate efficiently and stay resilient in challenging markets.

Visible can help you navigate your funding journey with ease. From managing investor updates to tracking your financial performance, Visible's platform streamlines the process and keeps your investors informed. Give it a free try for 14 days here.

Related resource: Portfolio Data Collection Tips for VCs

founders

Metrics and data

Burn Rate: What It Is and How to Calculate It

Managing your startup's finances effectively can be the difference between thriving and running out of cash. One critical metric every founder should know is burn rate- the rate at which your company spends capital to stay operational. Calculating and controlling burn rate helps you forecast your financial runway, optimize spending, and avoid unexpected cash crunches. This guide will break down burn rate, how to calculate it, what a good burn rate looks like, and best practices for keeping it under control.

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

What is Burn Rate?

Understanding your startup's burn rate is crucial for effective financial management and long-term success. Burn rate refers to the pace at which a company consumes its cash reserves to cover operating expenses before generating positive cash flow. Monitoring this metric helps founders assess their financial runway- the time a company can operate before needing additional funding or achieving profitability. By keeping a close eye on burn rate, startups can make informed decisions about budgeting, scaling operations, and fundraising strategies.

Gross Burn Rate

Gross burn rate represents the total cash outflow a company incurs monthly to fund its operations, excluding any revenue generated. This includes all operating expenses such as salaries, rent, utilities, and other overhead costs. Calculating the gross burn rate provides insight into the company's spending habits and cost structure, serving as a baseline for evaluating financial health.

Net Burn Rate

Net burn rate accounts for the company's revenue, reflecting the actual monthly cash loss after subtracting total revenue from total expenses. This metric offers a clearer picture of how quickly a company is depleting its cash reserves, considering both income and expenditures. Monitoring the net burn rate is essential for understanding the sustainability of current operations and planning for future financial needs.

By differentiating between gross and net burn rates, startup founders can gain a comprehensive understanding of their financial standing, enabling them to make strategic decisions to extend their runway and achieve long-term success.

How to Calculate Burn Rate

Now that you understand what burn rate is and why it’s crucial, let’s explore how to calculate it. There are two main types of burn rates to consider: gross burn rate and net burn rate. Both metrics help provide a snapshot of your startup’s financial health, but they serve different purposes. Gross burn rate focuses purely on expenses, while net burn rate factors in revenue. Here's how to calculate each type.

Related resource: How to Calculate Runway & Burn Rate

Calculating Gross Burn Rate

Gross burn rate refers to a startup's total operating expenses within a specific period, usually calculated monthly. It includes costs such as salaries, rent, utilities, and other overhead expenses. This metric highlights how much cash the company spends to keep operations running, independent of any revenue. Understanding gross burn rate helps identify key cost drivers and assess operational efficiency.

Source

Calculating Net Burn Rate

Net burn rate measures how quickly a company is depleting its cash reserves after accounting for revenue. It’s calculated by subtracting monthly revenue from monthly operating expenses. This metric reveals how much cash a startup needs to sustain operations each month. However, since revenue can fluctuate, it’s essential to monitor this variability. If revenue drops while expenses remain constant, the net burn rate will increase, potentially shortening the company's financial runway.

Source

What Is a Good Burn Rate for a Startup?

Determining a "good" burn rate for a startup depends on several factors, including the company’s stage, industry, available funding, and growth objectives. Early-stage startups typically have higher burn rates as they invest in product development, marketing, and team expansion. Whereas, more mature startups might aim to control burn rates while focusing on achieving profitability.

Key factors to consider:

Startup Stage:

Pre-seed and Seed Stage: Burn rates are often higher due to heavy investment in building and launching the product.

Series A and Beyond: Companies might balance growth spending with a path toward profitability, making cash efficiency more critical.

Industry Norms: Industries with longer development cycles, like biotech or hardware, may experience higher burn rates compared to SaaS or e-commerce startups.

Funding Availability: Startups with recent funding rounds may sustain higher burn rates to accelerate growth. A common guideline is to ensure your burn rate allows for at least 12-18 months of runway between funding rounds.

Growth Goals: High-growth startups might intentionally maintain a higher burn rate to capture market share quickly, while those focusing on sustainability may aim to keep burn rate low to extend their runway.

Ultimately, a good burn rate balances growth ambitions with financial sustainability, ensuring your startup doesn’t run out of cash before achieving critical milestones.

Related resource: Startup Metrics You Need to Monitor

Best Practices for Managing Burn Rate

Effectively managing your burn rate is essential to ensure your startup's financial health and longevity. By keeping your burn rate under control, you can extend your runway, make the most of your funding, and improve your chances of reaching key milestones. The following best practices will help you optimize spending, increase operational efficiency, and reduce the risk of running out of cash.

Regularly Review and Adjust Budgets

Frequent budget reviews are essential for keeping your startup's finances aligned with your current goals and market conditions. By revisiting your budget regularly- ideally monthly or quarterly- you can identify overspending, adjust for unexpected expenses, and reallocate resources to areas that drive growth. This practice helps you stay agile and responsive, ensuring your spending reflects your startup's strategic priorities. Consistent budget assessments also make it easier to anticipate financial challenges and adapt quickly, reducing the risk of depleting cash reserves unexpectedly.

Optimize Operational Expenses and Identify Unnecessary Costs

Streamlining your operational expenses is a key strategy for managing burn rate effectively. Start by analyzing all business expenses to identify non-essential costs that can be reduced or eliminated. Consider the following strategies:

Negotiate Contracts: Review contracts with vendors, landlords, and service providers to secure better rates or more favorable terms.

Embrace Automation: Implement tools and software that automate repetitive tasks, saving time and reducing labor costs.

Remote Work Flexibility: If possible, reduce office space or shift to a remote-first model to cut rent and utility expenses.

Monitor Subscriptions and Tools: Eliminate unused or redundant software subscriptions and services that drain resources without adding value.

Diversify Revenue Streams to Reduce Reliance on External Funding

Relying solely on external funding can leave your startup vulnerable to market fluctuations and investor sentiment. By developing multiple revenue streams, you create a more stable financial foundation and reduce the risk of cash flow gaps. Consider these strategies for diversification:

Explore New Customer Segments: Identify additional markets or demographics that could benefit from your product or service.

Offer Complementary Products or Services: Introduce new offerings that align with your core business to increase revenue potential.

Adopt a Subscription or Recurring Revenue Model: If applicable, recurring models can provide predictable and steady cash flow.

Create Strategic Partnerships: Partner with other businesses to cross-promote services, expand distribution channels, or bundle offerings.

Monetize Existing Assets: Leverage data, content, or intellectual property to create new revenue opportunities, such as licensing or premium features.

Monitor Cash Flow Projections Alongside Burn Rate

Combining cash flow projections with burn rate analysis is essential for maintaining financial control and making informed decisions. While burn rate shows how quickly your startup is depleting its cash reserves, cash flow projections estimate future inflows and outflows based on current trends and planned activities. Together, these metrics provide a comprehensive picture of your financial health.

Why it matters:

Identify Potential Shortfalls: Projections help you foresee periods when expenses might outpace income, allowing you to take corrective action early.

Plan for Fundraising: Knowing your projected runway helps you time fundraising efforts to avoid running out of cash.

Adjust Strategies in Real-Time: By tracking both metrics, you can quickly adapt spending plans, delay non-essential expenses, or accelerate revenue-generating activities.

Improve Decision-Making: Informed by data, you can confidently decide when to invest in growth initiatives and when to tighten spending.

Track Your Key Startup Metrics with Visible

Understanding and managing your burn rate is essential for keeping your startup financially healthy. Calculating gross and net burn rates, reviewing budgets, optimizing expenses, diversifying revenue streams, and monitoring cash flow projections can help you make informed decisions and extend your financial runway. Staying on top of these metrics also helps you avoid unexpected cash crunches and ensures you're prepared for growth.

Tools and software are a great way to keep tabs on your finances. Track key metrics, send investor Updates, and track the status of your next fundraise with Visible. Give it a free try for 14 days here.

Related resource: The Standard Metrics to Collect for VC Portfolio Monitoring

founders

Metrics and data

Breaking Down High Alpha's 2024 SaaS Benchmarks

High Alpha, in partnership with OpenView, teamed up to explore pricing models, churn, AI adoption, financial performance, and more in the 2024 SaaS Benchmarks Report.

Mike Fitzgerald and Blake Koriath of High Alpha joined us to dive into the report, highlighting key trends, data points, and themes.

A couple of key areas we hit on:

The makeup of the report

Market stabilization and expectations in today's market vs. previous years

Vertical vs. Horizontal SaaS performance

Why GTM execution is keeping founders up at night

How companies are balancing burn and growth

And much more

Download the full report to uncover other trends and benchmarks below:

founders

Metrics and data

Service Obtainable Market: What It Is and Why It Matters for Your Startup

Understanding your startup's potential for growth is crucial in determining how to allocate resources, set goals, and attract investors. One of the key metrics to evaluate is your Service Obtainable Market (SOM)—the portion of the market your company can realistically capture. In this article, we will break down what SOM is, how it differs from other market metrics like total addressable market (TAM) and Serviceable Available Market (SAM), and why it is essential for building a focused, sustainable strategy. You'll also learn how to calculate your SOM and how it helps refine your projections and increase investor confidence.

Related resource: How to Model Total Addressable Market (Template Included)

What is Service Obtainable Market (SOM)?

The Service Obtainable Market represents the portion of your total addressable market that your startup can realistically capture based on its current resources, capabilities, and competitive positioning. It is a refined market segment that takes into account the realities of your business—such as sales capacity, distribution channels, and brand recognition. While other metrics like TAM and SAM offer a broader view of market potential, SOM gives a grounded estimate of what’s achievable. For startups, this figure is crucial in shaping strategy, defining target customers, and setting realistic revenue expectations.

Factors of Service Obtainable Market

Several factors influence your Service Obtainable Market, helping you determine the most realistic portion of the market you can capture. These include:

Market Size and Reach

The size of the total addressable market (TAM) sets the foundation for calculating Service Obtainable Market. However, your actual reach depends on your geographic footprint, target demographics, and ability to effectively penetrate the market.

Related resource: Bottom-Up Market Sizing: What It Is and How to Do It

Product

The uniqueness and quality of your product will impact how much of the market you can capture. A product that meets specific needs or offers a strong value proposition can help you stand out and gain a larger share of the market.

Competition

The level of competition in your industry will directly affect your SOM. A highly competitive market may limit your share, while a niche market or one with fewer competitors can increase your potential capture.

Historical Performance and Research

Your past sales data and market research are valuable in estimating Service Obtainable Market. Trends in customer acquisition, product adoption, and overall performance provide a realistic basis for forecasting future growth within the obtainable market.

Understanding SOM, SAM, and TAM

To grasp the full scope of your startup’s market opportunity, it’s essential to understand three key metrics: TAM, SAM, and SOM. While TAM represents the total market demand for your product or service, SAM narrows it down to the portion you can serve based on your business model. SOM refines this even further, focusing on the market you can realistically capture given your resources and competitive positioning. Let’s explore these differences in more detail.

Related resource: Total Addressable Market: Lessons from Uber’s Initial Estimates

Service Available Market (SAM) vs. Service Obtainable Market (SOM)

Service Available Market (SAM) refers to the portion of the total market that your business can serve, based on factors such as your product offering, geographic reach, and target audience. It reflects the customers you could potentially access with your current business model.

On the other hand, Service Obtainable Market is a smaller, more realistic portion of SAM. It takes into account not only your ability to serve the market but also your competitive landscape, internal resources, and operational constraints. In essence, SOM is the market share you can realistically expect to capture in the short term.

Total Addressable Market (TAM)

Total Addressable Market (TAM) is the broadest metric of the three. It represents the total market demand for your product or service, assuming no competition or barriers to entry. TAM reflects the largest possible revenue opportunity available, but it often includes customers or segments beyond your reach or interest.

While TAM gives you a big-picture view of the entire market, SAM and SOM help you zoom in on the more actionable portions, with SOM being the most precise estimate of what your startup can capture in the near term.

Related resources:

Total Addressable Market vs Serviceable Addressable Market

What Is TAM and How Can You Expand It To Grow Your Business?

How to Calculate Your Service Obtainable Market

Calculating your Service Obtainable Market (SOM) is essential for setting realistic business goals and crafting an effective market strategy. While TAM and SAM provide a broader view of potential opportunities, SOM focuses on what your startup can actually capture in the market based on your resources and competitive strengths. To calculate Service Obtainable Market, you'll need to break down your market step by step, narrowing from the largest possible market to the portion you can truly serve. Let’s walk through the process of calculating SOM and how each step contributes to a precise understanding of your market opportunity.

Step 1: Define Your Total Addressable Market (TAM)

The first step in calculating your Service Obtainable Market is to define your Total Addressable Market the largest possible market for your product or service. To identify your TAM, you’ll need to evaluate the full demand for your offering across all potential customer segments, without considering competition or operational limitations.

Start by answering these key questions:

Who are your potential customers? Identify all possible user groups or industries that would benefit from your product.

What is the overall market size? Research the total number of customers or the revenue potential in your market globally or within your target regions.

How big is the need or demand for your product? Assess the pain points your product addresses and the number of customers affected by these challenges.

By combining industry data, market reports, and demographic insights, you can estimate the maximum revenue potential of your product or service in its ideal conditions—this is your TAM.

Step 2: Narrow to Your Serviceable Available Market (SAM)

Once you’ve defined your Total Addressable Market (TAM), the next step is to narrow it down to your Serviceable Available Market (SAM)—the portion of the market that you can realistically serve, based on your business model, product offering, and geographic reach.

To assess your SAM, consider the following:

Business Model: Which customers can you effectively serve with your current sales, distribution, and operational models? Some markets might be out of reach due to logistical or operational constraints.

Product Fit: Focus on the customer segments where your product or service directly addresses specific needs or problems. Not every customer in the TAM will find your solution relevant.

Geographic Limitations: Evaluate the regions where your business operates or where you plan to expand. Factors like local demand, regulations, and shipping constraints can limit which parts of the TAM are accessible to you.

By refining your TAM with these considerations, your SAM represents the subset of customers that you have the capability and infrastructure to reach and serve.

Step 3: Identify Your Competitive Edge

To determine your Service Obtainable Market (SOM), you need to identify your competitive edge—the unique advantages that set your startup apart from others in the market. This step involves analyzing your differentiators, understanding market barriers, and assessing your competition to pinpoint your realistic market share.

Consider the following:

Differentiators: What makes your product or service stand out? This could be superior technology, pricing, customer experience, or unique features that competitors lack. Your ability to leverage these differentiators will help capture a larger portion of the market.

Market Barriers: Identify any barriers to entry, such as high development costs, regulatory requirements, or brand loyalty to existing competitors. These barriers can limit your market access and must be factored into your SOM calculation.

Competitors: Analyze your competitors' market share, customer loyalty, and positioning. Understanding their strengths and weaknesses will help you identify untapped opportunities where your startup can outperform or gain a foothold.

By combining these insights, you’ll be able to estimate the portion of the SAM that you can realistically capture, giving you a clear picture of your Service Obtainable Market.

Step 4: Calculate SOM

Now that you’ve identified your competitive edge and assessed the market, it’s time to calculate your Service Obtainable Market. To do this, you'll need to apply real-world factors such as sales capacity, market penetration, and your ability to reach customers within your Serviceable Available Market.

A simple formula to calculate Service Obtainable Market is:

SOM = SAM × Market Penetration Rate

For example, if your SAM is valued at $10 million and your startup's estimated market penetration rate is 10%, your SOM would be:

SOM = $10,000,000 × 0.10 = $1,000,000

This means that, based on your current resources and competitive position, you can realistically expect to capture $1 million of the $10 million available market. The market penetration rate can be influenced by factors like your sales team’s capacity, marketing effectiveness, and brand awareness.

By using this formula, you can calculate a more grounded estimate of your startup’s revenue potential within the Serviceable Available Market (SAM).

Why Service Obtainable Market Matters for Startups

Understanding your Service Obtainable Market is more than just a calculation—it’s a key element in shaping your startup’s strategy and ensuring sustainable growth. For startups, having a clear view of SOM allows for smarter decision-making, from resource allocation to revenue forecasting. By focusing on a realistic portion of the market, founders can set achievable goals, secure investor confidence, and avoid overextending their business too early. In the following sections, we’ll explore the specific ways SOM impacts your startup’s strategy, projections, and long-term success.

Focused Strategy

Knowing your Service Obtainable Market helps your startup stay focused by clearly defining the portion of the market you can realistically target. Instead of spreading your resources too thin trying to capture an overly broad audience, Service Obtainable Market allows you to concentrate on the most relevant customer segments. This focus ensures that your marketing, sales, and operational efforts are directed toward the right customer base—those who are most likely to convert. By avoiding the trap of overextending into markets where your resources, product fit, or brand presence are lacking, you can optimize your efforts and build sustainable growth more effectively.

Realistic Revenue Projections

Your Service Obtainable Market provides a solid foundation for creating accurate sales forecasts and revenue models. By focusing on the market you can realistically capture, SOM allows you to project revenues based on achievable goals rather than overly optimistic estimates. This level of precision is critical when presenting your business to potential investors, as they expect realistic financial models backed by data. Accurate revenue projections help ensure that your growth planning is sustainable and aligned with your current resources, making it easier to set clear milestones and secure the funding you need to scale.

Resource Allocation

Identifying your Service Obtainable Market enables your startup to allocate resources more efficiently across marketing, sales, and operations. By understanding exactly which portion of the market you can realistically capture, you can focus your efforts on the most promising opportunities. This targeted approach ensures that marketing budgets are spent on channels with the highest conversion potential, sales teams can prioritize leads most likely to close, and operational resources are scaled according to actual demand. Instead of spreading your team and resources too thin, SOM helps you streamline efforts to maximize impact and achieve better results with fewer resources.

Investor Confidence

Having a clear Service Obtainable Market (SOM) is a strong signal to investors that your startup has a realistic and achievable market strategy. Investors are looking for startups that understand their market deeply and have a plan that balances ambition with practicality. By demonstrating that you’ve calculated your SOM based on data-driven insights and realistic assumptions, you show investors that your growth projections are grounded in reality. This boosts their confidence in your ability to execute your business plan, allocate resources wisely, and achieve sustainable growth, making it easier to secure the funding needed to scale your operations.

Connect with Investors with Visible

Understanding your Service Obtainable Market is essential for shaping your startup’s strategy, creating realistic revenue projections, and efficiently allocating resources. By focusing on the market you can realistically capture, you position your business for sustainable growth and build investor confidence.

As you refine your market approach and seek funding, having the right tools to engage with investors is critical. Visible can help you manage your investor relationships and provide the insights you need to stay on top of your fundraising efforts.

founders

Metrics and data

Lead Velocity Rate: A Key Metric in the Startup Landscape

In the fast-paced world of startups, tracking the right metrics is crucial for success. Among these, Lead Velocity Rate (LVR) stands out as a key indicator of business growth. LVR quantifies the increase in qualified leads over time, offering insights into future revenue potential. Unlike metrics that reflect past performance, LVR provides a forward-looking view, helping startups refine their strategies and predict future sales. By consistently monitoring LVR, startups can gauge their market traction, enhance their marketing efforts, and attract investor confidence, making it an indispensable tool for sustained growth and success.

What is Lead Velocity Rate (LVR)?

LVR is a metric that measures the growth rate of qualified leads over a specific period, typically month-over-month. It calculates the percentage increase in the number of qualified leads, providing startups with a clear picture of their lead generation efforts and potential future sales.

LVR is significant because it acts as a predictive indicator of future revenue. While metrics like Monthly Recurring Revenue (MRR) and overall revenue reflect past performance, LVR offers insights into future growth by highlighting trends in lead generation. By tracking LVR, startups can understand their market traction, evaluate the effectiveness of their marketing strategies, and make informed decisions to drive future growth.

For example, if a startup had 200 qualified leads last month and 250 this month, the LVR would be calculated as follows:

LVR = (250−200) / 200 x 100 = 25%

This 25% increase indicates a positive trend in lead generation, suggesting that the startup’s marketing and sales efforts effectively attract more potential customers.

LVR helps startups predict future sales growth, assess their current marketing strategies, and make data-driven decisions to optimize their lead-generation processes. Tracking LVR regularly allows founders to stay ahead of the curve, ensuring sustained growth and success.

Lead Velocity Rate vs. Customer Lifetime Value (CLV)

LVR and Customer Lifetime Value (CLV) are both critical metrics for startups, but they serve different purposes and provide distinct insights.

Lead Velocity Rate (LVR) measures the growth rate of qualified leads over a specific period, typically on a month-over-month basis. It calculates the percentage increase in the number of leads that meet predefined criteria for quality, such as those who have shown a strong interest in the product or service. LVR is a forward-looking metric, offering predictive insights into future revenue potential by indicating how effectively a startup is generating new leads. Essentially, it helps startups understand the momentum of their lead generation efforts and anticipate future sales growth.

Customer Lifetime Value (CLV), on the other hand, assesses the total revenue a customer is expected to generate over the entire duration of their relationship with a business. It considers the average purchase value, purchase frequency, and customer lifespan to estimate the overall financial contribution of a customer. CLV is a backward-looking metric that focuses on the value derived from existing customers, providing insights into customer retention, satisfaction, and long-term profitability. It helps startups understand the financial impact of their customer base and make strategic decisions regarding customer acquisition and retention efforts.

Why Lead Velocity Rate is an Important Metric for Startups

LVR is one of the most important metrics for startups to track because it provides a clear and actionable insight into a company’s growth trajectory. Unlike historical metrics such as MRR and overall revenue, LVR is a forward-looking indicator that measures the growth of qualified leads over time. This makes it a crucial tool for predicting future revenue and assessing the effectiveness of marketing strategies.

Lead Velocity Rate is not just a metric; it is a vital tool that enables startups to predict growth, optimize marketing efforts, and secure investor interest. By tracking LVR regularly, startups can ensure they are on the right path to sustained growth and success.

Measuring Growth Momentum

Lead Velocity Rate provides a clear and quantifiable measure of a startup's growth momentum by tracking the increase in qualified leads over time. This metric allows startups to see how well their lead generation efforts are working, offering a tangible indicator of market traction. By regularly monitoring LVR, startups can identify trends in lead growth, adjust their marketing strategies, and ensure they are continually attracting new potential customers. A rising LVR indicates that the startup’s efforts are translating into more qualified leads, which is a strong sign of growing market interest and business momentum.

Predictive Power

LVR is a powerful leading indicator of future revenue and business performance. Unlike historical metrics, which only show what has already happened, LVR provides a forward-looking perspective by measuring the growth of new leads. This allows startups to predict future sales more accurately, as an increasing LVR suggests a robust pipeline of potential deals. By understanding and leveraging LVR, startups can forecast their revenue more effectively, align their sales and marketing efforts with anticipated growth, and make proactive decisions to sustain or accelerate their upward trajectory.

Financial Health

Assessing the financial health of a startup is crucial for long-term success, and LVR plays a key role in this evaluation. A high LVR indicates that a startup is successfully generating a growing number of qualified leads, which is essential for sustaining revenue growth. This metric helps startups understand whether their lead generation strategies are effective and whether they have a strong foundation for future financial stability. By tracking LVR, startups can ensure they are building a healthy pipeline that supports continuous revenue generation and overall business health.

Investor Confidence

LVR serves as a powerful tool for attracting investors by demonstrating that a startup is on an upward growth trajectory. Investors look for startups with strong growth potential, and a consistently increasing LVR is a clear indicator of this. It shows that the startup is effectively generating new leads and has a promising outlook for future revenue. By presenting a high LVR, startups can enhance their credibility and appeal to investors, showcasing their ability to grow and succeed in a competitive market. This metric can significantly boost investor confidence and increase the likelihood of securing funding.

Related resource: Why Revenue Per Lead is Really Important to Track

How to Calculate Lead Velocity Rate

Calculating LVR is straightforward and provides valuable insights into your startup’s growth potential. Understanding how to measure LVR enables startups to track the effectiveness of their lead-generation strategies and predict future sales. The process involves comparing the number of qualified leads from one month to the next, clearly showing how well your marketing and sales efforts are performing. By consistently calculating LVR, startups can make informed decisions to optimize their growth strategies and ensure sustained success.

Lead Velocity Rate Formula

The formula for calculating Lead Velocity Rate is simple and easy to apply. Here’s the basic formula:

LVR = (Number of Qualified Leads This Month − Number of Qualified Leads Last Month) / Number of Qualified Leads Last Month × 100

To illustrate, if a startup had 200 qualified leads last month and 250 this month, the calculation would be:

LVR = (250 − 200) / 200 × 100 = 25%

This 25% increase in qualified leads indicates a positive trend in lead generation, suggesting that the startup’s efforts to attract potential customers are effective. By regularly calculating and monitoring LVR, startups can track their growth momentum, anticipate future sales, and refine their marketing strategies to maximize lead generation.

Related resource: Developing a Successful SaaS Sales Strategy

Challenges and Considerations for Tracking LVR

While Lead Velocity Rate is an invaluable metric for startups, accurately tracking and utilizing it involves overcoming several challenges and considerations. Ensuring the reliability of LVR requires a focus on data accuracy, timeliness, and a holistic evaluation of metrics. Understanding these factors is essential for leveraging LVR effectively and making informed strategic decisions.

Data Accuracy and Consistency

LVR relies heavily on the accuracy and consistency of data. Accurate LVR calculations depend on precise and complete data regarding the number of qualified leads. Any inaccuracies or inconsistencies in data collection can skew LVR results, misrepresenting a startup's growth trajectory. Therefore, startups must implement rigorous data collection and validation processes to ensure that the information used for LVR calculations is reliable and consistent over time.

Timeliness of Data

Timely data collection and reporting are crucial for accurate LVR measurements. LVR calculations require up-to-date data on qualified leads to accurately reflect the current state of lead generation. Data collection and reporting delays can result in outdated or irrelevant LVR calculations, which may not align with real-time decision-making needs. Startups must establish efficient data collection systems and workflows to ensure LVR calculations are based on the most current available data.

Holistic Metrics Evaluation

While LVR is a powerful metric, it should not be viewed in isolation. LVR should be considered alongside other KPIs such as Customer Acquisition Cost, Customer Lifetime Value, and Monthly Recurring Revenue for a comprehensive understanding of business performance. A holistic evaluation of these metrics provides a more complete picture of a startup's financial health, growth potential, and overall business performance. Balancing LVR with other KPIs allows startups to make more informed and strategic decisions.

Related resource: Your Company’s Most Valuable Metric

Secure Investor Interest with Visible

Lead Velocity Rate is a critical metric for startups, providing valuable insights into growth momentum, future revenue potential, and overall financial health. By accurately calculating and consistently tracking LVR, startups can measure their lead generation effectiveness, predict business performance, and attract investor confidence. Addressing challenges related to data accuracy, timeliness, and holistic metrics evaluation ensures that LVR serves as a reliable and powerful tool for driving strategic decisions.

To maximize the benefits of LVR and other key performance indicators, consider using Visible’s all-in-one platform to track and visualize your startup’s metrics - create your account here!

We want to hear from you. What is your Most Valuable Metric? Tell us here and we will share the results with the contributors!

Want to be alerted of our new blog posts? Subscribe to our email list.

Some more great posts about LVR

http://saastr.com/2012/12/12/why-lead-velocity-rate-lvr-is-the-most-important-metric-in-saas

http://www.revenify.com/important-metric-saas-lead-momentum-description-lead-velocity

http://www.referralsaasquatch.com/how-to-calculate-saas-growth

founders

Metrics and data

The Only Financial Ratios Cheat Sheet You’ll Ever Need

Understanding your business's financial health is crucial for making informed decisions and driving growth. Our comprehensive cheat sheet covers essential financial ratios, from profitability to valuation, providing clear formulas, practical examples, and insightful applications. This guide will help you decode complex financial data, compare performance with industry peers, and make strategic adjustments. Whether you're assessing liquidity, efficiency, or profitability, this cheat sheet is your go-to resource for confidently navigating financial analysis. Dive in and empower your business with the insights needed to thrive.

Profitability Ratios

Profitability ratios are crucial indicators of a company’s ability to generate profit relative to its revenue, assets, and equity. These ratios are widely used by founders, investors, analysts, and creditors to assess a business's financial health and operational efficiency. They help identify how well a company is performing in terms of profit generation and provide insights into areas where improvements can be made.

Gross Profit Margin

Gross Profit Margin measures how efficiently a company is producing and selling its goods. A higher margin indicates better efficiency and profitability. It is particularly useful for comparing companies within the same industry to gauge operational efficiency.

Formula:

Gross Profit Margin = Revenue − Cost of Goods Sold (COGS) / Revenue

Components:

Revenue: Total sales generated by the company.

Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold by the company.

How to Solve:

Calculate the gross profit by subtracting COGS from revenue.

Divide the gross profit by the revenue.

Multiply the result by 100 to get the percentage.

Operating Profit Margin

This ratio indicates the total revenue left after covering operating expenses. It helps assess the core business efficiency, excluding non-operational factors. A higher operating margin suggests better management of operating costs.

Formula:

Operating Profit Margin = Operating Income / Revenue

Components:

Operating Income: Revenue minus operating expenses (excluding interest and taxes).

How to Solve:

Calculate operating income by subtracting operating expenses from revenue.

Divide the operating income by the revenue.

Multiply the result by 100 to get the percentage.

Net Profit Margin

Net Profit Margin provides the bottom line profit relative to sales. It is a key indicator of overall profitability and is used to compare performance with competitors. A higher net profit margin indicates a more profitable and financially healthy company.

Formula: Net Profit Margin = Net Income \ Revenue

Components:

Net Income: Total profit after all expenses, including taxes and interest, have been deducted from revenue.

How to Solve:

Calculate net income by subtracting all expenses from revenue.

Divide the net income by the revenue.

Multiply the result by 100 to get the percentage.

Return on Equity (ROE)

ROE measures the return generated on shareholders' investments. It is crucial for investors to evaluate how effectively a company uses equity to generate profits. A higher ROE suggests a more efficient use of equity capital.

Formula:

ROE = Net Income / Shareholders’ Equity

Components:

Net Income: Total profit after all expenses.

Shareholders’ Equity: Total assets minus total liabilities.

How to Solve:

Divide the net income by the shareholders’ equity.

Multiply the result by 100 to get the percentage.

Return on Assets (ROA)

ROA indicates how efficiently a company uses its assets to generate profit. It is particularly useful for comparing companies in capital-intensive industries. A higher ROA means better utilization of assets.

Formula:

ROA = Net Income / Total Assets

Components:

Net Income: Total profit after all expenses.

Total Assets: Sum of all assets owned by the company.

How to Solve:

Divide the net income by the total assets.

Multiply the result by 100 to get the percentage.

Return on Capital Employed (ROCE)

ROCE assesses the efficiency and profitability of a company's capital investments. It is essential for evaluating long-term profitability and comparing across industries. A higher ROCE indicates more efficient use of capital.

Formula:

ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed

Components:

EBIT: Earnings before interest and taxes.

Capital Employed: Total assets minus current liabilities.

How to Solve:

Divide EBIT by the capital employed.

Multiply the result by 100 to get the percentage.

Solvency Ratios

Solvency ratios are vital for assessing a company's ability to meet its long-term obligations. These ratios provide insights into a business's financial stability and leverage, which are crucial for founders, investors, creditors, and analysts. By evaluating solvency ratios, stakeholders can determine the risk level associated with the company’s financial structure and its capability to sustain operations in the long run.

Debt-to-Equity Ratio

The Debt-to-Equity Ratio indicates the relative proportion of shareholders' equity and debt used to finance a company's assets. It is an essential measure for assessing financial leverage and risk. A higher ratio suggests that a company is more leveraged and may be at higher risk of financial distress. Conversely, a lower ratio indicates a more stable financial structure with less reliance on debt.

Formula:

Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

Components:

Total Liabilities: The sum of all debts and obligations the company owes.

Shareholders’ Equity: The net assets of the company, calculated as total assets minus total liabilities.

How to Solve:

Add up all the company's liabilities to get the total liabilities.

Calculate shareholders’ equity by subtracting total liabilities from total assets.

Divide total liabilities by shareholders’ equity.

Equity Ratio

The Equity Ratio measures the proportion of a company's assets financed by shareholders' equity. This ratio provides insights into the financial stability and capitalization structure of the business. A higher equity ratio indicates a more financially stable company with less dependence on debt, making it more attractive to investors and creditors.

Formula:

Equity Ratio = Shareholders’ Equity / Total Assets

Components:

Shareholders’ Equity: The net assets of the company, calculated as total assets minus total liabilities.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Calculate shareholders’ equity by subtracting total liabilities from total assets.

Divide shareholders’ equity by total assets.

Multiply the result by 100 to get the percentage.

Debt Ratio

The Debt Ratio measures the extent to which a company is financed by debt. It provides insights into the company's leverage and financial risk. A lower debt ratio indicates that the company relies less on debt to finance its assets, reducing financial risk. Conversely, a higher ratio suggests higher leverage and potential vulnerability to financial distress.

Formula:

Debt Ratio = Total Liabilities / Total Assets

Components:

Total Liabilities: The sum of all debts and obligations the company owes.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Add up all the company's liabilities to get the total liabilities.

Divide total liabilities by total assets.

Multiply the result by 100 to get the percentage.

Efficiency Ratios

Efficiency ratios evaluate how well a company utilizes its assets and liabilities to generate sales and maximize profits. These ratios are critical for founders, managers, and investors as they provide insights into operational efficiency, resource management, and overall business performance.

Asset Turnover

Asset Turnover measures how efficiently a company uses its assets to generate sales. A higher ratio indicates better utilization of assets. This ratio is particularly useful for comparing companies within the same industry to understand relative efficiency. For instance, a company with a higher asset turnover is considered more efficient in using its assets to produce revenue.

Formula:

Asset Turnover = Revenue / Total Assets

Components:

Revenue: Total sales generated by the company.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Identify the total revenue from the company's income statement.