Ask any founder who has raised venture capital, and they will likely tell you that fundraising is a sales process. You need to prospect, nurture, and move potential investors through an “investor funnel.”

As Mark Suster, Managing Partner at Upfront Ventures, puts it, “Remember that fund raising is a sales process. The investor is a customer and they have money to spend but only for a limited number of companies. They are buying trust in you that you will build a large business that will be valuable”. So where do you start? Just like a standard sales process; understanding who you’re selling to and building a list of prospects.

Your Ideal Investor Persona

It may sound obvious, but before you start building a list of potential investors you need to start with what your ideal investor looks like. Just as you would with potential sales leads, you’ll want to define who you are “selling & marketing” (read: pitching) to and why. (You can learn more about a traditional buyer/marketing persona here). Having a deep understanding of who you want to raise from will help as you put together decks, emails, and other fundraising documents. If done right, investors can be far more than a surge of capital and can offer relevant experiences, networks, and mentorship. A couple of traits to keep in mind while you build your “ideal investor persona”:

- Location – Where are you located? Do you need local investors? Or maybe you are looking for connections and networks in strategic geographies.

- Industry Focus – What type of company are you? Where should your future investors/partners be focused? e.g. If you’re a B2B SaaS company don’t waste your time with marketplace focused investors. Mark Suster suggest that it is best to prioritize investors with companies in your space.

- Stage Focus – What size check/round are you raising? e.g. If you’re raising a $1M seed round avoid a firm with $2B AUM. If you’re raising a $30M round avoid a firm with $75M AUM.

- Current Portfolio – What type of companies should be a signal to you that they’re a good fit? Is there a high likelihood they’ve invested in one of your competitors? If so, best to avoid as they likely won’t double down their bet with a competitor to a portfolio co.

- Motivators – What do want to get out of your investors and what do they want to get out of you? Do they need to match your values and culture?

- Deal Velocity – Are you in need of capital as soon as possible? Or are you taking your time and looking for strategic investors? Varying investor’s have different philosophies for the velocity they’re making deals. Point Nine Capital and Kima ventures are both regarded as top firms in Europe. However, Point Nine makes ~10 investments a year whereas Kima makes 1-2 investments a week.

Your ideal investor profile should remain dynamic as your company continues to grow. Take a look back once a quarter or every 6 months to iterate and make necessary changes.

Related resource: Accredited Investor vs Qualified Purchaser

Building a List

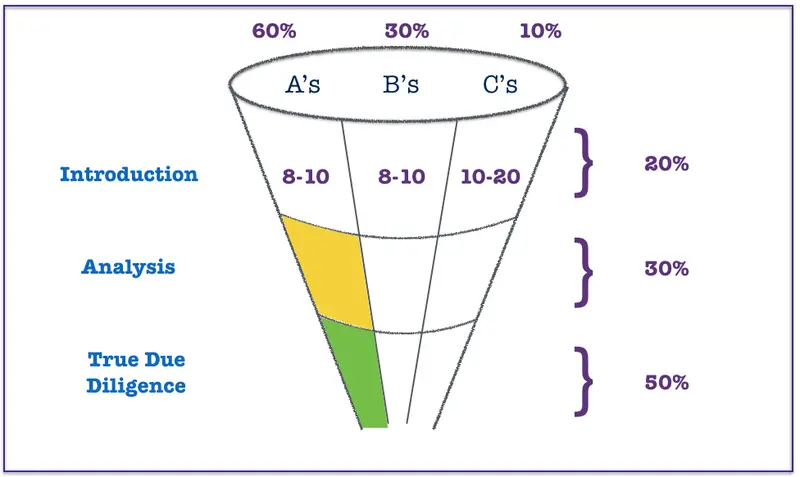

Once you’re honed in on your ideal investor start building a list of firms that fit the mold. Check out tools like AngelList and Crunchbase to get the ball rolling and continue to cherry pick investors as they seem fit. A simple Google Sheet with the firm demographics, point of contact, and necessary info should be included. Mark Suster suggests starting with a list of ~40 potential investors and ranking those as A, B, and C tier investors; “A” being your “Dream Schools” and “C” being your “Safety Schools”.

If you’re adding investors that fit your ideal investor profile everyone in your list should be qualified to some extent. Next week, we’ll take a look at continuing to qualify and move your potential investors through your fundraising funnel.

Find your ideal investor with our free investor database, Visible Connect, below: