What is a VC Fund?

A venture fund is capital that is ready to be deployed by the venture capital firm (or the management company). It’s a funding option that allows VC funds to buy equity in a startup. In turn, a startup gives up a percentage of their ownership with the hopes of growing their valuation and creating a successful exit for everyone on the cap table.

The Structure of a VC Fund

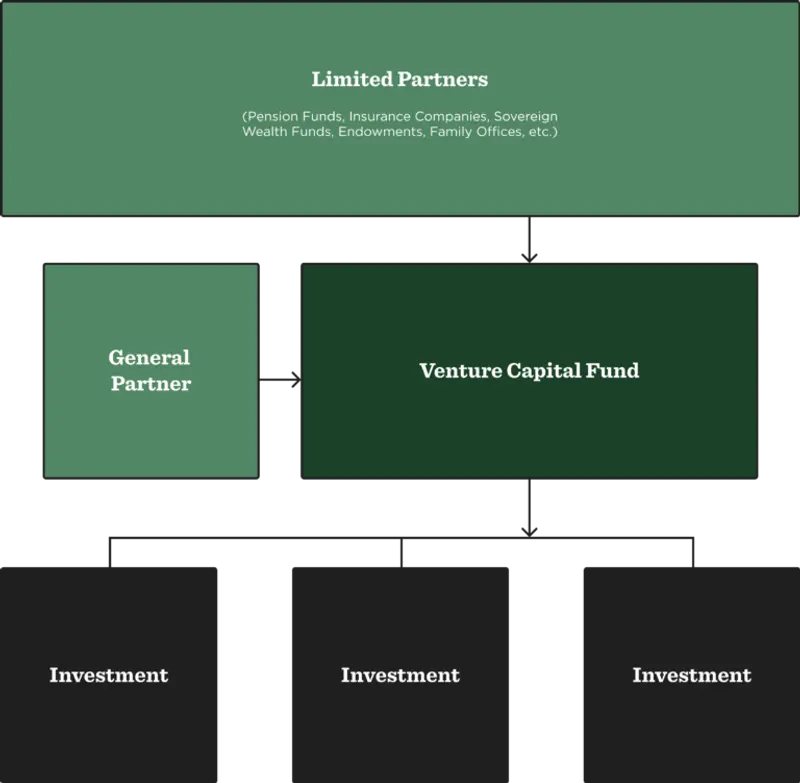

Capital for a venture fund comes from limited partners, which are generally much larger funds, and are looking to diversity their investing via venture capital funds.

Limited partners tend to be either university endowments, sovereign funds, family offices, pension funds, or insurance companies.

Then there’s a management company which is responsible for prospecting investments, collecting fees and expenses, branding, and more.

AngelList describes it as, “A management company is a business entity created by a venture firm’s general partners (GPs). It’s responsible for managing a venture firm’s operations across its funds.”

A general partner is someone who manages a venture fund and likely the management company. GPs oftentimes invest their own money so they have skin in the game.

Read the full article on VC Fund Structure here.

Types of Venture Capital Funding:

- Seed Capital

- Seed funding, which oftentimes includes “pre-seed” funding, is generally the first round of financing for a startup. There typically tend to be funds that specialize in pre-seed/seed-stage financings.

- Early Stage Capital (Often Series A or Series B)

- Early-stage capital is often when a company might have some traction and promise that it can grow into a massive company that is worthy of an exit.

- Expansion Capital

- Venture funds at this stage are likely huge funds that make fewer investments with larger check sizes. At the point of investment, most companies will have proven success to in turn will raise at higher valuations.

- Late Stage Capital

- This might be a final injection before a company sets to go public or to fund expansion into a totally new market.

- Rolling Funds

- While they are not typically dedicated to a specific stage (like the examples above) the way they raise financing and treat the general partner to limited partners relationship differs.

Startup Fundraising Checklist:

Step 1: Determine if VC is Right for Your Business

Step 2: Prepare Your Deck, Docs, and Metrics

Step 3: Find Investors (Check out our Connect Investor Database)

Step 4: Pitch Investors and Take Meetings

Step 5: Due Diligence

Step 6: The Term Sheet

Related Resource: Miami’s Venture Capital Scene: The 10 Best Firms

Tiger Global Management

Tiger Global Management is an investment firm that deploys capital globally in both public and private markets and beats out all other VC’s in the world with the highest count of unicorn portfolio companies. They are based in New York with a focus in global Internet, software, consumer, and payments industries

Some of their recent investments include:

- Amogy

- SleekFlow

- CloudQuery

Number of Unicorns in Portfolio

Tiger Global Management has 209 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 440 rounds within the last year.

SV Angel

SV Angel is a San Francisco-based angel firm that helps startups with business development, financing, M&A, and other strategic advice.

Some of their recent investments include:

- Graft

- Bubblehouse

- Gilde

Number of Unicorns in Portfolio

SV Angel has 23 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 57 rounds within the last year.

Related Resource: The 11 Best Venture Capitals in San Francisco

LocalGlobe

LocalGlobe is a venture capital firm that focuses on seed and impact investments. They are located in London, England and their investment geography is usually within Europe.

Some of their recent investments include:

- Cloudwall Capital

- &Open

- Shellworks

Related Resource: 15 Venture Capital Firms in London Fueling Startup Growth

Number of Unicorns in Portfolio

LocalGlobe has 18 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 52 rounds within the last year.

Greycroft

Greycroft is a venture capital firm located in New York that focuses on technology start-ups and investments in the internet and mobile markets.

Some of their recent investments include:

- Narmi

- Boulder Care

- Branch

Number of Unicorns in Portfolio

Greycroft has 9 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 80 rounds within the last year.

Bain Capital Venutre

Bain Capital Ventures is a global private equity firm located in Boston, with over $17 billion of assets under management. Since 1984, the firm has invested in over 200 companies, with such notable successes as Aspect Development, DoubleClick, Gartner Group, and Netfish Technologies. Bain Capital Ventures manages a $250 million fund. Bain Capital Ventures partners with exceptional management teams to help early stage companies become long-term leaders in their markets.

Some of their recent investments include:

- Auxilius

- Magical

- JupiterOne

Number of Rounds Participated in the last 12 Months

Bain Capital Venutre have participated in 66 rounds within the last year.

Andersson Horowitz

Andreessen Horowitz was established in June 2009 in Menlo Park, California by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

Some of their recent investments include:

- Entropy

- SCiFi Foods

- Adim

Number of Unicorns in Portfolio

Andersson Horowitz has 98 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 241 rounds within the last year.

Canaan Partners

Canaan Partners invests more than money in a company—they invest their time, experience, knowledge, connections and team-oriented approach. They place tremendous value on creating working partnerships with entrepreneurs and management teams who have the character and the drive to succeed. Prominent among Canaan’s resources is the breadth of operating, managerial and financial experience.

Some of their recent investments include:

- WorkMotion

- Appsmith

- Marvin

Number of Unicorns in Portfolio

Canaan Partners has 6 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 43 rounds within the last year.

Anthemis

Anthemis Group is a global platform that cultivates change in the financial system by investing in, growing, and sustaining businesses. They are located in New York and London and thein investment thesis is to focus on startups that leverage technology to significantly impact the financial system.

Some of their recent investments include:

- Hokodo

- Kasheesh

- Kinly

Number of Unicorns in Portfolio

Anthemis has 5 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 51 rounds within the last year.

General Catalyst

General Catalyst is a venture capital firm located in Cambridge, Massachusetts, that makes early-stage and growth equity investments with a focus in Consumer, Enterprise, Mobile, and Applications.

Some of their recent investments include:

- Guild

- Vibrant Planet

- Sanas

Number of Unicorns in Portfolio

General Catalyst has 72 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 115 rounds within the last year.

Related Resource: 11 Top Venture Capital Firms in Boston

TCV

TCV is a leading provider of capital to growth-stage private and public companies in the technology industry. They are located in Menlo Park, California but invest globally.

Some of their recent investments include:

- Trulioo

- FlixMobility

- FarEye

Number of Unicorns in Portfolio

TCV has 32 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 23 rounds within the last year.

Balderton Capital

Balderton Capital is an early-stage venture firm that’s based on the principles of teamwork and an intense dedication to building companies of lasting value. They provide superior service to entrepreneurs through a unique, team-oriented partnership. This team approach not only makes it more fun for them to come to work everyday, but more importantly, it benefits their portfolio companies. Instead of competing for resources, they share ideas, contacts and resources. They are located in London, England and primarily invest in European companies.

Some of their recent investments include:

- TestGorilla

- Request Finance

- Avi Medical

Number of Unicorns in Portfolio

Balderton Capital has 13 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 38 rounds within the last year.

Forum Ventures

- Location: New York City, San Francisco, and Toronto, United States

- Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

- Investment Stages: Pre-Seed, Seed

- Recent Investments:

- Sandbox Banking

- Tusk Logistics

- Vergo

Check out Forum Ventures profile on our Connect Investor Database

RRE Ventures

RRE Ventures is a New York-based venture capital firm that offers early-stage funding to software, internet, and communications companies.

Some of their recent investments include:

- Haystacks.ai

- Domain Money

- Palm NFT Studio

Number of Unicorns in Portfolio

RRE Ventures has 13 unicorns in their portfolio

Number of Rounds Participated in the last 12 Months

They have participated in 17 rounds within the last year.

Related Resource: Exploring the Top 10 Venture Capital Firms in New York City

Related Resource: Chicago’s Best Venture Capital Firms: A List of the Top 10 Firm

Related Resource: Atlanta’s Hottest Venture Capital Firms: Our Top 9 Picks

Looking for Funding? Visible Can Help- Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here and check out Visibles Fundraising page: https://visible.vc/fundraising