Virtual Deal Room

Discover the Power of Visible for Founders

Trusted by Thousands of Founders

Virtual Deal Rooms for VC-Backed Startups

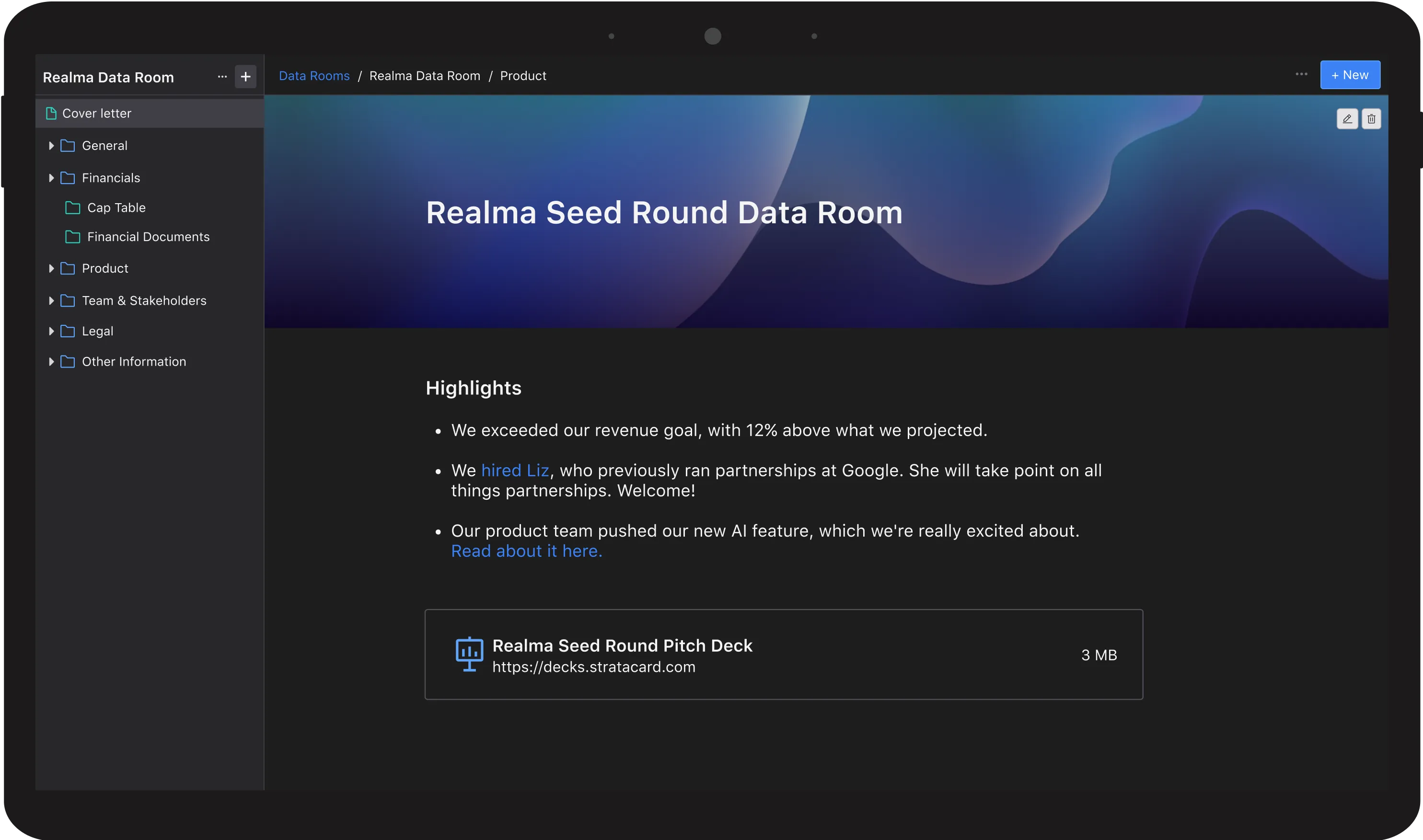

A virtual deal room (VDR) is a secure online space where startups can store, manage, and share critical business documents with investors, potential buyers, or other stakeholders. Interchangeable with data rooms for due diligence, a virtual deal room is optimized for ongoing investor relations, fundraising, and deal management. Many founders search for the best data room for startups to ensure they have the right platform in place before beginning their fundraising journey.

A virtual deal room supports continuous investor communication. Virtual deal rooms provide easy access and collaboration for founders and investors, making it simple to share and manage documents securely. Additionally, a virtual deal room for startups includes tools tailored to fundraising, such as pitch deck storage, investor tracking, and due diligence management. Many investors use a data room for investors checklist to ensure they are reviewing all necessary documents when conducting due diligence.

Why VC-Backed Startups Need a Virtual Deal Room

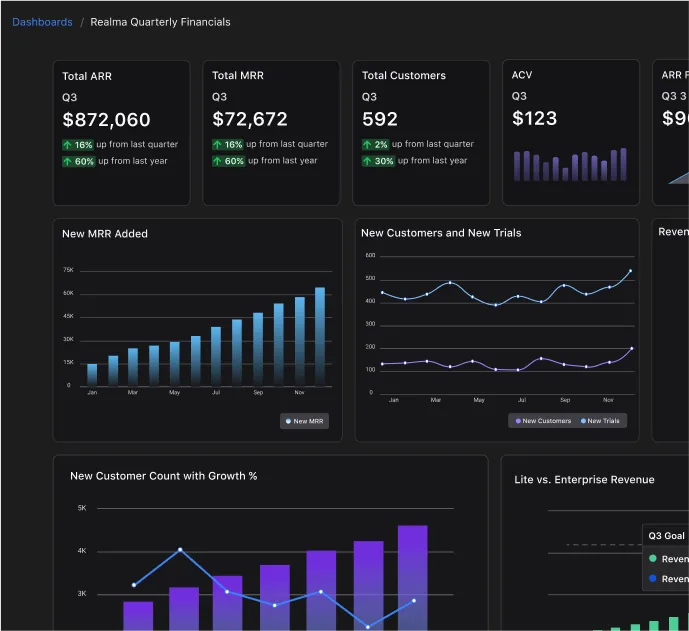

Founders managing venture capital funding must keep investor materials well-organized and accessible. A virtual deal room for startups streamlines this process by centralizing key documents, improving security, and accelerating due diligence. The benefits of using a virtual deal room include enhanced investor transparency, as it allows startups to keep investors updated with organized reports and growth metrics. It also speeds up fundraising by ensuring a data room for investors is ready to share when needed. Additionally, virtual deal rooms provide strong security and compliance features to protect sensitive startup information through encrypted file sharing.

For founders preparing a Series A data room checklist, having a virtual deal room free trial can be a great way to test the software before making a commitment. Some platforms also offer free data rooms for startups, though these may have limited storage and fewer security features.

What Documents Should Be in Your Virtual Deal Room?

A well-prepared virtual deal room should include essential documents such as the pitch deck, financial statements, cap table, and a Series A Data Room Checklist. Legal documents, customer metrics, and growth reports are also crucial for investors evaluating a startup's potential. Having a structured startup data room checklist ensures that investors can quickly find the information they need, making your startup more attractive and investable.

Key Features to Look for in a Virtual Deal Room

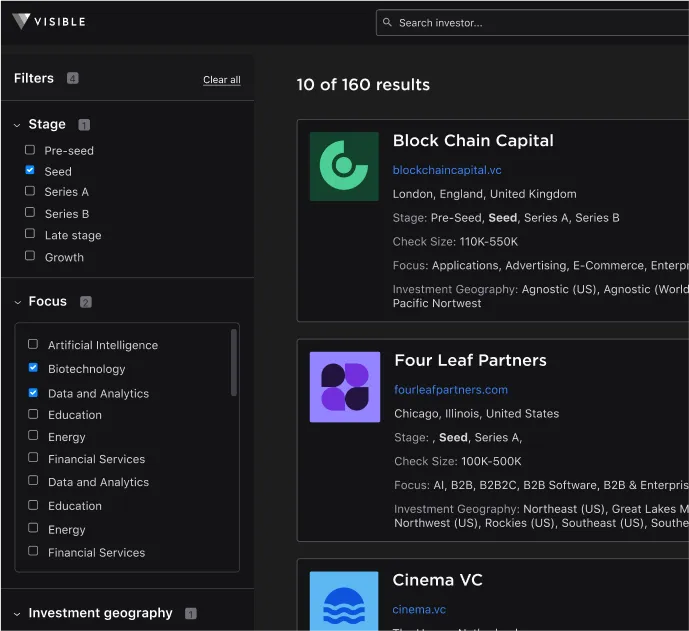

When evaluating the best virtual data room providers, startups should look for features that cater specifically to their needs. Security and compliance should be a top priority, ensuring encrypted access and permission controls. The platform should also have a user-friendly interface so both founders and investors can navigate with ease. Collaboration tools are essential, allowing investors to comment, request files, and track progress. Pricing flexibility is another key factor, as some of the cheapest data room options may lack essential features, making it necessary to compare virtual data room pricing per month before making a decision.

Pricing can vary widely depending on the provider. Some startups opt for a free virtual deal room or free virtual data room providers, while others invest in premium platforms that offer better security and integrations. A virtual data room price comparison can help founders determine the best option for their budget. Additionally, for those looking at long-term solutions, considering best virtual data room providers for M&A may be useful as their business scales.

Free & Affordable Virtual Deal Room Options for Startups

Startups often look for a free virtual data room or budget-friendly alternatives. While some free virtual deal room options exist, they may have limitations in security, storage, or collaboration. Pricing models vary, with some of the best virtual data room providers for small businesses offering cost-effective solutions that include essential features. Some free virtual data room providers provide limited storage, which may be a good starting point. Additionally, an open-source virtual data room allows for customization but often requires technical setup.

For those seeking a virtual deal room free trial, many providers offer temporary access to their platforms so that startups can test features before committing. Additionally, some solutions market themselves as virtual deal room apps, providing mobile-friendly access to fundraising documents on the go.

Virtual Deal Room Setup: A Step-by-Step Guide for Founders

1. Choose the Right Virtual Deal Room Provider

Research and compare virtual data room providers based on pricing, security, and features to ensure the best fit for your startup. Consider whether an M&A data room provider or a virtual deal room app review could help you evaluate your options.

2. Organize Your Documents

Use a startup data room checklist to gather and categorize key materials, ensuring that all critical files are easily accessible and well-structured.

3. Set Access Permissions

Proper access control is crucial. Ensure that investors and key stakeholders have the appropriate levels of access to maintain security and confidentiality.

4. Keep It Updated

A virtual deal room is a dynamic space that should be regularly updated with the latest financial reports, legal agreements, and growth metrics to keep investors informed. Founders can also explore a Google data room or other integrations to streamline access and organization.

Common Mistakes Startups Make When Using a Virtual Deal Room

One of the most common mistakes is poor document organization. Without a structured approach, finding and sharing key files becomes difficult. Using a data room for investors checklist can help structure files logically. Another common issue is ignoring security measures. Failing to set strict permissions or monitor access logs can lead to unauthorized data breaches. Additionally, some startups delay updating their virtual deal room, leaving investors with outdated financial reports, legal agreements, and cap tables. Keeping all materials current ensures a smooth due diligence process.

Startups also sometimes overlook the pricing aspect. Many founders focus on finding the best data room for startups free, but fail to consider the long-term implications of limited storage and functionality. A virtual deal room app free might work for early-stage companies, but growing businesses often require more robust platforms.

The Best Virtual Deal Room for Your Startup

A well-structured virtual deal room is a game-changer for VC-backed startups, streamlining investor relations and fundraising efforts. Whether you're looking for the best data room for startups, exploring virtual deal room free trials, or seeking a virtual data room price comparison, prioritizing security, ease of use, and investor-friendly features will ensure a seamless experience. Setting up your virtual deal room today ensures you're prepared for future funding rounds, M&A opportunities, and long-term success.

For founders looking for additional resources, exploring virtual deal room VDR reviews and analyzing the best virtual data room providers for M&A can help make an informed decision. A virtual deal room app review can also provide insight into which solutions offer the best user experience for both startups and investors.