Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Reporting

Product Updates

Product Update: Analyze Your Portfolio Data with Segment Metrics

Visible recently released Segment Metrics, a premium portfolio insights tool for VCs. The solution empowers investors to answer key questions about their portfolio performance in seconds instead of hours.

How investors can unlock portfolio insights faster with Segment Metrics

With Segment Metrics investors can find insights related to the sum, average, minimum, and maximum for any custom segment of their portfolio metric data and investment values.

Example Segment Insights

Examples of insights that can be uncovered with Segment Metrics include:

The amount invested in female founders vs non-female founders

The breakdown of investments based on sector, geography, and stage

A comparison of revenue across seed-stage investments

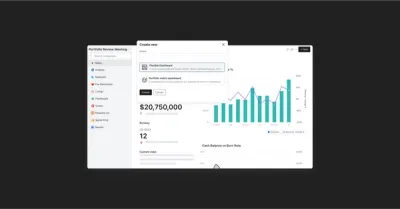

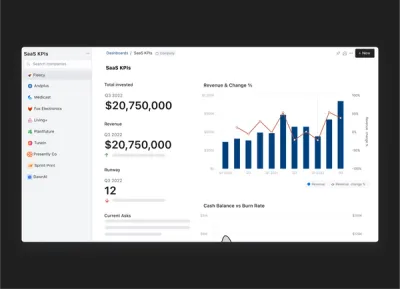

Investors can keep track of these insights by embedding the data visualizations on flexible, shareable dashboards in Visible as shown in the example below.

Learn more about setting up Segment metrics in our Knowledge Base.

Learn More About Visible

Visible has a suite of tools to help with portfolio data analysis including

Robust, flexible dashboards that can be used for Internal Portfolio Review meetings

Portfolio metric dashboards to help with cross-portfolio insights

Learn more about how 400+ Venture Capital investors use Visible to streamline their portfolio monitoring and reporting.

investors

Reporting

Senate Bill 54: What it is and How it Will Affect Your VC Firm

On October 8, 2023, California Governor Gavin Newsom signed into law Senate Bill 54. This law mandates that venture capital firms report the diversity of the founding teams in their portfolio to California’s Department of Civil Rights (DCR) annually.

Why is Senate Bill 54 important?

This law is the first piece of U.S. legislation aimed at increasing diversity within the venture capital industry which historically has allocated only 5% of capital to startups led by women, Black founders, or Latinx founders in any given year (source).

When does Senate Bill 54 go into effect?

The first report is due March 1, 2025. This means firms will be required to report accurate diversity data on investments they made during the 2024 calendar year by the start of March. Firms who do not comply may face a penalty as decided by the courts.

Combine your firm’s diversity and portfolio KPI reporting processes with Visible.

Which VC firms does Senate Bill 54 apply to?

Senate Bill 54 applies to any VC that:

Is headquartered in California.

Has a significant presence or operational office in California.

Makes venture capital investments in businesses that are located, or have significant operations, in California.

Solicits or receives investments from a person who is a resident of California.

Related Resource: California Adopts New Law Requiring VC Companies to Collect Diversity Data From Portfolio Company Founders

What diversity information will be required?

VC firms will be required to ask portfolio company founding teams to report their race, ethnicity, disabilty status, and sexual orientation. (Read the full requirements outlined in Senate Bill 54) Firms are required to make founders aware that this information is voluntary and founding teams will not be penalized for not reporting this formation. The information must also be collected in an anonymous fashion so that responses cannot be traced back to a founding team member.

This information will be aggregated and reported to California’s Civil Rights Department (CDR) on an annual basis.

Related Resource: 5 Actionable Steps to Improve Diversity at Your VC Fund

Getting a head start on portfolio diversity reporting

It’s important to make sure your firm has the internal capabilities to collect the required information from your portfolio companies before Senate Bill 54 goes into effect.

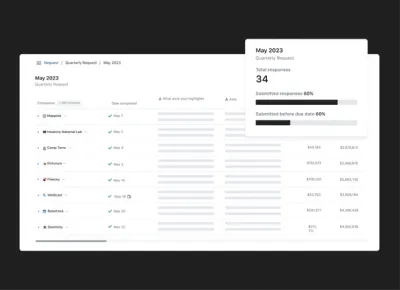

Visible’s Request feature streamlines the way investors collect custom KPI’s and diversity information from their portfolio companies.

investors

Product Updates

Reporting

Product Update: Visible AI Updates

Did you know that 60% of investors don't hear from their portfolio companies on a regular basis? This means that the startups sending regular communications to their investors stand out the most. In fact, startups that provide regular investor updates are 3x more likely to receive follow-on funding.

Making the time to write a compelling investor update regularly can be challenging for startup founders. This is where Visible AI Updates comes in.

What is Visible AI Updates

Visible AI Updates automatically turns Visible Request responses that portfolio companies submit to Visible into a narrative Update that startups can use to share with other investors and stakeholders. This equips founders to send regular, professional communications to all their greatest supporters (and sources of follow-on capital), with ease.

Learn more about Visible AI updates and how you can leverage it with your Visible account below.

How it Works

Visible AI Updates is available to founders who are completing Visible data Requests from their investors.

Using the metrics and qualitative answers from a data Request, Visible AI Updates adds context and builds charts to turn the information into a Visible Update that can be shared with other investors and stakeholders.

Visible AI Update Example

Using the qualitative answers and data included in your Request, we’ll help you turn the response into an Update using the following logic:

“{Company Name} Investor Update” — For example, “Acme Co Investor Update”

In order to create the content of the update we built a prompt for OpenAI that contains questions and answers from the request. We will create charts and tables for any metrics using the following logic:

If a metrics question contains >3 metrics we will create a single table with all these metrics within the update

Otherwise, we create bar charts for each metric in the question.

Note: if a metric only has a single data point we will create a number chart instead.

As always, we recommend reviewing your Update and making sure all of the content is correct and fits your voice. You can check out the full example of the Update here.

Visible AI Updates Takeaways

Providing investor updates regularly increases your likelihood of success and your ability to fundraise

Visible AI transforms your Requests responses into a professional narrative update that you can share with all your stakeholders

The Future of Visible AI

This is our first introduction of AI into the Visible platform. In the months ahead we plan on exploring AI models to help with fundraising email copy, identifying potential investors for your business, and more. We are always looking for feedback. Feel free to share your AI-related ideas to support at visible dot vc.

founders

Reporting

Using AI Prompts to Write Your Next Investor Update

Sending investor updates is a surefire way to tap into your current (or potential) investors' knowledge, capital, and experience. Investor updates keep your company top of mind and improve your odds of getting help with fundraising, hiring, strategy, and other issues that arise as a founder.

However, sitting down and writing an update can be challenging for many founders. By leveraging AI, you can get over the cold start problem and get a head start on your next update with just a few data points. Integrating ChatGPT can further enhance the reporting process by adding depth, analysis, and narrative context to the raw metrics. Here’s how founders can do it.

Related Resource: AI Meets Your Investor Updates

Data Preparation

Begin by exporting the key metrics and data points you want to share from Visible. This could include charts, graphs, or tables related to sales, customer growth, churn rate, financials, etc.

Ensure your data is well-organized and accurate so you can share the results with your generative AI model of choice. Have specific numbers on hand for quick reference, such as revenue growth, churn rates, user acquisition costs, etc.

Prompt Tips

Review & Personalize

Take the insights and analysis from ChatGPT and integrate them into your investor update. Adjust the language or depth of analysis to match the preferences and knowledge levels of your investors.

Incorporate Visuals

Visible already offers compelling visual data representation. Ensure that the written context provided by ChatGPT complements these visuals. For instance, a chart showing revenue growth coupled with a ChatGPT-derived narrative can provide a comprehensive view of financial health.

Fact-Check & Verify

Always double-check AI-generated content for accuracy. Ensure that the insights and interpretations align with your understanding and are factually consistent with the data from Visible.

Feedback Loop

After sending out the investor update, gather feedback. This will help you adjust the depth, tone, and content for future communications. By integrating ChatGPT's narrative capabilities with Visible's data representation, founders can create rich, insightful, and highly contextual investor updates that not only inform but also engage stakeholders in meaningful ways.

Related resource: How AI Tools are Reshaping Venture Capital: Tools to Know

Benefits of Using ChatGPT for Investor Updates

Utilizing ChatGPT or other advanced AI language models can significantly enhance the process of crafting investor updates in several ways:

Data Interpretation

Insightful Analysis: AI can quickly process and analyze large datasets, highlighting important trends, anomalies, and patterns that might be missed with manual analysis.

Contextual Comparison: By comparing your metrics with known industry benchmarks or historical data, AI can provide contextual insights into the company's performance.

Narrative Creation

Cohesive Storytelling: ChatGPT can help craft a narrative around raw data, turning numbers into a compelling story that communicates the company's journey, challenges, and triumphs.

Consistent Tone: AI ensures that the tone of the update remains consistent throughout, whether it's formal, friendly, or somewhere in between.

Time Efficiency

Quick Turnaround: Drafting updates can be time-consuming. ChatGPT can rapidly generate well-structured drafts based on provided data, which founders can then review and adjust as necessary.

Multi-version Generation: AI can generate multiple versions of an update, tailored to different investor personalities or preferences.

Content Suggestions

Comprehensive Reporting: AI can suggest relevant content to include, ensuring that critical aspects are not overlooked. This might include operational updates, financial highlights, or market trends.

Personalized Updates: ChatGPT can generate updates tailored to specific investor groups or individual stakeholders based on their interests or investment focuses.

Error Reduction

Grammar & Syntax: ChatGPT ensures that the language used is grammatically correct and professionally composed.

Fact-Checking: While AI isn't a replacement for manual fact-checking, it can help identify inconsistencies or potential errors in data presentation.

Feedback Analysis

Interpret Responses: If founders receive feedback or questions from investors, ChatGPT can help interpret and suggest appropriate responses or clarifications.

Iterative Improvement: By analyzing feedback over time, the AI can refine the style and content of updates to better meet investor expectations.

Scalability

Handling Volume: For founders managing multiple ventures or reporting to a large number of stakeholders, ChatGPT can scale the update creation process without sacrificing quality.

Template Generation

Standardized Reporting: ChatGPT can help create templates for regular updates, ensuring consistent reporting structures while still allowing for customization based on the period's specifics.

While ChatGPT and similar AI models offer numerous advantages in crafting investor updates, it's crucial for founders to remain actively involved in the process. The authenticity of the founder's voice, combined with the analytical power of AI, can create powerful and impactful communications.

Prompts for Crafting an Investor Update with ChatGPT

There are a few ways to approach ChatGPT as a source to help with your investor updates.

Individual Section Prompts

On one hand, you can enter each individual update section into ChatGPT and use a prompt for each section. For example, let’s say you have the following highlights from the last month:

Hired 2 new sales reps — Brett & Amanda

Grew 50% quarter over quarter to hit $1M in ARR

Launched Big Product X

You can enter the above into a prompt like this example "Briefly recap our company's highlights..." and carry on with this approach for each individual section of your update. Check out the most common content sections in Visible Updates below:

One Prompt

On the other hand, you can take any individual data points, qualitative or quantitative, from the previous period and enter them into ChatGPT with a prompt like the following:

"Turn the following into an investor update with additional context around the month-over-month KPI data and an intro of 40 words or less [Copied in Update Contents]"

Before ChatGPT

Using the prompt above, we took the follow update points and turned it into an Update

Highlights

Hired 2 new sales reps — Brett & Amanda

Grew 50% quarter over quarter to hit $1M in ARR

Launched Big Product X

Lowlights

Blake, our lead developer, has quit

KPIs

Product Launches

Big Product X has been a success.

We have signed up 1,000 users in the first week and $10,000 in revenue

Asks

We are looking for users for Big Product X. Ideally they are a marketing professional with a team of 5 or more

Looking for a lead developer that is based in Chicago with 8+ years experience

Fundraising Efforts

We are kicking off our seed round. Need intros to SaaS, Seed stage investors in midwest.

Thank Yous

Thanks to Kelley from Venture Fund X for making introductions to Big Company Y, our biggest customer yet.

After ChatGPT

In October, our journey marked significant achievements amid a few challenges. Let's delve into the details:

Highlights

Team Expansion: Welcomed Brett & Amanda to our sales team, enhancing our capabilities.

Impressive Growth: Achieved a 50% QoQ growth, hitting $1 million in Annual Recurring Revenue.

Product Success: The launch of Big Product X was a triumph, securing 1,000 users and $10,000 in revenue within a week.

Lowlights

Talent Loss: Unfortunately, our lead developer, Blake, departed.

KPIs - A Closer Look

September 2023:

Revenue: $100,000

Cash Balance: $1,000,000

Gross Profit: -$10,000

Headcount: 12

October 2023:

Revenue: $150,000

Cash Balance: $1,100,000

Gross Profit: $100,000

Headcount: 14

Asks

User Acquisition: Seeking users for Big Product X, particularly marketing professionals with a team of 5 or more.

Talent Search: In pursuit of a lead developer based in Chicago with 8+ years of experience.

Fundraising Efforts

We are launching our seed round and would greatly appreciate introductions to SaaS and seed-stage investors in the Midwest.

Thank Yous

Our heartfelt thanks to Kelley from Venture Fund X for the introductions that led to Big Company Y becoming our largest customer to date.

Your continued support is invaluable, and we look forward to sharing more accomplishments in the months ahead.

Sincerely,

[Your Name] [Your Title] [Your Contact Information]

Learn More About Visible Updates

With Visible you can find investors, send monthly Updates, share your pitch deck, and manage relationships with our CRM. Give Visible a free try for 14 days here.

investors

Reporting

Operations

[Webinar Recording] How to prepare for your 2023 fund audit

The volatility of the markets and decline in deal activity makes private valuation adjustments especially challenging this year. Yet even under these circumstances LP’s expect portfolio valuations to be accurate and justifiable. As a VC, you should be prepared for auditors to be even more involved during this year’s audit process as they ensure valuations are as close to reality as possible.

Webinar Overview

Belle Raab from Visible and Danielle Darley from Weaver discussed how to best prepare for your end-of-year audit.

Discussion topics:

What, why, who behind the audit process

What to anticipate for this year's audit

Preparing for the audit process

Establishing an audit timeline

Recommended do's & don'ts

Related Resources:

A Simple Breakdown of the VC Audit Process

Venture Capital Valuations: Tips for Preparing Valuations for Your Annual Audit

Five Simple Steps Key Venture Capital Staff Can Take to Support a Successful Audit

Establishing a Valuation Policy

founders

Reporting

How to Build a Strong Investor Relations Strategy

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Startup founders are responsible for many duties. — from hiring top talent, building and selling a product, fundraising, communicating with stakeholders, and everything in between.

Founders often get pulled in many directions so overlooking certain roles or duties can be easy. When done right, an investor relations strategy can take up little time every month and pay off with added help with hiring, fundraising, strategy, and more.

Related Resource: Investor Relationship Management 101

What is an investor relations strategy?

As put by the team at Investopedia, “The investor relations (IR) department is a division of a business whose job it is to provide investors with an accurate account of company affairs.”

Investor relations are typically associated with publicly traded companies to help investors make a decision to invest in a company. As you’ll notice in the definition above, they use a “division or department” whereas at a startup this is typically a department of 1 — the founder or CEO.

However, an investor relations strategy can be a lever for success for startups and privately held companies. An investor relations strategy will help founders tap into their current investors’ capital, time, network, and experience to help scale their business.

Challenges in investor relations

Building relationships with investors is easier said than done. Building a startup is full of ups and downs so approaching the individuals and firms that are invested in your business can be intimidating. Like all things related to building a business, there are some challenges when it comes to investor relations:

Sticking to a schedule

Sharing bad news

Finding the right information and data to share

Learn more about overcoming these challenges in our post, The Complete Guide to Investor Reporting and Updates.

Why an investor relations strategy is crucial for startups

As we previously mentioned, keeping up with all of the roles and responsibilities can be difficult. Having an investor relations strategy is a good way to tap into your existing stakeholders to unlock help when it comes to hiring, fundraising, strategy, and more.

Builds trust and credibility

First things first, investors need to trust you and your business so you can lean into them for help with your business. Investors are a well-networked community so word will get around quickly how you communicate with investors.

Something as quick as a monthly update to existing investors, will put you ahead of the majority of startup founders and help you stand out from the pack.

Attracts and retains investors

As put by Laurel Hess, the Founder of Hampr, “Taking the time to review your business with your stakeholders is actually a really great opportunity for growth – if you view it that way, there is a ton of potential to unlock.

I have gained the following from my regular updates:

Intros to potential investors

Additional capital for a round I’m working on

Intros to new verticals for expansion

Advice on strategy for a problem we are working on

Intros to new mentors/advisors to unlock the next phase of growth

All this for just 1 hour of my time each month? That is the definition of “no brainer.”

This 1 hour of monthly work can pay dividends when it helps to raise a new round of capital from existing investors or asking for introductions to potential investors down the road.

Helps with hiring, fundraising, and strategy

Startup investors are likely investors in 10s or 100s of other businesses and have a professional background of their own. Because of this, they are typically well-networked in the “startup world” and are able to help when it comes to hiring, fundraising, company strategy, and more.

In order to tap into their network, they need to trust you and be willing to put their reputation with their network on the line.

As put by Elizabeth Yin of Hustle Fund, “If you don’t write regular updates, your investors won’t want to help you. It’s hard to help a company and put your own social capital on the line with your network when you have no idea what is happening in your own portfolio company.”

Essential components of an investor relations strategy

An investor relations strategy will look different for every business. However, there are a few key components that most founders will benefit from including in their investor relations strategy.

Communication plan

Communication is at the core of any relationship. By sticking to a regular communication plan you’ll be able to strengthen relationships and build trust. For many early-stage founders a communication plan might look something like:

Regular monthly updates at the start of the month

Quarterly board meetings (in person or over Zoom)

One-off communication and phone calls as needed

Your mission, story, and vision

Investors need to buy into your company’s mission, vision, story, and values. This is typically done during the fundraising process but it is important to continually hit on your mission and vision.

Financial reporting and disclosures

Of course, investors need to know how your business is performing. At the end of the day, if investors are not aware of your financial position and core metrics, they will not be able to help where needed. Check out the most common metrics that VCs expect from their portfolio companies below (read more here):

Investor relationship management

As we previously mentioned, investor relationship management will look different depending on the founder or investor. However, when it comes to communicating and sharing information it typically helps to include some or all of the following:

Wins and mosses

Key metrics

Make specific asks

Stay consistent

Respond promptly

Learn more about the importance of investor relationship management in our blog, Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors.

Crisis management and contingency planning

A core part of an investor relations strategy is crisis management and contingency planning. For many startups, this will come to life during board meetings. However, having a plan for how to deal with a crisis is important.

For some founders, this could be a one-off phone call to board members or the most engaged investors. It could come in the form of email, in-person meeting, etc. At the end of the day, having a plan in place for when emergencies hit is important.

Investor feedback and engagement

For an investor relations strategy to truly work, your investor needs to be engaged. An investor relationship requires work from both the founder and the investor. Sticking to a plan and regular communication schedule will lend its way to investors engaging and offering feedback.

Being pointed about where you need help and how you can help investors is a great way to spur engagement. Another pro tip is to publicly call out the investors who are going above and beyond to help your business – this will help gamify your investor relations and encourage other investors to speak up.

Related Resource: Investor Outreach Strategy: 9 Step Guide

Maximize your investor relations strategy with Visible

Visible is the home of investor relations for thousands of startup founders. Use our Updates tool to reguarly share your key qualitative and quantitative data with investors. Build relationships with potential investors using our pitch deck sharing and data room tools and ultimately keep tabs on interactions with every investor using our investor CRM.

Give Visible a free try for 14 days here.

investors

Reporting

Product Updates

Q3 Product Webinar – Streamlining end of year reporting with Visible

Check out Visible’s recorded product webinar to learn about the most recent updates to Visible’s portfolio monitoring and reporting platform. The Visible team demonstrates how to leverage recent product changes to improve your portfolio reporting in Q4 and beyond.

Product webinar topics:

Common use cases for one-time Requests and how to set them up

Saving time by syncing company qualitative responses to Dashboards and One-Pagers

Exporting data to Google Sheets for external analysis and reporting

Embedding a dashboard in Notion to share with your team

Q&A

investors

Reporting

Operations

An Essential Guide on VC Fund Administration

What is fund administration?

Fund administration is a third-party service that handles the accounting, cash-flow movement, and LP reporting for Venture Capital funds. Hustle Fund argues that fund admins are the most important part of a VC’s back-office operations.

Key fundamentals of funds administration in Venture Capital

Fund Admins play an essential role in ensuring critical fund operations run smoothly and also can help VC firms maintain credibility with Limited Partners (LPs). Below we outline the key fundamentals of Fund Administration.

Cash flow management and capital allocation

Fund administrators are responsible for wiring money directly to founders. The main reason fund administrators handle this process and not the GP is to protect against fraud and ensure accuracy.

Fund administrators also handle the capital transactions between LPs and the fund. This includes managing the call-down process, determining how much to request from each LP, and sending letters to each LP with wire instructions. After an exit event, the fund administrators are also responsible for figuring out how much to distribute back to each LP.

That’s a lot of separate transactions to manage which is why this can be an extremely time-consuming process. It’s also a high-stakes process with no room for mistakes. An error in the numbers can even result in a lawsuit based on gross incompetence.

Limited Partner management

Since Fund Administrators are responsible for sending communications related to capital transactions and reporting to Limited Partners, it’s critical that fund administrators keep an up-to-date list of Limited Partner contact information. The fund should share updated contact information with fund administrators as changes occur.

Reporting

Fund administration also handles the formal LP reporting process as outlined in a fund’s Limited Partnership Agreement. This typically includes putting together quarterly reports of each company’s latest valuation on a quarterly basis but the reporting requirements can vary from fund to fund based on LP requirements. To put together this reporting, fund administrators will source the latest investment information from the VC fund which is why it’s important for firms to keep investment data and fair market value changes up to date and accessible. Preparing these quarterly reports helps streamline the annual audit at the end of the year.

Visible provides investors with an easy way to maintain accurate investment records that can easily be shared with fund administrators and auditors.

Compliance assistance

An important role of a fund administrator is making sure funds are maintaining compliance with the terms outlined in their Limited Partnership Agreement (LPA). This can include terms related to the timing of distributions, what can be considered a fund expense, and the deadlines for reporting.

Audit and tax

A fund administrator will work closely with other fund service providers such as auditors and tax-related providers to ensure the fund is performing in accordance with regulations.

Related resource –> Venture Capital Audit Process: What it is and how Visible can help

Modern technology and software solutions

There are a variety of fund administrators dedicated to serving the VC industry. As discussed, VC fund administrators play a key role in VC firm operations so it’s worth taking the time to select the provider that is going to be the best fit for your firm. A great way to start is by asking your community for referrals. From there, it’s wise to interview the administrators and actually speak with the representative who will be assigned to work with your fund.

Fund administrators differentiate themselves by variables such as the level of sophistication of their tech stack, whether they offer an LP portal, and also by the quality of the service they provide. It’s important to note that the quality of service can be dependent on the representative you work with at the organization. This is why it’s a great idea to meet with the rep in advance of signing a contract.

The benefits of working with fund administrators

Working with the right fund administrator can mean fewer headaches and more time to spend finding and supporting the best investment opportunities. Below we outline the top benefits of working with fund administrators regardless of your fund structure.

Saves your firm time and resources

Working with a fund administrator instead of trying to manage accounting in-house can save a firm time and money. This is because fund administrators are laser-focused on all the back-office functions and can be less costly than adding a full-time finance expert to your team.

Provides expertise and experience

A great fund administrator can provide funds with expertise based on working with dozens or even hundreds of VC firms. This can save less experienced GPs from costly accounting, legal, or capital transaction mistakes.

Assists with investor relations management

A fund administrator should provide timely and accurate communication to LPs. When fund administrators are executing well it should make the lives of the LPs easier which reflects positively on the fund.

Provides compliance and regulatory support

Since fund administrators have worked with hundreds and potentially even thousands of VC funds of varying stages, they’ve been exposed to many of the edge cases that could cause an inexperienced fund to make costly mistakes that could hurt their reputation. Fund administrators are well-versed in Venture Capital regulation and compliance which means GPs can leverage their fund administrators’ expertise when questions arise.

When is the optimal time to start working with a fund administrator

While not always required, it’s a good idea to start working with a fund administrator before even closing your first fund. This ensures your back office operations are set up for success right from the beginning. Many fund administrators have special pricing for emerging fund managers that makes it more affordable to get started.

Looking to improve your portfolio monitoring processes at your fund?

Visible streamlines the way you keep your companies’ financial KPI’s and investment data up to date and organized so sharing key information with service providers like your fund admin becomes even easier.

investors

Reporting

Operations

A Simple Breakdown of the VC Audit Process

VC Audit Definition

Before we address best practices it's important to define what the VC audit entails. A VC audit is when a Venture Capital firm enlists a third-party auditor to evaluate its financial compliance. The auditor will review key fund documentation alongside recent portfolio performance to ensure the firm's valuations are accurate.

Which VC Firms Require an Audit

On August 23, 2023 the SEC approved new rules for private fund advisers. The changes will require all SEC-registered private fund advisers to have an annual audit regardless of size. Prior to this change, some funds were considered exempt but it was still common for VCs to conduct an audit to help better position the firm for future fundraising from potential LPs who want to see audited financials.

Purpose of an Audit

The purpose of a VC audit can be summarized in three parts:

Ensure the fund’s General Partner(s) are operating in accordance with the fund’s LPA and that the financials reflect compliance

Confirm the fund’s valuations of portfolio companies and the fund’s ownership position in them

Give LPs confidence that a neutral third party validates the fund’s financial statements and assessment of its own success

General VC Audit Timeline

Audits are typically conducted on an annual basis using end-of-year figures. The audit process typically starts in the final month of the calendar year and wraps up during the first quarter of the calendar year.

Although audits only happen once per year, it’s important to maintain clean records of things like company valuations, company financial metrics, fund expenses, capital calls, and other transactions throughout the year. Continual hygiene of fund records translates into a smoother audit process at the end of the year.

Here's a general timeline for the VC audit process:

Q1 - Q4 - Collect portfolio company KPI's and monitor valuation changes

Q4 - Establish audit timeline with fund admin and auditor. Additionally, the pre-audit process should kick off so auditors have a chance to understand a firm's operations.

Q1 - In January, firms should be doing year-end valuations and closing their books. During this month fund managers should also be reviewing the books before sending the final figures to an auditor. During January or February, the audit process officially begins.

Q2 - April 30 is the official audit deadline but extensions to the deadline can be requested.

For more audit best practices check this webinar co-hosted with Visible and Weaver -- How to Prepare for Your Fund Audit.

How to Prepare for a VC Audit

Choosing an Audit Firm

This is an important step in setting yourself up for audit success. When choosing an auditor it's important to choose a service provider who specializes and understands the nuances of Venture Capital. Otherwise, you risk spending time during the audit process having to teach your auditor about your industry. You can do this by checking out their website and if they have published resources on Venture Capital then this is a great indication that they have knowledge of your industry. You should also ask the team you'll be directly working with whether they have experience in the VC industry.

If you're an emerging manager and expect to need hand-holding during the audit process, make sure you choose an auditor who is open for ad-hoc questions. During the diligence process, you should ask the auditor about their policy for asking questions and if there is an additional charge.

Related Resource: Five Simple Steps Key Venture Capital Staff Can Take to Support a Successful Audit

Establishing a Valuation Policy

It's a great idea to establish a valuation policy before your first audit. This policy outlines how your firm will justify its portfolio company valuations under different circumstances.

Related resource: Establishing a Valuation Policy

Preparing the Required Documents and Information

While not a comprehensive list, here are some of the items that funds will likely be asked to provide to auditors:

Limited Partnership Agreement

Financial statements

Fully signed deal documentation

Invoices to prove the firm is charging LPs for permitted expenses

Transaction records (capital calls, distributions, bank balances)

Updated ownership positions in each company (cap tables)

Proof of valuation calculations/policies

Portfolio company contacts (name and email address)

Portfolio company financials (year-end)

Portfolio company financing documents from most recent rounds

Portfolio company balance sheets

Portfolio company revenue reports

An established valuation policy

Pro Tip: Ensure you are sending your auditor the fully executed (signed) version of the documents. Doing this will help cut down time during the audit process and help firms save money.

Hustle Fund reminds investors in this article Fund Audit 101 – Everything You Need To Know that it’s the job of the VC to provide this information to auditors and that the required documentation can change from year to year. It can be helpful to ask your auditor to provide quarterly updates about what they will be asking for during the annual audit.

Related Resource: 8 Questions to Ask Before Auditing Your First Venture Capital Fund

Monitoring Portfolio Companies Using Visible

One of the most time-consuming parts of the audit process is the back and forth that can occur when auditors need more evidence on how the VC firm arrived at company valuation figures. To justify valuations, it's important to have key information from your portfolio companies at the ready. Check out the list below to see what you need to have on file.

Portfolio monitoring audit checklist:

Revenue budget vs actual

Cash on hand

Burn rate

Company performance vs business plan

Details about the last round of financing

Visible equips investors with a founder-friendly way to ask for key audit information from portfolio companies. Visible's Request feature allows for any custom metric, qualitative question, files, properties, and more. This streamlined approach to data collection helps VC firms keep up-to-date and accurate records about their portfolio companies throughout the year — leading to a smoother audit process.

Check out an Example Request in Visible.

More than 400+ VCs use Visible to streamline their portfolio monitoring and reporting.

investors

Metrics and data

Reporting

Streamlining Portfolio Data Collection and Analysis Across the VC Firm

Many Venture Capital firms struggle to efficiently collect updates from their portfolio companies and turn the data into meaningful insights for their firm and Limited Partners. It’s usually a painful process consisting of messy Google Sheets or Excel file templates being sent to companies. Then, someone at the VC firm is responsible for the painful task of tracking down companies and convincing them to send the metric template back to the investor. The end result is typically an unreliable master sheet that isn’t accessible or easy to digest for the rest of the firm.

Visible has helped over 350+ VC firms streamline the way they collect, analyze, and report on their portfolio and fund performance. Keep reading to learn how.

Streamlining Portfolio Data Collection

To set up a more efficient portfolio data collection process at your firm make sure you:

Don't require companies to manage another login

Visible’s data Requests are delivered directly to your companies’ email inboxes and the secure-linked base form ensures there is no friction in the data-sharing process.

Maintain founder privacy

Visible supports over 3.5k founders on our platform and the consistent feedback we hear is founders do not want their investors to have direct access to their data sources. Founders prefer to have control over what and when their data is shared with investors.

Customize which information you request from companies

Visible allows investors to create any custom metric, qualitative question, yes/no response, multiple choice, and more. This provides investors with the flexibility to use Visible for more than just financial reporting but also impact or diversity reporting and end-of-year audit preparation.

Related resource: Portfolio Monitoring Tips for Venture Capital Investors

Related resource: Which Metrics Should I Collect from My Portfolio Companies

Easy Ways to Analyze VC Portfolio Data

While having up-to-date, accurate investment data is important, being able to extract and communicate insights about your portfolio data is when it really becomes valuable. Visible supports three different types of dashboards to help you analyze your portfolio data more easily.

Flexible portfolio company dashboards — Visualize KPI’s by choosing from 9 different chart types and combine with rich text and company properties. These dashboards are a great fit to help facilitate more robust internal portfolio review meetings.

Portfolio metric dashboards — This dashboard allows you to compare performance across your entire portfolio and easily identify your top performers and the companies who may need additional support.

Fund analytics dashboards — This flexible dashboard lets investors control how they want to visualize and analyze their fund performance metrics. Choose from over 30+ fund metrics and auto calculated insights and easily add them to your shareable dashboard.

View an example of all three types of dashboards by downloading the resource below.

Sharing Portfolio Updates with Limited Partners

It’s important to remember that while Limited Partners are primarily focused on financial returns they also care about insights. VC firms who empower their Limited Partners with updates about sector trends and high-level insight into portfolio company performance are setting themselves up to be both trusted and valuable long-term partners to their investors.

LP Update Template Library — Visible makes it easy for firms to make engaging communication with Limited Partners a habit by providing free and open-source Update templates. Want to feature your LP Update template in out library? Get in touch!

Tear Sheets — Tear Sheets or One Pagers can be a great way to provide high-level updates about portfolio companies to your LPs. Visible’s tear sheet template solution helps VC firms create reporting with ease by merging information and data into beautiful charts that are automatically kept up to date.

View Tear Sheet examples to inspire your next reporting.

Related resource: Tear Sheets 101 (and how to build one in Visible)

Visible supports 400+ funds around the world streamline the portfolio data collection, analysis, and reporting process.

investors

Customer Stories

Reporting

[Webinar Recording] Leveraging portfolio analysis to improve your fund’s IRR

A recent poll of VCs shows that some of the primary reasons investors collect financial data from portfolio companies is to improve their post-investment support (66%) and inform future investment decisions (44%). To do this well, investors need to be able to analyze their portfolio company data through an advanced financial lens so they can extract actionable insights that lead to improved fund performance.

We recently sat down for a conversation on Leveraging Portfolio Analysis to Improve your Fund’s IRR with Kristian Marquez, CFA. Kristian is the CEO of FinStrat Management and a Chartered Financial Analyst (CFA) charterholder since 2004.

The webinar was designed for people working in Venture Capital who want to level up the way they understand and analyze their portfolio companies’ financial performance data.

Topics Discussed:

The WHY behind surfacing portfolio insights

Where to find benchmark data and how to use it

Top 4 performance indicators, what they mean, and how to calculate them

Using dashboards in Visible to evaluate portfolio company performance

Tips for moving from analysis to action

investors

Reporting

[Webinar Recording] VC Portfolio Data Collection Best Practices

Collecting updates from portfolio companies on a regular basis is an important part of running smooth operations at a VC firm. Well-organized, accurate, up-to-date portfolio data helps investors provide better support to companies, make data-informed investment decisions, streamline the audit process, demonstrate credibility during the fundraising process, and more.

However, collecting data from portfolio companies on a regular basis can also be a time-consuming, arduous process, especially if you’re not implementing best practices.

On Tuesday, June 20th Visible held a product webinar covering tips for streamlining the reporting process for you and your portfolio companies.

This webinar is designed for any VC looking to upskill their portfolio monitoring processes. Current Visible customers will benefit from a deep dive into recent product updates related to Visible’s Request feature.

Topics Discussed:

The top 6 most common metrics to collect from companies

How to collect budgets and actuals in Visible

Using formulas so you can ask for less data

[Product Walk-through] Highlighting recent product updates

Reviewing examples of different types of Portfolio requests

investors

Customer Stories

Reporting

Case Study: How Render Capital Uses Visible to Streamline Fund Reporting

Render Capital is a $30M early-stage VC fund with offices in Kentucky and Indiana. Led by Patrick Henshaw, Render has invested in 50+ companies as a part of its mission to create a robust and thriving regional economy where entrepreneurs see the Midwest and South as a place they can find appropriate risk capital necessary for them to start and grow.

For this case study, Visible interviewed Render Capital’s Operating Partner Mike Shepard.

Customer Story: How Render Capital Uses Visible to Streamline Fund Reporting

Watch the video below to learn why Render chose Visible to streamline their portfolio monitoring and reporting processes.

Prefer to read? Keep scrolling to read a paraphrased summary of Mike’s responses.

Q: How were you collecting data prior to using Visible?

Prior to Visible, Render was doing very little to collect data from companies because it was too time-consuming to do it via email and the process wasn’t very organized.

Q: What factors led you to choosing Visible?

We looked at other software to help with our fund management and the options seemed cumbersome, the relationships were tricky, and it seemed like it was actually going to be more work. I wanted to find a solution that let me pair our fund management alongside our own metrics so we could do our own reporting by creating dashboards and sharing those with LPs. We also liked that Visible helped collect reporting from our companies on a regular basis.

Q: What was the onboarding with Visible like?

I filled out a spreadsheet with our company and investment data. I prefer to be hands-on so the next step was just figuring out how to set up my own LP Update templates and reports. Visible was available to answer all my questions and the team was open to our feedback.

“It feels like we’re your only customer which is what you’re supposed to do.”

– Mike Shephard, Operating Partner at Render Capital

Q: What has been the result of using Visible

The results have been great. I created an LP Update template which we consider a marketing extension of our brand. To get this to look nice outside of Visible, in Excel, would have taken me a lot of time. I can use the template I created in Visible over and over again and it automatically updates. Our LPs are also really happy with the direction of our reporting and what we’re producing. We are getting our LPs the information that they want and need in a format that they can easily digest.

Over 350+ VC funds are using Visible to streamline their portfolio monitoring and reporting.

investors

Reporting

Metrics and data

Flexible Dashboards for Venture Capital Investors (with examples)

As a venture capital investor, it’s critical to maintain accurate, up-to-date information about your portfolio companies and investment data. This helps investors make data-informed investment decisions, provide better portfolio support, fulfill audit requirements with relative ease, and not to mention, impress LPs.

What’s even better than just having your data well-organized and easy to find, is when investors can seamlessly turn that data into meaningful insights that are easy to share with internal team members and stakeholders.

Below we describe three different dashboard types supported in Visible that help investors surface and communicate important updates about their portfolio.

Flexible Dashboards for Internal Portfolio Reviews

Flexible dashboards in Visible allow investors to integrate metric data, investment data, and properties directly into a dashboard. The flexible grid layout means investors have control over how they want to visualize and communicate updates to their team.

Investors commonly use these dashboards to facilitate internal portfolio review meetings which keeps their team up to date and engaged about important updates across the portfolio.

View flexible dashboard examples in the guide below.

Fund Performance Dashboards for Communicating with LPs

Visible allows investors to track, visualize, and share key fund performance metrics. Investors can choose from 14+ different chart types and use custom colors to incorporate their branding into their dashboards.

The fund metrics supported in Visible include:

TVPI

DPI

RVPI

MOIC

IRR

Unrealized and realized FMV

Total Invested

Capital Called

and more.

Learn about the 30+ fund metrics supported in Visible.

Related resource: VC Fund Performance Metrics 101

View a Fund Performance Dashboard example in the guide below.

Portfolio Metric Dashboards for Cross-Portfolio Analysis

As a venture capital portfolio grows, it’s helpful for investors to be able to pull quick insights across all their companies. Visible’s Portfolio Metric Dashboards let investors compare performance across the entire portfolio for a single metric. This view can be filtered by a custom segment and time period. Visible also automatically calculates quick insights such as:

Total

Min

Max

Median

Quartiles

View a Portfolio Metric Dashboard in the guide below.

Visible’s dashboards give investors control over how they want to track and visualize their portfolio KPIs and investment data. Learn more about Visible.

investors

Product Updates

Reporting

Unlocking Venture Capital Portfolio Insights with Dashboards

If your portfolio data is patched together in an excel file with questionable version control or is buried in a slide deck prepared six months ago, your team is likely missing the opportunity to take action on important portfolio insights.

Up-to-date, accurate portfolio insights help venture capital investors:

Provide better portfolio support

Make data-driven investment decisions

Validate markups and markdowns during evaluation exercises or an audit

Demonstrate traction to LPs while fundraising for future funds

…but only if the insights are accessible.

Visible’s dashboards help venture capital investors visualize and explain the journey companies are on in a way that actually resonates.

Learn more about leveraging dashboards in Visible.

About the Guide

This guide demonstrates how venture capital investors can turn their portfolio data into actionable, accessible insights. The guide also includes examples of three different flexible dashboard types in Visible.

Topics covered include:

Portfolio data collection best practices

Creating dashboards for internal portfolio reviews (Flexible dashboards)

Identifying cross-portfolio insights (Portfolio metric dashboards)

Sharing portfolio insights with Limited Partners (One pagers)

Visible has helped over 350+ venture capital funds streamline the way they collect, analyze, and report on core metrics from their portfolio companies on a regular basis.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial