Startups have different options when it comes to financing. One of the most popular options is venture capital. To better understand if venture capital is right for your business, check out our breakdown of different types of venture capital below.

If you believe you are ready to raise venture capital, understanding how and why the function will improve your odds of raising capital. To learn more about raising venture capital, check out our “All-Encompassing Startup Fundraising Guide.”

Related Resource: Types of Venture Capital Funds: Understanding VC Stages, Financing Methods, Risks, and More

What are the Types of Venture Capital Funding?

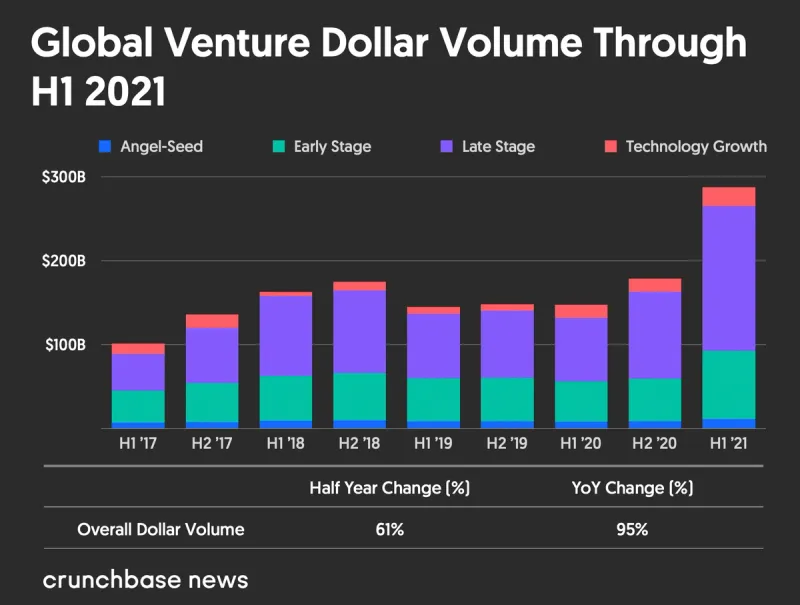

As venture capital continues to grow and evolve so do the types and expectations of funds. As the team at Crunchbase found, venture funding by year is growing, mainly between early-stage and late-stage funds:

Related Resource: Exploring VCs by Check Size

Learn more about different types of funding below:

Seed Capital

Seed funding, which oftentimes includes “pre-seed” funding, is generally the first round of financing for a startup. There typically tend to be funds that specialize in pre-seed/seed-stage financings.

However, as the seed stage has continued to grow so have the funds — later stage funds are now moving their way down to make seed investments. As the team at Crunchbase put, “One of the reasons many venture firms are stockpiling funds to invest into seed startups is that getting in at the earliest stages with a young startup lets those investors have a say in crucial decisions early on.”

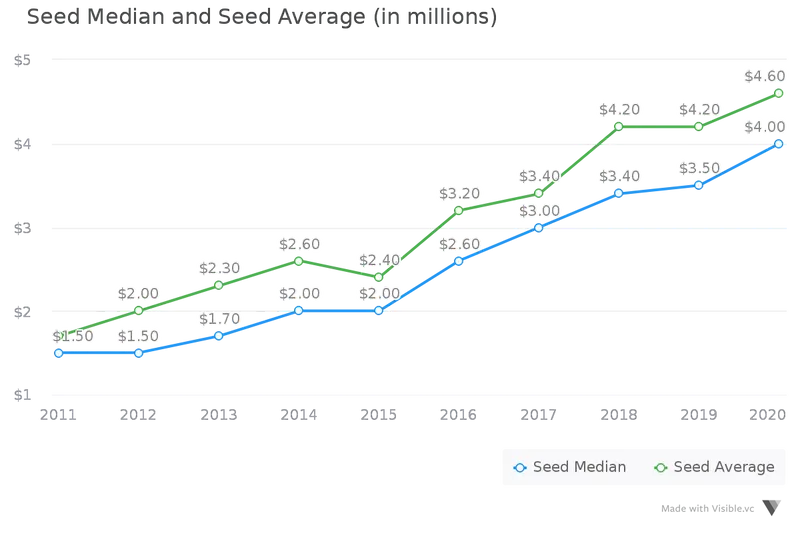

Check out the average seed size (from “large” investment funds) over the last 10 years below (from the team at Crunchbase):

VCs will typically get more attractive terms as they are taking on more risk at the seed stage. Because of this, seed-stage investors oftentimes make more investments in the hopes that a small percentage of their investments will turn into huge returns (learn more about the power-law curve in VC here).

Related Resource: Seed Funding for Startups: A 101 Guide

Early Stage Capital

Post seed or pre-seed funding comes to Series A and Series B funding. While some might categorize them as a later stage, both are earlier stage financings that come post-seed round.

Early-stage capital is often when a company might have some traction and promise that it can grow into a massive company that is worthy of an exit.

Related Resource: How to Model Total Addressable Market (Template Included)

Related Resource: The Rise of Venture Capital in Utah: A Look at Utah’s Top 10 VC Firms

Related Resource: Breaking Ground: Exploring the World of Venture Capital in France

Expansion Capital

Once a company has proven they have product-market fit, a massive market, and a repeatable sales process — chances are they are ready to expand. With this comes larger check sizes that will help you put your growth strategies to work.

Venture funds at this stage are likely huge funds that make fewer investments with larger check sizes. At the point of investment, most companies will have proven success to in turn will raise at higher valuations.

Related resource: Understanding the Role of a Venture Partner in Startups

Late Stage Capital

Lastly comes late-stage capital. These are borderline private equity funds and can be used to bridge financings for larger companies. This might be a final injection before a company sets to go public or to fund expansion into a totally new market.

Related Resource: Private Equity vs Venture Capital: Critical Differences

Rolling Funds

More recently, “rolling funds” have become a point of interest in the space. While they are not typically dedicated to a specific stage (like the examples above) the way they raise financing and treat the general partner to limited partners relationship differs. Learn more about rolling funds here.

Related Resource: 12 Venture Capital Investors to Know

Venture Capitalist Fund Structure

To better improve your odds of raising venture capital, you need to understand how they function. When pitching investors you’ll want to keep a few of these things in mind so you can fit into their duties as a VC.

Check out a visual of how venture capital funds are structured below:

Related Resource: A Guide to How Venture Capital Works for Startups and New Investors Guide

A couple of key terms to understand when it comes to a venture funds structure:

1) Venture Fund

As the Bank for Candian Entrepreneurs puts it, “A venture capital (VC) fund is a sum of money investors committed for investment in early-stage companies.” A venture fund is simply capital that is ready to be deployed by the venture capital firm (or the management company).

2) Management Company

The management company is the people behind the fund itself. Not be confused with a venture fund. A venture management company can raise multiple funds. As the team at AngelList writes, “A management company is a business entity created by a venture firm’s general partners (GPs). It’s responsible for managing a venture firm’s operations across its funds.”

Management companies often receive a management fee from their funds to help deploy and grow their funds.

A management company is responsible for prospecting investments, collecting fees and expenses, branding, and more.

3) General Partner (GP)

A general partner is someone who manages a venture fund and likely the management company. As defined by the team at Angel List, “A GP is a manager of a venture fund. They may be a partner at a large VC firm like Sequoia, or an individual investor using AngelList. Like fund managers in other arenas (stocks, mutual funds, crypto, etc.), they analyze potential deals and make the final call on what to do with the money they manage.”

General partners are typically paid between their carried interest and management fees. Carried interest is typically where a general partner makes a living. Typically carried interest for a GP is 20% which means that 20% of a funds profits will be paid to the GP.

It is worth noting that GPs oftentimes invest their own money so they have skin in the game. You can boil down a general partner’s responsibility into 2 key things — deploying capital in high-quality companies and raising future capital.

4) Limited Partners (LPs)

You might be asking yourself where does capital for a venture fund come from? The answer is limited partners. Limited partners are generally much larger funds and are looking to diversity their investing via venture capital funds. Traditionally, limited partners tend to be:

- University endowments

- Sovereign funds

- Family offices

- Pension funds

- Insurance companies

- Etc.

Because VC funds are competing with traditional assets, it is vital that they provide outsized returns to improve their odds of raising venture capital in the future. Learn more about the power law curves in our post, “Understanding Power Law Curves to Better Your Chances of Raising Venture Capital.”

5) Startups

Of course, there are the actual startups and investments that a venture fund are making. For a startup to be deemed venture-worthy they generally have to operate in a large market, have promising economics, and the ability to create a massive return for their investors (and their LPs).

Related Reading: Building A Startup Financial Model That Works

Limited Partnerships & LLCs Role in VC Fund Structure

As the team at Investopedia puts it, “A limited partnership (LP)—not to be confused with a limited liability partnership (LLP)—is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business. However, the general partner of a limited partnership has unlimited liability for the debt, and any limited partners have limited liability up to the amount of their investment.”

Because LPs do not partake in managing the business (e.g. the venture firm) they are relying on the GP and venture firm to be experts at investing. At the end of the day, every venture fund and firm wants to set out and raise a new fund every 10 years or so. This means that GPs need a strong record with LPs so when they seek further capital they have someone they can lean on.

This also means that LPs are expecting massive returns as they are trusting and deploying their capital with a general partner, likely in a space lesser-known to them.

Related resource: What is a Capital Call?

Three Examples of How Returns Are Generated

Of course, the goal of any venture fund is to generate returns for its limited partners. As we put in our post on power-law curves,

“A small % of VC funds take home a large % of venture returns. VCs are constantly working to make their way into the “winning” part of the curve so they can continue to attract capital from limited partners.

How does a VC fund become a “winner?” The best VC funds portfolio returns also follow a power-law curve. A small % of a VC funds investments will yield the majority of their returns.”

This means that VCs need to create liquidity and get returns to their investors so they can go out and raise capital again. This generally comes in 1 of 3 ways:

Related resource: Carried Interest in Venture Capital: What It Is and How It Works

1) Mergers and Acquisitions (M&A)

One of the most common ways that a startup exits are via a merger or acquisition. As put by the team at Investopedia, “Mergers and acquisitions (M&A) is a general term that describes the consolidation of companies or assets through various types of financial transactions, including mergers, acquisitions, consolidations, tender offers, purchase of assets, and management acquisitions.”

The terms of the merger or acquisition will impact how a VC is paid back. For example, an investor that invested at the seed stage will likely be greatly diluted if the exit is later in a companies lifecycle.

Related Resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

2) A Buyout of Shares

Less common is that startups shares will be bought out. This means that a new entity is taking a larger or majority stake in a company. This could come via a specific fund exiting their position or a founder finding liquidity. No matter the case, the terms, and conditions will greatly impact any fund.

3) Startup Reaches an IPO

Lastly, there is an IPO (initial public offering). Becoming rarer, an IPO has the opportunity to create huge returns for a venture capital fund — especially their seed and early-stage investors.

Looking To Get Funding for Your Startup?

Understanding if venture capital is right for your business is a small part of the battle. Determining how to raise capital, what investors to raise from, and pitching investors is where the real fun begins. Having a system in place to raise venture capital is a great way to increase your odds of raising capital.

Related Resource: All-Encompassing Startup Fundraising Guide

Related Resource: 8 Most Active Venture Capital Firms in Europe

Related Resource: 7 Best Venture Capital Firms in Latin America

Related Resource: Exploring the Growing Venture Capital Scene in Japan

If you’ve read this post and determined that venture capital is a good fit for your company, let us help. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.