The underrepresented founder’s ecosystem has grown over the past several years but there are still systemic barriers in the industry. One of the most common arguments heard is that diversity hampers quality but the stats don’t support that, as Jeff Karoub explains “For example, women-founded startups, on average, have twice the return of male-founded startups. So, without systemic barriers, more money should be invested in women-founded startups.”.

Another barrier for underrepresented founders has been accessing resources including, personal wealth, education, and network. The more money someone’s family has the more likely they are to go to a prestigious university, be introduced to a network of people that can help further their career goals, and have financial support from their families as they bootstrap their business to start.

If we help support underrepresented founders today we will begin to see a multi-generational wealth impact. This starts with having more diversity within VC’s (black investors make up only 4% of partner-level roles and women are at 5%) as well as creating more networks for underrepresented founders in which they can connect with one another and have access to mentorship and knowledge to help them grow in their journey and gain access to capital.

Related resource: The Femtech Frontier: Opportunities in Women's Health Technology + the VCs Investing

Underrepresented Founders Stats:

- “Global VC funding nearly doubled year-over-year to more than $640 billion in 2021, Crunchbase data shows. Black founders received only around 1.3 percent of total venture funding last year—up from 2020, but still a tiny fraction. On a percentage basis, funding to Latino founders has largely stalled, and for sole female founders, it actually fell last year.” source

- “According to The US Census, the country will be majority/minority by 2045. As demographics change, so does economic influence. Yet fewer than 3% of venture capital partners are Black and in the record-breaking first half of 2021, Black founders received a mere 1.2% of the $147 billion invested in startups.” source

- According to PitchBook, “only 18% of about $240 billion raised by all venture capital-backed companies fund female founders.” Source

- “The current system capitalizes women and minority founders at 80% less than businesses overall. But miraculously, about 80% of investors believe that minority and women business owners get the capital they deserve — spotlighting the disconnect.” source

- “One report found that minority tech startups in the U.S. saw almost no progress in venture capital funding from 2013 to 2020. In a January piece for Crunchbase, Kinsey Wolf, a fractional CMO at Chisos Capital, suggests several potential solutions, including cultivating an ecosystem that supports minority founders and holding traditional funding avenues accountable to diversity, equity and inclusion benchmarks.” source

- “While funding to black entrepreneurs quadrupled over the first half of this year, it still only represented 1.2% of total US venture dollars – and only 0.34% (!!) to black women. Investment in women-owned startups fell over the last year, to just 2.3% of funding. On the investor side, only 4% of investors are black (compared to 14% of the population), only 5% of investors are women, and Latinx venture representation dropped from 5% to 4% over that period.” source

Other Funding Opportunities

- Revenue-based financing with Founders First Capital Partners

- TechCrunch Article: First Capital Partners, a San Diego startup investment firm that uses a non-traditional approach to funding called revenue-based investment to invest in historically underrepresented founders

- AWS launches new $30M accelerator program aimed at minority founders

- Partner organizations include those that work with Black, Latino, LGBTQIA+ and women founders, including Black Women Talk Tech, Digitalundivided, StartOut, Backstage Capital and Lightship Capital.

- The Thiel Fellowship gives $100,000 to young people who want to build new things instead of sitting in a classroom.

- Venture for America: A national nonprofit and two-year Fellowship program that gives recent college graduates firsthand startup experiences that help them become leaders who make meaningful impacts with their careers.

- According to Forbes, “generalist funds like PayPal announced a $500 million fund, part of which was specifically black-led startups. Prudential committed $200 million to DEI in private equity. Funds were also raised with diversity as a core mandate. Female Founders Fund raised $57 million to invest in female founders. Harlem Capital raised $134 million, Collab Capital raised $50 million, Screendoor formed a $50 million fund, Sixty8 Capital closed $20 million. All in all, 134 venture organizations to-date have made commitments to back underrepresented founders (Harlem capital provides a comprehensive breakdown).”

Related resource: 10 Top Incubators for Startups in 2024

Resources

- The AllRaise Airtable of investors. All Raise is on a mission to accelerate the success of female founders and funders to build a more prosperous, equitable future.

- Data from the team at Diversity VC

- The Fundery’s Essential VC Database for Women Entrepreneurs

- This public airtable aggregating investors who invest in underrepresented founders

Investors and Accelerators in the Space:

Precursor Ventures

- Location: San Francisco, California, United States

- About: An early stage venture firm focused on classic seed investing.

- Thesis: We invest in people over product at the earliest stage of the entrepreneurial journey.

- Investment Stages: Seed

- Recent Investments:

- Noula Health

- AnyRoad

- Dispatch Goods

To learn more about Precursor Ventures check out their Visible Connect Profile.

MaC Venture Capital

- Location: Culver City, California, United States

- About: MaC Venture Capital is an early-stage venture capital firm focused on finding ideas, technology, and products that can become infectious.

- Thesis: We invest in technology companies that create infectious products that benefit from shifts in cultural trends and behaviors in an increasingly diverse global marketplace.

- Investment Stages: Seed

- Recent Investments:

- Petra

- Spora Health

- Edge Delta

To learn more about MaC Venture Capital check out their Visible Connect Profile.

Backstage Capital

- Location: Los Angeles, California, United States

- About: We invest in companies led by underestimated founders.

- Thesis: We invests in new companies led by underrepresented founders.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- A Kids Company About

- Hello Alice

- BookClub

To learn more about Backstage Capital check out their Visible Connect Profile

Lightship Foundation

- Location: Ohio, United States

- About: Hillman Accelerator focuses on companies led by underrepresented individuals in tech by developing venture backable companies.

- Thesis: We serve underrepresented tech-driven startups through mentorship, specialized curriculum, partnerships, and capital investments– providing them the resources and guidance they need to scale.

- Investment Stages: Accelerator, Pre-Seed, Seed, Series A

To learn more about Lightship Foundation check out their Visible Connect Profile.

SoGal Ventures

- Location: New York, United States

- About: As the first female-led millennial venture capital firm, SoGal Ventures represents how far our generation has come, and how deep our impact on the world can be. We believe in the power of diversity, borderless business, and human-centric design. We invest in seed stage diverse founding teams in the U.S. and Asia, and aim to be the first institutional investor for our portfolio companies. Our investments paint the future picture of how we live, work, and stay healthy.

- Thesis: We invest in the future of how we live, work, and stay healthy.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Lovevery

- Everyly Health

- Function of Beauty

To learn more about SoGal Ventures check out their Visible Connect Profile.

Women’s VC Fund

- Location: Oregon, United States

- About: Women’s Venture Capital Fund invests in early stage companies which have raised angel capital, developed their core technology and are demonstrating bona fide market traction. The Fund capitalizes on the expanding pipeline of women entrepreneurs leading gender diverse teams and creating capital efficient, high growth companies.

- Thesis: WomensVCFund II makes investments in early stage (A/B), revenue-generating, high-growth companies led by management teams inclusive of women.

- Investment Stages: Series A, Series B

- Recent Investments:

- Newsela

- HopSkipDrive

- Nvoicepay

To learn more about Women’s VC Fund Fund check out their Visible Connect Profile.

True Wealth Ventures

- Location: Texas, United States

- About: Investing in Gender Matters. We see value in the impact of women. True Wealth Ventures invests in smart female entrepreneurs, from consumer health innovators to sustainable product pioneers. Women-led companies have proven they deliver higher returns. It’s time to invest in new perspectives.

- Thesis: We like to be the first institutional investors at an early stage (usually Series Seed) with first checks up to $1M, and we often take a board seat. We generally reserve over half of our investment capital for follow-on investments. We look for companies where the founders see an acquisition exit opportunity within 3-5 years at a valuation of $100 million or more.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- UnaliWear

- BrainCheck

- Dermala

To learn more about True Wealth Ventures check out their Visible Connect Profile.

LGBT Capital

- Location: Harrow, England, United Kingdom

- About: LGBT Capital is a specialist corporate advisory and asset management business serving the LGBT consumer sector.

- Thesis: Is principally focussed on the LGBT Consumer segment as a credible investment sector and to demonstrate the business case for advancements in LGBT equality and inclusion globally.

To learn more about LGBT Capital check out their Visible Connect Profile.

BLCK VC

- Location: San Francisco, California, United States

- About: Connecting, engaging, empowering, and advancing Black venture investors by providing a focused community built for and by Black venture investors.

To learn more about BLCK VC check out their Visible Connect Profile.

Transparent Collective

- Location: San Francisco, California, United States

- About: Transparent Collective is a non-profit organization helping underrepresented founders access the growth resources and connections.

To learn more about Transparent Collective check out their Visible Connect Profile.

Forum Ventures

- Location: New York City, San Francisco, and Toronto, United States

- About: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

To learn more about Forum Ventures check out their Visible Connect Profile.

Start Your Next Round with Visible

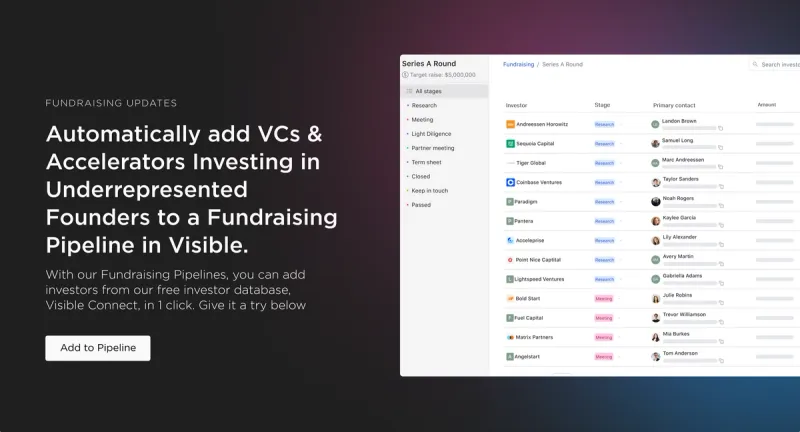

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Related Resources: