Evolving Travel Trends and Market Analysis

The pandemic not only gave rise to a new way of traveling but also changed how people want to travel, providing them with new opportunities. Investments in alternative accommodation startups and other businesses in this area have been on the rise, and this trend will continue.

With remote work now an option for most people, new growth opportunities for coworking, coliving, and traveling have emerged. There are also new alternatives to Airbnb, such as Kindred, which offers travelers a members-only home exchange network where the community can swap or share their homes to travel for a fraction of the cost.

Market Size and Growth

The global travel and tourism market is showing robust growth post-pandemic. According to the World Travel & Tourism Council (WTTC), the sector is projected to grow by 5.8% annually over the next decade, reaching $8.6 trillion in 2024. This recovery is driven by pent-up demand, easing travel restrictions, and a growing middle class in emerging markets.

Current Trends and Consumer Behavior

The pandemic has significantly reshaped how people approach travel, leading to new preferences and expectations. As travel begins to rebound, businesses must adapt to these changes to effectively meet consumer demands and capitalize on emerging opportunities. Here’s a look at the key trends that are currently influencing consumer behavior in the travel and tourism industry.

- Flexible Booking Policies: The uncertainty caused by the pandemic has led to a high demand for flexible booking options. Travelers prefer refundable bookings and the ability to change travel plans without penalties. According to Expedia’s Travel Trends Report, flexible booking options are a top priority for 78% of travelers.

- Remote Work and Digital Nomadism: The shift to remote work has led to a surge in digital nomadism, with more people combining work and travel giving rise to “flexcations”. Combining work and leisure, travelers are choosing destinations where they can work remotely while enjoying a vacation. This trend has led to an increase in demand for long-term rentals and accommodations with work-friendly amenities.

- Experiential Travel: There’s a growing preference for experiential travel, where travelers seek unique, immersive experiences rather than traditional sightseeing. This includes activities like culinary tours, cultural workshops, and adventure travel. Skift’s Megatrends 2023 report highlights that travelers increasingly seek personalized and authentic experiences that allow them to connect with local cultures and communities.

- Personalized Travel: Travelers are also looking for personalized travel experiences that cater to their individual preferences and interests. This includes tailored itineraries, unique accommodations, and bespoke tours.

- Technology-Driven Travel: The use of technology to enhance the travel experience is on the rise. This includes mobile check-ins, digital payment options, and virtual tours. Travelers rely heavily on apps and online platforms for booking, navigating destinations, and accessing travel information. The integration of AI and machine learning in these platforms helps in providing personalized recommendations and seamless travel planning.

- Sustainable Tourism: Sustainable tourism has gained significant traction as travelers become more environmentally conscious. Eco-friendly accommodations, carbon offset programs, and sustainable travel practices are in high demand. According to a report by Booking.com, 83% of global travelers think sustainable travel is vital, and 61% say the pandemic has made them want to travel more sustainably in the future.

Future Outlook: Technological Advancements Shaping the Travel and Tourism Industry

Rapid technological advancements and evolving consumer preferences will shape the future of the travel and tourism industry. For startups in this space, staying ahead of these changes is key to maintaining a competitive edge and meeting the needs of modern travelers. Here’s a look at what’s on the horizon.

Blockchain Technology

- Enhanced Security and Transparency

- Blockchain can revolutionize travel by providing secure and transparent transactions. It can improve the accuracy of booking systems, reduce fraud, and enhance data security. For example, blockchain can be used for secure identity verification and streamlining payments and loyalty programs.

- Decentralized Travel Platforms

- Startups can leverage blockchain to create decentralized travel platforms, reducing reliance on intermediaries and lowering costs for travelers. Companies like Winding Tree are already pioneering decentralized travel marketplaces, allowing direct transactions between suppliers and consumers .

Artificial Intelligence (AI)

- Personalized Travel Experiences

- AI can analyze vast amounts of data to provide personalized travel recommendations and experiences. Chatbots and virtual assistants powered by AI can offer 24/7 customer service, helping travelers with bookings, itinerary changes, and travel advice.

- Operational Efficiency

- AI can optimize operations for travel businesses by predicting demand, managing inventory, and automating repetitive tasks. For instance, AI-driven analytics can help airlines and hotels forecast occupancy rates and adjust pricing strategies in real-time.

Virtual Reality (VR) and Augmented Reality (AR)

- Immersive Pre-Travel Experiences

- VR and AR technologies can offer immersive previews of travel destinations, helping travelers make informed decisions. VR tours of hotels, attractions, and destinations can enhance the booking process.

- Enhanced On-Site Experiences

- AR can enhance travelers’ experiences at destinations by providing interactive guides, real-time language translation, and augmented reality tours. For example, AR apps can overlay historical information and directions onto real-world environments, enriching the travel experience.

Internet of Things (IoT)

- Connected Travel

- IoT can create a seamless travel experience by connecting various devices and services. Smart luggage that tracks its location, hotel rooms that adjust settings based on guest preferences, and connected transportation systems are some examples.

- Operational Improvements

- IoT can help travel businesses monitor equipment performance, manage energy usage, and enhance guest safety and convenience. For instance, airports can use IoT to track baggage and improve security systems.

Journey Ventures

- Location: Israel

- About: Journey Ventures is a multi-stage VC dedicated to the booming Travel Tech industry. Travel is one of the world’s fastest-growing sectors. Travel startups of the last few years have already disrupted some of the largest sectors in our industry, a momentum we expect to continue. This large market of ever-increasing Travel Tech offerings is ready for smart investments, and Journey Ventures is an expert in the field.

- Thesis: Our goal is to develop a portfolio of Israeli and international companies specializing in the fields of tourism, travel Tech and the hotel industry that have reached an advanced stage of technological development.

- Investment Stages: Pre-seed, Seed, Series A, Series B, Series C

- Recent Investments:

- Wenrix

- UpStay

- Roomerang LTD

Related Resource: 9 Active Venture Capital Firms in Israel

MairDuMont Ventures

- Location: Stuttgart, Germany

- About: MAIRDUMONT VENTURES is the venture capital arm of the MAIRDUMONT Group and has been supporting digital travel companies in their future growth since 2015. MAIRDUMONT VENTURES uses its unique sector focus “Travel” to dive deeply into different business models and to evaluate potentials together with our portfolio companies. We have extensive know-how and can leverage the huge network of the MAIRDUMONT Group – with well-known brands such as Marco Polo, DuMont, Baedeker, Kompass or Falk – to offer our portfolio companies not only financial resources, but also strategic and operational support. We invest in fast-growing, early-stage and innovative companies that revolutionize travel. These can be solutions for end customers (B2C) as well as business customers (B2B).

- Recent Investments:

- zizoo

- holidu

- Paul Camper

Related Resource: 8 Active Venture Capital Firms in Germany

JetBlue Technology Ventures

- Location: San Carlos, California, United States

- About: JetBlue Technology Ventures invests in and partners with early stage technology startups improving the future of travel and hospitality.

- Thesis: We invest in and partner with early stage startups improving travel and hospitality.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- NLX

- FLYR Labs

- Bizly

500 Startups

- Location: Mountain View, California, United States

- About: 500 Startups is a global venture capital firm with a network of startup programs headquartered in Silicon Valley.

- Thesis: Uplifting people and economies through entrepreneurship

- Investment Stages: Seed, Series A

- Recent Investments:

- Tripoto

- Wandero

- Flightfox

Fifth Wall

- Location: Venice, California, United States

- About: At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Loft

- Flyhomes

- Smart Rent

Thayer Ventures

- Location: Valencia, California, United States

- About: Thayer Ventures invests in Travel Technology.

- Thesis: We invest in early-stage travel and transportation technology.

- Investment Stages: Seed, Series A

- Recent Investments:

- Beekeeper

- Snapcommerce

- Swiftmile

Structure Capital

- Location: San Francisco, California, United States

- About: Structure Capital help passionate teams build great companies by investing seed-stage capital, time, experience and relationships.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Sonder

- CANOPY

- Unbabel

Portugal Ventures

- Location: Porto, Lisboa, Portugal

- About: Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

- Thesis: We invest in companies in the seed and early stages operating in the digital, engineering & manufacturing, life sciences and tourism sectors.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- DefinedCrowd

- Relive

- Sleep & Nature

aws Gründerfonds

- Location: Vienna, Wien, Austria

- About: Venture Capital for Ideas and Innovations aws Founders Fund invests venture capital during the start-up and early growth phase of Austrian start-ups. We offer support for your future (financial) plans as a long-term investor and partner and believe in the additional value of co-investments.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Innerspace

- Rendity

- CheckYeti.com

VentureFriends

- Location: Athens, Attiki, Greece

- About: VC fund based in Athens but investing across Europe, we focus on FinTech, Travel, PropTech, B2C & Marketplaces. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach

- Thesis: We are entrepreneurial investors who love to support startups and help them become impactful companies with a worldwide presence.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Blueground

- Home Made

- Welcome Pickups

Travel Impact Lab

- Location: Utrecht, Netherlands

- About: Travel Impact Lab helps start-ups to get started and sets existing travel organizations in motion.

- Investment Stages: Accelerator

Travel Capitalist Ventures

- Location: Irvine, California, United States

- About: Travel focused Venture Capital and Private Equity Investor.

- Thesis: We identify, invest and help travel companies rapidly and sustainably expand.

- Investment Stages: Seed, Series A, Growth

- Recent Investments:

- Jetsmart

- Voopter

- Guiddoo

Alstin Capital

- Location: Munich, Bayern, Germany

- About: Alstin Capital is an independent venture capital fund based in Munich. We invest in rapidly growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. We not only invest in convincing technology, but above all in the entrepreneurs behind the technology. We support our entrepreneurs with capital and know-how so that they can grow faster and more successfully. Our investment is based on the conviction that entrepreneurial know-how, many years of transaction experience, international networks and sales excellence are the success factors for sustainable growth. Our team brings a variety of complementary strengths to help make any investment a success.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Pilant

- Neodigital

- Circula

TruVenturo

- Location: Hamburg, Germany

- About: We believe venture capital will make the best returns if you invest in the big future markets. Therefore we are strong believers in Tech (managed by Norbert Beck), Brain Computer Interface (managed by Florian Haupt) and pharma to prevent age related disease and prolong healthy human lifespan managed by Nils Regge with the investment vehicle Apollo.vc.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Dreamlines

- HAPPYCAR

- DreamCheaper

Howzat Partners

- Location: London, England, United Kingdom

- About: We are looking to invest in and build internet businesses that have a “HOWZAT” factor. This may sound a little trite; but we see major changes caused by the internet and the opportunities are genuinely exciting. The right idea; the right business; the right time; should generate the “HOWZAT” feeling. David felt it when he came across Cheapflights and was involved in acquiring the Company in 2000. We are seeking the same feeling again in the investments we make.

- Investment Stages: Seed, Series A

- Recent Investments:

- Trivago

- LODGIFY

- otelz.com

Slow Ventures

- Location: San Francisco, California, United States

- About :Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Thesis: Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Investment Stages: Seed, Series A

- Recent Investments:

- Scout

- Vamo

- Hipcamp

Hangar 51

- Location: London, England, United Kingdom

- About: We are the innovation team at International Airlines Group, one of the world’s largest airline groups and home to iconic brands in the UK, Spain and Ireland. We are on a mission to transform aviation, helping test and scale high impact emerging technologies across our group. We scout for and partner with leading entrepreneurs to fund, support and scale solutions with the potential to transform the way we do things.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- ZeroAvia

- Monese

- Esplorio

Start Your Next Round with Visible

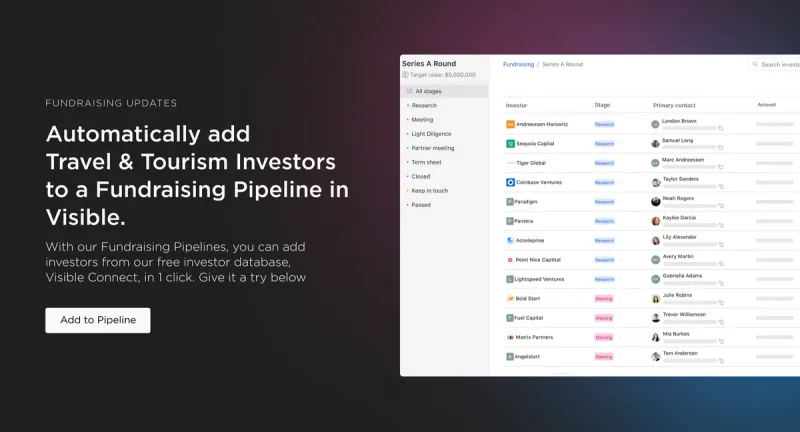

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.