This post is excerpted from our first book, The Ultimate Guide to Startup Data Distribution. You can download the book for free and learn more about how other top companies are building and operating high-impact data distribution systems to keep everyone that matters engaged in the their business. Check out the other parts if you haven’t already:

- Part 3. How to Find You Company’s Storytelling Framework

- Part 4. ‘Steal’ the Right Metrics for Your Company (Coming Soon)

You can also find more on the topic of Startup Data Distribution here:

- The 3 Key Pillars of Startup Data Distribution – OpenView Labs

- How to Tell Your Company’s Story – Medium

The way that a company tracks and analyzes the key performance indicators around its product development and distribution as well as its customers and employees is key in determining whether its data distribution system will be effective and yield long term positive results. It doesn’t matter how often a management team communicates with team members, investors and any other stakeholders if the communication isn’t actionable and relevant to what drives the success of the business.

Blake Koriath, CFO at SaaS-focused seed fund High Alpha, likes to start wide when working with companies, focusing first on business model and company stage, then digging into exactly who will be viewing specific metrics and when.

1. Understand your Business Model

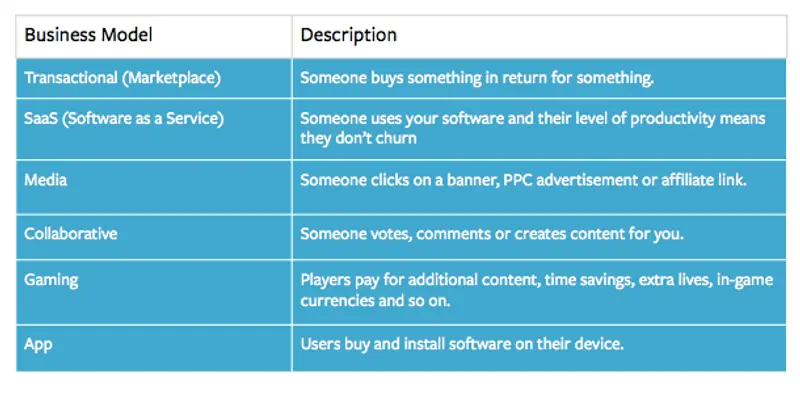

The way that you finance your operation, build your product, serve your customers, and generate revenue will be the primary driver behind what metrics you track. As Alistair Croll, one of the authors of “Lean Analytics” wrote, online businesses tend to primarily fall under one of the following business models:

He goes on to say that “no company belongs in just one bucket” as, for example, Amazon cares about “Transactional” KPIs when making sales on their site but looks to “Collaborative” KPIs when collecting product reviews.

2. Evaluate the stage of your business

In working with thousands of investors and operators over the last few years at Visible, we have come to understand the impact a company’s stage has on what metrics it should be tracking and how it should be tracking them.

Early stage teams may place more importance on things like cash in the bank and burn rate, hoping to extend the life of the business as they search for product/market fit and move from growth to scaling. Later stage companies, on the other hand, need to be much more qualitative in nature and understand how all of their different business units are contributing to their end goal as a business.

3. Determine who your intended audience is

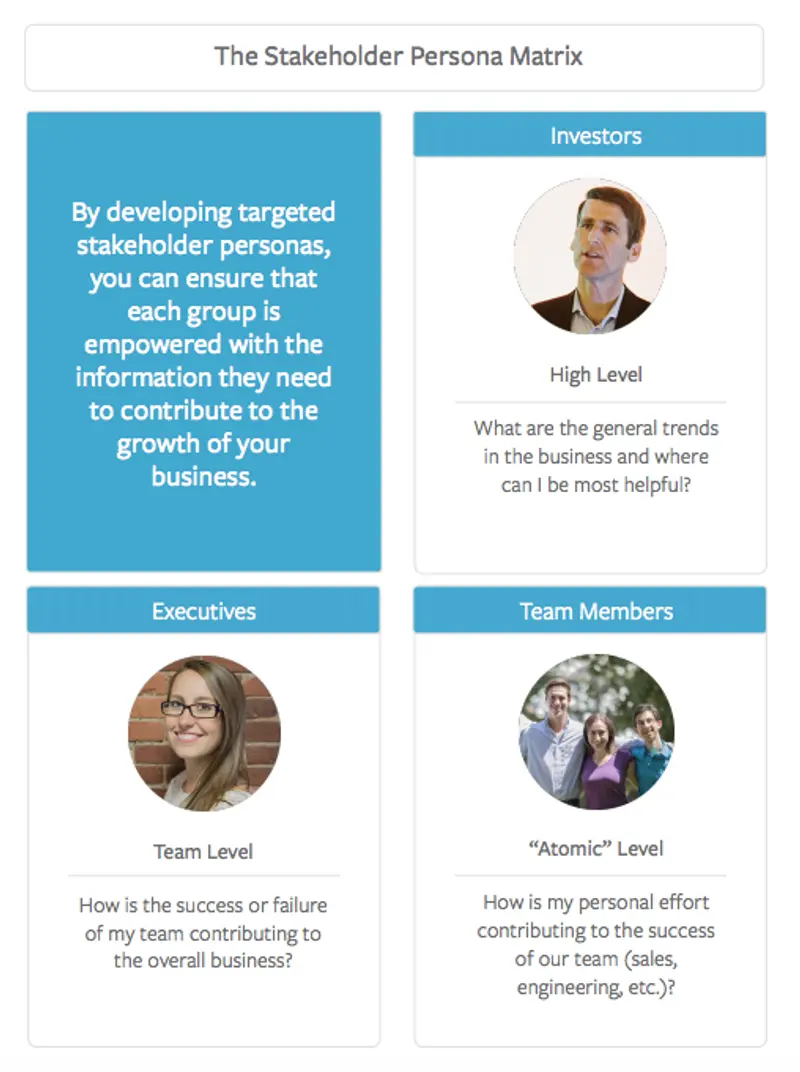

When bringing a product to market, customer personas play a major role in things like pricing, messaging and feature set. When distributing key information about the performance of your business, stakeholder personas help inform which subset of metrics you present as well as when and how you present them.

Investors, according to High Alpha CFO Blake Koriath, are often interested in the highest level metrics, enough information to quickly understand general trends in the business and also understand where they can have the most impact. Overall Gross Margin, MRR Added and LTV are examples of metrics SaaS investors may be interested in seeing.

Executive team members fall next in the hierarchy and need to understand how the success of their team is contributing to the overall direction of the business (for example, Lead Velocity Rate for a a Sales Manager). Finally, team members are likely interested in the “atomic units” of those higher-level metrics. That is to say, how are their individual contributions bubbling up to impact the metrics that determine success for their teams?

Getting the right information to the right people at the right time is essential in telling the story around your company’s data. By focusing on targeted stakeholder personas, you can ensure that each group is empowered with the information they need to contribute most effectively to the growth of the organization.