Understanding the intricacies of Schedule K-1 is crucial for founders and business owners navigating the tax landscape. Schedule K-1, an IRS tax form, plays a pivotal role in the financial and tax reporting for entities such as partnerships, S corporations, and trusts. Its primary function is to report each partner's share of income, deductions, and credits, allowing these amounts to be taxed at the individual level rather than at the corporate rate. This mechanism is a cornerstone of the "pass-through" taxation model, which is fundamental to entities that distribute earnings directly to their members.

Getting to Know Schedule K-1

The Schedule K-1 plays a crucial role in aligning the financial outcomes of entities like partnerships, S corporations, and trusts with the tax obligations of their individual members or beneficiaries. This alignment is pivotal, ensuring that income, deductions, and credits are reported transparently and accurately, directly impacting the tax filings of individuals involved in these business structures.

What is a K-1 Form?

The Schedule K-1 form is an essential tool used by the IRS to manage the complex "pass-through" taxation process, where the tax liability passes from the entity to the individual. This form reports the share of income, deductions, and credits from entities such as partnerships, S corporations, trusts, and estates to the IRS. Its primary purpose is to ensure that the income earned by these entities is taxed at the individual level, reflecting each member's or beneficiary's share of the entity's financial activities during the tax year. This approach avoids the double taxation typically associated with corporate earnings, ensuring a fair and equitable tax treatment for all parties involved.

Who Needs to Fill It Out?

The requirement to complete and file a Schedule K-1 extends to a diverse group of taxpayers. Partners in partnerships, shareholders in S corporations, and beneficiaries of trusts and estates must report their share of the entity's income, deductions, and credits through this form. This broad applicability underscores the form's importance in tax filing, ensuring that individuals accurately report their income from various sources and comply with federal tax laws.

Related resource: A User-Friendly Guide to Startup Accounting

Difference Between W-2s and K-1s

Understanding the distinctions between Schedule K-1 and W-2 forms is crucial for accurately navigating tax responsibilities. While employers issue W-2 forms to report wages, salaries, and other compensation paid to employees, Schedule K-1s serve a different purpose. K-1 forms report the income, losses, and dividends distributed by partnerships, S corporations, and other entities to their partners or shareholders. This fundamental difference highlights the diverse nature of income sources and the importance of correctly reporting them to the IRS. The K-1 form ensures that income from pass-through entities is taxed appropriately at the individual level. At the same time, W-2s cater to direct employment income, each playing a unique role in the broader tax reporting ecosystem.

Types of K-1 Forms by Business Structure

Navigating the tax implications of business earnings requires understanding the different Schedule K-1 forms applicable to various entity structures. Each type of entity—partnerships, S corporations, trusts, estates, and foreign alliances—uses a specific version of Schedule K-1 to report the income, deductions, and credits attributable to its members, shareholders, or beneficiaries. This differentiation ensures that each entity complies with tax regulations while providing accurate information for individual tax filings.

K-1 Forms for Partnerships

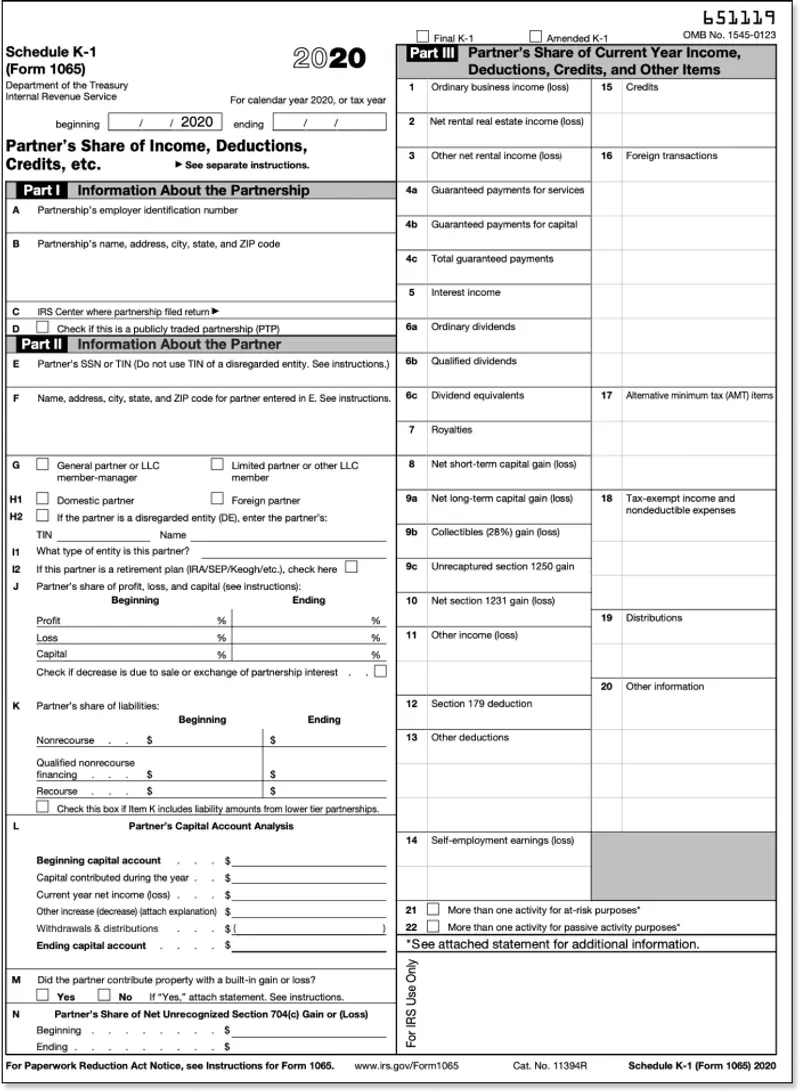

The Schedule K-1 form (Form 1065) is vital for partnerships. It details each partner's share of the business's income, deductions, and credits, allowing this information to be reported on individual tax returns. Partnerships, including general partnerships (GP), limited partnerships (LP), and limited liability partnerships (LLP), utilize this form to distribute the financial outcomes of the business operations to the partners, reflecting their respective shares according to the partnership agreement or the proportion of their investment.

K-1 Forms for S Corporations

S corporations use Schedule K-1 (Form 1120-S) to report each shareholder's proportionate share of the corporation's income, deductions, and credits. This form facilitates the pass-through taxation feature of S corporations, where the income flows through to the shareholder's tax returns. It's essential for ensuring that shareholders accurately report their income from the corporation, maintaining compliance with tax laws while avoiding double taxation of corporate earnings.

K-1 Forms for Trusts and Estates

Trusts and estates report income, deductions, and credits to their beneficiaries using Schedule K-1 (Form 1041). This form is crucial for managing income distribution from these entities, allowing beneficiaries to include this information in their tax filings. Using Schedule K-1 by trusts and estates ensures that the income is taxed at the beneficiary level, providing a precise tax reporting and compliancemechanism.

K-1 Forms for Foreign Partnerships

The Schedule K-1 forms issued to U.S. partners regarding foreign partnerships include additional requirements and considerations. These K-1 forms must account for income earned in other countries, and U.S. partners must report this foreign income on their tax returns. The complexity of tax treaties and international tax laws necessitates careful attention to accurately report foreign income and claim applicable tax credits or deductions. This ensures U.S. partners comply with U.S. tax obligations and the tax regulations of the foreign country where the income was earned.

Things to Consider While Filling Your K-1

Filling out your Schedule K-1 is more than transferring numbers from business documents to a tax form. This process involves nuanced considerations and complexities that can significantly affect your tax responsibilities and financial planning. It's crucial to approach this task thoroughly and understand the underlying principles and implications to ensure accuracy and compliance with tax laws.

Partnership Agreements

Partnership agreements are vital in reporting income, losses, and other items on Schedule K-1. These agreements outline the distribution of profits and losses among partners and can significantly impact the figures reported on each partner's K-1. Different contracts may allocate income and losses based on various factors, such as the percentage of ownership, invested capital, or other agreed-upon terms. This allocation directly influences each partner's tax obligations, highlighting the importance of accurately reflecting the partnership agreement terms on Schedule K-1.

Basis Calculation

The concept of basis calculation is central to understanding your financial stake in an entity and its implications on your taxes. Your basis in the partnership, S corporation, or trust represents your investment in the entity for tax purposes. It's crucial to determine the taxable portion of distributions you receive and calculate gain or loss on the sale of your interest in the entity. The basis starts with your initial investment and is adjusted annually by factors including your share of the entity's income, losses, and distributions. Understanding and accurately calculating your basis ensures you report the correct income or loss on your tax return, avoiding potential tax issues.

Reporting Income

Accurate income reporting on Schedule K-1 is essential for compliance with tax laws and minimizing your tax liability. Incorrect reporting can lead to audits, penalties, and interest on unpaid taxes. It's imperative to carefully review the K-1 form to ensure that income, deductions, and credits are correctly reported according to the entity's financial statements and tax returns. Any discrepancies should be resolved before filing to avoid potential issues with the IRS. Accurate reporting is crucial for preventing penalties and ensuring that you pay the correct amount of tax, neither overpaying nor underpaying.

How to File Your Schedule K-1

Filing your Schedule K-1 is essential in complying with tax regulations for individuals involved in partnerships, S corporations, trusts, and estates. Understanding the process and ensuring the inclusion of all necessary information is critical to a smooth and accurate filing experience.

What Information Should You Include?

When completing your Schedule K-1, there are several critical pieces of information you need to ensure completeness and accuracy in your filing:

- Entity Information: This includes the name, address, and EIN (Employer Identification Number) of the partnership, S corporation, trust, or estate. This identifies the entity with the IRS and ties your tax situation to the correct business entity.

- Partner or Shareholder Information: Your name, address, SSN (Social Security Number), or ITIN (Individual Taxpayer Identification Number) must be accurately reported. This information links you to the entity and ensures that your share of income, deductions, and credits is correctly reported to the IRS.

- Tax Year: Indicate the tax year for which the Schedule K-1 is being filed. This specifies the period for which the reported figures apply.

- Share of Income, Deductions, and Credits: Detail your specific share of the entity's income, deductions, and credits. This section is the core of the Schedule K-1, outlining what needs to be reported on your tax return. It includes various types of income, such as rental income, interest, dividends, capital gains, and deductions and credits you're entitled to claim.

- Capital Account Analysis: If applicable, include changes in your capital account for the year. This involves reporting contributions, withdrawals, and any changes in the ownership percentage.

- Additional Information: Some K-1 forms may require further information, such as details on foreign transactions, alternative minimum tax items, or other specific adjustments. This is particularly relevant for entities involved in complex transactions or those with international aspects.

Accuracy in reporting these details is paramount. The information provided on Schedule K-1 directly affects your individual income tax return and your overall tax liability. Errors or omissions can lead to audits or penalties from the IRS, making it crucial to double-check all entries and consult with a tax professional if you have any uncertainties.

Schedule K-1 FAQs

Navigating the complexities of Schedule K-1 can prompt many questions, primarily as taxpayers work to comply with IRS regulations and optimize their tax outcomes. Below, we address some of the most common queries related to Schedule K-1, aiming to shed light on its intricacies and help taxpayers understand their responsibilities.

K-2 vs. K-3: What's the Difference?

The distinction between Schedule K-2 and K-3 is primarily about the type of information they report, catering to the IRS's requirements for international tax dealings. Schedule K-2 is used by the entity (partnership, S corporation, trust, or estate) to report items of international tax relevance at the entity level. Meanwhile, Schedule K-3 is provided to the partners, shareholders, or beneficiaries, indicating their share of the global items reported on Schedule K-2. K-2 is for the entity's records, and K-3 is for the individual's tax return, ensuring compliance with international tax obligations.

Related resource: What Is Form 3921, and How Does It Affect Your Employees?

When Are K-1 Forms Due?

The deadline for issuing Schedule K-1 forms varies depending on the entity type. For partnerships and S corporations, the K-1 forms should be issued by March 15th or the 15th day of the third month following the end of the fiscal year if the entity operates on a fiscal year basis. Trusts and estates have until April 15th, or the 15th day of the fourth month after the end of their fiscal year, to issue K-1 forms. These deadlines ensure recipients have sufficient time to include this information in their tax filings.

Is K-1 Considered Income?

Yes, the income reported on Schedule K-1 is considered taxable income for the recipient and must be included on their income tax return. This income can affect the taxpayer's overall tax liability, potentially altering their tax bracket and influencing the total taxes owed. It's essential to accurately report K-1 income to avoid underpayment penalties and calculate the correct tax liability.

When Should I Get My K-1?

Recipients should typically receive their Schedule K-1 by the abovementioned deadlines: March 15th for partnerships and S corporations and April 15th for trusts and estates. If you haven't received your K-1 by these dates, contacting the entity is advisable to inquire about the delay. Delays in receiving your K-1 can impact your ability to file your tax return on time, so proactive communication is key. If necessary, consider filing for an extension on your tax return to accommodate the late arrival of the K-1.

Find the Right Investors for Your Startup

Navigating the complexities of Schedule K-1 and understanding its implications is crucial for startup founders looking to maintain compliance and optimize their tax positions. Securing the right investors becomes equally important as you steer your startup towards growth. Leveraging platforms like Visible can streamline this journey, find investors, track a fundraiser, and share a pitch deck directly from Visible. Give Visible a free try for 14 days here.

Related resource: EBITDA vs Revenue: Understanding the Difference