When starting a venture capital for a fundraise, it is important to stay focused on the right investors for your business. This means sticking to investors that fund companies in your industry, stage, geography, etc.

In order to best help founders find the right investors for their business, we’ve laid out 10 investors that are funding FoodTech startups below:

Quick Overview of the Food Tech Industry

As written by the team at Bread and Butter Ventures, “Food technology includes tech-enabled companies operating anywhere in the food value chain. From on farm to supply chain and manufacturing to restaurants and grocery. “Tech” can be software, hardware, bio sciences, or any combination of the three.”

Food and agriculture is a major aspects of the economy. Many venture capitalists and entrepreneurs find that there are inefficiencies in the food and agriculture sector and can be improved by funding innovative companies.

Related resource: Top 12 Industry Events and Trade Shows for Food and Beverage Startups (2024 - 2025)

Challenges in Foodtech

As put by the team at Blue Horizon in their post, The US food industry is facing a labor crisis and needs technology solutions to help solve it, “The food industry is strained from multiple forces, including heightened expectations from both customers and employees (e.g., wage increases, gig economy) as well as macro-economic pressures (e.g., inflation, supply chain constraints).”

Related Resource: The 16 Best Startup Newsletters

Related Resource: VCs Investing In Food & Bev Startups

1) Better Food Ventures

Location: Menlo Park, CA

Funding stage: Early-stage, seed stage

According to the team at Better Food Ventures, “Our investments in food and agriculture technologies span the value chain — from seed, soil, supply chain, store, supper to stomach— to support the digitization of today’s food system, and form the building blocks necessary to meet our food supply needs in 2050.”

According to their Visible Connect Profile, the team at Better Food Ventures typically writes checks anywhere between $250k and $10M. Some of Better Food Ventures most popular investments include:

- Milk Moovement

- Love with Food

- Byte

2) 1st Course Capital

Location: Redwood City, CA

Funding stage: Early-stage, pre-seed, seed

As the team at 1st Course Capital puts it, “1st Course Capital is an early stage venture capital firm investing in innovative business models and technologies changing how we grow, produce, and distribute food.”

Some of 1st Course Capital’s most popular investments include:

- BlueCart

- Farmshelf

- Gooder Foods

3) Nucleus Capital

Location: Berlin

Funding stage: Pre-seed and seed stage

As put on their website, “Nucleus Capital is a new venture capital firm supporting purpose-driven founders.

We believe that entrepreneurial innovation is necessary to tackle global threats to planetary health.

We deeply respect the entrepreneurial process and partner with founders at the nucleus of their journey, investing at the Pre-Seed & Seed stage.

We are most excited by mission-driven teams with relentless ambition, deep domain expertise and creative ideas.”

Nucleus is focused on pre-seed and seed stage investments. Some of Nucleus Capital’s most popular investments include:

- Planet A Foods

- Juicy Marbles

- Yuri

4) Tet Ventures

Location: Berlin, Germany

Funding stage: Early-stage

As put on their Visible Connect Profile, “We are one of the most active global foodtech VCs, investing in teams and technology building a better food system.”

Tet Ventures typically writes check anywhere between $50k and $250k. They look to fund companies anywhere in the world at the earliest stages.

Some of Tet Ventures most popular investments include:

- Farmstead

- Maven

- Gather Made

5) Bread and Butter Ventures

Location: Minneapolis, MN

Funding stage: Seed stage

As put by the team at Bread and Butter Venturese, “Bread and Butter Ventures is an early stage venture capital firm based in Minnesota, the Bread and Butter State, investing globally while leveraging our state and region’s unparalleled access to strong corporate connections, commercial opportunities, and industry expertise for the benefit of our founders.”

You can learn more about Bread and Butter in our podcast with Brett Brohl below:

The team at Bread and Butter typically writes checks anywhere between $100k and $400k. They traditionally focus on Food Tech, Health Tech, and Enterprise SaaS companies.

Some of Bread and Butter Venture’s most popular investments include:

- Alchemy

- Dispatch Goods

- Omnia Fishing

6) FoodHack

Location: Lausanne, Switzerland

Funding stage: Pre-seed to Series A

As written by the team at FoodHack, “Where Food & FoodTech professionals come to get the inside scoop on industry news and meet partners, friends, mentors, investors – and everything in between.

From our weekly newsletter, to our ambassador run Meetups and our annual FoodHack Summit – our goal at FoodHack is to make it easier for purpose driven food founders to access the funding, network and knowledge they need to successfully launch and scale their business.”

7) Bluestein Ventures

Location: Chicago, IL

Related Resource: Chicago’s Best Venture Capital Firms: A List of the Top 10 Firm

Funding stage: Early-stage — typically between seed and series A

As put by the team at Bluestein Ventures, “We look for that magic combination of strategic vision + flawless execution. We’re inspired by visionary entrepreneurs that challenge the status quo – purpose-driven teams that are hungry to change the paradigm – and translate that into action. Entrepreneurs are our focus. As experienced investors, we know the journey isn’t easy. That’s why we’re here to partner with you to help you succeed.”

Check out some of Bluestein’s most popular investments below:

- Cultured Decadence

- Meati

- New Culture

8) AgFunder

Location: San Francisco, CA

Funding stage: Seed to Series B

As put by their team, “AgFunder is an online Venture Capital Platform based in Silicon Valley. AgFunder invests in exceptional and bold entrepreneurs who are aiming to build the next generation of great agriculture and food technology companies.”

The team at AgFunder has written checks anywhere between $50k and $900k in a round. They invest in companies across the globe. Some of AgFunder’s most popular investments include:

- Atomo Coffee

- Alpha Foods

- FieldIn

9) S2G Ventures

Location: Chicago, Boston, and San Francisco

Funding stage: Anywhere from seed to growth stage

As written by the team at S2G, “Our strategy reflects a growing appetite for investment that combines financial returns with positive long-term social and environmental effects. S2G has identified tough tech sectors that are ripe for change and is building a multi-stage portfolio of seed, venture, and growth stage investments and flexible solutions including debt and infrastructure capital.”

The team at S2G will invest across many stages and are focused on companies that benefit the environment and society. Check out a few of S2G Venture’s most popular investments below:

- AppHarvest

- Ripple

- Beyond Meat

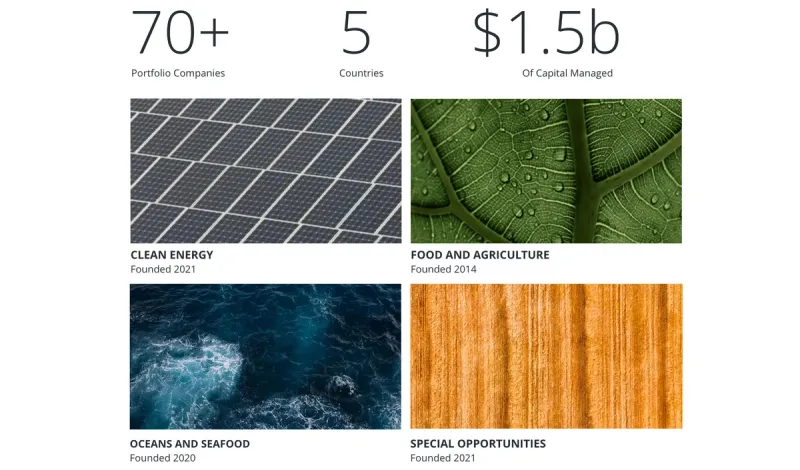

10) Blue Horizon

Location: Zurich, Switzerland

Funding stage: Seed to Series B

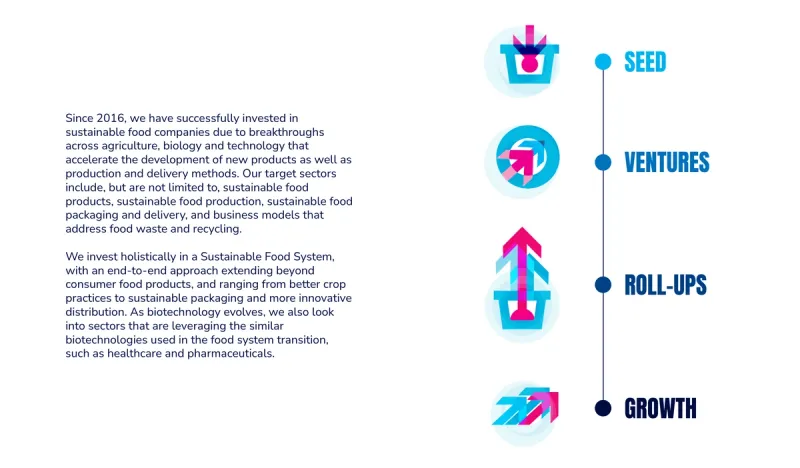

As written by the team at Blue Horizon, “Blue Horizon is accelerating the transition to a Sustainable Food System that delivers outstanding returns for investors and the planet. The company is a global pioneer of the Future of Food. As a pure play impact investor, Blue Horizon has shaped the growth of the alternative protein and food tech market. The company invests at the intersection of biology, agriculture and technology with the aim to transform the global food industry.”

Check out some of the most popular Blue Horizon investments below:

- Eat Just

- Impossible Foods

- Planted

11) Synthesis Capital

Location: London, England

Funding Stage: Series A, Series B, Series C

Synthesis Capital invests in game-changing founders, whose companies are transforming the food system through the synthesis of food technology and modern biotechnology.

Secure venture capital for your food tech startup with Visible

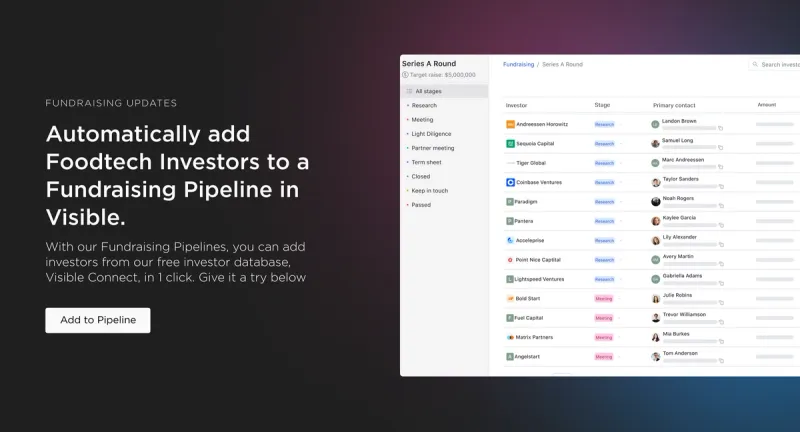

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.