Exploring the Growing Venture Capital Scene in Japan (in 2024)

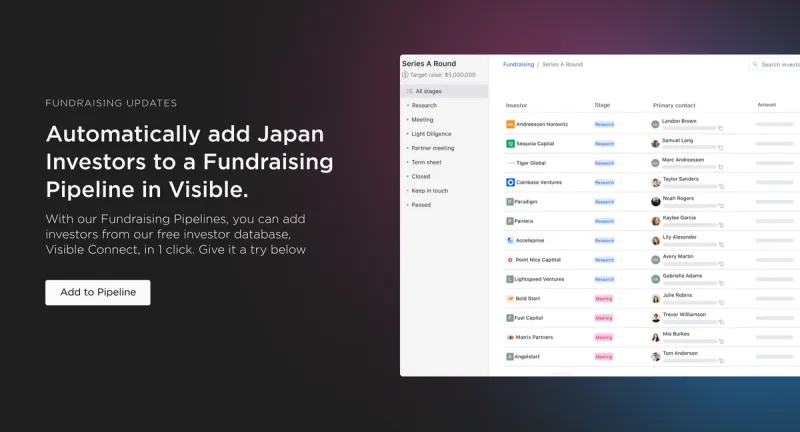

Fundraising is difficult. Building a process and system to attract and close investors can help move a fundraise along. At Visible, we often compare a venture fundraise process to a traditional B2B sales and marketing funnel.

- At the top of a fundraising funnel, you need to find the right investors for your business. Like identifying a qualified lead for sales and marketing, you need to define the investor that is a fit for your business.

- In the middle of the fundraising funnel, you need to nurture potential investors with meetings, emails, pitch decks, and more.

- At the bottom of the fundraising funnel, you are ideally closing new investors and delighting them with regular communication.

Related Resource: A Quick Overview on VC Fund Structure

In order to help you find the best investors for the top of your fundraising funnel, we created an investor database, Visible Connect. If you’re a founder located in Japan, check out our list of investors using Connect below:

1. Genesia Ventures

As put by the team at Genesia Ventures, “It would be no exaggeration to say that the world has entered a new era through digital technologies, and startups have played and are still playing pivotal roles in this game-changing transformation. The large industries and social infrastructure that have thus far led the world are on the brink of new development through the disruptive potential of the digital sphere. Simultaneously, developed regions are establishing new industries through a digital infrastructure that is not dependent on traditional modalities or assets.

Through seed and early-stage investment in startups, we believe we can help achieve a thriving society heralded by digital technology, and we are committed to supporting these startups and accelerating their growth, ushering in a world in which everyone can create wealth and has equal opportunities.”

Learn more about Genesia Ventures by checking out their Visible Connect profile →

Location

Genesia Ventures has offices in Japan, Indonesia, and Vietnam. They invest in companies across Southeast Asia and Japan.

Portfolio Highlights

Some of Genesia Ventures’ most popular investments include:

- Nudge

- Activaid

- Airboxr

Investment Focus

Genesia is focused on seed-stage and early-stage investments.

Related Resource: The Understandable Guide to Startup Funding Stages

2. Global Brain

As put by their team, “Global Brain’s mission is to “bring unimaginable innovation into society through business creation.” Our surrounding environment is significantly changing due to global risks including extremely intense global competition, pandemics, and global warming. We believe that in such a time of uncertainty lies the greatest opportunity.

The power of startups is vital to overcome unprecedented situations. The global economy is now largely led by many companies created right after the financial crisis.”

Learn more about Global Brain by checking out their Visible Connect profile →

Location

Global Brain has an office in Tokyo and 9 other office locations across the globe.

Portfolio Highlights

Some of Global Brain’s most popular investments include:

- Base Food

- August

- Fluently

Investment Focus

Global Brain invests in companies across all stages and all industries.

3. Monozukuri Ventures

As put by their team, “Monozukuri Ventures is a venture capital firm based in Japan and North America specializing in hard tech. In addition to the investment, we have a dedicated team to support hardware prototyping, mass production, and business development. We aim to create a world where entrepreneurs and startups can quickly produce and sell high-quality products, even in small quantities.

Our mission is to help the world’s entrepreneurs rapidly deliver high-quality products to the market, regardless of production volume. As a global ecosystem contributor, we provide founders with essential resources such as investment, mentorship, prototyping know-how, manufacturing expertise and community support.”

Learn more about Monozukuri Ventures by checking out their Visible Connect profile →

Location

Monozukuri Ventures has offices in Japan and North America and invests in companies in Japan and the US.

Portfolio Highlights

Some of Monozukuri Ventures’ most popular investments include:

- Mira

- Sembient

- HiberSense

Investment Focus

Monozukuri Ventures invests across all stages and primarily funds companies building hard tech.

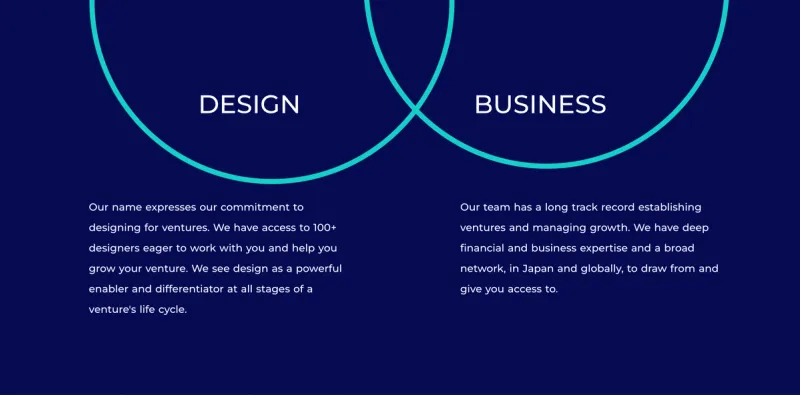

4. D4V (Design for Ventures)

As put by the team at D4V, “We help startups deliver not only financial returns but also positive impact on the world. Our work aims to support and strengthen the culture of entrepreneurship in Japan and beyond, accelerating the growth of a more entrepreneurial economy.”

Learn more about Design For Ventures by checking out their Visible Connect profile →

Location

D4V is located in Tokyo and primarily invests in entrepreneurs and companies located in Japan.

Portfolio Highlights

Some of D4Vs most popular investments include:

- Cinnamon AI

- HOMMA

- Nudge

Investment Focus

D4V is focused on early-stage investments. Some of the markets and verticals that they are focused on include:

- Digital Disruption and Industry Transformation

- New Lifestyles and Cultures

- Financial Tools and Wellbeing

- Lifelong Learning and Empowerment

- Personal and Public Health

5. Benhamou Global Ventures

As put by their team, “BGV is an early-stage venture capital firm focused on global Enterprise 4.0 technology innovation. The partners at BGV drove successive waves of enterprise technology disruption in Silicon Valley and have years of company-building experience.

Founded by Eric Benhamou, former chairman and CEO of 3Com, Palm and co-founder of Bridge Communications, BGV is comprised of global operating executives and investors, and is often the first and most active institutional investor in its portfolio companies.”

Learn more about BGV by checking out their Visible Connect profile →

Location

BGV has offices across the globe and invests in companies across the globe. BGV has an office in Kyoto.

Portfolio Highlights

Some of BGV’s most popular investments include:

- Kardinal

- Everest Labs

- Anch.ai

Investment Focus

BGV is focused on early-stage investments and specializes in “Enterprise 4.0 companies.”

As put by their team, “Enterprise 4.0 refers to a new wave of B2B startups that combine artificial intelligence, intelligent automation and proprietary access to data to deliver actionable insights for enterprise businesses. These disruptive startups provide full stack solutions in the form of hyper-niche vertical solutions, programmable cloud infrastructure or cloud-native security innovations to generate immediate business value and significant ROI improvements for their customers.”

Related Resource: How AI Can Support Startups & Investors + VCs Investing in AI

6. Sozo Ventures

As put by their team, “Sozo Ventures was formed in 2012 to invest in and support technology-enabled ventures with their global expansion. We invest in category leaders transforming global industries with advanced data technologies, ecommerce, enterprise cloud, fintech, IoT and healthcare IT, and other advanced solutions.

We are structured to connect the most ambitious entrepreneurial teams with the world’s most advanced and respected customers and distributors. We are at our best when we can share our expertise well before expansion strategies are set.”

Learn more about Sozo Ventures by checking out their Visible Connect profile →

Location

Sozo Ventures has office locations in Tokyo and Redwood City, CA. Sozo invests in companies across the globe.

Portfolio Highlights

Some of Sozo’s most popular investments include:

- Zoom

- Coinbase

Investment Focus

As put by the team at Sozo, “We look for companies that are at the ‘Readiness’ Stage – a term coined internally that details companies that have a strong management team and culture, stable long-term investors, credible and recognizable customers and traction, and appropriate organizational structures for target international customers. Readiness is achieved by different businesses at different stages – and Sozo is set up to be a long-term flexible supporter of companies that we partner.”

7. Beenext

As put by the team at Beenext, “We don’t just invest in startups, we get ‘invested in them. BEENEXT is a partnership of the founders, by the founders, and for the founders. When a founder partners with us, it partners with the entire BEENEXT community. We provide an opportunity for co-creation, inclusive growth, knowledge-exchange, mentorship and capital support.”

Learn more about Beenext by checking out their Visible Connect profile →

Location

Beenext has an office in Singapore but invests in companies in Japan, Southeast Asia, India, and the US.

Portfolio Highlights

Some of Beenext’s most popular investments include:

- AngelList

- SixSense

- Wellthy

Investment Focus

Beenext invests in companies across the globe and across many sectors and industries.

Looking for Investors? Try Visible Today!

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related Resource: Private Equity vs Venture Capital: Critical Differences