At Visible, we are on a mission to help more founders connect with investors — one of our key tools to help do this is “Decks.” This helps founders share any PDF document with potential investors and colleagues. It enables founders to share documents with security and peace of mind, they know who is viewing their document and the amount of time spent.

We are regularly asked how to construct a pitch deck by startup founders. While there is no silver bullet when it comes to building a pitch deck, we can share the data and best practices we have seen from other founders. We’ve collected thousands of data points related to pitch deck sharing. Learn more about best practices for crafting and sharing your pitch deck below.

The Ideal Startup Pitch Deck Length

The biggest theme we identified is that less is more. The ideal deck size for a stakeholder to view your entire slide deck is 12 slides or less.

We took a look at all decks that had a 100% completion rate. We found across the data set the average length was 12.2 pages/slides.

The average # of slides of a deck uploaded to Visible is 18 slides with a median of 16.

Learn more about how the specific slides and content you should be creating in our pitch deck guides below:

- Tips for Creating an Investor Pitch Deck

- 18 Pitch Deck Examples for Any Startup

- How to Pitch a Series A Round (With Template)

Sharing Your Pitch Deck

A pitch deck can be a powerful tool to help founders tell their story during a fundraise. Check out a few of our tips for sharing your pitch deck below:

When to Share a Pitch Deck?

There is a popular debate about whether or not to share your pitch deck prior to a meeting with an investor. Generally, we find it best to share your entire pitch deck until after a meeting. This will enable the pitch deck to be a tool for you. It will be 10-13 slides, that can be a refresher for the investors as to what your company is about. The market you are looking to penetrate. Investors can then click through your slides after your meeting as they discuss and weigh the investment opportunity.

The Teaser Pitch Deck

However, we suggest sharing a short (or teaser) pitch deck with investors before a meeting. This should be around 5 slides and give investors the context they need about your company to have a material discussion about your business in the first meeting. Brett Brohl of Bread & Butter Ventures shares what he likes to see in a teaser pitch deck below:

Related Resource: Our Teaser Pitch Deck Template

No matter how you decide to share your pitch deck, remember to keep it at a reasonable length for investors to easily digest. As our data points out, early-stage startups should try to keep their pitch deck to 14-15 slides at most. Keep things simple. Be brief. Be clear with your value proposition. The average minutes spent viewing a deck is 19.4 minutes. Make that 20 minutes count. As always, it is important to create the pitch deck that is right for your business. Some may require more or fewer slides than others!

Share Your Pitch Deck with Visible

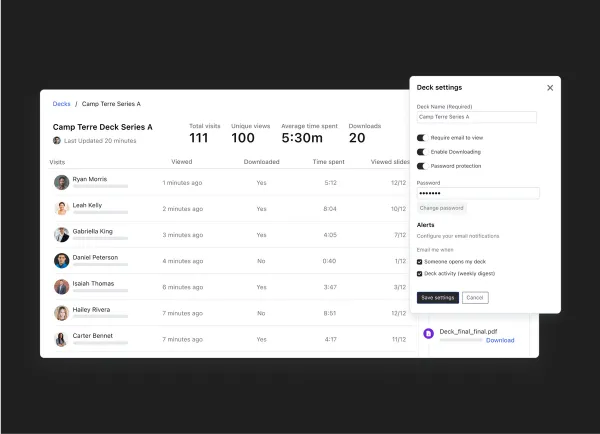

Fundraising oftentimes mirrors a traditional B2B sales process. You are adding investors to the top of your fundraising funnel, nurturing them throughout with meetings, email, and updates in the middle, and ideally closing them as new investors at the bottom.

Just as sales & marketing teams have tools to understand how leads are engaging with their emails and content, the same should be true for a fundraise. By having a tool in place to understand how investors are engaging with your pitch deck, you’ll be able to spend time with the investors that are most interested in your business.

Upload your pitch deck, track the progress of your fundraise with our Fundraising CRM, and share Updates along the way with potential investors using Visible. Give it a free try for 14 days here.