Top Trends and Leading VCs Investing in D2C Brands: A Comprehensive Guide for 2024

Direct-to-consumer (D2C) brands sell their products directly to consumers, bypassing traditional retail intermediaries like wholesalers and distributors. This business model allows D2C brands to offer products at lower prices while maintaining greater control over the customer experience and brand narrative.

In recent years, D2C brands have significantly disrupted the retail industry. By leveraging digital platforms, these brands have not only reduced costs but also created personalized and engaging shopping experiences that traditional retailers find challenging to match. This shift has been driven by changing consumer preferences, technological advances, and the increasing importance of online shopping, significantly accelerated by the global pandemic.

In this article, we will explore key trends in the D2C industry, delve into what attracts investors to these companies, and highlight successful strategies for sustained growth. Additionally, you will find a curated list of top venture capitalists investing in D2C startups.

Benefits of the D2C Business Model

The D2C business model offers substantial benefits, including cost savings, enhanced customer experiences, and operational agility. These advantages drive growth and profitability and position D2C brands to compete effectively in an ever-evolving retail landscape.

Eliminating the Middleman: Cost Savings and Pricing Advantages

One of the primary benefits of the D2C business model is the elimination of intermediaries such as wholesalers, distributors, and traditional retail outlets. By cutting out these middlemen, D2C brands can significantly reduce their costs, allowing them to offer competitive pricing to consumers. These savings can be reinvested into the business, whether it's through enhanced product quality, marketing efforts, or customer service initiatives. The direct relationship with customers also enables D2C brands to maintain higher profit margins than traditional retail models, providing a financial foundation for sustainable growth.

Enhanced Customer Experiences: Personalization and Direct Engagement

D2C brands have a unique advantage in creating personalized and engaging customer experiences. These brands gather valuable data on customer preferences, purchasing behavior, and feedback by selling directly to consumers. This data can be used to tailor marketing strategies, product recommendations, and overall customer interactions. The result is a highly personalized shopping experience that resonates with consumers on a deeper level, fostering brand loyalty and repeat purchases.

Direct customer engagement allows D2C brands to build strong, authentic relationships. Through social media, email marketing, and other digital channels, brands can communicate directly with their audience, promptly addressing their needs and concerns. This level of interaction enhances customer satisfaction and provides brands with real-time insights to continuously improve their offerings.

Related resource: Video: Shopify Ecommerce Dashboard

Agile and Adaptable Business Operations

The D2C model inherently promotes agility and adaptability, crucial traits in today's fast-paced market environment. Without the constraints of traditional retail systems, D2C brands can quickly respond to market trends, consumer demands, and industry changes. They can experiment with new products, marketing campaigns, and business strategies with minimal risk and immediate feedback.

This flexibility extends to supply chain management as well. D2C brands often have more control over their supply chains, enabling them to optimize processes, reduce lead times, and ensure product quality. The ability to swiftly adapt to disruptions, such as those experienced during the pandemic, further highlights the resilience of the D2C model.

Related resource: Top VCs Driving Transformation in Supply Chain and Logistics

Key Trends in the D2C Industry

By staying ahead of the following key trends, you can position your D2C brand for continued growth and success. Embrace the digital transformation, leverage technology, commit to sustainability, and harness the power of social media to connect with your audience in meaningful ways.

Integration of Technology and Data Analytics for Personalized Experiences

Integrating advanced technology and data analytics is a game-changer for D2C brands. Leveraging AI and machine learning allows you to analyze customer data more effectively, leading to highly personalized shopping experiences. Personalized emails, product recommendations, and targeted advertising can significantly boost customer engagement and conversion rates. Implementing robust analytics platforms helps you understand customer behavior, identify trends, and make data-driven decisions to refine your marketing and product strategies.

Sustainability and Ethical Practices in D2C Brands

Consumers today are more conscious of sustainability and ethical practices than ever before. As a D2C founder, embracing these values can differentiate your brand and build stronger connections with your audience. Consider adopting sustainable materials, ethical manufacturing processes, and transparent supply chains. Highlighting your commitment to social and environmental responsibility in your branding and marketing efforts can attract a loyal customer base that values sustainability.

Increasing Importance of Social Media and Influencer Marketing

Social media has become vital for D2C brands to reach and engage with their target audience. Platforms like Instagram and TikTok offer opportunities to showcase your products, tell your brand story, and interact with customers in real-time. Influencer marketing, in particular, has proven effective in building brand awareness and trust. Collaborating with influencers who align with your brand values can amplify your reach and drive authentic engagement. Developing a comprehensive social media strategy that includes regular content updates, interactive posts, and partnerships with relevant influencers is essential to maximize your brand's visibility and impact.

Why Investors Are Interested in D2C Companies

Higher Valuations and Rapid Growth Potential

Investors are increasingly attracted to D2C companies due to their potential for high valuations and rapid growth. The direct-to-consumer model allows brands to scale quickly by leveraging digital channels and bypassing traditional retail constraints. This scalability and the ability to maintain higher profit margins make D2C businesses highly appealing investment opportunities. As a D2C founder, demonstrating a strong growth trajectory and market potential can significantly enhance your attractiveness to investors.

Case for Long-Term Success

While the pandemic accelerated the shift to e-commerce, investors are looking for D2C companies to sustain success beyond this boom. They seek businesses with solid foundations, innovative strategies, and the ability to adapt to changing market conditions. Emphasizing your brand's resilience, adaptability, and long-term vision can help build investor confidence. Highlighting how your business is well-positioned for future growth is crucial.

Importance of Innovative Tech Stacks and Engaging Customer Experiences

Investors prioritize D2C companies that leverage cutting-edge technology to enhance their operations and customer experiences. A robust tech stack, including advanced analytics, AI-driven personalization, and seamless e-commerce platforms, can set your brand apart. Demonstrating how you use technology to optimize marketing, streamline supply chains, and personalize customer interactions will resonate with investors. Creating engaging and memorable customer experiences is paramount. Showcasing your commitment to customer satisfaction and retention through innovative solutions can make your brand attractive to potential investors.

Related resource: 20+ VCs Investing in E-commerce and Consumer Product

Key Factors Investors Look for in D2C Companies

To attract investment, it’s essential to understand the key factors investors look for in D2C companies:

- Scalability: Investors seek brands with the potential to scale rapidly. Highlight your plans for market expansion, product diversification, and scaling operations efficiently.

- Strong Brand Identity: A compelling brand story and a clear value proposition are critical. Investors are drawn to brands that resonate with their target audience and have loyal customers.

- Financial Health: It is crucial to demonstrate solid financial performance, including revenue growth, profitability, and prudent cash flow management. Providing detailed financial projections and a clear path to profitability can instill confidence.

- Customer Acquisition and Retention: Effective strategies for acquiring new customers and retaining existing ones are essential. Investors look for a balance between customer acquisition costs and lifetime value.

- Innovative Marketing Strategies: Showcase your ability to effectively leverage digital marketing, social media, and influencer partnerships. Highlight successful campaigns and your approach to staying ahead of marketing trends.

- Adaptability: Investors value brands that can pivot and adapt to market changes. Sharing examples of how your brand has navigated challenges and embraced opportunities will strengthen your case.

Related resource: Key Metrics to Track and Measure In the eCommerce World

List of Leading D2C Venture Capitalists Investing in 2024

Lightspeed Venture Partners

- Location: Menlo Park, California

- About: Lightspeed Venture Partners is a venture capital firm that is engaged in the consumer, enterprise, technology, and cleantech markets.

- Thesis: The future isn’t built by dreamers. It’s built today, by doers.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Cycognito,

- Kodiak Robotics

- Flink

- Netskope

Forerunner Ventures

- Location: San Francisco, California, United States

- About: VC firm investing in transformative B2C & B2B companies defining a new generation of business, with an eye on the consumer.

- Investment Stages: Seed, Series A, Series B, Growth

- Popular Investments:

- Curated

- Humane

- Clay

Bolt

- Location: San Francisco, California, United States

- About: Bolt is a pre-seed and seed-stage venture firm focused on investing at the intersection of the digital and physical worlds.

- Thesis: Investing at the intersection of the digital and physical worlds

- Investment Stages: Pre-Seed, Seed

- Popular Investments:

- Droplette

- Point One Navigation

- Nautilus Biotech

Menara Ventures

- Location: Tel Aviv, Israel

- About: A publicly traded VC investing in early-stage Digital Transformation startups.

- Investment Stages: Pre-Seed, Seed, Series A

- Popular Investments:

- Matics

- Pairzon

- Revuze

- Leo

Maveron

- Location: San Francisco, California, United States

- About: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

- Thesis: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- BookClub

- Daring Foods

- Thirty Madison

Felix Capital

- Location: London, England, United Kingdom

- About: We are a venture capital firm for the creative class, operating at the intersection of technology and creativity. We focus on digital lifestyle, investing in consumer brands and related enabling-technologies. Our mission is to be a partner of choice for entrepreneurs with big ideas, and help them build strong brands that stand out and have a positive impact on the world.

- Investment Stages: Both early and growth stages

- Popular Investments:

- Leocare

- Rally

- Mirakl

Andreessen Horowitz

- Location: Menlo Park, California, United States

- About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

- Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Merit

- Envoy

- Wonderschool

7 Percent Ventures

- Location: London, England, United Kingdom

- About: Early stage tech investing in UK, EU & US. Seeking the most ambitious founders with deeptech or transformative moonshot ideas to change the world for the better.

- Thesis: We invest in early stage tech startups which represent billion dollar opportunities.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Dent Reality

- Breeze, Humanity

- Koru Kids

Flow Capital

- Location: Toronto, Ontario, Canada

- About: Flow Capital provides founder-friendly growth capital for high-growth companies.

- Thesis: Providing venture debt and revenue-based financing for asset-light, high-growth businesses.

- Investment Stages: Series A, Series B, Series C, Alt. VC, Growth

- Popular Investments:

- Ask.Vet

- Kovo HealthTech Corporation

- Everwash

Quadia

- Location: Geneva Paris, Switzerland

- About: Founded in 2010, Quadia specializes in direct impact investments, though equity, debt and funds. In line with its mission «we finance the solutions for a regenerative economy», Quadia targets companies which have positioned their business model and strategic development on products and services that contribute to a regenerative economy. These transformative companies operate in the areas of sustainable food, circular products & materials, and clean energy.. An internal impact management methodology is implemented by Quadia in collaboration with each portfolio company, allowing it to go beyond simple measurement of impact, promoting an environmental and social transition among all its stakeholders. Since its creation, Quadia has financed over 45 companies, projects and investment funds for the equivalent of EUR 220 million.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Popular Investments:

- Hungry Harvest

- The Renewal Workshop

- Dott. CETIH

SuperAngel.Fund

- Location: New York City, New York, United States

- About: SuperAngel.Fund is an early stage fund that invests in Consumer, PropTech & Future of Work. The fund is led by Ben Zises who was the first investor and founding advisor to quip, Caraway & Arber, before each had its name. The fund launched on January 1, 2021 and currently has more than 100 investors. To date, I’ve invested over $6m into 50+ companies, including my angel, syndicate and fund investments.

- Thesis: Consumer (CPG, eCommerce infrastructure), PropTech & Future of Work.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Hurry

- Haus

- Caraway

Related Resource: 12 New York City Angel Investors to Maximize Your Funding Potential

CRV

- Location: Palo Alto, California, United States

- About: Charles River Ventures is one of the oldest and most successful venture capital firms. Companies like Cascade, CIENA, Chipcom, NetGenesis, Parametric Technology, Sonus, Speechworks, Stratus Computer, Sybase, Vignette and dozens more have gone from idea to reality with the financial, managerial and visionary backing of CRV. The firm’s investment returns are consistently among the highest of venture capital.

- Thesis: We are an equal partnership – figuratively and economically.

- Investment Stages: Seed, Series A, Series B, Growth

- Popular Investments:

- Fractional

- Cord

- Cradlewise

Cowboy Ventures

- Location: Palo Alto, California, United States

- About: Cowboy Ventures is a seed-stage focused fund investing in digital startups.

- Thesis: We seek to back exceptional founders who are building products that “re-imagine” work and personal life in large and growing markets – we call it “Life 2.0″

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- Drata

- Mon Ami

- Hone

Craft Ventures

- Location: San Francisco, California, United States

- About: Craft Ventures is an early-stage venture fund specializing in the craft of building great companies.

- Thesis: We invest in outstanding teams that are creating market-defining products.

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- Trusted

- SUPERPLASTIC

- Voiceflow

Creandum

- Location: Stockholm, Stockholms Lan, United States

- About: Creandum is a leading European early-stage venture capital firm investing in innovative and fast-growing technology companies.

- Thesis: We are a venture capital advisory firm powering innovation from Stockholm, Berlin, and San Francisco.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Lokalise

- Cake

- Pleo

- Craft Docs

To learn more about Lightspeed Venture Partners, check out their Visible Connect Profile here.

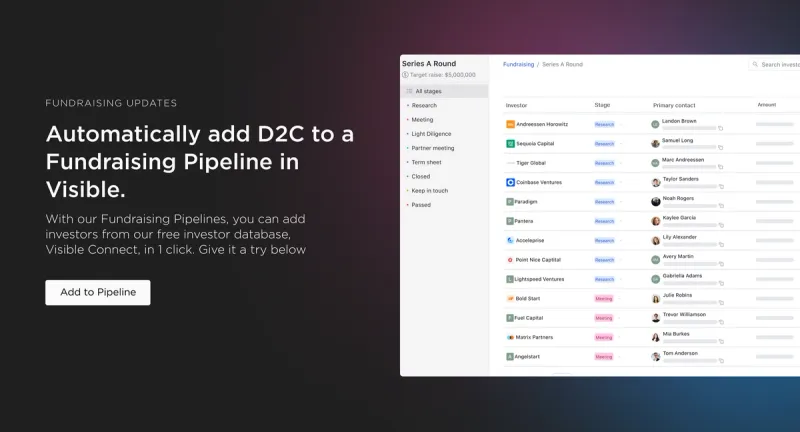

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Other Helpful D2C Resources

- Billion-Dollar Brand Club

- Get all the strategies and insights you need to take your brand direct to consumer in Shopify’s The Direct to Consumer Guide.

- ProfitWell’s Direct To Consumer Statistics & Trends to Grow Your DTC Business

- Twitter Threads about #dtc + @DTCNewsletter

- Sharma Brands is a firm that invests, advises, and operates to build brands.