Total Addressable Market vs Serviceable Addressable Market

When setting out to build a company, it is important to understand the potential market size, especially if you plan on raising venture capital. Venture capital funds follow a power-law curve, or simply put, a small % of firms capture a large % of industry returns.

Because of this, investors will want to see that your company is capable of a huge exit to help improve its returns. While some investors will tell you that they do not care about an accurate calculation of your addressable market, they will want to understand how your company can turn into a large company.

Learn more about calculating your TAM, SAM, and SOM below:

What is Total Addressable Market (TAM)

As put by the team at Corporate Finance Institute, “The Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved. It helps determine the level of effort and funding that a person or company should put into a new business line.”

Related Resources:

- What Is TAM and How Can You Expand It To Grow Your Business?

- How to Model Total Addressable Market (Template Included)

Real-life Example of TAM

For a TAM example, let’s say we are a software company called Adventure App that is helping campers find lesser-known camping spots. Let’s say that we charge customers $10/mo for our application. Using a bottoms-up approach we know that the average consumer would spend $120 a year ($10/mo X 12 months).

Next, we’d need to calculate how many customers exist in the space. Using research and our own data, we believe that there are 20,000,000 consumers in our market. That would lead to a total addressable market of $2.4B ($120 X 20M consumers).

How to Calculate TAM

There are multiple approaches when it comes to calculating your total addressable market. The most common being:

- Tops Down Approach

- Bottoms Up Approach

- Value Theory Approach

Learn more about calculating TAM and use our free template to get you started in our post below:

Related Resource: Total Addressable Market Template

Importance of the TAM

One of the more infamous examples of TAM is Uber. Initially, Uber modeled their TAM based on a luxury black cab service in select markets. In reality, Uber has transformed into a global company offering everything from shared rides to food delivery. Uber used both a top-down approach and modeled their future based on the past

Related Resource: Total Addressable Market: Lessons from Uber’s Initial Estimates

Uber is a case study on the importance of using the correct approach to an addressable market.

What is Serviceable Addressable Market (SAM)

TAM implies that you capture 100% of your addressable market. Of course, this is not realistic. Serviceable addressable market, or SAM, hones your market sizing one step further.

As Steve Blank describes it, “The serviceable available market or served addressable market is more clearly defined as that market opportunity that exists within a firm’s existing core competencies and/or past performance. The biggest consideration when calculating SAM is that a firm most likely can only service markets that are core or directly adjacent to its current customer base.”

Related Resource: TAM vs. Sam vs. SOM: What’s the Difference?

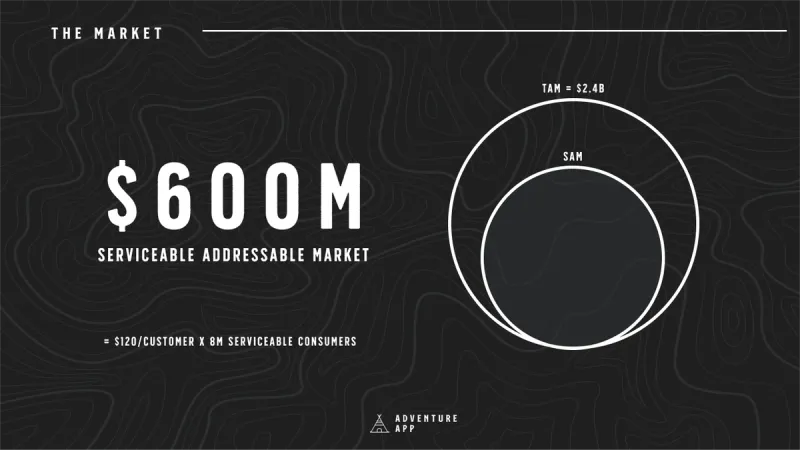

Real-life Example of SAM

Continuing with our Adventure App example from above, we’d want to continue to tweak that number with our serviceable addressable market. As Steve Blank put it above, “…a firm most likely can only service markets that are core or directly adjacent to its current customer base.” Your business will depend on what you define as “core or directly adjacent” to your customer base.

For Adventure App, let’s say that we believe that only 5M of the 20M potential consumers are in the geography we can support. That would mean that our SAM would be $600M ($120/yr X 8M).

Alternatively, you could calculate this by taking TAM of $2.4B and multiplying it by % of the serviceable market, 25% (5M/20M).

How to Calculate SAM

SAM requires equal parts art and science. It is on you to determine what % of the TAM you believe is core to your product it can vary how it is calculated. You will need to use publicly available data plus your own internal data to make sure your best assumption for what you can reasonably service.

Importance of SAM

Serviceable addressable market is important because it will give you a more realistic look at how large your business can be. 100% market penetration is not realistic (as demonstrated in TAM) so it is important to continue to hone in what % of the market you can realistically service.

What is Serviceable Obtainable Market (SOM)

Serviceable obtainable market, or SOM, dials in your addressable market 1 step further. As we wrote in our blog, Modeling Total Addressable Market, “ SOM is the percentage of the market that you can actually reach with your product, sales, and marketing channels. This should be a realistic view of the customer base your company can pursue.”

Related resource: Service Obtainable Market: What It Is and Why It Matters for Your Startup

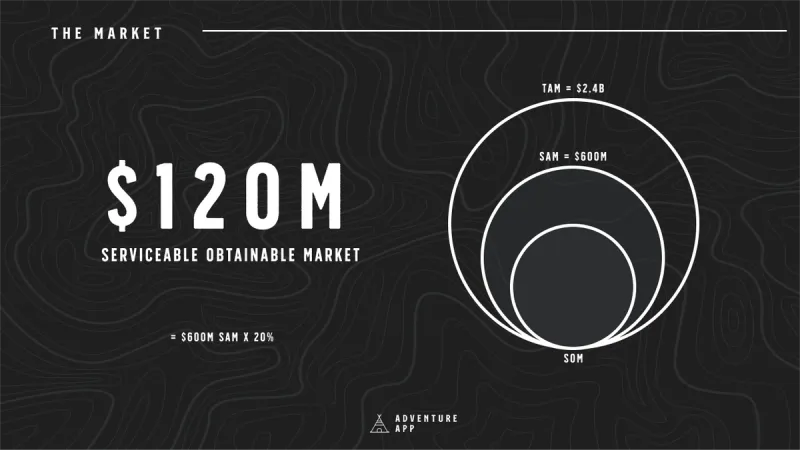

Real-life Example of SOM

While our example above shows that Adventure App has a serviceable market of $600M, we will want to hone that further to give an obtainable view of your market.

Using past data and public data, we know that Adventure App can penetrate 20% of our serviceable addressable market. That means that our SOM would be $120M ($600M X 20%).

How to Calculate SOM

Like a serviceable addressable market, there are a few ways to approach your SOM. Depending on how much data you have available will depend on how you calculate your SOM. For example, if you know your market share % you can use that against your SAM. If you do not know your true market share %, you can use the best data available to model the % of your SAM you believe you can capture.

Importance of SOM

SOM is important because it is the most realistic view of your business and your place in the market. It should offer a better short-term view and can be leveraged to set realistic goals and forecasts over the coming year or years.

The Similarities and Differences Between the Three Markets

TAM, SAM, and SOM all serve their own purpose but share many similarities and differences. They are all cut from the same thread. They are all versions of the addressable market but slowly narrowed down to be more realistic. They are all based on roughly the same estimates and slowly add in more restrictions as you hone in on the market.

For More Information on Markets Visit Visible Today

Want to learn more about calculating and tracking your total addressable market? Check out our free Google Sheet template here.