Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

4 Ways to get to $100 Million in ARR

Back in April we partnered with OpenView to share our free Total Addressable Market template. With an overwhelming positive response and some inspiration from Point Nine Capital’s “5 Ways to Build a $100 Million Business [Infographic]” we wanted to build a new forecasting template on how SaaS businesses can get to $100 million in annual recurring revenue.

For this template we partnered with our friends at Foresight & OpenView to provide 4 distinct forecasting models on how a business can grow to $100 million in ARR. You can get the template here!

Getting to $100 million in annual recurring revenue is one of those SaaS benchmarks you’ll hear about frequently. It’s a line in the sand that investors have drawn to deem your business “venture-backable” or not. I’m sure many have asked or received the follow question, “That’s great, but how does this get to $100mil in ARR?”

Click here to get the free SaaS forecasting template

No two paths are the same but there are some commonalities with different go-to-market strategies that can help frame your business. We’ll break down the following markets and their respective distinct metrics:

Consumer

SMB

Mid-Market

Enterprise

You’ll be able to define your customer acquisition channels, Average Revenue Per Account, contract lengths, growth assumptions, cost assumptions and more!

We hope you enjoy! You can find the post in full at Opeview and Foresight. Integrate the Google Sheet template directly with your Visible Account as well!

Get the free forecasting SaaS template here!

founders

Metrics and data

Ultimate Report Part 3 of 4: ARR Movements

Welcome to part 3 of 4 of our Ultimate Report series. When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target.

Part 1: Pacing

Part 2: Cadence & Operational Metrics

Part 3: ARR Movements

Part 4: Coming on July 12th

This week, our ultimate report is ARR Metrics. For any SaaS business, the movements in your recurring revenue are crucial to making decisions, hiring and resource allocation. What makes SaaS metrics great are that they are fairly easy to benchmark across industries.

Tracking Your ARR Movements

This report focuses on 4 key recurring revenue movements.

New Business ARR: When a lead converts to a customer (for the first time)

Expansion ARR: When an existing customers increases their recurring spend with you (more seats, better package, etc)

Contraction ARR: When an existing customers decreases their recurring spend with you (less seats, downgrade plan, etc)

Churn ARR: When a customer cancels their subscription and doesn’t renew.

If you want to dig into more SaaS metrics and definitions we recommend checking out our friends at ChartMogul and their SaaS Metrics Cheat Sheet. P.s. we have an awesome integration with them!

founders

Metrics and data

Ultimate Report Part 2: Cadence & Operational Metrics

Your Ultimate Report: Sharing Operational Metrics

Welcome to part 2 of 4 of our Ultimate Report series. When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target.

Part 1: Pacing

Part 2: Cadence & Operational Metrics

This week we want to touch on two key parts of the reporting process every company should be doing.

Operational Metrics

Developing a cadence for stakeholder reporting

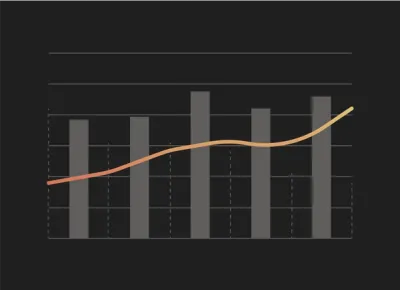

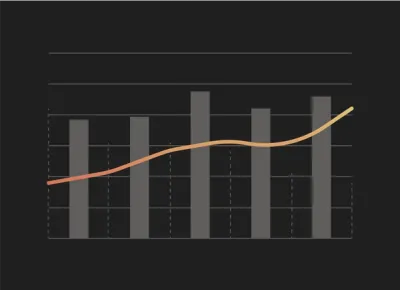

The below chart is a common one that most VCs love & one that you’ll see in just about every “Investor Update” template post online.

The goal here is to quickly see:

How fast is your top line growing?

How much cash is in the bank?

Is burn under control?

What does headcount look like?

With Visible, this is incredibly easy to visualize and automate through our different data integrations. Putting this together should take no more than a couple minutes.

The other key to great reporting is not doing it just once but building a repeatable cadence that is timely.

According to Peter Drucker, the key to building a successful company is about how well you attract and retain both talent and capital. Attracting capital (read: investors) is one thing; but how do you handle the added pressure of putting someone else’s capital to work? Regular communication.

While we spend most of our day talking with founders and operators we also spend a good amount of time speaking with stakeholders and those “consuming” reports. The one component they look for more than certain metrics, wins, losses, or other sections? Regular communication. With some back of the envelope math we have found companies that regularly communicate with their investors are twice as likely to raise follow on funding.

Consistent communication builds trust and helps keep you top of mind for your investors. It also creates accountability on both sides of the table. When an investor comes across a great designer looking to join a startup, who do you think she will recommend? The company she hasn’t heard from since wiring the money, or the one that comes to her each month with a quick overview on how things are going and how she can help?

But what is “regular communication”? That is something that should be answered by your, your team, and your stakeholders. Find a cadence that works best for both you and your stakeholders. One of our favorite cadences we see companies use is similar to the one below:

Weekly – Short, data heavy Updates sent to the entire team. Highlight big wins, losses, and your “North Stars” for individual departments

Monthly – A more qualitative focused Update sent to all Investors and stakeholders highlighting all important wins, losses, and questions from the month.

Quarterly – the “friends and family” Update. Send to any of your stakeholders that have interest in the business with a quick update on the state of the business while keeping potential investors in the loop.

Make sure to check our recurring templates in Visible to help automate your cadence.

founders

Metrics and data

Product Updates

Video: Formula Builder (Customer Acquisition Cost)

How to Calculate Customer Acquisition Cost in Visible

Check out the video above to get a glimpse of our formula builder. In this example we calculate customer acquisition cost by combining data from Salesforce and Google Sheets!

founders

Metrics and data

Why We Love Net Promoter Score (NPS)

We’re huge fans of the NPS (Net Promoter Score) at Visible. This article is all about NPS & is broken down into 4 sections.

What NPS is?

Why we love it!

How we implement it.

Do unanswered NPS surveys correlate to churn? (This question was the original idea for writing this post)

What is NPS?

If you’re not familiar with NPS, it is used to gauge the loyalty of a firm’s relationships. It is used by more than 2/3 of the Fortune 1000 and it can measure a company, employer or another entity. You have likely received an NPS survey yourself. It’s a score of 1 to 10 usually with a question of “How likely are you to recommend X to your friend or colleague?”

X could be your company, your customer support experience, an event, etc. If you answer 1 to 6 you are considered a detractor and at risk of customer churn, 7 & 8 are considered passives and 9 & 10 are considered promoters. To get your score take % Promoters – % Detractors. This creates a scale ranging from -100 to 100. 0 to 49 is considered good, 50 to 70 is Excellent and 70+ is World Class.

To give you an idea for the 4 Major Airline Carriers in the US the scores are as follows:

American: 3

Delta: 36

Southwest: 62

United: 10

On the other hand of the spectrum Apple clocks in at 89. (*note these are rough estimates from free online resources).

At Visible our NPS is a 75 and we are incredibly proud of that!

Why We Love NPS

We love NPS for a number of reasons but all of them are related to being a signal that is reported directly from our customers. We have written about NPS before in “How to measure customer experience better”.

With NPS we can identify problems we didn’t know about. Here is a real example… it looked like we have an incredibly active customer that loves our product but they recently answered our NPS survey with a 2 stating our pricing didn’t make sense for our business. This allowed us an opportunity to start a conversation on how we could better price our product for a particular customer prior to them churning.

A strong NPS is a great sales tool as well. It is something we can speak to with our customers, investors, potential hires, etc. Not only can we point to company logos as customers but we can prove that they love using the product. It’s also great for motivating the team internally as it touches all parts of the business.

NPS qualitative feedback is also amazing. The score is great but understanding why they scored the way they did is gold. At Visible we hear two things over and over again. 1) It’s simple and 2) great customer support. We always think about these two main pieces of feedback as we build the product and talk to our customers. We want to make sure we don’t overcomplicate the product and continue to serve the customer the best we can.

Finally, NPS is a great signal for early stage companies to use as an early identified or product-market fit before they have metrics at scale.

How Visible Implements NPS

We use NPS for all of our customer relationships. We’ve tried using NPS for free trial users or if customers used a particular feature but found that data didn’t yield any insightful data. We care most about the customers who providing us with their credit card in exchange for our service.

We use Promoter.io to handle the surveying, scoring and all things related to our NPS. There are a bunch of providers in the market but found that Promoter works best for our needs. Once a new customer signs up on Visible we then tag them as customer in Intercom. This then adds that customer to a queue in Promoter where we set a 20 day delay before the first survey is sent.

Why 20? We don’t want to survey right away as we want them to get all the benefits of the product, have a customer success interaction and fully dive into our offering. With a 20 day delay we also give ourselves 10 days to address any problematic issues with a customer that may be paying us monthly to avoid churn. From there the customer gets surveyed automatically 60, 90 and 180 days after the most recent survey. Each survey has an auto-reminder 3 days after an initial send if they haven’t responded.

Do unanswered NPS surveys correlate to churn?

There is a solid argument to make that detractor NPS scores (0 to 6) correlate to revenue churn; however, what about customers that don’t respond to NPS surveys? My hypothesis was that if customers don’t care enough to answer a simple survey that just takes one click to answer, do they really care about the solution?

Of our customers that churned in the past 6 months, 43% of them responded to the NPS survey. That response rate falls in line with our active customer base. Of those that answered, all of them were promoters (answered with 9 or 10)! This was actually quite perplexing and something I don’t have a great answer to (yet). If you do, we’d love to hear from you! I wish I had an amazing, ground-breaking takeaway for this last point but the reality is we are still in first inning of our NPS journey. As we get more data, more experience and learnings we’ll make sure to update it!

Questions, thoughts, comments? Email hi at visible dot vc. Want to share your NPS with your team and stakeholders? Sign up for Visible!

Up & to the right,

-The Visible Team

founders

Metrics and data

3 Metrics to Track to Start Sales Enablement

The success—or lack thereof—of a sales enablement team isn’t the easiest to track because the area itself isn’t always clearly defined. When a scaling company develops its initial sales enablement strategy, it’s often a struggle to determine exactly what the organization needs to focus on first. And that lack of clarity can present a real problem. “Enablement means something different in every company,” Katie MacDonald, global sales onboarding and enablement manager at Optimizely, said. “A lot of companies think they need enablement. But if there is not a clear understanding of the purpose of sales enablement, it can die very quickly.”

So how do you start? Simply. Focus first on a handful of easy-to-identify valuable functions that drive performance in a sales organization. Here are three great ways to start:

Decrease time to quota obtainment

All new hires face a steep learning curve when entering a new organization and a new sales process. Providing the right tools that boost a new hire into peak productivity mode is remarkably important. And cutting down the number of days until that happens can wildly profitable. So the role of a new sales enablement team must start hacking at that time to quota obtainment with insights for into the sales process. Empowering new hires with basic strategies that overcome common obstacles that have slowed success in the past is a key component in enabling the sales team. Identifying selling pitfalls, core value propositions and common pain points and some additional tricks of the trade helps shorten the road to top performance.

Decrease time to pipeline obtainment

In order to hit that quota, reps need to fill the pipeline first. Most companies will use the 3x sales pipeline-to-quota-ratio as the goal for the sales team. For the sales enablement team, it’s essential to identify the best ways new reps can hunt for new leads. Your enablement team can provide information on the right customer types, how to best reach them and how to determine which opportunities might be better than others.

Again, you’re providing new reps with a better roadmap to avoid obstacles others have already encountered. The bottom line is if your sales enablement team isn’t decreasing time to quota obtainment or pipeline obtainment, they aren’t providing the right boost to your onboarding efforts.

Decrease sales cycles

Finally, moving beyond new hires, sales enablement teams must deconstruct the sales cycle and find ways for the entire organization to cut down on the time to commitment. They have to monitor how deals track through the process and identify common factors that are often introduced and slow down the action. Sales enablement teams gather intelligence and data from across the team and synthesize the learnings into communication training that drives iterative improvement. That speeds up the process and makes enablement worthwhile in the long-run.

There is almost no end to the avenues your enablement team may explore to keep your organization innovating and working smarter. But by focusing first on just a few key areas, you can convince investors of the need for sales enablement and earn buy-in from the rest of your leadership team of its value.

founders

Metrics and data

Are you Measuring Product Qualified Leads?

As I’ve mentioned before, one of the best ways to ensure a healthy sales funnel is to reevaluate the quality of your leads. Better leads produce better results. And taking a product-first approach to qualifying leads can help optimize your funnel. But first, let’s look back at how

Categorizing leads

Instead of taking a one-size-fits-all approach, qualify your leads by placing each in three separate categories: “organization-level,” “opportunity-level,” and “stakeholder-level.” Then ask specific questions that will determine if your product actually fits their needs or if this is a customer destined for failure. This filter alone can save your customer success team a great deal of headaches in the future.

Types of lead qualifications

Beyond categorizing leads, it’s important to assess where your leads are coming from and what teams are qualifying these customers. Traditionally, lead qualifications have come from two areas:

Sales qualified leads (SQL): Some of the hardest earned customers come from SQLs, when your sales team identifies one of the customers in the previous three categories through research and deems them viable for a follow up call. With SQLs, you’re relying on a sales development rep (SDR) to cold-call to set a meeting or demo to get these clients into the funnel. These clients usually require a hefty amount of work to educate them on your offering, explain why you’ve identified them as a good fit and how your product solves their current pain points.

Marketing qualified leads (MQL): Inbound marketing efforts produce leads that engages with your company through a number of actions—like requesting a demo or downloading a buying guide-that help educate users before they ever receive a sales call. Before they are passed on to an SDR or account executive (AE), these clients will have some familiarity with the pain point your company can solve.

While effective strategies to help fill your sales pipeline, increasing the close rate on SQLs and MQLs can be difficult. One of the best ways to identify the potential customers with highest probability of purchasing is through product qualified leads.

Product qualified leads (PQL): When a potential customer is already using a version of your product—whether that be a trial participant or user in a freemium model—they can qualify as a PQL. With a PQL, the customer has hit a designated trigger that lets the sales team know they are ready for a follow up call. As Christopher O’Donnell notes, by using the product to educate the customer first, you’ve given your sales team a huge advantage. “If we flip the traditional model 180 degrees and start instead with product adoption, we find ourselves selling the product to folks who understand the offering and are potentially already happy with it, before they even pay,” O’Donnell writes.

Scale Leads, Create Focus

PQLs rely on the product selling itself. With this approach, you’re providing the best possible introduction to demonstrate how the product can be a long-term solution. That’s an easy process to replicate too. “[PQLs] are scalable because they require no human touch and they are high-quality leads,” Tomasz Tunguz writes. “When the sales team calls PQLs, customers typically convert at about 25 to 30%.”

If you have a freemium offering of your product, you can gain the benefits of the potential velocity of incoming leads while also earning the financial rewards of an inside sales price point.

Furthermore, a focus on PQLs can improve your product roadmap as well. Tunguz notes that PQLs actually serve as a management tool as well because the focus on customer action gets everyone onboard with revenue as the key performance indicator. are a “Typically, the product and engineering teams don’t have goals tied to revenue which bisects a team into revenue generating components (sales and marketing) and cost centers (eng and product).”

That can create a lack of effectiveness when it comes to creating a product that sells itself and providing the best ammo for a sales team to finish the job if needed. Of course, your product and engineering teams will have longer-term features that will not be revenue significant in the short-run. However, a mix of both can help get everyone on the same page and quickly end potential arguments. That’s a great addition to any company culture. “PQLs provide a rigorous framework for prioritizing development,” Tunguz writes. “Each feature can be benchmarked to determine the net impact to PQL which is ultimately funnel optimization.”

Measuring PQLs

If you’re ready to track PQLs, determine which triggers require an AE to follow up with a call. Product feature limits, a number of days in the free trial or specific actions in the product can all be good reasons to get in touch.

Because you’re relying on customer actions, a large volume of PQLs may be tough to attract at first. However, learning how to optimize all your sales efforts to create more PQLs is essentially one of the best ways to constantly be improving your funnel. Track the number of PQLs each month and see how that compares to MQLs and SQLs. Share these results at monthly or quarterly investor updates to help make the argument that the team is determined to create an exceptionally efficient sales process as the company scales. Adding more PQLs could be one of the best KPIs for your company’s growth in 2017.

founders

Metrics and data

How to Measure Customer Experience Better

It’s simple: if customers are happy, they are more likely to renew. Customer experience is essential—it can make-or-break your retention efforts, determine whether you’re at an acceptable churn rate and potentially drive your SaaS startup toward the all-important negative churn milestone. After all, as Tomasz Tunguz wrote, “startups that manage customer renewals better than their peers grow faster and require less capital.”

What are you customer experience metrics? You wouldn’t avoid measuring marketing leads or quantifying the success of your sales staff to hit its quarterly goal. So if you’ve avoided measuring and evaluating customer experience until now, you’ve ignored an indispensable part of assessing your business.

Luckily, your current client base likely offers a wealth of data you can quickly tap into if you ask your customers the right questions. One of the easiest ways to do this is to use Net Promoter Score (NPS).

How to start measuring NPS

It starts with a simple question: How likely are you to promote this company or product to a friend or colleague? Survey your customers and this will give you initial insight into the overall direction of your customer experience. Use a scale from 1-10 to measure their response. Here’s how the different scores are grouped.

Promoters(score 9-10) – These are the most loyal customers likely to renew and make recommendations to their friends and colleagues. It’s this group that will drive your company’s growth.

Passives(score 7-8) – Consider these customers satisfied, but unlikely to recommend you to others. Your company is vulnerable to losing this client base to a competitor if you’re not careful.

Detractors(score 0-6) – This is your unhappy customer base who can actually harm your company’s reputation and prevent referral growth.

To get your NPS average, subtract the percent of detractors from the number of promoters. According to Zendesk, a good average for a SaaS company is 29.

Establish your company’s first average as the baseline. This will help you determine whether future efforts work. Also, it will help as we move into the second part of developing NPS feedback: segmenting.

Filtering NPS

Paid vs. Trial

A one-size-fits-all approach to NPS can be limiting for a growth startup. In order to best measure customer experience, parse out different customer segments. Start by separating free trial signups and paid customers. Determine how each scores individually on their level of satisfaction. Trial customers won’t have enough experience with the product to deliver a quality assessment. However, they will provide insight into your conversion efforts. By evaluating this group’s NPS trend over time you’ll be able to measure your trial performance improvements. NPS can be the most important indicator of whether any new efforts the company is making actually produces customers.

As for paid customers, they can provide essential feedback on how well your product improvements work. After a new release, measure the NPS performance in the subsequent weeks to find how your customers are responding to the product tweaks.

Location

Customer experience can vary by location, especially if where a client lives determines how much they interact with your sales or customer success team in person. For international companies, different countries can have very different renewal or customer experience patterns.

Job Title

Are you selling to right customer? How is your company performing when the C-suite is using your product versus middle management? By segmenting NPS scores by job titles, you’ll know which groups like and dislike your product the most. That will help you improve messaging to the low-scoring groups and double-down efforts on selling the segments performing well.

Plan Type

If something like price point is causing dissatisfaction or an expanded offering of your product is driving customers to deliver high scores, segmenting plan type will reveal these sentiments. Parse out your different plans and you might find that some of your current offerings are weighing down the rest of your customer experience.

Number of users

By creating different segments by a range of the number of users, you develop an understanding of whether your products start to perform poorly at a certain number. If adding more users is a large part of your strategy to scale, identifying a breaking point in customer satisfaction by number of users could be a crucial red flag that the product needs immediately attention.

Determine your own

No one knows your company better than you. If the above groupings aren’t the best segmenting options, create your own based off the demographics that are most essential to improving your product.

Select experiences

Now that you’ve created customer segments, ask for feedback on specific experiences with your product. Do you have an appealing interface? How is your customer service response time? These kinds of questions can help you isolate problems and make necessary changes.

Qualitative feedback

Metrics aren’t the only things that matter. Once you’ve asked your customers the first NPS question, allow a free-form feedback option and/or an additional survey to drill down into specifics you might not catch in your segmentation. Zendesk found that 63 percent of customers that gave negative reviews left additional feedback—that can be remarkably important to your business’ growth.

Changing minds

It’s important to segment and identify who is unhappy early because changing a customer’s opinion is incredibly hard. Zendesk found that more than 70 percent of surveyed users that gave negative reviews in the past didn’t change their mind. The majority of positive reviewers maintained their high marks, but to a lesser extent than their negative counterparts. Zendesk also found that more than half of NPS respondents rate a company 0 or 10, so your product is likely to produce a pretty strong reaction from the people paying for it.

Share the results

Now that you’re receiving more customer experience data points, be transparent about the performance of different segments with your team and investors. This level of detail helps your organization focus and will inspire confidence in your investors that you’ve parsed the necessary numbers to make big improvements.

founders

Metrics and data

How to Avoid Revenue Growth Distortion

Last week in a post about hitting revenue milestones to prepare for a Series A, I mentioned the importance of achieving true growth rates and avoiding false indicators of success. The problem for many founders comes when they try too hard to show exciting growth numbers at the expense of a clearer picture of the company’s performance.

Avoid Misleading Metrics

You don’t want to look like an idiot in front of your investors. At the same time, you want to excite your backers with some of the new accomplishments that are adding to the bottom line. So how do you avoid misleading numbers? Be honest with the size of monthly recurring revenue (MRR) numbers and your month over month growth (MoM) percentage. Your investors are likely assessing revenue figures from a number of portfolio companies, which means they know where to find weak spots. Don’t look unprepared. Here are some of the most popular mistakes–according to Amplitude–that founders make when outlining revenue growth figures:

Don’t pass off big growth rates on small numbers

If you’re still gaining traction as a startup, your month over month numbers may be tiny. So boasting mega percentages in MoM growth will be laughable to seasoned investors if you’re passing the rate off as sustainable growth at scale.

January February March April May June July August September MRR 1000 1300 1800 2500 3300 4100 5000 6200 7300 MoM Growth Rate 30.00% 38.46% 38.89% 32.00% 24.24% 21.95% 24.00% 17.74%

Don’t hide MoM fluctuation It isn’t sustainable unless you can show a detailed strategy for sales and market growth. An early stage startup with 30 percent growth MoM may not wow new investors, but it is a sign that you’re moving at a strong pace. That’s only a problem if you’re passing off your big digit percentage as a large MMR number.

Your numbers can fluctuate. That’s perfectly normal. Especially over the course of quarter, a SaaS company can often begin their first two months hitting only 50 percent of its mark, but rally for more than 50 percent in the final month on the back of the groundwork down in the beginning. Make sure your founders now how your numbers may fluctuate from month-to-month. Showing the chart below and claiming a steady 15 percent growth rate over the course of nine months is inaccurate, even though the company hits that average over time.

January February March April May June July August September MRR 10000 13000 14000 18000 20000 22000 26000 31000 32000 MoM Growth Rate 30.00% 7.69% 28.57% 11.11% 10.00% 18.18% 19.23% 3.23%

Instead, show your investors a list of your monthly numbers and explain the factors that cause the fluctuations. If you’d like to calculate your compound monthly growth rate to have the metric on hand, use the following formula:

Compound Monthly Growth Rate = (Last month/First month)^(1/Number of months difference) – 1

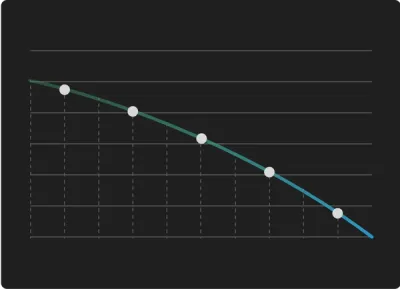

Don’t disguise declining growth rates

Using the compound growth rate (CMGR), the following chart shows a 15 percent average over the course of nine months:

January February March April May June July August September MRR 10000 13000 16000 19000 21500 24000 26500 28500 30500 MoM Growth Rate 30.00% 23.08% 18.75% 13.16% 11.63% 10.42% 7.55% 7.02%

But as you can also see, as this startups numbers continue to climb, the growth rate is slipping. That’s not always a red flag. Sometimes scaling your MRR is going to come at the cost of maintaining your growth rate. However, you don’t want to lead with your CMRG during the period without discussing the difficulty of holding that percentage moving forward.

In the long run, it’s only going to benefit you to share any bad news with investors, invite their help and be as transparent as possible to get everyone on board for the future. As Archana Madhavan said, distorting your company’s revenue picture can really damage your reputation moving forward. “When you fudge your growth models, you’re not just deluding yourself and your team,” he wrote. “You’re not just giving potential investors the signal that you don’t know what you’re doing.”

Be clear about your MoM goals and how they impact your company’s long-term success strategy. Your month-to-month performance isn’t going to be the only indicator of your company’s growth, especially if you’re sacrificing in the short-term to improve product or reformat with your team. Nevertheless, discuss these numbers with regular updates to investors in order to allow for the necessary information to be shared and everyone to feel confident in the future direction of the business.

founders

Metrics and data

Customer Segmentation Brings Focus to Startups Ready to Scale

Using Customer Segmentation to Your Advantage

Customer segmentation is a fantasy for startups struggling to gain customers. If your company hasn’t reached the product-market-fit stage, it’s hard to justify spending time segmenting your small client base.

But once your startup begins to grow at a strong pace, it’s no longer responsible for your startup to continue grabbing at any potential clients without a clear understanding of how it potentially impacts your business. Customer segmentation applies mostly objective differentiation around your varying client types and helps you build a strategy to scale each. Additionally, understanding the value of scaling each will drive decisions to dedicate resources and future planning.

Your investors aren’t going to be encouraged by your company’s direction if you’re not employing customer segmentation. “At the expansion stage, executing a marketing strategy without any knowledge of how your target market is segmented is akin to firing shots at a target 100 feet away — while blindfolded,” Tien Anh Nguyen writes for Openview. Bottom line: you might be wasting your time aiming for customers that aren’t worth the effort, while more valuable fish swim away.

Types of Segmentation

To get started on segmenting, Openview has developed a helpful guide for best practices for B2B companies. In this guide, Nguyen also outlines the three different types of segmenting strategies that are usually employed.

A priori segmentation

In this type of segmenting, classify potential customers based on publicly available information –like company or industry size. The biggest issue in this approach will surface when you find companies of a similar size or industry that have very different needs. Nevertheless, a priori segmentation can be one of the quickest and easiest ways to objectively differentiate customers if you’re just begin to use customer segmentation in your business.

Needs-based segmentation

What are the different needs your company serves? This segment separates out the different clients with different needs. You can verify these needs through primary market research. The needs approach is one of the most popular forms of segmenting, hitting on the “jobs to be done” mentality that can prevent customer segmentation from being too rigid or narrowly focused.

Value-based segmentation

This type of segmentation separates potential customers by their economic value to your business. Not all clients are going to be able to offer the same initial contract value nor will all clients be able to make your customer service efforts as worthwhile as others.

Depending on your company’s needs and product, your segmenting efforts might stray from the traditional forms of differentiation. By focusing one (or many) of the above strategies first, you’ll likely get into the pattern of recognizing the value of customer segmentation, which can help as you begin to make your model more custom.

Part of growing up as a company is focusing in on the customers that offer the most value—no longer feeling around for the right fit, but knowing your target client that is mostly likely to convert. Here’s how segmentation can help each area of your business focus:

How it improves marketing

One aspect that customer segmentation improves is the focus of your marketing message. By understanding the needs of your most valuable customers, you can tailor your communication strategy to address these pain points and offer solutions. Segmenting also identifies the value of creating different messages for different segments. If your customers are segmented by industry or company size, they may be more active on different platforms as well—providing yet another layer of marketing specificity that can improve messaging performance.

How it improves sales

Customer segmentation can focus a sales team quickly. If the segmentation process properly identifies the traits that make a potential client less valuable, your SDRs can avoid scheduling meetings and your AEs won’t have to worry about conducting demos or drawing up paper work. Instead, they’ll be digging in deeper to find out how to close the clients that really count and make more meaningful progress towards the quarterly goal. Then, the new information gleaned from the successes and failures can be poured back into the segmentation process to further parse out customer traits.

How it improves customer success

Understanding how each segment engages with your product and renews will also help you determine the cost of serving these clients. You might be able to identify how likely you are to upsell a client based on their current needs and the success of upselling similar customers in the past. On the other end, you’ll be able to better predict which customers might cancel quickly and add to your churn rate if the needs your servicing aren’t leading to renewals or if the company size tends to be in a low performing segment. While initial revenue might entice your sales team for the potential value of a customer, renewal segmenting might help you better identify the lifetime value of the customer you’re going after.

How it improves product

Trying to develop and improve a product that appeals to an unnecessarily large customer population can be overwhelming. By segmenting your potential client base, you can zero in on the specific needs that require attention first. As later iterations of your product are release, your priority structure and product road map could largely be dependent on how your customers are segmented.

So much of your success as a SaaS startup relies on execution. Share your updated customer segmentation profile with investors to help increase confidence that your company is taking additional steps to make the necessary improvements to scale.

founders

Metrics and data

Your Startup Needs Financial Planning Now

Your Startup Financial Planning

Financial planning for your startup is a real buzzkill. It’s a long, potentially arduous process that can feel like a gigantic distraction from the actual work needed to make your company grow. Not to mention the plans that founders create that end up closer to WAGs – wild assed guesses –than accurate plans.

But overlooking the importance of financial planning will cause major damage to your company. And if you’re only working on your plan once a year, you’re already doing it wrong. Your annual plan needs to be reviewed every month and possibly readjusted after every quarter. By reevaluating your financials every three months and checking in regularly, you’re performing maintenance on your startup—finding the weak parts of your business and testing your assumptions from the previous year. This is good discipline for any startup CEO.

Establish rigorous financial planning in your business and you’ll better understand how your unit economics are trending, whether headcount projections have created the expected outcome and what’s needed in the next few quarters to stay on track. In the early days it may be exhausting to reassess every quarter, but in the long-run you’ll be building a stronger business.

Tomasz Tunguz recommends creating and sharing two different financial plans every quarter with both the board and your company. The board plan includes the projections that you have 90 percent confidence in executing. With your board plan, you’re making a predictable commitment so you’re not over promising results, but still getting everyone on board in the room that the company is producing real growth. It’s the management team that will bear the responsibility if this plan goes awry, so setting responsible projections is essential.

Tunguz also advocates for a company plan that includes the goals you have 70 percent confidence in achieving. This should be broader, more ambitious and include the individual goals of each team. Your company plan is your reach plan, which helps fire up your troops to do more without applying too much pressure if you fall short. Every company plan should also help you measure department performance and reveal any under performing parts of the team.

The plan should be as detailed as possible so you understand the underlying factors of your business model. If your plan is just a sales number, that won’t show you where you need to improve or where your assumptions may be wildly off. Break out the plan into your different channels and show the key metrics for each. Whether it’s your cost per acquisition, number of marketing leads or customer lifetime value, it’s essential to have everything regularly measured to know if something is going wrong.

It’s not necessary to share all this information with your investors unless requested. Your investors are likely too busy to dig into the weeds. Stick to KPIs and telling the story of your company with your developed board plan. By creating two plans you are speaking to two audiences and maximizing the impact of your message. You’re setting up both ambitious goals and proper expectations. That’s financial planning without unnecessary stress.

Once you’ve hit the end of the quarter, if you feel like your business has only slightly over performed or underachieved on its performance, it’s best to stick to the plan for the next few quarters and not overreact to a potentially short-term trend. Especially if things are going well, the natural inclination of someone building a business is to think that positive performance will continue uninterrupted. Adjusting plan too quickly could cause you to overshoot your company’s ability in the next few quarters. As for under performing, even a one-time loss may provide a reason to add to headcount to help cover the gaps created so you can get back on track to hit your end of year goals.

Falling short of your quarterly goal could be a sign of bad planning on your end as well. Maybe you assumed all your reps would hit 100 percent of their quota instead of the more realistic 80 percent. If you’ve missed consecutive quarters or if your numbers are wildly off, readjust your plan for the next quarter. There may be external factors that are causing the plan to be disrupted as well, like unforeseen market forces or key employee loses that you didn’t expect. Either provides a reason to adjust your quarterly and annual figures. However, make sure these changes are being communicated to your board.

You wouldn’t avoid making constant improvements in any part of your business. A financial plan is no different. These exercises will keep you in constant communication with all parts of your business and allow you a better grasp on different aspects. This will be especially helpful when you face specific questions from investors. It will make you a better founder and executive.

Related Resources: How to Write a Business Plan For Your Startup

founders

Metrics and data

Are You Qualifying Leads the Right Way?

Qualifying leads properly is one of the most effective ways to ensure a healthy sales funnel. In order to do it right, your sales team has to examine whether or not a company qualifies on three different levels. As Bob Apollo argues, a good prospect will exhibit behaviors that earn a sales qualification in three separate categories: “organization-level,” “opportunity-level,” and “stakeholder-level.”

Let’s take a look at the kinds of questions Hubspot uses to determine what your team needs to ask and what they should understand about potential leads to find the right fit for your company.

Organization level

Is this company the right size? Do you sell to their industry? Is this a company that fits the buyer persona you’ve outlined?

Opportunity level

Can you actually fill a specific need for this potential client? Do they have the budget to make it happen?

Stakeholder level

Is this the person that can actually make the deal happen? Will the money come out of their budget? Who decides the criteria for making a purchasing decision?

If the client is way off from your buyer persona, you can cross them off the list immediately. They don’t qualify on an organizational level. If they aren’t feeling the specific pain your company serves, you’ll be wasting their time. You should know how to solve their problem better than the potential client. If they aren’t ready for the solution, you risk on-boarding someone doomed for a bad experience and a quick cancellation.

Remember the most important lesson: you don’t need to grow unnecessary leads. It’s one of the hardest lessons any sales staffs will learn (especially as sales development teams aim for lead quotas), but stuffing your pipeline with unqualified prospects will only clog your path to closing real customers. Reinvest your time into researching and listening to your best qualified prospects instead. Even if you close an unqualified lead, you’re setting yourself up to take a likely loss on lifetime value and won’t enjoy the negative churn opportunities with account expansion. Find incentives for your sales development teams to reign in only the best potential clients.

You might consider developing a qualification framework to deliver to your sales staff. Many deals your team will close will share similar behavior and commonalities. Providing a specific framework can help reinforce that message and methodology across the organization.

Ever since IBM popularized the method in the early days of software sales, BANT (Budget, Authority, Need, Timeline) has been the go-to framework for determining a client’s qualification. To make adjustments for the realities of SaaS sales, SalesHacker argues for an updated version of BANT. As Jacco Van der Kooij outlined, the prioritization of BANT doesn’t jive with the needs of most potential SaaS customers. “When SDRs are given BANT to qualify a deal, it backfires as they essentially are starting to sell while a client is still in ‘education’ mode,” he said. “When AEs are executing BANT to qualify a deal, they are getting affirmative answers yet the deal is still not qualified.”

For instance, budget will play less of a role for your SaaS sales efforts than it would for traditional software companies. Almost all your qualified SaaS leads won’t have to worry about clearing the necessary budget for the monthly or annual subscription fee. Your prospects will be more concerned about whether the problem you’re proposing to solve is worth prioritizing. Knowing that allows your account executives (AEs) or sales development reps (SDRs) to get more specific in qualifying. Let them ask “is what we’re offering something your company needs right now?” once a prospect has been properly educated on the product. Here’s how Van der Kooij would rework BANT to NTBA:

N = Need = Impact on the customer business

T = Time-line = Critical event for the customer

B = Budget = Priority for the customer

A = Authority = Decision Process the customer goes through

Finally, if your company uses lead scoring—a quantitative scoring sheet to analyze potential leads—makes sure to take a thorough qualitative assessment as well. There are almost an endless amount of behaviors that any client could display that might tip you off on their qualifications, but they may not rise to the surface immediately. Plus, it may months to score all the characteristics you require to qualify, which could lead to the decay of the initial behaviors. Instead of waiting on the client to take the actions you need, spend more time evaluating their potential need for the tools you’re offering and identifying the person in the organization who can make that happen.

Further reading

http://www.saleshacker.com/bant-sales-qualification-new-era/

https://mattermark.com/effective-lead-scoring-includes-company-data/

http://blog.hubspot.com/sales/ultimate-guide-to-sales-qualification#qualifying

http://www.inflexion-point.com/Blog/bid/95959/The-3-levels-of-sales-qualification-account-opportunity-sponsor

What’s an Acceptable Churn Rate?

founders

Metrics and data

What’s an Acceptable Churn Rate?

Calculating Your Customer Churn Rate

How do you know how many customers you can lose? Of course, you want to lose as few customers as possible and save as much revenue as you can. However, the reality is any startup is going to shed some clients no matter how well they perform. But both churn rates can help answer two vital questions facing your company: are you targeting the right customers? Is your company big enough?

Customer churn isn’t the same as revenue churn. The first refers to the number of customers that cancel their subscriptions. Revenue churn is simply the amount annual money lost in a month or year.

In the early days, you should have a higher churn rate than what your company will average over its lifespan. In your first few years, you can expect as high as a double-digit churn rate and not need to hit the panic button. But if you’re not seeing a steady drop year over year, you may have the wrong client base or need to invest more money in your client success team.

Talk to your clients that renew. Why did they continue the service? If they love what you offer, they may be the key to unlocking the best set of customers you can target. You don’t want your startup to waste time worrying over cancelled subscriptions if these clients are a natural mismatch and your current set of renewals can help find signal for your product and its go-to-market fit. Sometimes the best strategy for reducing churn rate happens at the acquisition stage.

When it comes to determining an acceptable churn rate, it’s every bit as important to understand the size of your customers’ business as it is your own company. You can accept about three to five percent of your small to medium sized businesses portfolio every month or less than 10 percent annually. As enterprise level businesses go, aim for a churn rate less than one percent. Your churn rate should continue to decline in subsequent years until you reach negative churn.

Reaching negative churn—monthly or annually—is going to be one of the most attractive metrics your company can showcase to its investors. It’s good to have a portfolio of customers “that are like high-yield savings accounts.” Negative churn, also known as account expansion, occurs when the new revenue you are earning from current customers (whether it comes from upsells or cross-sells) exceed the revenue you are losing from customers that cancel their subscriptions. As Lincoln Murphy writes: “Remember, it’s a lot easier to get more money from a customer who’s happy and already paying you than it is to get money for the first time from non-customers.”

Negative churn can also serve as one of the key metrics to judge your client success efforts, as expanding your account revenue beyond your subscription loss will help determine if your team is moving in the right direction. Tomasz Tunguz has even advocated for startups to aim for negative churn when deciding their pricing model and developing a customer success strategy. You’ll want to keep your eye on your minimizing your churn rate and show a sharp decline as years go on, but make sure to set forth on a path that will reach negative churn as your holy grail.

Related Reading: How To Calculate and Interpret Your SaaS Magic Number

founders

Metrics and data

Sales Development Rep (SDR) – KPIs Template

A Google Sheet Template for SDRs

Last week, we talked about the importance of SDRs. Sales Development Representatives (SDRs) have become an increasingly popular position to hire the past 10 years. Just check out this Google Trend from 2010 to now:

If you want to learn a little more about the history and progress of the role, PersistIQ has a great post here. When it comes to SDR teams, the process and metrics always vary depending on multiple factors like company stage, contact sizes, sales cycles and more. There may be no one size fits all playbook and the strategies and processes to get there could vary by a wide amount.

But in our research we found one important commonality in success SDR teams: handing off qualified leads to Account Executives (AE) is an essential goal.

Some teams consider a qualified lead a company that schedules a demo. Other teams wait for the AE to officially qualify the lead after a demo. Either way, you must allow AE’s to work on the most relevant deals to maximize their time and increase their likelihood to close.

Every company should also know the progress of their SDR team, the goals they need to hit and make sure management understands the return. Don’t forget about the intangibles either. Conner Burt, Chief Operating Officer at Lesson.ly, said the long-term prospects for SDRs can often be about more than just filling a funnel.

“Your building a bench that you can use to promote SDRs to quota bearing sales people. That’s an intangible benefit.”

With this in mind, we built a simple SDR KPIs template for sales teams in Google Sheets. It is flexible so you can remove any irrelevant info, manipulate it or add anything missing that fits your process. The template will also easily plug into your Visible account! Get it below!

Click here to get the Free SDR metrics template!

Feel free to copy the sheet and drop in your own goals, metrics and KPIs. Hopefully this is a great reference to get you started! Send any any all feedback our way to marketing at visible dot vc. If you want to integrate with your Salesforce account schedule a demo!

founders

Metrics and data

Why Revenue Per Lead is Really Important to Track

Are you tracking revenue per lead?

Sales can fix a lot of problems. As company growing pains continue as a business scales, it’s easier to focus on marketing initiatives or nip product bugs in the bud if your Monthly Recurring Revenue (MRR) regularly surpasses its goal. Drilling down to the core metrics that drive sales performance is one of the best ways to expose how well a startup scales after reaching initial traction.

As we’ve discussed before, Lead Velocity Rate (LVR) is the favorite metric many VCs want to see to evaluate a company’s sales. Jason Lemkin unabashedly loves LVR, calling it the #1 metric to determine the trajectory of SaaS company’s sales. But Lemkin is also an advocate of measuring Revenue Per Lead (RPL), noting it as the second crucial sales stat to track.

How do you measure RPL? The equation is simple division:

Revenue Generated/Number of Leads = RPL

On the other hand, the benefits of RPL can be widespread for your sales force. Take individual sales rep performance. Once you’ve established your company’s current RPL and track its growth, you’ve created an evolving benchmark that can help measure the effectiveness of everyone on the team. RPL will showcase which reps are able to convert leads into customers at the highest rate. It can also determine how many leads one rep can handle before the workload becomes counterproductive and RPL starts to slump.

More than Monthly Recurring Revenue (MRR), RPL can reveal whether or not your funnel is actually filled with Sales-Qualified Leads (SQL). It will also outline how well your team is converting SQLs and able to achieve additional revenue on each sale as the business scales. As Lemkin told InsightSquared:

“Leads are precious for a long time in startups, and if you can get 20 percent more out of each lead, that’s magic. But if you don’t measure it down to the individual rep level and you just look at MRR, you’re missing an opportunity to improve things.”

So for founders and investors, noting RPL in regular updates provides an easy top-line metric to communicate a startup’s health. It also a powerful indicator within a company of whether or not the business is steady as it scales.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial