This article includes insights from a webinar Visible co-hosted with the corporate venture firm JLL Spark Global Ventures and Counter Club, a network of corporate venture capitalists brought together by common challenges and opportunities to share best practices. To learn more about Counter Club and watch the full webinar recording head to Counter Club’s registration page.

Corporate Venture Capital Overview

Corporate Venture Capital (CVC) is the practice of large firms investing in small early-stage startups and offering strategic value. They differ from traditional VC’s because they are not only motivated to make impressive returns for Limited Partners (LPs), but are also focused on protecting their corporate strategy and gaining a competitive advantage.

The Limited Partner for a CVC is usually the singular firm which means the capital source is highly concentrated. The parent corporation is often heavily involved in the day-to-day of a corporate venture. CVC teams are expected to know what’s going on in their portfolio at all times and be ready to share insights and regular reporting with their corporate partner.

What is Portfolio Monitoring?

Portfolio Monitoring is taking a holistic approach to understanding what is going on with your portfolio. It can be thought of in three categories: Qualitative Updates, Financial Performance, and Operations Changes.

Narrative Updates: Arguably the most important part is understanding the narrative behind changes going on with certain companies. For example, what’s going right for this company right now and what’s hard right now and why?

Financial Performance: Other aspects of portfolio monitoring is understanding the financial performance of a company and oftentimes comparing that versus what was forecasted. You’ll want to be able to understand the current value of a companies key performance indicators but also extract insights such as quarter-over-quarter and year-over-year growth.

Operational Changes: As a part of portfolio monitoring you’ll want to stay on top of any major operational changes a company undergoes. For example, major changes in total headcount or moving a company’s headquarter to a larger facility could explain the recent change in a company’s burn. Another operational change to monitor is when a company secures additional follow on investment or a change in their cap table.

Learn more about using Visible to monitor your portfolio companies.

Why is Portfolio Monitoring Important within the CVC Context?

Insight into your portfolio companies is critical within the CVC context. By knowing what’s going on with your portfolio companies you’ll be able to provide more impactful, relevant support to your companies. You’ll also be able to gain the confidence of your corporate partner by demonstrating your ability to monitor, manage, and share insights about your portfolio companies.

“Communication is the lifeblood of any relationship. If you’re delivering updates back to the corporate partner and they know exactly what’s going on, you’re more likely to continue to get funding and resources.”

– Mike Preuss, CEO Visible

Benefits of Portfolio Monitoring:

- Being able to share meaningful insights with your corporate partner

- Using data to drive future investment decisions

- Helping portfolio companies succeed

- Make introductions to talent, investors, customers

- Provide relevant sector-specific expertise

- Leverage intraportfolio knowledge to better understand technology trends

- Staying organized with a central source of truth

- Building more trust with the corporation

“I think what’s really important is having a central source of truth for all of our data whether that be portfolio companies, how much we invested and what was the price, all the information around the deal. Having that in a central location for all the team to look up is really important.”

– Mikey Kailis, Counterpart Ventures, Visible User

Portfolio Monitoring Best Practices

Oftentimes CVCs know they should be monitoring their portfolio companies but don’t know what best practices look like. Here are curated best practices based on Visible’s experience supporting over 400 investors.

Ask for only 5-10 metrics and 1-2 qualitative questions

Staying below 10 metrics reduces the time it takes founders to complete their reporting so they can get back to building their companies.

Most Common Metrics to Track

- Revenue

- Cash Balance

- Monthly Net Burn*

- Cash Runway*

- Net Income

- Total Headcount

*Both of these metrics can be calculated in Visible using formulas and don’t need to be requested.

For more details check out ‘”Which metrics should I be tracking for my portfolio companies”

Use Metric Descriptions

Using metric descriptions helps with data accuracy and can reduce back and forth between you and your companies. Visible’s customer sucess team can help you establish the best descriptions to include with your metrics.

Collect Data Quarterly

According to Visible’s user activity, 70% of investors are requesting updates from their portfolio companies on a regular basis. By establishing a quarterly frequency with your companies you’re getting them into a rhythm of reporting expectations only 4 times a year. It’s also becoming more common to request ESG or DEI information on an annual basis.

For more best practices such as high to get high response rates from companies check out ‘Portfolio Data Collection Tips from Visible’.

Check out an Example Request in Visible.

Providing Strategic Value to Portfolio Companies as a CVC

Corporate VC’s are uniquely positioned to provide strategic value to their portfolio companies. CVC’s are often investing in sectors in which they have deep sector expertise, relevant networks, and commercial experience. All of this can be extremely valuable to companies but only if you know what is going on with your companies and have developed enough rapport for companies to share where they need help.

By incorporating qualitative questions in your portfolio data Request in Visible such as ‘How can we specifically support you this quarter in terms of customer introductions, talent, or market expertise’, CVCs can unlock rich opportunities to deepen relationships with companies and provide strategic value.

The two metrics JLL collects and reports back to corporate JLL to demonstrate strategic value add are ARR and the number of customers.

“Visible helped us develop regular communication with our portfolio companies. It helps us understand where our portfolio companies are focused and how we can best align with them. Our investors also are able to look back at these updates to understand if companies are struggling at the moment and how we need to prioritize our support.” — Kelly Wong, JLL Spark

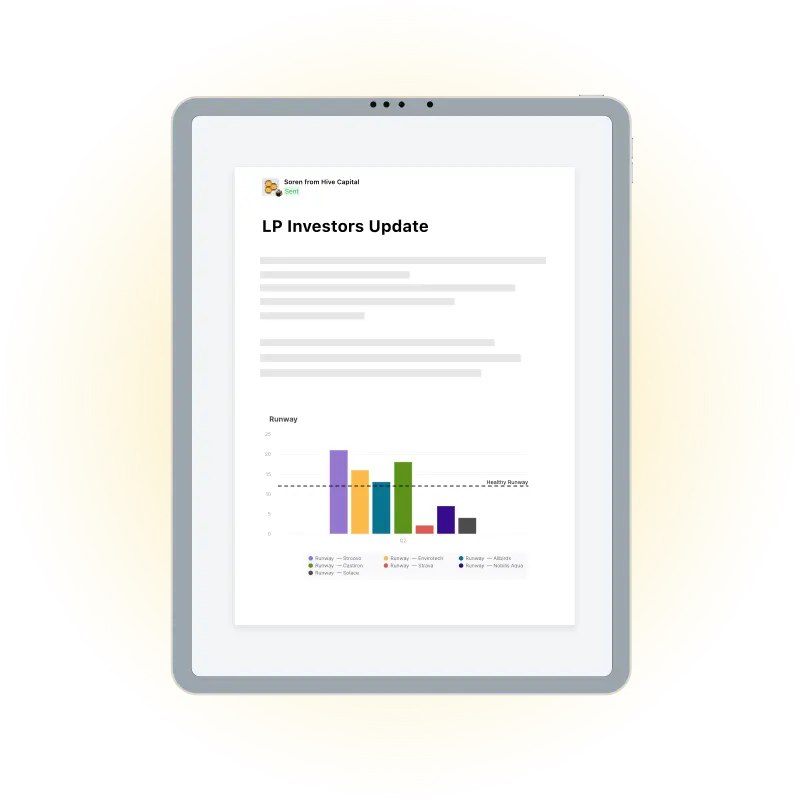

CVC Portfolio Reporting

You can share updates about your portfolio with your team and wider firm with Visible’s flexible dashboards, tear sheets, and LP Update features. Learn more.

Interested in exploring Visible for your Corporate Venture Capital fund?