The Canadian venture capital scene continues to thrive, with numerous venture capital firms in Canada actively funding startups across a wide range of industries in 2024. From early-stage investments to growth-stage funding, these Canadian VC firms are crucial partners for founders seeking to scale their businesses. Whether you're a startup founder searching for the right VC in Canada or an investor looking to understand the country's dynamic funding landscape, this list of top venture capital firms in Canada offers a comprehensive overview of the leading players driving innovation and entrepreneurship nationwide.

Related resource: Exploring Canada’s Emerging Tech Hubs: Where Innovation is Thriving

Overview of the Canadian VC Landscape in 2024

The venture capital landscape in Canada continues to evolve, with 2024 shaping up to be another pivotal year for startups and investors alike. Canadian venture capital firms are increasingly focusing on emerging technologies and industries, helping to fuel the growth of the country's vibrant startup ecosystem. Key regions such as Toronto, Vancouver, and Montreal remain the primary hubs for venture capital in Canada, each with unique industry strengths and active investor communities.

In Toronto, Canada's largest city, sectors like fintech, AI, and SaaS lead the charge, attracting significant investment from local and global VCs. Toronto’s robust tech ecosystem has solidified its position as a key player in North America's venture capital landscape.

Meanwhile, Vancouver is gaining recognition for contributing to industries like biotechnology, gaming, and clean technology. With a strong foundation of academic research institutions and a growing pool of tech talent, Vancouver-based startups are securing larger rounds of VC funding, particularly in clean energy and environmental innovation.

Montreal stands out as a leader in AI and deep tech, driven by strong government support and initiatives that foster innovation. Montreal’s thriving AI scene, supported by institutions like Mila (the Quebec Artificial Intelligence Institute), attracts venture capital and top talent from around the world.

Across Canada, biotech, sustainability, and fintech are seeing heightened interest from Canadian VC firms. These sectors align with global trends in healthcare innovation, climate technology, and financial disruption, all of which are receiving significant investment attention.

Government Support and Initiatives

Canada's government has played a crucial role in the growth of its venture capital ecosystem. Initiatives like the Venture Capital Action Plan (VCAP) and the Strategic Innovation Fund have helped unlock billions in VC funding for startups across the country. Programs such as SR&ED (Scientific Research and Experimental Development) tax incentives and Innovative Solutions Canada continue to support research-intensive startups, making Canada an attractive destination for founders and investors.

Due to these factors, the Canadian venture capital ecosystem has seen steady growth in deal volume and funding amounts over the past few years. In 2024, this trend is expected to continue, with Canadian VC firms increasingly participating in larger, later-stage funding rounds, reflecting the maturity of the startup ecosystem in Canada.

Top Venture Capital Firms in Canada

As the Canadian startup ecosystem continues to grow, having access to the right venture capital firms is crucial for founders looking to scale their businesses. Below is a curated list of top Canadian venture capital firms that are actively funding startups in 2024, providing not only capital but also strategic guidance, mentorship, and access to a vast network of industry leaders.

1. BDC Ventures

As put by the team at BDC Ventures, “Our venture capital funds present diverse opportunities for entrepreneurs to innovate in new and existing markets. The breadth of our funds across industries, technologies and company stage is unique in Canada’s venture capital space. Each fund is managed by a dedicated team with decades of experience bringing groundbreaking Canadian companies to the world stage.”

Location

BDC Ventures is focused on growing the venture capital ecosystem in Canada.

Company Stage

BDC Ventures invests in companies from early to late stages.

Preferred industries

The team at BDC Ventures is currently operating 6 funds that invest across multiple industries including:

- Sustainability Venture Fund

- Climate Tech Fund II

- Thrive Venture Fund and Lab for Women

- Deep Tech Venture Fund

- Industrial Innovation Venture Fund

- Growth Venture Co-Investment Fund

Related Resource: 10+ VCs & Accelerators Investing in Underrepresented Founders

Portfolio Highlights

Some of BDC Ventures’ most popular investments include:

- Hopper

- Unsplash

- Shoelace

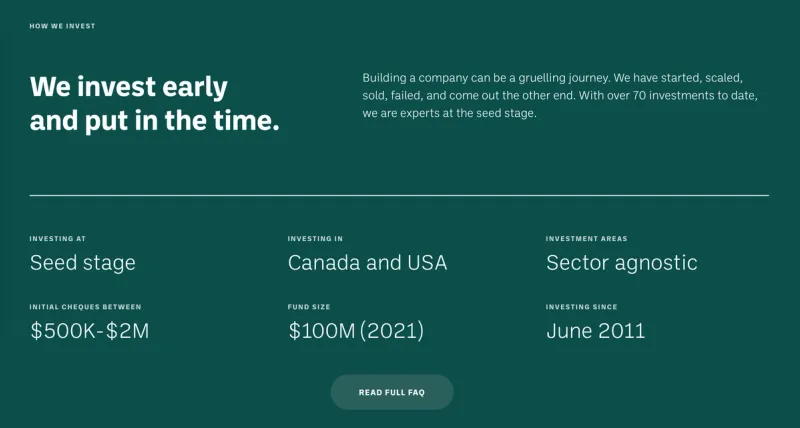

2. Golden Ventures

As put by the team at Golden Ventures, “We have a deep sense of empathy to founders and their craft. We challenge our portfolio and team to build remarkable companies. We are authentic and rational in our decision-making and apply the same honesty to our relationships.”

Location

Golden Ventures is headquartered in Toronto and invest in companies throughout North America.

Company Stage

Golden Ventures is focused on seed-stage companies. As put by their team, “We target initial commitments of $500K – $2M for between 7-15% of a company, and we reserve capital to follow on into companies based on progress.”

Related Resource: Seed Funding for Startups 101: A Complete Guide

Preferred industries

Golden Ventures is industry agnostic in its investment approach.

Portfolio Highlights

Some of Golden Ventures’ most popular investments include:

- ApplyBoard

- Yesware

- Stacked

3. Inovia Capital

As put by their team, “Inovia Capital is a venture capital firm partnering with founders to build impactful and enduring global companies.

With four active venture funds, two growth funds, a continuation fund and an expanding team of investors, operators and advisors, we are fully equipped to support founders with capital, insights and mentorship throughout their journey.”

Location

Inovia Capital is headquartered in Canada and invests in companies across the globe.

Company Stage

Inovia Capital invests in companies across all stages.

Preferred industries

As put by their team, “We focus on B2B and B2C SaaS companies and marketplaces.”

Related Resource: 32 Top VC Investors Actively Funding SaaS Startups

Portfolio Highlights

Some of Inovia’s most popular investments include:

- Bench

- Hopper

- Darwin AI

4. BlueSky Equities

As put by their team, “Bluesky Equities is a privately-owned, absolute-return focused, investment management company.

We are unconstrained in our approach, investing in public and private markets with a focus on alternative assets including venture capital, private equity, hedge funds, and real estate.”

Location

Bluesky Equities is headquartered in Calgary and invest in companies across Canada.

Company Stage

Bluesky Equities is focused on early-stage investments.

Preferred industries

Bluesky Equities is focused on B2B SaaS companies.

Related Resource: 15+ VCs Investing in the Future of Work

Portfolio Highlights

Some of Bluesky Equities’ most popular investments include:

- Ownly

- Active Door

- Spocket

5. ArcTern Ventures

As put by the team at ArcTern Ventures, “Since 2012, we’ve been investing in entrepreneurs obsessed with solving humanity’s greatest challenges—climate change and sustainability. We’re former startup founders ourselves, we get it, and like you, we believe technology can save our planet.”

Location

ArcTern has office locations in Toronto, San Francisco, and Oslo and invests in companies across the globe.

Related Resource: The 11 Best Venture Capitals in San Francisco

Company Stage

Explain the company stage this firm invests in.

Preferred industries

As put by their team, “We invest broadly in technology companies that have a positive impact on climate change and sustainability.” Some specific sectors include:

- Clean Energy

- Energy Efficieny and Storage

- Circular Economy

- Advanced Manufacturing and Materials

- Mobility

- Food Systems

Related Resource: VCs Investing In Food & Bev Startups

Portfolio Highlights

Some of ArcTern’s most popular investments include:

- Palmetto

- Span

- Flashfood

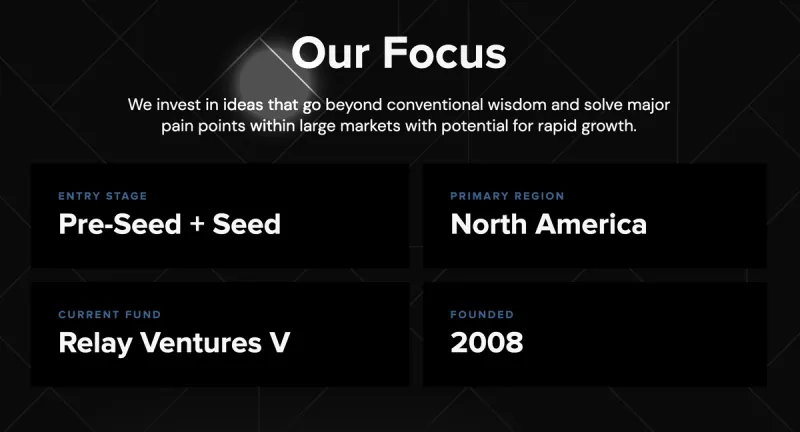

6. Relay Ventures

As put by the team at Relay Ventures, “We don’t fund companies. We fund founders. From the beginning, we have had a simple philosophy. We view founders as partners. We bring capital, networks, and experience, and our founders bring expertise, teams, and dreams. Together we build transformational businesses based on teamwork, trust, and aspiration. Because being a founder depends on it. Our track record speaks for itself.”

Location

Relay Ventures is headquartered in Toronto and invests in companies across North America.

Company Stage

Relay Ventures is focused on seed and pre-seed stage companies.

Preferred industries

Relay Ventures is industry agnostic and focuses on companies operating in large markets.

Portfolio Highlights

Some of Relay Ventures’ most popular investments include:

- Ecobee

- Bird

- Swift

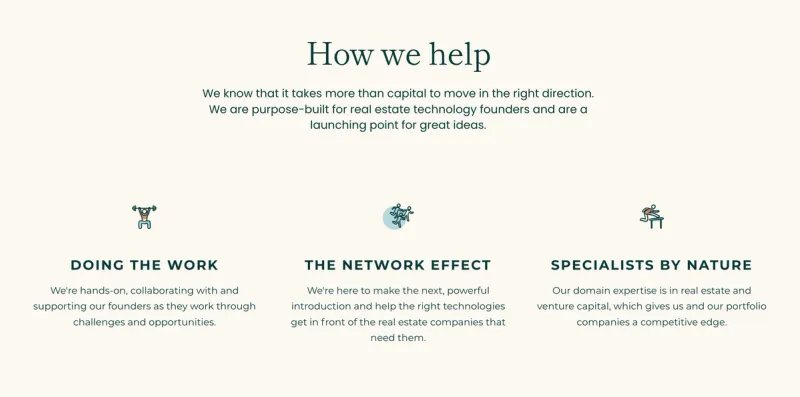

7. Alate Partners

As put by the team at Alate Partners, “We invest in courageous founders and transformational technology that will change the built world for the better. Founded as a partnership between Relay Ventures and Dream, our team has decades of experience in venture capital, operations, and real estate. In addition to providing capital, Alate has unique access to expertise and customers through our network of influential real estate partners, investors, and founders.”

Location

Alate Partners is headquartered in Toronto.

Company Stage

Alate Partners invest in companies around the Seed and Series A stages.

Preferred industries

As put by their team, “We exclusively invest in real estate and construction technology, so you can skip explaining the basics and focus on what matters most. Our knowledge and network are here to accelerate your growth.”

Portfolio Highlights

Some of Alate’s most popular investments include:

- Bird

- Altrio

- PadSplit

8. Real Ventures

As put by their team, “Real Ventures is an early-stage venture firm focused on serving daring entrepreneurs with the ambition to create successful, global companies. Since 2007, Real Ventures has dedicated itself to building the Canadian startup ecosystem on the belief that people, not money, build game-changing companies.

Real Ventures provides stage-specific guidance, mentorship, and access to networks and resources to fast-track founders’ personal and company growth. Real Ventures manages $325 million across five funds and its active portfolio of 100+ companies is currently valued at $10 billion.”

Location

Real Ventures is headquartered in Toronto and has an office in Montreal. They primarily invest in companies in Canada.

Company Stage

Real Ventures is focused on early-stage investments.

Preferred industries

As put by their team, “There is no standard answer, but there are three main things that we look for: a great team with unique insight on a market opening that has massive scaling potential. We like to hear bold ideas that have the potential to disrupt unconventional industries.”

Portfolio Highlights

Some of Real Ventures most popular investments include:

- Mejuri

- Integrate AI

- Unbounce

9. Georgian

As put by the team at Georgian, “We believe that entrepreneurs deserve an experience of growth capital that matches any other best-in-class technology partner. We’re focused on your experience as a growth-stage CEO, using data-driven insights to improve how our team supports you and your team.”

Location

Georgian is headquartered in Toronto and invests in companies across the globe.

Company Stage

Georgian is focused on companies that are generating $500k+ in MRR and are raising between $25M and $75M.

Preferred industries

Georgian is focused on B2B SaaS companies.

Related Resource: FinTech Venture Capital Investors to Know

Portfolio Highlights

Some of Georgian’s most popular investments include:

- Beam

- Shopify

- Ritual

10. Panache Ventures

As put by the team at Panache Ventures, “We invest in the most promising founders — those who are automating, decentralizing, democratizing, and expanding human capabilities.

We want to be the first to invest in your potential, and to support your leadership.”

Location

Panache is headquartered in Montreal and invests in primarily invests in companies in Montreal.

Company Stage

Panache invests in early-stage companies and tries to write the first check into their companies.

Preferred industries

Panache is industry agnostic in their approach.

Related Resource: 10 VC Firms Investing in Web3 Companies

Portfolio Highlights

Some of Panache Ventures most popular investments include:

- Altrio

- Dwelling

- Relay

VC Resources for Canadian Founders

For Canadian startup founders looking to secure venture capital funding, having access to the right resources can significantly improve your chances of success. Beyond venture capital firms, Canada offers a variety of support programs, incubators, and accelerators that provide additional funding, mentorship, and network opportunities. Below is a list of valuable VC resources for Canadian founders that can help guide you through your fundraising journey.

Government Funding Programs

Canada has a range of government-backed funding programs that offer support to startups at various stages. These programs can often serve as a stepping stone to securing venture capital investment.

- Scientific Research and Experimental Development (SR&ED): The SR&ED program offers tax credits and incentives for companies conducting research and development in Canada. This program can be particularly beneficial for tech startups or companies innovating in industries like biotech and AI.

- Venture Capital Action Plan (VCAP): VCAP is a federal government initiative designed to help increase the availability of venture capital for startups in Canada. Through this program, the government co-invests with private-sector VC firms, providing additional capital to Canadian startups.

- Innovative Solutions Canada (ISC): ISC offers funding and contracts to Canadian startups with innovative solutions. This program is focused on helping startups bring their technology to market by partnering with government departments.

These government programs can not only provide direct funding but also serve as validation when approaching Canadian venture capital firms for additional investment.

Startup Incubators in Canada

Startup incubators provide early-stage companies with resources like office space, mentorship, and access to investors. Many successful Canadian startups began their journeys in incubators that helped them refine their products and business models before seeking venture capital.

- MaRS Discovery District (Toronto): MaRS is one of the world’s largest urban innovation hubs, supporting startups in industries such as health, cleantech, fintech, and enterprise software. They offer mentorship, access to capital, and partnership opportunities.

- The DMZ (Toronto): Based out of Ryerson University, The DMZ is one of Canada’s top startup incubators, with a focus on scaling high-potential technology startups. The DMZ provides entrepreneurs with access to a network of investors, mentors, and industry leaders.

- District 3 (Montreal): District 3 is an incubator based in Montreal that helps founders grow their startups from early-stage to venture-backed companies. With a focus on technology and innovation, District 3 provides a combination of mentorship, workshops, and access to capital.

Joining an incubator can give founders a head start by connecting them with VC firms in Canada and offering the support needed to scale their startups.

Accelerator Programs

Accelerators are a great way for Canadian startups to fast-track their growth by receiving funding, mentorship, and resources in a short amount of time. Many Canadian venture capital firms closely follow the startups that come out of these programs, making them an excellent resource for founders seeking investment.

- Creative Destruction Lab (Multiple Locations): CDL is a globally renowned accelerator with locations across Canada, including Toronto, Vancouver, and Montreal. Focused on scalable, science-based startups, CDL provides founders with access to investors, business experts, and academic researchers.

- FounderFuel (Montreal): FounderFuel is a Montreal-based accelerator that offers startups mentorship, networking opportunities, and access to investors. The program culminates in a Demo Day, where founders present to top Canadian VC firms and angel investors.

- Techstars Canada (Toronto and Vancouver): Techstars runs accelerator programs in both Toronto and Vancouver, focusing on high-growth startups. The program provides mentorship, seed funding, and access to a global network of investors and industry experts.

Participating in these accelerator programs can dramatically improve your visibility with Canadian venture capital firms and help you prepare for your next fundraising round.

Top Canadian Venture Capital Trends in 2024

As the startup ecosystem in Canada matures, Canadian venture capital firms are increasingly aligning their investments with global trends and focusing on areas of innovation that promise long-term growth. In 2024, several key trends are emerging as focal points for venture capital in Canada, shaping the future of investment and startup success across the country.

1. Sustainability and Climate Tech

One of the biggest trends in 2024 is the heightened focus on sustainability and climate technology. Canadian venture capital firms are prioritizing investments in startups that address pressing environmental challenges, from clean energy solutions to waste reduction and carbon capture innovations. Firms like ArcTern Ventures and BDC Capital have established funds specifically targeting sustainable startups. This focus aligns with Canada’s broader commitment to reducing greenhouse gas emissions and transitioning to a greener economy.

2. Tech Innovation in AI and Fintech

Canada has emerged as a global hub for AI research and development, with venture capital firms in Canada heavily backing AI-driven startups. Montreal, in particular, has become a center for AI innovation, with firms like Inovia Capital and Real Ventures investing in AI startups that are revolutionizing industries such as healthcare, fintech, and autonomous vehicles.

Similarly, the fintech sector continues to grow, with Toronto leading the charge as one of the top fintech ecosystems in North America. Canadian VCs are actively funding startups that are disrupting traditional financial services, from blockchain and cryptocurrencies to AI-powered financial platforms. Georgian is one of the key players in this space, focusing heavily on fintech innovation and data-driven business models.

3. Female Founders and Diversity-Focused Investments

In recent years, the importance of diversity in the venture capital ecosystem has gained attention, and 2024 is no exception. Canadian venture capital firms increasingly recognize the value of diverse teams and are stepping up efforts to back female founders and underrepresented groups. Funds like BDC’s Thrive Venture Fund and Lab for Women are specifically focused on empowering women-led startups, providing capital, mentorship, and resources to help women founders scale their businesses.

4. Health and Biotech Innovation

The biotech and health tech sectors are seeing sustained interest from Canadian venture capital firms in 2024. With advancements in digital health, medical devices, and biotech research, Canada is positioned as a leader in health innovation. Venture firms like Lumira Ventures are at the forefront of backing companies pioneering new treatments, improving healthcare delivery, and utilizing AI for diagnostics and patient care.

5. Web3 and Blockchain Technologies

Another emerging trend is the rise of Web3 technologies and blockchain startups in Canada. Panache Ventures is one of the leading Canadian venture capital firms investing in this space, funding startups working on decentralized finance (DeFi), digital identity, and new blockchain-based business models. As blockchain technology continues to evolve, Canadian VCs are positioning themselves at the forefront of this global shift.

6. Government Support and Strategic Partnerships

Government initiatives, such as the Venture Capital Action Plan and other funding programs, continue to boost venture capital investment in Canada significantly. Canadian VCs leverage these programs to enhance funds and form strategic partnerships with government-backed initiatives. This collaborative effort has further strengthened the Canadian venture capital ecosystem, allowing firms to offer more capital and resources to startups nationwide.

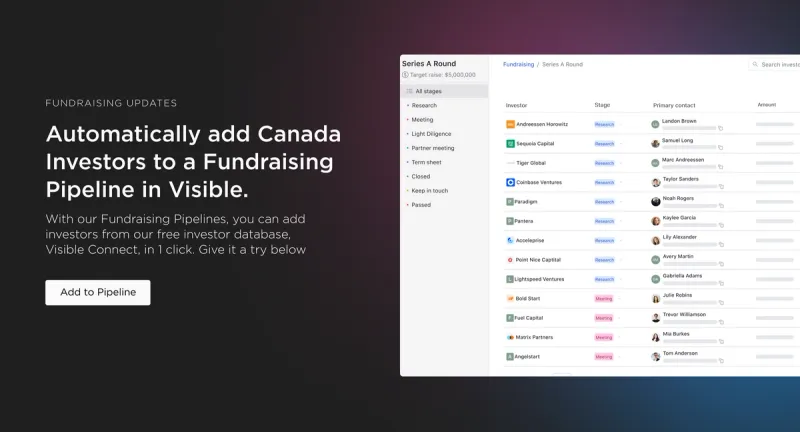

Maximize Your Fundraising Impact With Visible

At Visible, we typically compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you find potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you nurture potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Like sales, a healthy fundraising funnel starts by finding the right investors. This can be based on geography, check size, focus areas, etc.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.