Blog

Fundraising

Resources related to raising capital from investors for startups and VC firms.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Fundraising

Carried Interest in Venture Capital: What It Is and How It Works

Carried interest is a fundamental concept in venture capital (VC) that plays a pivotal role in shaping the financial rewards for venture capitalists. This financial term, often shrouded in complexity, directly influences the profits venture capitalists receive from successful investments. As founders navigating the intricate world of VC funding, understanding carried interest is crucial not only for grasping how VCs are compensated but also for appreciating the motivations behind their investment decisions. This article demystifies carried interest, detailing what it is, its importance, how it functions within a venture capital framework, and its implications for both fund managers and investors. By unpacking the intricacies of carried interest, founders can better position themselves to partner with venture capitalists, aligning interests towards mutual success.

Related resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

What is Carried Interest?

Carried interest, in the realm of venture capital, refers to the share of profits that general partners (GPs) of a venture capital fund receive as compensation, beyond the return of their initial investments. This form of income is contingent upon the fund achieving a return on its investments above a specified threshold, incentivizing GPs to maximize fund performance. Typically, carried interest amounts to about 20% of the fund's profits, with the remaining 80% distributed among the limited partners (LPs), who are the primary investors in the fund.

Why Carried Interest is Important

Carried interest is a critical component of the venture capital ecosystem for several reasons. It aligns the interests of GPs with those of the LPs, ensuring that fund managers are motivated to seek out and support businesses with high growth potential. Additionally, it serves as a reward mechanism for GPs, compensating them for the risk and effort involved in managing the fund and guiding the companies in their portfolio to success.

How Does Carried Interest Work?

Venture capital thrives on the principle of aligned interests, with carried interest at its core serving as the linchpin for this alignment. In this section, we’ll cover how carried interest functions, from incentivizing fund managers to maximizing investment returns- cementing the foundation for understanding its critical role in venture capital's operational and strategic framework.

Fund Structure and Contributions

Venture capital funds operate as partnerships between Limited Partners (LPs) and General Partners (GPs). LPs, including institutions like pension funds and high-net-worth individuals, provide most of the capital but are not involved in day-to-day management, limiting their liability to their investment amount. GPs manage the fund, making investment decisions and actively advising portfolio companies, with their income primarily derived from management fees (typically 2%) and carried interest (about 20% of the fund's profits), aligning their financial incentives with the success of the fund.

The structure, usually a limited partnership in the U.S., offers tax benefits through pass-through taxation, allowing profits to be taxed once at the partner level, and establishes a clear separation of operational roles and financial responsibilities between LPs and GPs. This model ensures a strategic alignment of interests, with GPs using their expertise to grow the investments and generate returns, acknowledging the inherent high-risk, high-reward nature of venture capital investing.

Related resource: A Quick Overview on VC Fund Structure

Management Fees

Management fees in venture capital funds are structured to cover the operational and administrative costs of managing the fund. These fees are typically calculated as a percentage of the fund's committed capital, ranging from 1% to 2.5%, and are charged annually to the fund's limited partners (LPs). The exact percentage can vary based on several factors including the size of the fund, the investment strategy, the fund's performance, and market norms. For instance, a fund with $100 million in committed capital charging a 2% management fee would incur a $2 million annual fee.

The primary purpose of management fees is to cover day-to-day operational costs such as salaries, office rent, legal and accounting services, due diligence costs, and other expenses associated with running the VC firm. This ensures that venture capital firms can continue to provide investment opportunities and support to their portfolio companies without compromising on the quality of management and oversight.

Management fees are an important consideration for both venture capital firms and their investors as they directly impact the net returns of the fund. While these fees are essential for the operation of venture capital firms, it's important for LPs to understand how they are structured and the factors that influence their calculation to ensure transparency and alignment of interests.

Profit Wharing: The 'carry'

Carried interest, or "carry," is a profit-sharing mechanism in venture capital funds, allowing fund managers (GPs) to receive a portion of the fund's profits, aligning their interests with the investors' (LPs). Typically, GPs earn carry after returning the initial capital to LPs, with a common share being around 20%, although this can vary from 15% to 30% based on market conditions and the fund's performance.

Carry is distributed after certain conditions are met, such as the return of initial investments and possibly achieving a hurdle rate. The distribution models include European-style, focusing on overall fund performance, and American-style, based on individual investment performance. The taxation of carried interest at capital gains rates, lower than ordinary income rates, has been debated as a potential "loophole".

Hurdle Rate

The hurdle rate is essentially a benchmark return that the fund must achieve before the fund managers (GPs) can start receiving their share of carried interest, which is a percentage of the fund's profits. This rate serves as a minimum acceptable return for investors (LPs) and ensures that GPs are rewarded only after generating sufficient returns on investments.

There are two primary types of hurdle rates: hard and soft. A hard hurdle implies that the manager earns carried interest only on the returns exceeding the hurdle rate. In contrast, a soft hurdle allows the manager to earn carried interest on all returns once the hurdle rate is met, including those below the hurdle.

The purpose of establishing a hurdle rate is to align the interests of fund managers with those of the investors, ensuring that fund managers are incentivized to achieve higher returns. The actual percentage of the hurdle rate can vary but is often related to a risk-free rate of return or a predetermined fixed rate. This mechanism ensures that fund managers focus on exceeding specific performance targets before benefiting from the fund's success.

In the context of venture capital, the typical hurdle rate is around 7-8%, benchmarked against returns from less risky asset classes like public stocks. This reflects the expectation that investors locking their money in a VC fund for an extended period should achieve annual returns exceeding those of more liquid and less risky investments.

Understanding the hurdle rate and its implications is crucial for founders considering venture capital funding, as it impacts how and when fund managers are compensated, ultimately affecting the fund's investment strategy and focus.

Distribution Waterfall

The distribution waterfall process in VC funds is a structured method to allocate capital gains among the participants of the fund, primarily the LPs and the GP. This process ensures that profits are distributed in a sequence that aligns the interests of both LPs and GPs, establishing fairness and transparency in the profit-sharing mechanism.

Understanding the distribution waterfall is crucial for founders as it impacts how VCs are incentivized and how profits from successful investments are shared. This knowledge can be particularly beneficial when negotiating terms or evaluating potential VC partners.

The waterfall structure typically follows a hierarchical sequence with multiple tiers:

Return of Capital: This initial tier ensures that LPs first receive back their initial capital contributions to the fund.

Preferred Return: After the return of capital, LPs are entitled to a preferred return on their investment, which is a predetermined rate signifying the minimum acceptable return before any carried interest is paid to the GP.

Catch-up: This tier allows the GP to receive a significant portion of the profits until they "catch up" to a specific percentage of the total profits, ensuring they are adequately compensated for their management and performance.

Carried Interest: In the final tier, the remaining profits are split between the LPs and the GP, typically following an 80/20 split, where 80% of the profits go to the LPs and 20% as carried interest to the GP. This tier rewards the GP for surpassing the preferred return threshold and generating additional profits.

The distribution waterfall can adopt either a European (whole fund) or American (deal-by-deal) structure. The European model favors LPs by requiring the return of their initial investment and preferred returns before the GP can receive carried interest, enhancing long-term investment returns motivation. In contrast, the American model allows GPs to receive carried interest on a per-deal basis, potentially enabling them to realize gains more frequently but also includes mechanisms like clawback clauses to protect LP interests if overall fund performance does not meet expectations.

Long-term Incentive

Carried interest aligns fund managers' (GPs') interests with investors' (LPs') by linking GP compensation to the fund's long-term success. It rewards GPs with a portion of the profits only after meeting predefined benchmarks, such as returning initial capital to LPs and achieving a hurdle rate. This ensures GPs are committed to selecting investments and supporting them to maximize returns over the fund's life, often spanning several years. For founders, this means VC firms are incentivized to contribute to their company's growth and success genuinely, reflecting a partnership approach aimed at mutual long-term gains.

Understanding Clawbacks and Vesting

Clawbacks and vesting are key elements tied to carried interest in venture capital, designed to align the interests of fund managers (GPs) with the fund's long-term success and the investors' (LPs') expectations.

Clawbacks act as a financial safeguard for investors. Imagine a scenario where a sports team pays a bonus to its coach based on mid-season performance, only for the team to finish the season at the bottom of the league. Similarly, clawbacks allow LPs to reclaim part of the carried interest paid to GPs if the fund doesn't meet overall performance benchmarks. This ensures GPs are rewarded for the fund's actual success, not just early wins.

Vesting in the context of carried interest is akin to a gardener planting a tree and waiting for it to bear fruit. Just as the gardener can't harvest immediately, GPs earn their carried interest over time or upon meeting certain milestones. This gradual earning process keeps GPs motivated to nurture the fund's investments throughout its lifecycle, ensuring their goals align with generating lasting value for LPs.

Together, clawbacks and vesting weave a tapestry of accountability and commitment in the venture capital ecosystem. They ensure that the journey to financial reward for GPs mirrors the fund's trajectory towards success, fostering a harmonious alignment of objectives between GPs and LPs in cultivating prosperous ventures.

Carried Interest Calculation

Calculating carried interest involves determining the share of profits that general partners (GPs) in a venture capital or private equity fund receive from the investments' returns. Here's a simplified process to understand how carried interest is calculated, keeping in mind that actual calculations can get more complex based on the fund agreement:

Determine the Profit: Start with the total returns generated from the fund's investments after selling them, then subtract the original capital invested by the limited partners (LPs). This figure represents the profit. Profit = Total Returns - Initial Capital

Apply the Hurdle Rate (if applicable): Before calculating carried interest, ensure that the returns have met any specified hurdle rate or preferred return rate. This rate is the minimum return that must be provided to LPs before GPs can receive their carried interest.

Calculate Carried Interest: Once the profit is determined and any preferred return obligations are met, apply the carried interest rate to the profit. This rate is usually agreed upon in the fund's formation documents and is typically around 20%. Carried Interest = Profit x Carried Interest Rate

For example, if a fund generates $100 million in returns with $80 million of initial capital, the profit is $20 million. If the carried interest rate is 20%, the GPs would receive $4 million as carried interest.

Example Calculation: $20 million (Profit) x 20% (Carried Interest Rate) = $4 million (Carried Interest)

Remember, this is a basic overview. The actual calculation may include additional factors like catch-up clauses, tiered distribution structures, and specific terms related to the return of capital. Fund agreements often detail these calculations, reflecting the negotiated terms between GPs and LPs.

Tax Implications for Carried Interest

Carried interest is taxed under the capital gains tax regime, which typically offers lower rates compared to ordinary income taxes. This tax treatment applies because carried interest is considered a return on investment for the GP of a VC or private equity fund, which receives this compensation after achieving a profit on the fund's investments. To qualify for long-term capital gains tax rates, the assets generating the carried interest must be held for a minimum of three years. This structure is sometimes debated for its fairness, with some viewing it as an advantageous "loophole" for high-income investment managers, allowing them to pay taxes at a lower rate compared to ordinary income rates.

Unlock Venture Capital Opportunities with Visible

Navigating the venture capital landscape can be a complex journey, but understanding the nuances of carried interest demystifies a crucial aspect of VC funding. This knowledge not only enlightens founders on how venture capitalists are rewarded but also sheds light on the motivations driving their investment choices. Through this exploration, we've delved into the essence of carried interest, from its foundational role in aligning GP and LP interests to its implications on fund structure, management fees, profit sharing, and more. Armed with these insights, founders are better equipped to forge partnerships with VCs, ensuring a unified path to success.

As you venture further into the intricacies of raising capital and managing investor relations, remember that tools like Visible can significantly streamline your efforts. Visible empowers you to effectively raise capital, maintain transparent communication with investors, and track important metrics and KPIs. With Visible, navigating the venture capital process becomes more manageable, allowing you to focus on growth and innovation.

For more insights into your fundraising efforts, Visible is the go-to platform. Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related resource: 25 Limited Partners Backing Venture Capital Funds + What They Look For

investors

Fundraising

Metrics and data

Customer Stories

[Webinar Recording] VC Fund Performance Metrics to Share When it’s ‘Early’ with Preface Ventures

It’s common for venture firms to start raising their next fund in the last year of capital deployment, typically years 3-4 of a fund’s life. This poses a sort of chicken-and-egg problem because many of the common fund performance metrics that Limited Partners use to drive allocation decisions only become reliable, and therefore more meaningful, around year six (Source: Cambridge Associates).

Farooq Abbasi, founder and General Partner of Preface Ventures, created a Seed Stage Enterprise VC Funding Napkin to help GPS think through alternative fund metrics that help communicate performance outside the traditional indicators that LPs use to measure success for more mature funds. The Seed Stage Enterprise VC Funding Napkin helps answer the question "What is good enough to raise a subsequent fund in the current market conditions".

Farooq from Preface Ventures joined us on Tuesday, February 27th for a discussion about the fund performance metrics GPs can use to benchmark and communicate fund performance when it's still 'early'.

View the recording below.

Webinar Topics

The issue with ‘typical’ fund performance metrics for ‘early’ funds

Overview of Preface Venture’s Seed Stage Enterprise VC Funding Napkin

Deep dive into alternative early performance benchmarks

How to keep track of alternative fund performance metrics

How to leverage alternative fund performance indicators into your fundraising narrative

Inside look into how Preface Ventures keeps LPs up to date

Q&A

Resources From the Webinar

Christoph Janz's What does it take to raise capital, in SaaS, in 2023?

Preface Ventures' A GP's View on VC Fund Performance When It's Early

Diversity VC

About Preface Ventures

Preface Ventures is a New York City-based firm started in 2020 led by Farooq Abbasi. Preface invests $500-$2M at the pre-seed and seed stage into startups who are building the Frontier Enterprise structure. Preface has 20 active positions in Fund II and 7 active positions in Fund III. (Learn more)

investors

Fundraising

Customer Stories

[Webinar Recording] Lessons learned from raising Fund II with Gale Wilkinson from VITALIZE

"The most successful fund managers are going to be the ones who are really authentic to what is important to them and they make sure every attribute of their model reflects that authenticity." - Gale Wilkinson

About the Webinar

Markdowns and lack of LP distributions resulted in a challenging fundraising year for many VCs. The firms that did close new funds in 2023 had to put in extra work to stand out and foster confidence from new investors.

Visible had the pleasure of hosting Gale Wilkinson from VITALIZE Venture Capital on Tuesday, January 30th to discuss what she learned while closing her second fund in Q4 of 2023.

You can view the webinar recording below.

Webinar topics

This webinar was designed for people working in Venture Capital who want to learn more about the VC fundraising process.

Webinar topics included:

Overview of VITALIZE's fundraising process

Pre-fundraising activities that made a difference

How LP diligence differed between Fund I and Fund II

How Gale leverages social media to build both her personal and professional brand

Reviewing VITALIZE's fundraising pitch deck

Advice for GP's raising in 2024

You can view the presentation deck here.

Key Takeaways

Expect raising your first and second fund to take 2-3 years

Stay authentic to what's most important to you as a fund manager and what you're great at. Make sure every attribute of that model reflects your authenticity.

Most GP decks are too long. Gale's advice --> Find out what about your story is most interesting and give enough information to make it extremely clear about who you are and what you do without going into confidential information.

investors

Fundraising

25 Limited Partners Backing Venture Capital Funds + What They Look For

Where Do LPs Get The Capital They Deploy?

The National Venture Capital Association states that limited partners (LPs) are typically institutions or high-net-worth individuals, family offices, and sovereign wealth funds that have a substantial amount of liquid capital to invest. Some examples could include pension funds, endowments, foundations, and insurance companies.

In many cases, these investors allocate a portion of their capital to alternative asset classes, such as private equity or venture capital, as part of a broader investment strategy. The LPs then pool these funds together and invest them in venture capital firms as limited partners. It carries a higher risk compared to traditional assets such as stocks and bonds but also offers the potential for higher returns. Institutional LPs generally invest between $5 million to $50 million in a fund.

The venture capital firm, in turn, uses the capital to invest in early-stage or high-growth companies with the potential for significant returns. If the investments are successful, the venture capital firm will generate returns for its limited partners, who may then reinvest those returns into other funds or asset classes, or distribute them to their own investors or stakeholders.

How To Find LPs

Finding limited partners (LPs) for a venture capital fund can be a challenging and time-consuming process. Here are some general steps that can help:

Develop a target investor profile: Before starting your search for LPs, you need to understand the type of investors who are likely to be interested in your fund. Consider factors such as their investment preferences, geographic location, size of investment, and sector focus.

Network: Networking is a crucial part of the fundraising process. Attend industry conferences, join venture capital associations and groups, and seek out opportunities to meet potential LPs in person or online.

Leverage existing relationships: Reach out to your existing network of investors, entrepreneurs, and industry contacts to see if they can introduce you to potential LPs.

Work with placement agents: Placement agents are firms that specialize in helping venture capital firms raise capital from institutional investors. They can provide access to a broader range of LPs and can help you navigate the fundraising process.

Use online databases: As mentioned earlier, there are online databases like PitchBook, Preqin, and NVCA that offer information on LPs investing in venture capital firms. These databases can help you identify potential LPs and get a better understanding of their investment preferences and history.

Hire a professional investor relations team: Larger venture capital firms often have dedicated teams focused on investor relations. If you have the resources, hiring a professional investor relations team can help you navigate the fundraising process and build relationships with potential LPs.

LPs and VCs typically connect through one of two channels, either directly, due to prior collaboration at another fund or in an adjacent area of finance, or indirectly, via a warm introduction from a trusted source.

When VCs set out to establish a new fund, they often seek out an initial, strong LP known as an anchor. The anchor commits to the fund and helps the VC identify other potential investors. Depending on the network of the VC and their anchor, the fund’s investors can include family offices, high net-worth individuals, or even large institutional funds such as a fund of funds, CALPERS, or university endowments.

While VCs tend to be selective in choosing who they allow to invest in their fund, the process of selecting an anchor by well-connected or respected individuals is even more deliberate and cautious. Securing the right anchor for a fund is a crucial task for a venture firm to successfully raise their fund and set the stage for subsequent rounds in the future.

What Kind of Limited Partner To Target For Your First Fund

If you are building your first fund, you should look for LPs who are interested in investing in early-stage venture capital funds and have a history of investing in first-time funds. These LPs are typically high-net-worth individuals or family offices who are willing to take on higher risks for potentially higher returns.

Additionally, you may want to consider looking for LPs who have experience in the industry or sector you are targeting with your fund. They can provide valuable insights and connections that can help you identify and evaluate investment opportunities.

It’s also important to consider the size of the LPs you are targeting. While institutional investors can provide significant capital, they may also have more stringent investment criteria and require a proven track record. On the other hand, smaller family offices and high-net-worth individuals may be more flexible and willing to take a chance on a first-time fund.

Related Resource: Visible’s Guide to Fundraising for Emerging Managers

Criteria That LPs Use to Evaluate VC Firms

Limited partners (LPs) use various criteria to evaluate new venture capital firms that are raising either their first fund or subsequent ones.

Investment thesis: LPs want to see that the VC firm has a clear and well-defined investment thesis that fits their interests and investment strategy.

Team: LPs evaluate the experience, track record, and expertise of the VC firm’s founding team. They want to see that the team has relevant experience and a strong network in the industry.

Transparency: LPs expect transparency from the VC firm on their investment activities, portfolio performance, and other relevant information. Use our templates for Investors to create transparency by sending your LPs updates!

Differentiation: LPs look for a unique and differentiated value proposition of the VC firm that sets it apart from other firms in the market.

Network: LPs consider the firm’s network of industry contacts, co-investors, and advisors to gauge their potential deal flow and access to investment opportunities.

Deal flow: LPs assess the firm’s ability to source high-quality deals and their process for evaluating potential investments.

Due diligence: LPs want to see that the VC firm has a rigorous and disciplined process for conducting due diligence on potential investments.

Alignment of interests: LPs look for a firm that aligns its interests with those of the LPs, such as having a significant investment in the fund, a reasonable management fee structure, and a fair carried interest arrangement.

Related Resources: VCs can use Visible.vc to send their LPs updates as well! Check out our LP Update templates below.

Returns That LPs Expect

There are very complex agreements between venture capital LPs and venture firms/GPs, as you might imagine.

Based on research from Cambridge Associates, over the past ten years, the highest 25% of venture capital funds have yielded an average annual return between 15% and 27%. In contrast, the S&P 500 has only yielded an average of 9.9% per year over the same period.

Generally, top-tier venture LPs are looking for something north of a 3x net return on invested capital. This is for venture funds that usually have a formal 10-year lifespan. Top-tier venture LPs usually would rather have higher returns than faster returns, i.e. they don’t really care about IRR if they can get high overall returns.

Related Resource: What is IRR for VCs

3x net return on invested capital doesn’t sound like a lot for a financing industry that helps fund companies like Google and Facebook, but there are surprisingly few venture firms that can generate that level of overall return over time.

Related Resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

What is Included in Limited Partner Agreements

Extensive documentation of the terms of an investment in a venture fund is contained within the Limited Partnership Agreement (LPA). The LPA outlines several critical terms, including:

Management Fee: This fee is paid quarterly by Limited Partners (LPs), the investors, to the General Partner (GP), the venture capitalist, to manage the fund. The fee is typically 2% of the committed investment but decreases once the fund has invested in new companies, typically after five or six years. After the investment period, the fee declines annually based on a negotiated formula.

Carried Interest: The GP earns a fee, generally 20% of any profits on the fund after the LPs have received back their invested capital up to the point of liquidity event that made the carried interest possible. Once the GP has paid back the LPs all that they have invested up to that point, the GP gets 20% of distributions, and the LPs receive 80%. For a period, the GP may get more to “catch up” and receive their 20% carry.

Hurdle Rate: While popular with private equity (PE) funds, a hurdle rate is not typical with venture capital (VC) funds.

GP Clawback: If the GP receives more than 20% of the profits at the end of the fund, the GP agrees to pay back the LPs. This may happen if the GP receives their 20% early in the fund’s life based on early successes, but the LPs continue to invest, and the fund performs poorly, with no future distributions to bring the LPs to the point where they have all their invested capital back and 80% of any distributions above the return of capital.

Investment Period: This is the period that the GP/VC has to make new investments, usually five to six years. After this period, the GP can only make follow-on investments in existing portfolio companies and cannot invest in new companies.

Term: The term of a fund is generally ten years, with potential extensions of up to three years. The extensions may require LP approval or not. In theory, once the fund term is over, the fund should be fully liquidated, although provisions for a longer fund life may be necessary to take care of some lingering investments.

Key Man: Many funds identify one or a few key employees (VCs) whose leaving can trigger something – usually the end of the Investment Period. So if the super star VC of the firm leaves or dies, something happens. Likely, the Fund at that point can’t make any new investments unless the LPs vote that they can. There are many variations of this. A typical clause would be if 2 or 3 of 5 named partners leaves then this is triggered also.

GP Commitment: The GP has to commit at least 1% of the capital of the fund, with more being better, but 1% is standard.

Fee Offset: If the GP takes any fees from portfolio companies, those fees go to reduce the management fee paid by the LPs. In a VC firm, the offset is usually 100%.

Investment Limitations: Limitations on investments in public companies, in hostile takeovers, in international companies…Limits on the amount of investment in any one company…

Borrowing: Limitations on the Fund’s ability to borrow or guarantee borrowings.

Related Resource: What should be included in a Data Room for LPs?

Resources

NVCA-2023-Yearbook

The NVCA Yearbook serves as an important industry resource documenting trends and analysis of venture capital activity from the past year.

OpenLP

Demystifies the LP perspective, helping GPs stay on top of their game and better understand how venture works.

4Degree Airtable LP List

A database with LP names, websites, investment manager names, and other information to help you with your fundraising

List of LPs

Foundry

We invest in startups and venture funds, creating a symbiotic network that propels innovation. Our approach to venture capital is characterized by long-term thinking and a “give first” philosophy.

Wellcome Trust

Wellcome Trust is a healthcare-focused private foundation with investments in various financial assets, including public or private corporate equity, real estate, and infrastructure, among others. Its investment portfolio is currently valued at $25.7 billion.

Point72

Point72 is a global asset manager led by Steven A. Cohen that deploys discretionary long/short equity, systematic, and macro investing strategies, complemented by a growing portfolio of private market investments.

Blackstone

Blackstone is the world’s largest alternative asset manager, with $975B in AUM. We serve institutional and individual investors by building strong businesses that deliver lasting value.

StepStone Group

StepStone Group provides investors with customized portfolios that integrate primaries, secondaries, and co-investments.

GIC

GIC is one of the three investment entities in Singapore that manage the Government’s reserves, alongside the Monetary Authority of Singapore (MAS) and Temasek.

Recast Capital

Recast Capital is a platform supporting and investing in emerging managers in venture capital. As our name suggests, we are breaking the traditional mold and doing things a bit differently.

MacArthur Foundation

The MacArthur Foundation supports creative people and effective institutions committed to building a more just, verdant, and peaceful world.

Plexo Capital

Plexo Capital is an institutional investor focused on investing into: 1/ venture capital funds led by general partners creating the next generation of leading franchises + 2/ private companies led by entrepreneurs building the future.

Partners Group

Partners Group is a large, independent investment firm that is truly dedicated to private markets. We are fully aligned with our clients and provide bespoke solutions to institutional investors, sovereign wealth funds, family offices and private investors globally.

MSD Capital

MSD Capital, L.P. was established in 1998 to exclusively manage the assets of Dell Technologies Founder, Chairman, and CEO Michael Dell and his family. MSD Capital engages in a broad range of investment activities with flexibility to invest in a wide variety of asset classes.

Emerson Collective

Emerson Collective is focused on several key issue areas. Complex issues require complex solutions, so we use a broad range of tools including philanthropy, venture investing, convening, and art to spur measurable, lasting change.

Soros Family Office

Soros Fund Management LLC (SFM) is the principal asset manager for the Open Society Foundations – one of the world’s largest private philanthropic funders. SFM invests globally in a wide range of strategies and asset classes, including public equities, fixed income, commodities, foreign exchange, alternative assets and private equity.

Vintage Investment Partners

Vintage is a global venture firm that invests in venture funds and startups via primary and secondary transactions.

Korea Venture Investment Corp

KVIC invests in VC funds globally, managing the ‘Korea Fund of Funds’ backed by Korean governments.

Argonautic Ventures

Argonautic Ventures is a Venture Capital and Hedge Fund that focuses on a handful of emerging and mature industries.

Mousse Partners

Mousse Partners is the investment division of Mousse Investments Limited that manages a proprietary global portfolio of investments.

Top Tier Capital Partners

Top Tier Capital Partners is a venture capital fund of funds, co-investment, and secondaries manager investing.

Next Play Capital

Next Play Capital is a venture investment firm that focuses on both funds and direct co-investments.

Greenspring

GA is a comprehensive platform focused on fund, direct and secondary investments solely within the venture capital asset class.

Sapphire Ventures

Sapphire is a venture capital firm that partners with visionary teams and venture funds to build companies.

Willougghby Capital

Willoughby Capital is an investment firm focused on partnering with growth companies across private and public markets.

Pritzler Vlock Family Office

Pritzker Vlock Family Office (PVFO) manages a diverse and international asset base that includes emerging bio tech and medical device companies, consumer technology products, real estate and more. Created with a vision to back great people with industry changing ideas, PVFO is a family backed organization that operates with a singular goal: to invest in capital efficient opportunities that result in meaningful and lasting impacts.

Seven Valleys

Seven Valleys is a New York City-based family office. The family office manages a portfolio across investments in commercial real estate, venture capital, private equity and other asset classes.

Related resource: Carried Interest in Venture Capital: What It Is and How It Works

Keeping Your LPs Up to Date with Visible

Over 400+ funds are tracking key metrics from their portfolio companies and keeping their Limited Partners up to date using Visible. Impress your LPs with data-informed, easy-to-build, updates about your portfolio and fund performance.

Related resource: Understanding the Role of a Venture Partner in Startups

investors

Fundraising

Visible’s Guide to Fundraising Best Practices for Emerging Fund Managers

This guide incorporates content from Visible’s webinar on the same topic hosted with guest Sara Zulkosky from Recast Capital. You can watch the full recording here.

Raising a venture fund is hard. General Partners (GPs) first have to find and then nurture relationships with potential investors, also known as Limited Partners (LPs). Then they have to build a persuasive enough case as to why the LP should entrust them as stewards of the LP’s capital for about 10 years — that’s the timeline if things go according to plan. When looking at it from this perspective, it makes sense why the VC fundraising process can take a year or in some cases even a few years.

Now throw in the challenge of not having prior experience raising a fund and the pursuit of becoming a GP sounds even more daunting. However, with the help of programs like Recast Capital and VC Labs, emerging managers have access to more support than ever to close on their first, second, or third fund.

Plus, according to a report from Cambridge Associates emerging managers are outperforming established funds which bodes well for GPs trying to make their case to LPs.

This article breaks down the fundamentals of raising a venture fund for emerging managers.

Understanding Different Types of LPs

Just like when starting a company, it is critical for GPs to find product market fit for their fund. The customers of the fund are LPs who are not only looking for a return but oftentimes are also interested in market insights, access to deal flow, and even impact. To set yourself up for success in finding the right LPs, it’s crucial to invest in getting to know your customers and their pain points.

Diana Murakhovskaya (The Artemis Fund) recommends…

“…ask questions like a startup would do if they were doing customer discovery. You need to learn about them (LPs) first. What drives them? What are they interested in besides returns? Treat LPs as individuals and not just a check.”

(Source: How to Source and Connect with LPs).

There are four major types of LPs that exist: High Net Worth Inviduals, Family Offices, Institutional LPs (including pensions and endowments), and Sovereign Wealth Funds.

The chart below outlines the Pros and Cons of the different LP types from the perspective of an emerging manager.

To summarize, high-net-worth individuals and family offices are typically the best fit for emerging managers. They’re more nimble and able to write smaller check sizes which is good because the typical fund size for emerging managers according to Recast Capital is $10 – $30 M. (Source: Webinar Recording Fundraising Best Practices for Emerging Managers)

Alternative LP types that shouldn’t be ruled out and that are becoming more common include corporations, banks, and fund of funds. Sara Zulkosky from Recast Capital encourages emerging managers to widen their lens a bit and consider exploring these alternative types of LPs.

How to Find LPs

Tap into Your Immediate Network

A great place to start fostering relationships with potential investors is by tapping into your current network. Communicate your goals and why you’re passionate about them with people already in your network but be sure to avoid violating General Solicitation laws. Don’t approach these conversations with a check in mind but rather to seek feedback on your thesis and approach. Even if no one in your immediate network may be able or interested in investing in your fund, there may be people willing to make an introduction to someone who is.

Foster Your Peer Network

Building out your peer network is important not only for fundraising but also for knowledge exchange, support, and emotional well-being — as stated before — fundraising is challenging and it’s helpful to have others in your corner who understand what you’re going through.

While GPs targeting the exact same sector, stage, and thesis might be considered competition, any GP with an adjacent approach can be a great source of support and even introductions.

Consider joining different communities of emerging managers such as Recast Capital, VC Lab, Women in VC, All Raise, or starting your own round table if you don’t already have a peer group in place.

The maxim holds true that rising tides raise all ships.

Use LinkedIn

LinkedIn is a powerful tool to find new contacts and leverage your existing network. While Family Offices are traditionally opaque, an easy search for ‘Family Office’ or ‘Private Family Office’ in people’s job titles results in people supporting different functions of this type of investor. From there, it’s always best to see who your second-degree connections are to understand if someone can make a warm introduction on your behalf or as Sara Zulkosky stated it’s also ok to “shoot your shot” and send a cold message.

Tips for Cold Emails:

Keep it short, sweet, and to the point.

Always take the time to personalize it when you can.

Flattery works. We’re all human and we all like it when people take the time to get to know what interests us.

Use Databases

While not free, if you can get access to PitchBook or Prequin these can be good sources to better understand the investment activity of LPs. You’ll be able to get an understanding of which LPs invested in certain funds (if it was disclosed) and for how much.

Drawing LPs to you

Some LPs seek out GPs so it’s a great idea to create thought leadership content that demonstrates your expertise. These can be articles that communicate your conviction around your thesis and the sectors in which you’re investing.

It’s also a great idea to share this content with LPs via email after you meet with them to stand out from other GPs.

While some GPs have created a robust social following by investing in content for twitter and LinkedIn, Sara Zulkosky stated this isn’t necessary and you should choose activities that are aligned with your personal brand and your fund’s brand.

Keeping Track of LPs

We’ve covered how to find LPs in general and which types of LPs at a high level might make sense for your fund. These potential investors should be considered your ‘top of funnel’ LPs and you should keep track of them in the first stage of your fundraising pipeline. Learn how to build a fundraising pipeline in Visible here.

Visible recommends tracking LPs in 6-8 pipeline stages to stay organized.

In this article Roseanne Wincek at Renegade Partners shared she used the following pipeline stages for her fundraising process:

Cold Lead

Warm Lead

Scheduling

First Meeting

Data Room

Second Meeting(s)

References

Docs

Learn about how to keep track of LP’s in your fundraising pipeline in Visible by booking some time with our team.

How to Qualify LPs

Next, it’s important to qualify LPs based on certain criteria to make sure you’re running an efficient fundraising process. Appropriately qualifying LPs will save both you and LPs a lot of time in the long run.

Here are some example criteria you can use to qualify LPs:

Check Size — Make sure the LP is able to write check sizes that will work for the size of the fund you’re raising

Thesis of Firm — Understand whether the LPs have a vested interest in your space

Room for Emerging Managers — Newer LPs often have more open slots for emerging managers as a part of their investment strategy

Vision Alignment — Does the LP understand and align with your vision

What does an ‘Ideal’ LP look like

While the points above are mandatory to appropriately qualify an LP, here are some other traits to look for in an ideal LP.

They’re someone you’d want to engage with regularly for at least 10 years.

They’re able to be patient with returns.

They can offer valuable support in a way that will benefit you or your fund.

What to Ask During a First Meeting with an LP

The first meeting is not just for the LP to get to know you — it’s also a great time for you to show you’ve done your homework by asking thoughtful questions to the LP.

Sara from Recast Capital’s advice to GP’s..

“You should always feel comfortable asking LPs questions to start the conversation and LPs should always be willing to answer them…Don’t feel shy. Definitely ask these questions because you’ll get a very good sense a few minutes in whether this is worth your time.”

Here is a list of example questions GPs should feel comfortable asking LPs in a first meeting:

Could you tell me more about your investment strategy?

Where do you want to be spending your time as it relates to your investment strategy?

What’s the size of your private portfolio?

Are you currently making new commitments?

What’s your typical check size?

What does your process look like to invest in an emerging manager?

Have you ever invested in an emerging manager?

What’s the smallest fund you’ve invested in?

The LP Diligence Process

The length of the diligence process depends on the LP organization and how much red tape there is internally. If an organization is small, nimble, and enthusiastic about your fund, it could take just a month but this is rare. The diligence process from Institutional LPs usually takes about 6 months. It can take even longer if advisors and consultants are involved.

Do your part to keep the diligence process streamlined by having your LP Data Room set up in advance.

Related resource: What to Include in your LP Data Room.

Visible supports Data Rooms for Emerging Managers — learn more.

Nurturing Relationships with LPs

It’s important to remember that LP’s have a lot of inbound interest to manage. For this reason, it’s a great idea to go the extra mile to stand out to LPs by following the tips below.

Demonstrate you’re an excellent communicator

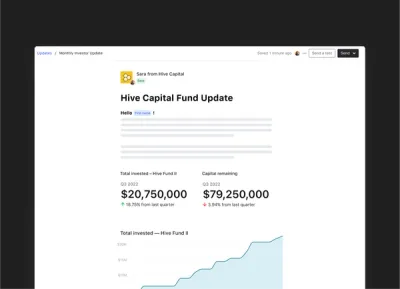

It’s a great idea to get into the habit of sending monthly fundraising updates to potential LPs that you’d like to build deeper relationships with. Check our Visible’s LP Fundraising Monthly Progress Update for inspiration.

Here’s what Elizabeth “Beezer” Clarkson, Partner at Sapphire Partners and institutional LP had to say about best practices for reaching out, building, and maintaining relationships with institutional LPs…

“Clear and consistent communication is imperative in helping create a strong GP/LP relationship. LPs want to know you’re in touch with your portfolio and you have a full assessment of its health: cash runway, pacing information, ownership, who was in the round, why you did the deal, how you found it, and how the company is doing. Some folks do routine newsletters, Zooms, or recordings – whatever works for you. Once a quarter is sufficient, and it’s always good to offer to stop by and visit when in town.”

(Source: “Ask an LP” with Beezer from Sapphire Partners)

Prove your sector expertise by sharing thought leadership content

Sara Zulkosky from Recast Capital recommends taking the time to write your own thought leadership pieces that focus on the sectors that you want to invest or your thesis.

Include these articles in your monthly updates or send a one-off email to an LP after a meeting to further demonstrate your expertise.

You can also use the content you’ve written as a reason to follow up with an LP who may have ghosted you after a first meeting. “I wanted to follow up with a recent article I wrote that was a continuation of the conversation we had last month…”.

Do what you say you’re going to do

LPs are only human after all and every single one of us respects the people in our lives who are true to their word. If you said you were going to do something or follow up with a resource, do it. This is both a powerful and easy way to build rapport.

Use Visible’s fundraising CRM to stay on top of when it’s time to follow up with a contact. Learn more here.

Know your metrics like the back of your hand — and how to communicate them

Even if this is the first time you’re raising a fund you will be expected to understand the core VC Fund Metrics and why they matter to LPs. Take the time to make sure you understand your fund model in and out and how the variables affect return possibilities.

Related Resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

Add bottom-of-the-funnel LPs to current LP Updates

And finally, a suggestion from Sara at Recast is to add the LPs with a serious interest, your ‘bottom of funnel’ LPs, to your current committed LP communication list. It’s a great way to make them feel special (because they are) and bring them into the folds of how you communicate and what you share with current LPs.

Concluding Thoughts

Raising a venture fund, especially for first-time managers, can seem like a daunting challenge. However, over time emerging managers are being recognized by both Limited Partners and startup founders as the best way to bring about positive change in the venture industry.

Visible provides professional fundraising tools for ambitious fund managers with its Emerging Manager Fundraising Toolkit.

investors

Fundraising

[Webinar Recording] Fundraising Best Practices for Emerging Fund Managers

Emerging Managers are often underserved and overlooked in the VC industry. However, the success of Emerging Fund Managers is widely considered the most promising way to improve the future of VC in terms of increasing returns, fueling innovation, and improving diversity.

Visible invited Recast Capital to deliver content on fundraising best practices for Emerging Fund Managers looking to raise their first, second, or third fund.

Sara Zulkosky has experienced every facet of Venture Capital from deal sourcing and managing investments, working as an LP at Greenspring Associates, graduating from the Kauffman Fellow program, and most recently co-founding and managing Recast Capital — a 100% women-owned platform investing in and supporting emerging managers in venture.

Sara walked us through fundraising best practices for Emerging Fund Managers and answered key questions like:

How to find Limited Partners

How to keep track of and nurture relationships with LPs

Which questions to ask LPs during a first meeting

Learn more about Visible’s Emerging Manager Fundraising Toolkit.

investors

Fundraising

What to Include in an LP Data Room

With uncertainty in the VC industry, LPs are being more cautious and scrutinous than in previous years. Meanwhile, LP teams are often understaffed meaning they lack the bandwidth to spend time doing due diligence on the growing number of VC funds.

What does this mean for you as you kick off your next fundraise?

You need to make it as easy as possible for LPs to understand, analyze, and build conviction about you and your fund. A well-structured, thoughtful data room plays a major role in streamlining the VC fund diligence process.

This article highlights how to build a data room LPs will get excited about.

What is a Data Room for LPs?

A Data Room is a repository comprised of folders, files, and pages created by potential fund managers to give their potential investors access to sensitive information about their team, fund, and track record. LPs use this to ensure a fund meets their own investment criteria. It’s in part a marketing tool, in part a legal requirement, and altogether a critical step in being able to raise capital from Limited Partners.

Learn more about Visible's fundraising tools for emerging managers.

When do I need to Create a Data Room for LPs?

You should start preparing your data room a month or two before officially kicking off your fundraise. At a minimum, you have a solid pitch deck in place and should be familiarizing yourself with an LP data room file checklist to start forming a plan around what content you’re going to need to get in order.

Download Visible’s LP Data Room Checklist to start preparing your Data Room.

What you need to avoid is having an LP ask for access to your data room and scrambling at the last second to put something together. That’s not the first impression you want to give when you’re trying to get someone to trust you with their money.

LP Data Room Pro Tips

Include excel files instead of PDFs wherever relevant. Analysts at Limited Partners organizations are going to be extracting and analyzing any data you give them so share it in excel format to make it easier on them.

Every LP is different so be prepared to share different Data Room views with different people.

Share your initial Data Room with a few LPs you trust and get feedback and then update as needed.

Consider sharing a table of contents first, and then asking what an LP needs access to, to save LPs from wasting time digging through all your folders to find what they need.

Always keep your founders’ privacy in mind when including information on portfolio companies.

Investors have limited bandwidth to spend on diligence. Focus on the quality, not the quantity, of the documents in your data room.

What should be included in my Data Room for LPs?

We’ve broken down our list below into two sections:

Initial Interest Data Room which includes the information you’d want to share with LPs who are just getting familiar with your fund.

In-Depth Data Room which includes more sensitive information that you’d want to share only when LPs have expressed serious interest in your fund.

Initial Interest Data Room for LPs

Cover Letter

A cover letter is a great way to add a personal touch to your data room (remember LPs are looking at hundreds of other data rooms) and should include high-level information about the GP and the fund.

Your cover letter can answer questions like why you’re starting this fund, why you’re uniquely qualified, and your contact information.

Table of Contents

Including a table of contents is a great way to quickly help investors navigate to the right place to help them find what they need.

Consider making your Cover Letter and Table of Contents public to pique the interest of LPs but make sure the rest of the folders are viewable only upon request.

Pitch Deck

Your pitch deck, especially if you’re an emerging manager, needs to shine. It is the main qualitative piece of content that LPs will use to vet your fund. If your deck doesn’t resonate or intruige an LP, they may immediately pass on viewing the rest of your data room.

The average fund deck is 15-20 pages in length and explains:

Your Team — Who is on your team and what relevant experience do they bring.

Sourcing Strategy — How are you uniquely positioned to find and attract deal flow.

Competitive Advantage — Why will founders choose your fund? What’s your value add?

Investment Focus — What are you investing in? Why do you know this market, sector better than anyone else?

Track Record — How have previous angel, personal, and private capital investments performed?

Fund Structure — What is the size of the fund, stage of investments, and the number of investments.

Network — Who is in your corner? Who have you collaborated with that could vouch for you?

Appendix — Additional materials for commonly asked questions.

The list above is inspired by Signature Block’s post on VC Fund Decks that Close LPs.

Investment Process

How are you going to find, attract, diligence, invest in, and support deals that are expected to yield a 10x+ return?

In this folder of your Data Room, compile content that demonstrates an understanding of your investment sector, market, how you will evaluate risk, and your decision-making framework.

Team

Don’t skimp out on this section by just including resumes. Especially if this is your first fund, you need to paint a compelling picture that answers ‘Why YOU?’.

What special experience and skills does your team exhibit? Why should an LP trust you with their capital and also want to engage with you on a regular basis for the next 10 years?

Newsletters or Monthly Updates

Your ability to communicate matters. LPs are investing not only for returns but also for insights. Are you able to analyze market trends, draw your own insights, and share them with stakeholders? Excellent! Include examples in this section.

Visible lets investors embed Updates directly into their Data Rooms.

Fund Model

This should be an Excel file forecast of your investment strategy in practice. It is critical to get the math in your model correct. Incorrect calculations in your model signal a poor understanding of VC fund management that will be hard to recover from.

Your fund model should include your fund size, average check size, management fees, carry, reserve for follow-on, average valuation, target ownership, etc, as it relates to your IRR goals.

To better understand portfolio construction at a high level check out this post.

Be sure to share your model in Excel, not PDF. LPs are going to use this file to stress test your model based on different assumptions.

Track Record

This should be an Excel file spreadsheet detailing your previous investments as well as a roll-up summary. The column headers should include the Company Name, Initial Investment Date, Initial Stage, Current Ownership, Realized Capital, Fair Market Value, Multiple of Capital, and IRR.

Ready to take the next steps with Visible?

If you’re raising your first fund and don’t have a fund track record, include examples of angel investments, SPVs, or personal investments. Be sure to specify how you found the deal and your specific involvement.

Read more about sharing your track record as an Emerging Manager.

Due Diligence Questionnaire (DDQ)

Think of this as a standardized FAQ that LPs will use to easily understand and compare your fund against other funds. This should be a living document and updated over time as you engage with different types of LPs.

No need to recreate the wheel for your DDQ. The Institutional Limited Partners Association (ILPA) has put together a standard template found here.

This concludes what should be in your ‘Initial Interest Data Room’. Keep reading to get a better idea of what LPs ask for once you’ve passed the initial stages of their diligence.

In-Depth Data Room for LPs

The content below is usually only shared when LPs are conducting more in-depth diligence on a fund. It’s not best practice to share these files from the start (unless asked) because investors only have limited attention and bandwidth.

In-Depth Data Room Content:

References

Sample Term Sheet

Details on Portfolio Companies

Case Studies

Limited Partnership Agreement

If you’re on your 2+ fund you may also be required to show the following:

Previous Investment Memos

Audited Tax Returns

ESG Policy

Conclusion

Creating a well-organized Data Room is an important step toward making a good impression on LPs during your fundraising process. Preparing your Data Room in advance will help you stand out in today’s competitive VC fundraising environment.

Interested in learning about Data Rooms for VC’s?

investors

Reporting

Fundraising

LP Reporting Templates for VCs

The General Partner (GP) and Limited Partner (LP) relationship is built on trust. The best way to establish trust with LPs is through transparency, authenticity, and regular communication. When LP reporting is done well, LPs should easily be able to understand how both the fund and the fund manager are performing and be able to use this information to inform their investment strategies in the future.

The best GPs view sending LP Updates as a relationship-building activity and as a fundraising tool — not as a way to simply check off a requirement from their LPA’s.

For emerging managers, your relationships with initial LPs are of critical importance for your reputation as a fund manager and future fundraising. This rapport forms the basis of the fund manager’s credibility and will surface again when future LPs are doing diligence on the emerging manager. First-time fund managers will need to have clean data to support their track record and positive relationships with current LPs to set themselves up for success in raising additional funds.

The Weekend Fund recently wrote a thoughtful article on How to Write LP Updates with four main takeaways:

Send LP updates consistently

Go beyond the basics

Be authentic

Don’t share sensitive information without portfolio founders’ sign-off

We’ve translated this guidance into actionable steps that can be streamlined with Visible’s Portfolio Monitoring and Reporting tools below.

1. Send LP updates consistently.

Weekend Fund Advice — “One of the biggest mistakes new fund managers can make is not sending LP updates consistently. Most send quarterly updates. At Weekend Fund we send updates approximately every two months. Regular, detailed, and transparent updates builds trust with your LPs, which is particularly important if you want them to write a check into your next fund.”

Visible provides fund managers with tools to make sending updates to LPs on a regular basis easier.

To start, you can Upload Your LP Contacts (including custom contact fields) via CSV within seconds. Then you can create Custom Lists to organize your contacts. We suggest organizing your LPs by Fund and also by whether they’re a current LP or a potential LP.

This means within minutes you have all your contacts organized into custom segments that are useful to you. You can then simply choose which list you want to send an Update to in the future.

Visible also streamlines the creation of your LP Update content by letting you choose from an Update Template Library. You can easily pull a template into your account, further customize it as needed, and save it as your own template to use for future updates.

2. Go beyond the basics.

Weekend Fund Advice — “Of course, you should introduce new investments, share updates from the portfolio, report performance metrics, and other key updates from the fund, but the best updates go a step further to educate and inform LPs. This might include your analysis on the market, perspective on emerging trends, or learnings from experiments.”

Visible’s LP Update editor supports rich text, videos, images, files, and perhaps best of all — custom data visualizations. This means you can visualize your custom fund analytics that will resonate with your LPs and embed them directly into your Update. The data is derived from data hosted within your Visible account and updates your charts in real time.

It’s also a great idea to include a market overview section at the top of your update to shed light on how you’re evaluating and staying ahead of the curve in the markets in which you invest. This is a great way to continue to instill LP confidence in you as the steward of their capital. On top of that, it’s important to remember that “many LPs invest in funds as a learning opportunity. The updates are the primary artifact to support that learning.” (Source)

You can also stand out to LPs by getting creative and embedding a video recording of your recent portfolio updates directly into your Updates. Open the update below to view an example of how a Visible customer incorporates video into their updates —

—> View Update Example with Video Embed

3. Be authentic.

Weekend Fund Advice — In general, people gravitate toward authenticity. Writing with personality is more engaging and magnetic. LP updates are an opportunity to share your unique voice and build your fund’s brand.

The Weekend Fund incorporates authenticity in their updates through their narrative updates and transparency, but also by including personal photos.

Visible lets you embed personal photos directly into your Update in two clicks.

—> View the Weekend Fund’s Update Template

4. Don’t share sensitive information without portfolio founders’ sign-off.

Weekend Fund Advice — “Fund managers often have inside knowledge into how a company is doing. Some founders are extremely sensitive to information shared about their company, even when the news is positive. It’s prudent to get approval for any non-public information shared with LPs.”

Visible recommends explicitly asking for portfolio company’s permission to share information with LPs. One way to do this is by incorporating it into the descriptions of your Request blocks. (How to Build a Request in Visible).

Here’s an example below —

It’s important to remember that as a GP you’re not only competing with other GPs for LP capital but also with every other asset class. So it’s to your advantage to use every tool in your toolkit to stand out and impress LPs.

Over 400+ VC funds are using Visible to streamline their portfolio monitoring and reporting processes.

investors

Operations

Fundraising

[Webinar Recording] The Benefits of a Hybrid SPV + Fund Strategy with Kingsley Advani of Allocations

Kingsley Advani is a British investor who started investing in 2013 and turned $34k in savings into ~$100m in private investments. Since then he’s co-founded an angel group with 1,000+ investors and founded a private markets platform, Allocations. Kingsley is joining Visible.vc to discuss the benefits of creating a hybrid SPV + fund strategy.

Kingsley Advani, Founder and CEO of Allocations joined us to discuss trends in SPV investing and the benefits of raising SPV’s for VC fund managers.

In this webinar recording, you can expect to learn:

SPV Overview (what are they, how did they become popular)

Kingsley’s perspective on the ‘Why Now’ for SPV’s

5 Benefits of Creating a Hybrid SPV + Fund Strategy

Demo of Creating an SPV in Allocations

Using Visible for SPV + Fund Reporting

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial