What is a Community-driven Company?

A community-driven business is a company that puts community at its core. This can be a case where the community is the product (e g. Reddit) or where the community is central to the business’s identity and success (e.g. Peloton).

A community-driven company is one whose value is its members and its success depends on them. The value that is derived from the community benefits both its members and the company.

The community can either be the company’s product or its community is built around its product. These companies are often founded by individuals who believe they can solve problems better through collaboration and are built around a specific mission, problem, or just simply the community itself.

Lolita Taub of Ganas Ventures points out that there are various takes on what community-driven companies are but it’s part of what makes this model so special. At Ganas, they focus on companies whose,

- customers identify as members

- members are able to create value for other members

- members start the marketing and sales flywheel

She also believes that companies with the community at the core will become unicorns and produce outsized returns.

What Makes a Community-driven Company Valuable and Successful?

Community-driven companies are becoming increasingly common in today’s competitive environment. In order to survive and thrive, organizations need to adapt to changing customer demands and expectations. Community-driven companies are able to respond faster to these changes because their users are directly involved in decision-making processes.

This new way of thinking about customer relationships means that companies no longer focus solely on selling products or services. Instead, they create value for their customers through the experience of the community- redefining the relationship between consumers and businesses.

Companies that are driven by their customer base and community are growing at a faster rate than other companies. They also tend to outperform competitors because they focus on solving real problems instead of chasing trends. Which is why community-based businesses are becoming increasingly popular.

Some of the other community-driven benefits include:

- Less marketing spend

- Brand Loyalty and LTV

- Lower operating and sales costs (companies can be leaner and small)

- Retention

- Referrals

- Defensible business model (difficult to replicate)

What’s a Community-Led Company’s Secret Sauce?

Community-led growth (CLG) is a type of go- to market strategy that these companies are using to leverage their communities to sell. The important thing to note here which Lolita points out, is that “community-led growth should not be confused with marketing. Community-led growth companies focus on creating a safe space for their community to come together, share value, create relationships, and best use their products/services to solve a problem or help achieve a goal.”. As a result of nurturing this space, “your community acts as a multiplier for company growth”.

Community-driven companies are also often considered more innovative because they focus on solving problems or sharing information, and they get the answers from the people that matter most- their customers as well as enthusiasts on the topic.

This approach has become known as ‘community-based innovation’ (CBI). They rely heavily on their customers or consumers to create new ideas, develop new products, and even provide feedback. This also tends to make running a community-driven company less expensive to start and run.

Taking feedback or observing what the community is saying gives you the best understanding of customer needs and wants. When you then use this information to shape future decisions you have a competitive advantage and can deliver exactly what is wanted and needed. This also helps build trust between the company and its customers. In addition, it allows the company to stay relevant and responsive to changes in the marketplace.

What Might the Future of Communities Look Like?

With social media platforms becoming more powerful than ever before, communities are booming. People are creating their own networks, sharing information, and collaborating together. This has led to the rise of the Creator Economy, which has allowed people to monetize their following.

According to CMX Community Industry Report, “Communities are cautiously dipping their toes into Web 3.0- 15% of communities are actively working on Web 3.0 focused projects and an additional 17% are considering it. Decentralized autonomous organizations (DAOs) are the most common form of Web 3.0 project that community teams are working on.” Web 3 is not only allowing companies to monetize on their community but their members can now also benefit as well through NFTs and DAOs.

What is the Difference Between a Web2 and Web3 Community-driven Company?

Ganas Ventures highlights two pain points for each:

“Web2 companies

– People create content, products, and services

– Companies earn money

Web3 companies

– People/communities create content, products, and services

– People/communities earn money”

Related Resource: 10 VC Firms Investing in Web3 Companies

Additional Resources and Tools for Startups

- Community-Driven Companies: What They Are and Why We’re Investing in Them

- CMX Community Industry Report

- Ganas Ventures Resources

- Follow Lolita Taub for updates in the space

- Origami– helps Web3 communities launch and grow their DAOs

- Paragraph– Paragraph turns your subscribers into members through NFTs which gives your audience ownership in your community.

VCs Investing in Community-Driven Companies

Flybridge

About: Flybridge is a seed and early-stage venture capital firm whose mission is to assist entrepreneurs in growing innovative, global companies. With more than $625 million under management, the firm is focused on seed and early-stage investing in technology markets and is led by a team with domain expertise and more than half a century of combined experience in venture capital.

Thesis: We see a vibrant community as a source of competitive advantage and we are excited to invest in companies and entrepreneurs who share our vision for the power of community across a range of sectors.

Investment Stages: Pre-Seed, Seed

Recent Investments:

- Dame Products

- Trend

- Teal

Ganas Ventures

About: Ganas Ventures invests in pre-seed and seed Web 2 and Web 3 community-driven startups in the US and Latin America.

Thesis: Ganas Ventures invests in pre-seed and seed Web 2 and Web 3 community-driven startups in the US and Latin America. It’s run by solo-GP Lolita Taub.

Investment Stages: Pre-Seed, Seed

SV Angel

About: SV Angel is a San Francisco-based angel firm that helps startups with business development, financing, M&A, and other strategic advice.

Investment Stages: Seed

Recent Investments:

- Kiln

- Payload

- FlowForge

Lerer Hippeau

About: Lerer Hippeau is an early-stage venture capital firm founded and operated in New York City. Since 2010, we have invested in entrepreneurs with great ideas who aren’t afraid to do hard things. Our portfolio includes more than 350 leading enterprise and consumer businesses including Guideline, MIRROR, Blockdaemon, K Health, Allbirds, ZenBusiness, and Thrive. We’re experienced operators who invest early and stay in our founders’ corners as they build iconic companies.

Thesis: We seek entrepreneurs with product vision, consumer insight, focused execution, and unwavering ambition. When we are lucky enough to meet such people, our hope is that they will choose us as a long-term partner.

Investment Stages: Seed, Series A, Series B, Series C

Recent Investments:

- Anode Labs

- Onward

- Bookkeep

The Community Fund

About: A $5 million early-stage fund that invests in community-driven companies through an investment partner team.

Thesis: We’re an early-stage fund that invests in community-driven companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

- Elektra Health

- Kindra

Founders Fund

About: Founders Fund is a San Francisco based venture capital firm investing in companies building revolutionary technologies.

Thesis: We invest in smart people solving difficult problems.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Namecoach

- Speak

- Elemental Machines

General Catalyst

About: General Catalyst backs exceptional entrepreneurs who are building innovative technology companies and market leading businesses, including Airbnb, BigCommerce, ClassPass, Datalogix, Datto, Demandware, Gusto (fka ZenPayroll), The Honest Company, HubSpot, KAYAK, Oscar, Snap, Stripe, and Warby Parker.

Thesis: General Catalyst is a venture capital firm that makes early-stage and growth equity investments.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

- Guild

- OneSchema

- Buildkite

K50 Ventures

About: K50 Ventures is the most trusted first-check investor for mission-driven founders building a better future for the 99%. We invest up to $2M in pre-seed and seed stage companies in the US and LATAM that are prioritizing access, affordability, and wellbeing across the categories of Health, Finance, and Work. K50 partners with those who refuse to accept the status quo; those who have a vision for how to radically improve daily life for everyone – in our local communities, and around the globe. Since 2016, we have invested in 170+ companies including Groww, Mammoth Biosciences, Self, Tul, Frubana, Kueski, Fintual, Valon, Real, Osana Salud, June Homes, among others.

Investment Stages: Pre-Seed, Seed

Recent Investments:

- June Homes

- HoneyBee

- Osana Salud

Halogen Ventures

About: Halogen Ventures is an early stage venture capital fund focused on consumer technologies prioritizing a female in the founding team.Thesis: Halogen Ventures is an early stage venture capital fund focused on female led consumer technology companies.

Investment Stages: Early Stage

Recent Investments:

- Ellevest

- Vivoo

- Live Tinted

Graph Ventures

About: We are a group of founders & operators with experience starting and scaling technology co’s globally. 300+ investments.

Investment Stages: Pre-seed, Seed

Recent Investments:

- Tract

- Comm Technologies

- Disclo

Founder Collective

About: Founder Collective is a seed-stage venture capital firm that has invested in over 300 startups, including Uber, Airtable, PillPack, SeatGeek, The Trade Desk, Whoop, and Cruise. Founder Collective’s mission is to be the most aligned fund for founders at the seed stage. FC has offices in NYC and Cambridge, MA and has been the top-rated seed fund on the Forbes Midas list for four of the last five years.

Investment Stages: Seed

Recent Investments:

- Kapu

- Odyssey Energy Solutions

- Gigasheet

Looking for Funding? We can help

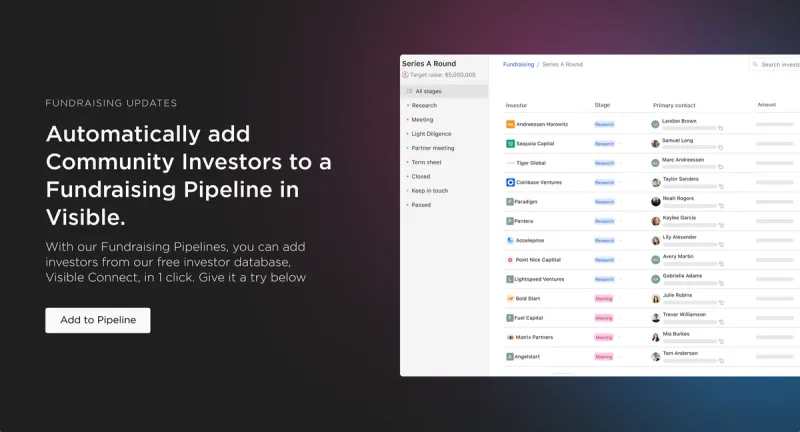

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like yours. Check out all our investors here and filter as needed. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Related Resource: All-Encompassing Startup Fundraising Guide

Related resource: Top 10 Growing Tech Hubs Transforming Latin America in 2025