Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

Our Ultimate Guide to SaaS Metrics

Finding Your SaaS Metrics

The software-as-a-service industry has experienced rapid growth in the past few years. Typical SaaS companies have added staff at rates exceeding 50 percent a year. At the same time, not every SaaS company grows at the same rate. Rapid growth and the nature of this sort of business can also expose startups to certain vulnerabilities that other kinds of companies may not have to contend with.

On the positive side, digital companies should have access to the right SaaS metrics in order to track and manage growth. Take a moment to understand these important performance indicators to make certain they’re properly collected and analyzed. With the explosion of the SaaS industry has come the explosion of the resources and data surrounding the industry. There are more SaaS metrics benchmarks available than ever before to make sure that your company is on the right track.

Related Resource: Check out our free Google Sheet Template to track your key SaaS Metrics here.

Related Resource: How to Start and Operate a Successful SaaS Company

Churn Rates

New companies may focus upon customer acquisition. Still, businesses almost always find they spend less keeping loyal customers than always having to seek new ones. The nature of SaaS billing makes it even more important to ensure customers keep renewing their monthly or annual subscriptions. Typical forecasting depends upon customers keeping their accounts active.

With that in mind, consider a couple of churn rates to track:

Customer churn rate: This simply refers to customers lost within specific time periods. Hopefully, you can also enhance these SaaS metrics with information about why the churn rate may have either spiked or declined under various circumstances.

Revenue churn rate: A SaaS business model may include various prices, based upon the number of unique accounts or levels of features or services. Hopefully, customers upgrade over time; however, if they’re not, SaaS companies should find out why.

Customer Value & Cost Metrics

SaaS businesses should track various SaaS metrics that help them compare the costs and revenues associated with acquiring and keeping customers. This helps them understand if they need to improve marketing, retention, and various other areas.

Customer Lifetime Value

You can estimate the lifetime value of your customers by following these steps:

Estimate your customer lifetime rate with this formula: 1/average churn rate. With an average churn rate of one percent, for example, your CLR would be 100.

Divide monthly revenue by the number of customers to calculate your average revenue per account, or ARPA. For example, 100 customers and a monthly revenue of $100,000 would work out to an ARPA of $1,000.

Finally, calculate the customer lifetime value, or CLV, by multiplying the ARPA by the CLR. In the example above, your CLV would be 1,000 X 100 = $100,000.

You can use the CLV to help you estimate the lifetime value of each customer. Companies can also use this handy metric to illustrate their value to investors.

Customer Acquisition Cost

After estimating how much value an average customer contributes to a SaaS business, it’s important to balance that against the price of acquiring them. Obviously, businesses need to compare these two numbers to demonstrate their business model’s viability. To accomplish this SaaS companies track their customer acquisition cost. The customer acquisition cost is the monetary cost it takes to acquire one new customer. Presumably with a SaaS company the cost of acquisition will lower as they acquire more customers. Simply divide all marketing and sales expenses by the number of customers acquired during a given month. If a SaaS company spent $10,000 to gain 10 new accounts, the CAC would be $1,000.

Related Resource: Customer Acquisition Cost: A Critical Metrics for Founders

Months to Recover Acquisition Cost

Figure out how long it takes for a business to recoup their acquisition costs by using customer acquisition cost, monthly gross margin, or MGM, and monthly recurring revenue. Your formula would look like this: CAC / (MGM X MRR).

Acquisition Cost to Lifetime Value Ratio

Such metrics as acquisition costs and lifetime value are only truly informative when compared to each other. Some financial experts will say that your LVR should exceed CAC by a factor of at least three. Ratios closer to one mean that you need to trim expenses. On the other hand, too large of a ratio may mean that you could spend more to gain even more business.

Customer Scores

Since SaaS businesses live and die by their ability to maintain customer subscriptions, they should consider SaaS metrics that help measure how well they keep customers active with their product subscriptions.

For instance:

Customer engagement: To create a customer engagement score, each business will need to figure out unique measures that apply to their product. Some examples could include how often customers login or stay logged in.

Customer health — Net Promoter Score: Similarly, companies should create customer health scores using factors that may indicate the likelihood of keeping accounts active or letting them expire. Seeking input from various players, like sales and customer service, can help develop good customer health scores.

Marketing Scores

Since new companies need to focus mostly upon custom acquisition, marketing scores will offer important insights for both marketers and upper management.

These SaaS metrics for marketing include:

Qualified marketing traffic: As your customer base grows, so will your traffic. For marketing, you need to separate prospects from existing customers when you analyze website visitors.

Qualified marketing and sales leads: Depending upon the SaaS product, the customer lifecycle can vary considerably. You can work to identify which step in the customer journey your leads are in. For instance, a qualified marketing lead may have already downloaded a marketing eBook or used a free demo. A qualified sales lead may have made a phone call and is ready for another contact.

Lead-to-customer rate: Sales and marketing can evaluate their effectiveness by analyzing ratios that tell them how many of their leads turn into customers, how long that takes, and so on. Taking steps to improve LTC rates should increase revenues.

Why SaaS Metrics Matter?

Good SaaS companies have a great chance to boom as their business model grows more popular. Still, SaaS companies may have their own vulnerabilities. For instance, some companies struggle to manage rapid growth as much as they might struggle to manage slow growth. While a business onboards many new customers, they also need to keep on eye on pleasing the customers they have already attracted.

At the same time, these digital businesses should have the luxury of easier metric collection. As is illustrated in the examples above, it’s not enough to simply collect gross numbers of website visitors or total revenue. Rapidly growing companies need to find the metrics that will help them make vital business decisions that can improve important business processes. That way, SaaS companies can attract investors, know who to hire, and adjust marketing and sales strategies to acquire and retain their customers.

Related Resource: Top SaaS Products for Startups

Related Resource: Who Funds SaaS Startups?

Related Resource: 20 Best SaaS Tools for Startups

The journey as a SaaS startup founder can often feel like you’re alone on the journey. Finding a reliable SaaS metrics benchmark can be an easy way to see how you are stacking up to your peers. With more data at our fingertips than ever before, there are more SaaS metrics benchmarks and tools available than ever before.

founders

Fundraising

7 Fundraising Takeaways From Our Webinar with Elizabeth Yin

Last week, we had the opportunity to talk to Elizabeth Yin of Hustle Fund. Elizabeth Yin is a co-founder and General Partner at Hustle Fund, a pre-seed fund for software entrepreneurs. Previously, Elizabeth was a partner at 500 Startups where she invested in seed stage companies and ran the Mountain View accelerator. In a prior life, Elizabeth co-founded and ran an adtech company called LaunchBit.

Our CEO, Mike, and Elizabeth chatted about all things related to fundraising. Elizabeth shared what she has seen in the VC market over the past few months and how founders can manage the supply and demand of their round. Check out the video recording or our favorite takeaways below:

Now is Actually a Good Time to Raise

Fundraising in good times and bad times is challenging. Fundraising over the past few months could almost feel impossible. Elizabeth saw her portfolio companies attempt to raise in early April and most struggled as larger firms slowed investment at the start of COVID. However, investors, both large and small, are quite active again. With US states beginning to open and more investors comfortable with making remote decisions investment activity has been picking up pace. With the uncertainty of a future lockdown in the US it may also be a good idea to raise now.

As Elizabeth puts it, “now is actually a good time to raise, especially from local investors.” In fact, Hustle Fund has even increased investment over the past 2 months.

Bifurcation of Terms

As Elizabeth puts it, “terms have been weird.” Elizabeth has been seeing a bifurcation of terms over the last few months. On one side, you have well networked founders raising at very high valuations similar to 2019. On the flip side, you have less networked founders raising at quite low valuations.

Why Invest Now?

When going out to raise it is important to understand how investors think to improve your odds of success. One of the first questions an investor will ask themselves is, “Why should I invest now?” However, most of the time “now” is not a great time for investors to make an investment. Generally, it is most beneficial for an investor to drag their feet as they can get more information and data.

So how do you make investors move faster? You need to make an investor feel like they cannot wait 6 months because the valuation will change and the deal won’t be on the table. As Elizabeth said, “your job is to generate demand on your deal from other investors… you want investors to basically be afraid of each other.” You can do this by running a strong process and talking to a LOT of investors.

Tranches Can Be Useful

When going out to raise a seed round it is difficult to get people to move faster on the deal. You have a large supply of your raise with little demand. At the earliest stages, investors rarely feel motivated to move quickly as the deal may still be on the table in 6 months. To help with this, Elizabeth suggests reducing the “supply of your round” using tranches.

As an example, Elizabeth uses a seed company going out to raise $2M total. This company may go out and raise a smaller tranche to create some demand from investors to move quickly. For example, if the smaller tranche is $500k investors may have a fear they will miss out as it is a smaller size round that is easier to raise. From here, it is a lot easier to go to larger investors as you can create some urgency around the round as you’ve already raised $500k.

While Elizabeth may be a black swan when it comes to her thoughts on tranches, it can certainly be a powerful way to manage the supply and demand of your round.

Customer Discovery… with Investors

If you are struggling to drum up any interest from investors you likely need to improve different aspects of the business. Feedback from investors can be a valuable asset for prioritizing your time. Elizabeth suggests harnessing customer development strategies when it comes to investors. While you may not hear back from most investors, getting feedback and data points from investors that rejected your company can be incredibly valuable. If you start to see a theme in why investors said no, that is a good indicator of where you need to improve your business.

Founders Should Fundraise Full Time

Elizabeth suggests that her founders do fundraising full time (when they set out to raise). This means that you are not working directly on the business. In a good raise, it can take anywhere from a few weeks to a few months to close your round. Juggling this and making sure the needle still moves without you there is challenging. Elizabeth promotes stacking your meetings so you may have 20+ meetings in a week as opposed to a handful. In the beginning, this is a great way to create urgency with investors. If you are taking second meetings and have a docket full of investor meetings, investors may feel the heat and move quicker.

Interested in joining our next webinar? Subscribe to the Founders Forward to stay up-to-date with our upcoming webinars.

founders

Metrics and data

Startup Metrics You Need to Monitor

You can’t improve what you don’t measure. Implementing metrics at your startup is a surefire way to bring focus to your entire organization. As David Skok, General Partner at Matrix Partners, puts it, “One of the greatest things about putting in place the right metrics is that showing them to people will automatically change their behavior to try to improve the metrics. Furthermore, the metrics make it clear what levers they can use to change performance.”

In addition to helping your team focus and grow. Metrics are often the first thing a potential investor will ask to see during a fundraise. As your company moves further and further through the venture fundraising lifecycle – from Seed to A to Growth rounds – the numbers gain importance in the overall story for the fundraise.

How do you know what metrics to track for your startup? We’ve laid out a few basic metrics to get you headed in the right direction.

Startup Sales Metrics

Metrics are vital to track in every aspect of a startup but are especially important when it comes to sales. Generally speaking sales metrics can be measured on an individual, team, or organization basis.

By setting up a strong system to track your sales metrics you will be able to make better informed go-to-market decisions.

Revenue Metrics

Revenue is the lifeblood of a for profit organization. Revenue can come in many shapes and sizes. There are startups that track monthly recurring revenue, annual recurring revenue, service revenue, and more.

There are generally two types of revenue for a SaaS company – the first is Subscription Revenue (called MRR or ARR). This is product focused revenue that is recurring and predictable — especially if you are able to sign customers to longer term agreements. Investors prefer this type of revenue because it signals a high quality product with a path to long-term profitability.

The second type of revenue is Services Revenue which often comes in the form on one-off (read: not predictable) consulting engagements or implementation fees. Because of the human-capital intensive nature of providing these services, they are far less profitable and scalable than Subscription Revenue.

Related Reading: What is a Startup’s Annual Run Rate? (Definition + Formula)

Annual Contract Value (ACV)

ACV is “the value of the contract over a 12-month period.” If you are seeing an uptrend in ACV over time (which is generally the goal), then your company is likely doing one or many of the following things:

Shifting to customers with a larger budget – more seats, usage, etc.

Employing a more effective sales strategy to convince customers to invest more heavily in your product

Building a product that continues to improve and provide increasing value

Effectively upselling existing customers

Increasing your annual contract value will allow your company to increase customer acquisition costs.

Pipeline Value

The pipeline value is exactly what it sounds like, the value of all active deals in your sales pipeline. For example, if you have 10 deals that are actively be sold but at different stages you can calculate the value of all deals with their likelihood of closing.

For those 10 deals, let’s say they are all worth $100 and:

3 are new deals with a 30% chance to close

3 deals have sat a call and are interested in buying with a 50% chance to close

4 deals have received a contract and are ready to sign with a 90% chance to close

That would be (3 new deals x $100 x 30%) + (3 calls sat deals x $100 x 50%) + (4 contract deals x $100 x 90%) = $600 in pipeline value. You can also break this number down by different stages. For example, the pipeline value of your new deals from the example above would be $90.

Understanding your pipeline value gives you a good understanding of the health of your current pipeline and can help with future forecasts.

Activity Sales Metrics

Activity sales metrics can be used to track individual reps and teams efforts on a daily or weekly basis. A few examples of activity sales metrics would be number of phone calls made, emails sent, demos sat, etc.

Tracking these numbers can be helpful for a few reasons. The first is so you can understand where an individual or team may be lacking if they are struggling to hit quota or numbers. They can also be used to create and build a predictable cadence with your potential customers. This data can be used to understand where and when your customers are buying to improve the likelihood of closing a potential customer.

Startup Marketing Metrics

Setting up and tracking marketing metrics can be an intimidating endeavor. There are countless metrics to track. From individual campaigns to website traffic metrics there is a lot to cover. However, properly picking and tracking your startup’s marketing metrics will set up your go-to-market team for success down the road.

Without getting too bogged down by the countless metrics, we’ve shared a few of our favorites below:

Customer Acquisition Costs

As we have written in the past, “Customer acquisition cost is the sum total of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.

The customer acquisition cost definition: the total cost it takes to bring a customer from first contact to sale.”

When you sit down and think about it, a lot goes into acquiring a new customer. You may be running multiple paid campaigns online, have a dedicated marketing team, and are contributing to in-person events. Let’s say that all of your cost dedicated to acquiring customers was $10,000 for the month and you brought on 50 new customers. That would be a customer acquisition cost of $200.

In order to be a successful business that means that your CAC needs to be less than the revenue that your customers will bring in the door. CAC can tell you a lot about the sustainability of your business and marketing efforts.

Related Reading: Breaking Down the Nuances of Annual Contract Value (ACV)

Customer Lifetime Value

In order to understand how sustainable your customer acquisitions costs are you need to understand the lifetime value of your customers. Customer lifetime value is the amount that the customer will spend with the business throughout their relationship with the business.

Calculating lifetime value can change greatly depending on your business. For example, a SaaS company may have a customer paying a monthly subscription fee for years (their total lifetime value) where a real estate company may only make one transaction with a customer.

Constantly tracking your LTV is a great way to keep your CAC in check and make sure you are the path to a profitable and sustainable business.

LTV:CAC Ratio

The LTV:CAC takes the 2 metrics mentioned above and keeps it to a digestible and easily understandable metric. You simply take your customer lifetime value and divide it by your customer acquisition costs. Ideally you want this number to be greater than 3.

In general, a good lifetime value (LTV) to customer acquisition cost (CAC) is 3:1. If a customer is being brought in for $100, their lifetime value should be at least $300. Otherwise, you will be spending too much drawing in your customers; it will become important to fine tune, streamline, and optimize your marketing and your advertising. If your ratio is 1:1 this would mean that you are not making any money on new customers and will eventually run out of cash and go out of business.

Related Reading: Unit Economics for Startups: Why It Matters and How To Calculate It

Website Traffic

No matter the business, essentially every business has a website today. Getting leads to your website is a great way to increase marketing and sales metrics across the board. Having a deep understanding your website traffic is a great way to tweak and improve content, website copy, button copy, paid campaigns, and more.

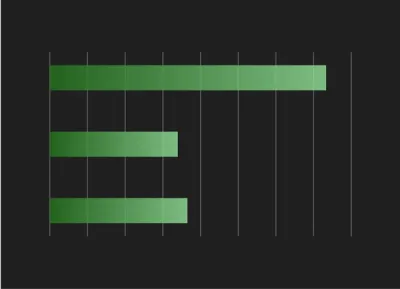

You will want to understand where your website traffic is coming from. This is generally referred to as the source. This can generally be bucketed into organic, paid, social, referral, and direct traffic. Knowing where your traffic is coming from will help inform your decisions for where to spend your time and budget. Example of a startup website traffic breakdown below:

Next you will want to understand what pages and content is converting well. For example, if you have a page on your website that converts to your call to action at a higher rate you will want to implement the ideas behind this page across the website. You should always be testing buttons and content copy to improve the likelihood of website users taking a specific call to action.

Startup Customer Success Metrics

Once you have a customer in the door, the work is not done. Being able to retain and grow your current customer base is the easiest way to grow your business. In order to do so, you need to have the right metrics in place so you can optimize what is working well when it comes to your customer success efforts.

Net Promoter Score

If you’re not familiar with NPS, it is used to gauge the loyalty of a firm’s relationships. It is used by more than 2/3 of the Fortune 1000 and it can measure a company, employer or another entity. You have likely received an NPS survey yourself. It’s a score of 1 to 10 usually with a question of “How likely are you to recommend X to your friend or colleague?”

X could be your company, your customer support experience, an event, etc. If you answer 1 to 6 you are considered a detractor and at risk of customer churn, 7 & 8 are considered passives and 9 & 10 are considered promoters. To get your score take % Promoters – % Detractors. This creates a scale ranging from -100 to 100. 0 to 49 is considered good, 50 to 70 is Excellent and 70+ is World Class.

To give you an idea for the 4 Major Airline Carriers in the US the scores are as follows:

American: 3

Delta: 36

Southwest: 62

United: 10

On the other hand of the spectrum Apple clocks in at 89.

Customer Churn

Customer churn is the % of customers (also called “logos”) that you lose over a given period of time. Let’s say that you have 10 customers and lose 2 of them over the past month. That would be a customer churn rate of 20%. Keeping your churn rate in check is an easy way to grow the business.

Revenue Churn

On the flipside revenue churn is the % of revenue dollars that you lose over a given period of time. Taking the example in the section above, let’s say that the 8 customers who did not churn are paying $100 and the 2 customers that did churn are only paying $10. That would be a churn rate of 2.4% ($20 in churned revenue divided by $820 in total revenue).

For world class companies they may actually have negative churn. This means that they are expanding current customers at a greater rate than they are losing customers.

Customer Retention Rate

As the team at HubSpot put it, “Customer retention refers to the ability of a company to — you guessed it — retain customers. Customer retention is impacted by how many new customers are acquired, and how many existing customers churn — by canceling their subscription, not returning to buy, or closing a contract.”

Startup Operations Metrics

At the end of the day, every metric impacts how your business operates. If the metrics above are not falling into place, the chances of your business operating for the long run are slim. You need to constantly have a deep understanding of where you company’s financials stand.

Burn Rate

As Investopedia defines it, “The burn rate is the pace at which a new company is running through its startup capital ahead of it generating any positive cash flow. The burn rate is typically calculated in terms of the amount of cash the company is spending per month.” Burn rate is an essential metric for every early stage startup leader to have their eye on.

If your burn rate gets out of hand it is important to bring it in as soon as possible. Potential and current investors will have their eye on your burn rate to make sure you can sustain your current business practices for the future.

Related resource: Burn Rate: What It Is and How to Calculate It

Months of Runway

Months of runway is exactly what it sounds like — the number of months your business can go on until it is out of cash. This is particularly important for early stage companies that have yet to find product market fit or are still in the early stages of developing their product. You can find your months of runway by taking your cash in the bank and dividing it by your net burn rate.

Related Resource: How to Calculate Runway & Burn Rate

Revenue per Employee

While revenue per employee is not the most informative metric for internal purposes it can be a great metric to benchmark against your peers. For example, if you are a seed software company comparing yourself to a publicly traded software company many of your metrics will not be comparable. However, revenue per employee allows you to break it down by the size of your business and have a benchmark to share with internal employees.

Related Resource: EBITDA vs Revenue: Understanding the Difference

Total Addressable Market

Total addressable market (TAM) is the estimated size of the market that your business can attack. As we wrote in our “Total Addressable Market Templated”, “TAM helps paint the picture of how big the opportunity is and if the business deserves to be venture backed.”

While TAM is not something that is tracked regularly it is important to have an understanding of your addressable marketing when you set out to fundraise.

Related Resource: A Guide to Building Successful OKRs for Startups

Startup Metrics Dashboards/Templates

Building A Startup Financial Model That Works

Check out our blog post and guide for building your first financial model (plus, a template to help you size your potential market). Check it out here.

Andreessen Horowitz Startup Metrics Template

Andreessen Horowitz (a16z) is one of the most prolific VC investors in the market today. With investments across a number of different stages, sectors, and business models, they have seen first hand the lack of (and the need for) standardization in the way private technology companies track metrics and present those metrics to current and potential stakeholders.

While their well known post, called “16 Startup Metrics“, dives deep into a number of great metrics for different business models – Marketplaces and Ecommerce in particular – we focused this video on SaaS metrics and how companies can use Visible templates along with other sources to benchmark themselves against others in the market and set themselves up for fundraising success. Check out a video explaining their metrics below:

Rockstart Digital Health Accelerator Startup Metrics Template

As with any early-stage company, focus is key. This is why Rockstart puts each company’s Most Valuable Metric front and center on the business dashboard. The primary reason to have a single, understandable metric for your business is to cut out the noise that comes with trying to track (and take action on) every single thing so that you can hone in on the one thing that drives your success. Read any startup post-mortem and you’ll quickly realize the negative impact that lack of focus can have on a company.

In the digital health sector, companies don’t all fit within the same bucket from a business model perspective. The first Rockstart Digital Heal Accelerator class has hardware companies (like Med Angel), marketplaces (like Dinst), and SaaS businesses (like Mount) who all likely have different true north metrics.

founders

Fundraising

Fundraising in Today's Environment With Elizabeth Yin

Fundraising is hard. Fundraising in the current environment can almost feel impossible. Being able to bring capital in to grow your business is a skill that all founders should hone.

In this webinar you’ll learn:

How the state of the venture capital has changed over the last 6 months

How fundraising has changed over the last 6 months

How to create supply and demand while fundraising

How VCs think and work so you can better your odds of raising

founders

Fundraising

The Guy Kawasaki Pitch Deck

Are you building your first pitch deck? The Guy Kawasaki pitch deck is a great place to start. It is not easy getting started on a pitch deck for you startup.A great pitch deck is concise, but thorough, informative, but not boring, simply designed, but with personality. Although you have a wealth of knowledge on your startup and market it is often intimidating trying to get everything you want to say in just a few slides. Enter: the Guy Kawasaki Pitch Deck Template.

Who is Guy Kawasaki?

Guy Kawasaki is a marketing specialist. He worked for Apple in the 1980s and is responsible for marketing the original Macintosh computer line in 1984. Guy is infamous for coining the term evangelist in marketing. He might be most famous for his simple pitch deck template and the 10/20/20 rule of Powerpoint and pitch decks.

What is the 10/20/30 Rule of PowerPoint?

What is the 10/20/30 rule of PowerPoint. The 10/20/30 rule is a presentation rule coined by Guy Kawasaki. As he wrote, “It’s quite simple: a PowerPoint presentation should have ten slides, last no more than twenty minutes, and contain no font smaller than thirty points.” The 10/20/30 rule is a great place to start when you are evaluating what should be in your pitch.

By only allowing for 10 slides you’re required to have a hyper-focus on what truly matters to your business. Of course, every business is different. Some may require more than 10 slides and some may even require less. However, start with the 10/20/30 rule and see what you need to add or subtract from there. Before even getting too deep in the weeds by laying out your 10 slides you’ll have a skeleton of what your presentation will look like.

The Guy Kawasaki Pitch Deck

To go along with the 10/20/30 Rule, Guy also has a pitch deck template that he uses for lay out the 10 slides for a pitch. It looks something like this (originally from our pitch deck guide):

Pitch Deck Slide 1

The first pitch deck slide of your business pitch is straightforward. A simple slide that shares your company name and contact info. Use this slide to set the stage for your pitch deck design.

Pitch Deck Slide 2

The second pitch deck slide consist of what problem you are solving. This can take form in what the opportunity is or what the pain your potential customers are feeling.

Pitch Deck Slide 3

The third pitch deck slide should explain the value proposition that you are offering. This explains the direct value that your customers receive when choosing your product or solution. This is where your business pitch template will come in handy as your describe your value.

Pitch Deck Slide 4

The fourth pitch deck slide explains what differentiates your solution than others in the market. Guy Kawasaki suggests using a visual pitch deck design here by using images, charts, and diagrams of your “secret sauce.”

Pitch Deck Slide 5

The fifth pitch deck slide should contain your business model. This shows how you are, or plan, to make money. Another slide where knowing your business pitch will be vital.

Pitch Deck Slide 6

The sixth slide should contain your plan for acquiring customers. This slide will share how you can effectively find new customers and the costs associated.

Pitch Deck Slide 7

The seventh pitch deck slide should show what the market looks like. This includes your competitor landscape. Guy suggests that “the more the better” for this slide.

Pitch Deck Slide 8

The eighth pitch deck slide should be a highlight of your management team. Include a brief profile of your company’s managers and any other associated stakeholders. This can include your investors, board members, and advisors.

Pitch Deck Slide 9

The ninth pitch deck slide should contain your financial projections and key metrics. The key to building a business is generating revenue and having a financial plan to effectively scale and grow. Use a top-down, not bottoms-up, projection to wow your investors. A visual pitch deck design will also help here by using charts to make your projections easy-to-understand.

Pitch Deck Slide 10

The last pitch deck slide should be an overall timeline of your business. Where have you been in the past? What are the major accomplishments you’ve achieved so far? Where is your business headed and will the person you are pitching fit into this timeline?

While every business differs, the Guy Kawasaki pitch deck template is a great place to start. Lay out your pitch using his style and see what you think. From here you can tailor it to your businesses’ needs. Once you’ve got your pitch deck in place, it is time to kick off your fundraise. Check out our guide on fundraising to make sure you’re making the most of your fresh pitch deck.

founders

Hiring & Talent

Operations

Operations

4 Takeaways From Our Webinar with Scott Dorsey

Leading under the current circumstances is an audition to lead for the coming years. Being able to step up as a leader amid the COVID-19 pandemic is an opportunity to cement a strong future for your company and yourself.

Last week, Scott Dorsey, Managing Director of High Alpha, joined us to chat about all things leadership and fundraising.

Prior to High Alpha, Scott co-founded ExactTarget and led the company as CEO and Chairman from start-up to global marketing software leader. ExactTarget went public on the New York Stock Exchange in March of 2012 and was acquired by Salesforce in July of 2013 for $2.5 Billion. Post-acquisition, he led the Salesforce Marketing Cloud which encompassed 3,000 employees around the world.

It is safe to say that Scott knows what it means to be a leader. Scott started ExactTarget during the Dot-com Bubble and successfully IPO’d shortly after the Great Recession.

The webinar was full of stories and anecdotes from Scott’s time building ExactTarget. Check out our favorite takeaways below:

Cash is King

While cash has always been king, Scott mentions that it is even more important during a downturn. As a founder, you need to have a deep understanding of your cash flow and burn rate. It may be difficult to fundraise during a downturn but you need to be able to show your investors that you can (1) make it through a downturn and (2) thrive on the other side. If you can successfully display that you’re in a good cash position and ready to thrive after, you’ll improve your odds of raising capital.

Closer than ever with Customers

During uncertain times, it is more important than ever to be close to your customers. Your customers are going through the same things that you are going through. Establish and preserve your relationship so you can grow together on the other side of the downturn.

In the early days, Scott suggests companies project confidence, show they’re stable, and are growing & innovative. One of the best ways to do this is by envisioning your 3, 5, and 10 year journey with potential customers. Where will you be in 10 years? What will the product and relationship look like? Clients want to lock-in on a long-term relationship. If you don’t have everything built in the immediate, that’s fine. Show that you can be all the way there in the future.

The Friday Note

During uncertain times most leaders communicate less. However, communication is one of the best ways to make it through a downturn. Scott has almost become synonymous with the “Friday Note.” Simply put, the Friday Note was an email Scott sent every Friday to everyone in the company letting them know what was happening with the business.

During the Great Recession, Scott found himself communicating with employees less. From that point, Scott made it a point to send a note every Friday to the team so everyone always knew what was happening and there was a path to 1-on-1 communication. In fact, Scott turned all of his Friday Notes into a book when ExactTarget was acquired by Salesforce.

Personal Board of Directors

According to Jim Rohm, “You’re the average of the 5 people you spend the most time with.” With that being said, it is important to surround yourself with a diverse mix of people who are smart, friendly, and can grow with.

Scott himself has a personal board of directors made up of about 5-6 people. These are people that Scott can lean on for guidance, faith, personal balance, etc. This is your inner circle — don’t be afraid to approach people you admire to ask for help.

We hope this is helpful as you work through these uncertain times. Scott is the definition of a leader and a reminder that great leaders and businesses can be built during downturns. As a reminder, you can check out the full webinar recording here.

founders

Operations

Leadership & Fundraising During Uncertain Times with Scott Dorsey

Leading under the current circumstances is an audition to lead for the coming years. Being able to step up as a leader amid the COVID-19 pandemic is an opportunity to cement a strong future for your company and yourself.

In this webinar, you’ll learn:

How to communicate with team members, investors, and customers during uncertain times

How to be an effective leader through turbulent moments

How Scott started ExactTarget during the dot com bust, managed The Great Recession, took a company public, and was eventually acquired by Salesforce for $2.5B

How to raise capital amid COVID-19 and uncertainty

founders

Fundraising

Reporting

Dr. Dan — The Burdensome Investor

Raising capital is hard. Raising capital during a pandemic can feel impossible. As we discussed with Lolita Taub in our webinar last week, more founders are looking for alternatives to venture capital.

Founders are looking to solutions like Pipe, Earnest Capital, ClearBanc, Angels, Friends & Family, among others. Raising from angels and friends/family came into focus during our webinar with Lolita. Note: Check out our “How to Find Angel Investors” guide if you’re searching for angels for your business.

Friends and family often make for an easier fundraising process. Less stringent due diligence combined with less pitching can make friends and family be an attractive option. However, a friend or family member could be less startup savvy than a traditional VC and can become a burden to you and your business.

Internally we call the burdensome investor, “Dr. Dan.” Maybe a family member or friend invested in your business but calls every week for status updates or to ask questions about a metric, etc. With the investor + founder relationships (8-10 years) lasting longer than the average U.S. marriage it is important that you are taking on investors that you can build a relationship with. So how do you approach a potential “Dr.Dan?”

Set Expectations Early

As we previously mentioned, a friend/family or angel investor may not be as startup sophisticated as your traditional VC. Sometimes an inexperienced investors’ expectations may be wildly different from reality. It is your job as a founder to make sure a potential angel investors expectations and reality are aligned.

Before you cash a check, make sure that these investors are aware of the realities of investing in a startup. Make it clear how and when they will hear from you, what the possible outcomes are, and where their capital will be going. Even though someone is an “accredited investor” they are investing their own money and it could be a considerable chunk of their savings.

Explore Other Options

If you’re talking to a potential “Dr. Dan” you may need to weigh other funding options. As we mentioned at the beginning of the post there are quite a few alternatives for raising capital. While the most ideal is using customer revenue to fuel growth, that is generally not an option for most startups — especially early stage.

There are countless alternatives and more popping up every day. You can check out a few of our favorite alternatives here.

Trust Your Gut

As Lolita Taub put it in our webinar, “You just have to hustle and do what you need to do for your business.” At the end of the day, only you know what the right decision is for your business. If you’re in dire need of capital, it may be worth the burden of bringing on a “Dr. Dan.” If you’re in a good spot financially, it may be time to re-evaluate and take your time to explore other funding options.

There are countless pros of bringing on a new investor — capital, new networks, fresh eyes, etc. On the flipside, an angel or family/friend investor can quickly become burdensome if they are inexperienced or unsure of what to expect from you. Remember bringing on a new investor means bringing on a new business partner for the foreseeable future — only you know what the right decision is for your business.

Already have angel investors? Send them a quick Update to let them know how your business is doing.

founders

Fundraising

The First-Time Founder's Guide to Fundraising With Lolita Taub

Fundraising is hard. Fundraising in the current environment as a first-time founder can feel impossible. Being able to bring capital in to grow your business is vital during these trying times.

In this webinar, you’ll learn:

How will COVID-19 impact the fundraising environment

How to split focus between fundraising and cash efficiency

How to conduct pre-fundraising research

How to build relationships with potential investors

How to manage and track my fundraise

How to raise as an underestimated founder

founders

Fundraising

Operations

Mike's Note — It is easier to change your preferred airline than it is your cap table

Seth Godin wrote “beware of experience asymmetry.” Reading his post, I thought about the time I got my first mortgage. I remember thinking, Am I getting a good rate? How much house should I buy versus how much house can I buy? It was stressful. I felt vulnerable. The internet and publicly available data helped me call around and shop rates. (I still would have paid handsome money for a local guide.)

Seth calls out venture capital in his post. This is an important place to get a local guide. In my opinion, the best local guide is another venture firm. This may sound counterintuitive, let me explain. If you’re looking to make a deal, having more than one venture firm in the mix will help you get a truer understanding of your market value and secure the fairest terms.

If you have more than one venture firm looking at your business, congrats. You are in rare air. Most are lucky to even get one interested. In those less-competitive cases, it’s still important to find a local guide. It could be a fellow founder, angel investor, trusted advisor, or a blog post from 2012.

Regardless of your path, always surround yourself with local guides for the various stages of your business. When fundraising, run a process with multiple firms and always do your homework on potential investors. Call up the companies in their portfolio that weren’t home runs. You will learn a lot.

It is hard to turn down money but sometimes you might want to because it is much easier to change your preferred airline than it is your cap table.

founders

Fundraising

Operations

Investor NPS: How likely are you to refer your current lead investor to fellow founders?

Last week, our CEO surveyed founders asking them, “How likely are you to refer your current lead investor(s) to fellow founders?” in his weekly note.

The results from the survey are below:

The Investor NPS

An NPS score of 23 falls below the average for the airline industry. Not a great industry to be compared to in terms of customer satisfaction scores.

Granted, there can be quite a bit of bias when surveying a founder asking their opinion of an investor (e.g. passed on a round). Nonetheless, founders are clearly looking for more out of their investors.

Once a check is cashed, there is no turning back. With the average length of a founder + investor longer than the average marriage in the U.S. (8-10 years) it is important for both founders and investors to strive for a strong relationship. Founders will get out of their investor relations what they put into it. At the end of the day, the investor and founder relationship comes down to communication, starting from the first fundraising meeting to company exit.

Before a fundraise, a founder should have a set of expectations from their investors outside of capital. It is the duty of the founder to communicate and gauge this during conversations and pitches. Easier said than done. Determining what investors to talk to, how to talk to them, and what to expect from them is a difficult process for founders.

Fundraising is an Asymmetric Experience

Fundraising is an asymmetric experience. Investors see hundreds of deals a year where founders may only talk to a handful of investors in a year. Investors are strapped with an abundance of data used during the decision-making process. As Seth Godin writes,

“In these asymmetric situations, it’s unlikely that you’re going to outsmart the experienced folks who have seen it all before. It’s unlikely that you’ll outlast them either.

When you have to walk into one of these events, it pays to hire a local guide.”

Our goal is to uncover more data, advice, and resources to become a “local guide” for founders to lean on during the fundraising process. In order to do so, we’ve started laying the ground work with Visible Connect, our community-sourced investor database. We will be able to uncover things like investor NPS with Visible Connect and create more symmetry in the fundraising process.

Find Investors with Visible Connect

Interested in learning more? Check out the Visible Connect database here.

founders

Reporting

Mike’s Note — Investor NPS

How likely are you to refer your current lead investor(s) to fellow founders? Let us know through this NPS form. Answers are 100% anonymous.

We keep hearing from founders wanting a “Glassdoor for investors.” There is a lot to unpack there. e.g. How do you:

Keep founders safe through anonymity but validate the information is accurate?

Remove bias if a founder is an upset that an investor says no? (Which they do 99% of time)

Until then, I am curious to see what the response rate is. If you are comfortable just select 1-10.

founders

Hiring & Talent

Operations

How To Manage Remote Teams: 16 Tips From a Remote Startup

Our learnings and takeaways from 5 years of being a remote first startup.

Remote work has been a core tenant of how Visible gets work done since 2015. It is crazy to believe that five years ago working remotely was not nearly as mainstream as it is today. In that time, we’ve learned a ton, mostly through experimentation and failure. The coronavirus and pandemic in 2020 accelerated the adaption of remote work as more companies are transitioning to a remote or hybrid workplace. Being a remote-first organization, we believe that team members do their best work when, how, and where they want. Below we share our guide to getting started with and implementing remote work at your organization. By no means are we perfect or do we know all of the answers. This guide is simply our learnings and takeaways from 5 years of being remote.

Why We Became a Remote-First Startup

Rewind to 2015 and Visible looks just like any early stage startup. We had some fresh capital, early team members, and were eager to get to market with a product. There was not necessarily a hard set reason for starting remote but naturally swayed that way as we added employees across the globe.

Advantages of Remote Teams

It was clear that everyone enjoyed the remote work setting. As the team at Buffer discovered in their State of Remote Work report, 97.6% of employees would like the option to work remotely for the rest of their careers. As we dove into remote work, the advantages were obvious:

Team members do their best work when, how, and where they want.

Working primarily asynchronously allows work to get done while communication becomes the lifeblood.

Our hypothesis is that the #1 challenge for most in-person work environments is open communication whereas we believe this is the biggest strength of all remote-first organizations,

Team members can prioritize their personal well-being to bring the best version of themselves to work (now one of our company values: inside out).

The talent pool for hiring is worldwide.

No physical office and being able to hire outside of major tech hubs means a lower burn rate (you don’t have to shell out for market SF salaries). Don’t forget the ruthless competition and recruiting dynamics.

An opportunity to learn and be at the forefront of something which has the potential to be the future of work

Since then, we have discovered many other pros and cons.

Disadvantages of Remote Teams

On the flip side, there were a few disadvantages spotted.

Always on — When working from home, it can be difficult to shut down and feel like you are truly “off.” A routine and habits to start and end your day can help greatly when trying to manage your workday from home.

Isolation — In an office you have countless interactions. When working from home, employees can feel isolated. A co-working spot or a visit to a local coffee shop can be a good way to combat this.

Time Zones — Communicating across many time zones can be difficult. However, you can solve this when setting expectations and hiring within a given timezone range.

You can check out a few of the struggles with remote work from the 2021 State of Remote Work below as well:

Building a remote organization is certainly challenging, but the reward and pleasure of working remotely far outweigh the challenges (at least in our opinion).

16 Proven Strategies To Manage a Remote Team

Over our 5 years building a remote-first organization, we have stumbled upon a few strategies that we have found to be beneficial. Our 16 strategies can be broken down into a few buckets — culture tips, communication, team-building activities, hiring, and more.

Remote Work Culture Tips

Inherently, building a company culture when all team members are dispersed is more difficult than when everyone is in the same building.

For organizations exploring remote-first work, the ability and ideas behind remote work need to be rooted in the organization’s culture. At Visible, starting as a remote-first organization and having a team comfortable with remote work, our culture has naturally formed around these ideas.

In the past, people have associated startup culture with ping pong tables and a fridge full of beer. However, startup culture is not built in an office; it is built on how individuals work, collaborate, and communicate.

1. Create a Remote Work Mission Statement

If you Google “remote work culture” (or anything related) you’ll notice that most blogs mention the difficulties of building a strong culture as a remote organization. Our mission and values have naturally evolved over the course of time but our culture has always been rooted with remote work and a deep focus on each team member’s own well-being.

We have a number of core values at Visible but the two that have stood the test of time and have enabled a strong remote culture are:

“Inside Out” — We believe that team members should take care of themselves and their family first. Remote work enables this because they can focus on their own health then bring their entire self to work.

“Harmony” — There is no such thing as “work/life balance”. There is just life. We strive to bring harmony to all aspects of our life. As it relates to work, this means some days may require staying on to 8pm as we work through a customer issue and some days you may cut out at 2pm to get on your longboard.

Regardless of how your company culture takes form there is no denying the importance of communication, especially at a remote organization.

2. Set Clear Expectations

Just because you are not in an office, it does not mean you should have working hours and expectations. It is important to have expectations well defined and documented.

A couple of questions we suggest that you think about and answer when setting your work expectations and policies:

What are work hours/time zone expectations?

Can people work from anywhere?

Which communication channels (email, Slack, Asana message, video) are used for what purpose?

What work-from-home office equipment do employees have to buy?

3. Ensure Everyone Has the Tools They Need

Tools and software are at the core of a productive remote-work environment. We’ll dig into the software tools and apps we use below but always suggest you have great internet, a comfortable desk and chair, and a quiet room to take calls and virtual meetings from.

4. Build Trust and Watch for Stress or Burnout

As we mentioned previously, it can be difficult to shut off from work when working remotely. Leaders need to understand and keep an eye for stress and burnout from the team. In order to spot stress and burnout, there needs to be a level and trust and comfort between the team. Check out some of our tips for building trust and collaboration below:

Remote Work Communication and Collaboration Tips

If communicating as a remote team was easy, every organization would be remote. There are definitely challenges when communicating when you are a virtual team. Most people believe that communication is easier when you are all in the same building.

However, with a set of expectations and a communication system in place, remote communication can easily be heightened to match the level of being a physical office. Trust, transparency and open communication is at the core of communication; remote or not.

Trust is vital, especially to remote work, when it comes to hiring, team building, and individual growth. Many individuals may think that trust can only be built when sitting at a desk next to someone. We believe that trust is something that is built through communication, regardless of your location. Trust is just built differently when working remotely.

5. Don’t Just Mimic In-Person Meetings

Communication will naturally force different methods. Do not try to mimic an office when working remotely/from home.

As Jason Fried, CEO of Basecamp, writes, “This also isn’t a time to try to simulate the office. Working from home is not working from the office. Working remotely is not working locally. Don’t try to make one the other. If you have meetings all day at the office, don’t simply simulate those meetings via video. This is an opportunity not to have those meetings. Write it up instead, disseminate the information that way. Let people absorb it on their own time. Protect their time and attention.”

Written communication has become one of the most important things that we do at Visible. Remote or note, written communication is vital to just about every company. Jeff Bezos often relies on his 1997 letter to shareholders to portray company values and vision.

We are constantly tweaking our methods and finding ways to communicate using our suite of tools. At Visible, that has meant using Slack, Zoom, Notion, Jell, written notes, and our own product to facilitate communication and build trust (more on the tools we use in a later section).

6. Share Video Meeting Guidelines

As we shared in our blog post, “How We Work: Zoom Calls,” we try our best to communicate in Slack but have a series of set meetings and one-off meetings that place over video. In order to make video meetings as productive as possible, we try to make sure everyone is in a quiet place without a distracting background. Depending on the type of call, we generally like everyone to have their audio unmuted and video on to mimic an in-person meeting as much as possible.

7. Schedule a Weekly All-Hands Meeting

This gets us warmed up for the week. We’ll see how everyone’s weekend went and dig into the week ahead.

Mike (our CEO) will start by giving a quick recap of our company-wide metrics, goals, news from the previous week, and priorities for the coming week.

We will then review our current product & marketing boards to see if there are any obstacles, outstanding questions, etc. This is not a time to go in-depth but rather schedule a follow-up time to pair with your colleagues.

Related Reading: How to Build Organizational Alignment Easily

8. Use Collaboration Calls for In-Depth Work

Collaboration calls are a time for us to get together as a team and work on a larger project or idea. Generally, we will decide on our Monday kickoff call what we will discuss on a team collaboration call. Some ideas:

Review a product cycle item — What is the status of a current product cycle item? What is needed from others here? Is there a mockup that someone would like to present? Etc.

Play a game — Use this as a time to play a collaborative game as a team.

Brainstorm — Working on a bigger product or marketing idea that you need input from others? Use this as a time to present and collaborate on bigger ideas that involve the entire company. Be prepared with activities to guide the brainstorm session!

Other talking points:

Give a shout-out to a team member and thank them. Tell them why!

Tell us a story about something Visible related! Could be a customer story, a bug you found, something you designed, etc

What did you learn last week? (Doesn’t have to be Visible related!)

What is something you are proud about from last week?

9. Set up Recurring One-on-One Meetings

One-on-one calls are to make sure we are identifying opportunities to serve one another better, a chance to deepen our relationship as well as uncover any challenges before they grow into something larger.

The time should also be spent talking about near terms goals & priorities but also long-term development as well.

Every one-on-one check-in is the employee’s time and the time can be used for whatever they deem most valuable (90% of the time for the employee). To make sure the time is used in a mutually beneficial way we want to make sure the employee is providing a quick update (before the call) with how everything is going, how they are feeling, and what challenges they are facing.

10. Use Show & Tells To Share and Connect

Every Thursday a team member presents a show and tell. The topic does not have to be work related. It can range from your favorite tacos to how venture capital works to budgeting apps for personal finance!

Remote Team-Building Tips

Having different opportunities for casual conversations and team building is a surefire way to improve remote work for everyone. One of our favorite ways is by playing virtual games (Jackbox Games, CodeNames, etc.) to loosen up and have fun. We have also seen success when giving individuals the opportunity to connect and work with cross-functional teammates.

11. Create a Virtual Water Cooler

The “virtual water cooler” in Slack has been a great way to connect with teammates outside of work. As we wrote in the post above,

“We do not have hard-set guidelines for what should be posted in the #watercooler channel but it generally consists of the following:

Food/what we ate — Pictures or recipes for what we are cooking at home/eating at restaurants. We all love to eat at Visible so this is big for us.

Random videos/pictures/stories from our day-to-day lives — For example, a current event or something big that may be happening in someone’s respective city/neighborhood/etc.

Travel and Hobbies — Being a remote company, a lot of us spend a good amount of time in different locations. We love to share pictures and stories from our time in new places.

Work Inspiration — This is also where we share examples and inspiration of something cool we see a different company doing. Anything from a new product feature to an intriguing marketing email.

Fun Stories — If someone runs into a fun story, stat, or fact they run into online, we tend to share it in #watercooler.”

12. Have Fun With Regular Non-Work Activities

Bringing teammates together with non-work activities is a great way to build camaraderie and relationships. Check out our post, 34 Remote Team Building Ideas for Growing Startups, to learn about some of our favorite specific activities.

13. Plan Yearly Company Offsites To Get Together

Nothing beats the energy from getting to meet with team members in person. We relentlessly prioritize getting together two times a year as a time. Offsites serve three purposes:

To have fun

To give us the chance to connect in person and collaborate on big, strategic initiatives.

To see a more human side of your team.

To see how tall your colleagues are ;).

Offsites have become an integral part of our culture and how we work together. Over the course of a week we are able to break down big problems and initiatives then channel that into focused work when we depart back to our homes.

Over the last few years, we’ve had offsites in the following locations:

Copenhagen

Indianapolis

Montreal

Chicago

Dublin

Amsterdam

Lisbon

Barcelona

Tulum

The term “offsite” gets thrown around a lot in the startup and corporate world but what does an offsite actually look like to a remote organization?

Choose a Location and Date for the Offsite

At Visible, we are spread out across the world. We have employees in North America, Europe, and Asia. With that being said, finding a location for our offsites can be tricky. A couple of things we look for in an offsite location:

A location that everyone can get to in a reasonably timed and priced flight. We do not want someone to have to fly for 24 hours with 2+ layovers, etc.

A location that is not too expensive once you are there. Breaking bread is a cornerstone of our offsites, so having a place where you can go out for a nice meal without breaking the bank is important to us. For example, a dollar went a long way in Lisbon compared to Copenhagen.

A location that has a tech culture. It is fun to go somewhere with a strong tech/startup culture. In the past, we’ve been able to meet and work with our customers.

Somewhere new. Being a small team, we are able to go to places that are new to each of us. Inevitably, this won’t always be the case but is a fun factor for now.

Once we pick a location, we will book accommodations. Our goal is to give everyone their own bedroom, have a place to work as a group, and be in a central location that is within walking distance to restaurants, bars, and transportation.

We’ve done everything from a high-end hostel, to single Airbnbs and even a houseboat on the canals of Amsterdam. Depending on the city, different options may make more or less sense. As we are all travelers ourselves, we have found Airbnbs to be the most practical for us as a group.

In order to maximize our time, we generally have to include a weekend or a weekend day (which no one ever has an issue with). This allows us to wrap the offsite around a weekend and not miss an entire week of our usual day-to-day work. We send out a Doodle which makes it incredibly easy to coordinate everyone’s availability.

Decide How You’ll Work During the Offsite

Deciding when and how to work during an offsite is something that we are constantly tweaking. While offsites are intended to strengthen personal relationships we have accomplished some awesome work.

The last few offsites we come with a big vision or theme for the week. From here, each individual (eventually may just be unit leaders/managers, etc.) is responsible for coming up with a group session related to their business unit.

For example, we kept hearing from our customers about the pain points of fundraising. This became a focal point of our fall 2019 offsite and how the “fundraising” product was born. We came back with a beta version of the product, design for future versions, our Connect database (named at the offsite), and a marketing webpage for the new Fundraising product.

Decide What Non-Work Activities You Will Do

As mentioned, everyone is responsible for coming up with a work session for the offsite. In tandem, we pair up with a different co-worker (someone we may not always work directly with) and come up with a team activity that is unrelated to work.

We are assigned a day with our partner and set out to find an activity. This has led to some of our best memories and is often what we look back on at future offsites. A couple of things we have found to work best:

Boating/Sailing — A fan favorite has been sailing and boat cruises we’ve taken as a team. We have generally found these on Airbnb Experiences but are an awesome chance to check out a new city and relax with teammates.

Cooking Classes — A chance to work directly with a teammate, plus eat great food. Will certainly be including more of these in the future.

Escape Rooms — Fun way to work on team building.

Sports/Hiking — Another chance to find a new skill and work as a team. We all learned how to longboard at our last offsite!

Dinner — Believe it or not, coordinating dinner for a large group can be tough. We would highly encourage having reservations in advance to avoid long waiting times or eating at subpar restaurants.

We learn something new about running an offsite at each one. By no means do they go off without a hitch, but they are invaluable to us and something we relish.

Remote Hiring and Onboarding Tips

Hiring for a remote organization is a double-edged sword. You have the world as a hiring pool but… you also have the world as a hiring pool. What we mean is that you have the ability to hire anyone in the world so you don’t have to compete with tech hubs and “hot” companies for top talent. However, this means that you are likely getting a huge number of applicants and need to have a dialed system to vet and hire candidates.

14. Post Jobs on the Right Remote Boards

Leveraging job boards are a great way to get the word out about a new position. There have been countless job boards specific for remote workers as well as traditional options. Some popular options:

AngelList

Remote.co

We Work Remotely

15. Simulate Remote Work During the Interview Process

You likely do not have the opportunity to meet with them in person so being comfortable with video calls and evaluating work/writing is crucial.

As we previously mentioned, building trust does not need to take place in a physical office. It takes place in evaluating communication and work. This same idea is relevant when hiring.

At Visible, we are generally in search of “self-starters” and someone that is comfortable working alone/remote. Like most companies, our hiring process starts with short video calls with Visible team members. Once we have determined if they are a fit for Visible, we try to simulate remote work as much as possible.

To start, we use a paid project for the candidate. From the second we start a paid project, we are building trust with the potential candidate. Generally, the project is related to a future Visible product, marketing plan, idea, etc. To best simulate remote work, we invite the candidate to a Slack channel where they can ask questions and interact with the team.

Hiring for a remote position is challenging but rewarding. No matter how you approach hiring a remote employee, communication and trust should be front and center of the process.

16. Start Onboarding Remote Employees Before Day One

Onboarding an employee across the country or globe can feel odd. In order to make sure a remote onboarding goes smoothly, we suggest a few of the following steps:

Timeline — Set up an agenda and expectations for the first few days/weeks for a new hire. We use a Notion doc and create a day-by-day agenda for the first week so they know exactly what to expect and what needs to be completed.

Introductions — Give new employees an opportunity to pair with different teams and teammates. It is a great way for new employees to get a lay of the land and build relationships.

Software — Part of our timeline/onboarding document, is setting up the software and explaining what each one does.

Merch — Send a shipment of your merch and team gear so they feel welcome!

Technology — Make sure your new hires have the hardware they need to get the job done.

Remote Work Tools To Level Up Your Team

As we mentioned previously, Slack and Zoom have combined to essentially become our office but we have a number of other tools we use to help communicate and facilitate remote work.

Slack for Messaging, Company Updates, and Fun

Slack is the lifeblood of our business. 95% of our communication takes place in Slack. We break our channels into different business units and try to have as much automation as possible within Slack. For example, we have a channel where we can see when a new trial is started, a channel that funnels in our Intercom conversations, etc.

We do try to keep most of our Slack conversations in public channels. As a note, we are a smaller team so most channels are not too noisy and anyone is welcome to mute a channel that they find irrelevant/distracting.

Zoom for Video Conferencing

As we mentioned earlier, we use Zoom for any necessary face-to-face meetings. As a distributed team, meetings are a crucial medium for our team to connect, share & collaborate. Here are some general guidelines for all meetings.

Video should always be on by default (unless you have some serious connection issues).

Your microphone should always be on and not muted. We want to feel like we are next to each other in a meeting. Visual and verbal queues & feedback are important ways we communicate.

Try to find a quiet place with limited background noise.

When applicable, send out an agenda, documents, etc prior to the meeting for the attendees to review.

Jell for Daily Standups

Jell — Jell is a tool we use to post personal standups on a daily basis. Each morning, every team member fills out a simple prompt that asks what they are working on that day. From here, the answers are sent to a channel in Slack where we can see where other team members may need help.

Notion for Task Management and Internal Documentation

Notion — We recently switch to Notion for (1) our task management and (2) our internal Wiki.

We use Notion to monitor our current product cycle, current marketing tasks, and customer success tasks. Each team member has full access to all boards to see the status of different projects and tasks.

We also use Notion as our internal Wiki. This is where we host everything and anything about Visible and how we work. If someone has a question about a company policy or workflow, they can check Notion. We are also diligent about documenting meetings so we this is where team members can find notes and discussions from past meetings.

HIVEGEIST for Working Remotely

The HIVEGEIST community consists of remote working professionals who share their vision of a decentralized life. With HIVEGEIST, you not only belong to the strong network of our members, you also immerse yourself in the local community. Use one-time code, VISIBLE20, for a 20% discount on the first month for your community.

Visible for Aligning Our Team

We use Visible to dogfood our own product and for our CEO to send out a weekly Update to the team. A weekly note from our CEO allows everyone to have a holistic view of what is happening with the business and where current metrics stand.

Final Thoughts on Managing Remote Teams

As technologies continue to advance so will the way we work. Remote work may not be a perfect fit for every company but we believe that it is here to stay. Each day we learn something new about working remote and the benefits that come with it.

If you’re interested in getting started with remote work or want to learn more, shoot us a message to marketing@visible.vc

Other Resources on Remote Work

Below are the blog posts, guides, and other resources that we have looked to when implementing remote work at Visible:

Our 9 Favorite Posts on Remote Work

The 2021 State of Remote Work

Why Everyone Loves Remote Work

Remote Stories

Why Naval Ravikant Thinks Remote Work Is The Future

How to Lead a Remote-Friendly Startup

How Remote Workers Make Work Friends

Remote First Capital

founders

Metrics and data

Calculate Your Natural Rate of Growth with this Template

In case you missed it, our CEO, Mike, wrote about Natural Rate of Growth in his weekly newsletter last week. In short, OpenView Labs recently featured a new SaaS metric they are coining “Natural Rate of Growth.” Read the original blog post form OpenView here.

With the emergence of product led growth (PLG) companies there is a need for new metrics. The traditional SaaS metrics and growth rates are becoming out of date.

Essentially, Natural Rate of Growth removes paid channels to calculate growth. As OpenView states, “One way to think about it is how fast a company grows without even trying—before layering on incremental investments in sales and marketing. We’re looking to pinpoint the percentage of your recurring revenue that comes from organic channels and starts with your product.”

The formula to calculate Natural Rate of Growth is pretty simple. We’ve shared a Google Sheet template you can use to get started below:

Natural Rate of Growth is simply 100 (X) Annual Growth Rate (X) % Organic Signups (X) % ARR from Products

Annual Growth Rate = Simply your ARR growth from year to year

% Organic Signups = From the OpenView blog post, “An organic signup is any signup that you didn’t have to pay for. These new users come from referrals, organic search, organic social and direct to your website.”

% ARR from Products = From the OpenView blog post, “We’re looking for how much of your incremental recurring revenue comes from users who started by using the product, whether via a free trial, free product, open source product, freemium version or paid self-service product. Those users who immediately went down a sales-assisted path before getting into the product, for example those who requested a demo, do not count.”

Simple enough. OpenView goes on share benchmarks for what a good, better, and best Natural Rate of Growth looks like.

To give you an idea, Slack’s Natural Rate of Growth is 55%, Zoom’s is 93%, while HubSpot’s is 14%.

Thanks to OpenView labs for creating something new and compelling. We hope the template helps you PLG/SaaS companies.

Remember that market defined metrics can be a great proof point when fundraising and benchmarking your company to other SaaS companies.

founders

Metrics and data

Mike’s Note — Natural Growth Rate

Publishing this on the weekend…It would be a lie if I said I was A/B testing engagement. I ended up in an all day workshop Friday with some university students — it is always refreshing seeing what the next generation is working on. I digress…

I recently came across a great blog post by OpenView called “The New SaaS Metric You Should Be Tracking“. In short, the argument is that current SaaS metrics are dated and as go-to-market models shift to product led growth we should evaluate these businesses with a new set of metrics. The core thesis is that PLG companies don’t have the same immediate growth rates as SaaS companies of yesteryear since they take time to compound.

In the post, they introduce a metric called “Natural Rate of Growth”, how to compute it and some associated benchmarks. NRG is essentially a growth metric that removes paid channels such as BDRs, paid ads, events, etc. It primarily accounts for organic, direct and referral customers. We built an easy Google Sheet to calculate your rate here.

I felt that this was worth sharing because many companies are adapting their go-to-market motion as the macro environment is changing. Market defined metrics are great proof points in fundraising as well as benchmarking yourself to other SaaS companies. Reminder: Here is the Google Sheet.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial