Business Storytelling

Looking for a New Year’s Resolution? Keep reading!

Storytelling in business has become a clear competitive advantage over the past decade. Customers, investors and talent have more choices than ever and are armed with more information than ever. Companies that can effectively tell their story will create emotional engagement with their stakeholders, cut through the noise and ultimately drive growth.

In relation to fundraising, storytelling is a crucial component of driving interest and ultimately term sheets. This is especially true in the early stages as checks are written more on vision than traction.

There are a lot of great resources for storytelling in relation to fundraising so check back for Part II next week for storytelling specifics.

Today I wanted to focus on one often overlooked part of fundraising & storytelling and that is “connecting the dots”. Simply put, how do you create a cadence with potential investors and consistently drip information so that when you are fundraising trust is established and momentum can be created.

As with my things in life, what you invest in is what you’ll get out. Fundraising is no different. Investing in stakeholder relationships early on and putting in the effort will pay dividends down the line. While fundraising is legally a “transaction” it is far from one to actually get there.

(Sidenote: fundraising is a funny thing isn’t it? Investors tell you are fundraising 24/7/365 but they also tell you to tell investors you are not fundraising.)

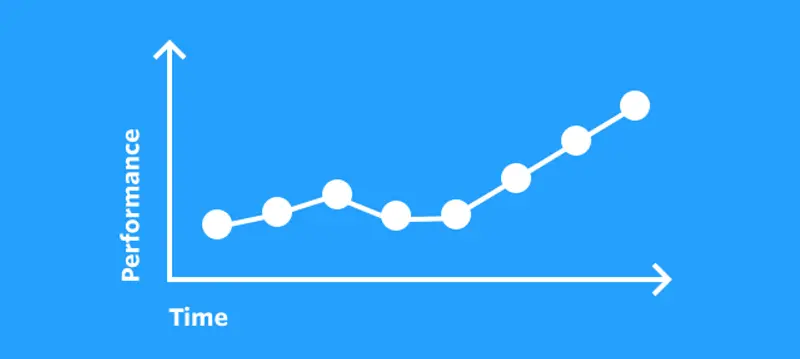

Seasoned investors won’t invest on their first interaction. They invest in lines & trends. They want as many data points as possible before make a decision. Afterall trends tell a story. Mark Suster penned this perfectly over 7 years ago in, “Invest in Lines, Not Dots”.

“Most importantly tell them what you plan to achieve by the next time you see them. Hopefully by then you’ve made good progress. You’ll be able to give them an update on key hires, pilot customers, key tech innovations — whatever. Keep these interactions low-key and short. Quick coffees, whatever. Swing by their offices to make it easy for them to say yes and promise not to take up more than 30 minutes for the update (and stick to it).”

Your interactions with stakeholders might look like this before you are officially fundraising:

Each one of these dots represents an interaction and the chance to further tell your story. Over time you’ll build the trend and establish a rapport. You’ll be surprised how your entire fundraising process will change for the better. This doesn’t relate to just fundraising. It can be applied to key hires, potential acquirers and other key partners.

Want to put your marketing hat on? Utilize Visible Updates + Lists to drip updates to potential investors in between your in-person interactions. Sign up here!

Want to maximize your round competition and decrease decision marking time? Make sure to check out Part II.

Up & To the right,

Mike & The Visible Team