Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Product Updates

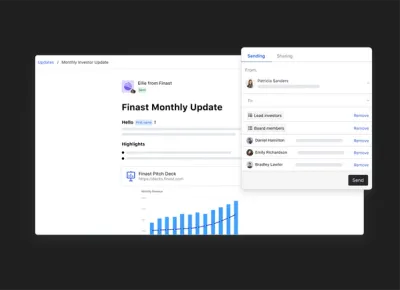

Shameless Plug: The 97 Second Update

Send an Investor Update in Under 2 Minutes

We recently rolled out our Google Sheets integration in Beta and are stoked on the possibilities this presents for telling the story around your data. With the addition of our Google Sheets integration we have taken what used to hours of work into a few minutes of your time… Seriously, check it out:

In addition to sending out Updates you can do the following with our Google Sheets integration:

Automatically grab data from Google Sheets and bring into Visible.

Create beautiful visualizations and dashboards for your stakeholders.

Combine Google Sheets data with other data source integrations or custom metrics.

If you’re ready to start telling your company’s story using Google Sheets and Updates you can check out a quick article here or shoot us a message at hi@visible.vc

founders

Reporting

Investor Letters: One Ford

Ford was Founded in 1903 and has been a staple of American culture since. No company has created the stories and memories like those of Ford; the Model T, the assembly line, the Mustang, the Pinto, and most recently “their 2008 comeback”.

We are all too familiar with the financial crisis in 2008. The automotive industry was hit particularly hard and faced challenging questions all while on the brink of collapsing. Alan Mulally, Ford’s newly appointed CEO at the time, stuck to his guns and pulled out a historical comeback. Mulally’s plan, ONE Ford, is prevalent while the company fought to stay afloat in one of the most uneasy times in recent history. Although Alan stepped down in 2014, ONE Ford is still largely influential at Ford and crucial to their company history.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Ford’s 2008 Letter to Shareholders

A Message from the President and CEO,

In 2008 the automotive industry faced a deep recession in the United States and Europe, the worst worldwide financial crisis in decades and a dramatic slowdown in all major global markets. Like all automakers, Ford Motor Company was adversely impacted by these extraordinarily difficult economic conditions.

However, the plan Ford is operating under – what we call ONE Ford – is helping us endure these current conditions and position ourselves for future success. Our plan has been consistent for the past two years:

Aggressively restructure to operate profitability at the current lower demand and changing model mix.

Accelerate the development of safe, fuel-efficient, high-quality new products that customers want and value.

Finance our plan and improve our balance sheet.

Work together as one team, leverage our global assets.

ONE Ford has transformed us into a different auto company: different than others today and from ourselves a few years ago. However, the worldwide economic slowdown – driven by tight credit markets and weak consumer confidence – has shaken the foundation of even the strongest companies, in the automotive sector and in every other industry.

A plan so simple it can fit on a business card – yet so influential it overhauled the culture at Ford. ONE Ford was the first step Alan Mulally took when he took over the reigns as Ford’s CEO in 2006. The plan, simply enough, revolved around creating one vision for everyone on the team – not just executives and managers. The fruits of the plan have paid off greatly as Ford has generated record profits while staying lean and innovative.

Certainly, the severe economic challenges of 2008 had a significant impact on our results for the year, both in terms of our operating losses and cash flow. After earning a profit in the first quarter of 2008, we had an overall net loss of $14.7 billion for the year, with $6 billion of that coming in the fourth quarter. That compares with an overall net loss of $2.7 billion in 2007. Our worldwide Automotive revenue was $129.2 billion in 2008, compared with $154.4 billion in 2007. At yearend 2008, our total Automotive liquidity was $24 billion, including gross cash of $13.4 billion.

Fortunately, we began aggressive restructuring efforts under ONE Ford before the current crisis began. We eliminated excess manufacturing capacity, closing plants and reducing our workforce. We negotiated a new contract with the UAW to improve our competitiveness. We shifted to a balanced product lineup offering high quality, proven safety, excellent fuel economy and good value.

As part of our ONE Ford plan we also secured credit in advance of the financial market meltdown. As a result of all of these actions and based on our current planning assumptions, we have sufficient liquidity to make it through this global downturn while maintaining our product plans, without the need for government bridge loans. However, as we told Congress in our business plan submission in December 2008, in this environment a number of scenarios could put severe pressure on our Automotive liquidity, causing us to require such a loan – including most importantly a significantly deeper economic downturn, or a significant industry event such as the uncontrolled bankruptcy of a major competitor or major suppliers that caused a major disruption to our supply base or dealers.

When Mulally took over as CEO, in 2006, Ford mortgaged all of their assets to finance the loans spoken of above. At the time, Ford was in desperate need to restructure their company as whole and saw the need for “a cushion to protect for a recession or other unexpected event”, as Mulally put it in a separate interview. As an added bonus, staying away from a bailout was solid for marketing and created a positive image of Ford for many consumers.

Staying aligned with their plan, Ford sold off most of their marques in order to stay agile and focus on their most important brand; their own. In the year or so leading up to this annual report Ford sold off their interest in Aston Martin, Jaguar, Land Rover, and Mazda. A few years after the report they would continue the trend and sell off their share in Volvo as well as discontinuing the Mercury line.

We continue to take the decisive actions necessary to lower production to match lower worldwide demand and reduce costs. We expect this will contribute to significantly reduced negative Automotive operating-related cash flow in 2009 as compared with 2008, and position Ford for growth when the economy rebounds. Based on our current planning assumptions, we believe we are on track for total Company and North American Automotive pre-tax results and Automotive operating-related cash flow to be at or above breakeven in 2011, excluding special items. Our ultimate goal remains unchanged: to create a viable Ford Motor Company and a lean global enterprise delivering profitable growth for all.

Looking ahead, we anticipate very weak global industry sales volumes during 2009, with a full-year decline in the range of about 15% from 2008 levels. Significant government policy stimulus is being implemented in most markets and is expected to improve the environment for sales later this year. Financial markets remain under significant stress, however, and further government and central bank actions are needed to provide liquidity and stabilize banks.

For Ford, the year ahead will be marked by an unprecedented number of new product introductions. Consistent with our ONE Ford plan, we are introducing more products that customers want and value.

As other automotive companies were solely focused on gathering capital, Ford’s previously mentioned loans allowed them to continue to invest in the introduction of new products and technologies. This has included the innovation of their hybrid/electric vehicles and renewed success of their staple models, such as the Focus.

Ford also is on track with its plan to invest in new, smaller, fuel-efficient vehicles and achieve a more balanced global product portfolio. Within the next five years, all Ford vehicles competing in global segments will be common in North America, Europe and Asia, fulfilling a key element of our ONE Ford plan. This includes Ford Fiesta- and Focus-sized small cars, Fusion- and Mondeo-sized midsize cars and utilities, as well as commercial vans. Importantly, every new product will be the best or among the best in its segment for fuel economy, while providing top quality, safety, smart technologies and value.

In another instance of ONE Ford, Mulally touches on the importance of consolidating their platforms and becoming a global company. In the above graphic, pulled from a 2015 Ford corporate update, you can see the continuance of consolidating their platforms. Currently all of Ford models share just 9 platforms and roughly 80% of the same parts; by doing so Ford has been able to create massive economies of scale.

We also are launching the most aggressive vehicle electrification program in the industry. By 2012, we plan to produce at least four high-mileage vehicles that will use the most advanced forms of battery technology in a family of hybrids, plug-in hybrids and battery-powered vehicles.

In addition to producing these vehicles, we are employing a comprehensive approach to electrification that will tackle commercial issues such as batteries, standards and infrastructure. We are working with Southern California Edison, the Electric Power Research Institute and six additional electric utility companies from New York, Atlanta, Detroit and Raleigh to develop plug-in hybrid vehicles and infrastructure.

Despite an extremely difficult year we continue to see many positive developments. These ongoing improvements make us more confident than ever that we have the right plan and are taking the right actions to survive the downturn and emerge as a lean, globally integrated company poised for long-term profitable growth.

As always, we thank you for your support of our efforts.

Alan R. Mulally

founders

Reporting

Investor Letters: The Etsy Economy

In the world of business, moving first can be difficult and dangerous. Etsy, the Brooklyn-based marketplace connecting sellers and buyers of handmade and vintage goods, who IPO’d in 2015 is finding this out the hard way.

When it went public, Etsy was the largest (and one of the first) B Corporations ever to do so at a market cap of over $3B. Since, Etsy’s value has slipped to under $1B and it is yet to convince investors of its long term viability in light of widening losses and competition from Amazon (“your margin is my opportunity”).

In this week’s Investor Letter, which was included as part of the company’s S-1 filing, CEO Chad Dickerson makes the case for Etsy as a public company and tries to push Wall Street analysts to see past simple profits and also evaluate the company on the community it has built and the economic impact it has had…good luck with that.

The Etsy Economy

Since inception, Etsy has challenged conventional ways of thinking about commerce, business, individuals and communities. I intend to keep our unconventional operating philosophy as we become a public company, and I welcome new investors into our community.

When I joined Etsy almost seven years ago, Etsy was an online marketplace for handmade goods, vintage items and craft supplies that connected sellers and buyers. Even in my early days at Etsy, it was clear to me that the vision for Etsy could extend far beyond the founding idea of the company and have even more potential to impact the world for good.

Vision is just the starting point. I believe Etsy can truly change the world when our vision is met with strong culture, a powerful team and disciplined execution. In my time at Etsy, I’ve put my heart and soul into nurturing a culture and building a team and company that match the ambition of our mission. Today our mission is much more expansive than when Etsy began: to reimagine commerce in ways that build a more fulfilling and lasting world.

The reimagination of commerce means transforming every aspect of how goods are made, bought and sold. We believe that Etsy has the long-term potential to transform the world economy into one that is more people-centered and community-focused—one that values and honors designers and makers and one that creates stronger connections among people who make, sell and buy goods. We see an economy that is more sustainable and transparent—and one that is more joyful. We believe in an economy that transcends price and convenience, one that emphasizes relationships over transactions and optimizes for authorship and provenance. We call this the Etsy Economy.

Building the Etsy Economy matters more than ever. For decades now, the conventional and dominant retail model has relentlessly focused on delivering goods at the lowest price, valuing products and profits over community, short-changing the future with the instant gratification of today. I do not believe that this race to the bottom is a sustainable, successful model. Our growing community has made it clear that they desire thoughtful alternatives to mass commerce and impersonal retail and products that better reflect their personal style and values. Person by person, sale by sale, we are building a new model to replace the old. With GMS of $1.93 billion in 2014, I see the Etsy Economy emerging.

Etsy’s Values

If you want to understand Etsy, you’ll have to understand our values.

We are a mindful, transparent and humane business.

We plan and build for the long term.

We value craftsmanship in all we make.

We believe fun should be part of everything we do.

We keep it real, always.

Fundamentally, we believe that companies can and should use the power of business to create social good, which is reflected in our status as a Certified B Corporation.

As we noted in the intro, Etsy was the largest (and one of the first) B Corporation ever to do so at a market cap of over $3B. Rally Software, out of Denver, was the first of the group to go public (at a market cap of just over $300MM). It has since been acquired by CA Technologies for $480MM. Natura Brazil (Market Cap: $12.4B) is the world’s largest publicly traded B Corp but it received certification after it was already public

Other well known B Corporations include Ben & Jerry’s, Warby Parker, which could overtake Etsy as the largest B Corp IPO should it choose to take that route.

Our commitment to using business as a force of good manifests itself in the way we run our business.

People often ask me how I choose between the success of our community and the success of our business. My answer is that I don’t have to choose; we have built a business that does well when our community is successful. Making money matters to Etsy because our financial success creates long-term sustainability for our community. The more we invest in our platform, the more we enable Etsy sellers to pursue their craft and grow their businesses and the easier we make it for Etsy buyers to find unique goods. We call this Etsy’s Empowerment Loop.

Community

At Etsy, we believe that our strength and business success rest in the interdependence among Etsy sellers, Etsy buyers, responsible manufacturers and our employees—in other words, our community.

Etsy sellers represent a diverse mosaic of needs and aspirations. Some sellers are first-time small business owners and benefit greatly from our seller support and education programs. The vast majority of sellers on Etsy are one-person shops, and we continue to embrace and develop new ways to support them. Other sellers have grown and need help scaling with the assistance of responsible manufacturers, creating opportunity for other participants in the Etsy Economy. In all cases, we empower each Etsy seller to succeed on her own terms.

I have heard concerns that by allowing our sellers to partner with responsible manufacturers, we are diluting our handmade ethos. I share our community’s desire to preserve what is special about Etsy. After all, Etsy has always served as an antidote to mass manufacturing. We still do. With our vision of responsible manufacturing, we are promoting a new, people-centered model in which artisans can preserve the spirit of craftsmanship and grow responsibly by collaborating with people at small-batch manufacturers to make their goods. This brings more hands together to build both products and more diverse local, living economies. These local, living economies band together into a larger Etsy Economy made up of individuals with diverse roles but all sharing a collective vision of an economy based on community.

When individuals share a collective vision, the power and possibility of community manifest in profound ways. Etsy is, by design, a collection of many small things. As we grow, Etsy becomes a larger collection of individuals and communities, with compounding benefits when they connect with each other. Etsy sellers have self-organized into more than 10,000 groups around the world, known as “Etsy Teams.” They provide local support to each other and collaborate with Etsy on initiatives, such as teaching entrepreneurship to economically disadvantaged people in their communities, lobbying the government on issues important to Etsy sellers, running local craft fairs and translating Etsy’s site into other languages.

In 2012, Mayor Larry Morrissey reached out to me on Twitter asking how to build an Etsy Economy in his community of Rockford, Illinois. Rockford is a city that has faced challenges familiar to many cities in America and around the world: loss of manufacturing jobs, high unemployment and a struggling economy. We worked with Mayor Morrissey, members of the local Rockford Etsy Team, the public education system, local arts organizations and the public housing authority to launch the Etsy Craft Entrepreneurship Program. This program teaches people with a craft skill that entrepreneurship and economic opportunity are within reach on our platform. We have extended this program to 10 cities around the world and see it as an inspirational model for even deeper community involvement in the coming years.

Our concept of community includes the cities where we live and work, and we run Etsy in a way that supports our own local economy and ecosystem. At our headquarters in Brooklyn, twice a week we serve a meal that we call “Eatsy.” Our approach is to foster community and productivity through a meal, designed for employees to eat together on picnic-style benches. This meal allows employees to engage with each other, within and across teams, and increases team-building and work relationships throughout the company. Eatsy also serves as an end point for company-wide meetings, so that employees can continue the conversation on important workplace topics.

In 2014, we sourced food from over 40 local businesses with an emphasis on our health and ecological impact. We eat on compostable plates, and employees sign up to deliver our compost by bike to a local farm in Red Hook, Brooklyn, where it is turned back into the soil that produces the food we enjoy together. In this way, Eatsy goes into the very soil we live and work on. Eatsy is a metaphor for how I think about many aspects of our business and our relationship to the world around us: regenerative, mindful, interdependent, community-based and fun.

Why Etsy Should be a Public Company

I believe the principles and resources of being a public company align well with the model of shared success that is fundamental to Etsy’s way of doing business, namely that we make money when our sellers make money. Investing in the growth of our business and increasing Etsy’s visibility will help elevate Etsy sellers and attract more buyers, which creates more opportunities for everyone.

This section is perhaps the most interesting since it attempts to answer a question that, to this day, the public markets feel has not been put to rest.

To date, the public markets have shown an unwillingness to accept a company like Etsy where profit seems to take a back seat to impact — unless, of course, that company is Amazon whose scorched earth brand of market expansion appeals a great deal to Wall Street in spite of minimal profits.

Accountability / transparency

Etsy has a long history of providing data to the community, everything from key financial metrics, to our gross happiness index, to our carbon footprint data, to our workplace diversity stats. As a public company, we will be able to provide a higher level of transparency and accountability to a broader number of people.

Community participation

Being a private company means that most people don’t have an opportunity to invest in Etsy. When Etsy is a public company, anyone will be able to own a piece of Etsy, including our sellers, our buyers and anyone else who shares Etsy’s values and mission. These shareholders will be valued members of our community.

Long-term sustainability

We want to be a company that spans generations. Eighty-six of the original companies in the S&P 500 index are still publicly traded after 58 years. I view going public as an important step towards providing Etsy with the capital and long-term corporate structure to achieve similar longevity.

In light of Amazon’s foray into the handmade goods market and Etsy’s struggles as a public company (likely related), there has been some chatter about a buyout. As we noted above, Amazon has a history of scoffing at traditional Wall Street desires and with its acquisition of Zappos in 2009 proved it is willing to take bets on company whose culture seems to be at odds with their own.

Making the world more like Etsy

I believe that Etsy can be a public company that holistically integrates the concerns of people and the planet, the present and the future, profitability and accountability. If we succeed, then other companies might replicate our model. We think the world will be a better place for it.

As a public company, we will continue to concentrate on the long term. Our mission to reimagine commerce is a big goal and it will take time to achieve it; success will be based on strategies that evolve over years and decades, not just quarters. We are more focused on creating long-term results for us and our community than short-term results that lack that promise. I believe this approach will deliver the most sustainable long-term returns to investors.

When we’re public, we do not plan to give quarterly or annual earnings guidance. I think providing quantitative earnings guidance is misaligned with Etsy’s mission. For example, the pressure to hit a quarterly financial target could incent us too heavily to seek near-term gains, which could diminish our ability to fulfill our larger mission over the long-term.

We will continue to be transparent with our investors. Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

What’s Ahead

I am intensely grateful to all of the people who have given so much of themselves to build Etsy, and I am excited to welcome new like-minded shareholders to our community.

We are entering a new era. I believe that successful businesses will be those that combine vision, execution and discipline with values, heart and conviction. That is how I plan to lead Etsy and work with our community to build a more fulfilling and lasting world through commerce. Etsy will be entering its second decade this year, and we look forward to many more in our new form as a public company.

founders

Operations

6 More Great Startup Newsletters

Last year, we put together a list of 17 startup newsletters that people here on the Visible team read and love. In one way or another, each of those newsletters helps to inform our decision-making around strategy and product or features content that we find generally entertaining and insightful.

Related Resources:

Our 15 Favorite Newsletters for Startup Founders

The 16 Best Startup Newsletters

In the months since, we have come across a few more newsletters that have quickly become can’t miss material for us each week.

Snippets from Social Capital

As a firm, Social Capital focuses on backing companies solving big problems. Snippets, their weekly newsletter surfaces content to help readers learn more about those big areas – like healthcare, education, and technology’s impact on society.

The Ringer

While the newsletter from Bill Simmons’ new venture, The Ringer, doesn’t even remotely focus on product or business – like his old site, Grantland, it focuses on the intersection of sports and pop culture – it does allow the reader to follow along with how one of the media world’s more interesting thinkers is going about building something from the ground up (albeit with an existing audience of millions).

UX Design Weekly

Kenny Chen’s newsletter is pretty simple — which any good UX designer knows is important. The best UX focused content from around the web sent out weekly. The list includes articles, tools, resources, and even portfolios to help readers advance their understanding of how to build usable products.

L2 News – The Daily & The Week, Winners & Losers

If you follow our blog, you know we love the stuff produced by L2 Digital and include videos and images from their reports in a lot of our posts. The firm focuses on benchmarking the performance of firms in the digital space — for example, how effective are Nike’s Ecommerce efforts vs. competitors — and their newsletters deliver all of that great content right to your inbox.

Farnam Street Brain Food

The Farnam Street Blog is difficult to describe succinctly. Basically, founder Shane Parrish has tried to build a site that pulls together great resources to make readers smarter and better. Decision-making, mental models, leadership, innovation…these are all topics that the blog touches on. The newsletter distills the best stuff from the site each week.

Paul Singh’s Weekly Newsletter

Over the years, Singh has worked on both sides of the table – founding multiple companies and working as a partner at 500 Startups. Since selling his most recent company, Disruption Corp., to 1776, Singh has built a community around his newsletter, where he shares 10 or so links that he and his community loved in the last week.

And since you made it all the way to the end…we’d love to have you check out our little newsletter, The Visible Foreword. We generally send stuff twice per week. On Wednesdays, we share a new investor letter and over the weekend we provide some commentary on what we launched, learned, wrote, and thought about during the week.

founders

Reporting

Investor Letters: Howard Marks on Liquidity

Like Warren Buffett, Howard Marks is a master craftsman of memos on the state of the market, investment psychology, and investment philosophy. In January of 2016 as capital seemed to be pouring out of public and private equity markets – at the time of his post, the S&P was down almost 9% from where it ended 2015 – and liquidity was on the minds of many investors and operators.

For people building companies (as opposed to investment firms), his notes on liquidity provide ample learning opportunities to help effectively navigate periods of exuberance and tightening that inevitably occur.

Marks framed his thoughts on liquidity well at the beginning of this Bloomberg interview where he states: “The best defense against liquidity is not needing it. It is buying things you can hold for a long period of time.”

We have pulled out our favorite sections and added our thoughts below. The full investor letter (pdf) can be found at the bottom of this post. All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Oaktree’s Howard Marks on Liquidity

Liquidity Defined

Sometimes people think of liquidity as the quality of something being readily saleable or marketable. For this, the key question is whether it’s registered, publicly listed and legal for sale to the public.

“Marketable securities” are liquid in this sense; you can buy or sell them in the public markets. “Nonmarketable” securities include things like private placements and interests in private partnerships, whose salability is restricted and can require the qualification of buyers, documentation, and perhaps a time delay.

But the more important definition of liquidity is this one from Investopedia: “The degree to which an asset or security can be bought or sold in the market without affecting the asset’s price.” Thus the key criterion isn’t “can you sell it?” It’s “can you sell it at a price equal or close to the last price?” Most liquid assets are registered and/or listed; that can be a necessary but not sufficient condition. For them to be truly liquid in this latter sense, one has to be able to move them promptly and without the imposition of a material discount.

Much ink has been spilled in recent periods about the lack of liquidity – using the definition Marks’ favors – in the private markets. Companies of all stages are struggling to raise fresh capital without taking a haircut (selling an asset below the last price) and the IPO window is firmly closed.

Liquidity Characterized

I often say many of the important things in investing are counter-intuitive. Liquidity is one of them. In particular, it’s probably more wrong than right to say without qualification that something is or isn’t “liquid.”

If when people ask whether a given asset is liquid they mean “marketable” (in the sense of “listed” or “registered”), then that’s an entirely appropriate question, and answering it is straightforward. Either something can be sold freely to the public or it can’t.

But if what they want to know is how hard it will be to get rid of it if they change their mind or want to take a profit or avoid a possible loss – how long it will take to sell it, or how much of a markdown they’ll have to take from the last price – that’s probably not an entirely legitimate question.

It’s often a mistake to say a particular asset is either liquid or illiquid. Usually an asset isn’t “liquid” or “illiquid” by its nature. Liquidity is ephemeral: it can come and go. An asset’s liquidity can increase or decrease with what’s going on in the market. One day it can be easy to sell, and the next day hard. Or one day it can be easy to sell but hard to buy, and the next day easy to buy but hard to sell.

In other words, the liquidity of an asset often depends on which way you want to go . . . and which way everyone else wants to go. If you want to sell when everyone else wants to buy, you’re likely to find your position is highly liquid: you can sell it quickly, and at a price equal to or above the last transaction. But if you want to sell when everyone else wants to sell, you may find your position is totally illiquid: selling may take a long time, or require accepting a big discount, or both. If that’s the case – and I’m sure it is – then the asset can’t be described as being either liquid or illiquid. It’s entirely situational.

There’s usually plenty of liquidity for those who want to sell things that are rising in price or buy things that are falling. That’s great news, since much of the time those are the right actions to take. But why is the liquidity plentiful? For the simple reason that most investors want to do just the opposite. The crowd takes great pleasure from buying things whose prices are rising, and they often become highly motivated to sell things that are falling . . . notwithstanding that those may be exactly the wrong things to do.

Select Passages

Specific investor actions can have a dramatic impact in illiquid markets For example, the price of an illiquid asset can rise simply because one buyer is buying, in which case selling the asset becomes very easy. When that buyer stops buying, however, the market can quickly reset to much lower levels in terms of both price and the liquidity enjoyed by sellers (and it can overshoot in the other direction if the buyer decides to sell what he bought.

People have pointed out that the slowdown in VC funding (to whatever extent it has or will happen) has been largely a VC conspiracy and it is tough to write this off entirely — although I am sure that in this imagined world of VC “conspiracies” a yoga studio or vest-shopping excursion replaces the dark, smoke-filled rooms of old-timey conspiracy theories.

The reality is that the venture market is small and quite illiquid, so when a few major firms decide to focus more on their existing portfolios or non-traditional players like mutual funds decide to slow down, liquidity begins to trickle out of the market.

And in an already illiquid market, change can happen fast. In describing current market conditions, Mark Suster of Upfront Ventures noted the following:

If you want to see what was on my mind – I started foreshadowing change publicly in October 2015 with a forecast of what I expected in 2016 VC funding markets at a presentation I gave at the annual Cendana VC/LP conference hosted by Michael Kim. Word travels at light speed amongst this small network of people who all know each other and even though they’re rivals they also sit on boards together and many probably went to business school together.

So when something in changing those at ground zero, in my word, “get the memo.” Of course it’s not literally a memo but that’s a metaphor for knowing that things have dramatically changed. If you’re not in this closed group of VCs you will eventually figure out the new game but the memo arrives more slowly. Many of the industry’s top thinkers were at Cendana’s annual meeting and panel after panel privately debated what they were seeing.

On the other hand, at the right time, investors can make tremendous amounts of money simply by being willing to supply liquidity (are accept illiquidity). When everyone else is selling in panic or sitting frozen on the sideline, refusing to buy, cash can be king. Often when a crash follows a bubble driven run-up, most people are short of cash (and/or the willingness to spend it).

A few paragraphs before this passage, Marks touches on the need to think about liquidity levels carrying over from one asset or market to another. This was the case in 2008 and 2009, when it seemed people in all markets were content to sit on the sidelines and reserve cash. During that time, investors who were unwilling to spend their cash (supplying liquidity) in the early stage private markets would have missed out on investing in generation-defining companies like Uber, Slack, and Airbnb.

The bottom line is unambiguous. Liquidity can be transient and paradoxical. It’s plentiful when you don’t care about it and scarce when you need it most. Given the way it waxes and wanes, it’s dangerous to assume the liquidity that’s available in good times will be there when the tide goes out.

What can an investor do about this unreliability? The best preparation for bouts of illiquidity is:

Buying assets, hopefully at prices below durable intrinsic values, that can be held for a long time – in the case of debt, to its maturity – even if prices fall or price discovery ceases to take place, and

Making sure that investment vehicle structures, leverage arrangements (if any), manager/client relationships and performance expectations will permit a long-term approach to investing.

These are the things we try to do.

In the section above, Marks is talking about the Oaktree approach to building their firm and later notes two benefits to their approach:

We aren’t highly reliant on liquidity for success, and

Rather than be weakened in times of illiquidity, we can profit from crises by investing more – at lower prices – when liquidity is scarce.

Rephrased for someone building a company and not an investment firm, the benefits to this type of strategy would be:

1. We aren’t highly reliant on another round of funding for success

2. Rather than be weakened when the funding market pendulum swings, we can profit from downturns by investing more – at lower prices – in things like talent and customer acquisition

This mirrors the approach of Slack’s Stewart Butterfield who has tried to take advantage of a period of high liquidity to protect his company (financially and psychologically) from a market downturn.

“And really the thing we get out of having the cash in the bank at this point is options. We’re in a really good position where when opportunities arise that we want to take advantage of, we can just do them. Whether that’s acquisitions, international expansion, advertising — whatever it is that comes up that feels like the best move for the business, we will take advantage of. Having the freedom to pursue opportunities without the constraint of capital enables all kinds of things which otherwise wouldn’t have been possible.” – Stewart Butterfield, Business Insider Interview

founders

Reporting

This YouTube Investment Memo Shows You the Path to the Perfect Pitch

Every company going out to try to raise capital from angel investors or VCs seems to have some derivative of the same question – “What should we include in our pitch deck?”

While the outsize clout people give a simple slide deck may seem silly, it speaks the importance of being able to weave a compelling narrative about your business.

Roelof Botha of Sequoia Capital is one of the most successful venture capitalists of all time. He sits on the board of companies like Square and Jawbone and led investments in Youtube and Meebo before they were acquired by Google. Recently, he checked in at #18 on CB Insights list of the top 100 venture capitalists.

Basically, he knows what it takes to build great companies and how those companies should think about raising capital.

Thanks to court records from the 2010 Viacom-YouTube lawsuit, we can take a first hand look at how the Youtube founders pitched Botha (exhibit 1) and how Botha pitched Youtube internally to his Sequoia partners (exhibit 2). From there, we can better understand how companies should think about structuring their own pitches to investors as well as the major hurdles companies need to get over to turn a potential investor into an advocate who makes sure to push their deal forward.

Exhibit 1 – Youtube’s Pitch

Here is the rundown of the order in which the Youtube founders presented their business opportunity and our interpretation of the reasoning. As you will see, the way this is presented does a great job of continually answering questions and pushback that would be brought up in the preceding section.

Purpose – Why should I care?

Problem – What point of friction are you attacking? Money is made at points of friction.

Solution – How are you removing (extracting value from) that friction point?

Market Size – How much value can you conceivably capture from this new offering?

Competition – If the market is so big there must be others after it, right? While some argue that competition is not a good thing, a Blue Ocean approach to entering the market shows you have thoughtfully evaluated where others have failed and understand how to attack those areas.

Product Development – What is the actual product that will serve as the conduit for this better customer experience?

Sales & Distribution – How will you make the market care about this cool product?

Metrics – Have any of your previous predictions been tested and evaluated by your target market? How has it gone?

Team – Are you the people that are going to connect all of these dots?

Exhibit 2 – Botha’s Pitch to His Sequoia Partners

Raising a seed round is like making a sale to a SMB customer — smaller amount of money in play, usually one decision-maker, and a relatively short sales cycle.

Raising institutional money is more like conducting an Enterprise sale. The check size is bigger, the timeline is longer, and you need to find an advocate on the inside that is going to continually work to push the deal forward and get buy-in from other decisionmakers.

This latter process is the one we see at play here in Exhibit 2, where Botha takes us the Youtube cause internally at Sequoia and present the case for investment to his partners. Here, we get a rare glimpse into how an investment decision is made at a VC firm.

As a founder, reading through this section is instructive in that it can help you anticipate some of the questions an investor will face from partners so you can be sure to address those in your own presentation.

Intro – What is the thesis and (like in the previous section) why should we care?

Deal – How do the terms and structure of the deal (valuation, our ownership, etc.) fit in overall with the portfolio we are building?

Competition – How does this company fit into the marketplace of both large and small competitors? An outline of the competition quickly helps investors build a framework for what your go-to-market strategy may look like.

Hiring Plan – Does this company have a plan and the ability to attract talented executives and key employees to bring the business from where it sits today to where the founders have said it will be in the future?

Key Risks – What factors will cause the statements that have been made around market, product, distribution, and team to not come true? What is the likelihood and scale of those risks?

Recommendation – As Thrive’s Miles Grimshaw put it in his blog post on the document, how does management, market, and monetization all tie together?

founders

Reporting

Investor Letters: Overstock’s Super-de-Duper Year

Overstock has long been a bit player in the world of Ecommerce. Founded in Utah in 1999 (at the height of the Dot-Com boom), the company grew rapidly and IPO’d in 2002 (a week after Netflix and almost right at the bottom of the Dot-Com bust) on annual revenue of $40mm and at a market cap of just under $350MM dollars.

Despite being one of the few companies to come out of the Dot-Com crash alive, its long term growth has disappointed and the value of the company today sits just a few million dollars north of where they IPO’d 14 years ago.

Still, the company and its CEO, Patrick Byrne have a way of keeping themselves in the news. There was the battle with naked shortsellers, its rebrand to O.co, and its early adoption of cryptocurrency.

There has also been his ongoing embrace of transparency, which started with the following letter to shareholders recapping the company’s 2003 performance. The general tone and openness of this letter is uncommon for a public company and calls to mind the way Warren Buffett approaches his shareholder communication. So while the performance of the company hasn’t quite kept up with its peers, Byrne’s approach to stakeholder management is as relevant as ever.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Overstock’s “Super-de-duper” Sales Numbers

The rhythm of the Dao is like the drawing of a bow. – Lao-zi

Dear Owners:

My colleagues executed well this quarter. Were 2003’s four quarters a boxing match, I’d say we were dropped to our knees in the first, cleared our head in the second, got on our toes again in the third, and won the fourth on a decision.

In this letter I will describe how my colleagues accomplished this, and detail some mistakes your chairman made that prevented victory by a knockout.

First, I will explain why I am appending this letter to our earnings release. Simply put, I want owners to understand their business: they entrust capital to me and I owe them no less.

I am warned that a letter such as this has risks. A lawyer told me that my use of this more colloquial style may be misconstrued, saying: everything you write will be Exhibit A in a lawsuit against you, (but lawyers say that about most things). Bill Mann of The Motley Fool says that we live in a time when, if things go passably well, CEOs say, Everything is super-de-duper, and when they go poorly they say, Everything is just super-duper. In such a climate, if I write, X went pretty well, but I could do better on Y and Z, the former is read as an admission of mediocrity, and the latter, calamity.

This fits in with what many founders in the early stage world worry about. Everyone else is “killing it”, why aren’t we? Stakeholders – as Byrne touches on above – deserve to hear from management in an honest and open fashion that lays out what has worked, what hasn’t, and what is coming next.

Lastly, cynics claim that my candor is but an attempt to pump my stock by drawing investors looking for someone who does not pump his stock: I am flattered to have attributed to me such Machiavellian subtlety! (And I suggest they look up Popper’s Falsification Principle.)

Saved you a click…

For six quarters I have struggled to reconcile my desire to report in this fashion to Overstocks owners with the more traditional approach used by most companies. Trying to mold a murky reality into a few lines of happy quotes has always been difficult. I have thus decided (when able and time permitting) to write lengthier and more informative letters to owners, filtering out points that concern individuals, details, or strategies that might bore readers or advantage competitors. Note, then, shareholder, that when I write, X is going pretty well, just because I did not say, X is super-de-duper it does not mean, X is a disaster. Sometimes a cigar is just a cigar. The journalists, lawyers, and cynics will find their own way.

Ed Note – The entirety of the 2003 letter from Overstock is about 10 pages long…we’ve pulled out a few of our favorite passages here. You can read the entire letter here.

Sales

To begin with, sales were super-de-duper. They truly were. We returned almost to the hyper-growth curve (94% year-on-year growth).

Just to give you a sense of the size of the business at the time of this writing, Overstock brought in just under $300mm in revenue during the preceding year and was, as Byrne notes, growing rapidly.

As you would expect, this growth has since slowed significantly due to a number of factors – increased competition and the buyer behavior shift to mobile being a couple. Still, the company has returned to double digit revenue growth in the last three years.

Expense Discipline

I believe I can do much better here. At the risk of giving an excuse I’d note that it is difficult to get expenses precisely right when one starts a quarter with a range of expected GMS from $80 million to $120 million: optionality costs money. Still, in retrospect, I believe I could have saved $1-2 million if I had addressed some issues earlier.

Something that teams at any high growth company can likely relate to.

Capital Needs

Funds call me regularly offering to do PIPE’s (private investment in public equity) at X% discounts with Y% warrant coverage struck up Z%, etc. etc. I am a bear of little brain, and my reaction to such invitations is roughly the same as being asked to join a game of Three Card Monte in Times Square. Yet their enquiries do keep me thinking about the issue of capital.

Build a model of our business at break-even and growing 100%. Do we need capital? If we were a brick factory the answer would be, “yes”, but for the float reason given above the answer is, hard as it may be to imagine, maybe not. Yet my answer would continue, That is, if we are comfortable skimming along at times with a weeks worth of cash in the bank, as we did at one point this Q4 when we bulked up for Christmas.

Are we at break-even? Not yet: our GAAP loss in Q4 2003 was 2.6% of revenue. Should we strive to be at break-even? What if, by continuing to lose two-and-a-half pennies on every dollar of sales, we could grow at our current rate for three more years (and thus turn into a >$2 billion GAAP revenue business): should we? What if we could lose four pennies but grow at 200%: should we? It depends, I suppose, on what our net margin would be when we throttled back growth.

In sum, then: it is not clear that Overstock needs more capital; if we do, it is not clear we need it now; if we do need it now we are not going to raise it through a warrant-warted PIPE. That said, we will continue to look at our capital needs and try to position ourselves so that we will be able to raise capital conveniently if the right time arrives. For example, we are in the process of obtaining an inventory line of credit. Please know that I have the benefit of an excellent board, well-versed in capital and which views advising me on this issue as one of its main duties.

In the early stage market, it is common to see founders plan or go through fundraising processes at a certain pace and targeting a certain amount of money just because they think it is what they are supposed to do or because it is available.

While there is almost never anything wrong with opportunistically raising capital to increase optionality, the decision to raise capital of any type should always be well thought out else you risk wasting your time chasing opportunities that are not a good fit.

Operations

We had a few sleepless nights here. At this point I suppose I should mention that, as Team Overstock’s player/coach, it is my occasional and regrettable duty to reposition, bench, trade, and sometimes cut teammates, alas. “Benching” takes the form of sending people home on paid leave to recoup and to allow us to rearrange. For example, two summers ago I benched someone by sending him and his family to Hawaii while I took his job myself: when he returned I gave him a different job (in fact, things like this happen often enough that “getting sent to Hawaii” is synonymous around here with “getting a last chance.”)

This Christmas season an executive moved to the bench: I did not put out a press release about it, partially out of respect for him, but also because his future role in the game was unclear. As I have noted recently, he is no longer with the company. While I acknowledge that losing one’s COO during the Christmas rush is discomforting (as I know better than anyone), I hope that this clarifies my thinking satisfactorily.

Rare insight into how the CEO of a public company thinks about what is likely the most important responsibility he has, attracting and retaining good people. Image below via First Round’s “State of Startups”.

Conclusion

A man crosses a desert by shooting an arrow from his bow and retrieving it as he walks. He must cross the desert with the fewest shots possible. At times he strains the bow with all his strength and lets his arrow fly, but sacrifices accuracy, at times shooting the arrow wildly off course. Other times he aims carefully and draws timidly, attempting little but guaranteeing himself small, solid progress. In time he finds the balance of draw and aim that covers the most ground in the fewest shots.

I have not yet found such balance. Yet in 2003 Q4 we drew the bow deeply, and our shot went far and fairly straight. On such a deep draw I could have blundered the shot (as I have before), and only the excellent work of my colleagues prevented mishap. I do not enjoy chancing so much on each shot. Yet I saw an opportunity to let one fly, and we still have much ground to cover.

Your humble servant,

Patrick M. Byrne

President

P.S. As much as I like hearing from owners and potential owners, I am now deluged by the volume of contacts from those saying they want to invest but must get to know me better before they do. I am flattered; I am humbled (believe me, you’d be disappointed if we met); I am torn between wanting to help answer their questions and Reg FD; but mostly, I am out of time. Though I enjoy hearing and learning from owners I must, regrettably, propose two alternatives. First, in the investor relations section of our site I intend to include material that will elucidate our business philosophy. Second, for any who actually visit us in Utah I will always make time to meet with you.

Sounds like Patrick needs a “one-to-many” tool to manage the communication with his investors a bit more efficiently…we know where he can find one 😉

founders

Operations

The Momentum Flywheel

“ As a founder, there is no variable more important to manage adeptly than momentum” – Glenn Solomon, GGV

Settling on a single definition for “momentum” in an early stage business is difficult.

There is product momentum — delivering on the value proposition you promise to existing and potential customers time and time again.

There is team and hiring momentum — fostering a culture that effectively attracts and retains great people.

There is revenue momentum – building a predictable growth engine that targets the right segment of the market and packages your solution effectively over time.

There is fundraising momentum – regularly engaging with current and potential investors to gauge the market and lay the groundwork for future fundraising events.

All of these different momentum subsets contribute to the overall momentum (and long-term success) of a business. But how should a Founder prioritize these (and other types of) momentum? After all, if any of these processes lag for too long, the company is likely to fail.

The 1 Weird Momentum Trick!

Notice the words we used above to explain different types of momentum a CEO needs to manage:

“Time and time again…”

“Predictable growth engine…”

“Regularly engaging…”

All of these hint at the single best way to make sure you are successful managing your company’s momentum: Consistency.

Stakeholders – your team, your customers, your investors – need to know that you, as CEO, are doing something every single day to push the ball forward in each of those areas.

Leveraging Your Time to Build Momentum

Understanding that you should be trying to move the needle in each of these areas each day is the easy part. Now, where will the time to actually deliver on that commitment come from?

Trying to micromanage every process in your company is a recipe for disaster – you lose the trust of the your team (which you were trying to gain by touching every project) and the context switching saps you of energy and limits your effectiveness.

To most effectively leverage your time, think of the momentum management process like a flywheel:

We often talk on this blog about the two types of resources a business has – talent and capital. By focusing first and primarily on the attraction and retention of those two areas each day, you leverage the impact you can make on the momentum of your company. Great people build great products and bring them to market. Those results compound over time and become visible to new talent and capital. That new capital enables new growth strategies and more hiring and those new people step in to execute on the expanded mission. It is the virtuous cycle of startup momentum.

founders

Reporting

Investor Letters: Starbucks in the Dot-Com Bust

Starbucks was founded in 1971, was purchased in 1987 Howard Schultz (the man globally associated with the brand), went public in 1992, and opened its first international location in Japan in 1996. By the late 1990’s when the dot-com boom was in full swing, Starbucks was onboard, investing in eventual blow-ups like Kozmo, Talk City, and Living.com.

In 2000 – just as the company was taking writedowns on the investments listed above – Howard Schultz and Orin Smith penned the following letter to shareholders which laid out core focus areas and set the table for the massively important technology company Starbucks has become today.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Starbucks’ 2000 Letter to Shareholders

To our Shareholders,

We entered the new Millennium with a great sense of accomplishment and excitement, knowing that we were poised to share the Starbucks Experience with even more people around the world. Today, the anticipation we experienced as we began fiscal year 2000 has been more than fulfilled, thanks to the passion and dedication of our partners (employees), our unwavering commitment to the highest quality coffee, and the connection that we are fortunate to enjoy with our customers. We believe that the possibilities for our future achievements are virtually limitless, and we are even more inspired to climb to greater heights. These are still the early days of building our company and the Starbucks brand.

Starbucks experienced tremendous success and growth in fiscal year 2000. We had record revenues of $2.2 billion for the year.

Our stellar performance included three consecutive quarters of double-digit comparable store sales increases – an amazing achievement for any retail company of our size and maturity, culminating in a 9 percent comparable stores sales growth for the full year, the highest it has been since 1995.

While 9% comparable store sales growth represented an “amazing achievement” in 2000 – when the company had around 3,000 locations – the fact that they have maintained that growth over the last decade and a half and still see strong comparable growth at 20,000+ locations is…whatever you call something more amazing than an “amazing achievement”.

We far exceeded our projected target of 600 new store openings for the year, with 1,035 new company owned and licensed locations worldwide, including 778 stores in North America alone. We surpassed our goal to open 150 international stores, opening 257 international locations by the end of fiscal year 2000. In the United Kingdom, we opened 63 new locations, well ahead of our target of 50 stores. We also entered a number of international markets including Lebanon, the United Arab Emirates, Qatar, Hong Kong, Shanghai and Australia, bringing our total number of international locations to 525 at the end of the fiscal year. During the year we acquired a majority interest in our Thailand operations. We were also thrilled to announce our plans to enter Switzerland, our first market in continental Europe. Our remarkable success in virtually every international market we have entered to date has inspired us to set ambitious targets for the future. We plan to have 650 Starbucks locations throughout Europe by the end of fiscal year 2003, and we believe that customers in the European market will embrace the Starbucks Experience.

Over the years, Starbucks has struggled with growth in its European markets as it has had to combat an embedded coffee and cafe culture that shuns the impersonal, big box experience Starbucks was reputed to have.

That has since turned around a bit as both comparable store sales in the EMEA region and anecdotal evidence – lines to or out out the door in Lyon, France and Geneva, Switzerland seen during Visible’s recent trip to Europe.

Our outstanding growth is testimony to the strength of the Starbucks brand worldwide. When we opened our first store in Tokyo, consultants told us that Japanese customers would never use to-go cups or drink coffee while walking on the street. If you visit Japan today, you will see people proudly holding Starbucks cups with the logo facing out. As the result of our customers’ warm acceptance, Starbucks Coffee Japan became profitable in fiscal year 2000 – more than two years ahead of plan. Additionally, we were extremely pleased that Nikkei Restaurant Magazine, one of Japan’s most respected food service industry publications, recognized Starbucks as the most preferred restaurant chain in Tokyo, just four years after our entry into the market. In addition, Interbrand Corporation, the world’s leading brand consultancy, recently ranked Starbucks as one of the top 75 global brands. These accomplishments confirm our belief that we have incredible opportunities ahead.

By the end of fiscal year 2000, Starbucks had more than 3,500 locations worldwide, serving more than 12 million customers per week in 17 countries. We believe that in the past we dramatically underestimated the size of the global market and the power of the Starbucks brand. We now believe that we have the potential to have at least 20,000 locations worldwide, with as many as 10,000 locations in international markets.

Amazingly, they have surpassed this number at the beginning of Q1 2014 and haven’t looked back!

Our core retail business in North America continues to thrive. We introduced the sumptuous White Chocolate Mocha and Caramel Apple Cider drinks early in the year, followed by two decadent new blended beverages for summer – Chocolate Brownie Frappuccino ® and Orange Mocha Chip Frappuccino ®. These popular additions to our menu provided our customers with delightful indulgences for every season. We also introduced the Starbucks Barista AromaA ™ coffeemaker and thermal carafe – an instant hit with customers. And our positioning for Holiday 2000, “Home for the Holidays,” offered simple, traditional messaging designed to capture our customers’ hearts. In addition to festive favorites such as the Eggnog Latte and our unique Christmas Blend coffee, we introduced the delectable Gingerbread Latte to bring alive the flavor of the season. We also created and unveiled the revolutionary Starbucks Barista Utopia™ vacuum coffee brewing system. This stylish, innovative machine brews the perfect cup of Starbucks ® coffee for our customers to savor at home. Customers gave the Utopia a very enthusiastic reception, and we were delighted by its success.

This was a pivotal year for two Starbucks brands that complement the coffeehouse experience – Tazo® tea and Hear Music™. In fiscal year 2000, Tazo Tea crafted and introduced a new line of filter bag and full-leaf teas to tempt customers’ palates. Our customers also enjoyed an enhanced music program through Hear Music’s displays and branded compilation discs. These two emerging brands are positioned for strong growth, and they add to the richness and texture of the Starbucks Experience.

One mark of a great company is its ability to choose business partners who reflect its core values and guiding principles. Our Business Alliances group, part of our specialty operations, created and nurtured relationships that reach more than 20 million customers per month by providing increased access and visibility to the Starbucks brand. During the year, we signed licensing agreements with several key accounts, including Albertson’s, Inc., Safeway Inc., Dayton Hudson Corporation (Super Target stores) and Marriott International, Inc. Our achievements to date have extended the Starbucks brand and created significant momentum for our future growth. We are confident that we have the potential to open many more licensed locations in grocery stores, airports and other convenient venues.

We also announced an exciting alliance with The New York Times, which recently became the exclusive nationwide newspaper sold in all of our company-owned locations in the United States. As part of this strategic three-year agreement, The Times will use its advertising resources to promote the Starbucks brand. We are proud to team up with The Times to provide our customers with one of the world’s most widely read and respected newspapers.

A newer Starbucks partnership worth noting is their tie-up with Lyft, which again positions the coffee maker as one of the most employee-friendly and forward thinking companies on earth (more on those two things below!).

Even in the best years, we face challenges. In the fourth quarter, we took a non-cash write-down of our entire investment in living.com Inc. and the majority of our equity positions in Kozmo.com, Inc., Cooking.com, Inc. and Talk City, Inc. to reflect fair value. We have learned from this experience and we believe this knowledge will benefit our business going forward. Starbucks is an entrepreneurial company, and we have achieved extraordinary benefits from courageous and innovative business practices. That spirit and practice of innovation will continue. However, we remain focused on our core business, and we realize that the growth potential within that core business is far greater than even we previously imagined. Going forward, we will pursue only those opportunities that we feel will complement our core operations.

After these specific setbacks and the meltdown of the market as a whole, many businesses would have (and did) shy away from investing in (either internally or externally) technology. Starbucks did not do this, instead opting to commit to the Internet (and later, mobile) and an important part of their long-term business. Starbucks is a technology company and they have been since well before the popularization of the “every company is a technology company” idea.

L2 Digital is one of our go-to resources for understanding what drives the growth (and decline) of individual companies as well as broad sectors. They have done a number of studies and reports on Starbucks and their tech success over the years. Here are a couple of our favorites

Our people are crucial to ensuring that we deliver the Starbucks Experience every day. The passion they bring to our customers is one of our greatest assets. To ensure that our partners share in Starbucks success, we provided stock option grants to eligible partners under the Bean Stock Plan for the 10th consecutive year. Our ongoing commitment to providing a great work environment has also had many positive impacts on our partners and customers. One indication of our collective passion is the dedication and team spirit displayed by partners at our LaBrea & San Vicente store (opened through our alliance with Earvin “Magic” Johnson). The morning after these outstanding partners won the fourth largest lottery jackpot in California history, they chose to come to work and cheerfully opened the store at 5:30 a.m. to serve their customers.

It may be buried down towards the end of this letter but a commitment to building a culture that attracts and fosters the growth of talented people – at all levels of the company – is one area where Starbucks truly stands out. Through a partnership with Arizona State University, Starbucks covers tuition for its team members across the United States. In total, the company spends more per year on employee benefits than it does on coffee beans!

Starbucks long-term success as a company will be measured in part by our ability to be a responsible global citizen. As part of our ongoing efforts to address social and environmental issues in coffee origin countries, we committed to a year-round offering of shade grown, organic or Fair Trade certified coffees. We launched this Commitment to Origins™ category with Shade Grown Mexico coffee in collaboration with Conservation International, and we were proud to introduce Fair Trade Certified coffee to our customers through a new alliance with TransFair USA. In addition, we significantly increased our commitment to provide financial support for Conservation International’s work to protect global biodiversity. Starbucks also continues to be one of the largest North American contributors to CARE, the international aid and development organization, and we are honored to support their work to improve the lives of people in coffee origin countries.

We are also deeply committed to bringing the joy of reading to people around the world. The Starbucks Foundation assisted more than 100 organizations in fiscal year 2000 by providing more than $1 million in literacy grants in North America. We also extended the program to include initiatives in New Zealand, Thailand and the Philippines. In addition, we held our fourth annual All Books for Children drive, through which we collected more than 335,000 books for schools and literacy programs.

Our joint venture with Earvin “Magic” Johnson’s Johnson Development Corporation to open Starbucks Coffee stores in under-served urban neighborhoods continues to enrich lives and contribute positively to the communities in which the stores operate. During fiscal year 2000 we opened 11 new stores in six states in the United States through this unique joint venture.

We each assumed new leadership roles in fiscal year 2000 that were designed to leverage our respective skills and experience in our growing and dynamic company. We feel that our transition has been seamless, and we are more confident than ever that the Starbucks brand has tremendous opportunities ahead. We are humbled by Starbucks success. The achievements of the past inspire us to continue this amazing journey together as we strive towards our goal of becoming a great, enduring global brand.

For all of you who bring Starbucks to life, thank you for your ongoing support.

Warm regards,

founders

Reporting

Investor Letters: Mark Zuckerberg before Facebook’s IPO

Driven primarily by Mark Zuckerberg’s desire to keep his company nimble, Facebook waited a long time to go public. This brought intense scrutiny from a lot of onlookers who were quick to pile on when the company’s IPO got off to a rocky start.

Weeks prior to the actual IPO as part of the company’s S-1, Zuck outlined his vision for the future in a letter to Facebook’s shareholders and made it clear that he was playing the long game.

All of the charts, images, quotes, and emphasis below were added by us.

Facebook was not originally created to be a company. It was built to accomplish a social mission – to make the world more open and connected.

We think it’s important that everyone who invests in Facebook understands what this mission means to us, how we make decisions and why we do the things we do. I will try to outline our approach in this letter.

At Facebook, we’re inspired by technologies that have revolutionized how people spread and consume information. We often talk about inventions like the printing press and the television – by simply making communication more efficient, they led to a complete transformation of many important parts of society. They gave more people a voice. They encouraged progress. They changed the way society was organized. They brought us closer together.

Today, our society has reached another tipping point. We live at a moment when the majority of people in the world have access to the internet or mobile phones – the raw tools necessary to start sharing what they’re thinking, feeling and doing with whomever they want. Facebook aspires to build the services that give people the power to share and help them once again transform many of our core institutions and industries.

There is a huge need and a huge opportunity to get everyone in the world connected, to give everyone a voice and to help transform society for the future. The scale of the technology and infrastructure that must be built is unprecedented, and we believe this is the most important problem we can focus on.

And there is still a long ways to go!

We hope to strengthen how people relate to each other.

Even if our mission sounds big, it starts small – with the relationship between two people.

Personal relationships are the fundamental unit of our society. Relationships are how we discover new ideas, understand our world and ultimately derive long-term happiness.

At Facebook, we build tools to help people connect with the people they want and share what they want, and by doing this we are extending people’s capacity to build and maintain relationships.

People sharing more – even if just with their close friends or families – creates a more open culture and leads to a better understanding of the lives and perspectives of others. We believe that this creates a greater number of stronger relationships between people, and that it helps people get exposed to a greater number of diverse perspectives.

By helping people form these connections, we hope to rewire the way people spread and consume information. We think the world’s information infrastructure should resemble the social graph – a network built from the bottom up or peer-to-peer, rather than the monolithic, top-down structure that has existed to date. We also believe that giving people control over what they share is a fundamental principle of this rewiring.

An Example of a Facebook Social Graph

We have already helped more than 800 million people map out more than 100 billion connections so far, and our goal is to help this rewiring accelerate.

And accelerate, they have both on the Facebook platform and through acquisitions of user-base behemoths WhatsApp and Instagram.

Facebook (The Big Blue App) Monthly Active Users

We hope to improve how people connect to businesses and the economy.

We think a more open and connected world will help create a stronger economy with more authentic businesses that build better products and services.

As people share more, they have access to more opinions from the people they trust about the products and services they use. This makes it easier to discover the best products and improve the quality and efficiency of their lives.

One result of making it easier to find better products is that businesses will be rewarded for building better products – ones that are personalized and designed around people. We have found that products that are “social by design” tend to be more engaging than their traditional counterparts, and we look forward to seeing more of the world’s products move in this direction.

Our developer platform has already enabled hundreds of thousands of businesses to build higher-quality and more social products. We have seen disruptive new approaches in industries like games, music and news, and we expect to see similar disruption in more industries by new approaches that are social by design.

In addition to building better products, a more open world will also encourage businesses to engage with their customers directly and authentically. More than four million businesses have Pages on Facebook that they use to have a dialogue with their customers. We expect this trend to grow as well.

We hope to change how people relate to their governments and social institutions.

We believe building tools to help people share can bring a more honest and transparent dialogue around government that could lead to more direct empowerment of people, more accountability for officials and better solutions to some of the biggest problems of our time.

By giving people the power to share, we are starting to see people make their voices heard on a different scale from what has historically been possible. These voices will increase in number and volume. They cannot be ignored. Over time, we expect governments will become more responsive to issues and concerns raised directly by all their people rather than through intermediaries controlled by a select few.

Through this process, we believe that leaders will emerge across all countries who are pro-internet and fight for the rights of their people, including the right to share what they want and the right to access all information that people want to share with them.

Finally, as more of the economy moves towards higher-quality products that are personalized, we also expect to see the emergence of new services that are social by design to address the large worldwide problems we face in job creation, education and health care. We look forward to doing what we can to help this progress.

Our Mission and Our Business

As I said above, Facebook was not originally founded to be a company. We’ve always cared primarily about our social mission, the services we’re building and the people who use them. This is a different approach for a public company to take, so I want to explain why I think it works.

I started off by writing the first version of Facebook myself because it was something I wanted to exist. Since then, most of the ideas and code that have gone into Facebook have come from the great people we’ve attracted to our team.

Most great people care primarily about building and being a part of great things, but they also want to make money. Through the process of building a team – and also building a developer community, advertising market and investor base – I’ve developed a deep appreciation for how building a strong company with a strong economic engine and strong growth can be the best way to align many people to solve important problems.

Simply put: we don’t build services to make money; we make money to build better services.

And we think this is a good way to build something. These days I think more and more people want to use services from companies that believe in something beyond simply maximizing profits.

By focusing on our mission and building great services, we believe we will create the most value for our shareholders and partners over the long term – and this in turn will enable us to keep attracting the best people and building more great services. We don’t wake up in the morning with the primary goal of making money, but we understand that the best way to achieve our mission is to build a strong and valuable company.

This is how we think about our IPO as well. We’re going public for our employees and our investors. We made a commitment to them when we gave them equity that we’d work hard to make it worth a lot and make it liquid, and this IPO is fulfilling our commitment. As we become a public company, we’re making a similar commitment to our new investors and we will work just as hard to fulfill it.

Over the years, Facebook has made a lot of investors very happy both…during their private days and – apart from a post-IPO blip since their IPO

The Hacker Way