The creator economy is rapidly transforming the global economy, driving billions of dollars in value as it reshapes how content is created, distributed, and monetized. At the intersection of technology and creativity, startups within the creator economy are pioneering innovative platforms and tools that empower individuals to turn their passions into professions. This rapidly growing sector not only offers vast opportunities for creators but also attracts significant attention and investment from venture capitalists keen to support the next wave of digital innovation.

What is the creator economy?

In today's digital age, the "creator" embodies a broad and dynamic role, reflecting the vast opportunities for individual creativity and entrepreneurship online. A creator is anyone who produces content across various platforms to engage, entertain, or educate an audience, leveraging digital tools and social media to monetize their skills and passions. This definition spans from writers, artists, and musicians to influencers, vloggers, and podcasters, among others, who utilize platforms like YouTube, TikTok, Instagram, and Twitch to share their work and generate revenue through ad shares, sponsorships, merchandise sales, and more.

The creator economy has democratized content production and distribution, enabling individuals to turn their passions into professions without the traditional barriers of entry like access to large capital or institutional gatekeepers. With just a smartphone and internet access, creators can reach a global audience, exemplified by individuals who have gained fame and financial success through platforms like TikTok and YouTube with minimal initial investment.

In the evolving landscape of the creator economy, founders, content creators, and VCs are witnessing a dynamic shift towards diversified revenue streams beyond traditional brand partnerships. The spotlight has increasingly turned towards direct audience monetization strategies, including digital product sales, affiliate marketing, ad revenues, and brand deals.

This shift underscores the importance for stakeholders in the creator economy to innovate and adapt. For creators, it's about embracing new technologies and platforms to engage with audiences and monetize their content effectively. For founders and VCs, the emphasis is on investing in and developing tools that support creators in these endeavors, recognizing the value of direct audience relationships and the growing independence of creators from traditional advertising models.

It's not just about creating content but also about understanding the ecosystem's business models, audience engagement strategies, and monetization mechanisms. As the creator economy continues to evolve, staying informed and adaptable will be key to leveraging its potential for individual growth and investment opportunities.

Related Resource: 18 Pitch Deck Examples for Any Startup

Creator Economy Areas of Investment

VCs are investing in tools to help influencers operate and monetize. Here are some examples of the areas of focus that we gathered from SignalFire’s Creator Economy Market Map.

Related Resource: 14 Gaming and Esports Investors You Should Know

Content Creation Tools

- Video

- Photography / Graphic Design

- Motion Photos

- Music

- Podcast

Influencer Marketing

- Specialized Influencer Marketing Agencies.

- Influencer Marketing Platforms and Marketplaces:

- CRM Tools

Patronage Platforms

- Ad Hoc Project-Based Funding

- Kickstarter, Indiegogo, and GoFundMe

- Subscription-Based Funding

- Tip Jar Concept

- Ko-fi and Buy Me a Coffee

Other Opportunities

- Community Engagement Tools

- Finance Management Tools

Key Insights for Founders in the Creator Economy Space

We pulled some key insights from ConverKits State of the Creator Economy 2024 Report:

Shift in Preferred Content Formats

Written Content Dominates: Contrary to previous predictions, written content such as emails, newsletters, articles, blog posts, and books has emerged as the most popular and lucrative form of content. In 2023, 58% of creators produced emails or newsletters, and 51% focused on articles, blog posts, or books.

Decline in Short-Form Videos: The percentage of creators making short-form videos decreased significantly, dropping from 45% in 2022 to 23% in 2023. This trend suggests a pivot away from platforms like TikTok towards more substantial, written content.

Gender Pay Gap Progress

Closing Income Disparity: The creator economy is witnessing a positive trend towards earning equality. The percentage of female creators earning six figures or more has increased, reflecting a closing gender pay gap.

Notable Female Creators: Examples of successful female creators include Bonnie Christine, Nisha Vora, XayLi Barclay, and Chaitra Radhakrishna, who have built substantial businesses and incomes in the creator space.

Transition from Traditional Jobs

Leaving 9-5 Jobs: A significant number of creators are leaving traditional salaried jobs to focus on their creator businesses. Economic uncertainty and layoffs have spurred this shift, with creators seeking more control over their income and career.

Income Expectations and Speed: Many creators expect to earn more from their creator businesses in 2024 compared to 2023, with full-time creators often starting to make money within their first year of operation.

Diverse Income Streams

Multiple Revenue Sources: Full-time creators typically have six or more income streams, compared to hobbyists and part-timers who have fewer. This diversification is key to their financial stability and growth.

Top Income Sources: Professional services (36%), digital products (18%), advertising (11%), and affiliate marketing/links (10%) are among the top ways creators earn their income.

Generational Differences in the Creator Economy

Cultural Differences Between Generations: Generational differences are evident in the creator space. Gen-Z, known as the side-hustle generation, accounts for the largest share of hobbyists and part-time creators. While 87% of Gen-Z creators earn under $10,000 a year, there are positive trends for this group. Initially, around 3% of Gen-Z respondents were full-time creators; now, about a quarter of all Gen-Z creators make a full-time living from their business.

Actionable Insights for Startup Founders

Focus on Written Content: Prioritize developing solutions for written content, as this format has proven to be both popular and profitable for creators.

Facilitate Career Transitions: Provide resources and guidance for creators looking to transition from traditional jobs to full-time creator roles.

Diverse Revenue Models: Help creators develop multiple income streams to enhance their financial resilience and growth potential.

Top 8 VCs Actively Investing in the Creator Economy

Venture capitalists play a crucial role in fueling the growth of the creator economy by providing the necessary capital and resources for startups to thrive. Here are eight leading VCs that are making significant investments in this sector:

1. SignalFire

Location: San Francisco, California, United States

About: SignalFire is a venture capital firm that invests in seed-stage companies and breakout companies.

Investment Stages: Seed, Series A, Series B

Popular Investments:

- OneSignal

- Ledger Investing

- Join

2. Antler

About: Antler is a global startup generator and early-stage VC that is building the next big wave of tech. With the mission to turn exceptional individuals into great founders, Antler aims to create thousands of companies globally.

Thesis: We identify and invest in exceptional people

Investment Stages: Pre-Seed, Seed

Popular Investments:

- Mast Technologies

- Upflowy

- Appboxxo

3. Harlem Capital

Location: New York, United States

About: Harlem Capital is an early-stage venture firm that invests in post-revenue tech-enabled startups, focused on minority and women founders.

Thesis: Women or POC founders (no deep tech, bio, crypto, hardware)

Investment Stages: Seed, Series A, Series B, Growth

Popular Investments:

- Lami

- Gander

- The House of LR&C

4. Night Ventures

Location: Texas, United States

Thesis: Our LPs are 50+ of the top creators in the world across YouTube, TikTok, Twitch and elsewhere. Together, we specialize in influence – understanding what’s popular, what’s trending and how to acquire more customers/fans of your product.

Popular Investments:

- Moonpay

- Pearpop

- Beacons

5. Slow Ventures

Location: San Francisco, California, United States

About: Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

Thesis: Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

Investment Stages: Seed, Series A

Popular Investments:

- Juice

- Stem

- Human

6. Behind Genius Ventures (BGV)

Location: Los Angeles, California, United States

About: Behind Genius Ventures invests in pre-seed/seed stage companies centered around product-led growth. Co-Founded by two Gen Z investors: Joshua Schlisserman and Paige Doherty.

Investment Stages: Pre-Seed, Seed

Popular Investments:

- Decaf

- Impulse

- Maca Payments

7. Crush Ventures

Location: LA and NYC

About: We formed Crush Ventures to focus on early stage investing at the intersection of media, culture, and commerce. To founders, we bring to bear our capital, operating expertise and powerful relationship network earned from two decades spent building Crush Music into a global powerhouse.

Thesis: We invest in founders building the future of how talent will discover, engage, and monetize fans.

Investment Stages: Pre-Seed, Seed

RPopular Investments:

- Beacons

- Create O/S

- Splice

8. Freestyle Capital

Location: California, United States

About: Freestyle is an early-stage VC with $565M+ AUM & investments in 150+ tech co’s like Airtable, Intercom, Patreon, BetterUp and Snapdocs.

Thesis: We are high-conviction, low-volume investors and invest in only 10-12 companies each year. This gives us the freedom to work closely with founders, and holistically support our companies. We typically lead Seed rounds with a $1.5M — $3M check. We make decisions efficiently and are 100% transparent with you along the way. We invest in founders building soon-to-be massive tech companies across many verticals.

Investment Stages: Pre-Seed, Seed

Popular Investments:

- Spot

- Change

- Grain

9. SevenSevenSix

Location: They are a remote-first company with locations in Miami and Los Angeles

About: Seven Seven Six is a venture capital firm founded by Alexis Ohanian, co-founder of Reddit, with a mission to invest in bold and ambitious startups that have the potential to significantly impact their industries and communities. Established in 2020, Seven Seven Six focuses on early-stage investments, providing not only capital but also strategic guidance and support to help founders scale their businesses effectively.

Thesis: The firm has a strong focus on the creator economy, supporting platforms and tools that enable creators to monetize their work and engage with their audiences. Additionally, Seven Seven Six invests in sectors such as consumer technology, blockchain, and fintech, always looking for disruptive innovations that can redefine industries.

Investment Stages: Seed

Popular Investments:

- Dispo

- Pearpop

- Simulate

10. Creandum

Location: Stockholm, Berlin, and San Francisco

About: Creandum is a leading European early-stage venture capital firm investing in innovative and fast-growing technology companies.

Thesis: We are a venture capital advisory firm powering innovation from Stockholm, Berlin, and San Francisco.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Popular Investments:

- Depop

- Kahoot!

- Spotify

11. R/GA Ventures

Location: New York, USA

About: R/GA Ventures is a venture capital firm that partners with startups to build and scale their businesses. It leverages the resources of R/GA, a globally recognized innovation consultancy, to provide startups with strategic guidance, mentorship, and access to a vast network of industry experts. R/GA Ventures focuses on fostering innovation in various industries by helping startups develop transformative products and services.

Thesis: Focusing on companies that are at the intersection of technology, design, and digital innovation. Their thesis revolves around backing startups that leverage technology to disrupt traditional industries and create new market opportunities. R/GA Ventures aims to support startups that are developing cutting-edge solutions in areas such as AI, IoT, digital media, and the creator economy.

Investment Stages: Early-stage startups, including Seed and Series A rounds

Popular Investments:

- Cameo

- Teachable

- SuperPhone

Alternative Funding for Creator Economy Founders

Along with VC, accelerators and incubators, you can consider Gumroad’s new innovative funding model.

- Gumroad’s Creator Investing Play: Gumroad, an ecommerce platform helping creators sell digital products, offers a unique funding alternative to traditional venture capital. Instead of pursuing equity, Gumroad buys a 10% stake in creator-led businesses, providing checks ranging from $100K to $500K directly to creators. This approach allows creators to maintain full control over their business while Gumroad receives regular dividends on the business’s earnings.

- Benefits of Gumroad’s Model: This funding model aligns with creators' needs and goals, emphasizing sustainability and revenue growth over exits or liquidity events. Sahil Lavingia, Gumroad’s founder, highlights that creators have a competitive advantage due to their deep audience connection, quick adaptability, and authenticity as founders and business leaders.

- Addressing Growth Challenges: Despite the growth of creator-led startups, there remains a lack of clear blueprints for scaling while maintaining brand integrity. Lavingia points out that aspects like hiring teams, managing expenses, and balancing growth with creativity are still uncharted territory. However, initiatives like Gumroad's funding model aim to address these challenges and provide a path forward for creators.

Related resource: 10 Top Incubators for Startups in 2024

Top 8 Content Creation and Creator Economy Startups

As venture capital continues to flow into the creator economy, numerous startups have emerged as leaders in facilitating content creation, distribution, and monetization. These companies are at the forefront of innovation, providing creators with the tools and platforms they need to succeed in a digital-first world.

Related Resource: 7 Startup Growth Strategies

1. Caffeine

Caffeine is a live-streaming platform that focuses on gaming, sports, and entertainment content. Founded by Ben Keighran and Sam Roberts, it went live in early 2018 and has quickly gained traction among users and creators alike. Caffeine distinguishes itself by emphasizing interactive and real-time engagement between broadcasters and their audiences, aiming to create a more dynamic and engaging experience than traditional broadcasting platforms.

- Location: Redwood City, California.

- Funding Rounds and Amount Raised: Caffeine has successfully raised significant funds through various rounds. In September 2018, it secured a $100 million investment from 21st Century Fox. As of 2019, the company had raised $146 million from investors across three rounds, including prominent names like 21st Century Fox, Andreessen Horowitz, and Greylock Partners.

2. Spotter

Spotter is an innovative startup that has carved a unique niche within the creator economy, focusing on YouTube content creators. It offers a financial model that provides creators with upfront cash for licensing their existing or upcoming content. This approach is designed to assist creators in scaling their brands, funding ambitious projects, and growing their businesses more efficiently. Spotter’s model is likened to a venture capital investment but for the digital content creation space, aiming to secure a stake in the future success of these creators by investing in their content libraries.

- Location: Los Angeles, California.

- Funding Rounds and Amount Raised: A significant milestone was a $200 million Series D funding round led by SoftBank Vision Fund 2, part of a combined $755 million raised across this and other undisclosed rounds. This influx of capital has elevated Spotter's valuation to $1.7 billion. The company plans to invest $1 billion directly into its YouTuber partners to assist in their business growth. Spotter's total funding has reached $240.6 million, underscoring its robust financial backing and confidence from investors.

3. Jellysmack

Jellysmack leverages machine-learning technology and data analytics to create and optimize video content for social media platforms. Founded in 2016, it aims to identify social video trends, optimize video performance, and uncover niche audience segments to build vibrant communities around content creators. Jellysmack is known for its innovative approach to the creator economy, helping creators amplify their reach and monetization across multiple platforms.

- Location: New York with additional offices in Los Angeles, Corte, Corsica, Paris, and London.

- Funding Rounds and Amount Raised: Jellysmack has secured $16 million in total funding.

4. Passionfroot

Passionfroot provides a unified no-code platform for creators, focusing on simplifying their business operations. It offers tools for storefront management, CRM, collaborations, and cash flow, targeting younger millennial & GenZ creators and small media brands, particularly those involved in B2B monetization like sponsorships and ad placements.

- Location: Berlin, Germany.

- Funding Rounds and Amount Raised: Raised €3.4 million in a pre-seed funding round.

5. Stir

Stir is a platform designed to help digital creators manage their revenue streams, analytics, and collaborations. It facilitates the sharing of funds among collaborators, aiming to streamline the financial aspects of content creation. The startup has introduced tools like Collectives for shared financial management among creators.

- Location: San Francisco, California.

- Funding Rounds and Amount Raised: Stir raised $4 million in a seed funding round with contributions from notable investors including Casey Neistat, YouTube co-founder Chad Hurley, and others.

6. Kajabi

Kajabi, founded in 2010 by Kenny Rueter, is a SaaS platform designed for creators and entrepreneurs to create, market, and sell digital content. It has quickly risen to prominence as a tech unicorn, valued at $2 billion. The platform supports creators across various niches, offering tools for online courses, membership sites, and more, emphasizing its role in the booming creator economy. With a mission to empower digital entrepreneurs, Kajabi has facilitated over $3 billion in sales, serving thousands of users worldwide.

- Location: Irvine, California.

- Funding Rounds and Amount Raised: In November 2019, Kajabi received its first outside investment from Spectrum Equity Partners. A significant funding milestone was reached in May 2021 with a $550 million round led by Tiger Global, along with TPG Capital, Tidemark Capital, Owl Rock, Meritech Capital, and Spectrum Equity, catapulting Kajabi to a $2 billion valuation.

7. Linktree

Linktree, launched in 2016 by co-founders Alex Zaccaria, Anthony Zaccaria, and Nick Humphreys, revolutionized the way individuals and businesses manage their online presence. Conceived as a solution to the limited link options on social media platforms, Linktree enables users to share multiple content links through one bio link, facilitating a centralized online presence. This technology startup quickly became a staple tool for influencers, creators, publishers, and brands, seeking to streamline their digital footprint. The platform's user-friendly interface and versatile application across various social media sites have propelled its growth, making it a critical tool in the digital arsenal of the modern internet user.

- Location: Melbourne, Australia, with additional operations in Darlinghurst, NSW, Australia.

- Funding Rounds and Amount Raised: Linktree has raised over a series of 4 rounds with a total of $176.2 million invested.

8. Sagespot

SageSpot, established in 2020, emerges as a transformative player within the creator economy, offering a subscription-based social media platform. This innovative platform distinguishes itself by empowering creators to foster interest-based communities, enabling a direct monetization path through engaged and dedicated followers. By focusing on this model, SageSpot aims to rectify the monetization challenges creators face on legacy platforms, providing a more sustainable and creator-focused alternative for monetizing content and personal brands. The platform's focus on subscription-based models offers a promising alternative to ad-revenue dependency, potentially leading to a more sustainable and fulfilling creator-follower relationship.

- Location: New York.

- Funding Rounds and Amount Raised: $5.6 million led by Khosla Ventures.

Related Resource: 7 Essential Business Startup Resources

Looking for Funding? Visible Can Help- Start Your Next Round with Visible

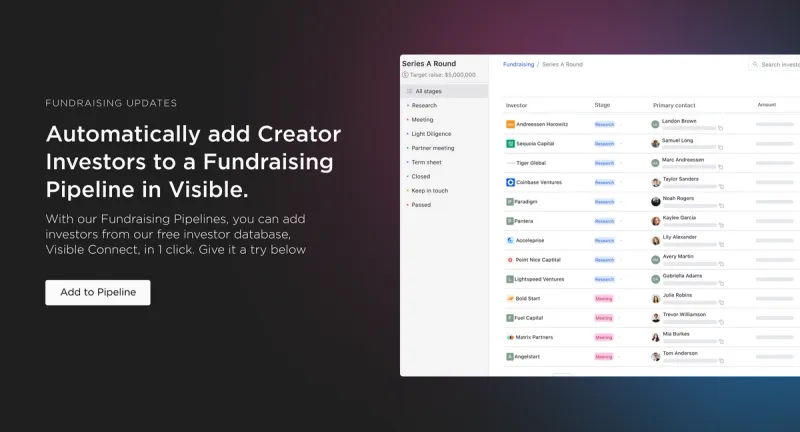

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here and check out Visibles Fundraising page: https://visible.vc/fundraising

Related resources: