Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Seed Funding for Startups: Our Complete Guide

Raising capital as a startup founder is difficult. On top of building a product, hiring a team, and scaling revenue, founders need to make sure that their business is funded for success.

If you are a founder starting to raise your seed round, check out our guide below:

What is Seed Funding?

Seed funding is capital that a company raises in its earliest stages — typically the earliest form of outside capital. Seed funding is integral to getting ideas off the ground and giving a potential company and idea life.

After a seed round, startups go on to raise future rounds of capital — e.g. Series A, Series B, Series C, etc.

You can learn more about seed fundraising and future rounds in our post, The Ultimate Guide to Startup Funding Stages.

What is the Purpose of Seed Funding?

The purpose of seed funding is simple. It is intended to give a founding team enough capital to pursue a certain idea or market to prove if the concept works. Different investors may have different requirements for a seed-stage company but generally, they are pursuing “product-market fit.” As Marc Andreessen, Founder of Andreessen Horowitz, defines it, “Product/market fit means being in a good market with a product that can satisfy that market.”

Seed size rounds are exploding in size and the purpose may be vary quite a bit from company to company and investor to investor.

When is it the Right Time to Raise Seed Funding?

The timing to raise seed funding for a startup can be tricky. First and foremost you should approach seed investors when you believe you have a strong enough product, market, or team (or combination of those) to build a company that deserves to be venture-backed. This means that you can scale and grow to the valuations where an investor can generate a solid return on your company.

As the team at Y Combinator writes, “Founders should raise money when they have figured out what the market opportunity is and who the customer is, and when they have delivered a product that matches their needs and is being adopted at an interestingly rapid rate. How rapid is interesting? This depends, but a rate of 10% per week for several weeks is impressive. And to raise money founders need to impress. For founders who can convince investors without these things, congratulations. For everyone else, work on your product and talk to your users.”

If you believe that your business has what it takes to generate massive returns for an investor, it is likely time to start your fundraising process.

Related Resource: What is Pre-Revenue Funding?

How to Raise Seed Funding for Startups

The key to successfully raising a seed round is to have a system and process in place to raise capital. Just as you have a systematic approach to your sales and marketing funnel the same should be done for your fundraising efforts.

Regarding fundraising, we like to think of it as similar to a traditional sales and marketing funnel for a B2B enterprise business. In its simplest form, a traditional sales & marketing process can be broken into 3 steps:

Attracting and adding qualified leads to your top of the funnel on a regular basis.

Nurturing and moving the leads from through the funnel with the goal of closing them as a customer. (aka get them into a buying process)

Serving customers and creating a great experience until they become evangelists or promoters.

You can convert those same ideas into a “Fundraising Funnel” that looks something like this:

Filling the top of your funnel with qualified potential investors. These investors generally come from cold outreach, warm introductions, or inbound interest. You want to make sure these fit your “ideal investor persona” — right sector, stage, geography, check size, etc.

Nurturing and moving investors through your funnel. While you may not be actively trying to close new investors and add capital you should constantly be working the top of your funnel. Staying fresh on the mind of potential investors 365 days a year using traditional marketing tactics will pay dividends when it’s time to pull the string on a new round of capital. Pro tip: send them a lite version of your quarterly investor update.

Building relationships and communicating with your current investors. Customer success is key to maintaining a strong relationship with customers once they reach the bottom of the funnel. The same can be said for your investor funnel. As a founder, one of the first places to look for capital is current investors. One of the first places a new investor will look to for guidance will also be your current investors. At the end of the day your current investors should be the ultimate evangelist for your business.

Related Resource: Startup Mentoring: The Benefits of a Mentor and How to Find One

Just like a standard B2B sales process, you need to have “leads” (read: investors) coming to the top of your funnel so you can move them through the funnel to ultimately close them (read: close your round).

To get started, you need to understand who the right investor is for your business and how you fit into their greater vision and can be of benefit to them (more on this below).

We sat down with Jonathan Gandolf, CEO of The Juice, to uncover his learnings and thoughts from his seed raise. Give episode 1 a listen below:

How Much Seed Funding Should You Raise?

The average round of seed funding has gradually grown since 2014. However, the last few years have been a turbulent time in the venture world, and have seen the average seed round size level out since 2021.

Deciding how much seed funding you should raise is entirely up to you, the founder. As a general rule of thumb, you should raise enough to reach profitability or to the point where you can easily reach your next “funding milestone.” This can be a revenue number, user benchmark, etc. but generally speaking, should be within 12-18 months.

To model this you need to have a thorough understanding of how your business functions and what it will take to get to the next milestone. Understand how much it cost to acquire a new customer, retain a customer, how much an engineer costs, salesperson, etc. To help, you can check out our popular financial modeling tools here.

Related Reading: Building A Startup Financial Model That Works

Types of Seed Funding for Startups

There are a few types of seed funding. For the sake of this post we will mostly talk about raising venture capital but to cover off on a few other options:

Friends & Family

One of the most common sources of seed funding comes from friends and families. This often follows a similar approach to the funnel discussed above but likely less intensive as you, the founder, likely have an existing relationship with this group. Keep in mind that you are investing their capital in a highly risky asset class and they need to be made aware of this situation.

Crowdfunding

Another form of “seed funding” that is becoming more popular is crowd funding. Sites like Republic and StartEngine allow startups to raise equity rounds from individuals so check sizes can be as little as $100.

Non-Traditional Firms

More firms are coming out with new financial instruments to offer as an alternative to venture capital. Earnest Capital is one of our favorites. Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses. Earnest Capital uses their own financing instrument called a Shared Earnings Agreement (SEAL). Check out other non-traditional investment funds here.

Related Resource: Advisory Shares Explained: Empowering Entrepreneurs and Investors

Incubators

As put by the team at TopMBA, “A startup incubator is a collaborative program designed to help new startups succeed. Incubators help entrepreneurs solve some of the problems commonly associated with running a startup by providing workspace, seed funding, mentoring, and training. The sole purpose of a startup incubator is to help entrepreneurs grow their business.”

Incubators are hit or miss if they come with capital. Some will include a small injection of capital while others are solely resources to help founders get their business off the ground.

Check out our list of incubators and startup studios here.

Related resource: 10 Top Incubators for Startups in 2024

Accelerators

As put by the team at Silicon Valley Bank, “Private startup accelerators do provide funding and the money helps cover early-stage business expenses, as well as travel and living expenses for the three-month residency at the in-person startup accelerators. However, the funds and guidance come at a price. Just like any other equity funding, signing an accelerator agreement typically means giving up a slice of your company. Startup accelerators generally take between 5% and 10% of your equity in exchange for training and a relatively small amount of funding.”

Check out our list of active accelerators here.

Angel Investors

Angel investors are a great starting point for any founder. Similar to friends and family investors, an angel investor is an individual that is looking to diversify their investment portfolio and back intriguing startups. However, angel investors tend to be more seasoned professionals and generally have an understanding of the risks of investing in a startup.

Related Resource: How to Effectively Find + Secure Angel Investors for Your Startup

Corporate Seed Funding

A newer form of seed funding is corporate venture arms and funds. As large corporations continue to seek innovation and new revenue streams, the development of corporate venture funds have become popular. Corporations generally partner with a proven VC (or launch a fund internally) and deploy capital across seed-stage companies that fit into the company's thesis or growth plans.

How Long Does it Take to Raise Seed Capital

Raising seed capital for a startup can be a burdensome process for founders. Brett Brohl of Bread & Butter Ventures, suggests five months to raise capital. It can be broken down into the following rules (which Brett calls the 1-3-1):

One Month — Building investor lists and getting documents ready

Three Months — Actively pitching and taking meetings with potential investors

One Month — Closing investors and going through due diligence

Brett's 1-3-1 rule is a great starting point. Other peers and investors will suggest a similar timeline — we typically see founders raise seed capital anywhere between three and nine months.

Financing Options for Seed Rounds

The different finance instruments and options available to founders raising a seed round can feel intimidating. There are countless options and different legal meanings that make things complicated. Seed round financing options can be broken into two buckets — convertible debt or SAFEs and equity.

Convertible Debt & SAFEs

Convertible debt and SAFEs have become the norm in the venture world over the last decade. YC popularizes SAFEs and has made templates available for startups across the globe. You can learn more about SAFEs in our post, "The Startup's Handbook to SAFE: Simplifying Future Equity Agreements."

Equity

Pure equity financing has become less common in the venture world since the emergence of SAFEs. Equity financing means setting a valuation and stock prices and selling new shares to investors.

As always, we recommend consulting with a lawyer when determining the financing options that are best for your business.

Related resource: Navigating Pro Rata Rights: Essential Insights for Startup Entrepreneurs

How to Build Your Seed Round Pitch Deck

Fundraising is very much a process. Along the way, there are tools and resources that founders can leverage to better tell their story. One of those tools is the pitch deck.

Pitch decks are a powerful tool that can help you tell that story. Different investors will have different opinions about pitch decks. Some investors might want to receive them before a meeting, some might only want them sent via PDF or link, and some investors might not care if you have a pitch deck at all.

A pitch deck is about the content that you are sharing. However, there is a fine line between beauty and functionality when building your seed stage pitch deck. Investors will likely have feedback that will require changes but you do want to display it in a meaningful way.

To learn more about crafting the perfect pitch deck for your seed round check out our post, Our Favorite Seed Round Pitch Deck Template (and Why It Works).

The 5 Most Important Elements of a Successful Pitch Deck

There is no prescriptive pitch deck template that will work for every startup, but there are a few things investors generally want to and expect to see in a pitch deck:

Concise & Compelling — you want your pitch deck to give investors the information they need in a concise and straightforward way. This includes your problem and solution. Related: How to Write a Problem Statement [Startup Edition]

The Market — investors want to understand the market you are operating in and why you have an opportunity to seize a large percentage of the market and become a large company. Related: How to Model Total Addressable Market (Template Included)

Acquisition Model — going hand-in-hand with the market is your acquisition model. You want to demonstrate to investors that you have a clear and scalable way to attract new customers. Related: Pitch Deck 101: The Go-to-Market and Customer Acquisition Slide

Financials — Some investors will want to see financial projections and others might not care at the seed stage because they are typically wrong. So why include them? Investors want to see how you think about your future and are thinking through metrics and models correctly. Related: Building A Startup Financial Model That Works

Traction — While it might be limited at the seed stage, investors want to see what you’ve done to date. What product have you built, customers, attracted, and more.

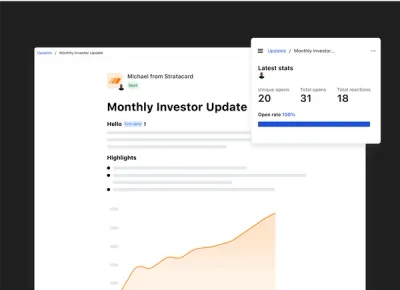

Use Visible to share your pitch deck. Once you’ve built out your target list of investors, you can start sharing your pitch deck with them directly from Visible. You can customize your sharing settings (like email-gated, password-gated, etc.) and even add your domain. Give it a try here.

How to Choose Investors for Seed Funding

Once you have defined what your ideal investor looks like it is time to start researching, finding, and contacting them. To find the right investors we suggest browsing different databases and networks to find your perfect fit.

You may already have investors in mind or have networked with investors in the past — awesome start! If you want to continue to find investors, Visible Connect is our free database built by founders, for founders. Visible Connect allows founders to find active investors using the fields we have found most valuable (like check size, geography, traction metrics, etc.).

As you begin to browse and find investors for your startup, we suggest keeping tabs on them. You most likely have an involved CRM or process to keep tabs on your current and potential customers. Should the same be true for your investors? This can be in the Visible Fundraising CRM (you can add investors directly from Connect into the CRM) or a simple Google Sheet. No matter what you decide, make sure you have a system in place to track and monitor conversations to make your life easier moving forward.

Related Reading: How To Find Private Investors For Startups

Building Your Investor List

As you start to build your list of potential investors — we suggest breaking it down into 3 “tiers” — Tier 1, Tier 2, and Tier 3. Tier 1 are the firms you believe to be most qualified, followed by tier 2 and 3.

We highly encourage taking on these investors in “sets.” This means grouping investors in sets of ~5 (suggest trying to keep sets to 5 investors or less) so you have the opportunity to better evaluate and tailor your pitch as you move through your sets.

As a rule of thumb, you’ll want to make sure you mix in Tier 1, 2, and 3 investors in each “set.” For example, if you pitch all of the Tier 1 investors in the first set, you’ll potentially miss an opportunity to tailor your pitch and only be left with less qualified (Tier 2 and 3) investors.

Related Reading: What is an Incubator?

What is the Difference Between Seed vs. Series A Funding?

Series A funding is the next jump in a company’s funding lifecycle. In a seed round is the first capital into a business, a “Series A” is generally the next round of capital. As we defined in our Startup Funding Stages post, Series A funding is:

“When a company is first founded, stock options are generally sold to the company’s founders, those close to them, and angel investors. After this, a preferred stock can be sold to investors in the form of a Series A. Series A allows investors to get in early with a business that they truly believe in. It’s a mutually beneficial relationship for both the company and the future stock holders.”

When a company reaches their “Series A” they likely have product-market fit and are ready to scale their business to a $1M or more in revenue. At Series A you likely have solid revenue in place and a scaleable plan to bring on more customer sand revenue whereas at the seed round you may have little to no revenue.

A seed round is used to demonstrate your product, service, or team can seize a market. A series A round is used to scale the product, service, or team to attack and scale in your market (or a new market).

Additional Seed Funding Resources

There are hundreds of resources out there to help you raise your seed round. At the end of the day the more entrepreneurs that raise capital the better the startup ecosystem does as a whole. At Visible, we do our best to curate and write the best resources to improve a founders chances of success.

Here are a few of our favorite resources to help founders improve their odds of raising venture capital:

Everything a Startup Founder NEEDS to Know about Pro Rata Rights

Check out our guide and tips for handling pro rata rights during an early stage fundraise and negotiation.

Our Favorite Seed Round Pitch Deck Template (and Why It Works)

In our guide, we share a step-by-step guide to help build your seed round pitch deck. Plus, we offer a direct download to the template so you can get started immediately.

Our Startup Funding Stages Guide

Our in-depth guide covering all things related to the startup funding lifecycle. Understand what it takes to go from seed stage funding to Series A and later.

Building A Startup Financial Model That Works

Templates and resources to help you build your first financial model for your startup. In order to improve your odds of raising capital you need to understand the ins and outs of your business.

Our Guide to Sending Your First Investor Update

Tips and best practices for using investor updates to leverage your current and potential investors to help with fundraising, hiring, and strategic decision-making.

Visible Connect: Our Investor Database

Browse our investor database that is hand curated by the team at Visible. We include the fields and filters we find most important when searching for new investors.

Visible Lite: Pre-Traction Template

This template is intended for companies that are pre-traction/revenue. Even if it is simple, sending Updates from day 1 is a great way to stay top of your investors mind’s moving forward.

We hope this guide is helpful to you as you kick off your seed round. To get your fundraise started check out Visible Connect, our investor database. Automatically add your investors into a pipeline to manage conversation and engagements so you can focus on building your business.

Related resource: Top Creator Economy Startups and the VCs That Fund Them

Kick Off Your Seed Round With Visible

We believe a VC fundraise mirrors a B2B sales motion. The fundraising process starts by finding qualified investors (top of the funnel) and building relationships (middle of the funnel) with the goal of them writing a check (bottom of the funnel).

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck, directly from Visible. Give Visible a free try for 14 days here.

founders

Fundraising

The 10+ Best Gaming VCs Investing in 2024

As we advance into a technologically-driven future, gaming has evolved beyond mere entertainment. It converges art, technology, and commerce.

For founders in the gaming industry, understanding the intricacies of current technological advancements, especially in AI, is not just beneficial—it’s crucial.

AI’s transformative impact promises to shape the very fabric of gaming experiences, ensuring that they remain dynamic, engaging, and continuously evolving

The investment landscape for gaming in 2023 is still very strong. Key trends spurring VC interest in gaming include:

The rise of mobile gaming: Mobile gaming is the fastest-growing segment of the gaming market. In 2021, mobile gaming accounted for 52% of the global gaming market, and this number is expected to grow to 60% by 2026. This growth is being driven by the increasing popularity of smartphones and tablets, as well as the development of new mobile gaming platforms like Apple Arcade and Google Stadia.

“Revenue in the Mobile Games market is projected to reach US$286bn in 2023. Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 7.08%, resulting in a projected market volume of US$377bn by 2027. The average revenue per user (ARPU) in the Mobile Games market is projected to amount to US$148.80 in 2023.” Statista

The increasing popularity of esports: Esports is a competitive video gaming industry that has seen significant growth in recent years, driven by the increasing popularity of live-streaming platforms like Twitch and YouTube, as well as the growing number of professional esports leagues and tournaments.

Statista Report:

Revenue in the Esports market is projected to reach US$3.75bn in 2023.

Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 9.54%, resulting in a projected market volume of US$5.40bn by 2027.

The largest market is Esports Betting with a market volume of US$2.13bn in 2023.

With a projected market volume of US$871.00m in 2023, most revenue is generated in the United States.

In the Esports market, the number of users is expected to amount to 720.8m users by 2027.

User penetration will be 7.5% in 2023 and is expected to hit 9.1% by 2027.

The average revenue per user (ARPU) is expected to amount to US$6.47.

The development of new technologies: New technologies like AI, virtual reality (VR), and augmented reality (AR) are also driving investment in the gaming industry. These technologies have the potential to create new and immersive gaming experiences that have never been possible before.

Gaming Now and In The Future

“Gaming is a massive market that will only continue growing. The growth is easy to see: In 2019, the global gaming market was $152 billion. By 2021, it reached $214 billion and is on track to generate over $300 billion in 2026. Bigger than all other forms of entertainment.” NFX

The gaming industry is one of the fastest-growing industries in the world, with a market size of over $200 billion. The industry’s future will be heavily influenced by advancements in AI, Virtual Reality (VR) and Augmented Reality (AR). These technologies are shaping immersive gaming experiences and will continue to hold a significant role. However, the real game-changer will be the effective application of AI technologies.

The five key areas where AI is having an impact on gaming: generative agents, personalization, AI storytelling, dynamic worlds, and AI copilots. By harnessing AI, games can become “neverending”, maintaining their appeal indefinitely through personalized experiences, AI storytelling, and dynamic, evolving worlds.

The rise of social elements in games, powered by AI copilots and intelligent chat functions,.will drive engagement and longevity in the player base, heralding the future of social gaming

Business Implications of AI in Gaming

AI’s integration into the sector offers a transformative experience not just for players but also for gaming businesses. From enhancing player engagement to providing advanced monetization avenues, AI is in fact game-changing.

Monetization Models Enhanced by AI

Optimized In-Game Purchases: AI can monitor player behavior and preferences, offering real-time personalized suggestions for in-game purchases. For instance, if a player frequently struggles at a specific game level, AI might suggest a power-up or equipment purchase that can assist them. This not only increases potential sales but also enhances the gaming experience for the player.

Dynamic Subscription Models: Instead of a one-size-fits-all subscription model, AI enables gaming platforms to offer tailored subscription packages. By analyzing a player’s gaming habits, frequency, and genre preferences, AI can suggest a subscription model that offers the best value, encouraging higher subscription rates.

Smarter Advertisements: AI’s predictive analysis can forecast when a player is most likely to be receptive to advertisements, thereby reducing ad fatigue and increasing click-through rates. Furthermore, AI can customize ad content based on player preferences, ensuring higher engagement and conversion.

Market Analysis and Forecasting

Predicting Market Trends: AI can analyze vast amounts of data from forums, social media, and other platforms to spot emerging trends. By identifying what players are discussing or showing increased interest in, developers can prioritize certain game features, genres, or mechanics that are gaining traction.

Player Retention Forecasting: AI can predict when players are likely to stop playing, allowing developers to introduce timely interventions, whether it’s through in-game events, updates, or other engagement tactics. This leads to increased player longevity and, consequently, higher lifetime value.

Adjusting Game Development Strategies: By monitoring real-time feedback and player behavior within a game, AI can help developers understand which aspects of the game are most loved or which areas need improvement. This feedback loop can be invaluable, especially during beta testing, ensuring that the final product is better aligned with market demands.

AI for Game Design & Player Experience

The infusion of Artificial Intelligence (AI) into the gaming industry is not merely about adding smarter enemies or more realistic visuals. At its core, AI has the potential to revolutionize how games are designed and how players experience them. The intricate dance between game mechanics and player response is more sophisticated than ever, thanks to AI. Let’s dive deep into its multifaceted impact.

AI Integration in Game Design

AI in Procedural Content Generation: No longer are game worlds static or bounded by the limitations of manual design. With AI, games can generate levels, terrains, and even entire universes on-the-fly. This not only ensures each gameplay is fresh but also vastly enhances the replayability of games. Imagine embarking on a new adventure each time you play, with unpredictable terrains and challenges.

AI in Game Testing: Quality assurance in gaming is paramount. However, with expansive game worlds and intricate mechanics, manual testing can be labor-intensive and might not cover all potential scenarios. Enter AI bots, which can simulate countless hours of gameplay, identifying glitches, and ensuring a seamless player experience.

Dynamic Difficulty Adjustment (DDA): One-size-fits-all is a passé concept in modern gaming. AI can continuously monitor a player’s performance and adapt the game’s difficulty in real-time. This ensures that games remain engaging and challenging but stop short of being overly frustrating. It’s about striking the right balance to keep players invested.

AI in Player Experience

Player Behavior Analysis: Each player is unique, and AI recognizes that. By studying patterns, preferences, and behaviors, AI can modify game environments or suggest personalized paths, ensuring an immersive experience tailored for each gamer.

Customized Game Narratives: Story-driven games have always been popular, but what if the narrative changed based on every choice you made? AI can weave intricate storylines that diverge and converge based on player decisions, ensuring that each gameplay tells a distinct tale. Your choices matter more than ever, and the narrative payoff is genuinely your own.

AI in Multiplayer: The multiplayer realm benefits immensely from AI. Beyond crafting smarter Non-Player Characters (NPCs) that challenge even the most seasoned gamers, AI can step in when human players drop out, ensuring the game continues without a hitch. This seamless blend of AI and human intelligence creates dynamic multiplayer arenas that are unpredictable and exhilarating.

Incorporating AI into game design and player experience has shown it’s not about replacing the human touch but enhancing it. It’s about crafting expansive, responsive, and deeply personal gaming worlds where every player feels seen, challenged, and, most importantly, immersed.

Gaming Essentials to Include in Your Pitch Deck

Overview of Your Game:

Type/Category

Supported Devices

Revenue models, Key Performance Metrics (if known)

Current progress stage

Primary technology (like game engine)

Consider incorporating a demo video, early versions, or visual snapshots.

General Info:

Brief game concept overview (1-2 sections)

Titles that inspire you

Fundamental gameplay elements

Intended player demographic

Game universe/background

(Divide this into 2 or 3 slides for clarity)

Distinguishing Features / Selling Points:

What makes your game unique from competitors?

Why players will be drawn to it

Basic gameplay and overarching game narrative

Primary game cycle

Secondary game narratives

Highlighted characteristics

(Organize this info across 2-3 slides for visual appeal)

Monetization Strategy:

Free or Paid model?

Plan for in-game purchases, advertisements, or both? Types of in-game offerings envisioned? If it’s a paid model, potential pricing?

Artistic Direction:

Showcase visual inspirations, preliminary designs, prototypes, animated sequences.

(Recommendation: Integrate visuals from the actual game not just here, but throughout the presentation for consistency and immersion)

Projected Development Journey and Funding Needs:

Duration of current production time?

Anticipated project milestones?

Financial projections and needs?

Beneficial to include: Visual representation of the development journey, manpower allocation, and post-release content strategy.

Team:

Your base location?

Team size and roles?

Competencies and strengths?

Any previous successful launches?

Your overarching mission and goals?

Resources & Good Reads

Gaming VC profiles in Visible’s Fundraising CRM

YC Advice for Gaming Startups

The NeverEnding Game: How AI Will Create a New Category of Games

The Generative AI Revolution in Games

Communities

The International Game Developers Association (IGDA) is the world’s largest nonprofit membership organization serving all individuals who create games.

The Game Developers Conference (GDC) is the world’s largest annual gathering of game developers.

VC Firms Investing in Gaming Companies

Konvoy Ventures

About: Konvoy Ventures is a venture capital fund dedicated to esports & video gaming

Thesis: We invest in the infrastructure technology, tools, and platforms of tomorrow’s video gaming industry.

Wonder Ventures

About: Wonder Ventures invests in entrepreneurs who build the world’s most innovative technology companies.

Thesis: Our mission is to invest earlier than anyone in Southern California’s best founders.

Lumikai

About: We are India’s first gaming & interactive entertainment venture fund. We catalyse game-changing, early stage founders building the future of gaming and interactive media.

Thesis: We are curating and supporting a select tribe of India’s most forward thinking, creative and talented founders. Our vision is to find and fund game-changing early stage founders with a bold vision for the future and to help them achieve outlier success. We bring decades of sector strategic experience and knowledge, while leveraging our all-star local and global networks to help propel our founders to success.

Kakao Ventures

About: Kakao Ventures (circa 2012 as K Cube Ventures, rebranded in 2017) is the most active seed stage VC in Korea, with over 190 portfolios and AUM of $300M (330B KRW) as of date. Kakao Ventures believes in harnessing the power of startups to change our world. Our mission statement is to be the backers of smart entrepreneurs who set their courses, in the form of startups armed with competitive edge, to solve real-world problems. Hence we hold entrepreneurs in the highest regard, and leads us to our raison d’être – making the world a better place for talented people to continuously make an impact to the world around theirs.

Serena Capital

About: Serena Capital caters to technology companies with seed, early, and later stage venture investments. Investment strategy: We handpick on average four to five teams per year and focus on helping them reach their maximum potential. We are not looking for early exits. We back Europe-based entrepreneurs willing to build continental or worldwide category leaders. We strongly prefer to lead or co-lead rounds.

Thesis: Serena was founded by entrepreneurs on the belief that your VC should work for you and not the way around. We are not industry-specific as long as your business model is scalable and your product is digital. We have a special affection for DeepTech, enterprise software, marketplaces, and entertainment.

BITKRAFT Ventures

About: Built by founders for founders, BITKRAFT is a global early- and mid-stage investment platform for gaming, esports, and interactive media. We focus on Seed, Series A, and Series B investments in game studios, interactive platforms, and immersive technology.

Sweetspot check size: $ 3M

Traction metrics requirements: No hard requirements; preference for second-time or serial entrepreneurs

Thesis: Vision of Synthetic Reality (https://www.bitkraft.vc/vision/)—the increasing convergence of the physical and digital worlds

WndrCo

About: WndrCo is a holding company that invests in, acquires, develops, and operates consumer technology businesses for the long term.

Andover Ventures

About: Andover is a venture fund investing in early stage software-enabled start-ups ranging from Pre-seed to Series A. We are sector agnostic; however, our team has a background in software development and financial technology. We make co-investments alongside larger funds, angel groups, and other family offices.

Aura Ventures

About: We are an early stage venture capital firm dedicated to investing in ambitious entrepreneurs to define and dominate a new generation of commerce.

Velo Partners

About: Velo Partners invests and manages a portfolio spanning the global gaming and gambling industry across mobile, online, land-based, real-money, social, B2B, and B2C assets.

Thesis: Velo typically invests in Series A or early growth stage rounds. Our ideal investment candidates demonstrate strong early traction and a clear understanding of their unit economics and growth trajectory. We also work in association with a gaming accelerator called RNG FOUNDRY for earlier stage investment opportunities. Once invested, we typically follow our rights for later investment rounds and work with management to define good corporate governance and reporting. We will opportunistically evaluate later stage investments on an ad-hoc basis.

Hiro Capital

About: Hiro Capital invests in UK, European and North American innovators in Videogames, Esports, Streaming and Digital Sports. We invest in Metaverse technology founders and Game creators who are building the future. We believe that Games and Games technologies will be at the heart of next generation human societies. For us, play is deep. We are battle-scarred entrepreneurs who back next generation entrepreneurs. We have founded games and technology disruptors worth billions of dollars. We have led companies from startups to IPO in London and New York. We are gamers and sports nerds. We love games, stories, characters and deep tech.

Thesis: We Invest in the innovators building the future of Games, Esports, Digital Sports

Griffin Gaming Partners

About: Griffin Gaming Partners is a leading venture capital firm singularly focused on investing in the global gaming market. We are founder-friendly, care deeply for our industry and bring decades of investment, advisory and operational experience.

Andreessen Horowitz / a16z

About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

Sweetspot check size: $ 25M

Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

Makers Fund

About: A venture capital fund created to support founders, combining deep industry experience with multi-stage investment across Seed to Series B.

March Capital Partners

About: March Capital Partners invest in breakthrough technology companies in Silicon Beach, Silicon Valley, and the world.

Thesis: March Capital is a top-tier venture capital & growth equity firm headquartered in Santa Monica, California and investing globally since 2014. We identify entrepreneurs with a provocative vision to lead the future and later-stage companies poised for hyper-growth, then dare to go all in by leading rounds with deep conviction and concentration risk.

Northzone

About: We’re a multi-stage venture capital fund partnering with founders from Seed to Growth. Across Europe and the US.

Bessemer Venture Partners

About: Bessemer Venture Partners is the world’s most experienced early-stage venture capital firm. With a portfolio of more than 200 companies, Bessemer helps visionary entrepreneurs lay strong foundations to create companies that matter, and supports them through every stage of their growth. The firm has backed more than 120 IPOs, including Shopify, Yelp, LinkedIn, Skype, LifeLock, Twilio, SendGrid, DocuSign, Fiverr, Wix, and MindBody. Bessemer’s 16 investing partners operate from offices in Silicon Valley, San Francisco, New York City, Boston, Israel, and India. Follow @BessemerVP and learn more at bvp.com.

Sweetspot check size: $ 15M

Atomico

About: Atomico is a risk capital group. They are entrepreneurs with global perspectives who invest their own capital in passionate entrepreneurs with powerful ideas. Through their experience building Skype, Joost and Kazaa, they understand the value of game-changing business models and have created a worldwide ecosystem to help accelerate the growth of the companies in which they invest.

The Games Fund

About: TGF is an early-stage VC fund founded by video game industry veterans.

We invest in future leaders: game developers, gaming technologies, and services.

We share best practices and offer our experience and personal touch.

Looking for Investors? Try Visible Today!

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related Resource: Gaming VC profiles in our Fundraising CRM

founders

Fundraising

Exploring the World of Venture Capital in France (in 2024)

At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: The Understandable Guide to Startup Funding Stages

Just as a sales and marketing funnel starts by finding the right leads, the same is true for a fundraise. Founders raising venture capital should start by identifying the right investors for their businesses. If you’re a founder located in France and are looking for venture capitalists in your area, check out our list below:

1. Alven Capital Partners

As put by their team, “Alven is an independent venture investment firm with a successful track record of 5 successive funds backing more than 130 startups over 20 years.

Our team consists in seasoned investors and functional experts with significant startup experience, to identify promising startups and accelerate their growth.”

Learn more about Alven by checking out their Visible Connect profile →

Location

Alven has offices in Paris and London and invests in founders across Europe.

Portfolio Highlights

Some of Alven’s most popular investments include:

Algolia

ChartMogul

Stripe

Funding Stage

Alven attempts to be the first check into a business after angel investors — typically seed or series A. Their typical investment is between €500K and €5M.

2. Partech

As put by their team, “Partech is a global investment platform for tech and digital companies, led by ex-entrepreneurs and operators of the industry spread across offices in San Francisco, Paris, Berlin and Dakar.

We invest from €200K to €75M in a broad range of technologies and businesses for enterprises and consumers, from software, digital brands and services to hardware and deep tech, across all major industries.”

Learn more about Partech by checking out their Visible Connect profile →

Location

Partech has offices across the globe and has multiple funds to invest in companies across the globe.

Portfolio Highlights

Some of Partech’s most popular investments include:

Bolt

The Bouqs Co.

Zeel

Funding Stage

Partech has multiple funds that are geared towards different stages — from seed to growth stage.

3. Sofinnova Partners

As put by their team, “At Sofinnova Partners, we focus on breakthrough innovations that have the potential to solve the world’s most pressing problems. Experience, agility, and diverse points of view push us forward, driving our ability to evolve in a complex environment.

“Partners for Life” is a cornerstone of our identity: nurturing strong relationships through trust and transparency. We invest in people and science to create opportunity. We commit to long-term partnerships with entrepreneurs who are as passionate as we are about pushing the frontiers of innovation to contribute to a better future.

Founded in 1972, Sofinnova Partners has backed more than 500 companies over 50 years, creating market leaders around the globe. Today, Sofinnova Partners has over €2.5 billion under management.”

Learn more about Sofinnova Partners by checking out their Visible Connect profile →

Location

Sofinnova is located in Paris.

Portfolio Highlights

Some of Sofnnova’s most popular investments include:

Avantium

Kiro

NuCana

Funding Stage

Sofinnova has 6 different fund strategies that are targeted on different stages and markets. They are:

Sofinnova Capital

Sofinnova MD Start

Sofinnova Crossover

Sofinnova Industrial Biotech

Sofinnova Telethon

Sofinnova Digital Medicine

Related Resource: The Top VCs Investing in BioTech (plus the metrics they want to see)

4. Seventure Partners

As put by their team, “Seventure Partners adopts an extremely rigorous but collegial process when selecting innovative companies for investment. Determining whether we can establish a relationship based on trust and work effectively with a company’s management team are key elements that we take into consideration.

Investments are aimed at strengthening the equity capital of innovative companies at all stages: from seed to growth capital. As we are often the lead investor, we actively partner with entrepreneurs, encouraging and supporting them in reaching their full potential in order to achieve a leadership position within their fields.

Our presence as directors on the company’s board or in a supervisory role creates a holistic approach that supports entrepreneurs in their development and companies throughout the key phases of their growth.”

Learn more about Seventure Partners by checking out their Visible Connect profile →

Location

Seventure is located in Paris.

Portfolio Highlights

Some of Seventure Partner’s most popular investments include:

Hivency

Skinjay

Sumup

Funding Stage

Seventure invests in companies across all stages — from seed to growth stage.

Related Resource: A Quick Overview on VC Fund Structure

5. Eurazeo

As put by the team at Eurazeo, “From fledgling startups to SMEs, mid-caps and multinationals, we detect, finance, accelerate and support companies that are inventing and reinventing themselves, innovative entrepreneurs, and emerging talent.

We turn constraints into opportunities, challenges into ways to create value, and bold ideas into success stories.

Every day, we work alongside management teams and investors at the grass-roots level. In the right place, at the right time, and over the long term, we help them reveal the best of themselves and, ultimately, contribute to creating meaningful growth.”

Learn more about Eurazeo by checking out their Visible Connect profile →

Location

Eurazeo has offices across the globe.

Portfolio Highlights

Some of Eurazeo’s most popular investments include:

Swile

Grab

Wefox

Funding Stage

Eurazeo funds companies across all stages.

6. Omnes Capital

As put by their team, “Our Venture Capital activity, the historic heart of Omnes, with €700M under management, supports innovative European start-ups in the fields of deeptech.

We back extraordinary founders executing on a clear vision and building worldwide leading businesses in the fields of techbio, cybersecurity, new space, quantum computing, new materials, carbone capture and novel food.”

Learn more about Omnes Capital by checking out their Visible Connect profile here →

Location

Omnes Capital is headquartered in Paris.

Portfolio Highlights

Some of Omnes’ most popular investments include:

Opensee

Artifakt

Gourmey

Funding Stage

As put by their team, “First investment from €2M to €7M with potential follow-on up to €20M.”

7. Vantech

As put by their team, “Ventech is a global early-stage VC firm based out of Paris, Munich, Berlin, Helsinki, Shanghai and Hong Kong with over €900m raised to fuel globally ambitious entrepreneurs and their visions of the future positive digital economy.

Since inception in 1998, Ventech has made 200+ investments such as Believe, Vestiaire Collective, Botify, Freespee, Ogury, Veo, Picanova and Speexx; and 90+ exits including Webedia, Meuilleurs Taux.com, Curse, StickyADS.tv and Withings).”

Location

Vantech has offices across Europe and Asia including Paris, Berlin, Munich, Helsinki, Hong-Kong, Shangai.

Related Resource: 8 Most Active Venture Capital Firms in Europe

Portfolio Highlights

Some of Vantech’s most popular investments include:

Adore Me

Mobius Labs

Picanova

Funding Stage

Vantech invests in companies across all stages.

Related Resource: Private Equity vs Venture Capital: Critical Differences

8. Aster

As put by their team, “Aster Capital arranges equity and debt-secured accounts for Proof of Funds uses on a fixed-return basis to facilitate various funding requirements, providing organizations and individuals the capability to meet on-going project needs. The investment process is simple and secure, and can be completed in as little as two banking days. Aster can arrange funding for various types of accounts and instruments for a broad range of requirements.”

Location

Aster has offices in Paris, London, and Nairobi. They make investments in companies located in Europe, US, and Israel.

Portfolio Highlights

Some of Vantech’s most popular investments include:

Betterway

Habiteo

Candi

Funding Stage

Vantech funds companies that are raising anything from a seed round to series B.

Looking for Investors? Try Visible Today!

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

Understanding the Role of a Venture Partner in Startups

In the dynamic realm of venture capital, where innovation meets investment, the success of startups often hinges on the expertise, networks, and strategic insight provided by the key players within VC firms. Venture partners, uniquely positioned within the VC ecosystem, offer a blend of expertise, networks, and capital that can significantly influence the trajectory of startups. Their role extends beyond mere financial investment, encompassing a broad spectrum of activities designed to nurture and propel startups toward success. This article delves into the nuances of venture partners' responsibilities, their distinct positions within VC firms, and the invaluable assets they bring to the startup world.

Who is a Venture Partner?

Venture partners are seasoned professionals who collaborate with venture capital firms on a flexible basis. Unlike general partners, who are integral to the VC firm's day-to-day operations and investment decisions, venture partners typically engage in a more focused capacity. Their primary function is to identify promising investment opportunities, leverage their expertise and networks to guide startups and represent the VC firm within the broader entrepreneurial ecosystem. The distinction between venture partners, general partners, and limited partners lies in their involvement level, compensation structure, and role in investment decision-making and firm governance. Venture partners often work on a part-time or project basis, may receive carried interest but not necessarily a salary, and usually do not have full voting rights on investment decisions.

Related resource: 25 Limited Partners Backing Venture Capital Funds + What They Look For

The Unique Role of Venture Partners in Startups

Venture partners occupy a distinctive and influential position within the startup ecosystem, bridging the gap between VC firms and the innovative companies they invest in. Their contribution extends far beyond mere financial backing; venture partners bring a wealth of expertise, strategic insight, and invaluable networks to the table.

Sourcing Potential Investments

Venture partners are essential in VC for scouting startups and fostering founder relationships. They combine market research, sector expertise, and tech trends to spot investment opportunities. Through networking and direct outreach, they build early trust with entrepreneurs, offering advice and connections. This role is pivotal for VC firms to gain a competitive edge, ensure portfolio diversity, and maintain a consistent investment pipeline. In essence, venture partners' insights and networks enable VC firms to capture high-potential investments and sustain their market leadership.

Offering Expertise and Guidance

Venture partners offer crucial expertise and guidance to startups, leveraging their extensive experience and industry knowledge to mentor and advise companies within a VC firm's portfolio. They typically have a deep understanding of specific sectors, market dynamics, and the challenges that emerging companies face. This enables them to provide strategic advice on a wide range of issues, including product development, market entry strategies, scaling operations, and navigating competitive landscapes.

Their guidance often extends to helping startups refine their business models, improve operational efficiencies, and develop go-to-market strategies that enhance their chances of success. Moreover, venture partners can assist in preparing startups for future funding rounds, advising on the best approaches to attract further investment.

By acting as mentors, venture partners not only contribute to the immediate growth and stability of startups but also help build the foundation for long-term success. Their involvement can significantly impact a startup's trajectory, accelerating growth and reducing the risk of failure.

Representing VC Firms

Venture partners play a key role in representing VC firms within the broader startup ecosystem. By actively participating in events, conferences, and panels, they not only enhance the visibility of their VC firm but also engage directly with emerging startups, investors, and industry thought leaders. This involvement allows them to stay abreast of the latest trends, technologies, and opportunities, fostering relationships that could lead to future investments. Their presence at these gatherings underscores the VC firm's commitment to the startup community, facilitates the exchange of ideas, and positions the firm as a key player in the entrepreneurial landscape. Through these engagements, venture partners effectively bridge the gap between VC firms and the dynamic world of startups, ensuring their firm remains at the forefront of innovation and investment opportunities.

Provides Access to Networks

Venture partners significantly enhance a startup's growth potential by providing access to their extensive networks, introducing startups to potential clients, strategic partners, and key hires. This access can accelerate a startup's market penetration, expand its customer base, and secure partnerships that offer competitive advantages. Additionally, leveraging a venture partner's network for talent acquisition can help startups attract experienced and skilled professionals crucial for scaling their operations. This network access is invaluable for startups looking to navigate market challenges and capitalize on opportunities more efficiently, underlining the venture partner's role in facilitating connections that drive success and growth.

Related resource: A Quick Overview on VC Fund Structure

The 5 Types of Venture Partners

Venture partners can be categorized into five distinct types, each bringing unique skills and focus areas to the VC firm and its portfolio companies:

1. Operating Partners

Operating partners represent a vital resource within the VC ecosystem, offering a unique blend of operational expertise and strategic guidance to help portfolio companies navigate growth challenges and scale successfully. Their hands-on approach and deep involvement in the operational aspects of a business differentiate them from other types of venture partners and make them invaluable allies for startups looking to maximize their potential and achieve sustainable growth.

Role and Responsibilities

Operational Support

Operating partners provide hands-on support to portfolio companies, helping them scale operations, improve efficiency, and navigate complex business challenges. They often work closely with the company's management team to implement best practices, optimize processes, and drive growth.

Expertise in Specific Areas

They typically have a wealth of experience and expertise in specific functional areas such as sales, marketing, finance, human resources, or technology. This expertise allows them to offer tailored advice and strategies to address the unique needs of each portfolio company.

Value Creation

The primary goal of an operating partner is to create value for the portfolio company by leveraging their operational expertise. This could involve leading turnaround efforts, driving go-to-market strategies, optimizing supply chains, or implementing technological innovations.

Strategic Initiatives

Operating partners may lead or contribute to strategic initiatives within the portfolio company, such as entering new markets, launching new products, or pursuing mergers and acquisitions.

Mentorship and Coaching

They often serve as mentors and coaches to the CEOs and leadership teams of portfolio companies, sharing insights from their own experiences to guide leaders in making informed decisions.

Duration of Engagement

The involvement of an operating partner with a portfolio company can vary, ranging from a short-term project to a long-term engagement, depending on the specific needs and goals of the company.

How They Differ from Other Venture Partners

The key differentiator of operating partners is their hands-on, operational focus. While other venture partners might concentrate on broader strategic, advisory, or networking roles, operating partners are deeply involved in the trenches with portfolio companies, working to solve operational problems and drive tangible improvements.

Benefits to Startups and VC Firms

Accelerated Growth and Scale

By implementing best practices and strategic initiatives, operating partners can significantly accelerate the growth and scaling efforts of portfolio companies.

Risk Mitigation

Their expertise and oversight can help identify and mitigate potential risks before they become significant issues.

Increased Value

Through operational improvements and strategic guidance, operating partners can increase the value of a portfolio company, leading to better outcomes for both the company and its investors.

2. Board Partners

Board partners serve as a bridge between the strategic oversight required by a board of directors and the operational support provided by the broader VC firm and its network. By leveraging their experience, networks, and strategic insight, board partners contribute significantly to the growth and success of portfolio companies. Their role underscores the importance of governance and strategic planning in the fast-paced startup environment, ensuring that companies not only grow but also adhere to sound business principles and practices.

Role and Responsibilities

Strategic Guidance

Board partners provide strategic direction and advice to portfolio companies, helping them navigate complex decisions and align their operations with long-term objectives.

Governance

They play a crucial role in governance, often serving on the boards of portfolio companies. Their presence ensures that there is an experienced voice to guide decision-making processes, oversee the management team, and ensure that the company adheres to its strategic goals.

Network and Connections

Board partners leverage their extensive networks to assist startups in finding potential clients, partners, and even future employees. Their connections can be invaluable in opening doors that might otherwise remain closed to early-stage companies.

Fundraising and Financial Oversight

They can also play a significant role in helping startups secure further funding, providing advice on financial structuring, and preparing for rounds of financing. Their experience can be critical in negotiating terms with new investors and in financial planning.

Crisis Management

In times of crisis, board partners can offer seasoned perspectives to help navigate through challenging periods, whether the issues are financial, operational, or market-related.

How They Differ from Other Venture Partners

The main differentiation of board partners from other types of venture partners lies in their primary focus on governance and strategic oversight rather than operational support or deal sourcing. Board partners are specifically brought into the VC ecosystem for their ability to contribute at the board level, offering insights and guidance that can steer a company towards success.

Benefits to Startups and VC Firms

Improved Decision-Making

With their extensive experience and strategic vision, board partners can significantly improve the quality of decision-making within a startup, steering it clear of potential pitfalls.

Enhanced Credibility

Their involvement can enhance a startup's credibility in the eyes of investors, customers, and partners, given their reputation and track record.

Strategic Networking

Board partners open up their network of contacts, providing startups with access to a broader ecosystem that can support growth and expansion.

Risk Mitigation

Their governance role ensures that the company adheres to best practices and regulatory requirements, thereby mitigating risks associated with compliance and operational missteps.

3. Fundraising Partners

Fundraising partners facilitate the flow of capital that fuels innovation and growth within the VC firm's portfolio. By leveraging their expertise, networks, and understanding of the financial landscape, they ensure that both VC firms and their portfolio companies have the resources they need to succeed. Their role underscores the importance of strategic fundraising in the competitive and fast-paced world of venture capital, making them indispensable allies in the quest for growth and success.

Role and Responsibilities

Capital Raising for VC Funds

Fundraising partners are instrumental in raising new funds for the VC firm. They engage with potential investors, articulating the value proposition of the fund, its investment thesis, and the track record of the firm to secure commitments.

Supporting Portfolio Companies

Beyond raising capital for the VC firm itself, fundraising partners often assist portfolio companies in their fundraising efforts, helping them to prepare for rounds of funding, from seed stage to later-stage financing rounds.

Strategic Networking

They utilize their extensive networks of investors, including institutional investors, family offices, and high-net-worth individuals, to introduce potential funding sources to both the VC firm and its portfolio companies.

Market Intelligence and Trends

Fundraising partners keep a pulse on market trends, investor sentiments, and the regulatory landscape to advise on the most opportune times to raise funds, the best strategies to employ, and the types of investors to target.

Investor Relations and Communication

They play a key role in managing relationships with existing investors, ensuring transparent communication, and keeping LPs informed about the performance of their investments and the progress of portfolio companies.

How They Differ from Other Venture Partners

The distinguishing feature of fundraising partners compared to other types of venture partners is their focus on the financial ecosystem surrounding venture capital and startups. While operating partners may delve into the operational aspects and board partners may focus on governance and strategy, fundraising partners are deeply entrenched in the financial networks and activities that fund the venture ecosystem.

Benefits to Startups and VC Firms

Access to Capital

Fundraising partners open doors to capital by connecting startups and the VC firm itself with potential investors, crucial for both launching and scaling ventures.

Strategic Fundraising Guidance

They provide strategic advice on the fundraising process, helping to structure deals in ways that are attractive to investors while safeguarding the interests of the startup and its founders.

Enhanced Credibility

The involvement of a seasoned fundraising partner can enhance the credibility of a fundraising round, attracting more and potentially better-suited investors.

Efficient Fundraising Process

Their expertise and network can streamline the fundraising process, reducing the time and resources that startups need to invest in securing funding.

4. Sourcing Partners

Sourcing partners serve as the bridge between promising startups and the capital they need to grow. Their ability to identify and evaluate potential investments, coupled with their deep understanding of market trends and networks within the startup community, makes them invaluable to VC firms looking to invest in the next wave of innovative companies. Through their efforts, VC firms can maintain a robust pipeline of investment opportunities, ensuring sustained growth and success in the competitive venture capital landscape.

Role and Responsibilities

Deal Flow Generation: Sourcing partners are responsible for generating a steady flow of investment opportunities by identifying promising startups and entrepreneurs. This involves attending industry events, networking, and staying abreast of emerging trends and sectors.

Initial Evaluation and Screening: They conduct initial evaluations of potential investments, screening opportunities based on the VC firm's criteria such as market potential, team quality, product innovation, and fit within the firm's portfolio strategy.

Relationship Building: Sourcing partners build and maintain relationships with startups and entrepreneurs, even before these entities are ready for investment. This helps in creating a pipeline of potential future investments and ensures the VC firm has early access to high-potential deals.

Market Research and Analysis: They conduct market research and analysis to identify emerging trends, sectors, and technologies that present new investment opportunities. This insight helps the VC firm to stay ahead of the curve and invest in future growth areas.

Collaboration with Investment Team: Sourcing partners work closely with the broader investment team to share insights, evaluate deals, and contribute to the decision-making process. Their on-the-ground intelligence is crucial for informed investment decisions.

How They Differ from Other Venture Partners

Sourcing partners differ from other types of venture partners in their primary focus on the top of the investment funnel—identifying and securing new deals. Unlike operating or board partners, who might engage more deeply with portfolio companies post-investment, sourcing partners are pivotal in the pre-investment stage, dedicating their efforts to discovering and vetting potential investment opportunities.

Benefits to Startups and VC Firms

Access to Opportunities

For VC firms, sourcing partners provide access to a broad and deep pool of potential investments, including early access to high-potential startups that might not yet be on the radar of the broader investment community.

Strategic Alignment

They ensure that the investment opportunities align with the VC firm's strategic goals and investment thesis, optimizing the firm's portfolio for success.

Competitive Advantage

By building strong relationships with entrepreneurs and startups early on, sourcing partners can give VC firms a competitive edge in securing investments in highly sought-after ventures.

Efficient Investment Process

Their expertise and initial screening efforts streamline the investment process, enabling the VC firm to focus its resources on the most promising opportunities.

5. Business Development Partners

Business development partners focus on leveraging strategic partnerships and growth initiatives to drive value creation within the portfolio of a VC firm. Their role is instrumental in helping startups achieve scale, access new markets, and develop sustainable business models. Through their efforts, business development partners not only enhance the growth potential of individual companies but also contribute to the overall success and return on investment for the VC firm and its stakeholders.

Role and Responsibilities

Strategic Partnerships

Business development partners identify and facilitate strategic partnerships for portfolio companies. These partnerships can range from alliances with other companies, channel partnerships, or joint ventures that can help startups scale quickly and efficiently.

Market Expansion

They play a crucial role in helping portfolio companies enter new markets, whether geographic or demographic, by providing insights into market dynamics, regulatory environments, and competitive landscapes.

Customer Acquisition and Sales Strategies

Business development partners assist in refining and implementing effective sales and customer acquisition strategies. Their goal is to accelerate revenue growth and market penetration for the portfolio companies.

Networking and Introductions

Leveraging their extensive networks, they introduce portfolio companies to potential customers, partners, and industry influencers, opening up new opportunities for business growth and collaboration.

Operational Scaling

They provide guidance on scaling operations, from optimizing sales processes to enhancing product delivery, ensuring the company's infrastructure can support growth.

How They Differ from Other Venture Partners

Business development partners distinguish themselves from other types of venture partners by their focus on operational growth and market expansion activities. While sourcing partners concentrate on finding new investment opportunities and fundraising partners on capital inflow, business development partners are deeply involved in the strategic and operational scaling of existing portfolio companies. Their work is hands-on, directly impacting the revenue and growth trajectory of the companies they support.

Benefits to Startups and VC Firms

Accelerated Growth

Business development partners contribute directly to the accelerated growth of portfolio companies through strategic initiatives and partnerships, enhancing the value of the VC firm's investments.

Market Access

Their efforts help startups gain access to new markets and customer segments, crucial for companies looking to scale beyond their initial niche or geographic location.

Strategic Alliances

By fostering strategic alliances, they enable startups to leverage the strengths and capabilities of other companies, potentially bypassing years of solo development and scaling efforts.

Enhanced Revenue Streams

Their focus on optimizing sales strategies and customer acquisition can lead to enhanced revenue streams and improved market positioning for portfolio companies.

Expert Guidance

The operational and strategic guidance provided by business development partners can be invaluable for startups navigating the complexities of scaling a business, helping to avoid common pitfalls and accelerate success.

Qualities of a Successful Venture Partner

A successful venture partner embodies a set of key qualities that enable them to contribute effectively to the growth of startups and add value to VC firms. These qualities include:

Industry Expertise: Deep understanding of specific sectors, enabling them to provide valuable insights and guidance.

Strategic Thinking: Ability to develop and advise on strategies that drive startup growth and innovation.

Networking Skills: Extensive connections across the startup ecosystem, facilitating introductions and partnerships.

Communication Skills: Clear and persuasive communication, crucial for representing VC firms and advising startups.

Analytical Skills: Strong ability to assess market trends, financial data, and startup potential, guiding investment decisions.

Mentorship: Commitment to supporting and guiding entrepreneurs through the challenges of scaling their businesses.

Adaptability: Flexibility to navigate the fast-paced and ever-changing startup landscape.

Integrity and Trustworthiness: Building trust with entrepreneurs and within the VC firm by acting with honesty and integrity.

Start Your Funding Journey With Visible

Venture partners represent a critical nexus between venture capital firms and startups, offering a combination of capital, expertise, and networks that can significantly accelerate a startup's path to success. Their multifaceted role underscores the collaborative spirit of the venture capital ecosystem, where diverse talents and resources converge to nurture innovation and growth.

Start your funding journey with Visible, where you can tap into a wealth of resources, expertise, and connections to propel your startup forward. Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related resource: Private Equity vs Venture Capital: Critical Differences

founders

Fundraising

The Ultimate Guide to Startup Funding Stages

Building a startup is challenging. On top of building a product, hiring a team, and scaling revenue — founders are responsible for securing capital for their business.

For many startups, this comes in the form of venture capital. Learn more about the different funding stages and venture capital rounds below.

What Are Startup Funding Stages?

There are multiple stages of startup funding: Seed, Series A, Series B, Series C, and so forth. Startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. Here’s an overview of the major startup stages.

As of 2023. Source Crunchbase

Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders. An early-stage startup may also look for funding through bank loans, but angel investments are usually preferred. Seed funding is used to start the company itself, and consequently, it’s a fairly high risk: the company has not yet proven itself within the market. There are many angel investors that specifically focus on seed funding opportunities because it allows them to purchase a part of the company’s equity when the company is at its lowest valuation.

Related Reading: Valuing Startups: 10 Popular Methods

The next stage of the startup funding process is Series A funding. This is when the company (usually still pre-revenue) opens itself up to further investments. Series A funding is generally much more significant than the funding procured through angel investors, with funds of more than $10 million usually being procured. Series A funding is often acquired to help a startup launch. The business will publicize itself as being open to Series A investors and will need to provide an appropriate valuation. Finally, there’s Series B, C, D, and beyond funding. Later stage funding is sought by companies that have already become successful and are trying to expand that success.

Each stage of the startup funding process operates very similarly, despite the different stages the business might be in. During the startup funding process, the company has to be able to establish it’s valuation and will need to have clear plans for how it is planning to use the money it procures. Each round of funding will also, by necessity, dilute the company’s equity. Also regardless of stage, it's important to leverage a startup fundraising platform like Visible in order to save time and close quickly.

Related resource: The Ultimate Guide to Startup Funding StagesPre-Seed Funding

Over the last few years, a new funding stage has emerged, pre-seed funding. A pre-seed round is a round of venture capital that is generally the first round of institutional capital that a startup raises. A pre-seed round generally allows a founding team to find product-market fit, hire early employees, and test go-to-market models.

As a general rule of thumb, funding should last somewhere between 12 and 18 months. It should be enough capital to allow you to comfortably hit your goals and the forecast you laid out during your pitching and fundraising process.

Related Reading: What is Pre-Seed?

Average Pre-Seed Funding Amount