Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Reporting

Cap Table: What It Is, Why It’s Essential for Startups, and How to Create One

A well-maintained cap table is one of the most critical tools for startup founders navigating the complex world of equity and ownership. As a startup grows, managing and understanding equity distribution becomes essential for making informed decisions, attracting investors, and maintaining transparency. A clear cap table can help founders visualize ownership, anticipate dilution, and ensure accurate fundraising. Whether you’re preparing for investment rounds, employee stock options, or future exits, having a reliable cap table is crucial for your startup’s financial health and long-term success.

What Is a Cap Table (i.e., Capitalization Table)?

A cap table, or capitalization table, is a detailed spreadsheet or document that outlines a startup's equity ownership. It provides a breakdown of all the company’s securities, including common and preferred shares, options, warrants, and convertible instruments. Each entry typically includes details such as the type of security, the number of shares issued, the names of shareholders or stakeholders, and their ownership percentage.

Cap tables also help illustrate how ownership evolves over time, especially after significant events like fundraising rounds, employee stock option grants, or equity transfers. A comprehensive cap table allows founders, investors, and employees to understand who owns what portion of the company and how that ownership could be diluted in future scenarios.

Related resource: Emerging Fund Managers You Want on Your Cap Table

What Is the Difference Between a Cap Table and a Term Sheet?

While both a cap table and a term sheet play crucial roles in a startup’s equity management and fundraising, they serve distinct functions and provide different types of information.

Cap Table:A cap table is a current snapshot of a company’s ownership structure. It details all the securities issued, such as shares, options, warrants, and convertible notes, and specifies who owns them. The cap table evolves with each new investment, equity issuance, or employee stock grant. It helps founders and investors understand who owns what percentage of the company, track dilution, and plan for future fundraising.

Term Sheet:A term sheet is a forward-looking proposal provided by an investor during a funding round. It outlines the terms and conditions of a potential investment, such as the amount of capital being invested, the company’s valuation, equity percentage, liquidation preferences, voting rights, and other key terms. A term sheet is non-binding (except for certain confidentiality or exclusivity clauses) and serves as the basis for negotiating and drafting the final investment agreement.

In summary:

The cap table is a snapshot of the company’s current equity structure.

The term sheet sets the groundwork for future changes to the cap table based on agreed-upon investment terms.

Both documents are critical during fundraising, but they address different aspects of the process- one tracks equity, and the other negotiates terms.

Related resources:

6 Components of a VC Startup Term Sheet (Template Included)

Navigating Your Series A Term Sheet

Why Is a Cap Table Important for Startups?

A cap table is essential for maintaining transparency, managing equity, and making informed business decisions as your startup scales. It provides a clear view of who owns what, how ownership changes over time, and the potential impact of future investments or stock option grants. For founders, a cap table helps protect against excessive dilution and ensures strategic equity allocation. It offers investors insight into the company’s ownership structure and potential risks. Without an accurate and up-to-date cap table, startups can face challenges during fundraising, audits, or key financial decisions, making it a foundational tool for growth and sustainability.

Understanding the Ownership Breakdown of Founders, Investors, and Employees

Founders must always be aware of what their cap table means for ownership of their company. Understanding ownership is critical as the company grows and develops. Cap tables tell investors who owns what part of a company. Current investors want to see who has control. They also want the ability to forecast potential payouts and dilution under specific scenarios based on the ownership split. The breakdown of ownership in a startup can affect the company's overall value for future fundraising rounds, as well as who needs to be at the table for certain critical company decisions.

Related Resources:

How to Fairly Split Startup Equity with Founders

Understanding Contributed Equity: A Key to Startup Financing

Monitoring Equity Value and Tracking Company Valuation

Monitoring equity value and tracking company valuation are crucial for both employees and investors. An up-to-date cap table provides a transparent view of how much the company is worth and how each stakeholder’s equity is affected by funding rounds, option grants, or changes in ownership.

A well-maintained cap table helps all stakeholders understand how ownership changes, ensuring alignment and confidence in the company’s growth trajectory. By consistently monitoring equity value, startups can facilitate fair and transparent equity management, essential for long-term success.

For Employees: Employees who hold equity, such as stock options, need to understand the potential value of their shares. A detailed cap table helps them see how their ownership stake evolves over time, providing clarity on the potential value of their equity and how it may be diluted with new investments. This transparency can also increase motivation and align their interests with the company’s growth.

For Investors: Investors rely on the cap table to evaluate their ownership percentage, potential returns, and dilution risk. By tracking the company’s valuation over time, investors can assess whether their investment is growing in value and determine how future funding rounds will impact their stake. Accurate valuation data also informs strategic decisions during follow-on investments or exit planning.

Facilitating Fundraising Rounds with Transparency and Accuracy

In addition to current investors utilizing a cap table for forecasting and dilution predictions for different investment outcomes, potential investors and future fundraising can also be affected by cap tables. By viewing a cap table, potential investors can evaluate how much control and leverage could be maintained during negotiations. Historical insight provided in a cap table can affect negotiating current valuation for new funding raises. Additionally, an existing shareholder can easily determine what percentage of the company to give to the new investors in exchange for the capital contributed.

Preparing for Financial Audits and Regulatory Compliance

Maintaining an accurate and up-to-date cap table is essential for startups to ensure compliance with legal and regulatory requirements. Regulatory authorities and auditors often require companies to present their cap tables annually, ensuring adherence to legal standards and facilitating processes such as capital rounds and ownership changes.

A well-maintained cap table provides a transparent record of the company's equity structure, which is crucial for:

Regulatory Filings: Accurate cap tables are necessary for filings with regulatory bodies, such as the Securities and Exchange Commission (SEC), to comply with securities laws and regulations.

Tax Reporting: Proper documentation of equity ownership and transactions ensures compliance with tax obligations and helps avoid penalties and legal issues.

Investor Relations: Transparency in equity distribution builds trust with investors, demonstrating responsible management and adherence to legal standards.

Why Do Investors Want to See the Cap Table?

Investors want to review a startup’s cap table because it offers a comprehensive snapshot of the company’s ownership structure. This transparency is crucial for assessing risk, understanding equity dynamics, and making informed investment decisions. A well-maintained cap table helps investors evaluate several key aspects:

Equity Distribution: Investors can see how ownership is split between founders, employees, and previous investors. This helps them gauge how much control the founding team retains and identify any potential risks related to future decision-making authority.

Dilution Risk: The cap table reveals how new investments might dilute existing ownership. Investors need to understand how their stake may change in future funding rounds and whether the current equity structure leaves room for sustainable growth.

Investor Rights and Preferences: A detailed cap table shows who holds preferred shares, warrants, or convertible instruments. This helps investors understand potential liquidation preferences and voting rights, which can affect exit strategies and return on investment.

Potential Red Flags: A cap table can highlight any irregularities, such as over-diluted founders or complicated equity structures that might hinder future fundraising.

What Does a Cap Table Look Like?

A cap table typically takes the form of a spreadsheet or specialized software-generated table that organizes the company's equity information clearly and structured. It generally includes stakeholders in rows and types of equity details in columns, making it easy to see who owns what and how much. For more complex startups, the cap table can include additional details like option pools, convertible notes, and transaction history.

Key components of a cap table often include:

Shareholder Names: Lists founders, employees, investors, and other stakeholders who hold equity in the company.

Number of Shares: The total number of shares each stakeholder owns.

Type of Security: Categories like common shares, preferred shares, stock options, warrants, or convertible instruments.

Ownership Percentage: Each stakeholder's proportional ownership of the company based on their share count.

Investment Date: The date each stakeholder acquired their shares or invested in the company.

Valuation Details: Information on the price per share and company valuation at each investment round.

Image source

Does a Cap Table Show Debt?

A cap table does not typically show debt. Rather, it is specifically designed to track a company's equity ownership structure, detailing shares, options, warrants, and other equity instruments. Its primary function is to outline who owns portions of the company and how ownership is distributed among stakeholders like founders, employees, and investors.

However, while debt is not shown on a cap table, certain debt-related instruments might be included if they have the potential to convert into equity. For example:

Convertible Notes: These are debt instruments that convert into equity at a later stage, often during a future funding round. Convertible notes are generally tracked on the cap table because they will eventually affect ownership percentages once converted.

SAFEs (Simple Agreements for Future Equity): Similar to convertible notes, SAFEs are agreements where investors provide funding in exchange for the right to future equity, and they typically appear on the cap table before conversion.

Traditional loans or other forms of debt (e.g., bank loans, lines of credit) are tracked separately in the company’s financial statements, such as balance sheets, rather than on the cap table. This separation helps maintain clarity between the company’s equity structure and its liabilities.

Related resources:

The Startup's Handbook to SAFE: Simplifying Future Equity Agreements

SAFE Fundraising: When to Consider & Benefits

Information to Include in a Cap Table

There is no fixed format for a cap table, but a comprehensive cap table should include key components that provide a clear picture of the company's equity structure. These components ensure transparency for founders, investors, and employees, helping to avoid misunderstandings and potential errors during fundraising, audits, and strategic planning. Here are the essential elements to include:

Shareholders and Stakeholders: A list of all individuals and entities that hold equity in the company, including founders, employees, angel investors, venture capital firms, and advisors. This helps identify who owns portions of the company and their respective roles.

Equity Details: Information on the type of equity held, such as common shares, preferred shares, stock options, warrants, and restricted stock units (RSUs). Each entry should specify the number of shares issued and any associated terms.

Valuation and Ownership: Details on the company's valuation at different stages (e.g., pre-money and post-money valuations) and the percentage of ownership each stakeholder holds. This helps illustrate how equity is distributed and how ownership changes with new investments.

Option Pool: The number of shares allocated for current and future employees as part of an equity incentive plan. The option pool is important for understanding potential dilution and planning for new hires.

Related resource: The Essential Guide to Option Pools: Definition, Purposes, and Benefits for Startups

Convertible Instruments: Any convertible notes, SAFEs (Simple Agreements for Future Equity), or other instruments that may convert into equity in the future. These should include details such as the conversion terms, amounts, and potential dilution impact.

Transaction History: A record of all equity-related transactions, including issuance dates, purchase prices, investment rounds, and transfers. This historical data is crucial for maintaining accuracy and demonstrating compliance during audits.

Restrictions and Agreements: Information on any restrictions or agreements related to equity, such as vesting schedules, buyback rights, or shareholder agreements. This helps stakeholders understand the conditions attached to their equity and any limitations on transferring shares.

How Do You Make a Cap Table?

Cap tables can be created and managed in a variety of ways. Typically, it is common for new startup founders to build their initial cap table in a spreadsheet. However, as your startup grows and the valuation and stakeholders get more involved and complex, a simple cap table design in a program like Excel won’t work.

Some companies will use tools like CapShare or Carta, to build and manage their cap tables. These tools are typically more dynamic and less manual than managing via Excel. They can be easier to utilize to share out and circulate with employees and investors.

In other scenarios, it might make the most sense to outsource the production and management of a cap table. When founders choose to self-manage their own cap table, they are susceptible to risks. Some of these risks include miscalculating valuations, which can lead to giving up too much equity and over-diluting shares in new investment rounds. Additionally, there might be tax consequences or legal issues arising from the mismanagement of a cap table. By outsourcing the production and management of a cap table. Typically, this management is outsourced to a legal team to ensure accuracy and compliance. Outsourcing is more expensive than managing with a software but can be much less expensive at the cost of major mistakes or miscalculation of value.

How to Use a Cap Table?

When using a cap table, it’s important to understand the following formulas:

Post-Money Valuation = Pre-Money Valuation + Total Investment Amount

Price-Per-Share = Pre-Money Valuation / Pre-Money Shares

Post-Money Shares = Post Money Valuation/ Price-Per-Share

Investor Percent Ownership = Investor Shares / Post-Money Shares

These formulas are essentially what will be laid out in a cap table so understanding them is crucial. These formulas can also be used to update the cap table as it grows more complex via different significant financial rounds.

The more investment rounds or other significant financial changes on the table, the more complex the cap table gets. This breakdown essentially showcases the additional steps and participants who are stakeholders in the startup.

Founders round – this is the simplest version of the cap table and will typically showcase the simple split of equity between the founders of the company.

Seed round – this introduces investors to the table who now own a portion of the company along with the founders and have given cash to the startup altering the overall value.

Options pool round – when options are provided for new employees, this changes the value and breakdown of the company as represented by the cap table. Overtime, as more employees are hired and more options are granted, the more complex the cap table gets.

VC round(s) – With any additional funding rounds taken on by the startup, the valuation drastically changes as does the list of stakeholders on the cap table.

All of these events or rounds are significant and will change the breakdown and complexity of the cap table.

How Do You Keep a Cap Table Updated?

With the array of cap table management tools on the market, updating and keeping tabs on your cap table is easier than ever before. Generally, founders need to stay on top of their cap table management. If you raise a new round, offer new employee grants, terminate an employee, etc., you need to make the changes as soon as possible to avoid future headaches.

If you put off updating your cap table in real-time, it could end up being a costly mistake as you need a lawyer to update and correct the table.

To make your life as easy as possible, we recommend using software to manage and update your cap table. There are countless options, but we recommend Pulley. You can learn more about cap table management (and Pulley) in our Founders Forward Podcast with Pulley CEO and Founder Yin Wu here.

Cap Table Examples/Templates

Instead of starting from scratch, many founders will use a template to build out a cap table. Check out these templates below:

1. S3 Ventures Template

S3 Ventures offers a template in Excel that they recommend for their portfolio companies.

2. Eqvista Template

Eqvista's template includes ownership structure and the capital committed.

3. Cap Board Template

Cap Board's template is a basic cap table on Google Spreadsheet, with formulas included, that can be used for any early-stage startup.

4. CFI Template

CFI’s has many free excel templates. The spreadsheet below contains two sections – valuation and ownership. All numbers in blue are hard-coded assumptions and all numbers in black are formulas.

Manage Your Stakeholders Effectively with Visible

Effectively managing your cap table is essential for maintaining transparency, building investor confidence, and making informed decisions. With Visible, you can streamline your stakeholder communication by centralizing key data, sharing investor updates, and tracking interactions- all in one platform. Visible makes it easy to keep investors informed and engaged while helping you stay organized and focused on growth.

Ready to simplify stakeholder management? Give it a free try for 14 days here.

founders

Fundraising

Reporting

Venture Capital vs. Angel Investors: Which Path Is Right for Your Startup?

Every startup founder eventually faces the critical decision of how to fund their business. Once you’ve determined that raising capital is the right path, the next step is deciding which type of investor best fits your needs: venture capitalists or angel investors. Both offer unique advantages and challenges depending on your growth stage, funding goals, and long-term vision. Whether you're a first-time founder or new to fundraising, understanding the differences between these two funding sources is key to making an informed decision. In this guide, we’ll explore the distinctions between venture capital and angel investors and provide practical advice on when and how to approach each.

What Are Venture Capitalists?

Venture capitalists (VCs) are investors who provide funding to early-stage, high-potential startups in exchange for equity, or ownership shares, in the company. They typically operate through venture capital firms that pool money from various sources to create a managed fund. These sources include high-net-worth individuals, institutional investors, corporations, and other entities known as limited partners (LPs). LPs provide the capital but leave the investment decisions to the general partners (GPs), who are the venture capitalists managing the fund. LPs expect a return on their investment, while GPs use their expertise to identify and invest in startups that show the potential for rapid growth and high returns.

How Venture Capital Works

Venture capital funding follows a structured process, typically broken down into different stages, known as funding rounds. Startups generally progress from seed funding to Series A, B, C, and beyond, with each round representing increased capital raised and expectations for growth.

In the early stages, startups may receive seed funding from venture capital firms to help develop their product and prove the concept. As the business gains traction, it moves into larger rounds, such as Series A, which is used to scale the company, grow its team, and expand into new markets. Later rounds, like Series B and C, focus on further growth and scaling, often leading to an eventual exit via an IPO or acquisition.

Venture capitalists conduct due diligence before investing, analyzing the startup’s market opportunity, product potential, and founding team’s expertise. In exchange for their investment, VCs receive equity in the company and often take an active role in guiding its growth, such as by joining the board of directors.

VCs expect startups to have high growth potential and scalability, with the ability to disrupt existing markets or create entirely new ones. In return, they seek significant returns on their investment, typically aiming for 10x or more. This expectation drives VCs to focus on companies that can scale quickly and potentially become “unicorns”—startups valued at over $1 billion.

Related resource: What to Include in a Data Room for Investors: Essential Guide for Startups

Advantages of Venture Capital

Venture capital offers several advantages for startups looking to grow rapidly and achieve significant market impact:

Access to large capital: One of the primary benefits of venture capital is the ability to raise substantial amounts of funding. This is especially valuable for startups in capital-intensive industries like technology, biotech, or hardware, where scaling requires significant resources.

Strategic support: Beyond providing funding, VCs often offer strategic guidance and mentorship. With their deep industry knowledge and extensive networks, venture capitalists can help startups refine their business models, access key markets, and connect with potential partners, customers, or even future investors.

Opportunities for rapid scaling: With large capital infusions, startups can accelerate their growth by hiring top talent, expanding into new markets, and investing in product development. Venture capital funding enables companies to pursue aggressive growth strategies that might otherwise be out of reach with smaller funding sources.

Credibility and visibility: Securing venture capital from a well-known firm can serve as a strong endorsement for a startup, boosting its credibility with customers, potential employees, and future investors. Increased visibility can help open doors and attract additional opportunities.

Disadvantages of Venture Capital

While venture capital can offer substantial benefits, there are also significant downsides that founders should carefully consider:

Dilution of ownership: In exchange for large sums of capital, VCs take equity in the company. As a result, founders often see their ownership stake reduced, especially after multiple funding rounds. This dilution can leave founders with a smaller percentage of the company over time, even if the valuation increases.

Loss of control: Venture capitalists frequently require a seat on the board and may have a say in key decisions, such as company strategy, hiring, and exit planning. This can limit the founder’s autonomy and introduce differing priorities, especially if the VC’s goals do not fully align with the founder’s vision for the company.

Pressure for quick exits: VCs typically seek a return on their investment within 5-10 years, often through an acquisition or IPO. This pressures startups to grow and scale rapidly, potentially leading to decisions focused on short-term gains rather than long-term stability. Founders may feel pushed toward an exit strategy earlier than they are comfortable with.

High expectations: Because VCs are looking for significant returns, they expect startups to achieve rapid growth. This can lead to increased stress and pressure on founders to hit aggressive milestones, often at the cost of the company's culture or long-term sustainability.

Related resource: Our Guide to Building a Seed Round Pitch Deck: Tips & Templates

Key Differences Between Angel Investors and Venture Capital

While both angel investors and venture capitalists provide funding to startups, they operate in distinct ways and cater to different stages of growth. Angel investors tend to invest earlier, often with a more personal and flexible approach, whereas venture capitalists come in during later stages, offering larger sums of capital and more structured involvement. Understanding these key differences is crucial for founders as they decide which type of funding is best suited for their startup’s needs, growth goals, and long-term vision.

1. Investment Stage

Angel investors typically enter the picture at the earliest stages of a startup’s development. They often provide funding during the seed stage, when a company is just starting out and may not yet have a fully developed product, steady revenue, or proven market fit. Angels are often willing to take on higher risks and support startups in their infancy, helping founders turn ideas into viable businesses.

On the other hand, venture capitalists usually invest during later stages of growth. Startups that seek VC funding have typically moved beyond the idea phase and are beginning to scale, with some level of market validation and revenue generation. VC funding often comes into play in Series A rounds and beyond, when larger sums of capital are required to fuel rapid expansion, hire additional talent, or enter new markets.

2. Investment Amount

One of the most notable differences between angel investors and venture capitalists is the amount of money they typically invest. Angel investors usually provide smaller sums, often ranging from $25,000 to $100,000 per deal, though in some cases, they may invest up to $500,000. Their investments are generally sufficient for startups in the early stages, such as covering product development, initial hiring, or early marketing efforts.

Venture capitalists, on the other hand, invest much larger amounts. For example, in a Series A round, VC firms may invest anywhere from $1 million to $10 million or more, depending on the company’s potential and the firm’s investment thesis. As a startup progresses to later rounds (Series B, C, etc.), the investment amounts can increase significantly, often reaching tens or even hundreds of millions. This capital is geared toward aggressive scaling, including market expansion, large-scale hiring, and product development.

3. Level of Involvement

Angel investors often take a hands-on, personal approach to the startups they fund. Since many angels invest their own money, they tend to be more emotionally invested in the company's success. Angels frequently provide personalized mentorship and guidance, leveraging their experience to help founders navigate early challenges. In some cases, angel investors might even have direct relationships with the founders, allowing for a more informal, collaborative dynamic. This personal involvement can be highly beneficial for early-stage startups that need both financial support and hands-on advice.

Venture capitalists, by contrast, tend to have a more structured and strategic role. While VCs may offer mentorship and strategic guidance, their involvement is often more formalized, especially in later stages. VCs usually sit on the board of directors and participate in high-level decision-making, helping shape the company’s long-term strategy, product direction, and scaling efforts. However, VCs are often less involved in day-to-day operations, leaving the founders and executive team to manage the company’s execution.

4. Risk Tolerance

Angel investors tend to have a higher risk tolerance compared to venture capitalists. Since angels often invest in the earliest stages of a startup, they are accustomed to backing unproven business models, nascent products, and founders who may not have extensive experience. For angel investors, the potential for high returns justifies the risk, and they are often willing to take a chance on innovative ideas or disruptive technologies that might not yet have market validation. This willingness to take on higher risk makes angel investors particularly valuable for startups still in the idea or prototype phase.

On the other hand, venture capitalists typically seek more proven business models. While VCs are still taking significant risks, they generally prefer startups that have already demonstrated product-market fit, some level of revenue, and the ability to scale. By the time a venture capital firm invests, the company’s risks are more related to execution and growth rather than proving the core viability of the business. VCs conduct extensive due diligence to mitigate these risks and look for startups with a clear path to substantial returns.

5. Decision-Making Process

The decision-making process for angel investors is typically quicker and more informal than venture capitalists. Since angels often invest their own money, they can make independent decisions based on their judgment and intuition. This can result in faster funding decisions, especially if the angel investor has a personal connection with the founder or is passionate about the industry. Angel investors may rely less on extensive due diligence, instead placing greater trust in the founder's vision and potential.

Venture capitalists, on the other hand, follow a more formal and rigorous decision-making process. Since VCs manage funds from limited partners, they must ensure each investment aligns with the fund’s strategy and risk tolerance. VCs typically conduct thorough due diligence, which involves analyzing the startup’s financials, market opportunity, product, and team. This process can take several weeks or months as VCs carefully vet the company to minimize risk. Additionally, decisions are often made by an investment committee, further adding to the complexity and formality of the process.

6. Exit Strategy

The exit strategies of angel investors and venture capitalists differ significantly in terms of flexibility and expectations for returns. Angel investors generally have more flexible exit strategies because they are often motivated by factors beyond financial returns, such as a personal passion for the business or a desire to support entrepreneurs. Angels may be satisfied with smaller exits, such as when the company is acquired or returns a modest profit. They are often open to longer timelines and may not push for an aggressive exit, allowing the startup more room to grow at its own pace.

Venture capitalists, however, typically have more specific and ambitious exit goals. Since VCs are responsible for delivering high returns to their limited partners, they often aim for significant exits through initial public offerings (IPOs) or large acquisitions. VCs usually operate on a timeline of 5-10 years to realize their returns, and they push for scaling and growth that align with these exit strategies. As a result, venture capital-backed companies are more likely to pursue aggressive growth plans to meet the high return expectations of their investors.

When to Pitch Venture Capitalists

When considering venture capital, it’s essential to understand the structure of a VC firm. Venture capital firms are typically divided into general partners (GPs), who manage the firm and make investment decisions, and limited partners (LPs), who provide the capital but don’t participate in the decision-making. Limited partners may include wealthy individuals, insurance companies, pension funds, and foundations.

VCs are looking to invest in startups that have the potential to deliver outsized returns. They aim to secure a spot on the Power Law Curve, where a small percentage of companies generate most industry returns. For this reason, VCs are often searching for unicorns- startups with a valuation over $1 billion- that can provide exponential returns on investment.

When pitching to VCs, it’s important to know what they are looking for: a strong combination of product, market, and team.

Product: VCs want to see a product that stands out and has the potential to dominate its market. Your product should be a "need to have," not just a "nice to have."

Market: A large market opportunity is crucial. The larger and less saturated the market, the better. However, being too early in an untapped market can also pose risks for VCs.

Team: A talented and experienced founding team can be a key differentiator. VCs are more likely to take a risk on a startup led by seasoned industry veterans or entrepreneurs with a proven track record of success.

If you’re confident in your product, the market you’re entering, and the team you’ve built, pitching to venture capitalists could be the right move for your startup.

When to Pitch Angel Investors

While VCs are looking for that perfect mix of Market, Product, and Team and always searching for the elusive unicorn to double or triple their money, Angels may be a better bet if you’re extremely small and looking to get started vs. scale rapidly. Typically, angels offer better terms for investment. Angels of course still look for returns. However, they may also invest because they are passionate about the space, and because it’s their money directly, are more open to investing in an idea that will potentially just make them their money back in order to help a new entrepreneur get off the ground. Funding rounds with angel investors are often called “friends and family” rounds because its much more common for individuals to invest in those they care about and believe in vs. the biggest and best ideas.

Angel investors are better to pitch to when your company is extremely early stage. When starting the company look to close friends, family, and professionals that can make a small investment and when you’re ready to scale quickly and take more risk after you’ve proven your concept a bit more, turn to VCs.

Recommended Reading: The Understandable Guide to Startup Funding Stages

Manage Investor Relationships Effectively with Visible

Choosing between angel investors and venture capitalists depends on your startup’s stage, funding needs, and long-term goals. Angels typically invest early and offer flexible terms, while VCs provide larger sums for rapid scaling but expect high returns and growth. Understanding the key differences—such as investment size, risk tolerance, and exit strategies—will help you make informed decisions about which type of funding best suits your business.

As you prepare for your startup’s next steps, ensure you stay connected with potential investors using Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Resource: Top 6 Angel Investors in Miami

founders

Reporting

The Most Common Update Content Blocks

Best-in-class founders use investor updates to help with hiring, fundraising, strategy, and more. To help understand what is included in their Updates, we took a look at our own data.

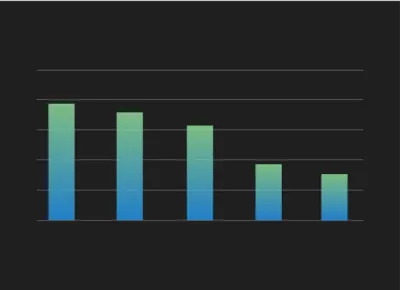

The Most Common Content Blocks

We recently launched Content Blocks for Updates. Content Blocks allow you to pick different text sections to build out an investor update template. The following have been the most commonly used Content Blocks:

81% of Updates include “Highlights”

47% of Updates include a “Team” section

42% of Updates include “Product Launches”

42% of Updates include a “KPIs” section

39% of Updates include a “Fundraising” section

At the end of the day, sending investor updates on a regular basis is what matters most. Every business is different so be sure to use the content and data that is most relevant to your business.

Send an Update with Visible

Start crafting your investor update using content blocks below:

founders

Reporting

Navigating Pro Rata Rights: Essential Insights for Startup Entrepreneurs

Understanding pro rata rights is essential for startup founders navigating the complex world of venture capital. These rights, often included in SAFE (Simple Agreement for Future Equity) agreements, allow investors to maintain their proportional ownership as the company raises more capital. Pro rata rights help prevent dilution of investor shares, ensuring their initial investment value is preserved. For founders, comprehending these rights is crucial as they influence funding strategies, investor relations, and equity distribution, ultimately impacting the company's growth and stability.

What Are Pro Rata Rights?

Pro rata rights are provisions that allow investors to purchase additional shares in a company during future funding rounds to maintain their proportional ownership. These rights are crucial in preventing dilution, which occurs when new shares are issued, reducing the percentage ownership of existing investors. By exercising pro rata rights, investors can avoid a decrease in their ownership stake due to subsequent investments by new or existing investors. For startup founders, understanding pro rata rights is essential as they play a significant role in attracting and retaining investors, ensuring fair equity distribution, and supporting the company's growth trajectory.

Related resource: Pre-money vs Post-money: Essential Startup Knowledge

How Do Pro Rata Rights Work?

Pro rata rights are negotiated and agreed upon during the initial funding rounds of a startup. They grant investors the option—but not the obligation—to participate in future funding rounds by purchasing additional shares. This allows investors to maintain their initial ownership percentage as the company raises more capital.

When a startup plans a new funding round, it notifies investors with pro rata rights about the opportunity to invest. These investors can then decide to buy enough new shares to keep their ownership stake proportional to their original investment. Pro rata rights are especially common in early-stage investments, providing a mechanism for investors to support the company's growth while protecting their equity stake.

Shareholder Dilution

Shareholder dilution occurs when a company issues new shares, reducing the ownership percentage of existing shareholders. Pro rata rights directly address this issue by giving investors the ability to buy additional shares and maintain their proportional ownership. Without these rights, existing investors would see their ownership diluted as new investors come on board and additional shares are issued. For founders, managing dilution is critical as it affects the company's equity structure and investor relations. Pro rata rights help ensure that early investors, who took on initial risks, are not disproportionately disadvantaged in future funding rounds.

Pro Rata Rights Example

Pro rata rights are generally calculated on a percentage basis (example below) but there are rare circumstances where they can be calculated on a dollar basis.

Investor ABC invested $100,000 at a $1,000,000 valuation (with pro rata rights) into Startup XYZ and owns 10% of the company.

Startup XYZ is raising a future round at $2,000,000 valuation. Because of dilution, Investor ABC will now own less than 10% of the company.

If Investor ABC exercises their pro rata rights, they will have the option to buy enough shares to maintain 10% ownership in Startup XYZ.

Related resource: Deal Flow: Understanding the Process in Venture Capital

Legal and Financial Implications

Understanding the legal and financial implications of pro rata rights is crucial for startup founders. These rights can significantly impact your company's equity structure and future funding strategies.

Legal Aspects of Pro Rata Rights in Investment Agreements

Pro rata rights are typically outlined in investment agreements during the early stages of fundraising. These agreements legally bind the startup to offer existing investors the option to purchase additional shares in subsequent funding rounds. It is essential for founders to clearly define the terms and conditions of pro rata rights in these agreements to avoid any future disputes. Consulting with a legal expert to draft and review these terms is a best practice to ensure that all parties understand their rights and obligations.

Financial Implications for the Startup’s Equity and Capital Structure

The exercise of pro rata rights impacts the startup's equity and capital structure. When investors exercise these rights, they inject additional capital into the company, which can be beneficial for funding growth and operations. However, allowing investors to maintain their ownership percentage can limit the availability of shares for new investors, potentially affecting the valuation and attractiveness of the startup to future investors. Founders must carefully balance the need for new capital with the rights of existing investors to maintain a healthy and appealing equity structure.

Best Practices for Compliance and Transparency

By following these best practices, founders can foster trust with their investors, ensure legal compliance, and maintain a balanced capital structure that supports the startup's growth.

Clear Documentation: Ensure all terms related to pro rata rights are explicitly stated in investment agreements.

Regular Communication: Keep investors informed about upcoming funding rounds and their pro rata rights well in advance.

Legal Review: Periodically review investment agreements with legal counsel to ensure they comply with current laws and regulations.

Equity Management: Use reliable equity management tools to track ownership stakes and the exercise of pro rata rights accurately.

Related resource: Seed Funding for Startups: Our Complete Guide

Alternatives to Pro Rata Rights

While pro rata rights are a popular mechanism for protecting investors' ownership stakes in startups, there are several alternative strategies that founders can consider. These alternatives offer various benefits and protections for investors, and can sometimes be more appealing depending on the specific circumstances of the startup and its funding strategy. Here are some key alternatives to pro rata rights:

1. Pre-emption Rights

Pre-emption rights provide investors with the first opportunity to purchase new shares before they are offered to other investors. This mechanism ensures that existing investors can maintain their ownership percentage in the company if they choose to invest additional capital.

These rights are particularly valuable for early investors who have a vested interest in the company's growth and success. By exercising pre-emption rights, these investors can increase their stake and continue to play an influential role in the company's development. This not only secures their investment but also strengthens their commitment to the company's long-term vision.

For founders, offering pre-emption rights can be an attractive proposition to early investors, as it demonstrates a commitment to protecting their interests and encouraging their ongoing participation. This can help build strong, supportive relationships with investors who are more likely to provide additional funding, guidance, and resources as the company grows.

2. Drag-Along and Tag-Along Rights

Drag-along and tag-along rights are provisions that give investors the ability to sell their shares alongside existing investors during specific events, such as an acquisition or an initial public offering (IPO).

Drag-Along Rights: These rights allow majority shareholders to compel minority shareholders to join in the sale of the company under the same terms and conditions. This ensures that the sale can proceed smoothly without minority shareholders blocking the transaction, which can be crucial for achieving favorable terms in a sale.

Tag-Along Rights: These rights enable minority shareholders to join a sale initiated by majority shareholders. This means that if a significant shareholder sells their stake, minority shareholders can sell their shares on the same terms, ensuring they are not left behind in a potentially lucrative deal.

Both drag-along and tag-along rights offer significant security and liquidity for investors. They protect minority investors by ensuring they can participate in major liquidity events, thereby aligning their interests with those of majority shareholders. This alignment can incentivize investors to remain committed to the company over the long term, as they have assurances that they will not be excluded from important financial opportunities.

For founders, offering these rights can make the company more attractive to investors by providing clear exit strategies and promoting investor confidence in the company's governance and future prospects.

3. Participation Rights

Participation rights are similar to pro rata rights but come with a key difference: they allow investors to invest a specific amount in future funding rounds, rather than an amount proportional to their current stake. This predetermined amount can be beneficial for both startups and investors in several ways.

For startups, participation rights offer greater flexibility in managing their capital structure and equity distribution. By agreeing on a fixed investment amount in advance, founders can better plan for future funding needs and avoid unexpected dilution. This also simplifies the process of raising new capital, as the terms of additional investments are clearly defined from the outset.

For investors, participation rights provide the opportunity to continue supporting the company without the need to maintain a proportional ownership percentage. This can be particularly appealing for investors who want to stay involved and benefit from the company's growth but may not have the resources or desire to increase their investment significantly in later rounds.

Participation rights balance the interests of startups and investors, offering a structured yet flexible approach to future investments. They help ensure ongoing support and involvement from early investors while allowing the company to navigate its funding strategy more effectively.

4. Discounted Future Rounds

Offering discounted future rounds is another strategy startups can use to attract and retain investors. This approach involves providing investors with a discount on the share price in subsequent funding rounds, serving as an incentive for them to participate.

For investors, discounted future rounds present an attractive opportunity to secure additional value from their investment. By purchasing shares at a reduced price, investors can potentially enhance their returns if the company continues to grow and increase in value. This incentive can be particularly appealing to those looking to maximize their investment gains and maintain their support for the company over the long term.

For startups, offering discounted share prices in future rounds can be an effective way to secure necessary funding more easily. This approach can make the investment more appealing, especially in competitive markets where multiple startups are vying for capital. Additionally, by incentivizing existing investors to continue their support, startups can foster strong, ongoing relationships with their investor base, which can be beneficial for future fundraising efforts and overall growth.

5. Convertible Notes with Liquidation Preference

Convertible notes with liquidation preference are an effective fundraising tool for startups, offering a blend of flexibility and investor protection. These financial instruments convert into equity based on specific terms during a future funding round or other triggering events, such as an acquisition.

Convertible Notes: The primary advantage of convertible notes is that they allow startups to raise capital without setting an upfront valuation. This is particularly beneficial in the early stages when accurately valuing the company can be difficult. The notes typically convert into equity at a later date, often at a discount to the future share price or with a valuation cap, ensuring early investors receive favorable terms.

Liquidation Preference: Adding a liquidation preference to convertible notes provides additional security for investors. In the event of an exit, such as a sale or liquidation of the company, investors with liquidation preference are prioritized for repayment before common shareholders. This helps protect their investment if the company's exit value is lower than expected or if the company faces financial challenges.

Benefits for Startups:

Fundraising Flexibility: Startups can secure needed funds quickly without the pressure of determining a valuation prematurely. This flexibility can be crucial in fast-paced or uncertain market conditions.

Investor Attraction: The combination of potential equity upside and downside protection through liquidation preference makes these notes attractive to investors, increasing the likelihood of securing capital.

Aligned Interests: Offering favorable conversion terms and repayment priorities helps align the interests of investors and startups, fostering strong and supportive investor relationships.

6. No Dilution Protection

Some startups choose not to offer any dilution protection to their investors. This approach can streamline the negotiation process and expedite fundraising, as it removes the need to discuss and agree upon complex terms related to ownership percentage maintenance and future share purchases.

Advantages for Startups:

Speed and Simplicity: Without dilution protection, the fundraising process can be faster and less complicated. This simplicity can be beneficial for startups needing to secure capital quickly or wanting to avoid lengthy negotiations.

Flexible Capital Structure: By not committing to dilution protection, startups maintain greater flexibility in managing their equity and capital structure. This can be advantageous when navigating multiple funding rounds and dealing with various investor demands.

Disadvantages for Investors:

Less Attractive in Competitive Markets: In markets where startups are vying for investor attention, the lack of dilution protection can be a significant drawback. Investors may prefer opportunities that offer safeguards for their investment, such as pro rata rights or other dilution protections.

Increased Risk: Investors without dilution protection face the risk of their ownership percentage being significantly reduced in future funding rounds. This potential dilution can diminish their influence and the value of their investment, making the opportunity less appealing.

For founders, the decision to forego dilution protection should be weighed carefully. While it can simplify and accelerate the fundraising process, it may also limit the pool of interested investors, particularly those seeking more security for their investment. Balancing the need for speed and simplicity with investor expectations and competitive market conditions is crucial for successful fundraising and long-term growth.

Why Are Pro Rata Rights Important to Investors?

Pro rata rights are often seen as a main advantage for early-stage venture firms and investors. The ability to follow on and maintain their ownership percentage is vital to the firm’s ability to make an exponential return on their investment.

Investors often have different views about extending their pro rata rights. For example, Point Nine Capital guarantees they’ll invest in any of their portfolio companies’ Series A round. As Christoph Janz, Managing Partner at Point Nine, explains:

In ~ 80–90% of cases, we want to do our pro-rata anyway.

In ~ 5-10% of cases, we don’t want to but kind of have to, to prevent harm from the portfolio company due to bad signaling.

Committing to our pro-rata in the remaining ~ 10% might lead to some sub-optimal capital allocation, but this will be far offset by all the other advantages.

On the flip side, angel investors or smaller firms may not have the capital to continue to invest and choose to waive their rights. However, firms like Point Nine may not have the option to continue to invest, even if they would like to.

According to Fred Wilson, Founder of Union Square Ventures, “In the last ten or so years, companies, lawyers, boards, management teams, founders, and in particular late-stage investors have been disrespecting the pro rata right by asking early-stage VCs to cut back or waive their pro rata rights in later stage financings.”

When a company sets out to raise a later round, the company is likely doing well, so allocations get tighter. The only way for these later firms to get their desired piece of the pie is to ask early-stage investors to hold back from investing.

Understandably, this can be a major point of disappointment and frustration for early-stage firms, as they’ve taken the risk of investing early, which helped make it possible for the company to grow. Ultimately, a pro rata right is a legal obligation and is seen as an agreement a founder is expected to live up to.

When Would an Investor Waive Their Pro Rata Rights?

As mentioned earlier, there are instances where an investor might waive pro rata rights:

Lack of Capital: If raising at a later stage or high valuation, some early-stage investors with pro rata rights simply might not have enough capital to invest.

Poor Data: If an investor does not believe in the company or its investment ability, they might pass.

Against Thesis: Sometimes a fund has an investment thesis that might keep capital or ownership constrained, so they might waive their rights.

Build Meaningful Relationships with Your Investors

Founders can leverage monthly investor updates to tap into their investor’s network, capital, and experience to move their business forward. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Understandably, pro rata can be a tough conversation for both founders and VCs. On one hand, a pro rata right is a legal contract and something investors should expect to be honored when the time comes. While on the other hand, founders are getting pulled in every direction and are obliged to make the right decision for their company.

As Mark Suster puts it, “Make sure you have an open conversation with your early investors about their interest in participating in subsequent rounds as those fundraisings become imminent and that might range from ‘Are you willing to show some support in the next round, which might be important to incoming investors?’ to, ‘Are you willing to step back a small amount from pro rata to make room for new investors if need be?’ Knowing how your investors are thinking is critical as is open communication.”

The simplest way to keep all parties happy? Form a relationship and have the difficult conversations before you’re put in a tough spot under the wire. Founders, don’t be afraid to have open and difficult conversations with your investors. They are invested in what is best for your company as well.

If investors are not aware of a portfolio company raising funds and the potential for a new investor taking a larger percentage, there is clearly something broken in the communication process by both parties. A simple way to up your communication skills? A monthly investor update. Try Visible free for 14 days.

founders

Reporting

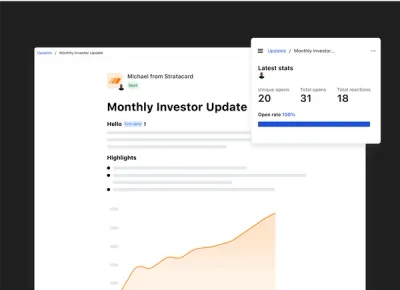

How To Write the Perfect Investor Update (Tips and Templates)

What is an Investor Update?

An investor update is a document that includes recent wins and losses, financials, team updates, customer wins, and core metrics. They are typically shared via email but can also be shared via PDF, deck, or link.

For many startup founders, investor updates are shared every month but can also be shared on a quarterly (or more frequent) basis. Learn more about why and how to create investor updates for your business below:

Why Send Investor Updates?

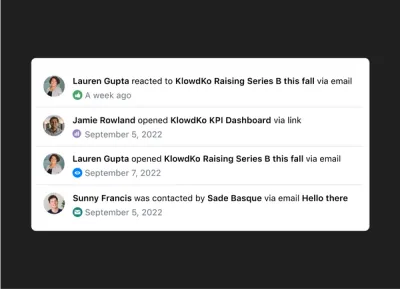

Step into the shoes of your investors and it will help understand the importance of investor updates. Put simply, an investor’s (venture capitalist) job is to deploy limited partners’ capital by investing in startups, generate excess returns, and pay back their limited partners with the hopes of doing it again. This means that an investor’s success hinges on the success of their portfolio company. Put simply, your investors need you to succeed.

Your investors likely have other investments and can’t be expected to know exactly where to help each company. In a crowded space building, strong relationships centered on trust and transparency is an easy way to stand out amongst other startups. By sending regular investor updates you can stay top of mind for your investors and tap into their knowledge, resources, and capital to continue to grow your business.

Below you will find our guide to help you write the perfect investor update by understanding what metrics and data to share, properly asking for help, sharing big wins and losses, and raising additional capital. We’ve also included 7 of our favorite investor update templates.

Related resource: What is a Capital Call?

Essential Communication

We believe that regular communication with investors and important stakeholders is key to a startup’s success. If your investors don’t know what’s going on in your business, they don’t know how to help. Building a reporting cadence with your investors is a great way to promote transparency and build a relationship focused on trust.

Related Reading: Should You Send Investor Updates?

Follow-On Funding

One of the biggest reasons to report to your investors is the increased likelihood of follow-on funding. In our own research, we have found that companies that regularly communicate with their investors are twice as likely to raise follow-up funding.

Try Visible to find investors, track your raise, share your deck, and update investors. Give it a free try for 14 days here.

Networking Opportunity

Generally speaking, investors' networks often have had experience as an operator and investors. Tapping into their network can be an easy way to find introductions to investors, partners, potential hires, and mentors. Getting an investor to go to bat for you will likely carry a bit more weight. As Tomasz Tunguz, VC at Redpoint Ventures, states;

“Investors network frequently, work together, and have long-term relationships with each other so a referral should go a long way.”

Finding Talent

In hand with tapping into their network, investors are a great resource when it comes to hiring top talent. Between their other portfolio companies and previous experience most investors likely know a number of solid candidates to fill a role. If they don’t have someone in mind for the job, they can at least help talk you through the different candidates you are weighing for an open position.

Knowledge and Experience

Between their own experience and other portfolio companies, investors have seen just about anything. If you have an operational or tactical question investors are a great resource and can lend experience and knowledge.

Related Resources:

Our 15 Favorite Newsletters for Startup Founders

How to Write the Perfect Investment Memo

3 Tips for Cold Emailing Potential Investors + Outreach Email Template

Accountability & Reflection

One of the often overlooked benefits of sending monthly investor updates is the reflection and accountability it offers founders. Investor updates can be a great forcing function for founders to look back at the previous month or quarter and better understand what is and is not working for their business.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Tips For Writing Investor Updates

Investor updates can be a tricky balance between informing investors and keeping things succinct and digestible. Most things boil down to keeping your updates consistent and regular.

Keep the Cadence Consistent

If you commit to sending a monthly update, you'll want to make sure you stick to sending an investor update every month. Skipping an update when times are tough can be a negative signal to investors.

Keep Metrics the Same

Make sure to keep the metrics you are tracking stay the same from month to month. For example, if you are calculating net new MRR using a certain formula, keep that consistent from month to month.

Stick to a Format

When creating an update, sticking to a regular format or template is a great way to help get the ball rolling every month. If you're not sure where to get started, we studied our data to understand the most popular components founders include when using our investor update software, check it out below:

81% of Updates include “Highlights”

47% of Updates include a “Team” section

42% of Updates include “Product Launches”

42% of Updates include a “KPIs” section

39% of Updates include a “Fundraising” section

Investor Update Templates: Examples For Your Next Update

Sending your first investor update can be a daunting task. We believe that the best place to learn is from someone who has been there before. Luckily, countless founders and investors have shared their templates and best practices for sending investor updates.

We suggest starting with a template you like and tweaking it to your needs (more on this later). Once you’ve found your format, it is all about making sure you keep tabs on the data and context so you are not scrambling when it is time to send. A couple of small steps when sending your first Update:

Gather your data — As you should be sharing other a few metrics with investors, it is important to keep tabs here. These should be vital to your business and something that you have on hand at all times.

Review the month — A perk of sending an investor update is the ability to look back at the previous month. Think about any major highlights, lowlights, areas you need help, so you can start to craft your Update.

Add context — Sharing your data without context can be dangerous. Do your best to explain any metric movements.

Send it — Getting your update sent out a consistent basis is a win. If you’re looking to get an idea of when founders using Visible send their Updates, check out our post, “Most Popular Times to Send Your Investor Update.”

1. Techstars Minimum Viable Update

In the “Minimum Viable Investor Update”, Jens Lapinski, Former Managing Director of Techstars METRO, lays out 3 items that he finds most useful in his portfolio early-stage company monthly updates.

2. Founder Collective “Fill-in-the-Blank” Investor Update Email Template

An investor Update template for busy founders put together by the team at Founder Collective. Simply fill out the bolded sections and have your investor Updates out the door in no time.

3. Kima Ventures Investor Update Template

An Update template put together by Jean and the team at Kima. Quickly fill in the quantitative and qualitative data Kima finds most useful.

4. GitLab Investor Investor Update Email Template

A 6 part template put together by the team at GitLab. Built for investors to quickly read and locate the information that is most relevant to them.

5. Y Combinator Investor Update Template

An investor update template from Aaron Harris of Y Combinator. Aaron recommends highlighting repeatable key performance indicators (KPIs) and major asks for your investors.

6. Shoelace: Investor Update Email Template

A template based off of Reza Khadjavi’s, Founder & CEO of Shoelace, investor update email used to wow investors.

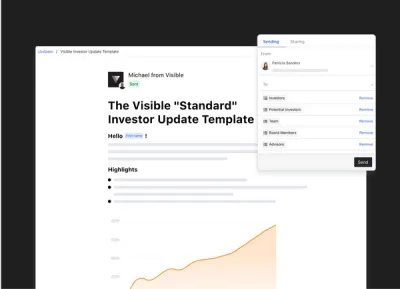

7. The Visible “Standard” Investor Update Email Template

Our Standard Monthly Investor Update template put together from best practices and tips from Visible users.

For more ideas, check out our investor update template library here.

Related Reading: 4 Items to Include in Your Next Investor Update (If You Want to Drive Engagement)

8. Bread & Butter Ventures Update Template

Bread & Butter Ventures is an early-stage VC firm based in Minnesota investing globally while leveraging their state and region’s unparalleled access to strong corporate connections, commercial opportunities, and industry expertise for the benefit of our teams. Learn more about what Brett Brohl of Bread & Butter Ventures likes to see in an Update below:

Sharing Metrics and Data

Determining what metrics and key performance indicators (KPIs) to share with your investors can be tricky. There are a slew of different key metrics and different investors may have their eyes on different things. Changing metric names or what you are reporting can be an easy way to break trust with investors. At the end of the day, it is most important that you share the same metrics from month to month. And as we’ve discussed before, it is okay to share bad months!

We suggest sharing a handful of key performance indicators (KPIs) with your investors. Depending on your relationship, some may only want to see 3 metrics while others may want to see 10. Talk with your investors and discuss what types of key metrics they’d like to see. A couple of examples are churn rate, number of active users, monthly recurring revenue (MRR), burn rate, and more.

Related reading: Startup Metrics You Need to Monitor

Every company has missed the mark and any investor is aware that this happens. Building a company is hard! With that being said, we do have a few areas where investors would expect some data:

Revenue

Being able to generate revenue is essential to a business. However, you determine to measure revenue should be kept consistent from month to month. For example, don’t share bookings one month and revenue the next. For SaaS companies, including your monthly recurring revenue (MRR) and the movements are always good to include as well.

Cash Flow

Cash is king. Cash is the lifeblood of your business and investors expect some insight into how their capital is being managed and used. This is also a great way for you as a founder to stay accountable and on top of your spending as you continue to grow your business.

Burn Rate

As we mentioned above, cash is king. By tracking and reporting your burn rate, you will be able to avoid surprises with investors. A common mistake we see founders make is surprising their investors when their cash balance is low and months to 0 is nearing. Sharing your burn rate is an easy way to build trust with your investors and give them a better idea of when you’ll need to raise a new round.

Margins

Generating solid margins is a must for any successful business. Except the “gig economy,” Frank Mastronuzzi of Greenough Consulting Group suggest that every business should have at least a 55% margin. While likely more important during a fundraise, sharing your margins will help investors evaluate your COGS and acquisition costs.

Number of Active Users

Depending on your company goals and KPIs, the number of active users could be valuable to understanding growth.

Churn Rate

Being able to keep your burn rate under control is an easy way to grow your business. In the early days, some investors may want to keep close tabs on burn rates to understand what part of your funnel may be lacking.

Customer Acquisition Costs

Being able to efficiently acquire and expand customers is a surefire way to grow. Without a sustainable way to acquire new customers, a business will struggle to grow or even exist.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Sharing Wins and Losses

One of the most exciting aspects of being a founder is sharing and celebrating your victories. As we all know, with every victory comes plenty of losses. Investors are keyed in on your success so it is important to stress both wins and losses equally.

Sharing Wins/Highlights With Investors

Sharing your company’s accomplishments is generally pretty straightforward. Share why and how you accomplished your goal and carry on. Investors generally won’t be able to move the needle for your wins but is best to keep them informed so they can signal to their network of your successes.

Most important is to call out individual contributors when it comes to sharing major accomplishments. All employees like to be recognized for their contributions and there is no greater place to do so than in front of your outside stakeholders.

Along the lines of sharing individual kudos, it is also a great time to highlight new hires. A shout-out to new hires will make offer them a warm welcome and the chance to open up to investors.

Sharing Losses/Lowlights With Investors

The most dreaded and arguably the most important aspect of an investor update; sharing losses. Startups are hard and everyone involved with the process knows this. It is vital that you key your investors into any troubles you are facing and why you are facing them. We find it best to layout the lowlight and offer a solution to improve this moving forward (If you do not have a solution read on to the “Asking for Help” section below).

Generally speaking, nothing is ever as good or as bad as it seems. Sharing bad news is an easy way to strengthen your relationship with investors and they know you’ll be open and honest with them moving forward. Most importantly, this gives your investors an opportunity to step in and help to keep you moving in the right direction.

Related Reading: How to Deliver Bad News to Investors

Asking Investors for Help

Last but certainly not least is asking your investors for help. While every section mentioned above lends itself to asking questions, it is most important to lay out actionable questions where you believe your investors can help.

By laying out a pointed list of areas you could use help, you can easily tap into your investors’ network, resources, experiences, and capital. A couple of key areas we see founders have the most success:

Related Resource: Navigating Investor Feedback: A Guide to Constructive Responses

Closing Deals

From our article, “You Should be Asking Your Investors for Help. Here’s How.”

“At its core, building a VC-backed business is about generating revenue. The biggest value add for a business? Closing more deals. Your investors are in the “deal-making” business and likely have a knack for closing deals.

Use your investor’s professional networks to make an intro, set a meeting, or bring in the necessary backup to close a large deal. If you see your investor has a specific connection you’re looking for, don’t beat around the bush. Ask the investor for the exact intro you’re looking for and tell them how they can be of most value.”

Help With Hiring

Talent is the resource every company is in competition for on a daily basis. Any tool or resource you can use to find top talent for your business is worth leveraging. Investors generally happen to help fill an open role and often have an extensive network to do so. Be specific as possible about the role, as well as items like the experience level required, and target compensation to make it low-maintenance for your investors.

Pro tip: Include a direct link to a LinkedIn search that fits the criteria of the person you’d like to hire to make it easy as possible for investors.

Fundraising

One of the main reasons to send investors monthly updates is the increased likelihood of raising follow on funding. If you have properly communicated with investors, chances are they will be more enthusiastic to invest in your next round. We have found that companies that regularly send investor updates double their chances of raising follow on funding. When it comes down to it and an investor has to make a decision between 2 investments; 1 that has been communicating and 1 that has not been communicating. It is easy to go with the one that has been transparent and has made an effort to build a relationship.

Even if your investors are not interested in committing follow-on capital, they may be able to introduce you to other investors they know. Investors know other investors. Venture capital is a tight-knit community and one positive recommendation can make waves.

Related Resource: 9 Tips for Effective Investor Networking

Pro tip: Include a light version of your pitch deck that investors can circulate with investors they can make an intro to.

Recommended Reading: How to Write the Perfect Investment Memo

Investor Update Template Real Life Example

If you’ve browsed through our investor update template, you’ve probably noticed they share a lot of similarities. Most of the Updates include the sections listed above. Of course, every business is different. The size, stage, and relationship with your investors will impact your Update template.

In order to help you best write an Update, let’s use a real-life example. Let’s say we are a seed stage SaaS company that has recently raised $1M and we are starting to scale revenue:

The Intro

First things first, we need to write an introduction. This can be as personalized or informal as you’d like. We suggest something like the following:

“Hey Investor Name — Hope all is well! I can’t believe August is already in the books. We had a great month that we’ll dig into below. As always, feel free to reply back to this email with any questions or give me a call at 123.456.7890.”

Highlights

We suggest starting with highlights. This will set the tone for the Update and give investors a quick rundown of what is going well for your business. This should include things like new hires, product updates, and growth (always try to quantify if you can!). Here is an example of some company highlights:

We just hired person X to head up our sales team. They bring 10+ years of experience in the space and are going to be a great fit. You can connect with them on LinkedIn here.

We have finally gotten New Product Y out of beta and into the hands of our users. Early signs show a big opportunity. We’ve increased usage by 50% week over week and have already exceeded our quarterly goal of Y users.

Our sales team is on fire! We’ve closed our largest 2 clients to date — Big Name A and Big Name B. Both are great logos and are our largest contracts to date.

Lowlights

Sharing lowlights is never. However, it is a crucial part of building trust with investors so they can help you overcome pain points. Including steps for how you plan to fix the problem is always appreciated. Check out an example below:

We have been struggling to find a customer success leader. We’ve opened up our search to new job boards and are offering a bonus to anyone who refers a new hire. If you know anyone that fits these parameters, please send them our way.

New trials have been lagging behind pace. In order to help get this back on track, we are bringing in an SEO specialist to help us increase website traffic and website-to-trial conversion.

Asks

Ask are potentially the most beneficial aspect on an investor update. As you are requesting help from your investors, be as pointed and direct as possible to make it easier on them. Here are some examples:

Here is our target list of investors for our Series A round and our most up to date fundraising deck. We’re looking for introductions to any of the investors listed in the ‘Research’ stage.

We’re looking for introductions to candidates for this [specific job title] in the [specific industry]. Ideally, this person would work at a company with at least X employees and control his own budget.

Do you know someone I should meet in [specific city]? I’ll be traveling there next month and am trying to fill my calendar.

Metrics

As we mentioned above determining what metrics to share is up to you and your investors. For our example, we’ll focus on a couple of key metrics every company should be tracking. Here is an example of how you might present that data:

KPI 1

As we mentioned earlier, revenue has been cruising this month. It is our best month to date and we’ve closed our largest customers.

KPI 2

As you know, our team has been rallied around improving our True North KPI. Our recent product pushes and GTM campaigns have really paid off as shown above.

KPI 3