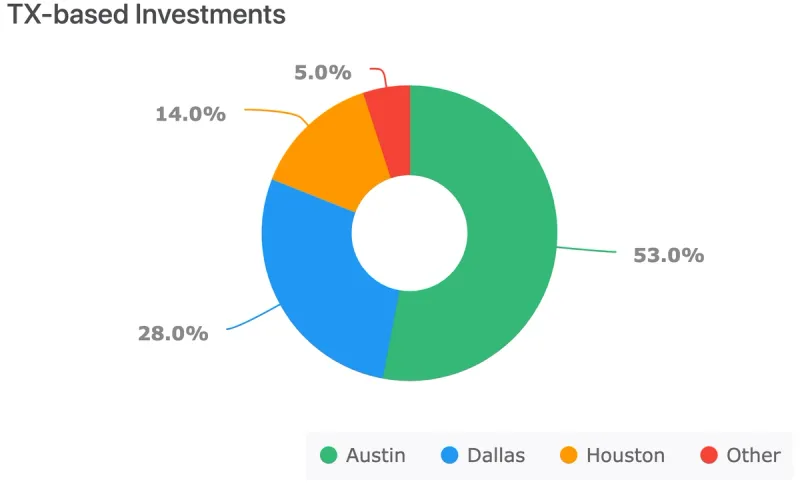

San Francisco and NYC hold the largest amount and value of venture investing across the US. However, with a plethora of urban areas, Texas is continuing to offer venture funding at a rapid pace. We will evaluate various VCs who are involved throughout Austin, Dallas, Houston, and San Antonio.

To keep an eye on Texas-based investments we wanted to share which venture capitalists are geologically active.Visible Connect is our investor database. Connect allows founders to find active investors using the fields we have found most valuable, including:

- Check size — minimum, max, and sweet spot

- Investment Geography — where a firm generally invests

- Board Seat — Determines the chances that an investment firm will take a board of directors seat in your startup/company.

- Traction Metrics — Show what metrics the Investing firm looks for when deciding whether or not to invest in the given startup/company.

- Verified — Shows whether or not the Investment Firm information was entered first-handed by a member of the firm or confirmed the data.

- And more!

Using Visible Connect, we’ve identified the following investors, segmented by Austin, Dallas, Houston, and San Antonio. Search through these investors and 11,000+ more on Visible’s Connect platform.

S3 Ventures

With over 14 years of investing experience, S3 targets startups with a focus on Business Technology, Consumer Digital Experiences, and Healthcare Technology. S3 has branded themselves as “The Largest Venture Capital Firm Focused on Texas.” Led by Brian Smith, S3 invests between $250k – $10M.

To learn more about S3 Ventures, check out their Visible Connect profile.

Santé Ventures

Santé invests at the intersection of health care and technology. Douglas French, Joe Cunningham, and Kevin Lalande are the three founding, managing directors of the Austin-based firm. Santé often leads entry-level rounds and is on the mission to improve people’s lives with every investment.

To learn more about Santé Ventures check out their Visible Connect profile.

ATX Venture Partners

ATX looks to invest in post-revenue companies with initial investments ranging from $300k – $3M. With a focus on the central-south US, ATX has always had a people-centric view and looks to drive performance through each of their investments. Brad Bentz, Danielle Weiss Allen and Chris Shonk lead the firm as Co-Founders and Partners.

To learn more about ATX Venture Partners check out their Visible Connect profile.

LiveOak Venture Partners

LiveOak is a premier seed and series A investor that looks to invest into teams. They focus primarily on tech-enabled businesses based in the Texas area. With over 15 years of VC experience, LiveOak has invested over $200M into Texan companies. Initial heck sizes range between $500k and $5M.

To learn more about LiveOak Venture Partners check out their Visible Connect profile.

Next Coast Ventures

Next Coast is a forward-thinking VC with over 30 investments. They follow investment themes relating to software, future of retail, communities, future of work, marketplaces, and self-care. They also run a blog with resources for founders and insight into their VC’s direction.

To learn more about Next Coast Ventures check out their Visible Connect profile.

NEXT VENTŪRES

NEXT VENTŪRES invests in the sports, fitness, nutrition, and wellness markets. Managed by Lance Armstrong, Lionel Conacher, and Melanie Strong, NEXT has a focus on passion and energy. NEXT is open to investments all over the world and offers check sizes between $500k and $3M.

To learn more about NEXT VENTŪRES check out their Visible Connect profile.

RevTech Ventures

RevTech is all about investing in the future of retail. RevTech looks to lead or follow onto deals at the pre-seed and seed level. Initial checks are around $100k and follow on capital ranges anywhere from $200k to $4M. David Matthews is the Managing Director.

To learn more about RevTech Ventures check out their Visible Connect profile.

Goldcrest Capital

Led by Adam Ross and Daniel Friedland, Goldcrest invests into private tech companies. They have logged over 20 investments and typically write checks between $1M and $10M.

To learn more about Goldcrest Capital check out their Visible Connect profile.

Perot Jain

Perot Jain has a focus on US-based companies that are tech-enabled. They offer up to $500k in initial checks to B2B businesses throughout seed and early-stage investments. The investment firm is led by Ross Perot Jr and Anurag Jain. Perot Jain ultimately partners with bold and innovative entrepreneurs.

To learn more about Perot Jain check out their Visible Connect profile.

Work America Capital

Work America Capital invests in Houstonians and Houston-based businesses by partnering with high-potential, talented leaders with a passion for building a business. Work America invests more than just capital. They look to offer coaching and mentoring to new business leaders. They are managed by Mark Toon and Jeffrey Smith.

To learn more about Work America Capital check out their Visible Connect profile.

Vesalius Ventures

Vesalius Ventures focuses on the intersection of medicine and emerging technology. As they focus on both early and mid-stage companies, Vesalius looks to offer both capital and management help to various health tech companies surrounding Texas.

To learn more about Vesalius Ventures check out their Visible Connect profile.

Active Capital

Active Capital has been investing in B2B SaaS companies for over 20 years. Active looks to participate in pre-seed and seed rounds, as they invest anywhere between $100k to $1M. They have an extensive and successful list of portfolio companies outside of Silicon Valley.

To learn more about Active Capital check out their Visible Connect profile.

Texas Next Capital

Texas Next has long created profitable companies throughout the industries of oil & gas, ranching, agriculture and real estate — which have stood as staples of the state. Their strategy is to invest directly into Texas, partner with Texas leaders/investors, and focus on small businesses.

To learn more about Texas Next Capital check out their Visible Connect profile.

To view Texas-based VCs and over 11,000 other global VCs, visit Visible Connect!

Connect With Investors in Texas Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Texas' investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.