Collecting updates from portfolio companies on a regular basis is an important part of running smooth operations at a VC firm. Well-organized, accurate, up-to-date portfolio data helps investors provide better support, make data-informed investment decisions, and share more engaging insights with LPs.

However, collecting data from portfolio companies can also be a time-consuming and frustrating process if you’re not implementing best practices.

On Thursday, March 28th, Visible hosted a product webinar covering tips for streamlining the portfolio data collection process for VCs.

This webinar recording is not made publicly available. Reach out to our team to learn more about Visible.

Webinar Poll Results

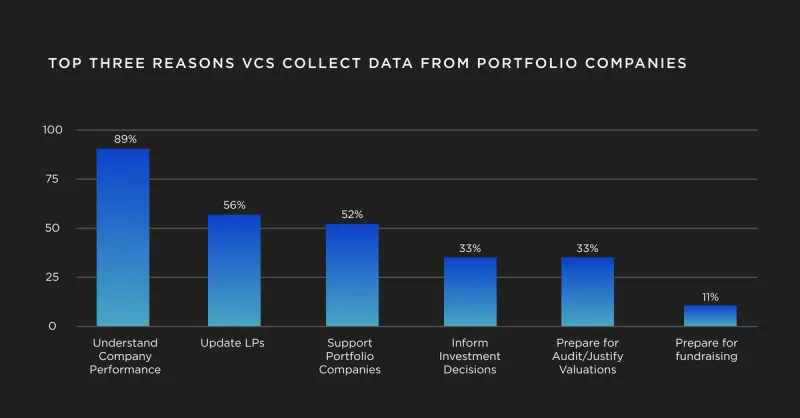

Here are the results from the poll conducted during the webinar. The top three reasons VCs collect data from companies are:

- Understand company performance in general

- Send updates to current LPs

- Provide better support to portfolio companies

Topics Discussed

- Why VCs collect data from portfolio companies (poll)

- Top 5 most common metrics to track

- Founder-friendly data collection

- What other investors are doing

- How to set your firm up for data collection success

- Advice from Visible customers

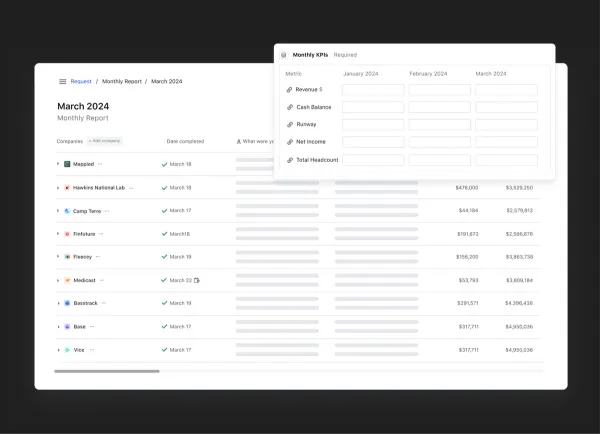

- Demo of recent product updates

- Time for questions

This webinar recording is not publicly available. Reach out to our team to learn more about VC portfolio data collection best practices.

Related Resources