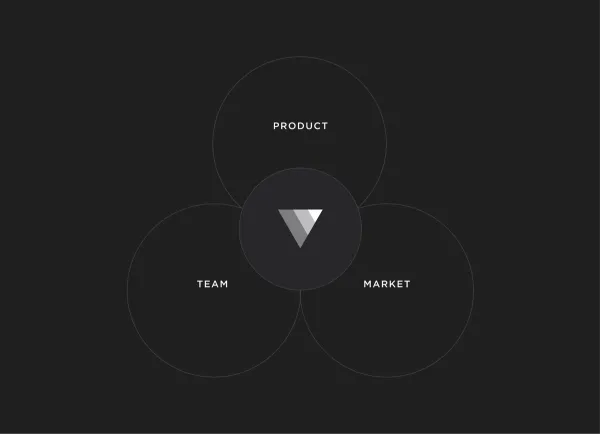

It’s an endless debate: product, market or team.

Which matters most? That depends on whom you ask. The beauty of this startup conundrum is often in the eye of the beholder VC. Even the most prominent firms rooted on Sand Hill Road can’t agree on what matters most in funding decisions. “The difference between venture firms in a lot of ways is how they rank the importance of market, product and team,” Marc Andreessen said.

To better understand why, we took a look at the reasons given from a few notable groups.

Product

There may be no better advocate for the creation of the undeniable, unbeatable product than the “Competition is For Losers” spouting investor Peter Thiel. The Paypal co-founder and famed Silicon Valley contrarian even developed a seven-part test to determine if a founder’s new technology meets his criteria to make a bet on its success. Is your team good enough? They’ll pass the test. Is your market big enough? Who cares—create a new one if it isn’t. Thiel argues good innovation sells itself. “If your product requires advertising or salespeople to sell it, it’s not good enough.” He wrote in Zero to One. “Technology is primarily about product development, not distribution.”

The Founder’s Fund, which Thiel co-founded, has a longer manifesto here that explains in greater detail their investment philosophy on startups.

Market

Don Valentine keeps his philosophy simple: “great markets make great companies.” Dubbed the “Grandfather of Silicon Valley,” Valentine, who founded Sequoia Capital, famously fired Sandy Learner and Leonard Bosack, the co-founders of Cisco Systems, from the company they started and the technology they built. Without its founders, Cisco continued to succeed under the leadership of professional CEO John Morgridge. “I like opportunities that are addressing markets so big that even the management team can’t get in its way,” Valentine said.

People can be hard. Benefitting from a rapidly growing market can be easier.

In a remarkable talk (below) with the Stanford Graduate School of Business (unsubtlety titled “Target Big Markets”), Valentine explains how Sequoia Capital is most often interested in markets already populated by a few products. “We were not interested in creating markets. It’s too expensive. We were interested in exploiting markets early.”

Team

Marc Andreessen is acutely aware of the inherent absurdity in startup investing, where having 15 of 30 investments succeed —a batting average that would sicken hedge fund managers—can make for a dynamite portfolio. No matter what’s prioritized: market, product or team, Andreessen is under no illusion that growing a company is easy. “The default setting of every startup is dying in obscurity.”

But if someone is going to solve big problems, Andreessen wants invest in the person doing it. On a recent podcast, Andreessen explains that team is makes the most sense of the three to back: “We struggle from a distance to evaluate market, he said. “And we also actually struggle to evaluate product. But if you can get yourself in business with really good people, I think number one: if it works it’s great, because those are really good people to be in business with and they, with you, can build something great. But even if it doesn’t work—if it’s the wrong market or the wrong product—you’ll still learn so much working with the right people and you’ll build such a valuable network for what you do next.”

It’s wise to do reconnaissance on the investors you’re going to pitch to find out which matters most to them. The answer may not jive with what makes your company is great, but even in the worst of circumstances, you’ll understand why you’re getting told “no.”