The following is a guest post from the team at Sendspark. Use Sendspark to connect with customers, investors, team members, and other stakeholders. Learn more here.

Communicating with investors is a skill all founders should hone. Regular and predictable communication is a surefire way to build trust and improve your odds of unlocking an investor’s capital, network, experience, and more. Learn how you can leverage video + email updates to communicate with your investors below:

Why Send Videos in Investor Updates

Whether you’re pitching new investors or updating existing ones, sending videos to investors can help you build investor relationships.

Here are some ways it can help you:

- Stand out from the crowd

- Build a personal relationship

- Show, rather than tell

- Save time

- Have great communication skills

Let’s dive into the best use cases and strategies that are going to help you close your next round!

When to Send Videos to Investors

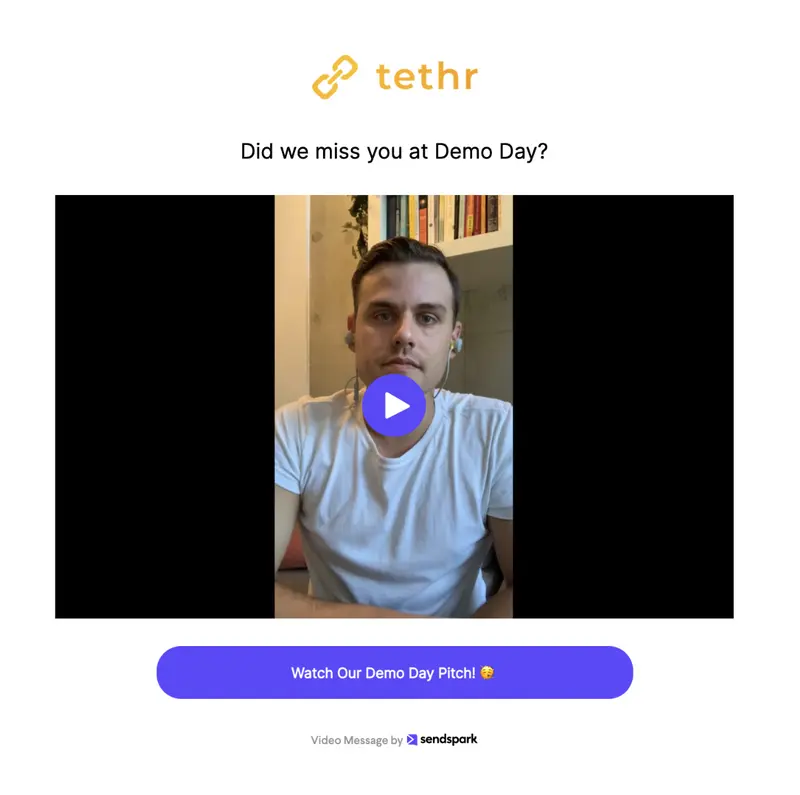

1. Investor Outreach

A strong video in your investor pitch can help you get that first conversation.

One question that comes up a lot is should you make a personalized video when pitching investors?

And the answer is a bit nuanced. The world seems to be changing, but right now, I’d still recommend getting a warm introduction to an investor (even if that means cold emailing one of their portfolio founders), and using a video as a supplemental material in your “forwardable email”.

This helps you play it cool, while still getting valuable information across in your blurb and video.

Personalized videos become significantly more important after the first meeting, on your way to closing the deal.

2. Investor Follow Up

Sending a video recap after an investor conversation is a great way to lock in key points. Investors might have had 10 other conversations with strong founders that day, so this short video can remind them what they liked most about you. It can also help you stand out among the competition.

A video recap will give investors a shareable clip to pass around to other partners or decision makers at the firm who didn’t get to speak to you directly. This way, the wonderful aspects that make your pitch unique won’t get lost in translation.

For this video, I’d 100% recommend making it truly personalized to the investor you spoke with. Don’t try to include everything about your business, just the key points that you found best resonated with them during the call.

3. Diligence

When it comes to diligence, video messages can help you speed up the process. Here are some ways you can use video to get to a “yes” faster:

- Record over your usage dashboards or product metrics

- Request video testimonials from customers who can advocate for your product

- Respond to any objections or concerns thoroughly

4. Investor Updates

An investor investing is the first step in a long partnership. Great investor communication over time will help you build a strong partnership, help investors help you, and lead to subsequent checks in future rounds.

Just like in B2B Sales, it’s easier to get your existing customers to pay more than to close new customers. Never take your investors for granted, and continue to keep them informed and excited about what you’re building.

Here are some ways you can strengthen your investor updates with video:

- Record yourself discussing your current initiatives

- Show off a new feature or product launch

- Introduce a new team member or advisor

- Request a video from a customer to share why this matters to them

How to Send Videos in Investor Updates

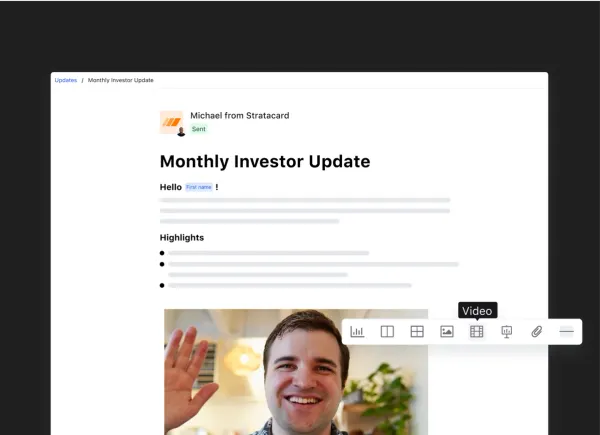

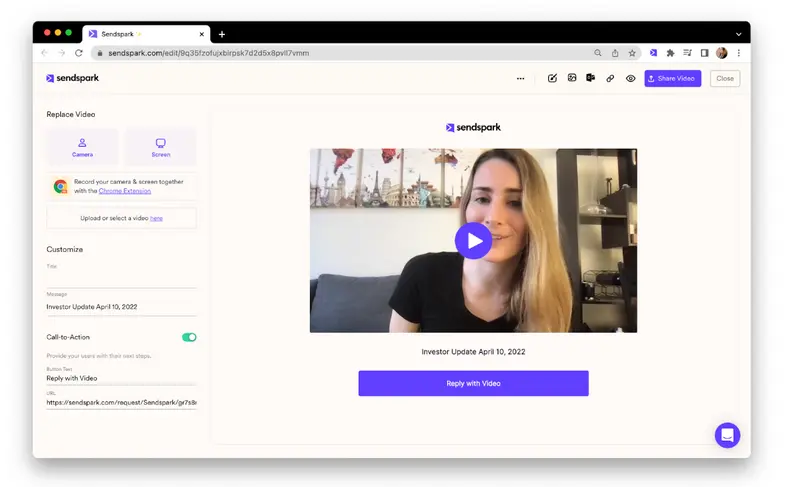

You can send videos in investor updates using Sendspark and Visible together. First, create a free account with Sendspark to easily record videos of yourself or your product.

Sendspark is great for this because…

- It’s super fast to record a video of yourself or your product — no editing needed!

- Videos will automatically look polished and professional with your own branding and logo

- You can add calls-to-action for investors to schedule a meeting, reply with video, or take another next step

- You get insight into who’s watching your video, how far they watched, and what actions they’re taking

After creating your video, just paste your video URL into your investor update on Visible. You’ll see the video preview automatically appear in your email, giving you a super polished and professional-looking update. Check out an example below:

Give Visible a free try for 14 days here. Send investor updates, manage your fundraise, and keep tabs on your most important metrics — all from one platform.

Tips for Making Great Investor Videos

- Be clear and concise. When it comes to pitching investors, Aaron Blumenthal, Director of Global Accelerator Programs at 500 Startups, says, “every 10 seconds buys you your next 10 seconds.” You need to keep your viewer engaged for the entire length of your video — so make it easy for yourself and keep your video to 20-30 seconds.

- Give the gift of information. Whether it’s a pitch, a recap, or an update, reward your viewer with a nugget of information that makes them feel great that they watched the video. That being said, remember rule #1 and don’t try to put everything in the video. Just discuss 1-2 points that are better said or shown than written.

- Be conversational. Even if you are recording a video for multiple investors at once, each one is viewing alone, so use singular words like “you” instead of “y’all” to make the experience more intimate and personable. Imagine you are speaking 1×1 to an investor via Zoom — not pitching a room full of people at Demo Day.

- Know your video will be shared. This has two implications: (1) don’t put confidential information in your video that you don’t want floating around, and (2) use this knowledge to your advantage with soundbites that you want shared – your vision, your asks, your unique spark, etc. Don’t include content that you wouldn’t want shared among different audiences.

- Don’t overthink it. Remember: we are our own harshest critics (especially us founders ????). Investors — especially those who have already invested — love getting these more personal updates. They are not judging you nearly as hard as you are judging yourself (especially if your numbers are up and to the right).

Final Thoughts

When fundraising, and running a business in general, you see a lot of “shoulds.” You should do this, you shouldn’t do that. All great founders do this, and if you don’t, you’ll never succeed. However, that’s not the point of this post. You don’t HAVE to use video when emailing investors. Rather, it’s a great option to have in your arsenal.

My belief is that the founders who win lean into their strengths and indisynchronies. What makes you special? What makes you unique? Video can help you tap into that – and easily communicate who you are, what you’re doing, and why it’s important – in far less time than text. I hope Sendspark helps you have fun and enjoy the ride.