Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Pitch Deck Designs That Will Win Your Investors Over

At its core, a successful fundraise comes down to storytelling. Founders need to tell a narrative to investors that piques their interest and ultimately leads to a check down the road. As Kristian Andersen of High Alpha puts it,

“I always encourage founders to start with a story and think about it very fundamentally. Think about it very fundamentally. What is the plot? You have a protagonist, you have an antagonist, you have a climax. That storytelling structure can and should be applied to a pitch.”

Outside of a verbal pitch, there are countless tools you can use to help tell your story. One of the most popular (and important) tools is a pitch deck. A pitch deck can be a powerful visual tool to help fuel your storytelling and increase your odds of a successful raise.

In this guide, we’ll dive into what makes for a well-designed pitch deck. We cover everything from visualizing data to choosing fonts and layouts.

What Makes a Good Pitch Deck Design

A pitch deck is a tool that is used to visualize and assist with your story as you “pitch” a group. For this instance, we’ll be talking about pitch decks and how they apply to a venture fundraise. A pitch deck is a small but important part of a successful pitch and fundraise.

Some investors won’t necessarily require a pitch deck, they are widely accepted (and expected). Some investors, like Gale Wilkinson of Vitalize, are fine with an investment memo, Notion document, or a pitch deck.

If you do decide that building a pitch deck is right for your business, there are a few points to consider:

Do you need a pitch deck?

Why should someone care about your pitch?

How long do you want it to be?

How much context should you give investors before sharing it with them?

How should you balance design vs. content?

To learn more about building a pitch deck, check out this post from the team at High Alpha.

At the end of the day, pitching your company (and building a pitch deck) is an opportunity to talk about your company and your vision — fundraising is incredibly difficult and time-consuming but it can and should be exciting! Lindsay Tjepkema, CEO of Casted, summed it perfectly when she said:

“There’s nothing better than being able to talk to person after person about your company. That’s a great feeling and it’s exhilarating and it’s exciting to be able to share your passion with someone else. That’s also the hardest part because it’s your baby. And when you share something with so many people and you get so many nos, that’s hard.”

Bottling up that passion for your company and vision can be a great backbone when going into creating your pitch deck. You are putting your company on display and want to make sure it is something you are personally confident and proud of.

Related Reading: 18 Pitch Deck Examples for Any Startup

Pitch Deck Designing Best Practices

Different investors will tell you different things when it comes to pitch deck design. Some will say it needs to be polished and perfect. Others will say too well-designed is a signal a founder is spending too much time on it (and not enough on the business).

What you present and share with investors is ultimately up to you but there are a few key focus areas if you’re not sure where to get started with your design:

Keep it Simple

Keeping your pitch deck simple is incredibly important. Investors are likely looking through hundreds or thousands of decks in a given year so keeping it simple and digestible is important. A few tips to keep things simple:

Has a natural flow

Legible fonts

Simple branding

Easy-to-understand data visualizations and images

Media files are digestible

Be Awesome at Storytelling

As we mentioned at the beginning of this post, a pitch deck is ultimately a tool to help you tell your story. You can quite literally think through your pitch deck as you would a story. What is the plot? Who is your audience? Who is the antagonist? Who is the protagonist?

Use Data in Form of Charts and Graphs

As we mentioned earlier, oftentimes simple is better. Charts, graphs, and data visualizations are your friend. They can be leveraged to easily and creatively display key data about your business. However, data without context can be dangerous. Investors are potentially looking through your data without you so make sure it is incredibly clear and can be understood if you’re not in the room with them.

Whenever Possible Use Icons or images

Different icons and images can be useful when trying to convey different messages and points throughout your pitch deck as well. Instead of writing a story of how a customer is leveraging your product, consider using images of them and telling the story yourself.

If you do decide to include images make sure they are high quality. This is true for company headshots and any supporting images throughout your pitch.

Make Your Objective Crystal Clear

If you’re keeping your pitch deck simple you should only be including things that are necessary to your story and pitch. Each slide should be well thought out and have an obvious point or call to action that you are trying to get across. No matter what the content is on a given slide (image, written, video, etc.) the point and intent should be obvious.

Consider Using Different Types of Layouts

You can keep your pitch deck simple but engaging at the same time. Different layouts are a great way to put emphasis on different points and sections of your story and pitch. For example, if you want to highlight a big problem or metric that is exciting, you can use a big splash like the example below:

Or if you want to demonstrate how you’ll be putting capital to use, you can use a timeline like the example below:

Use a Chart to Display Milestones

While a story is a driving force behind a pitch, investors will want to dig into different data points and metrics from your success thus far. Be sure to include charts that show traction or growth. These can be great areas to excite and motivate your investors to move through the fundraise quickly.

Consider a Professional Pitch Deck Designer

Of course, being a founder is incredibly busy. You are building your business, hiring, closing customers, and more so designing your pitch deck might sit on the backburner. In order to help you build a great pitch deck, there are countless agencies and tools out there to help you. Freelancers are a great option or the team at 4th & King has helped founders raise $5B+ with their help.

Related Resource: Our Startup Pitch Deck Template

Pitch Deck Designs Brought to you by Visible

Fundraising and pitching your company is incredibly difficult. No matter where you land on the importance of a well-designed pitch deck, just remember it is an opportunity for you to talk about your company and passion to hundreds of investors. If you’d like to learn more about building your pitch deck, check out our in-depth guide, “Tips for Creating an Investor Pitch Deck.”

Visible is here to help with your next fundraise. Find investors, share your pitch deck, and track your raise all from one place. Try it for free for 14 days here.

founders

Metrics and data

Defining Customer Lifetime Value for Startups: A Critical Metric

Customers are the lifeblood of a business. At the end of the day, a business needs customers and revenue to survive. In order to better help companies understand how customers are interacting and spending with your business, you need to have a set of metrics in place.

Customer lifetime value (CLV) (also referred to as the lifetime value of a customer) is a popular marketing metric to help you understand how much a single customer spends with your business of the lifetime of your relationship. As the team at Shopify puts it, “The lifetime value of a customer, or customer lifetime value (CLV), represents the total amount of money a customer is expected to spend in your business, or on your products, during their lifetime.”

Understanding your CLV is useful because it can help inform your acquisition and go-to-market efforts. It can help you answer questions like:

What is the most money our company can spend on marketing/sales for customer acquisition

What is the most we can spend on customer service to retain an existing customer

Who are the most valuable customers and how can we better target them for future sales?

Related Reading: Startup Metrics You Need to Monitor

Related Resource: Customer Acquisition Cost: A Critical Metrics for Founders

How to Calculate Customer Lifetime Value For Startups

Determining your customer lifetime value is pretty straightforward but can vary depending on the business model and product. In the simplest form, a formula for customer lifetime value is:

CLV = Avg. value of one purchase X number of expected purchases in a given year X length of relationship (in years)

For example, let’s say you sell snowboards. It might look like:

CLV = $500 average order for a customer X 1 snowboard purchased by a customer in a year X 7 years = $500x1x7 = $3500 CLV

If you have a subscription-based or SaaS model, your CLV might look something like this (at a very simple level):

CLV = Avg. Revenue Per Account (ARPA) / Churn Rate

Let’s say you have $100,000 in ARR and 1,000 customers, your ARPA would be $100 a year.

And let’s say you have a churn rate of 5%. Your CLV would be $2,000 ($100/.05).

However, things can get a bit more complicated when you add in things like the expansion and contraction of different accounts.

Why Determining Your Customer Lifetime Value is Important

The formula for customer lifetime value might seem simple enough but you might want to understand why you should be tracking it for your business. Learn more about the advantages of tracking your CLV below:

Advantages of CLV

The biggest advantages of calculating and tracking your CLV are the insights you can uncover. These insights will help you understand your best acquisition channels (more on this below) and how to improve your customer retention rates.

By understanding the value of a customer over the lifetime of your relationship, you’ll be able to better allocate capital and headcount towards different initiatives, channels, and product development.

Historic CLV Vs Predictive CLV

When it comes to calculating and analyzing your CLV there are 2 further formulas and decisions to make. On one hand, you have historic CLV, which is based on existing data that you’ve already collected. On the other sid,e you have predictive CLV which is based on predictions (using data you already have) for how much a customer will spend over their lifetime.

How to calculate historic CLV

Calculating your historic CLV is often more difficult and can be a lagging indicator for success. Simply put, historic CLV calculates all of the transactions and is multiplied by gross margin % over the course of a relationship with a customer. So it looks like something like:

Historical CLV = (Transaction 1 + Transaction 2 + Transaction 3…) X Gross Margin %

How to calculate predictive CLV

Predictive CLV tends to be a better option for most businesses and can be a better interpretation of your CLV. Predictive CLV is more in line with the formulas we shared above and takes a holistic look a the business so you are multiplying your average customer spend by the amount of time they are a customer.

Put Your CLV Calculations to Work

If you’re going to take the time to calculate and track your customer lifetime value, you want to make sure you are getting the most out of it as possible. Check out some of our favorite ways to leverage CLV for growth below:

Prioritize your marketing spend

Arguably the biggest benefit of tracking your CLV is understanding how to better acquire new customers. A higher CLV means you can spend more to acquire new customers. A lower CLV obviously means you can spend less.

This means different channels might be more fruitful or economical for different models. If you have a low CLV, you will need to find more organic and cheaper acquisition channels. If you have a huge CLV, you can use more robust and hands-on channels.

As a general rule of thumb in the SaaS world you want to make sure your CLV:CAC (customer acquisition cost) ratio is at least 3:1. This means that your customer lifetime value is 3x what you are spending to acquire them.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Reduce customer churn and hammer loyalty

One of the highest leverage activities to increase CLV is by lowering churn. If you take our example from the beginning — a SaaS company with CLV of $2,000 ($100 ARPA / 5% churn rate) — and change their churn to 1% you’ll see their CLV goes to $10,000 ($100 ARPRA / 1% churn rate).

By tracking CLV you’ll be able to better understand how you can properly service your current customers to decrease churn and increase loyalty. You might find that if they spend $10,000 over the course of a few years, you can run additional campaigns or offer them a dedicated account manager so they stick around.

Related Reading: What’s an Acceptable Churn Rate?

Design new enterprises that grow the business

If you find a certain segment of your customers or particular product has a particularly high CLV, you can double down. You can find and design new enterprises that could have a higher CLV.

Tips for Enhancing CLV

Tracking your CLV is a small part of the battle. Constantly drawing insights and enhancing your CLV is where the real fun begins. There are a few key areas where you can focus to improve your CLV. Learn more below:

Make Improvements to the onboarding process

A surefire way to increase your CLV is by improving your onboarding process for new customers. This helps in a few different ways.

An improved onboarding process helps to make sure your customers are engaged with your product. In turn, this reduces churn and increases your CLV.

A more engaging onboarding experience is a great way to build a relationship with customers. This can help you expand their account size in the future as they are familiar with your product and team.

Provide high-quality content to your customers

Another great way to increase your CLV is by focusing on high-end content for your customers. This is especially true for SaaS businesses that might rely on a customer to use the product themselves.

By having great and engaging content for your customers they will understand how to use and leverage your product best and will be less likely to churn. A couple of examples:

A knowledge base or support articles that are well written and easy to understand for users.

Videos and tutorials that demonstrate exactly how things can be accomplished in the product.

Stories and insights from other customers that show how the best customers and companies are using your product.

Offer the best high-end customer services

Going hand-in-hand with the points above is offering a superior customer experience. Offering incredible customer service will assure customers they want to stick with your business and will churn at a lower rate.

Build relationships with customers

You might be noticing a trend here — the best way to improve your CLV is by having an incredible customer experience that reduces churn. Building relationships takes a series of approaches. It doesn’t happen overnight but by implementing a few of the ideas from above you’ll be able to strengthen your relationship and build trust with customers — the key to reducing churn and increasing your average revenue per customer.

Track your CLV with Visible

Customer lifetime value (CLV) is an important metric for any business to track. Having a calculated approach to your acquisition and customer support efforts is a surefire way to grow your business and bring in new capital from investors when needed.

Need a place to track your CLV (and other key metrics) and share it with your key stakeholders (like team members, investors, board members, etc.)? Check out Visible. Track key metrics, raise capital, send updates and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

How to Pitch a Perfect Series B Round (With Deck Template)

With an average round size of $58M, a company’s Series B Round is a serious endeavor. Early funding rounds such as pre-seed, seed, or even Series A, are all about showcasing the potential for your business and generating monetary buy-in to make that potential a reality. With a Series B, the stakes are much higher.

A Series B Round is about building on proven momentum and securing further confidence that your business continues to be a strong, fast-growing, and profitable investment for the VCs and private investors participating. Instead of proving to investors why they should help launch or fuel the early potential of your business, a perfect series B round pitch deck is all about demonstrating to investors that your company is a rocketship and this is their ticket to the moon.

Examples of Series B Funding Rounds

Making it to a point in your business where it makes sense to raise a Series B round. With less than 5% of SaaS startups making it past the first year, raising any money at all is a risk and an opportunity most companies don’t even get. With the high growth that is possible with significant Series B funding, it’s important to understand what a Series B round even looks like. We’ve outlined 5 different Series B rounds to explore:

Iterable – $23M

In December 2016, Iterable announced their 23M Series B round. Iterable is a cross-channel platform that powers unified customer experiences and empowers marketers to create, optimize and measure every interaction throughout the customer journey. The company has gone on to continue it’s massive growth raising over $300M to date. . Their 2016 Series B was led by Index Ventures, with participation from CRV and previous angel investors. Per a note from their CEO, the round’s purpose was presented for product-specific innovations alongside marketing, sales, and engineering team growth.

Lattice – $15M

After launching in 2015 and participating in Y-Combinator in 2016, the performance management platform scaled quickly, raising a $15M Series B in 2019. Although on the smaller side of Series B, the investment was led by Shasta Ventures with participation from Thrive and Khosla Ventures as well. At the time of their series B, Lattice had surpassed the 1,000 customer mark – providing incredible credibility and excitement for the investors participating in this round.

Beekeeper – $45M

Beekeeper, the mobile platform for frontline communication, raised a significant Series B to kick off 2021. The Swiss-based company with offices in Poland, Germany, and the US raised this round with a large number of investors participating. The round was co-led by Thayer Ventures and Swisscanto Invest, with participation from other investors including Atomico, Alpana Ventures, Edenred Capital Partners, Fyrfly, Hammer Team, High Sage Ventures, investiere, Keen Venture Partners, Samsung NEXT, Swiss Post, and Swisscom. Beekeeper’s largest target market is the hospitality industry and after the large hit that industry took in 2020, the demand for technology to improve employee retention and effectiveness is more in-demand than ever making the value of Beekeeper higher than ever and a strong catalyst for this funding round.

Evernote – $10M

Throwing it back to 2009 when the financial market was uneasy, Evernote was able to prove enough value in a risky market to raise a $10M Series B. The suite of software for organizing notes and information across multiple platforms has universal appeal with a product-led growth strategy in place. This round was led by Morgenthaler Ventures, with participation from prior investors including DOCOMO Capital and Troika Dialog. Despite their ability to raise funding even in a questionable financial period, Evernote is a cautionary tale of more money, more problems. Despite the resources, they struggled with product decisions, leadership, and execution and have since been surpassed and fallen behind in their space.

Calendly – $350M

To close out the examples, we have to highlight one of the largest Series B rounds in recent memory. Calendly, the modern scheduling platform, raised a staggering $350M at the start of 2021 from OpenView Ventures and Iconiq. Prior to this incredibly large round, Calendly had only raised $550,000 but had 10M monthly users and 70M in subscription revenue last year. Poised as an especially valuable piece of software for the new wave of remote work as the norm, Calendly had the right validation and timing to close out this impressive round.

Related Resource: Best Practices for Creating a Top-Notch Investment Presentation

How to Get Investors Excited About Your Series B Pitch

As a founder, its critical to bring a specific set of qualities and elements to the boardroom for your Series B pitch. The stakes are higher and confidence and preparedness are more critical than ever before. We suggest implementing a few tactics and pre-work steps to ensure the investors you’re pitching get excited by your series b pitch.

Analyze and Prepare

The quickest way you’ll lose credibility with an investing team is by coming unprepared to speak to the numbers. The SaaS metrics of your business should be your guiding light. Know them front to back, run through all the possible questions that each metric could spur. From average deal size to burn rate to ARR, make sure you have it down pat and expect the toughest questions about the data to come your way. If you thoroughly analyze and prepare to present the data completely with clear, data-driven rationale for every business decision and outcome fueling your Series B ask, you will prove major credibility to your potential investors and give them the confidence that their money is going to a team with the business savvy to handle and spend every dollar efficiently.

Lead with Confidence

You’ve got the SaaS metrics of your business down and could recite them in your sleep. However, if your delivery and presence during the pitch fall flat, it might not matter. Confidence is key when executing your Series B pitch. Show that not only do you know your numbers but that you know your business is in fact an extremely valuable business opportunity for these investors to participate in. Nobody wants to invest millions of dollars into a founding team that doesn’t seem to believe they can become a billion-dollar business. SaaS founders don’t become founders because it’s a quick way to make money. Rather, they validate a great idea and take big risks to realize that idea. This takes confidence to do well and that same confidence is critical to bring to the Series B pitch, a big step on the way to this big goal.

Tailor to Your Audience

Typically with a pre-seed, seed, or Series A round the firms you may be pitching are smaller and there might even be more of a focus on individual angel investors or friends and family. With Series B, the opportunity may be present to pitch to much larger, more established firms with prominent and successful investing experience. It’s crucial to keep this in mind and tailor your pitch to this new type of audience. Research your potential investors’ portfolios, understand their previous investments and position in your pitch, how an investment in your company is complementary to their current portfolio and investment style as well as how you add a new value and new opportunity not currently present in their portfolio today.

Understand Your Competition

While competitors can be tough for your sales team to navigate FUD and a pain in the side for your product team to ensure innovation and differentiation, strong competition can actually be a key sign of validation for your business to investors. However, it’s absolutely critical that you understand your competition inside and out for your Series B pitch. Competition shows that there is demand in the market (as there should be if you’re at the point of asking for Series B level money), but if you can’t properly differentiate why you win and why your take on the market is the superior one then an investor may choose to pass and seek out other investment opportunities in your space.

Dig into the metrics of your competition as much as you do your own business. Spend time in your pitch highlighting the competitive landscape and outlining clearly (with confidence) the key differentiators for your biz and how you plan to lead the market. This will show investors that you are keenly aware of challenges and how to analytically approach those threats – showing good business sense.

The Perfect Series B Pitch Deck (Step-by-Step Template)

As with Series A, you might not have a lot of time to communicate your investor pitch or you may be one of the dozens of pitches that a particular investment team is hearing that day. This makes your pitch deck critical to nail. As a starting point, get an idea of strong pitch decks from Seed and beyond to understand the general styles and methodologies that have historically worked well for other SaaS companies. Bonus points if you study successful decks from the portfolios of investors you’re pitching to.

Related Reading: 18 Pitch Deck Examples for Any Startup

We recommend the following flow to ensure you capture the right information and nail your Series B Pitch. Fewer slides is better but each slide can be extended into a second slide as needed:

Problem Slide

Make it crystal clear what large problem exists, with specific emphasis on how big said problem is. Emphasize the metrics of the problem, how expensive is it? What is the potential financial opportunity in this problem space? If you’re asking for a big sum of money to solve said problem, it’s critical to really prove outright from the start of your pitch how critical that problem really is.

Solution Slide

Introduce your company as the solution to that massive problem. Keep it simple with a clear statement of what your company is and how you solve the problem. The solution equals your company and your company’s mission statement is how you aim to solve this massive problem.

Metrics Slide

Why are you worth a fair chance to solve the problem you’ve outlined? With seed or Series A it’s proving that the idea is strong and you have early signs of validation. With Series B, let existing success metrics validate this for you. Showcase significant growth metrics such as customer count, month over month or year over year growth, ARR, etc… Use these numbers to clearly capture and hold attention.

Competitive Landscape and Advantage

Further, call out that the problem your company solves is one worth solving. Highlight the market including any significant competitors, both indirect and direct, and concisely share how your approach to this problem is different and stronger. Further, validate with growth data vs. competitor growth data if possible.

Related Reading: How to Model Total Addressable Market (Template Included)

Product Highlights

Naturally, your potential investors want to see the product but don’t think that means they have time for a full-fledged demo. Share 1-2 slides highlighting how the product works with some screenshots or a quick peek at the live platform. Make it clear how your end-user would interact with the product but don’t feature dump.

Product Roadmap

Talk about the possibility and future of your product. What will you do in the next 6 months, years, 5 years? Highlight how your product evolves with the problem and continue to expand its footprint in your defined space.

Funding Use Plan

Outline how you plan to use Series B funding. For most companies, this is a natural expansion of the product roadmap. However, if you have other growth plans such as hiring etc.. highlight that need to and what that expansion will let you do to scale and make money for your investors even faster.

Team Slide

Prior to closing, make sure to highlight the amazing team you work with. Highlight your executives, the existing board members, and investors. This is a good way to close with credibility and highlight the connections and team supporting what you do.

Closing Slide

Keep your close simple. Re-highlight your company mission and the big problem you plan to solve, thank the investors for your time, and open up for any questions if appropriate.

Prepare Your Investors In Advance

Just as you did with a seed round or Series A, the more you can prepare your investors (or potential investors) ahead of the time set for the actual Series B pitch meeting, the better.

Plan to circulate the deck, a summary of your current terms sheet, high-level company info for new investors, and key metrics no later than 48-hours prior to your pitch. This will ensure that all investors and potential investors have a clear understanding of what your ask is and who your company is today. This pre-understanding will make your time more valuable and even allow investors to come prepared with or share questions before – making the time more valuable and pointed for all. Alongside your series B pitch deck, a simple company introduction deck can prove to be extremely valuable.

How Visible Helps Startups Raise More in Series B

The Series B Pitch is a major milestone for startup founders to achieve. You’ve shown your business is on the right path, have credible early success in the market, and are ready to take on more serious amounts of capital to scale. Mastering the Series B Pitch is possible by following a clear, data-driven, and confident approach, tailoring to your audience, and deeply understanding your competition as the landscape for your space takes off. The Visible pitch deck for a Series B Pitch offers a straightforward template for success with this next-level investment task. Visible is helpful for companies at all stages of growth but especially helpful for founders looking to improve and expand their investor communications. Check out a free trial of Visible – create your account and get started today.

founders

Metrics and data

Breaking Down the Nuances of Annual Contract Value (ACV)

Annual Contract Value (ACV) Defined

Annual contract value (ACV) is the average revenue per customer over a given year. ACV tends to be best for companies with recurring revenue.

For example, if you have 200 customers on average paying $1,000 a month, the ACV is $12,000 ($1,000 x 12 months). Learn more about how to calculate, track, and make decisions using ACV below.

Calculating Annual Contract Value

One of the tricky aspects of calculating and tracking ACV is that there is no hard-set rule or formula. Different businesses will calculate ACV in different ways. The main differences are between what is and is not included.

For example, let’s use our example from above — a company has an ACV of $12,000. This is straightforward and easy to get to with customers paying $1,000 a month on average.

However, let’s say that they also include a $2,000 setup fee (or any one-time fee). Some companies might include this in their ACV, while others don’t. It all comes down to the business and what they believe is best for them.

All in all, find the calculation that works best for your business and stick with it from month to month. Plus, make sure that your investors and team members are aware of how it is calculated and tracked.

Annual Contract Value Formula

At the core, annual contract value can be calculated by taking the sum of all customer contracts for 1 year and dividing it by the # of customers under contract. As we mentioned before, this is generally best suited for SaaS businesses.

ACV = Sum of all customer contracts for 1 year / # of customers Under Contract

For example, let’s say we have $120,000 in customer contracts for a year and 100 customers under contract. Our ACV would be $1,200 ($120,000/100 customer).

Learn more about why you should track your annual contract value below:

Why is Annual Contract Value Important?

For SaaS companies, tracking annual contract value is vital to understanding your acquisition efforts and go-to-market strategy.

Better decision making on Acquisitions

At the end of the day, your business needs to generate revenue and a profit. Understanding your ACV will better help you determine your acquisition and pricing strategy. Are you going to search for higher contract customers but less volume? Or lower contract customers at high volume?

Determining your pricing and acquisition strategy will have ultimately touch every decision you make when it comes to building products, hiring, fundraising, etc. For example, a lower contract product might require a more self-service product whereas a higher contract product might require a more hands-on approach from sales and team members.

Calculating ACV can help with sales and marketing

As we mentioned before, your ACV will determine your sales and marketing strategy. For a product with lower ACV, your strategy will require scale and volume. You need to make sure that your sales and marketing motions are repeatable as you are adding on a higher volume of customers. Buyers will likely have little to no interaction with the sales team. Instead, you might have a more robust marketing organization that can bring in new leads at scale.

On the flip side, a higher ACV might warrant spending more to acquire a single customer. Because the volume is lower you can take a more tailored and custom approach to new customers. You might have a more robust sales organization that warrants spending more to acquire a single customer.

Determining Your ACV Strategy

Determining your ACV strategy will impact every aspect of your business. We break down 2 different examples below to show how ACV will impact your customer makeup if you want to achieve $1M in ARR.

Small ACV Strategy

To start, let’s say we want to land at $1M in annual recurring revenue (ARR). There are quite a few different ways to get there. For our first example, let’s say that we have a small ACV — companies are paying us on average $500 a year. That means that we’ll need roughly 2,000 customers ($1,000,000 in revenue / $500 ACV). 2,000 customers means you’ll need a scalable marketing playbook to fill your top of funnel.

As you’ll need to service 2,000 customers, this means you’re product should be user-friendly and have the resources someone needs to support themselves (knowledge base, videos, guides, etc.).

Large ACV Strategy

On the flip side, let’s take the example from above ($1M in ARR) but with a higher ACV. Let’s say that we have an ACV of $10,000. That means that we’ll need roughly 100 customers. Because of the higher contract size, there are likely fewer customers that fit the mold so you will need to spend more to find and nurture your ideal customers.

Because customers will be spending $10k a year they will expect a more hands-on approach from your team. This means you might need a dedicated account manager, or recurring performance check-ins, etc.

Related Reading: Roundup: The Importance of SDRs

Tips on Increasing Annual Contract Value

Naturally, you might be thinking, “How do I increase our ACV?” Check out a few tips and examples for increasing ACV below:

Consider upselling/cross-selling

The first place to start is generally with upselling. As the team at BigCommerce puts it, “Upselling is the practice of encouraging customers to purchase a comparable higher-end product than the one in question, while cross-selling invites customers to buy related or complementary items.”

For SaaS products, this generally means using paywalls and different pricing plans. For example, one plan might cost $99/mo but if you want additional feature sets you can upgrade to a plan that costs $199/mo. Understanding where the value in your product lies is crucial to determining future product features and pricing plans.

Increase current prices

Simply put, you can increase your price as a whole. There are considerations to be made when increasing pricing but can be worthy of a test for your business. According to Harry Beckwith, author of Selling the Invisible, 15 to 20 percent of people should resist your pricing. Yes, even in the startup stage.

Narrow in on marketing and sales

Your marketing and sales efforts can also be a way to increase your ACV. Every interaction someone has with your business matters. The sum of these interactions is ultimately your brand. For companies with a strong brand, they can likely increase ACV based solely on the positive experiences your customers (or potential customers) have had with your brand.

Related Reading: How to Determine if Your Channel Partners are Actually Working

Put the Customer First

Having a strong customer experience is a surefire way to increase your ACV. At the end of the day if a customer is not pleased with your product or service they won’t feel the desire to upgrade or pay more in future years. By putting your customer first, you are giving yourself better odds of future upsells and expansion.

How to track your ACV

Tracking and taking action on your ACV is vital for a SaaS business to succeed. Give Visible a try to help your track your ACV and other key SaaS Metrics. Give it a try here.

investors

Operations

3 Ways to Better Support Your Portfolio Companies

We surveyed founders in our community and asked, “How likely are you to refer your current lead investor(s) to fellow founders?” (AKA — NPS score).

The results were shocking with an NPS score of 23. An NPS score of 23 falls below the average for the airline industry. Not a great industry to be compared to in terms of customer satisfaction scores.

As the venture space continues to grow and mature, the importance of investor’s adding value and opportunities is higher than ever. In order to better help investors support their portfolio (and hopefully move that NPS score up) we’ve put together 3 tips below:

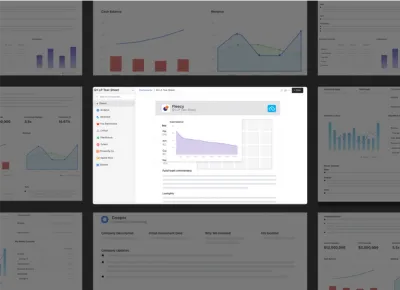

Systemize your data collection

As Peter Drucker put it, “if you can’t measure it, you can’t improve it.” In order to best help the founders in your portfolio, you need to have a system in place to collect data, quantitative and qualitative, so you can jump in and help when needed.

Setting up a system requires a fine balance between being beneficial for your fund and being efficient and easy on the founder. With that said, it is important you only collect what is absolutely necessary (for founders who are already taking the time to send investor updates you want to make sure they are not duplicating efforts). What we suggest requesting from a founder to start:

With Visible for Investors, founders can fill out simple Update Requests from their investors (like the example above) and use their data to fuel future investor Updates. Learn more about Visible for Investors here.

Take action on the data

Collecting portfolio company data is only half the battle. Once you have the data in hand (qualitative or quantitative) you need to make sure you are closing the loop.

Keep an eye on qualitative data

As we displayed in our example request above, best-in-class investors are specifically requesting a “Where can we help/problems” section.

Being sure you can track and manage this data over time will improve your ability to take action. By setting up a view in Visible or exporting answered requests, you can keep your eye on where your companies stand and where your help is needed.

Metric alerts and benchmarking

When collecting metrics and data from your companies on a recurring basis, you’ll be able to uncover trends for individual companies and your portfolio as a whole.

If you notice a core metric for a specific company is slipping month over month, it might be a good time to intervene and see if they need a hand to tackle a problem.

Fundraising and Introductions

Startups are in constant competition for 2 resources — capital and talent. As an investor, you will oftentimes see founders need help with 1 (or both) of those 2 areas. Being able to make an introduction to a potential investor or new hire can have a huge impact on a startup’s growth.

Being able to open up your rolodex will be a huge win in the eyes of your founders.

On the flip side, you can use the data from your portfolio as a whole to help benchmark and uncover new trends to the rest of your portfolio. For example, if you see a go-to-market strategy picking up steam with a few companies, it can be a good time to introduce the ideas to other companies that might benefit from the strategy.

Learn more about how you can use Visible for Investors to better support your portfolio companies here.

Make the most of it

Setting up a system to collect data from your portfolio companies is no easy feat so you’ll want to make sure you are getting the most value out of the data as possible. Outside of helping your portfolio companies, you do have your own set of investors you need to report to.

Having a strong system to collect portfolio data is a natural backbone to power your next LP report. Building strong rapport with your LPs is a surefire way to make sure your next fundraise goes smoothly.

Using Visible, you can roll up your data and use Updates to report to your LPs. No exporting or additional data needed. Simply take the data from your portfolio, add in any necessary fund/investment data, and keep your LPs in the loop. Check out an example report here.

Check out more LP update templates here.

Learn more about using Visible for Investors to report with your LPs here.

Stay engaged with your founders right from your pocket. Monitor your portfolio and be the value-add investor you want to be with Visible for Investors. Schedule a demo to learn more here.

founders

Fundraising

How to Raise Capital Using RUVs ith Jeremy Sonne

As AngelList puts it, “Rollup Vehicles (RUVs) are special purpose vehicles (SPVs) that allow founders to consolidate multiple smaller investors into a single investing entity. It saves founders (and their legal teams) the hassle of collecting funds and signatures from many individuals, both to close the round in question and on future stockholder consents.”

Jeromy Sonne, CEO and Founder of Decibel, recently leveraged RUVs and online communities to help raise a financing round. Jeromy was able to raise ~$150k from 41 different investors. The best part? He didn’t have to do a single investor call.

Jeromy joined us to break down how he raised using an RUV. A few topics we discussed:

What is a roll-up vehicle

How do RUVs compare to SAFEs and other instruments

How they can complement a financing round

What tools and resources exist for raising via RUVs

How Jeromy raised using an RUV

founders

Fundraising

Our 5 Favorite Quotes About Pitch Decks from the Founders Forward

On season 2 of the Founders Forward Podcast, we interviewed 10 different startup investors. We covered everything from storytelling to mental health.

However, fundraising was a constant theme throughout the season. Many of our guests broke down their thought processes and what they like to see from founders. As pitch decks continue to become an integral part of a fundraise, we dug into how different guests view and look for in pitch decks from potential investments.

Check out our 5 favorite takeaways about pitch decks from season 2 below:

Brett Brohl on the 4 Slide Pitch Deck

Brett Brohl of Bread & Butter Ventures shares the idea of using an email intro deck. He suggests a 4 slide deck that your network can use to forward and share with potential investors. The idea is that a 4 slide deck gives a potential investor enough context to be intrigued but not too much information where they will already have a strong opinion on your company before meeting you. Listen to the full episode here.

Elizabeth Yin on Using Pitch Decks for Conversation

Elizabeth Yin of the Hustle Fund makes the case that founders don’t actually need a pitch deck. However, she does recommend that founders have a 5 slide pitch deck to use during the fundraising process. This gives the investor enough information but can lead to a conversation as opposed to a pure pitch. Listen to the full episode here.

Kristian Andersen on Crafting Your Narrative with a Pitch Deck

Kristian Andersen of High Alpha shares why a pitch deck is never a linear template. Kristian suggests that founders think about the story of their company and pitch before building their deck. The story should be applied to your pitch and can help build out the direction of your pitch deck. Listen to the full episode here.

Ezra Galston on What to Share Before a Meeting

Similar to Elizabeth Yin, Ezra Galston of Starting Line does not have a strong opinion on the medium founders use when sharing information with investors. However, he wants to make sure that he has enough context before having a conversation with a potential founder. Listen to the full episode here.

Gale Wilkinson on Must-Haves in a Pitch Deck

Gale Wilkinson of Vitalize recommends that founders have a pitch deck or one-pager that founders can share with potential investors. Gale goes on to break down the slides that she believes founders should always improve in their pitch deck. Listen to the full episode here.

founders

Fundraising

Reporting

How to Build an Investor List with Gale Wilkinson of Vitalize

On episode 10 of the Founders Forward Podcast, we welcome Gale Wilkinson. Gale is the Managing Partner at Vitalize Ventures — “an early-stage fund & angel community investing in software focused on future of work and future of learning.”

About Gale

Before starting Vitalize, Gale started her career in venture capital at Irish Angels. Gale is one of our favorite follows on Twitter where she shares tactical tips for founders on fundraising. She joins us to break down some of her most popular threads on Twitter and offers countless takeaways to help early-stage founders fundraise — covering everything from list building to ownership benchmarks.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Gale. You can give the full episode a listen below (Or listen on Spotify, Apple Podcasts, or any standard podcast player):

What You Can Expect to Learn from Gale

How VC has changed over the last 10 years

Why Vitalize is launching an angel group

Why list building is vital to a successful fundraise

How many investors a founder should expect to talk to during a raise

What catches her eye in a cold email from a founder

What she looks for in a pitch deck

Why she cares about financial modeling at the early stages

Related Resources

Gale’s Twitter

Gale’s LinkedIn

Vitalize’s Visible Connect Profile

[Thread] Gale on Cold Emails

[Thread] Gale on Data Rooms

[Blog] How Long Does Fundraising Take?

founders

Fundraising

Determining if an Accelerator is Right For You with Lisa Besserman of Expa

On episode 9 of the Founders Forward Podcast, we welcome Lisa Besserman. Lisa Besserman is the Managing Director at Expa — an accelerator based in Austin, TX dedicated to supporting pre-seed companies.

About Lisa

Lisa started her career as an economist but ultimately found her way to founding Startup Buenos Aires — an accelerator located in Buenos Aires to help support startups in Latin America. Since then, Lisa has made the move to Expa where is the managing director of their accelerator. Between her time at Startup Buenos Aires and Expa, Lisa has a wealth of knowledge related to all things company building, fundraising, and leading — especially at the early stages.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Lisa. You can give the full episode a listen below (Or listen on Spotify, Apple Podcasts, or any standard podcast player):

What You Can Expect to Learn from Lisa

How founders can best connect with investors

How to determine if an accelerator is right for your business

What kind of companies Expa is interested in funding

Why founders should try their best for a warm intro

What she likes to see in a cold email

How to determine how much to raise

What she thinks the future of VC looks like

Related Resources

Lisa’s Twitter

Lisa’s LinkedIn

Application to apply for Expa

Expa’s Visible Connect profile

founders

Fundraising

How to Raise Your Series A With Michael Rangel of Novo

Building a company is difficult. Being a founder can almost feel impossible. There are very few people that have been in the shoes of a founder. As a startup founder, there is no one better to learn from than the person that has been there before.

The team at Novo recently raised a $41M Series A. Novo’s CEO, Micheal Rangel, was generous enough to join us and talk about how they raised it. Micheal breaks down everything from his preparation to pitch to metrics and more.

A few topics we discuss:

Determining if you are ready for your Series A

How to prepare yourself for a raise

How to prepare your company for a raise

How to prepare your pitch and documents for a raise

How to craft your Series A pitch deck and narrative

founders

Fundraising

The Past, Present, and Future of VC Funding with Anne Dwane of Village Global

On episode 8 of the Founders Forward Podcast, we welcome Anne Dwane. Anne is the partner and co-founder at Village Global — an early-stage venture capital firm backed by successful entrepreneurs.

About Anne

Anne has a unique perspective on the VC space as she founded her first successful startup, Military.com, in the 1990s. After Military.com, Anne founded a startup later acquired by Chegg where she helped scale as they went public. Anne joins us to share what she has learned from time in the space. We discuss who founders should look to for advice, the thought process behind the roster of Village Global’s LPs, and how founders can build a fundraising process.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Anne. You can give the full episode a listen below:

What You Can Expect to Learn from Anne

What Anne learned from helping scale Chegg

How the startup world has transformed since her time founding Military.com in the 90s

Why founders should look for a “thought partner”

Why founders funding founders is a good thing

How to build a fundraising process

What she likes to see in a cold email from a founder

Related Resources

Anne’s Twitter

Anne’s LinkedIn

The Village Global application

Village Global’s Visible Connect Profile

founders

Fundraising

Product Updates

Introducing Decks — Manage Your Raise From Deck to Check

The pitch deck is the core marketing asset that jumpstarts any fundraising effort. It acts as the catalyst for connection, conversation, and relationship building.

How Pitch Deck Sharing Works

We talked to hundreds of founders, and three problems emerged around pitch deck sharing:

I’m not sure how prepared a potential investor is before heading into a meeting.

I’m under-networked. I share my deck to get meetings but want to understand who is engaged.

I iterate on my deck every hour. Sharing the latest version is a pain.

Introducing Visible Pitch Decks

Today, we are launching Decks. A dead-simple way to host and share a pitch deck on Visible. Decks are completely integrated with our fundraising crm and leading investor updates platform. You’ll be able to set customized sharing permissions, notifications when investors view your deck, upload new versions without clicking a button, and understand how potential investors have engaged with your content.

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck directly from Visible and completely integrated.

Want to see a Deck hosted on Visible in action? Take a look here.

Whether we are building fundraising automation with our Zapier Connection or crafting integrations with companies like ProfitWell, we are driven by giving founders a better chance of success. It is going to be a very fun fall 😉

Up & to the right,

Mike & The Visible Team

investors

Reporting

4 Tear Sheet Examples to Give You Inspiration for Your Next LP Report

Tear Sheets (also known as one-pagers or fact sheets) are an effective way to communicate the performance of your portfolio on an individual company level. In Venture Capital, tear sheets are commonly shared with Limited Partners (LPs) on a monthly or quarterly basis to keep investors updated on company performance.

Common Tear Sheet Elements

Some common elements that should be included in tear sheets are:

Investment performance – Cost, value, board information

Financial metrics – Revenue, Cash Balance, Burn Rate, Runway

Company-specific KPIs – Keep this consistent for each reporting cycle.

Commentary – Add your own analysis on company metrics and performance.

Company context – Include details such as the company description, sector, HQ location for context.

Download Our Tear Sheet Examples

Download our packet of Tear Sheet Examples built with Visible.vc’s software for investors for inspiration before your next reporting cycle:

With Visible.vc you can create professionally formatted Tear Sheets for your entire portfolio within minutes. To learn more, schedule a demo with our team.

founders

Fundraising

Operations

Customer Stories

How Design Can be a Competitive Advantage with Kristian Andersen of High Alpha

On episode 7 of the Founders Forward Podcast, we welcome Kristian Andersen. Kristian is a founder and partner at High Alpha, a venture studio located in Indianapolis.

About Kristian

Before launching High Alpha, Kristian founded the prolific design agency, Studio Science. During his time at Studio Science, Kristian primarily served software companies which ultimately led to him being a founding partner at High Alpha. Between Kristian’s experience at Studio Science and his time at High Alpha helping launch 30+ companies, it is safe to say he knows a thing or 2 about design and storytelling. Kristian joins us to break down how design can be a competitive advantage, the importance of storytelling in business, the High Alpha Studio model, and much more.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Kristian. You can give the full episode a listen below:

What You Can Expect to Learn from Kristian:

How the High Alpha Studio models work

What kind of co-founders they look for at High Alpha

How design can be a competitive advantage

Why storytelling is important in business and fundraising

Why Coco Chanel, Teddy Roosevelt, and Ralph Lauren are great storytellers

What he likes to see in a cold email from a founder

Related Resources:

Kristian’s Twitter

Kristian’s website

Apply to become a High Alpha Co-founder

High Alpha’s Visible Connect Profile

founders

Fundraising

Reporting

10 Fundraising Takeaways from Season 2 of the Founders Forward

We are just over halfway through season 2 of the Founders Forward. We’ve talked to 6 awesome investors and have dug into everything from pitch decks to mental health.

To recap the first half of the season, we’ve shared our favorite quotes and thoughts from the season so far below. If you’d rather skip to a specific episode, you can do so below:

The Supply & Demand of Venture with Kenn Shasta

One of the questions we have asked all guests this year is, “What is one tip to help founders create momentum in their fundraise?” We’ve heard a flurry of great answers but really love the advice from Kenn So of Shasta Ventures.

Kenn recommends founders start to include target investors on their monthly/quarterly Updates. This way investors already know what’s going on and have already build a trend line when it comes to your company. Give the full episode a listen below:

Creating Momentum in Your Fundraise with Brett Brohl

One of the most common mistakes we see founders make is underestimating the amount of time it takes to complete a fundraise. From finding and researching investors to signing a term sheet can take 5+ months. We love how Brett Brohl of Bread & Butter Ventures broke down a fundraise into 5 months, or 1-3-1:

1 month — Researching and finding the right investors

3 months — Actively pitching investors

1 month — Time to close after it is fully committed

To learn more fundraising tips and advice for seed-stage founders, give the full episode with Brett a listen below:

How to Create FOMO During a Fundraise with Elizabeth Yin

When going out to raise a round of capital, most founders assume that you should try to find a few large investors that can fill the round so you can be done. However, Elizabeth Yin of Hustle Fund argues that small checks can be a really powerful tool.

While there are certainly some downsides, smaller checks allow you to create momentum and build your network. Elizabeth shared an example of a portfolio company that landed one small investor who ended up introducing them to the majority of their investors. Give the full episode with Elizabeth a listen below:

Building a Calm Company with Tyler Tringas

One of the questions we have asked all guests is, “What catches your eye in a cold email from a founder?” Tyler Tringas of Calm Company Fund had a great and unique take. Tyler likes to see a quick video of the product actually working. This can help create excitement and give him an idea of the state of the product.

Give our episode with Tyler a full listen below:

How Founders Can Address Their Mental Health with Ezra Galston

Before sitting a meeting with an investor there is an expectation that you will send over some kind of pitch deck or data or synopsis. Some investors will tell you full deck. Others might suggest a mini-deck. Regardless of the medium, Ezra Galston of Starting Line just wants enough context to have a good conversation.

Sending over enough context beforehand enables Ezra to understand some basics and have enough information to dig into questions and have a strong conversation. Give our interview with Ezra a full listen below:

All Things Community-Led Growth with Corinne Riley

A seed-stage and Series A fundraise can feel quite different for a founder. At the seed stage you likely have little to no revenue, few metrics, and a simple product. By the time you get to your Series A, you likely have product-market fit and have a solid revenue base. While the business might look different, some parts of your pitch stay the same.

We love how Corinne Riley of Greylock breaks down constant things she looks for in a pitch, regardless of stage. Give the full episode with Corinne a listen below:

How Design Can be a Competitive Advantage with Kristian Andersen

A successful pitch and story can make or break a fundraise. As the co-founder of the venture studio, High Alpha, Kristian has helped countless early-stage companies craft their narratives and build their pitch deck.

In our interview with Kristian, he points out the importance of starting with your story when crafting your pitch deck.

The Past, Present, and Future of VC Funding with Anne Dwane

As a first-time founder, finding someone you can lean on for advice and experience can be crucial. Anne Dwane of Village Global recommends that founders can find a “thought partner.” This might be a peer that is someone who is at a similar stage or only a step or 2 ahead.

Determining if an Accelerator is Right For You with Lisa Besserman

The importance of being able to send a strong cold email was a consistent topic with all of our guests this season. More than anything else, Lisa Besserman of Expa likes to see a deck from a founder. In our interview with Lisa, she breaks down what specifically she likes to see in a deck as well.

How to Build an Investor List with Gale Wilkinson

Fundraising generally mirrors a traditional B2B sales funnel. Just like a sales funnel, you need leads and a strong customer profile at the top to fuel your process. Gale Wilkinson of Vitalize suggests that founders have a running list of investors that are a fit for your business.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial