Impact investments can be made across many different sectors and asset classes but target startups whose mission is to produce environmental or social benefits. These industries can include electric cars, renewable energy, sustainable agriculture, or affordable and accessible housing, healthcare, and education.

Impact investing aims to target areas that are often missed by sustainability-themed approaches in an effort to tackle global problems as well as go after the underserved in the global economy.

For each investment target, an SDG might invest in a range of companies that support that. For example, if the target is climate change their investments might go after green buildings and renewable energy.

There is a growing focus of funds understanding the importance of embedding ESG practices into their investment thesis. Robeco defines ESG funds as “portfolios of equities and/or bonds for which environmental, social and governance factors have been integrated into the investment process. This means the equities and bonds contained in the fund have passed stringent tests over how sustainable the company or government is regarding its ESG criteria.”

Mercer breaks down the following when it comes to key elements in investing and implementation.

“Key elements of impact investing:

- Intentionality: contributing to positive social or environmental outcomes

- Measurability: the intended social or environmental impact needs to be measured and reported on clearly and reliably

- Additionality: pursue social or environmental benefits that would not have otherwise occurred without the investment.

How to implement impact investing

Investors typically approach an impact investment allocation with three key issues in mind: 1) intention and themes to target; 2) portfolio allocation and implementation options; 3) how outcomes will be measured and reported to different stakeholders. There are many ways that themes or topics can be identified and prioritized by investors. We have identified those that we believe are key from an impact investment perspective, in both environmental and social categories.”

Events

- SOCAP is the largest and most diverse impact investing community in the world

- The GIIN Investor Forum is designed to advance and scale the impact investing market by bringing all the crucial elements of the world’s impact ecosystem together in one place.

- Social enterprise and impact investing events in 202Social enterprise and impact investing events in 202

Investors and Accelerators in the Space

Impact investments are made by both institutional and individual investors such as private foundations, NGOs, individual investors, fund managers, family offices, as well as religious and financial institutions/ banks. Here are our top pics from our Connect Investor Database.

Buoyant Ventures

- Location: Chicago, Illinois, United States

- Thesis: Digital Solutions for Climate, we look to make investments that adapt to and mitigate from climate change at the speed and scale required.

- Investment Stages: Seed, Series A

- Recent Investments:

- Raptor Maps

- SupplyShift

- FloodFlash

Better Ventures

- Location: Oakland, California, United States

- About: Better Ventures backs mission-driven founders leveraging breakthrough innovations in science and technology to build a more sustainable and equitable economy in which both people and planet thrive.

- Thesis: We back founders on a mission to build a better world.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- SMBX

- 54gene

- agathos

Obvious Ventures

- Location: San Francisco, California, United States

- About: Obvious Ventures brings experience, capital, and focus to startups combining profit and purpose for a better world.

- Thesis: Let’s reimagine trillion-dollar industries together.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Anagenex

- MycoMedica Life Sciences

- Tandym

Bethnal Green Ventures

- Location: London, England, United Kingdom

- About: Europe’s leading early-stage tech for good VC.

- Thesis: We invest in ambitious and diverse founders using technology to create positive impact at scale.

- Investment Stages: Pre-Seed, Seed

- Recent Investments:

- aparito

- Chatterbox

- Commonplace

Blackhorn Ventures

- Location: Denver, Colorado, United States

- About: Blackhorn Ventures is an early stage venture firm that invests in capital-efficient companies redefining resource use, enabling the decarbonization of the toughest to transition sectors in our economy (Transportation, the Built Environment, Supply Chain, and Energy).

- Thesis:Blackhorn Ventures invests in world-class founders building digital infrastructure to redefine industrial resource efficiency.

- Investment Stages: Seed, Series A

- Recent Investments:

- CoFi

- Ecoworks.tech

- Iso.io

Blue Bear Capital

- Location: San Rafael, California, United States

- About: Blue Bear Capital is a VC investor supporting companies that apply data-driven technologies to the energy supply chain.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Raptor Maps

- Copper Labs

- First Resonance

Braemar Energy Ventures

- Location: New York, New York, United States

- About: Braemar Energy Ventures was formed in 2002 to create a venture capital firm with that expertise. Focused exclusively on technology and communications opportunities in the energy sector, Braemar Energy Ventures has both the industry and operating knowledge to select promising young companies, bring them into the larger energy world and guide them to reach their full potential.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Recent Investments:

- Utilidata

- LO3 Energy

- Aledia

Cultivian Sandbox

- Location: Chicago, Illinois, United States

- About: Cultivian Sandbox is a venture capital firm focused on building next-generation disruptive agriculture and food technology companies

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Full Harvest

- Leaf

- Cooks Venture

Core Innovation Capital

- Location: San Francisco, California, United States

- About: Core Innovation Capital is a venture capital firm investing in companies committed to empowering small businesses and everyday Americans.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Arrived

- Column Tax

- Ness

CRE Venture Capital

- Location: New York, United States

- About: CRE Venture Capital finances and partners with entrepreneurs in technology-enabled startups in Sub-Saharan Africa.

- Investment Stages: Seed, Pre-Seed, Series A

- Recent Investments:

- Stitch

- Sabi

- Carry1st

Resources

- IRIS+ is a great resource for developing impact measurement frameworks

- The GIIN’s Investors’ Council is a leadership group for active large scale impact investors.

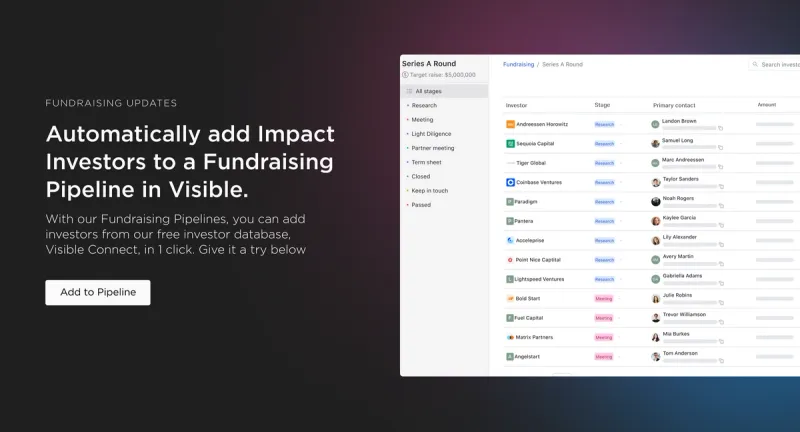

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.