Venture capital (VC) has become an instrumental force in driving innovation and growth across various industries, and healthcare is no exception. Within the article, we’ll cover venture capital within the healthcare sector, its significance, the healthcare investment landscape, the benefits it brings, and the types of healthcare companies that VCs actively invest in.

The Role of Venture Capital in Healthcare

Venture capital serves as a catalyst for progress in the healthcare industry. By providing funding and expertise to early-stage and high-potential companies, VCs help drive innovation, accelerate research and development, and bridge the gap between groundbreaking ideas and commercial success. With their financial resources and industry knowledge, venture capital firms empower healthcare entrepreneurs to transform their visions into tangible solutions that improve patient care, enhance medical outcomes, and reshape the healthcare landscape.

The Healthcare Investment Landscape

VC firms are actively seek opportunities in a wide range of healthcare sectors, including biotechnology, medical devices, healthcare IT, and healthcare services.

Despite a slight slowdown, venture capital funds managed to raise an impressive amount of nearly $22 billion in 2022, making it the second-largest fundraising year on record. The positive momentum continued into Q1 2023, with the fundraising pace accelerating slightly to $6.8 billion. Notably, early-stage investors showed a preference for seed and Series A investments, indicating their confidence in backing promising startups at the initial stages of their growth journey.

As venture capital funds still have a significant amount of capital yet to be deployed in the healthcare sector, it is expected that top companies will continue to attract investor interest. However, this interest is likely to come with investor-driven valuations, as investors seek to balance risk and returns in an increasingly competitive market. The abundance of available capital presents a unique opportunity for healthcare startups to secure the necessary funding to fuel their growth and innovation.

Although the overall investment pace experienced a slowdown in Q1, with investors navigating macro uncertainty and market downturns, they remained focused on supporting their promising later-stage portfolio companies. This support was evident through insider extensions and bridge rounds, allowing companies to bridge the funding gap and continue their growth trajectory.

Looking ahead to the second half of 2023, there is an expectation of an uptick in larger, outsider-led funding rounds. These rounds may see valuations being adjusted to better reflect market conditions, potentially resulting in down rounds or flat “engineered” rounds that include incentives for new investors.

“CVS is betting big on primary care. Here’s a breakdown of its 5 biggest deals of 2023.

CVS is aggressively investing in and acquiring digital health companies while competitors retrench. We dig into the pharmacy giant’s recent primary care moves.” Anand Sanwal, founder of CBInsights, Newsletter

Benefits of Venture Capital in Healthcare

Venture capital firms play a pivotal role in shaping the future of healthcare by providing critical funding, expertise, and strategic guidance.

- Access to Capital

- One of the primary advantages of venture capital in healthcare lies in its ability to bridge the funding gap for early-stage companies. Healthcare ventures often require substantial financial resources to advance research, conduct clinical trials, and navigate complex regulatory landscapes.

- Expertise and Guidance

- Beyond financial support, VC firms bring a wealth of industry knowledge and experience to the table. Seasoned investors offer strategic guidance, mentorship, and operational expertise to healthcare entrepreneurs. Their deep understanding of the sector helps startups refine their business models, overcome regulatory hurdles, and optimize their commercialization strategies. The invaluable insights and advice provided by venture capitalists significantly enhance the chances of success for healthcare ventures.

- Validation and Credibility

- Securing VC funding serves as a powerful validation for healthcare startups. The rigorous due diligence process conducted by venture capitalists not only validates the viability of the company’s products or services but also enhances its credibility in the eyes of other stakeholders. This validation opens doors to additional funding opportunities, attracts potential partners and customers, and positions the company as a trusted player in the industry. The stamp of approval from venture capitalists acts as a strong endorsement, driving confidence in the startup’s vision and mission.

- Network and Partnerships

- Venture capital firms possess extensive networks within the healthcare ecosystem, comprising key players such as healthcare providers, pharmaceutical companies, regulatory bodies, and industry experts. By partnering with venture capitalists, startups gain access to these invaluable networks, which can facilitate collaborations, strategic partnerships, and distribution channels. The connections offered by VCs are instrumental in accelerating market adoption, expanding reach, and tapping into new markets. The network effect of venture capital opens up a world of possibilities for healthcare startups to thrive and make a significant impact.

- Long-Term Support and Sustainability

- Unlike short-term investors or traditional lenders, venture capital firms typically take a long-term view when investing in healthcare companies. They are committed to supporting startups throughout their growth journey, providing follow-on funding rounds as needed. This long-term support ensures the sustainability and continuity of healthcare ventures, enabling them to focus on innovation, research, and achieving long-term objectives. The stability and backing of venture capitalists give healthcare startups the confidence and resources to navigate challenges and pursue ambitious goals.

Types of Healthcare Companies VCs Invest In

Venture capital firms invest in a wide array of healthcare companies, each with its unique value proposition and growth potential. These are some of the top healthcare industries that are attracting VC investment along with some other trending industries as well

Biotech Companies

Biotech companies leverage biological processes and living organisms to develop innovative therapies, diagnostic tools, and research solutions. VCs invest in biotech firms due to the tremendous potential for groundbreaking discoveries, the ability to address unmet medical needs, and the prospects of substantial returns on investment.

Subindustries within Biotech include:

- Gene Editing: Companies developing innovative gene editing technologies like CRISPR-Cas9, enabling precise modification of genetic material for potential therapeutic applications.

- Immuno-oncology: Companies focusing on immunotherapies that enhance the body’s immune system to target and fight cancer cells, including cellular therapies and immune checkpoint inhibitors.

- Precision Medicine: Companies that leverage genomic data and advanced analytics to develop personalized medicine approaches, tailoring treatments to individual patients based on their genetic makeup, biomarkers, and other unique characteristics.

Check out our investor list article, The Top VCs Investing in BioTech.

Medical Device Companies

Medical device companies focus on developing advanced medical technologies and devices that enhance patient care, improve treatment outcomes, and streamline healthcare delivery. These companies often require significant financial backing for research, development, clinical trials, and regulatory approvals. VCs invest in medical device companies to support their growth and innovation in this rapidly evolving sector.

Subindustries within Medical devices include:

- Minimally Invasive Surgical Devices: Companies develop innovative medical devices and instruments for minimally invasive surgeries, offering improved patient outcomes, reduced recovery time, and enhanced surgical precision.

- Digital Health Monitoring Devices: Companies create wearable devices and remote monitoring technologies, enabling continuous tracking of vital signs, remote patient monitoring, and real-time health data analysis.

- Artificial Intelligence (AI) in Medical Imaging: Companies combining AI and medical imaging to improve diagnostic accuracy, automate image analysis, and assist radiologists in interpreting medical images such as X-rays, MRIs, and CT scans are attracting investment.

Healthcare IT Companies

Healthcare IT companies play a vital role in transforming the delivery of healthcare by leveraging technology to address industry challenges and improve overall outcomes. They develop innovative solutions that enhance clinical workflows, optimize administrative tasks, ensure data security and privacy, and facilitate seamless interoperability among various healthcare stakeholders.

They do this through creating software, systems, and platforms that streamline processes, improve patient care, enhance data management, and enable efficient communication within the healthcare ecosystem.

VCs are attracted to companies that bring innovative and disruptive solutions to the industry, leveraging technologies like AI, machine learning, and big data analytics. These solutions have the potential to transform healthcare practices and enhance patient care.

Additionally, companies that focus on cost reduction and operational efficiency by automating tasks and streamlining workflows are interesting to VCs. These companies enable healthcare providers to optimize resources, minimize errors, and achieve cost savings.

VCs also acknowledge the importance of regulatory compliance and data security in the healthcare sector. Companies specializing in robust cybersecurity measures and privacy protection tools are in high demand.

Subindustries within Healthcare IT include:

- Telehealth Platforms: Companies developing telehealth platforms, telemedicine apps, and remote patient monitoring solutions to support virtual consultations, remote diagnostics, and remote care delivery.

- Health Data Analytics: Companies specializing in advanced data analytics and artificial intelligence to derive insights from healthcare data are receiving investments, supporting population health management, personalized medicine, and improved clinical decision-making.

- Cybersecurity and Privacy: Companies focusing on healthcare data security, patient privacy protection, and compliance with regulations such as HIPAA. These companies develop solutions to safeguard electronic health records, secure data sharing, and prevent data breaches.

Healthcare Services Companies

Healthcare services companies encompass a wide range of organizations dedicated to providing essential healthcare services to individuals and communities. These companies, can include hospitals, clinics, nursing homes, home healthcare providers, and diagnostic services.

VCs recognize the increasing demand for healthcare services due to factors such as population aging and rising healthcare needs. Investing in healthcare services companies allows VCs to capitalize on this growing market and generate favorable financial returns.

Moreover, VCs seek out healthcare services companies that bring innovation and differentiation to the industry. Companies that introduce novel care delivery models, leverage technology advancements and enhance patient experiences attract VC investments. By investing in such companies, VCs aim to support the transformation of healthcare services delivery and improve patient outcomes.

Subindustries within Healthcare services companies include:

- Digital Health Platforms: Investment is flowing into companies offering comprehensive digital health platforms, integrating electronic health records (EHRs), patient engagement tools, telehealth capabilities, and data analytics to improve care coordination, patient outcomes, and operational efficiency.

- Home Healthcare Services: Companies providing innovative home healthcare services, including remote monitoring, virtual consultations, and personalized care delivered in the comfort of patients’ homes, are attracting investment.

- Mental Health Services: Investments are being made in companies focusing on digital mental health solutions, such as online therapy platforms, mental health apps, and virtual support networks, to address the increasing demand for accessible and convenient mental healthcare.

6 Venture Capital Firms Investing in Healthcare

Numerous firms are actively investing in healthcare innovation and shaping the future of the industry. Below we’ll explore six notable venture capital firms that have made significant contributions to the healthcare sector. These VCs bring a wealth of experience, expertise, and financial resources to support the growth and success of healthcare startups and companies. Their strategic investments have helped drive advancements in biotechnology, medical devices, healthcare IT, and healthcare services, propelling the industry forward and improving patient care.

1. Felicis Ventures

Felicis Ventures is a boutique VC firm that backs iconic companies reinventing existing markets and creating frontier technologies. At Felicis Ventures we back the world’s iconic companies of today and tomorrow. We have a passion for products and out-of-the-box thinking.

Company Stage: Seed, Series A, Series B, Growth

Location: Menlo Park, California, United States

Portfolio Highlights

- Guild

- Predibase

- Operant

2. New Enterprise Associates

New Enterprise Associates is a global venture capital firm investing in technology and healthcare. NEA’s proven investment strategy spans all stages of a company’s growth, from seeding innovations in emerging markets to funding early-stage companies in high-growth markets to fueling the growth of market leaders. Any stage of growth is the right stage to partner with NEA. We can add value and offer expert guidance throughout your company’s lifecycle—whether your big idea is at its inception or has already progressed to be a viable reality.

Company Stage: Pre-Seed, Seed, Series A, Series B, Series C, Growth

Location: Menlo Park, California, United States

Portfolio Highlights

- PixieBrix

- Regression Games

- Timescale

3. BoxGroup

Investing in dreams at the earliest stage with companies like Plaid, Airtable, Ro, Ramp, and many more.

We support companies based on conviction in the team. We believe in “founder market fit” – the concept that certain teams are able to unlock specific markets. This is the first step to get to “product market fit.” Ideas tend not to be equal opportunity which means that it requires the right team to bring a vision to life.

Company Stage: Pre-Seed, Seed, Series A

Location: New York, United States

Portfolio Highlights

- Plaid

- Airtable

- Ramp

4. SV Health Investors

SV Health Investors, formerly SV Life Sciences, is a leading healthcare and life sciences venture capital and growth equity firm. Their goal is to transform healthcare – one investment at a time – by supporting the entrepreneurs who create and build breakthrough companies and treatments. In biotechnology, we are venture-focused. In healthcare services and digital health, we seek growth equity opportunities. In medical devices, we pursue a range of opportunities from early stage/venture-focused to early commercialization to growth equity.

Company Stage: Pre-Seed, Seed, Series A, Series B, Growth

Location: Boston, Massachusetts, United States

Portfolio Highlights

- Therini Bio

- Nimbus Therapeutics

- Quell Therapeutics

5. Elevate Capital

For some populations, there is a noticeable gap in gaining access to investment capital. These aspiring entrepreneurs are both underserved and overlooked, yet they have the courage and vision it takes to start and scale a business. At Elevate Capital, we believe there is a tremendous opportunity to invest early and offer mentorship to these entrepreneurs. We provide the venture capital and guidance they need to turn their startups into great companies.

Elevate Capital is the nation’s first institutional venture capital fund that specifically targets investments in underserved entrepreneurs—such as women and ethnic minorities, or those with limited access regionally to capital and opportunities. We support visionaries with disruptive ideas and products through two specialized investment vehicles.

Company Stage: Pre-Seed, Seed, Series A

Location: Portland, Oregon, United States

Portfolio Highlights

- TrovaTrip

- The Bacon

- HacWare

6. StandUp Ventures

StandUp Ventures is a Toronto-based, seed-stage venture capital fund focused on investing in high-growth ventures with at least one female founder in a key leadership role. We believe that women-led companies think outside the box, recruit great talent, and serve bigger markets. We invest in seed-stage, for-profit technology companies with at least one woman in a C-level leadership position within the company and an equitable amount of ownership.

We’re dedicated to curious, confident, and fearless entrepreneurs building ground-breaking technology companies. We partner with ambitious founders across Canada to break through from Seed to Series A.

Company Stage: Seed

Location: Toronto, Canada

Portfolio Highlights

- ODAIA

- Acerta Analytics

- TealBook

7. Civilization Ventures

Civilization Ventures is a venture capital firm focused on cutting edge innovations in exponential health tech and biology.

Company Stage: Seed, Series A, Series B

Location: San Francisco, California, United States

Portfolio Highlights

- Foresight Diagnostics

- Evonetix

- Infinimmune

Partner With VCs Investing In The Future of Healthcare with Visible

Venture capital has emerged as a powerful catalyst for progress in the healthcare industry. By bridging the funding gap, providing expertise, and fostering innovation, VCs enable healthcare startups to thrive and create transformative solutions.

Funding not only drives financial success but also cultivates a future where patient care is enhanced, medical outcomes are improved, and the boundaries of what is possible in healthcare are continually pushed.

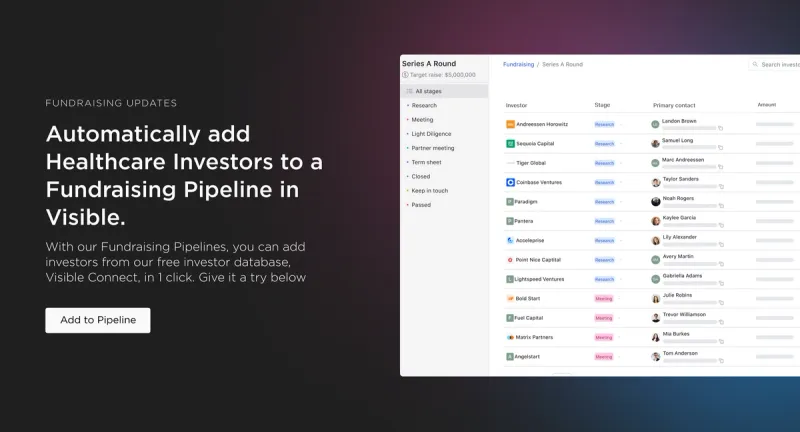

Check out Visible’s investor database, Connect, to find VCs investing specifically within the healthcare space.

Also here are two more of our list articles,

- 10+ Founder Friendly Venture Capital Firms Investing in Startups

- The 12 Best VC Funds You Should Know About

Companies should leverage VCs expertise and resources to accelerate their growth, navigate regulatory challenges, and scale their impact.

Also, get access to Visible for free for 14 days: https://app.visible.vc/create-account