Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Reporting

8 Ways to Level Up Your Investor Relations in 2023

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

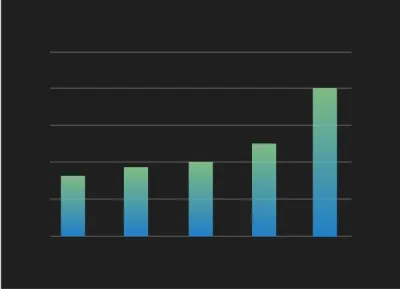

2022 has been a challenging year in the startup world. After a hot start to the year, funding and growth has slowed. As Tomasz Tunguz pointed out in the chart below, funding has collapsed since October.

At Visible, we’ve spent 2022 building tools to help founders update investors, raise capital, and track key metrics. With the help of these 6 new features, founders will be able to level up their investor relations and strike when the funding iron is hot. Check them out below:

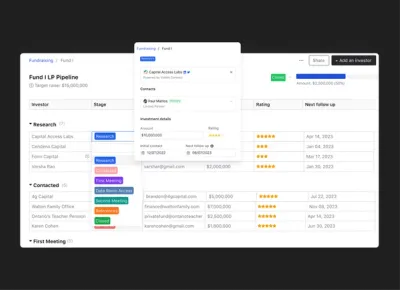

Share and Comment on Fundraising Pipelines

You can now share a fundraising pipeline via link. This allows you to ask current investors or peers for introductions or information about investors in your pipeline. In turn, your investors or peers can leave a quick comment to help make an introduction to investors they know.

Customize Fundraising Columns and Properties

Our fundraising pipelines have become more flexible so you can further tailor your pipeline to match your fundraise. With customizable fundraising columns and properties, you will be able to select the properties you would like to see at the pipeline level. Check out some of the most popular custom fundraising properties below:

Min & max check size

Who can make/made a connection?

Data room shared?

Investor type

Will they lead?

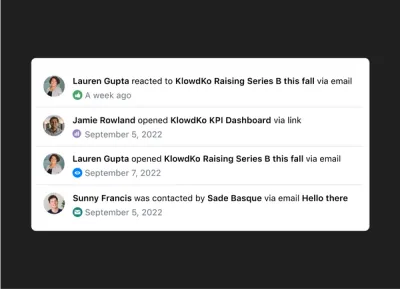

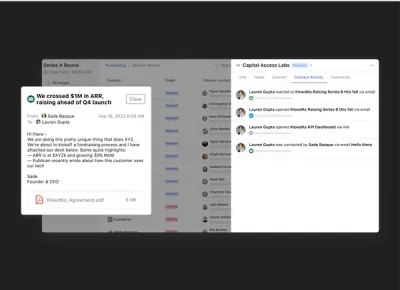

Log Emails with Potential Investors in Visible

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Automatic Fundraising Follow-up Reminders

Over the course of a fundraise, most founders should expect to communicate with 50-100+ investors. In order to best help you stay on top of their ongoing conversations, you can now set email reminders for when to follow up with potential investors. This is a great way to speed up the fundraising process and get back to what matters most — building your business.

Pitch Deck Branding and Custom Domains

Control your fundraise from start to finish. With Visible Decks, you can share your deck using your own domain. Plus you can customize the color palette of your deck viewer to match your brand. You can check out an example here.

Include Pitch Decks in Updates

Keeping current and potential investors in the loop is a great way to speed up the process when you are ready to raise capital. In order to best help nurture current and potential investors, you can now include your Visible Decks directly in Updates. This can help when kicking off a raise, nurturing potential investors, or sharing a board deck with your board members.

Custom Properties as Merge Tags in Updates

As we mentioned above, updating current investors and nurturing potential investors is a great way to speed up a fundraise when the time is right. To best help you customize your Visible Updates, you can now use custom properties as merge tags in Updates. For example, if you’re tracking the city in which your investors live you can use that in an Update.

Improved Dashboard Layout and Widgets

If you’re sharing Visible Dashboards with your team or more involved investors, you can now customize the layout and include additional widgets (like text, tables, and variance reports). This will allow you to give additional context to any of the data your key stakeholders might be looking at regularly.

Our mission at Visible is to help more founders succeed. Over the next 12 months, we’ll be building more tools to help you do just that. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

3 Ways to Get a Head Start on Fundraising

Tomasz Tunguz, VC at Redpoint Ventures, recently shared a chart (above) detailing the best time of the year to raise capital. 2022 looks a lot different than 2021 (and the previous 10 years). After a hot start, the # of deals has collapsed since October.

As fundraising slows and the holidays/New Year approach, founders might want to consider re-grouping and putting together a plan for raising in 2023. Check out 3 ways to get a head start on your 2023 fundraising efforts below:

1. Build the right audience

As we mentioned in a previous Visible Weekly, most founders should expect to communicate with 50-100 investors over the course of a raise. When balancing 50+ conversations it is important to make sure you are spending time on the right investors.

Use Visible Connect, our free investor database, to filter and sort investors by the fields that matter (sweet spot check size, investment geography, fund size, etc.).

2. Track ongoing conversations

50+ conversations is a lot. If you’re running a fundraising process off the cuff, using the last few weeks of the year to set up a pipeline and outreach process will allow you to spend more time on what matters most — building your business. Check out some tips for setting up a Fundraising Pipeline here.

3. Keep investors engaged with updates

If you’re planning on sending an investor update to your current investors at the end of the year, you can use a “lite version” to engage with potential investors (think big wins, fundraising status, high growth metrics, etc). Check out an example here.

Reading List

The Best Time of Year to Raise for Your Startup

Tomasz Tunguz of Redpoint Ventures studies recent funding data to understand the best month to raise venture capital. Read more

3 Tips for Cold Emailing Potential Investors + Outreach Email Template

On the Visible Blog, we share a template to help you craft cold emails for potential investors. Read more

Founder How-To: Writing Forwardable Emails

Stephanie Rich of Bread & Butter Ventures breaks down how founders can best write a “forwardable email” for fundraising. Read more

investors

Product Updates

Visible’s 2022 Year in Review

Visible is a founder-friendly portfolio monitoring and reporting solution used by VC’s around the world.

Thanks to the continued engagement from our investor community, the last twelve months at Visible have been full of growth. As a Visible user, you’ve helped bring more transparency to the Venture Capital industry through improved KPI tracking, accessing deeper portfolio insights, and by more regularly communicating with your companies, teammates, and LP’s.

Here are some 2022 highlights:

7k+ Requests completed by portfolio companies around the world

550+ LP Updates were sent to investors

800+ Investors deepened their VC expertise by engaging with our educational webinars

300+ VC firms verified their profiles in our Connect database

Biggest Product Updates of 2022

More Flexible & Scalable Dashboards

Portfolio Dashboard Templates – A more scalable way to visualize and extract insights from portfolio company data.

Flexible Dashboard Grids – Flexible widget sizing means you have more control over how you can display data visualizations for you and your team.

Intraportfolio Benchmarking and Insights – Compare individual company performance against portfolio quartiles using custom segments.

Improved Portfolio Request Experience

Request UI Overhaul – It’s now much easier to understand when your Request has been sent, % completion, and when the next scheduled reminder email will be sent.

Multiple File Uploads in Requests – Companies can upload multiple files into the same file block in a Request, saving them time each reporting cycle.

Export Request Summaries – Easily export and analyze Request responses in just a few clicks.

Re-open a Request – Mistakes happen. Re-opening a Request lets companies re-submit their data.

Advanced Investment Insights

Chart Investment and Fund Metrics – Chart and visualize key fund metrics such as TVPI, RVPI, DPI, and more.

Automatic SAFE Conversion & Token Support – Visible supports 6+ investment types.

Multiple Funds – Segment your investment data by fund in custom-built reports.

Interested in learning more about Visible’s portfolio monitoring solution for investors? Book a demo below.

Interested in learning more about Visible?

Meet with Our Team

Webinar Recap from 2022

More than seven thought leaders from around the world joined us to share their expertise in different topics related to improving the venture capital ecosystem. Check out the recordings and resources below.

ESG Best Practices with Tracy Barba ESG for VC –> Watch Here

Building Scalable Support with Jessica Lowenstein of K50 Ventures and Erica Amatori of Left Lane Capital – Watch Here

Benefits of a Hybrid SPV + Fund Strategy with Kingsley Advani of Allocations — Watch Here

LP Reporting Best Practices with Aduro Advisors — View the Report

SaaS Company Benchmarking with Christoph Janz of Point Nine Capital — Watch Here

Best practices for portfolio monitoring & reporting with Gale Wilkinson of VITALIZE Venture Capital — Watch Here

Interested in learning more about Visible?

Meet with Our Team

How to Partner with Visible in 2023

Increase your VC firm’s brand awareness by hosting your Update template in our public Update Library for investors.

Refer your investor friends to Visible and receive a $500 Amazon gift card.

Invite us to host a webinar for your portfolio companies on ‘Investing in Investor Updates’.

Verify your firm’s profile in our investor Connect Database.

To get started with any of the partnership opportunities above, send an email to belle@visible.vc.

Interested in learning more about Visible?

Meet with Our Team

founders

Reporting

Wringing Out Investor Updates

A few years ago we interviewed Lindsay Tjepkema, Founder of Casted, about starting a podcast. One of her key tips was to “wring out your content.” If you’re going to take the time to record a podcast, you should take the time to repurpose and distribute that content on different channels.

How to Repurpose Investor Updates

The same is true for investor relations and fundraising. If you’re going to take the time to send an investor update, you can “wring out” your metrics, big wins, asks, audience, etc. to fuel other fundraising materials. An investor update can be re-purposed to help build out other fundraising assets — for example:

Potential Investor Monthly Updates — For a simple hack, take your normal investor update and edit it down to a few key metrics and wins to nurture potential investors.

Pitch Decks — If you’re sharing data in your investor updates, this can be used to help build out the different metrics and data you’ll need in a pitch deck.

Data Rooms — Data rooms are a combination of all of the data and assets you’ll share over the course of a fundraise. Including past investor updates is a surefire way to show potential investors your history of regular communication.

Cold Emails to Investors — Investor updates can be a starting point for crafting a cold email to potential investors.

Board Decks — There is likely a lot of crossover between the content in an investor update and a quarterly board meeting. Investor updates can be a great backbone for building out the different slides in a board deck.

Team Updates — A modified version of your investor update is also a great way to keep your team in the loop and build trust.

Investor communication is no easy feat for founders. Taking the time to send monthly updates already puts you ahead of 50% of portfolio companies — taking the few minutes to wring out your investor updates will help you speed up your next raise when you are ready.

Reading List

How to Handle: Keeping Your Investors Updated

Brett Brohl of Bread & Butter Ventures breaks down the 5 components he likes to see in investor updates. Learn more

Investor Outreach Strategy: 9 Step Guide

On the Visible Blog, we share a 9 step guide to help founders develop a plan to reach out to potential investors. Read more

Why You Should Always Send Your Investor Updates

Kera DeMars of Hustle Fund makes the case why founders should send investor updates. Read more

founders

Fundraising

The Top VCs Investing in Community Driven Companies

What is a Community-driven Company?

A community-driven business is a company that puts community at its core. This can be a case where the community is the product (e g. Reddit) or where the community is central to the business’s identity and success (e.g. Peloton).

A community-driven company is one whose value is its members and its success depends on them. The value that is derived from the community benefits both its members and the company.

The community can either be the company’s product or its community is built around its product. These companies are often founded by individuals who believe they can solve problems better through collaboration and are built around a specific mission, problem, or just simply the community itself.

Lolita Taub of Ganas Ventures points out that there are various takes on what community-driven companies are but it’s part of what makes this model so special. At Ganas, they focus on companies whose,

customers identify as members

members are able to create value for other members

members start the marketing and sales flywheel

She also believes that companies with the community at the core will become unicorns and produce outsized returns.

What Makes a Community-driven Company Valuable and Successful?

Community-driven companies are becoming increasingly common in today’s competitive environment. In order to survive and thrive, organizations need to adapt to changing customer demands and expectations. Community-driven companies are able to respond faster to these changes because their users are directly involved in decision-making processes.

This new way of thinking about customer relationships means that companies no longer focus solely on selling products or services. Instead, they create value for their customers through the experience of the community- redefining the relationship between consumers and businesses.

Companies that are driven by their customer base and community are growing at a faster rate than other companies. They also tend to outperform competitors because they focus on solving real problems instead of chasing trends. Which is why community-based businesses are becoming increasingly popular.

Some of the other community-driven benefits include:

Less marketing spend

Brand Loyalty and LTV

Lower operating and sales costs (companies can be leaner and small)

Retention

Referrals

Defensible business model (difficult to replicate)

What’s a Community-Led Company’s Secret Sauce?

Community-led growth (CLG) is a type of go- to market strategy that these companies are using to leverage their communities to sell. The important thing to note here which Lolita points out, is that “community-led growth should not be confused with marketing. Community-led growth companies focus on creating a safe space for their community to come together, share value, create relationships, and best use their products/services to solve a problem or help achieve a goal.”. As a result of nurturing this space, “your community acts as a multiplier for company growth”.

Community-driven companies are also often considered more innovative because they focus on solving problems or sharing information, and they get the answers from the people that matter most- their customers as well as enthusiasts on the topic.

This approach has become known as ‘community-based innovation’ (CBI). They rely heavily on their customers or consumers to create new ideas, develop new products, and even provide feedback. This also tends to make running a community-driven company less expensive to start and run.

Taking feedback or observing what the community is saying gives you the best understanding of customer needs and wants. When you then use this information to shape future decisions you have a competitive advantage and can deliver exactly what is wanted and needed. This also helps build trust between the company and its customers. In addition, it allows the company to stay relevant and responsive to changes in the marketplace.

What Might the Future of Communities Look Like?

With social media platforms becoming more powerful than ever before, communities are booming. People are creating their own networks, sharing information, and collaborating together. This has led to the rise of the Creator Economy, which has allowed people to monetize their following.

According to CMX Community Industry Report, “Communities are cautiously dipping their toes into Web 3.0- 15% of communities are actively working on Web 3.0 focused projects and an additional 17% are considering it. Decentralized autonomous organizations (DAOs) are the most common form of Web 3.0 project that community teams are working on.” Web 3 is not only allowing companies to monetize on their community but their members can now also benefit as well through NFTs and DAOs.

What is the Difference Between a Web2 and Web3 Community-driven Company?

Ganas Ventures highlights two pain points for each:

“Web2 companies

– People create content, products, and services

– Companies earn money

Web3 companies

– People/communities create content, products, and services

– People/communities earn money”

Related Resource: 10 VC Firms Investing in Web3 Companies

Additional Resources and Tools for Startups

Community-Driven Companies: What They Are and Why We’re Investing in Them

CMX Community Industry Report

Ganas Ventures Resources

Follow Lolita Taub for updates in the space

Origami– helps Web3 communities launch and grow their DAOs

Paragraph– Paragraph turns your subscribers into members through NFTs which gives your audience ownership in your community.

VCs Investing in Community-Driven Companies

Flybridge

About: Flybridge is a seed and early-stage venture capital firm whose mission is to assist entrepreneurs in growing innovative, global companies. With more than $625 million under management, the firm is focused on seed and early-stage investing in technology markets and is led by a team with domain expertise and more than half a century of combined experience in venture capital.

Thesis: We see a vibrant community as a source of competitive advantage and we are excited to invest in companies and entrepreneurs who share our vision for the power of community across a range of sectors.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Dame Products

Trend

Teal

Ganas Ventures

About: Ganas Ventures invests in pre-seed and seed Web 2 and Web 3 community-driven startups in the US and Latin America.

Thesis: Ganas Ventures invests in pre-seed and seed Web 2 and Web 3 community-driven startups in the US and Latin America. It’s run by solo-GP Lolita Taub.

Investment Stages: Pre-Seed, Seed

SV Angel

About: SV Angel is a San Francisco-based angel firm that helps startups with business development, financing, M&A, and other strategic advice.

Investment Stages: Seed

Recent Investments:

Kiln

Payload

FlowForge

Lerer Hippeau

About: Lerer Hippeau is an early-stage venture capital firm founded and operated in New York City. Since 2010, we have invested in entrepreneurs with great ideas who aren’t afraid to do hard things. Our portfolio includes more than 350 leading enterprise and consumer businesses including Guideline, MIRROR, Blockdaemon, K Health, Allbirds, ZenBusiness, and Thrive. We’re experienced operators who invest early and stay in our founders’ corners as they build iconic companies.

Thesis: We seek entrepreneurs with product vision, consumer insight, focused execution, and unwavering ambition. When we are lucky enough to meet such people, our hope is that they will choose us as a long-term partner.

Investment Stages: Seed, Series A, Series B, Series C

Recent Investments:

Anode Labs

Onward

Bookkeep

The Community Fund

About: A $5 million early-stage fund that invests in community-driven companies through an investment partner team.

Thesis: We’re an early-stage fund that invests in community-driven companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Elektra Health

Kindra

Founders Fund

About: Founders Fund is a San Francisco based venture capital firm investing in companies building revolutionary technologies.

Thesis: We invest in smart people solving difficult problems.

Investment Stages: Seed, Series A, Series B

Recent Investments:

Namecoach

Speak

Elemental Machines

General Catalyst

About: General Catalyst backs exceptional entrepreneurs who are building innovative technology companies and market leading businesses, including Airbnb, BigCommerce, ClassPass, Datalogix, Datto, Demandware, Gusto (fka ZenPayroll), The Honest Company, HubSpot, KAYAK, Oscar, Snap, Stripe, and Warby Parker.

Thesis: General Catalyst is a venture capital firm that makes early-stage and growth equity investments.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

Guild

OneSchema

Buildkite

K50 Ventures

About: K50 Ventures is the most trusted first-check investor for mission-driven founders building a better future for the 99%. We invest up to $2M in pre-seed and seed stage companies in the US and LATAM that are prioritizing access, affordability, and wellbeing across the categories of Health, Finance, and Work. K50 partners with those who refuse to accept the status quo; those who have a vision for how to radically improve daily life for everyone – in our local communities, and around the globe. Since 2016, we have invested in 170+ companies including Groww, Mammoth Biosciences, Self, Tul, Frubana, Kueski, Fintual, Valon, Real, Osana Salud, June Homes, among others.

Investment Stages: Pre-Seed, Seed

Recent Investments:

June Homes

HoneyBee

Osana Salud

Halogen Ventures

About: Halogen Ventures is an early stage venture capital fund focused on consumer technologies prioritizing a female in the founding team.Thesis: Halogen Ventures is an early stage venture capital fund focused on female led consumer technology companies.

Investment Stages: Early Stage

Recent Investments:

Ellevest

Vivoo

Live Tinted

Graph Ventures

About: We are a group of founders & operators with experience starting and scaling technology co’s globally. 300+ investments.

Investment Stages: Pre-seed, Seed

Recent Investments:

Tract

Comm Technologies

Disclo

Founder Collective

About: Founder Collective is a seed-stage venture capital firm that has invested in over 300 startups, including Uber, Airtable, PillPack, SeatGeek, The Trade Desk, Whoop, and Cruise. Founder Collective’s mission is to be the most aligned fund for founders at the seed stage. FC has offices in NYC and Cambridge, MA and has been the top-rated seed fund on the Forbes Midas list for four of the last five years.

Investment Stages: Seed

Recent Investments:

Kapu

Odyssey Energy Solutions

Gigasheet

Looking for Funding? We can help

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like yours. Check out all our investors here and filter as needed. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Related Resource: All-Encompassing Startup Fundraising Guide

Related resource: Top 10 Growing Tech Hubs Transforming Latin America in 2025

investors

Reporting

Fundraising

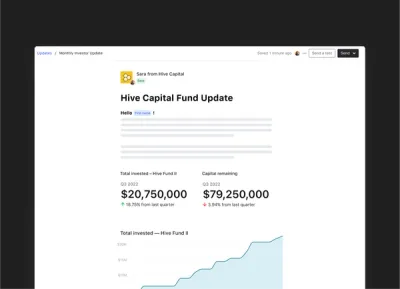

LP Reporting Templates for VCs

The General Partner (GP) and Limited Partner (LP) relationship is built on trust. The best way to establish trust with LPs is through transparency, authenticity, and regular communication. When LP reporting is done well, LPs should easily be able to understand how both the fund and the fund manager are performing and be able to use this information to inform their investment strategies in the future.

The best GPs view sending LP Updates as a relationship-building activity and as a fundraising tool — not as a way to simply check off a requirement from their LPA’s.

For emerging managers, your relationships with initial LPs are of critical importance for your reputation as a fund manager and future fundraising. This rapport forms the basis of the fund manager’s credibility and will surface again when future LPs are doing diligence on the emerging manager. First-time fund managers will need to have clean data to support their track record and positive relationships with current LPs to set themselves up for success in raising additional funds.

The Weekend Fund recently wrote a thoughtful article on How to Write LP Updates with four main takeaways:

Send LP updates consistently

Go beyond the basics

Be authentic

Don’t share sensitive information without portfolio founders’ sign-off

We’ve translated this guidance into actionable steps that can be streamlined with Visible’s Portfolio Monitoring and Reporting tools below.

1. Send LP updates consistently.

Weekend Fund Advice — “One of the biggest mistakes new fund managers can make is not sending LP updates consistently. Most send quarterly updates. At Weekend Fund we send updates approximately every two months. Regular, detailed, and transparent updates builds trust with your LPs, which is particularly important if you want them to write a check into your next fund.”

Visible provides fund managers with tools to make sending updates to LPs on a regular basis easier.

To start, you can Upload Your LP Contacts (including custom contact fields) via CSV within seconds. Then you can create Custom Lists to organize your contacts. We suggest organizing your LPs by Fund and also by whether they’re a current LP or a potential LP.

This means within minutes you have all your contacts organized into custom segments that are useful to you. You can then simply choose which list you want to send an Update to in the future.

Visible also streamlines the creation of your LP Update content by letting you choose from an Update Template Library. You can easily pull a template into your account, further customize it as needed, and save it as your own template to use for future updates.

2. Go beyond the basics.

Weekend Fund Advice — “Of course, you should introduce new investments, share updates from the portfolio, report performance metrics, and other key updates from the fund, but the best updates go a step further to educate and inform LPs. This might include your analysis on the market, perspective on emerging trends, or learnings from experiments.”

Visible’s LP Update editor supports rich text, videos, images, files, and perhaps best of all — custom data visualizations. This means you can visualize your custom fund analytics that will resonate with your LPs and embed them directly into your Update. The data is derived from data hosted within your Visible account and updates your charts in real time.

It’s also a great idea to include a market overview section at the top of your update to shed light on how you’re evaluating and staying ahead of the curve in the markets in which you invest. This is a great way to continue to instill LP confidence in you as the steward of their capital. On top of that, it’s important to remember that “many LPs invest in funds as a learning opportunity. The updates are the primary artifact to support that learning.” (Source)

You can also stand out to LPs by getting creative and embedding a video recording of your recent portfolio updates directly into your Updates. Open the update below to view an example of how a Visible customer incorporates video into their updates —

—> View Update Example with Video Embed

3. Be authentic.

Weekend Fund Advice — In general, people gravitate toward authenticity. Writing with personality is more engaging and magnetic. LP updates are an opportunity to share your unique voice and build your fund’s brand.

The Weekend Fund incorporates authenticity in their updates through their narrative updates and transparency, but also by including personal photos.

Visible lets you embed personal photos directly into your Update in two clicks.

—> View the Weekend Fund’s Update Template

4. Don’t share sensitive information without portfolio founders’ sign-off.

Weekend Fund Advice — “Fund managers often have inside knowledge into how a company is doing. Some founders are extremely sensitive to information shared about their company, even when the news is positive. It’s prudent to get approval for any non-public information shared with LPs.”

Visible recommends explicitly asking for portfolio company’s permission to share information with LPs. One way to do this is by incorporating it into the descriptions of your Request blocks. (How to Build a Request in Visible).

Here’s an example below —

It’s important to remember that as a GP you’re not only competing with other GPs for LP capital but also with every other asset class. So it’s to your advantage to use every tool in your toolkit to stand out and impress LPs.

Over 400+ VC funds are using Visible to streamline their portfolio monitoring and reporting processes.

founders

Fundraising

Operations

Quitting vs. Giving Up with Mike Evans, the Founder of GrubHub

For a bonus episode of the Founders Forward Podcast, we are joined by Mike Evans. Mike is the founder of GrubHub and the current CEO of Fixer — Fixer provides skilled experts, solving a variety of home problems in one visit.

About Mike Evans

Mike shares the ins and outs of his time building GrubHub — from humble beginnings in his Chicago apartment to the IPO 10+ years later. We cover everything from the difference between quitting and giving up, to building a valuable board, to raising capital, and more.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Mike Evans. You can give the full episode a listen below:

What you can expect to learn from Mike Evans:

The difference between quitting and giving up

Why Mike doesn’t like NPS as a metric

How a board can be valuable

How to build a list of potential investors

Why cash doesn’t fix problems

How to turn problems into resolutions

Related Resources:

Hangry: A Startup Journey

Mike Evan’s personal website

Building Your Ideal Investor Persona

founders

Metrics and data

How to Calculate the Rule of 40 Using Visible

Since the start of 2022, there have been major macroeconomic changes taking the startup world by storm. Rising inflation, paired with the tumultuous public markets (especially in the technology sector), has made its way downstream to startup fundraising. As the team at OpenView Ventures put it, “For operators, this has led to whiplash from grow at all costs to cut at all costs.”

We partnered with OpenView Ventures for the 2022 SaaS Benchmarks Survey. The main takeaway? Nearly every company is cutting spend, regardless of how much cash they have in the bank.

Valuations are also changing. In 2021, valuations were largely based on growth rates for the next 12 months. However, there has been a transition to public valuations being based on the “Rule of 40.” Put simply, the rule of 40 means a company’s YoY revenue growth % + profit margin % should exceed 40.

As the team at OpenView points out, “For companies with ARR below $10M, Rule of 40 can vary widely from quarter to quarter. Achieving 40 each quarter is not required. But, it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

Learn how you can calculate, and automate, the rule of 40 using Visible below:

1. Track Revenue

First things first, to calculate the rule of 40 you need to know your revenue for multiple years (or periods). You can enter this into Visible manually or using 1 of our integrations (likely Google Sheets, Xero, or QuickBooks).

Once you have your revenue # in Visible, we’ll automatically calculate your growth % (more on this in step 3).

2. Track or Calculate Profit Margin %

Next, you’ll want to make sure you have the necessary metrics in Visible to track your profit margin %. If you are using one of our accounting integrations (like Xero or QBO), or tracking this in a Google Sheet, you’ll be able to automatically bring this in. If you’re starting from scratch, you’ll simply need your revenue and COGs (or Gross Profit).

Once you have your Revenue + COGs metrics in Visible, you’ll be able to calculate it using our formula builder. The formula for Profit Margin % is =

Profit Margin % = ((Revenue – COGs)/Revenue) x 100

Which will look like the following in Visible:

3. Calculate Rule of 40

Now that we have Revenue and our Profit Margin %, we just need to add the two together. We’ll create a new formula shown below (Note: we’ll want to make sure we are using the annual change % insight for Revenue — this is automatically calculated):

4. Chart & Share

Once your formula is set up, it will automatically be calculated as new data enters Visible. From here, you can chart and share your Rule of 40 using Updates and Dashboards — check out an example below:

Track your key metrics, update investors, and raise capital all from one platform. Give Visible a free try for 14 days here.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

founders

Reporting

The 5 Metrics VCs Want to See

The world has been consumed by data and metrics — startups are no exception. Founders need to leverage their key data and KPIs to fuel growth, build products, create interest from potential investors, and more.

At Visible, we have a tool built for VC funds to collect data from their portfolio companies and enable GPs to report to their investors (LPs). In order to better help founders determine what metrics they should be tracking, we analyzed our data and found the most common metrics VCs are collecting from their portfolio companies. Check them out below:

The Most Common Metrics

Revenue

Cash

Headcount

Customers / Users

Total Operating Expenses

The 5 metrics above are high level metrics that might sound obvious. However, great founders are able to recall them at anytime. Not knowing your key operating metrics is a ????. These can be used as the backbone for investor updates, board meetings, and determining more granular metrics to track.

P.S. 75% of investors are collecting anywhere between 1 and 10 metrics so chances are your own investor updates should land in the same range.

Reading List

Key Insights from High Alpha’s Finance Leaders

The team at High Alpha shares key takeaways from the finance leaders in their portfolio — they share why efficiency metrics are key in the current market, how data storytelling can be a differentiator, and more. Read more

Time to Refine Your Metrics: Defining Growth and Success at a PLG Company

Mikaela Gluck of OpenView Ventures highlights the key metrics that product-led companies should be tracking. Read more

6 Metrics Every Startup Founder Should Track

On the Visible Blog, we share 6 basic metrics that every founder be tracking and sharing with their stakeholders. Read more

founders

Hiring & Talent

Metrics and data

Developing a Successful SaaS Sales Strategy

Founders are tasked with hundreds of responsibilities when starting a business. On top of hiring, financing, and building their product, early-stage founders are generally responsible for developing initial strategies — this includes the earliest sales and market strategies.

In this article, we will look to help you craft a successful SaaS sales strategy. We’ll highlight the elements you will want to think of when you start to build your sales motion. This will help your team to understand how to measure the number of potential customers in your pipeline and the growth potential you might see in your revenue numbers.

How are SaaS sales different from other types of sales?

Like any sales strategy, it is important to start with the basics when looking at a SaaS sales strategy. At the top of your funnel, you have marketing leads that likely find your brand via content, word of mouth, paid ads, your own product, etc.

From here, leads are moved through the funnel. In the middle, SaaS companies can leverage email campaigns, events, product demos, etc. to move leads to the bottom of their funnel. However, as the SaaS buying experience takes place fully online — sales and marketing organizations can be creative with their approach. The online experience allows companies to track more robust data than ever before. Additionally, SaaS products have turned into their own growth levers as well — the ability to manipulate pricing and plans has led to the ability for companies to leverage their own product for growth.

Related Resource: How SaaS Companies Can Best Leverage a Product-led Growth Strategy

The online presence and emergence of product-led growth have led to new sales strategies unique to SaaS companies. Learn more below:

3 Popular SaaS sales models

There are countless ways to structure your Saas sales strategy. For the sake of this post, we’ll focus on 3 of the most popular strategies. Learn more about the self-service model, transactional model, and enterprise sales model below:

Related Resource: The SaaS Business Model: How and Why it Works

Self-service model

The self-service model allows prospects to become customers without communicating with your team. As put by the team at ProductLed, “A SaaS self-serve model is exactly what it sounds like. Rather than rely on a dedicated Sales team to prospect, educate, and close sales, you design a system that allows customers to serve themselves. The quality of the product itself does all the selling.” This strategy is typically best for a strong and simple product that typically has a lower contract size.

Transactional sales model

The transactional model allows you to create income-generating actions where prospects have to become a customer at that point in time. This requires transactional sales models to have high-volume sales that can be supported by a strong sales and customer support team.

Enterprise sales model

The enterprise model is a strategy to sell more robust software packages to corporations – you will need baked-in features in a prepackaged manner to sell to a fellow business. Enterprise sales is the model that shares the most similarities with a traditional B2B sales funnel.

Inbound vs outbound sales

In a Saas sales funnel, you are constantly looking to consistently fill your sales funnel with fresh prospects. Once you have prospects you will look to find which prospects are worthy of being qualified and have a high likelihood of converting so you can spend your time communicating with those high-quality prospects.

There are two popular strategies for creating fresh prospects that would be defined as inbound and outbound sales strategies. Inbound sales is when you invest in marketing to create prospects reaching out to you – fresh prospects reaching out to your business to ask about your software product. As put by the team at HubSpot:

“Inbound sales organizations use a sales process that is personalized, helpful, and directly focused on prospects’ pain points throughout their buyer’s journey. During inbound sales, buyers move through three key phases: awareness, consideration, and decision (which we’ll discuss further below). While buyers go through these three phases, sales teams go through four different actions that will help them support qualified leads into becoming opportunities and eventually customers: identify, connect, explore, and advise.”

An inbound strategy typically works best for SaaS companies that need a greater volume of customers and can nurture them and move them through their funnel at scale (e.g. self-service model)

Outbound sales on the other hand are having members of your organization reach out to potential prospects to see if they would be interested in using your service. Outbound sales require highly targeted and proactive pushing of your messaging to customers.

Generally, outbound sales require dedicated team members to manually prospect and reach out to potential customers. This means that outbound sales organizations do not naturally scale as well as an inbound sales organizations and will likely require a higher contract value. An enterprise model would rely heavily on Outbound sales, while a self-service business model will rely heavily on Inbound sales.

The SaaS Sales Process

The best Saas sales strategy will be a hybrid of inbound and outbound sales, but all of them should include a sales funnel. This funnel should have stages that help to qualify your prospects. These stages should be:

Step 1: Lead generation

This activity is often times a marketing activity that gives you contact or business information to explore the fit further

Step 2: Prospecting

This is where you develop the bio of who is the contact you are reaching out to within the organization. It is always helpful to prospect for someone who can make a buying decision

Step 3: Qualifying

In this step, you need to understand whether the prospect has the resources to pay for your product and the problem that your product can solve. This step is often the time for you to ask questions of your prospects

Step 4: Demos and presenting

This is when you will share the features and capabilities of your product with the qualified prospect. You want to show them the different features and where they can get the most value.

Step 5: Closing the deal

After your demo or a presenting call, the prospect should be pushed to a point where they need to make a decision on whether to buy your product.

Step 6: Nurturing

Once someone becomes a customer, you need to make sure to nurture them and grow your product offering with their business. This is the most difficult stage. Make sure to share your new product releases, stay in tune with how they are using your product, and build relationships with your customers.

Cultivating a robust sales team

To create a sustaining sales team, it is important to hire talented and tenacious people to own your sales funnel. They will need to track conversion numbers, stay organized with their outreach to prospects, and grow your funnel over time.

There are three key roles within a Saas sales funnel. Those positions within your organization are:

Sales development representatives

(also known as business development representatives) These members of your team own lead generation, prospecting, and qualifying potential customers on your sales team. They get paid 40-60k/year depending on geographical location and experience. They should be tasked with outreach and drumming up new business.

Account executives

Account executives should focus on giving product demos, closing deals, and nurturing existing customers. They should be a bit more buttoned up in their approach and have a commission incentive associated with the # of accounts they manage.

Sales managers/VPs

Sales managers and Vice presidents of sales should take ownership of the data within your sales pipelines. Numbers like # of new leads, # of new qualified leads, # of new customers, # of churned customers, amount of new revenue, and lead to customer conversion %. Growing these sales numbers each quarter. Measuring these numbers weekly, monthly, and quarterly. Making them visible to the rest of the company regularly.

8 Key Elements of a successful SaaS sales strategy

One of the most important elements of building a successful business is having a like-minded team around you to support and work with you. Make sure to align with all your team members and hire people with good work ethics and similar values of your company. A good sales team should be competitive, goal-oriented, and metric-driven. The sales managers and VPs will be really crucial in shaping the team dynamics and culture of your business. Hire great people and the numbers will take care of themselves!

We’ve identified 8 elements of a successful sales strategy that every Saas sales strategy should include

1. Solidify your value proposition

It is so important to understand thoroughly and communicate your product’s core value proposition. If someone decides to buy your product, they should know how to use the product and how to get the most out of it.

2. Superb communication with prospects

Communication is of the utmost importance. Make sure your prospects understand your product and how it will help their business. Inform them of new product updates

3. Strategic trial periods

An effective strategy is to give potential customers a free trial of your product to understand your value proposition. You want to make sure not to make this trial period too short or too long. Make it strategic so the prospect will understand the value prop but also be encouraged to make a buying decision.

4. Track the right SaaS metrics

Tracking your core metrics is vital to success. See a few of those below:

Customer Acquisition Cost – the amount of money it takes to acquire a new customer

Customer Lifetime Value – the amount of value a customer provides your company over the course of their relationship with you as a customer.

Lead velocity rate – the growth percentage of qualified leads month over month. This will help you understand how quickly you are qualifying your leads

Related Resources: Our Ultimate Guide to SaaS Metrics & How To Calculate and Interpret Your SaaS Magic Number

5. Develop a sales playbook

Every successful sales management team should develop a playbook on how to deploy their resources and where each team member should spend their time. Playbooks are often thought of in sports terms, but they also work wonders in the business world. They will help you do things efficiently and effectively.

6. Set effective sales goals

How many new customers does your business hope to bring in next month? This is an important question and one your whole sales team should understand and work towards!

7. Utilize the right tools to enhance the process

Your team should have all the resources at their disposal to communicate effectively and track their metrics. As you build out your strategy and team, be sure to give them all possible resources at their disposal. There are tons of great tools out there for teams to make the most out of their time and have direct methods of communication with customers and one another.

8. Establish an effective customer support program

A huge part of an effective sales strategy is welcoming potential customers and making sure your existing customers are not forgotten about. When customers reach out, it is important to talk and listen to their issues. Understand what they are needing so your product can continue to evolve.

Make sure anyone getting introduced to your product will also have the information they need to use your product successfully. It might be helpful to include this member of your team in your sales meetings and keep them informed as to messaging and efforts for growth!

Generate support for your startup with Visible

Developing a successful SaaS sales strategy is not an easy task. It will take a hybrid approach of many of the elements listed in this article and will need attentive members of your team to nurture it and test new things. We created Visible to help founders have a better chance for success. Stay in the loop with the best resources to build and scale your startup with our newsletter, the Visible Weekly — subscribe here.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

founders

Fundraising

Tailoring Your Fundraising Efforts

Last week we covered how many investors founders need in their fundraising pipeline. When communicating with 50+ investors during a fundraise, founders need a system to track and manage their ongoing investor conversations.

Default Properties

At Visible, we help founders do just this with our Fundraising CRM. Like any CRM, we offer default properties for investor contacts (e.g. potential investment amount, star rating, contact date, follow up date, etc).

Popular Custom Properties

In addition to the default properties, founders are using custom properties to match their fundraising efforts — check out the most common custom properties below to see how other founders are keeping tabs on their pipeline:

Min & Max Check Size — In addition to our default check size property, we are seeing founders track min and max check size amount to get a more accurate look at where their round stands.

Connection — Warm introductions are valuable when fundraising. Founders are tracking who made/can make an introduction.

Data Room Shared — If a founder is moving an investor down their fundraising funnel, chances are a data room will be shared. In order to keep track of who has access, founders are creating a yes/no property to track who has access.

Investor Type — We are seeing founders track the type of investor to have a better look at the mix of investors in their pipeline — e.g. strategic, existing, lead, etc.

Will They Lead — Finding a lead investor is a must for a fundraise. Keeping an eye on lead investors is a surefire way to help founders stay focused on the right investors.

Of course, these are just a few of the custom properties founders are using — we’ve even seen a few founders track an investor’s favorite sports team or personal interests. Learn more about our Fundraising CRM and give it a try below:

Learn More

Reading List

Level up Your Fundraising Process with Email Syncing

In order to best help founders stay on top of their raise, we recently launched a BCC tool to help founders sync emails from outside Visible to the respective investor record in Visible. Read more

A Guide to Seed Fundraising

The team at Y Combinator shares an in-depth guide covering the ins and outs of raising a seed round. Read more

Seamlessly Manage Relationships with an Investor CRM

On the Visible blog, we break down what founders should look for in an investor CRM and fundraising tracking tool. Read more

investors

Metrics and data

Operations

How to Establish ESG Monitoring and Reporting Practices at Your VC Firm

As we invest in rapidly changing technologies that impact people and the planet, it’s of the utmost importance to consider the unintended consequences—even at the early stage. As the world felt the effects of several major crises in recent times, Environmental, Social, and Governance (ESG) principles have rightfully risen to the spotlight in the venture capital industry and now play a critical role in investment decision-making.

Investors hold a responsibility to guide their portfolio companies in ESG practices, not just because the world is watching—but because companies that are as concerned with their impact as they are with building their products are proven to perform better in the long run.

Visible recently hosted an ESG for Venture Capital webinar with Tracy Barba, Head of ESG at 500 Startups and Director at ESG4VC, where she answered the common questions about establishing ESG reporting practices at VC firms. We’ve shared answers to some of those questions below as well as guidance on using Visible for ESG portfolio monitoring.

What is ESG for Venture Capital?

ESG policies and practices help investors and companies manage their environmental, social, and governance risk and identify opportunities for value creation. VCs—including 500 Startups—are widely embracing the shift. In the 2020 ESG Annual Report spearheaded by Tracy Barba, 500 Startups said their policies include:

Environmental criteria to examine how a company performs as a steward of nature.

Social criteria to consider a company’s relationship with its employees, suppliers, customers, and communities where it operates.

Governance criteria to review a company’s leadership, shareholder rights, executive pay, audits, and internal controls.

VC firms can and should provide an ESG framework as startup companies grow. It’s never too early to care—as we’ve seen in the news, large tech companies have found themselves in legal and ethical trouble over issues that could have been resolved in the earlier stages.

In How Venture Capital Can Join the ESG Revolution, Stanford’s Social Innovation Review pointed out that eventually, ESG should not be understood as an “add-on” but a core value in a VC leading to better investments and companies. Ethical and legal considerations should not be ignored in the service of achieving rapid growth and swift time to market. As a VC firm, there is a risk in your ownership percentage if a portfolio company were to face legal battles, public scrutiny, and other risks that could have been prevented if they were identified earlier.

ESG as a term is often used interchangeably with impact investing. As Tracy Barba points out, impact investing is thinking about the end goal and the impact of the companies you’re investing in. Having a strategy around water or climate is an example of an impact strategy, so you’re filtering deals based on that. ESG is a screening for every company, regardless of the type, measuring their environmental, social, and governance criteria.

It’s hard for an early-stage company to know their impact, such as environmental waste, if they don’t have a product yet. That’s why it’s important to map ESG to relevant stages of a company’s development. At an early stage, the goal is to start to have a conversation. It’s much easier to think about how a company affects the environment from the beginning and address any issues upfront rather than fix or replace already-established processes in the future. At later stages, more detailed discussions will be appropriate.

Founders overwhelmingly do care and want to consider ESG, but many don’t know when or how to get started. As an investor, you can help them start to think through ESG by adding it as an agenda item on your monthly or quarterly check-ins. An example question is: “Are you tracking your carbon footprint?” Their answer might simply be “Yes”, or it might be, “No we aren’t, but we’d like to. How can we get started?”

Why is ESG Becoming More Common in Venture Capital?

There is a growing understanding that ESG policies help with customer loyalty, retaining talent, and attracting more investors. It’s beneficial if a company directs time and energy towards making sure they’re operating responsibly.

In venture capital, some topics are gaining momentum:

Diversity – there are demonstrated benefits to having culturally diverse teams and boards.

Gender equality – supporting more women and as founders and funders.

Data protection & privacy of users – startups are not exempt from laws such as the GDPR and CCPA which protect the personal data privacy of consumers.

Environmental impact trends – caring about carbon emissions, ethical sourcing of materials, waste management, etc.

It’s important to be mindful of regulations and how they can change over time. The Sustainable Finance Disclosure Regulation (SFDR) in Europe aims to prevent greenwashing and to increase transparency around sustainability claims (source: Eurosif). While the SEC currently only recommends ESG disclosure, it may also create firm rules in the future. Companies may start measuring and reporting their ESG progress in preparation for new regulations.

More than ever, founders care about being backed by VCs they align with. VCs can drive a positive shift by integrating ESG into their own operations. Showing that you care as an investor is integral in instilling ESG policies into your portfolio.

How To Monitor ESG Metrics Across your VC Portfolio

You can start tracking ESG metrics across your portfolio by sending them an annual questionnaire. 500 Startups, for example, collects their founder diversity info on a quarterly basis, measuring their progress over time and benchmarking to the VC industry.

Founders already get asked for a lot of information, so to encourage their participation in your ESG questionnaires, ask fewer questions and use simple yes/no answers whenever possible. With Visible, you can fully customize your ESG reporting questions using Requests.

Preview of an ESG Request in Visible below —

View best practices for collecting metrics with Visible below:

You can track answers and hold founders accountable for how they are going to implement best practices, how they are going to hire, etc.

ESG questionnaires are not meant to penalize startups, but to get a sense of where they currently are—they may only just be starting to think about tracking and monitoring their water usage or diversity, for example. Once they gain customers, the questions you ask them will grow more detailed.

If an early-stage company feels they do not have the resources or bandwidth to manage ESG concerns, you can help them get started by simply putting an employee manual or non-discrimination policy on the agenda for your next check-in. Remember, it’s going to be more expensive if they wait longer to implement those practices.

Tips for ESG Fund Reporting

External consultants can help VC firms evaluate their policies and processes across recruitment, HR, and deal flow, and recommend ways to improve. Since external consultants collect data across venture capital firms, they can educate them about best practices and compare how they are doing relative to the entire industry.

Tracy Barba, Head of ESG at 500 Startups, reported that working with external consultants like Diversity VC was helpful in providing them with an external validation point. This type of industry benchmarking is now growing as a field and becoming more common practice.

Resource: How to increase Diversity at your VC Fund

How to Incorporate ESG Into Your Portfolio Support

Now that you’ve gathered ESG data from your portfolio companies and identified opportunities for improvement, what’s next? VC firms can take the initiative to provide education, tools, training, and resources for their companies—whether in-house or through outside service providers and consultants.

500 Startups provides a vast array of ESG resources for their founders and the public, including webinars, which are available on their website: ESG for Early-Stage.

Resource: Portfolio Support Best Practices for Venture Capital Investors

Tracy Barba’s nonprofit ESG4VC aims to provide education, office hours, and research for venture capital firms to help establish standards and encourage movement in a positive direction across the industry.

It’s been said that we can’t fix what we can’t measure. When it comes to improving the impact business has on the environment, workers, and communities, investors can be proactive in incorporating ESG policies at the very early stages so that everyone can benefit.

View Examples of How to Request Metrics in Visible below:

founders

Product Updates

Level up Your Fundraising Process with Email Syncing

The Fundraising Funnel

Raising venture capital often mirrors a traditional B2B sales & marketing funnel. At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

Just as a sales & marketing team has dedicated tools, so should a founder that is raising venture capital. By having a CRM in place to track and monitor the status of a raise, founders will be able to spend more time on what matters most — building their business.

We’ve helped thousands of founders manage their raise with our Fundraising CRM. In order to help founders take their tracking to the next level, we are excited to announce our BCC email feature. Learn More

Tracking Conversations with BCC

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. Check out an example below:

This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Related Resource: 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

founders

Fundraising

Fundraising is a Numbers Game

Raising venture capital is a numbers game.

The Fundraising Funnel

At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

This process is full of “nos”, “maybes”, and “ghosts.” Inevitably, different investors will pass for different reasons so it is important to have a thorough list to keep the momentum going. Between our own product, the Founders Forward Podcast, and online resources, we’ve found the following benchmarks for how many investors you need in your funnel:

How Many Investors Should You Expect to Target

40+ — Mark Suster of Upfront Ventures, “Ideally, you want to have 40–50 qualified and interested investors in your funnel.” Learn more here.

48 — The average # of investors a Visible user has in a Fundraising Pipeline. Learn more about our Fundraising tools here.

50+ — Gale Wilkinson of Vitalize Ventures, “If you don’t have a list and you’re raising now, don’t worry. Spend a weekend and write down who are your top, you know, 50 to 75 that you want to target?” Learn more here.

60+ — Brett Brohl of Bread & Butter Ventures, “You’re going to have to reach out to probably about 60 funds and have about that many meetings to close a round.” Learn more here.

100+ — Elizabeth Yin of Hustle Fund, “I made up a rule of thumb: 5-100-500. Over 5 weeks, meet with 100 investors to close $500k in your seed round. If you want to close $1m, double all of these numbers.” Learn more here.

Before building your list of investors it is important to understand your ideal investor. Once you have an understanding of your ideal investor, check out free databases, like Visible Connect, to find investors for your startup. Give it a try and filter through our 5,000+ early-stage investors below:

Find Investors

P.S. If you filter by “Verified” that means these investors have personally verified the data in their profile is correct.

Related Reads

How to Build an Investor List with Gale Wilkinson of Vitalize

On the Founders Forward Podcast, Gale Wilkinson of Vitalize Ventures offers countless takeaways to help early-stage founders fundraise — covering everything from list building to ownership benchmarks. Listen now

The Fundraising Wisdom That Helped Our Founders Raise $18B in Follow-On Capital

The team at First Round Review shares an in-depth guide for running a fundraising process using best practices from their portfolio companies. Read more

Building Your Ideal Investor Persona

On the Visible Blog, we break down the attributes that a founder should consider when identifying their ideal investor. Read more

founders

Fundraising

Who Funds SaaS Startups?

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Being a startup founder is hard. On top of finding customers, hiring top talent, building a product, and managing an acquisition funnel — founders need to secure funding for their business. At a high level, most funding options for early-stage startups are similar. However, there are some nuanced differences based on a company’s vertical or market.

Over the last 2 decades, SaaS (software as a service) companies have risen in prominence. At the same time so has the venture capital industry and the funding options available to startups.

Learn more about this data from Silicon Valley Bank here.

Related Resource: The SaaS Business Model: How and Why it Works

Learn more about SaaS financing and funding options below:

What is SaaS startup financing and how is it unique?

Over the last 2 decades, SaaS startups have become a popular investment vertical for venture capitalists and investors in general. As put by the team at Salesforce, one of the original SaaS companies, “Software as a service (or SaaS) is a way of delivering applications over the Internet—as a service. Instead of installing and maintaining software, you simply access it via the Internet, freeing yourself from complex software and hardware management.”

SaaS companies can increase margins and build at scale with a smaller team due to the ease of access for their customers. Naturally, monthly or annual pricing (subscriptions) has become the norm for SaaS companies. These areas combine to fuel investor interest as SaaS companies can efficiently grow and become large, profitable companies.

As SaaS is still relatively new, so are the funding options. Over the past few years, the funding options available to SaaS startups have been improved and expanded. Learn more about the common types of SaaS funders below:

Types of SaaS startup funders

As we mentioned above, the funding options available to SaaS startups have improved and expanded over the last 2 decades. The innovation has led SaaS startups to a plethora of funding options fit for any stage.

Related Resource: Valuing Startups: 10 Popular Methods

Learn more about the most common SaaS funders below:

Venture capital

As put by the team at Investopedia, “Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.” Venture capital has been integral in the funding of SaaS companies.

VCs are generally willing to take risks and fund startups with little to no revenue in the hopes the company will create long-term value. However, this comes with a set of pros and cons — learn more below:

Pros

Venture capital certainly comes with its list of pros. We boiled down the list into a few key points below:

No personal capital of the founding team. Getting a SaaS startup off the ground requires some form of capital investment. To help get things started, VC can be a popular option as it does not require capital (or free time) from a founder.

VC requires little traction or data. Traditional funding methods (like bank loans) require collateral or some type of traction. VC investors are buying equity in the hopes that your company will grow into a large company.

Lastly, VCs offer extensive networks and resources. VC funds need resources and tools to help founders succeed to stand out among their peers. This can be everything from helping with hiring to helping with product strategy.

Related Resource: All Encompassing Startup Fundraising Guide

Cons

Of course, venture capital comes with its own set of cons. We boiled the list down to a few key points below:

Giving up equity. In order to secure venture capital, startup founders need to give up equity in their businesses. This can be costly in the long run.

VC pressure. A VC fund’s duty is to generate returns for their LPs (limited partners) with the hopes of raising another fund in 10-12 years. Because of this, some of the pressure to exit or change business strategy might fall on the shoulders of portfolio founders as GPs look to generate returns for their own investors.

Notable venture capital funders

As SaaS has become a hot commodity in the VC funding space, there are thousands of investors out there. Below are a few of our favorites (check out our free investor database, Visible Connect, to find more SaaS investors):

High Alpha

OpenView Ventures

Harlem Capital

Bessemer Venture Partners

M25

Related Resource: 23 Top VC Investors Actively Funding SaaS Startups

Angel Investors

As put by the team at Investopedia, “An angel investor is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company.”

Related Resource: Venture Capitalist vs. Angel Investor

Angel investors invest in a similar style as VCs — buying equity in a business with cash. However, they are often single individuals that write smaller checks and are investing to diversify their assets.

Pros

Like venture capitalists, angel investors come with their own sets of pros and cons. We laid out a few of the main pros of raising capital from an angel investor below:

Like VC, angel investors require founders to spend zero personal capital. This can help alleviate the financial stress of startup and building a SaaS business.

Occasionally, angel investors can be strategic investors. Some angels might have expertise in your space or direct experience building a company in your space. This can be incredibly helpful when it comes to developing products, go-to-market strategy, and hiring leaders in the space.

Angel investors can be integral in building momentum during a fundraise. Due to their smaller check size and an investment committee, angel investors can make investments quickly. This will help when building momentum in a fundraise. As an added bonus, angel investors often know other investors that can make introductions. Elizabeth Yin of Hustle Fund makes the case for smaller angel checks below:

Cons

Of course, angel investors come with their own set of cons as well. We laid out a few of the main cons of raising capital from an angel investor below:

Lack of experience. Some angel investors might be new to investing which can create a burden for some founders as they might have more frequent questions and asks for founders.

Smaller checks. While we mentioned smaller checks can be a pro of angel investing, it can also be a con. With newer funding instruments, these small checks can be rolled into 1 investment there are instances where many angel investors can create a headache on a cap table.

Notable angel investors

Angel investors are all around you. Angel investors can be anyone from your dentist to a former boss. However, there are a few angel investors that have made a name in the space:

Keith Rabois

Kim Perell

Chris Sacca

Reid Hoffman

Accelerators and incubators

As put by the team at Investopedia, “An incubator firm is an organization engaged in the business of fostering early-stage companies through the different developmental phases until the companies have sufficient financial, human, and physical resources to function on their own.”

Related Resource: What is an Incubator?

Accelerators and incubators have made a name in the startup space as a valuable resource for companies just getting started with limited to no customers or revenue. Learn more about the pros & cons of incubators and accelerators below:

Pros

Accelerators and incubators come with their own set of pros and cons. We laid out a few of the key pros below:

Peer networking. One of the major pros of going through an accelerator is the networking opportunities with the other founders. By going through an accelerator you’ll be linked to other founders and have peers to learn from and lean on as you build your business.

Investment. Many times, accelerators make the first investment in many startups. Over the course of your time in an accelerator, chances are they will help with introductions to potential investors (or even make follow-on investments themselves).

Education. Education and programming is built into most accelerators. Over the course of a program, many accelerators will bring in thought leaders and experts to help hone different skills.

Cons

Of course, accelerators and incubators come with cons as well. We laid out a few of the key cons below:

Equity. In turn for investment and resources during an accelerator, you will need to give them equity in your business. Do your research and talk to past founders to make sure trading equity is worth it.

Time. Most accelerator programs take place between 10 and 14 weeks. Traditionally they have been in person but there are various virtual programs. For most founders, this is a serious time commitment and could require moving or relocating.

Notable incubators and business accelerator programs

Since Y Combinators’ inception in 2005, accelerators and incubators have become well-known in the startup space. Check out a few of the most popular accelerators and incubators below:

Y Combinator

Techstars

Expa

To find more accelerators, check out our saved list in Visible Connect, our free investor database.

Revenue-based financing

As put by the team at Investopedia, “Revenue-based financing is a method of raising capital for a business from investors who receive a percentage of the enterprise’s ongoing gross revenues in exchange for the money they invested. In a revenue-based financing investment, investors receive a regular share of the business’s income until a predetermined amount has been paid.”

Pros

Revenue-based financing comes with its own set of pros. Check out a few of the key pros below:

Maintain ownership. Revenue-based financing does not require giving any equity to investors. This means all existing members on the cap table will not be diluted.

Faster funding. As we mentioned above, raising venture capital is very much a process. Due to this, it can take months to receive capital. Revenue-based financing can be procured in a matter of days or weeks.

Cons

Of course, revenue-based financing comes with its own set of cons too. We laid out a few of the key cons below:

Requires revenue. Most early-stage companies likely have little to no revenue (and when they do, it is largely unpredictable). This can make revenue-based financing not viable until later stages.

Future payments. Revenue-based financing requires a monthly payment. Most early-stage startups are generally cash conscious and would prefer to make monthly payments.

Venture debt

As put by the team at Silicon Valley Bank, “Venture debt is a type of loan offered by banks and nonbank lenders that is designed specifically for early-stage, high-growth companies with venture capital backing. The vast majority of venture-backed companies raise venture debt at some point in their lives from specialized banks such as Silicon Valley Bank.”

Pros

Venture debt comes with its own set of pros and cons. We laid out a list of the key pros of venture debt below:

Debt over equity. As we’ve mentioned previously, equity is the most expensive asset a startup has. Venture debt allows you to avoid giving up any additional equity.

Timeline. Venture debt is commonly tagged on at the end of a venture capital round. Because of this it can move quickly and offer an extended runway for startups

Cons

Of course, venture debt comes with cons too. Check out a few key cons of venture debt below:

Financial covenants. Venture debt comes with a set of required performance metrics. The penalties for missing the required financials can be large for startups.

Future funding. Having debt on a balance sheet can be a negative signal for future funders.

Alternative types of funding

The SaaS funding options above are a few of the most common. However, SaaS funding options have continued to evolve over the last decade. Check out a few different alternative SaaS financing options below:

Crowdfunding

As put by the team at Investopedia, “Crowdfunding is the use of small amounts of capital from a large number of individuals to finance a new business venture. Crowdfunding makes use of the easy accessibility of vast networks of people through social media and crowdfunding websites to bring investors and entrepreneurs together, with the potential to increase entrepreneurship by expanding the pool of investors beyond the traditional circle of owners, relatives, and venture capitalists.”

Bootstrapping