Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

How to Calculate the Rule of 40 Using Visible

Since the start of 2022, there have been major macroeconomic changes taking the startup world by storm. Rising inflation, paired with the tumultuous public markets (especially in the technology sector), has made its way downstream to startup fundraising. As the team at OpenView Ventures put it, “For operators, this has led to whiplash from grow at all costs to cut at all costs.”

We partnered with OpenView Ventures for the 2022 SaaS Benchmarks Survey. The main takeaway? Nearly every company is cutting spend, regardless of how much cash they have in the bank.

Valuations are also changing. In 2021, valuations were largely based on growth rates for the next 12 months. However, there has been a transition to public valuations being based on the “Rule of 40.” Put simply, the rule of 40 means a company’s YoY revenue growth % + profit margin % should exceed 40.

As the team at OpenView points out, “For companies with ARR below $10M, Rule of 40 can vary widely from quarter to quarter. Achieving 40 each quarter is not required. But, it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

Learn how you can calculate, and automate, the rule of 40 using Visible below:

1. Track Revenue

First things first, to calculate the rule of 40 you need to know your revenue for multiple years (or periods). You can enter this into Visible manually or using 1 of our integrations (likely Google Sheets, Xero, or QuickBooks).

Once you have your revenue # in Visible, we’ll automatically calculate your growth % (more on this in step 3).

2. Track or Calculate Profit Margin %

Next, you’ll want to make sure you have the necessary metrics in Visible to track your profit margin %. If you are using one of our accounting integrations (like Xero or QBO), or tracking this in a Google Sheet, you’ll be able to automatically bring this in. If you’re starting from scratch, you’ll simply need your revenue and COGs (or Gross Profit).

Once you have your Revenue + COGs metrics in Visible, you’ll be able to calculate it using our formula builder. The formula for Profit Margin % is =

Profit Margin % = ((Revenue – COGs)/Revenue) x 100

Which will look like the following in Visible:

3. Calculate Rule of 40

Now that we have Revenue and our Profit Margin %, we just need to add the two together. We’ll create a new formula shown below (Note: we’ll want to make sure we are using the annual change % insight for Revenue — this is automatically calculated):

4. Chart & Share

Once your formula is set up, it will automatically be calculated as new data enters Visible. From here, you can chart and share your Rule of 40 using Updates and Dashboards — check out an example below:

Track your key metrics, update investors, and raise capital all from one platform. Give Visible a free try for 14 days here.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

founders

Reporting

The 5 Metrics VCs Want to See

The world has been consumed by data and metrics — startups are no exception. Founders need to leverage their key data and KPIs to fuel growth, build products, create interest from potential investors, and more.

At Visible, we have a tool built for VC funds to collect data from their portfolio companies and enable GPs to report to their investors (LPs). In order to better help founders determine what metrics they should be tracking, we analyzed our data and found the most common metrics VCs are collecting from their portfolio companies. Check them out below:

The Most Common Metrics

Revenue

Cash

Headcount

Customers / Users

Total Operating Expenses

The 5 metrics above are high level metrics that might sound obvious. However, great founders are able to recall them at anytime. Not knowing your key operating metrics is a ????. These can be used as the backbone for investor updates, board meetings, and determining more granular metrics to track.

P.S. 75% of investors are collecting anywhere between 1 and 10 metrics so chances are your own investor updates should land in the same range.

Reading List

Key Insights from High Alpha’s Finance Leaders

The team at High Alpha shares key takeaways from the finance leaders in their portfolio — they share why efficiency metrics are key in the current market, how data storytelling can be a differentiator, and more. Read more

Time to Refine Your Metrics: Defining Growth and Success at a PLG Company

Mikaela Gluck of OpenView Ventures highlights the key metrics that product-led companies should be tracking. Read more

6 Metrics Every Startup Founder Should Track

On the Visible Blog, we share 6 basic metrics that every founder be tracking and sharing with their stakeholders. Read more

founders

Hiring & Talent

Metrics and data

Developing a Successful SaaS Sales Strategy

Founders are tasked with hundreds of responsibilities when starting a business. On top of hiring, financing, and building their product, early-stage founders are generally responsible for developing initial strategies — this includes the earliest sales and market strategies.

In this article, we will look to help you craft a successful SaaS sales strategy. We’ll highlight the elements you will want to think of when you start to build your sales motion. This will help your team to understand how to measure the number of potential customers in your pipeline and the growth potential you might see in your revenue numbers.

How are SaaS sales different from other types of sales?

Like any sales strategy, it is important to start with the basics when looking at a SaaS sales strategy. At the top of your funnel, you have marketing leads that likely find your brand via content, word of mouth, paid ads, your own product, etc.

From here, leads are moved through the funnel. In the middle, SaaS companies can leverage email campaigns, events, product demos, etc. to move leads to the bottom of their funnel. However, as the SaaS buying experience takes place fully online — sales and marketing organizations can be creative with their approach. The online experience allows companies to track more robust data than ever before. Additionally, SaaS products have turned into their own growth levers as well — the ability to manipulate pricing and plans has led to the ability for companies to leverage their own product for growth.

Related Resource: How SaaS Companies Can Best Leverage a Product-led Growth Strategy

The online presence and emergence of product-led growth have led to new sales strategies unique to SaaS companies. Learn more below:

3 Popular SaaS sales models

There are countless ways to structure your Saas sales strategy. For the sake of this post, we’ll focus on 3 of the most popular strategies. Learn more about the self-service model, transactional model, and enterprise sales model below:

Related Resource: The SaaS Business Model: How and Why it Works

Self-service model

The self-service model allows prospects to become customers without communicating with your team. As put by the team at ProductLed, “A SaaS self-serve model is exactly what it sounds like. Rather than rely on a dedicated Sales team to prospect, educate, and close sales, you design a system that allows customers to serve themselves. The quality of the product itself does all the selling.” This strategy is typically best for a strong and simple product that typically has a lower contract size.

Transactional sales model

The transactional model allows you to create income-generating actions where prospects have to become a customer at that point in time. This requires transactional sales models to have high-volume sales that can be supported by a strong sales and customer support team.

Enterprise sales model

The enterprise model is a strategy to sell more robust software packages to corporations – you will need baked-in features in a prepackaged manner to sell to a fellow business. Enterprise sales is the model that shares the most similarities with a traditional B2B sales funnel.

Inbound vs outbound sales

In a Saas sales funnel, you are constantly looking to consistently fill your sales funnel with fresh prospects. Once you have prospects you will look to find which prospects are worthy of being qualified and have a high likelihood of converting so you can spend your time communicating with those high-quality prospects.

There are two popular strategies for creating fresh prospects that would be defined as inbound and outbound sales strategies. Inbound sales is when you invest in marketing to create prospects reaching out to you – fresh prospects reaching out to your business to ask about your software product. As put by the team at HubSpot:

“Inbound sales organizations use a sales process that is personalized, helpful, and directly focused on prospects’ pain points throughout their buyer’s journey. During inbound sales, buyers move through three key phases: awareness, consideration, and decision (which we’ll discuss further below). While buyers go through these three phases, sales teams go through four different actions that will help them support qualified leads into becoming opportunities and eventually customers: identify, connect, explore, and advise.”

An inbound strategy typically works best for SaaS companies that need a greater volume of customers and can nurture them and move them through their funnel at scale (e.g. self-service model)

Outbound sales on the other hand are having members of your organization reach out to potential prospects to see if they would be interested in using your service. Outbound sales require highly targeted and proactive pushing of your messaging to customers.

Generally, outbound sales require dedicated team members to manually prospect and reach out to potential customers. This means that outbound sales organizations do not naturally scale as well as an inbound sales organizations and will likely require a higher contract value. An enterprise model would rely heavily on Outbound sales, while a self-service business model will rely heavily on Inbound sales.

The SaaS Sales Process

The best Saas sales strategy will be a hybrid of inbound and outbound sales, but all of them should include a sales funnel. This funnel should have stages that help to qualify your prospects. These stages should be:

Step 1: Lead generation

This activity is often times a marketing activity that gives you contact or business information to explore the fit further

Step 2: Prospecting

This is where you develop the bio of who is the contact you are reaching out to within the organization. It is always helpful to prospect for someone who can make a buying decision

Step 3: Qualifying

In this step, you need to understand whether the prospect has the resources to pay for your product and the problem that your product can solve. This step is often the time for you to ask questions of your prospects

Step 4: Demos and presenting

This is when you will share the features and capabilities of your product with the qualified prospect. You want to show them the different features and where they can get the most value.

Step 5: Closing the deal

After your demo or a presenting call, the prospect should be pushed to a point where they need to make a decision on whether to buy your product.

Step 6: Nurturing

Once someone becomes a customer, you need to make sure to nurture them and grow your product offering with their business. This is the most difficult stage. Make sure to share your new product releases, stay in tune with how they are using your product, and build relationships with your customers.

Cultivating a robust sales team

To create a sustaining sales team, it is important to hire talented and tenacious people to own your sales funnel. They will need to track conversion numbers, stay organized with their outreach to prospects, and grow your funnel over time.

There are three key roles within a Saas sales funnel. Those positions within your organization are:

Sales development representatives

(also known as business development representatives) These members of your team own lead generation, prospecting, and qualifying potential customers on your sales team. They get paid 40-60k/year depending on geographical location and experience. They should be tasked with outreach and drumming up new business.

Account executives

Account executives should focus on giving product demos, closing deals, and nurturing existing customers. They should be a bit more buttoned up in their approach and have a commission incentive associated with the # of accounts they manage.

Sales managers/VPs

Sales managers and Vice presidents of sales should take ownership of the data within your sales pipelines. Numbers like # of new leads, # of new qualified leads, # of new customers, # of churned customers, amount of new revenue, and lead to customer conversion %. Growing these sales numbers each quarter. Measuring these numbers weekly, monthly, and quarterly. Making them visible to the rest of the company regularly.

8 Key Elements of a successful SaaS sales strategy

One of the most important elements of building a successful business is having a like-minded team around you to support and work with you. Make sure to align with all your team members and hire people with good work ethics and similar values of your company. A good sales team should be competitive, goal-oriented, and metric-driven. The sales managers and VPs will be really crucial in shaping the team dynamics and culture of your business. Hire great people and the numbers will take care of themselves!

We’ve identified 8 elements of a successful sales strategy that every Saas sales strategy should include

1. Solidify your value proposition

It is so important to understand thoroughly and communicate your product’s core value proposition. If someone decides to buy your product, they should know how to use the product and how to get the most out of it.

2. Superb communication with prospects

Communication is of the utmost importance. Make sure your prospects understand your product and how it will help their business. Inform them of new product updates

3. Strategic trial periods

An effective strategy is to give potential customers a free trial of your product to understand your value proposition. You want to make sure not to make this trial period too short or too long. Make it strategic so the prospect will understand the value prop but also be encouraged to make a buying decision.

4. Track the right SaaS metrics

Tracking your core metrics is vital to success. See a few of those below:

Customer Acquisition Cost – the amount of money it takes to acquire a new customer

Customer Lifetime Value – the amount of value a customer provides your company over the course of their relationship with you as a customer.

Lead velocity rate – the growth percentage of qualified leads month over month. This will help you understand how quickly you are qualifying your leads

Related Resources: Our Ultimate Guide to SaaS Metrics & How To Calculate and Interpret Your SaaS Magic Number

5. Develop a sales playbook

Every successful sales management team should develop a playbook on how to deploy their resources and where each team member should spend their time. Playbooks are often thought of in sports terms, but they also work wonders in the business world. They will help you do things efficiently and effectively.

6. Set effective sales goals

How many new customers does your business hope to bring in next month? This is an important question and one your whole sales team should understand and work towards!

7. Utilize the right tools to enhance the process

Your team should have all the resources at their disposal to communicate effectively and track their metrics. As you build out your strategy and team, be sure to give them all possible resources at their disposal. There are tons of great tools out there for teams to make the most out of their time and have direct methods of communication with customers and one another.

8. Establish an effective customer support program

A huge part of an effective sales strategy is welcoming potential customers and making sure your existing customers are not forgotten about. When customers reach out, it is important to talk and listen to their issues. Understand what they are needing so your product can continue to evolve.

Make sure anyone getting introduced to your product will also have the information they need to use your product successfully. It might be helpful to include this member of your team in your sales meetings and keep them informed as to messaging and efforts for growth!

Generate support for your startup with Visible

Developing a successful SaaS sales strategy is not an easy task. It will take a hybrid approach of many of the elements listed in this article and will need attentive members of your team to nurture it and test new things. We created Visible to help founders have a better chance for success. Stay in the loop with the best resources to build and scale your startup with our newsletter, the Visible Weekly — subscribe here.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

founders

Fundraising

Tailoring Your Fundraising Efforts

Last week we covered how many investors founders need in their fundraising pipeline. When communicating with 50+ investors during a fundraise, founders need a system to track and manage their ongoing investor conversations.

Default Properties

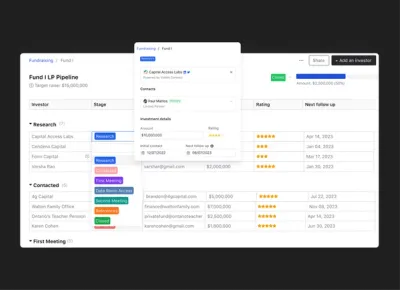

At Visible, we help founders do just this with our Fundraising CRM. Like any CRM, we offer default properties for investor contacts (e.g. potential investment amount, star rating, contact date, follow up date, etc).

Popular Custom Properties

In addition to the default properties, founders are using custom properties to match their fundraising efforts — check out the most common custom properties below to see how other founders are keeping tabs on their pipeline:

Min & Max Check Size — In addition to our default check size property, we are seeing founders track min and max check size amount to get a more accurate look at where their round stands.

Connection — Warm introductions are valuable when fundraising. Founders are tracking who made/can make an introduction.

Data Room Shared — If a founder is moving an investor down their fundraising funnel, chances are a data room will be shared. In order to keep track of who has access, founders are creating a yes/no property to track who has access.

Investor Type — We are seeing founders track the type of investor to have a better look at the mix of investors in their pipeline — e.g. strategic, existing, lead, etc.

Will They Lead — Finding a lead investor is a must for a fundraise. Keeping an eye on lead investors is a surefire way to help founders stay focused on the right investors.

Of course, these are just a few of the custom properties founders are using — we’ve even seen a few founders track an investor’s favorite sports team or personal interests. Learn more about our Fundraising CRM and give it a try below:

Learn More

Reading List

Level up Your Fundraising Process with Email Syncing

In order to best help founders stay on top of their raise, we recently launched a BCC tool to help founders sync emails from outside Visible to the respective investor record in Visible. Read more

A Guide to Seed Fundraising

The team at Y Combinator shares an in-depth guide covering the ins and outs of raising a seed round. Read more

Seamlessly Manage Relationships with an Investor CRM

On the Visible blog, we break down what founders should look for in an investor CRM and fundraising tracking tool. Read more

investors

Metrics and data

Operations

How to Establish ESG Monitoring and Reporting Practices at Your VC Firm

As we invest in rapidly changing technologies that impact people and the planet, it’s of the utmost importance to consider the unintended consequences—even at the early stage. As the world felt the effects of several major crises in recent times, Environmental, Social, and Governance (ESG) principles have rightfully risen to the spotlight in the venture capital industry and now play a critical role in investment decision-making.

Investors hold a responsibility to guide their portfolio companies in ESG practices, not just because the world is watching—but because companies that are as concerned with their impact as they are with building their products are proven to perform better in the long run.

Visible recently hosted an ESG for Venture Capital webinar with Tracy Barba, Head of ESG at 500 Startups and Director at ESG4VC, where she answered the common questions about establishing ESG reporting practices at VC firms. We’ve shared answers to some of those questions below as well as guidance on using Visible for ESG portfolio monitoring.

What is ESG for Venture Capital?

ESG policies and practices help investors and companies manage their environmental, social, and governance risk and identify opportunities for value creation. VCs—including 500 Startups—are widely embracing the shift. In the 2020 ESG Annual Report spearheaded by Tracy Barba, 500 Startups said their policies include:

Environmental criteria to examine how a company performs as a steward of nature.

Social criteria to consider a company’s relationship with its employees, suppliers, customers, and communities where it operates.

Governance criteria to review a company’s leadership, shareholder rights, executive pay, audits, and internal controls.

VC firms can and should provide an ESG framework as startup companies grow. It’s never too early to care—as we’ve seen in the news, large tech companies have found themselves in legal and ethical trouble over issues that could have been resolved in the earlier stages.

In How Venture Capital Can Join the ESG Revolution, Stanford’s Social Innovation Review pointed out that eventually, ESG should not be understood as an “add-on” but a core value in a VC leading to better investments and companies. Ethical and legal considerations should not be ignored in the service of achieving rapid growth and swift time to market. As a VC firm, there is a risk in your ownership percentage if a portfolio company were to face legal battles, public scrutiny, and other risks that could have been prevented if they were identified earlier.

ESG as a term is often used interchangeably with impact investing. As Tracy Barba points out, impact investing is thinking about the end goal and the impact of the companies you’re investing in. Having a strategy around water or climate is an example of an impact strategy, so you’re filtering deals based on that. ESG is a screening for every company, regardless of the type, measuring their environmental, social, and governance criteria.

It’s hard for an early-stage company to know their impact, such as environmental waste, if they don’t have a product yet. That’s why it’s important to map ESG to relevant stages of a company’s development. At an early stage, the goal is to start to have a conversation. It’s much easier to think about how a company affects the environment from the beginning and address any issues upfront rather than fix or replace already-established processes in the future. At later stages, more detailed discussions will be appropriate.

Founders overwhelmingly do care and want to consider ESG, but many don’t know when or how to get started. As an investor, you can help them start to think through ESG by adding it as an agenda item on your monthly or quarterly check-ins. An example question is: “Are you tracking your carbon footprint?” Their answer might simply be “Yes”, or it might be, “No we aren’t, but we’d like to. How can we get started?”

Why is ESG Becoming More Common in Venture Capital?

There is a growing understanding that ESG policies help with customer loyalty, retaining talent, and attracting more investors. It’s beneficial if a company directs time and energy towards making sure they’re operating responsibly.

In venture capital, some topics are gaining momentum:

Diversity – there are demonstrated benefits to having culturally diverse teams and boards.

Gender equality – supporting more women and as founders and funders.

Data protection & privacy of users – startups are not exempt from laws such as the GDPR and CCPA which protect the personal data privacy of consumers.

Environmental impact trends – caring about carbon emissions, ethical sourcing of materials, waste management, etc.

It’s important to be mindful of regulations and how they can change over time. The Sustainable Finance Disclosure Regulation (SFDR) in Europe aims to prevent greenwashing and to increase transparency around sustainability claims (source: Eurosif). While the SEC currently only recommends ESG disclosure, it may also create firm rules in the future. Companies may start measuring and reporting their ESG progress in preparation for new regulations.

More than ever, founders care about being backed by VCs they align with. VCs can drive a positive shift by integrating ESG into their own operations. Showing that you care as an investor is integral in instilling ESG policies into your portfolio.

How To Monitor ESG Metrics Across your VC Portfolio

You can start tracking ESG metrics across your portfolio by sending them an annual questionnaire. 500 Startups, for example, collects their founder diversity info on a quarterly basis, measuring their progress over time and benchmarking to the VC industry.

Founders already get asked for a lot of information, so to encourage their participation in your ESG questionnaires, ask fewer questions and use simple yes/no answers whenever possible. With Visible, you can fully customize your ESG reporting questions using Requests.

Preview of an ESG Request in Visible below —

View best practices for collecting metrics with Visible below:

You can track answers and hold founders accountable for how they are going to implement best practices, how they are going to hire, etc.

ESG questionnaires are not meant to penalize startups, but to get a sense of where they currently are—they may only just be starting to think about tracking and monitoring their water usage or diversity, for example. Once they gain customers, the questions you ask them will grow more detailed.

If an early-stage company feels they do not have the resources or bandwidth to manage ESG concerns, you can help them get started by simply putting an employee manual or non-discrimination policy on the agenda for your next check-in. Remember, it’s going to be more expensive if they wait longer to implement those practices.

Tips for ESG Fund Reporting

External consultants can help VC firms evaluate their policies and processes across recruitment, HR, and deal flow, and recommend ways to improve. Since external consultants collect data across venture capital firms, they can educate them about best practices and compare how they are doing relative to the entire industry.

Tracy Barba, Head of ESG at 500 Startups, reported that working with external consultants like Diversity VC was helpful in providing them with an external validation point. This type of industry benchmarking is now growing as a field and becoming more common practice.

Resource: How to increase Diversity at your VC Fund

How to Incorporate ESG Into Your Portfolio Support

Now that you’ve gathered ESG data from your portfolio companies and identified opportunities for improvement, what’s next? VC firms can take the initiative to provide education, tools, training, and resources for their companies—whether in-house or through outside service providers and consultants.

500 Startups provides a vast array of ESG resources for their founders and the public, including webinars, which are available on their website: ESG for Early-Stage.

Resource: Portfolio Support Best Practices for Venture Capital Investors

Tracy Barba’s nonprofit ESG4VC aims to provide education, office hours, and research for venture capital firms to help establish standards and encourage movement in a positive direction across the industry.

It’s been said that we can’t fix what we can’t measure. When it comes to improving the impact business has on the environment, workers, and communities, investors can be proactive in incorporating ESG policies at the very early stages so that everyone can benefit.

View Examples of How to Request Metrics in Visible below:

founders

Product Updates

Level up Your Fundraising Process with Email Syncing

The Fundraising Funnel

Raising venture capital often mirrors a traditional B2B sales & marketing funnel. At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

Just as a sales & marketing team has dedicated tools, so should a founder that is raising venture capital. By having a CRM in place to track and monitor the status of a raise, founders will be able to spend more time on what matters most — building their business.

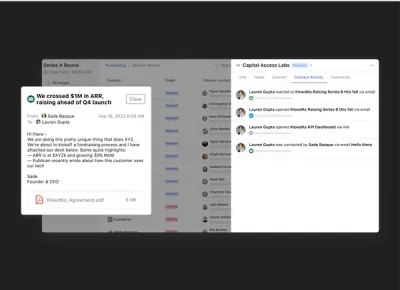

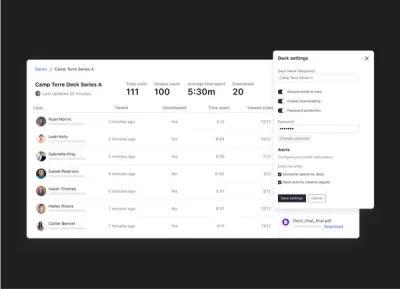

We’ve helped thousands of founders manage their raise with our Fundraising CRM. In order to help founders take their tracking to the next level, we are excited to announce our BCC email feature. Learn More

Tracking Conversations with BCC

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. Check out an example below:

This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Related Resource: 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

founders

Fundraising

Fundraising is a Numbers Game

Raising venture capital is a numbers game.

The Fundraising Funnel

At the top of your funnel, you are identifying potential investors through research, direct outreach, and intros from your peers. In the middle of the funnel, you are sharing your pitch deck, meeting with GPs, and perhaps the entire partnership. At the end of the funnel, there are (hopefully) multiple term sheets and negotiations ahead of closing.

This process is full of “nos”, “maybes”, and “ghosts.” Inevitably, different investors will pass for different reasons so it is important to have a thorough list to keep the momentum going. Between our own product, the Founders Forward Podcast, and online resources, we’ve found the following benchmarks for how many investors you need in your funnel:

How Many Investors Should You Expect to Target

40+ — Mark Suster of Upfront Ventures, “Ideally, you want to have 40–50 qualified and interested investors in your funnel.” Learn more here.

48 — The average # of investors a Visible user has in a Fundraising Pipeline. Learn more about our Fundraising tools here.

50+ — Gale Wilkinson of Vitalize Ventures, “If you don’t have a list and you’re raising now, don’t worry. Spend a weekend and write down who are your top, you know, 50 to 75 that you want to target?” Learn more here.

60+ — Brett Brohl of Bread & Butter Ventures, “You’re going to have to reach out to probably about 60 funds and have about that many meetings to close a round.” Learn more here.

100+ — Elizabeth Yin of Hustle Fund, “I made up a rule of thumb: 5-100-500. Over 5 weeks, meet with 100 investors to close $500k in your seed round. If you want to close $1m, double all of these numbers.” Learn more here.

Before building your list of investors it is important to understand your ideal investor. Once you have an understanding of your ideal investor, check out free databases, like Visible Connect, to find investors for your startup. Give it a try and filter through our 5,000+ early-stage investors below:

Find Investors

P.S. If you filter by “Verified” that means these investors have personally verified the data in their profile is correct.

Related Reads

How to Build an Investor List with Gale Wilkinson of Vitalize

On the Founders Forward Podcast, Gale Wilkinson of Vitalize Ventures offers countless takeaways to help early-stage founders fundraise — covering everything from list building to ownership benchmarks. Listen now

The Fundraising Wisdom That Helped Our Founders Raise $18B in Follow-On Capital

The team at First Round Review shares an in-depth guide for running a fundraising process using best practices from their portfolio companies. Read more

Building Your Ideal Investor Persona

On the Visible Blog, we break down the attributes that a founder should consider when identifying their ideal investor. Read more

founders

Fundraising

Who Funds SaaS Startups?

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Being a startup founder is hard. On top of finding customers, hiring top talent, building a product, and managing an acquisition funnel — founders need to secure funding for their business. At a high level, most funding options for early-stage startups are similar. However, there are some nuanced differences based on a company’s vertical or market.

Over the last 2 decades, SaaS (software as a service) companies have risen in prominence. At the same time so has the venture capital industry and the funding options available to startups.

Learn more about this data from Silicon Valley Bank here.

Related Resource: The SaaS Business Model: How and Why it Works

Learn more about SaaS financing and funding options below:

What is SaaS startup financing and how is it unique?

Over the last 2 decades, SaaS startups have become a popular investment vertical for venture capitalists and investors in general. As put by the team at Salesforce, one of the original SaaS companies, “Software as a service (or SaaS) is a way of delivering applications over the Internet—as a service. Instead of installing and maintaining software, you simply access it via the Internet, freeing yourself from complex software and hardware management.”

SaaS companies can increase margins and build at scale with a smaller team due to the ease of access for their customers. Naturally, monthly or annual pricing (subscriptions) has become the norm for SaaS companies. These areas combine to fuel investor interest as SaaS companies can efficiently grow and become large, profitable companies.

As SaaS is still relatively new, so are the funding options. Over the past few years, the funding options available to SaaS startups have been improved and expanded. Learn more about the common types of SaaS funders below:

Types of SaaS startup funders

As we mentioned above, the funding options available to SaaS startups have improved and expanded over the last 2 decades. The innovation has led SaaS startups to a plethora of funding options fit for any stage.

Related Resource: Valuing Startups: 10 Popular Methods

Learn more about the most common SaaS funders below:

Venture capital

As put by the team at Investopedia, “Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.” Venture capital has been integral in the funding of SaaS companies.

VCs are generally willing to take risks and fund startups with little to no revenue in the hopes the company will create long-term value. However, this comes with a set of pros and cons — learn more below:

Pros

Venture capital certainly comes with its list of pros. We boiled down the list into a few key points below:

No personal capital of the founding team. Getting a SaaS startup off the ground requires some form of capital investment. To help get things started, VC can be a popular option as it does not require capital (or free time) from a founder.

VC requires little traction or data. Traditional funding methods (like bank loans) require collateral or some type of traction. VC investors are buying equity in the hopes that your company will grow into a large company.

Lastly, VCs offer extensive networks and resources. VC funds need resources and tools to help founders succeed to stand out among their peers. This can be everything from helping with hiring to helping with product strategy.

Related Resource: All Encompassing Startup Fundraising Guide

Cons

Of course, venture capital comes with its own set of cons. We boiled the list down to a few key points below:

Giving up equity. In order to secure venture capital, startup founders need to give up equity in their businesses. This can be costly in the long run.

VC pressure. A VC fund’s duty is to generate returns for their LPs (limited partners) with the hopes of raising another fund in 10-12 years. Because of this, some of the pressure to exit or change business strategy might fall on the shoulders of portfolio founders as GPs look to generate returns for their own investors.

Notable venture capital funders

As SaaS has become a hot commodity in the VC funding space, there are thousands of investors out there. Below are a few of our favorites (check out our free investor database, Visible Connect, to find more SaaS investors):

High Alpha

OpenView Ventures

Harlem Capital

Bessemer Venture Partners

M25

Related Resource: 23 Top VC Investors Actively Funding SaaS Startups

Angel Investors

As put by the team at Investopedia, “An angel investor is a high-net-worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company.”

Related Resource: Venture Capitalist vs. Angel Investor

Angel investors invest in a similar style as VCs — buying equity in a business with cash. However, they are often single individuals that write smaller checks and are investing to diversify their assets.

Pros

Like venture capitalists, angel investors come with their own sets of pros and cons. We laid out a few of the main pros of raising capital from an angel investor below:

Like VC, angel investors require founders to spend zero personal capital. This can help alleviate the financial stress of startup and building a SaaS business.

Occasionally, angel investors can be strategic investors. Some angels might have expertise in your space or direct experience building a company in your space. This can be incredibly helpful when it comes to developing products, go-to-market strategy, and hiring leaders in the space.

Angel investors can be integral in building momentum during a fundraise. Due to their smaller check size and an investment committee, angel investors can make investments quickly. This will help when building momentum in a fundraise. As an added bonus, angel investors often know other investors that can make introductions. Elizabeth Yin of Hustle Fund makes the case for smaller angel checks below:

Cons

Of course, angel investors come with their own set of cons as well. We laid out a few of the main cons of raising capital from an angel investor below:

Lack of experience. Some angel investors might be new to investing which can create a burden for some founders as they might have more frequent questions and asks for founders.

Smaller checks. While we mentioned smaller checks can be a pro of angel investing, it can also be a con. With newer funding instruments, these small checks can be rolled into 1 investment there are instances where many angel investors can create a headache on a cap table.

Notable angel investors

Angel investors are all around you. Angel investors can be anyone from your dentist to a former boss. However, there are a few angel investors that have made a name in the space:

Keith Rabois

Kim Perell

Chris Sacca

Reid Hoffman

Accelerators and incubators

As put by the team at Investopedia, “An incubator firm is an organization engaged in the business of fostering early-stage companies through the different developmental phases until the companies have sufficient financial, human, and physical resources to function on their own.”

Related Resource: What is an Incubator?

Accelerators and incubators have made a name in the startup space as a valuable resource for companies just getting started with limited to no customers or revenue. Learn more about the pros & cons of incubators and accelerators below:

Pros

Accelerators and incubators come with their own set of pros and cons. We laid out a few of the key pros below:

Peer networking. One of the major pros of going through an accelerator is the networking opportunities with the other founders. By going through an accelerator you’ll be linked to other founders and have peers to learn from and lean on as you build your business.

Investment. Many times, accelerators make the first investment in many startups. Over the course of your time in an accelerator, chances are they will help with introductions to potential investors (or even make follow-on investments themselves).

Education. Education and programming is built into most accelerators. Over the course of a program, many accelerators will bring in thought leaders and experts to help hone different skills.

Cons

Of course, accelerators and incubators come with cons as well. We laid out a few of the key cons below:

Equity. In turn for investment and resources during an accelerator, you will need to give them equity in your business. Do your research and talk to past founders to make sure trading equity is worth it.

Time. Most accelerator programs take place between 10 and 14 weeks. Traditionally they have been in person but there are various virtual programs. For most founders, this is a serious time commitment and could require moving or relocating.

Notable incubators and business accelerator programs

Since Y Combinators’ inception in 2005, accelerators and incubators have become well-known in the startup space. Check out a few of the most popular accelerators and incubators below:

Y Combinator

Techstars

Expa

To find more accelerators, check out our saved list in Visible Connect, our free investor database.

Revenue-based financing

As put by the team at Investopedia, “Revenue-based financing is a method of raising capital for a business from investors who receive a percentage of the enterprise’s ongoing gross revenues in exchange for the money they invested. In a revenue-based financing investment, investors receive a regular share of the business’s income until a predetermined amount has been paid.”

Pros

Revenue-based financing comes with its own set of pros. Check out a few of the key pros below:

Maintain ownership. Revenue-based financing does not require giving any equity to investors. This means all existing members on the cap table will not be diluted.

Faster funding. As we mentioned above, raising venture capital is very much a process. Due to this, it can take months to receive capital. Revenue-based financing can be procured in a matter of days or weeks.

Cons

Of course, revenue-based financing comes with its own set of cons too. We laid out a few of the key cons below:

Requires revenue. Most early-stage companies likely have little to no revenue (and when they do, it is largely unpredictable). This can make revenue-based financing not viable until later stages.

Future payments. Revenue-based financing requires a monthly payment. Most early-stage startups are generally cash conscious and would prefer to make monthly payments.

Venture debt

As put by the team at Silicon Valley Bank, “Venture debt is a type of loan offered by banks and nonbank lenders that is designed specifically for early-stage, high-growth companies with venture capital backing. The vast majority of venture-backed companies raise venture debt at some point in their lives from specialized banks such as Silicon Valley Bank.”

Pros

Venture debt comes with its own set of pros and cons. We laid out a list of the key pros of venture debt below:

Debt over equity. As we’ve mentioned previously, equity is the most expensive asset a startup has. Venture debt allows you to avoid giving up any additional equity.

Timeline. Venture debt is commonly tagged on at the end of a venture capital round. Because of this it can move quickly and offer an extended runway for startups

Cons

Of course, venture debt comes with cons too. Check out a few key cons of venture debt below:

Financial covenants. Venture debt comes with a set of required performance metrics. The penalties for missing the required financials can be large for startups.

Future funding. Having debt on a balance sheet can be a negative signal for future funders.

Alternative types of funding

The SaaS funding options above are a few of the most common. However, SaaS funding options have continued to evolve over the last decade. Check out a few different alternative SaaS financing options below:

Crowdfunding

As put by the team at Investopedia, “Crowdfunding is the use of small amounts of capital from a large number of individuals to finance a new business venture. Crowdfunding makes use of the easy accessibility of vast networks of people through social media and crowdfunding websites to bring investors and entrepreneurs together, with the potential to increase entrepreneurship by expanding the pool of investors beyond the traditional circle of owners, relatives, and venture capitalists.”

Bootstrapping

Bootstrapping is when a founder (or founding team) starts a company by using their own capital and taking no outside capital. From here, bootstrapped companies generally use company revenue to fuel the growth of their business.

Related Resource: Bootstrapping 101: Pros & Cons of Bootstrapping Your Startup

Nondilutive Options

Over the last few years more nondilutive funding options have been created for SaaS companies. One of the most popular is Pipe. As they put it, “Pipe transforms recurring revenue into up-front capital for growth without dilution or restrictive debt.”

Related Resource: Checking Out Venture Capital Funding Alternatives

Which is the most popular funding source for SaaS startups?

Traditionally, raising venture capital or bootstrapping a SaaS startup has been the most popular funding source. As the options available to SaaS startups, the most popular options will ebb and flow. However, venture capital will likely always find itself as the most popular option as more SaaS companies create outsized returns for VCs (fueling more VC investment into SaaS companies).

At Visible, we like to compare a venture fundraise to a traditional B2B sales and marketing funnel. At the top of the funnel, you are adding new investors, nurturing them with meetings and updates in the middle, and ideally closing them as new investors at the bottom of the funnel.

Just as a sales and marketing team have dedicated tools — we believe founders should have the same to manage their most expensive asset, their equity. Find investors for your startup, share your pitch deck, nurture them with updates, and track your conversations all from one platform — give Visible a free try for 14 days here.

Succeed in your venture capital efforts with Visible

Determining the right funding option for your startup is only half the battle. If you’re raising venture capital — finding the right investors and having a game plan to manage your fundraise will allow you to spend time on what matters most, building your business.

Find investors for your startup, share your pitch deck, nurture them with updates, and track your conversations all from one platform — give Visible a free try for 14 days here.

founders

Operations

7 Essential Business Startup Resources

Building a startup is difficult. For most founders, it is their first time starting and building a business. However, there is not academy or university a first-time founder can lean on the learn the ways.

The best way to learn as a founder is by doing. But founders need to turn to their peers, investors, stakeholders, and resources along the way to help hone their skills and build their company.

Related Resource: Business Startup Advice: 15 Helpful Tips for Startup Growth

Learn more about the best startup resources for founders below:

What are startup resources?

As we mentioned earlier, building a startup is difficult. Leveraging the existing resources around is a surefire way to hone your founder skills on the fly. Instead of having to build and learn things in-house, founders can lean on the apps, leaders, and tools around them to build their businesses.

Related Resource: Top SaaS Products for Startups

Learn about the resources and tools available to startup founders below:

1. Accounting and finance

At the core of any business are the financials and data surrounding it. To help with accounting and finance, founders can lean on different software to help automate and improve accounting efforts.

In addition to software and tools, there are countless accounting and finance firms geared specifically towards startups. Learn more about popular startup accounting firms below:

Related Resource: A User-Friendly Guide to Startup Accounting

Accounting software

Chances are, most founders do not have the skill set to maintain their startup books. In addition to the skill, it is also time-consuming. Thankfully, there are countless accounting tools that startups can use to stay on top of their financials. Check out a few popular accounting software options below:

Xero

QuickBooks Online

Freshbooks

Invoicing software

Like accounting, invoicing is a critical part of startup financials. Leveraging software to collect invoices is a surefire way for everyone involved to save time. As most startups use invoicing software, the options are generally robust and can handle any customizations for your business. Check out a few popular options below:

Zoho

Stripe

Square

Related Resource: Important Startup Financials to Win Investors

2. Domain and website tools

For most modern-day startups, a website is table stakes. As more commerce takes place online, having a modern website can separate you from the field. Of course, most founders don’t have the domain and website knowledge to build a website from scratch. However, there are hundreds of tools to help founders manage their domain and build a website with limited design and coding knowledge. Check out a few of the most popular website tools below:

WordPress

Webflow

GoDaddy

Google Domains

Related resource: 20 Best SaaS Tools for Startups

3. Marketing and content management

Going hand in hand with a modern website is a modern approach to marketing. Currently, most startups are running some form of content and marketing playbook – no matter how big or small. For most startups, this looks like regular email communication, occasional blogs, and a presence on social media.

In order to help teams stay on top of their content and marketing efforts, there are hundreds of dedicated tools. Learn more below:

Analytics software

As the old saying goes, “you can’t improve what you don’t measure.” As a baseline, startups that are investing in content should have some analytics in place to properly measure what is working. Most of these tools can be implemented with limited tech expertise and can be built out as your company scales. Check out a few popular analytics tools below:

Google Analytics

Google Search Console

Amplitude

Customer relationship management (CRM) software

Another tool that most founders should invest in is a customer relationship management (CRM) tool. CRMs are the lifeblood of productive sales and marketing teams and allow everyone to track conversations and pipeline data.

CRMs come in all shapes and sizes. Some are dedicated to specific use cases while others cover everything from manual data entry to robust integrations and add-ons. Learn more about a few of the most popular CRMs below:

HubSpot

Salesforce

Pipedrive

Email marketing

As we previously mentioned, email marketing has become an important aspect of how startups market and communicate with their customers. There are hundreds of email marketing tools that founders can leverage to build out their email marketing efforts. Check out a few of the popular email marketing tools below:

Mailchimp

HubSpot

SendGrid

Social media management

At this point, it is expected that every business will have some sort of presence on social media. As the platforms continue to grow (Twitter, Instagram, Facebook, Tik Tok, etc.) staying on top of all of them can be a hassle. In order to help marketers stay on top of their social media efforts, there are countless tools to help. Check out a few of the most popular tools below:

Hootsuite

Buffer

Sprout Social

4. Project management

One of the differentiators of a startup is the fact that the team can iterate and move quickly. Whereas larger corporations have thousands of employees and guidelines, building products or new acquisition strategies can come with long delays. On the flip side, startups generally have smaller teams and the ability to push a new product or test new acquisition efforts overnight.

In order to stay on top of these efforts, startups should consider implementing a project management tool to stay on top of their day-to-day projects. This can mean everything from bug fixes in products to full-fledged marketing campaigns. Check out a few of the most popular project management tools below:

Asana

Teamwork

Monday

Notion

5. Human resources management

As startups grow, having the resources in place for employees is vital. Most startups don’t bring on a dedicated human resource manager until later in their company lifecycle. To save time and to make sure you are offering the resources your teammates need, consider a management tool to help. Check out a few of the most popular human resource management tools below:

Gusto

Bamboo HR

Zenefits

6. Legal help

Over the course of starting and building a business, founders will face legal aspects. Chances are most founders don’t have the legal chops to get through the basic practices needed throughout their businesses lifecycle it is important to have help with legal. This can come in the form of bringing on an outside law firm or leveraging tools and software to help with the legal aspects that come with building a business.

7. Investor relationship management

For startups that have raised venture capital, having a plan in place to communicate and leverage their investors is a must. At Visible, we have found companies that regularly communicate with their investors are 300% more likely to raise follow on funding.

Raising venture capital is a relationship-based game. In order to best your chances of raising capital, you need to build relationships and trust with potential investors. Chances are that potential investors will turn to your current investors for due diligence so it is important they give a glowing review.

Additionally, investors can be a wealth of knowledge when it comes to hiring, strategy, and building product. Learn more below:

Related Resource: The Complete Guide to Investor Reporting and Updates

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Related Resource: Advisory Shares Explained: Empowering Entrepreneurs and Investors

Fund your startup with Visible

Raising capital for your business is another skill founders need to hone. There are countless resources and tools to help founders raise capital too.

Related Resources:

All-Encompassing Startup Fundraising Guide

Business Venture vs Startup: Key Similarities and Differences

Find investors for your business, track your fundraising, share your pitch deck, and update investors all from one platform. Give Visible a free try for 14 days here.

founders

Metrics and data

7 Startup Growth Strategies

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Whether a venture-backed startup looking to attack a massive market or a bootstrapped business, startups are generally in pursuit of growth. One of the main competitive advantages of a startup is the ability to test new growth strategies and move quickly compared to its predecessors.

Related Resource: The Understandable Guide to Startup Funding Stages

Finding a growth strategy or channel can make or break a company. In order to best help you find and develop the growth channels that work best for your business, we’ve laid out a few key strategies below:

1. Develop a strong value proposition

First things first, you need to develop a strong value proposition. As put by the team at Investopedia, “A value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. A value proposition is part of a company’s overall marketing strategy. The value proposition provides a declaration of intent or a statement that introduces a company’s brand to consumers by telling them what the company stands for, how it operates, and why it deserves their business.”

This should be used at the backbone of your growth strategies and can be used to define your channels, messaging, and overall growth strategy. It is important to be thoughtful when laying out your value proposition — talk to customers, potential customers, and other stakeholders to help construct your value proposition.

Related Resource: How to Easily Achieve Product-Market Fit

2. Understand and embrace your target audience

After you’ve laid out your value proposition, you need to define the market and audience you would like to target. This is similar to creating your ideal customer profile.

As put by the team at Gartner, “The ideal customer profile (ICP) defines the firmographic, environmental and behavioral attributes of accounts that are expected to become a company’s most valuable customers. It is developed through both qualitative and quantitative analyses, and may optionally be informed by predictive analytics software.”

Related Resource: How to Write a Business Plan For Your Startup

Identify why a customer wants your product or service

If you’ve properly laid out your value proposition, this should be fairly easy. If you understand the value you are offering your customer, it should be straightforward why they would want to purchase your product or service.

Segment your overall market

For modeling purposes, you will likely start with your market as a whole. From here, it is important to narrow down your target and hone in on your specific segment in a market.

For example, if you are selling snowboards your total addressable market might be every outdoors person but you’d likely want to hone in your market to just anyone that has snowboarded in the last X years.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

Research the market

Once you’ve honed in on your market, you need to make sure you are an expert in all things related to the market. When reaching out to potential customers, chances are they will turn to you for best practices on the market and space. To go above and beyond, come equipped with the right knowledge.

Choose the segmented market

After researching and analyzing the different markets, make the choice. Pick your segmented market and make sure you have the messaging and product in place to win the market.

3. Research and analyze your top competitors

Inevitably, when speaking and targeting potential customers you will be compared to your competitors. In order to best combat any pushback, you need to come prepared. In order to best grow you need to understand how your product or service compares to competitors.

If you can understand your strong points (and weak points) in comparison to competitors you’ll be able to better tailor your messaging and campaigns.

4. Establish smart key performance indicators

As the old adage goes, “you can’t improve what you don’t measure.” When testing and finding growth strategies, it is important to have the right KPIs in place to track your performance.

Related Resource: Startup Metrics You Need to Monitor

Depending on the growth strategy or campaign will dictate what metric you should track. Check out a few examples below:

Return on investment (ROI)

One of the most common KPIs to track in relation to a growth strategy is return on investment. In order to continue investing in a growth strategy, you need to make sure it is generating returns.

As put by the team at Investopedia, “Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.”

Churn rate

On the flip side, growth can be fueled by improving your churn rate. If you’d like to grow your current customer base, focusing on churn rate is a surefire way. Learn more about tracking and improving your churn rate below:

Related Resource: Our Ultimate Guide to SaaS Metrics

Customer acquisition cost

As we wrote in our post, “Customer Acquisition Cost: A Critical Metrics for Founders,” customer acquisition cost is “The sum of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

By monitoring your customer acquisition costs, you’ll be able to determine what channels make the most sense for your business. A surefire way to fuel growth is by improving your CAC. For example, if you are running ads at a high cost that do not convert to customers, chances are you’d be better suited to reallocate those costs to a better converting channel with lower acquisition costs.

Customer lifetime value

As put by the team at NetSuite, “Customer lifetime value (CLV) is a measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client.”

By monitoring your customer lifetime value, you’ll be able to boost margins and warrant spending more on acquisition costs. Learn more about customer lifetime value below:

Related Resource: Defining Customer Lifetime Value for Startups: A Critical Metric

5. Scale wisely and effectively

In the early days of building a business, the old adage goes, “do things that don’t scale.” However, as you find your rhythm and have a valuable product with growth strategies that work, it is time to scale. During uncertain times, it is especially important to scale efficiently to work towards profitability.

Scaling involves taking your existing channels and growing them at scale (and ideally improving margins). This means making smart hires that will take certain areas of your business to the next level.

Related Resource: Scaling != Growth

6. Continuously review your business model

As you find the growth strategies and channels that work best, it is important to be consistently evaluating your business model. Markets and customer needs change quickly so it is important to make sure you are staying ahead of them.

This means that you are likely evaluating your different acquisition channels, your product, and your hiring plans. If you find your business is most capable of executing in a certain area (for example, product-led growth), you might want to consider hiring and building your product around product-led growth.

Related Resource: How to Write a Business Plan For Your Startup

7. Engage your investors to build relationships

Once you have found the growth strategies that work best for your business, you’ll need to make sure you have the resources in place to grow and scale. This is capital and talent.

One of the most common ways to source capital for a startup growth strategy is by raising venture capital. You’ll want to make sure that you are engaging with current and potential investors along the way to improve your odds of raising venture capital.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Grow your startup with Visible

Finding the right growth strategies for your business is only half the battle. Having the resources in place to track your key growth metrics will help you make informed decisions along the way.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

investors

Metrics and data

The Standard Metrics to Collect for VC Portfolio Monitoring

Visible supports hundreds of investors around the world to streamline their portfolio monitoring. One of the most common questions we receive is — what metrics should I be collecting from my portfolio companies?

Everyone from Emerging Managers writing their first checks to established VC firms ask this question because they want to make sure they're monitoring their portfolio companies in the most effective way possible.

The Standard Metrics Value-Add Investors Should be Monitoring

It’s important to know which metrics are the best to collect from portfolio companies so that investors can extract the maximum amount of insight from the least number of metrics. This streamlined approach is easiest for founders and allows investors to get what they need to provide better support to their companies, inform future investment decisions, and have good records in place for LP reporting or fundraising.

Below we outline the six most common metrics investors collect from portfolio companies.

1) Revenue

Definition: Money generated from normal business operations for the reporting period; also known as ‘net sales’. We recommend excluding ‘other revenue’ from secondary activities and excluding cash from fundraising.

Revenue tells you how a company’s sales are performing.

This metric is a key indicator for how a business is doing. It can be analyzed to understand if new marketing strategies are working, how a change in pricing might affect the demand for a good or service, and the pace of growth in a market.

By asking for revenue from just ‘normal business operations’ you’re excluding money a company could also be making from secondary activities that are non-integral to their business. This helps keep the revenue data more precise, allows you to compare the metric more accurately across the portfolio, and will allow you to use it more accurately in other metric formulas such as Net Income.

Visible helps over 400+ VCs streamline the way they collect data from companies with Requests. Check out a Request example below.

2) Cash Balance

Definition: The amount of cash a company has in the bank at the end of a reporting period.

Cash Balance is an important indicator of ‘life expectancy’.

This metric is essential to track because it tells you about the financial stability and risk level of the company. There’s no bluffing with this Cash Balance metric. A company either has a healthy amount of cash in the bank at the end of its reporting or they don’t. Cash balance also gives you an idea of how soon a company will need to kick off its next round of financing.

3) Monthly Net Burn

Definition: The rate at which a company uses money taking income into account. The monthly burn rate will be positive for companies that are not yet profitable and negative for companies that are considered profitable. Net burn is usually reported as monthly and calculated by subtracting a company’s ending cash balance from its starting cash balance and dividing that by the number of months for the period. We recommend collecting this metric from companies on a quarterly basis but still asking for the monthly rate — this helps rule out any one-off variability.

Monthly Net Burn = (Starting cash balance – ending cash balance) / months

Monthly Net Burn is an indicator of operational efficiency.

This metric becomes even more relevant during market downturns when the focus shifts from growth at all costs to growth with operational efficiency. This is a good metric to benchmark and compare across all companies in your portfolio.

You can also use this metric to calculate a key metric, Cash Runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

4) Cash Runway

Definition: Cash runway is the number of months a business can survive before it runs out of cash. It can be calculated as:

Runway = Cash Balance / Monthly Net Burn

Cash runway tells you when a company will run out of cash.

This metric is essential because it determines when a company needs to kick off their next fundraising process, usually, it’s when they have 6-8 months of runway left. If you see one of your companies hit a cash runway of six months or less, you should be reaching out to see if they need support or guidance on their fundraising efforts.

While Runway is definitely considered a key metric, you don’t need to ask your companies for it since it can be calculated easily with other data you should already have on hand (Cash Balance & Monthly Net Burn Rate).

5) Net Income

Definition: Net income is a company’s total earnings (or profit) after all expenses have been subtracted. It is calculated by taking a company’s revenue and subtracting all expenses, including operational expenses, interest expenses, income taxes, and depreciation and amortization.

Net Income = Revenue – Total Expenses

Net Income is an indicator of profitability.

If net income is positive, meaning revenue is greater than a company’s total expenses, it is considered profitable. This is a metric that startups should have readily available since it’s the ‘bottom line’ of an Income Statement, making it very easy to report.

This metric can also be used in a formula to calculate Net Profit Margin, total expenses, and cash runway.

6) Total Headcount

This is the total number of full-time equivalent employees excluding contractors. Contractors are excluded because of the variability of the nature of contract work — a contractor may only work a few hours a month or they could work 20 hours per week. This variability will cause back-and-forth clarification between you and your companies which wastes time.

This metric gives you insight into company growth and operational changes.

This metric is important to track because it’s a reflection of decisions made by the leadership team. If there’s an increase in headcount, the leadership is investing in future growth, on the other side, if there’s a major decrease in total headcount it could be because the leadership team has decided to reduce burn by letting people go or employees are churning. All are post-signs of operational changes worth paying attention to.

Check out an Example Request in Visible.

Suggested Qualitative Questions to Ask Your Companies

While metrics are the best way to aggregate and compare insights across your portfolio, you may also be wondering which qualitative questions you should ask portfolio companies as well. Qualitative prompts can be a concise and valuable way for startups to share more narrative updates on company performance with their investors.

Below we outline the two most common qualitative questions investors ask portfolio companies as well as suggested descriptions.

1) Recent Updates & Wins

Description: Please use bullet points and share updates related to Sales, Product, Team, and Fundraising. This will be used for internal reporting and may also be shared with our Limited Partners.

We suggest asking companies for bullet points on these four categories because it’s a focused way for investors to understand the narrative context behind a company’s metrics.

With your companies’ permission, this narrative update can also serve as the foundation for your tear sheets for your LP reporting and your internal reporting.

2) Asks

Description: How can we best support you this quarter?

You can make your reporting processes more valuable for your portfolio companies by asking your companies if there are specific ways you can provide support to them in the next quarter.

Once you have responses from your portfolio companies, you can take action on their requests and you’ll be able to extract support themes to inform the way you provide scalable portfolio support.

Monitor Your Portfolio Companies Seamlessly With Visible

It’s important to know which are the most important metrics to collect to ensure your portfolio data collection processes are streamlined and valuable both for you and your companies. In this article, we highlighted Revenue, Net Income, Cash Balance, Runway, Net Burn Rate, and Total Headcount as the top metrics to collect from all your portfolio companies. With Visible, its also easy to ask for any custom metric and assign it just to specific companies.

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Book some time with our team to learn how Visible can automate your portfolio monitoring processes.

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform used by over 400+ VCs.

founders

Reporting

Build Stronger Investor Relationships with Video Updates

The following is a guest post from the team at Sendspark. Use Sendspark to connect with customers, investors, team members, and other stakeholders. Learn more here.

Communicating with investors is a skill all founders should hone. Regular and predictable communication is a surefire way to build trust and improve your odds of unlocking an investor’s capital, network, experience, and more. Learn how you can leverage video + email updates to communicate with your investors below:

Why Send Videos in Investor Updates

Whether you’re pitching new investors or updating existing ones, sending videos to investors can help you build investor relationships.

Here are some ways it can help you:

Stand out from the crowd

Build a personal relationship

Show, rather than tell

Save time

Have great communication skills

Let’s dive into the best use cases and strategies that are going to help you close your next round!

When to Send Videos to Investors

1. Investor Outreach

A strong video in your investor pitch can help you get that first conversation.

One question that comes up a lot is should you make a personalized video when pitching investors?

And the answer is a bit nuanced. The world seems to be changing, but right now, I’d still recommend getting a warm introduction to an investor (even if that means cold emailing one of their portfolio founders), and using a video as a supplemental material in your “forwardable email”.

This helps you play it cool, while still getting valuable information across in your blurb and video.

Personalized videos become significantly more important after the first meeting, on your way to closing the deal.

2. Investor Follow Up

Sending a video recap after an investor conversation is a great way to lock in key points. Investors might have had 10 other conversations with strong founders that day, so this short video can remind them what they liked most about you. It can also help you stand out among the competition.

A video recap will give investors a shareable clip to pass around to other partners or decision makers at the firm who didn’t get to speak to you directly. This way, the wonderful aspects that make your pitch unique won’t get lost in translation.

For this video, I’d 100% recommend making it truly personalized to the investor you spoke with. Don’t try to include everything about your business, just the key points that you found best resonated with them during the call.

3. Diligence

When it comes to diligence, video messages can help you speed up the process. Here are some ways you can use video to get to a “yes” faster:

Record over your usage dashboards or product metrics

Request video testimonials from customers who can advocate for your product

Respond to any objections or concerns thoroughly

4. Investor Updates

An investor investing is the first step in a long partnership. Great investor communication over time will help you build a strong partnership, help investors help you, and lead to subsequent checks in future rounds.

Just like in B2B Sales, it’s easier to get your existing customers to pay more than to close new customers. Never take your investors for granted, and continue to keep them informed and excited about what you’re building.

Here are some ways you can strengthen your investor updates with video: