Chicago’s Best Venture Capital Firms: A List of 10+ Firms Investing in 2024

Chicago boasts a rich history as a major industrial hub. As of 2023, it ranked second in the U.S. for the concentration of Fortune 500 companies, with 31 headquartered in the city. This industrial legacy has created a fertile ground for innovation and entrepreneurship, making Chicago an attractive location for startups and established businesses alike.

Benefits of Starting Up in Chicago

Starting a business in Chicago comes with several key advantages:

- Access to Talent: Chicago is a top tech talent hub, attracting professionals from diverse backgrounds. The city's educational institutions produce a steady stream of skilled graduates, and programs like the Illinois Department of Innovation & Technology's trainee program help build a pipeline of tech talent.

- Cost of Living: Compared to other major tech cities like San Francisco and New York, Chicago offers a more affordable cost of living. This allows startups to allocate more resources towards growth and innovation rather than exorbitant living expenses.

- Supportive Community: Chicago has a strong and collaborative startup community. Numerous events, meetups, and organizations like Hyde Park Angels and P33 foster a supportive environment for entrepreneurs. The city is also noted for its efforts to create an equitable business environment, particularly for minority and women founders.

- Robust Infrastructure: Chicago's infrastructure supports business growth with its extensive transportation network, including two major international airports, major highways, and railroads. This connectivity facilitates easy access to national and global markets.

Key Innovation Hubs and Facilities

Chicago's founders benefit from a robust network of startup accelerators and incubators that provide essential support and resources. Notable among these are Techstars Chicago and the Chicago Innovation Exchange, which have been pivotal in nurturing early-stage ventures. Innovation hub 1871 continues to be a cornerstone of Chicago’s tech ecosystem, hosting the AI Innovation Lab in June, which fosters industry innovation and networking opportunities.

Educational and Research Strengths

Chicago's startup growth is significantly driven by its abundance of top-tier universities and research institutions, including Northwestern University, The University of Chicago, and the Illinois Institute of Technology. These institutions supply a steady stream of talent and foster innovation through dedicated programs and funding initiatives. The UChicago Startup Investment Program is a $25 million fund that invests in startups led by UChicago faculty, students, staff, and alumni, thereby fueling the city’s entrepreneurial spirit. Additionally, the City Colleges’ Digital Scholars summer pipeline program connects high school and first-year college students to startup opportunities, further enhancing the ecosystem's talent pipeline.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

Chicago VCs Actively Investing in Startups

At Visible, we often compare a startup fundraising process to a traditional B2B sales and marketing funnel. At the top of your funnel, you are adding qualified investors. Nurturing them in the middle of the funnel with email, meetings, pitches, etc. And ideally closing them as a new investor at the bottom of a funnel.

Just like a sales and marketing funnel, a fundraising funnel needs to start with the right investors for your business (e.g. qualified lead or qualified investor). One of the aspects founders will want to research is the geography of the investor and where they invest.

Check out a few popular venture capital firms located in Chicago below:

1. Hyde Park Venture Partners

According to the team at Hyde Park Venture Partners, “We’re an early-stage venture capital firm focused on high-growth, mid-continent technology startups. We seek companies with an exceptional founding team and fast-growth potential, looking to raise a first or second round of capital. With offices in Chicago and Indianapolis, our team is tenacious, responsive, and committed to adding value to each investment.”

Learn more about Hyde Park Venture Partners and check out their Visible Connect Profile here →

Investment Range

The team at Hyde Park invest in early-stage companies — pre-seed to series A. According to their Visible Connect Profile, the team at Hyde Park Venture Partners generally writes checks anywhere between $250k and $4M.

Industries

Hyde Park Venture Partners primarily invests in SaaS, marketplace, and tech-enabled companies.

Popular Investments

Some of Hyde Park Venture Partners most noteable investments include:

- G2

- Avant

- High Alpha

- Terminus

2. Chicago Ventures

As the team at Chicago Ventures put on their website, “We lead seed rounds before it’s obvious, and serve as active, operationally-involved partners during a company’s earliest days.” The team at Chicago Ventures pinpoints 4 areas where they are best suited to help their portfolio companies:

- Talent: Build your company

- Community: Skill up

- Customers: Identify + connect

- Communication: Tell your story

Learn more about Chicago Ventures and check out their Visible Connect Profile here →

Investment Range

The team at Chicago Ventures has a focus on leading seed rounds. According to their Visible Connect Profile, this can range in checksizes from $500k to $5M.

Industries

The team at Chicago Ventures is agnostic in their industries and look to invest in “overlooked teams.”

Popular Investments

Some of Chicago Ventures most noteable investments include:

- Logicgate

- Project44

- Tock

3. LongJump

According to their website, “LongJump is an investment fund, run by founders and operators. We invest in high potential founders and help them turn their ideas into fast-growing businesses. In addition to capital, we also provide connections and community to our portfolio, helping to connect you with other investors, employees, and advisors.”

The team at LongJump is full of founders and operators which offers portfolio companies the opportunity to lean on their experience and networks.

Learn more about LongJump and check out their Visible Connect Profile here →

Investment Range

The team at LongJump is focused on seed investments (particularly writing the first check in a company). They typically write checks anywhere between $50k and $100k.

Industries

The team at LongJump is agnostic in their investment industries. You can learn more in their thesis below:

“The population of founders in Chicago (and everywhere else, too) should mirror the community around them. But we don’t see that. Instead we see deep bias towards certain people, certain industries, and certain backgrounds — none of which are predictive of success. And we see this opportunity gap widening over time, creating a chasm that prevents many from starting companies and getting them to the next level.

That’s why we’re creating LongJump. To help founders of all backgrounds, all races, all genders, and all socio-economic conditions to get their start. This isn't a charity; this is an opportunity.”

Popular Investments

Some of LongJump’s most noteable investments include:

- Stabl

- STIGMA

- Anjoy

4. Origin Ventures

According to their website, “Origin Ventures is an early-stage venture capital firm investing in software, consumer, and marketplace businesses in the Digital Native economy.”

Learn more about Origin Ventures and check out their Visible Connect Profile here →

Investment Range

According to their Visible Connect Profile, the team at Origin Ventures typically writes checks anywhere between $500k and $5M.

Industries

The team at Origin Ventures has an intense focus on software, marketplace, and consumer apps. You can learn more in their thesis below:

“We believe businesses built for Digital Natives have an outsized growth advantage.

The Digital Native Economy is powered by 140M Millennials and Gen Z between the ages of 10 and 40. They’re the first generations to have a smart phone, pervasive high speed internet, and social media from a young age.

Digital Natives grew up with a cell phone in their hand, and they do things differently than prior generations as a result. We’ve identified themes driven by these behavioral changes and use them to drive our investment strategy.”

Popular Investments

Some of Origin Venture’s most noteable investments include:

- GrubHub

- Cameo

- Tock

5. Energy Foundry

According to their website, “Energy Foundry invests venture capital in today’s most promising energy innovators, and we work with the world’s leading energy companies to build and scale new ventures. Our approach merges venture capital with the perks of partnership, and includes an arsenal of essential tools and relationships to help bring great ideas to market.”

Learn more about Energy Foundry and check out their Visible Connect Profile here →

Investment Range

According to their Visible Connect Profile, the team at Energy Foundry typically writes checks anywhere from $750k to $10M.

Industries

The team at Energy Foundry has a focus on disruptive energy and cleantech startups. You can learn more about their approach below:

“We invest early-stage venture capital in energy start-ups with transformational technologies, an eye towards growth, and ridiculously talented teams.

Technology advancements are disrupting the energy industry and creating new venture opportunities. Those who understand this dynamic landscape can unlock value. That’s why we focus exclusively on energy.

Energy Foundry effectively deploys capital and leverages strategic tools to de-risk investments and accelerate time to market for the most promising ventures.”

Popular Investments

Some of Energy Foundry’s most noteable investments include:

- Azumo

- Bractlet

- e-Zinc

6. Starting Line

According to the team at Starting Line, “Starting Line invests in founders who are willing to take on substantial personal risks, out of fear of living a life of regret. That fear of wondering what life might have looked like if you’d just gone for it.”

Learn more about Starting Line in our interview with Ezra Galston of Staring Line below:

Investment Range

The team at Starting Line directly lays out their investment range below:

“We are a first check venture capital fund, meaning that we aim to anchor true seed rounds with check sizes ranging from $750,000 – $2,000,000 in rounds ranging from $1 – $6M. Our sweet spot within that range is leading $1-1.25M into a $2.5M seed round.

We typically write our largest check in a Company’s first round, though we do retain reserves for all portfolio investments.”

The Starting Line team is extremely transparent and offers countless opportunities to learn about their investment process on their website here.

Industries

As put on their website, “Starting Line is a thematic early stage venture capital fund focused on investing in consumer marketplaces, services and products that are cheaper and better, improve access for the 99% + as well as the software infrastructure that enables it.”

Popular Investments

Some of Starting Line’s most noteable investments include:

- Substack

- Made in

- Spothero

7. Jump Capital

According to the team at Jump Capital, “Jump provides series A and B capital to data-driven tech companies within the FinTech, IT & Data Infrastructure, B2B SaaS and Media sectors. We back entrepreneurs with bold vision seeking a business partner and not just a financial investor.”

Learn more about Jump Capital and check out their Visible Connect Profile here →

Investment Range

The team at Jump Capital typically writes checks somewhere between $1M and $10M. Learn more below:

Industries

The team at Jump Capital is primarily focused on the following industries:

- Fintech

- IT and Data Infrastructure

- Media

- B2B SaaS

Popular Investments

Some of Jump Capital’s most noteable investments include:

- 4C Insights

- Fast Radius

- Lumere

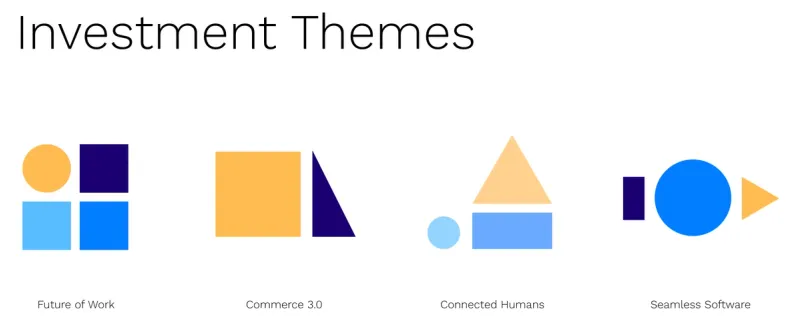

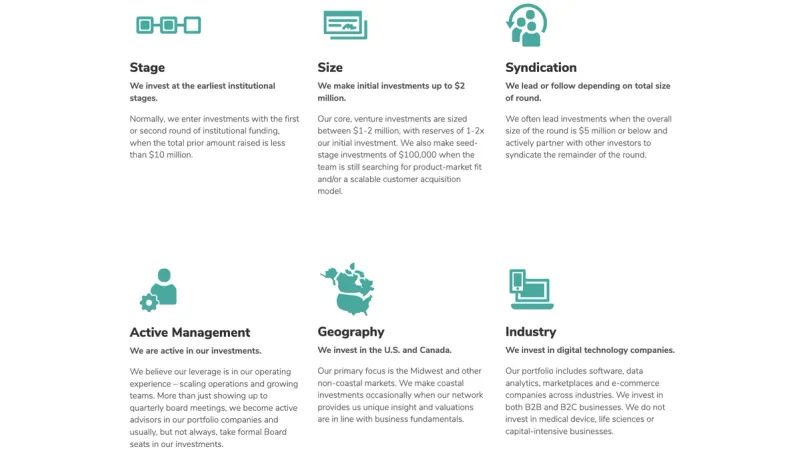

8. MATH Venture Partners

As put by the team at MATH, “We believe companies that have an unfair advantage in customer acquisition will outperform. This advantage is usually inherent in the business model – leveraged sales, channel partners, compliance triggers, network effects, expansion opportunities or some other element creating urgency in the market.”

Learn more about MATH Venture Partners and check out their Visible Connect Profile here →

Investment Range

The team at MATH Venture Partners typically writes checks anywhere between $1M and $2M. You can learn more abou their investment criteria below:

Industries

As put by the team at MATH, “Our portfolio includes software, data analytics, marketplaces and e-commerce companies across industries. We invest in both B2B and B2C businesses. We do not invest in medical device, life sciences or capital-intensive businesses.”

Popular Investments

Some of MATH Venture Partners most noteable investments include:

- 86 Repairs

- Spothero

- Acorns

9. New Stack Ventures

As the team at New Stack said, “At New Stack, we invest in outsiders. Our startups don’t look like what’s commonly funded in Silicon Valley. The standard formula of Stanford educated, Google trained, Bay Area-located is not what we’re looking for. We believe in mission-driven founders with an irrational commitment to their cause –regardless of location or circumstance.”

Learn more about New Stack Ventures and check out their Visible Connect Profile here →

Investment Range

The team at New Stack Ventures typically writes checks between $500k and $1.5M.

Industries

As put on their website, “New Stack invests broadly across sectors and categories with an emphasis on B2B SaaS, Fintech, Supply Chain, Cyber, Proptech, Healthcare, and eCommerce.” New Stack also has themes they look for in their companies below:

- “TRACTABLE: Tools that give non-experts, expert capabilities

- UGV: Platforms that empower users to generate value

- ACCESS TO IDLE SUPPLY: Activating idle capacity

- TROJAN HORSE: Targeted beachhead provides access to broader opportunity

- NETWORK EFFECTS: Value increases as users increase

- BD INNOVATION: Customer acquisition strategy is as novel as the product

- COMPETING W/ NON-CONSUMPTION: Turning non-consumers into consumers

- MOUNTING LOSS: As individual usage increases, switching costs increase”

Popular Investments

Some of New Stack Ventures most noteable investments include:

- Hologram

- Fixer

- WithMe

10. Cultivian Sandbox Ventures

As put by the team at Cultivian Sanbox Ventures, “Cultivian Sandbox is a venture capital firm focused on building next-generation food and agriculture technology companies capable of generating superior returns. As early investors and active board members, we employ a hands-on approach to building companies and are often directly involved in setting company strategy, recruiting key executives, and raising additional capital.”

Investment Range

According to their website, “Cultivian Sandbox makes equity investments of $1-10M and participates in follow-on financings of high-performing companies. We generally focus initial investments on early-stage companies and invest selectively at later stages.”

Industries

Cultivian Sandbox Ventures has a focus on next-generation food and agriculture technology.

Related Resource: VCs Investing In Food & Bev Startups

Popular Investments

Some of Cultivian Sandbox Venture’s most noteable investments include:

- Copper Cow Coffee

- Full Harvest

- Culture

11. CMT Digital

CMT Digital is a venture capital firm engaging in the crypto asset and Blockchain technology industry. The firm focuses on asset trading, blockchain technology investments, and legal and policy. It was founded in 2017 and is based in Chicago, Illinois.

Investment Range:

CMT Digital typically invests in pre-seed companies but they have also been known to invest in mid-stage companies, with investment amounts ranging from $500,000 to $5 million.

Industries:

- SaaS

- Crypto

- Fintech

- Financial Services

- Blockchain

- Software

- Consumer Goods

Popular Investments:

- BlockFi: A leading provider of crypto-backed loans and interest-bearing accounts for cryptocurrency holders, aimed at making crypto assets more accessible and useful.

- Brave: The privacy-focused web browser that rewards users with cryptocurrency for viewing privacy-respecting ads, enhancing online privacy and monetization.

- Synthetix: A decentralized finance protocol that enables the creation of synthetic assets, providing new avenues for trading and investment in digital assets.

12. Sandbox Industries

Sandbox Industries is at the forefront of fostering transformative change in crucial sectors such as healthcare, insurance, and sustainability. The firm is dedicated to creating meaningful impacts on people's lives by challenging and improving existing systems.

What sets Sandbox Industries apart is its hybrid approach to investing, blending traditional and corporate strategies. The firm collaborates closely with industry stakeholders to ensure that their portfolio companies receive strategic guidance and support. By engaging industry leaders as strategic limited partners, Sandbox Industries creates a unique ecosystem that bridges the gap between strategic investors, financial backers, and innovative startups, facilitating a collaborative environment that drives growth and innovation.

Investment Range:

Sandbox Industries typically invests in early to mid-stage companies, with investment amounts varying based on the needs and potential of the startup. While specific investment ranges are not publicly detailed, the firm’s involvement often includes substantial financial backing coupled with strategic support to ensure the growth and success of its portfolio companies.

Industries:

Sandbox Industries focuses on three main sectors:

- Healthcare: Investing in innovative solutions that improve patient outcomes and streamline healthcare delivery.

- Insurance: Supporting startups that bring new technologies and business models to the insurance industry, enhancing efficiency and customer experience.

- Sustainability: Funding companies that develop sustainable technologies and practices, aiming to address environmental challenges and promote long-term ecological health.

Popular Investments:

- GoHealth: A leading health insurance marketplace that simplifies the process of finding and enrolling in health insurance plans.

- Tempus: A technology company focused on collecting and analyzing clinical and molecular data to enhance precision medicine.

- Bloomscape: An online plant retailer that delivers healthy plants directly to customers’ homes, accompanied by expert advice and care tips.

13. M25

Early-stage VC investing in startups headquartered in the Midwest across a wide variety of industries.

Learn more about M25 and check out their Visible Connect Profile here →

Investment Range:

$ 250K - $ 500K with a sweet spot check size of $ 350K

Industries:

- SaaS

- E-commerce

- Consumer and Consumer Goods

- Marketplaces

- B2B and B2C

- Mobile

- Enterprise

Popular Investments:

- Continuum: a ConnectWise company, is the proactive platform for what’s next. With technologies and integrated services spanning security to backup to monitoring, the Continuum platform anticipates and tackles MSPs’ next challenges—enabling them to grow confidently.

- Redi Health: Redi puts more simplified tools in the hands of patients than ever before and creates novel pathways of connectivity to the support and resources patients wouldn’t otherwise have access to.

- Authenticx: Authenticx provides a single source of conversational data for customer insight analytics to inform business decisions.

14. Arch Venture Partners

ARCH Venture Partners invests primarily in companies co-founded with leading scientists and entrepreneurs, concentrating on bringing to market innovations in information technology, life sciences, and physical sciences. ARCH currently manages five funds totaling over $700 million and has invested in the earliest venture capital rounds for more than 90 companies. ARCH investors include major corporations, financial institutions, and private investors.

Investment Range:

$ 50K - $ 150M

Industries:

- Biotechnology

- Health Care

- Life Sciences

- Energy

- Finance

- Consumer Goods

Popular Investments:

- FogPharma: The company is pioneering the discovery, development and commercialization of HeliconTM peptides, a new drug modality that uniquely combines the broad targeting power of monoclonal antibodies with the cell-penetrating ability of small molecules.

- Moonwalk Biosciences: Moonwalk Biosciences operates a genomic medicine company that aims to provide a new class of precision epigenetic medications.

- Accompany Health: Accompany Health provides comprehensive in-home care to patients who live in sometimes underserved regions.

15. Pritzker Group

Pritzker Group, the investment firm founded by Tony and J.B. Pritzker, comprises three professional investment teams: middle-market acquisitions, technology venture capital and asset management. Unlike private equity and venture capital firms with traditional limited partner structures, Pritzker Group’s permanent capital base brings significant advantages, including alignment with management teams, efficient decision-making and flexible transaction structures. The Pritzkers’ history and the firm’s success give their companies access to an unparalleled network of advisors, strategic partners and customers.

Investment Range:

$ 500K - $ 5M

Industries:

- SaaS

- Software

- E-Commerce

- Consumer Goods

Popular Investments:

- Fuel Me: Fuel Me simplifies the fuel procurement process while enabling customers to manage all purchases on a single platform, optimizing operations and administrative procedures while providing extensive cost savings.

- Machinery Partner: We are experts in industrial machinery who help companies that use heavy equipment make more money, by growing their operation.

- CarbonBuilt: CarbonBuilt's Carbon XPrize-winning technology enables the production of ultra low-carbon concrete products, driving gigatonne-scale greenhouse gas reductions through the cost-effective mineralization of carbon dioxide.

Alternative Funding in Chicago

Chicago's local government actively supports startups through various initiatives, grants, and programs.

- Illinois Department of Innovation & Technology (DoIT): This state department offers programs aimed at building a pipeline of tech talent and supporting innovation across the state, including initiatives for underserved communities.

- P33 TechRise: This nonprofit received significant funding to support underserved founders in scaling their startups. The initiative focuses on creating an inclusive business environment and providing resources to minority entrepreneurs.

- Office of Minority Economic Empowerment (OMEE): OMEE works to create equitable business opportunities for Black entrepreneurs and other minority groups, offering various grants and support programs to foster diversity in the startup ecosystem.

Connect With Investors Today

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: The 12 Best VC Funds You Should Know About

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Read: Private Equity vs Venture Capital: Critical Differences