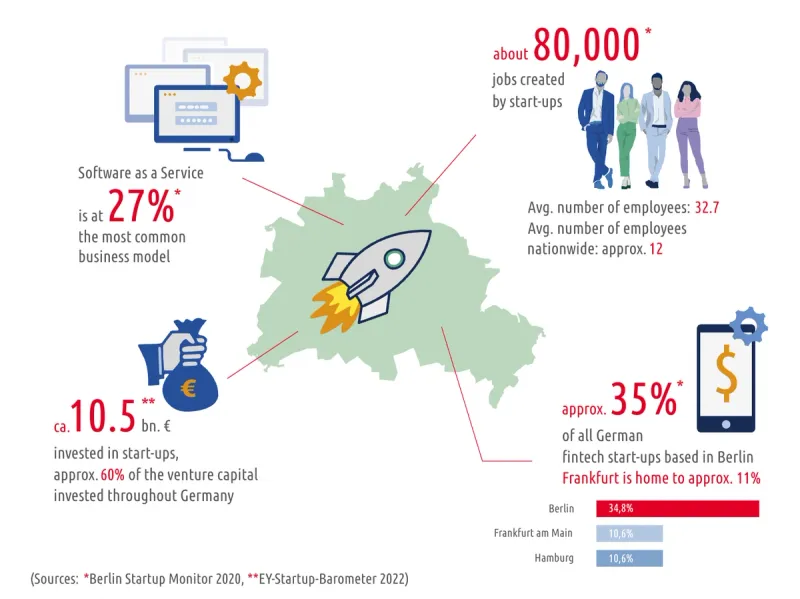

Over the last decade, Berlin has transformed into the Silicon Valley of Germany and become a hotspot for founders and venture capital, with over 500 startups and around 40,000 business registrations per year. The city is the perfect environment for entrepreneurs to start and scale their businesses. Favorable conditions include highly qualified international talent, lots of networking opportunities and a vibrant social scene, a high standard of living at a relatively low cost, and a very active VC scene. Some of the well-established startups that call Berlin home are Soundcloud, Zalando, GetYourGuide, Delivery Hero, HelloFresh, N26, Tier Mobility, and Grover- just to name a few.

Alternate funding opportunities, accelerators, and startup communities that are specific to Berlin

- Berlin government grants

- Accelerators and Incubators

- entrepreneur first

- Antler

- SIB (Startup Incubator Berlin)

- Expedite Ventures: Expedite Ventures is a Business Angel group of CTOs and CPOs. “We support tech founders hands-on with our know-how and capital. We’re nerds at heart, all passionate founders ourselves – some of us are still running startups. We have decades of collective experience in building and scaling technology companies. We offer a true hands-on mentoring approach, which we think is at least as important as capital. That’s why we provide both – plus a perspective that typical business-oriented angels and most VCs simply can’t provide.”

- Startup Scholorships

- IHK Berlin: Set-up subsidy for those unemployed

- Bayer G4A– partners with healthcare startups and technology companies that are developing innovative solutions in healthcare.

- Encourage Ventures: The investor network for female founders

- Notable Angels include co-founders and former MDs from Blinkist, N26, and mysugr.

- Innovators Room– helps founders, investors, corporate innovators as well as rising talent to network and advance their career together, through our Slack community, TechJobs newsletter and various online and offline learning events.

- Factory Berlin– provides members a curated network of entrepreneurs, professionals and creators, exclusive networking and knowledge-sharing events and programs, and access to our two locations in Berlin.

- WLOUNGE– a connector, change-maker, door opener, inspiration, access, enabler, and empowerment, headquartered in Berlin. A key player in the German Tech ecosystem and globally. We are global, founded to support diversity and women in business and technology. Each year we provide innovative services, workshops, round tables, The Tech Awards Gala, delegations, conferences, investment scouting, female founders program, leadership and fundraising, Growth opportunities, matchmaking activities between startups and corporates.

- BerChain– A non-profit association based in Berlin, connecting and promoting the Berlin Blockchain community from throughout the Blockchain ecosystem and beyond, positioning Berlin as the global Blockchain Capital.

- Hubraum-hubraum is Deutsche Telekom’s tech incubator. By bringing early-stage startups and the leading European telco together, hubraum sparks innovation transfer and creates business opportunities for both sides. Since 2012, hubraum has been collaborating with the digital ecosystem out of its campuses in Berlin, Krakow and Tel Aviv.

- EXIST– EXIST aims at improving the entrepreneurial environment at universities and research institutes.

- FoodLabs– FoodLabs is a venture studio and investor for startups that shape the future of nutrition, sustainability and health.

Berlin VC Investment Within the Last 10 Years:

Events

- StartUpNight– This will be the 10th year of the event which includes stage programs, workshop sessions, and pitch opportunities, experts from venture capital firms, corporates, and funding institutions will give founders the opportunity to present themselves and their innovations and get answers to their questions on important topics such as funding.

- Hub.berlin– The business festival for digital movers and makers.

- TOA– Tech Open Air

Resources

- Berlin Startup Report (only in German)

- Berlin Startup Resources

- Berlin Startup Map

- Top 10 Government Grants

- Guide to Berlin startup funding

- German Startup News

- EU Startups

- Business Insider: Grunderszene

- Startup-Insider

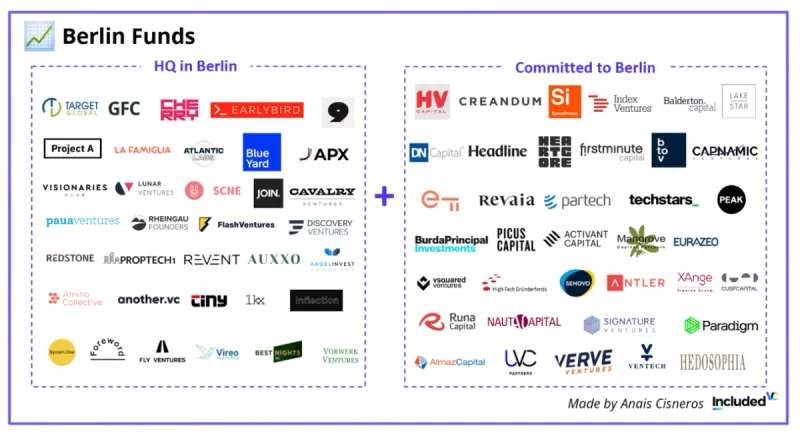

VCs Investing in Berlin Startups

Lakestar

- Location: Zürich, Zurich, Switzerland

- About: Lakestar invests with a long term view across all stages from Seed to Growth. We have been privileged to partner with some of the world’s best tech entrepreneurs. Their stories are inspirational and make us proud.

- Thesis: Our vision is of a world of technology-enabled, progressive societies, born of the very best ideas that founders can dream up and that we can help realise.

- Investment Stages: Seed, Early, Growth

- Recent Investments:

- 1047 Games

- AccuRx

- Aetion

Related Resource: 8 Active Venture Capital Firms in Germany

June Fund

- Location: Berlin, Germany

- About: June is a global technology investor, backed by leading industrial minds. June invests into new paradigms across all stages – from networks to infrastructures to open software platforms. We take a macro-thematic view on technological progress, new economic models and value creation. June’s breadth of experience, intellectual curiosity and long-term thinking have attracted exceptional teams and individuals.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Reebelo

- Statespace

- SimScale

HV Capital

- Location: Berlin, Munich, Germany

- About: Founded in 2000, they are one of the leading independent European early stage funds.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Storyblok

- KoRo

- Flip

Target Global

- Location: Berlin, Berlin, Germany

- About: We’re an international VC headquartered in Berlin with €800m+ AuM, focusing on fast-growing tech companies across their lifecycles. With offices in London, Tel Aviv, & Barcelona, we connect the key European startup ecosystems. We help exceptional entrepreneurs to build market leaders.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Masterschool

- Reverence

- Casava

Acton Capital

- Location: Munich, Bayern, Germany

- About: Acton Capital Partners is a specialist investor in internet- and mobile-based, consumer-oriented businesses. Having managed more than 30 investments since 1999 as the corporate venture capital business of Hubert Burda Media, the German family-owned global media company, the Acton team brings a wealth of expertise to the companies in which it invests, delivering superior capital returns.

- Investment Stages: Series A, Series B

- Recent Investments:

- Convelio

- Zenjob

- Knix Wear

IBB

- Location: Berlin, Germany

- About: Investing in Berlin-based start-ups with a focus on Tech (e.g. Software & IT, Industrial Tech, Health Care) and other business model innovations (e.g. Digital Consumer and Media Businesses).

- Thesis: IBB Ventures is for all those who make a difference and create a sustainable future. We invest public funds as venture capital and, together with Berlin startups, help to promote our capital as a business location. Our focus is on innovative ideas and ambitious founders. With our many years of experience we are at your side and help you to successfully implement your ideas.

- Investment Stages: Seed, Series A

- Recent Investments:

- Blinkist

- Babbel

- The Female Company

Speedinvest

- Location: Berlin, London, Munich, Paris, and Vienna, Austria

- About: We have 40 investment pros in Berlin, London, Paris, Munich, Vienna, San Fran & an in-house team of 20 operational experts to support you from day one. We fund early-stage Fintech, Digital Health, Consumer Tech, Network Effects, Deep Tech & Industrial Tech. Send us your pitch!

- Thesis: Speedinvest is a leading early-stage venture capital firm with more than €600M AuM and 40 investors based in Berlin, London, Munich, Paris, and Vienna. Our dedicated sector-focused teams are the first to fund Europe’s most innovative technology startups and our in-house operational experts are on-hand to offer founders ongoing support with growth, HR, US market expansion, and more. Wefox, Bitpanda, TIER Mobility, GoStudent, Wayflyer, CoachHub, Schüttflix, TourRadar, Adverity, and Twaice are among our portfolio of 250+ companies. Learn more at www.speedinvest.com.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Bliq

- Byrd

- Kevin

Verve Ventures

- Location: Zürich, Switzerland

- About: Verve Ventures provides its pan-European network of selected private and institutional investors access to those top-tier investment opportunities. The company invests from EUR 500k to several million from Seed to Series B and beyond across Europe. Verve Ventures’ dedicated team helps startups with their most pressing needs such as hiring, client introductions and access to an expert network of high-profile individuals. To become part of Verve Ventures’ growing network of entrepreneurs and investors, visit verve.vc.

- Thesis: Investing in technology and science-driven startups. Adding value through our exclusive network of investors.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Soter Analytics

- Byrd

- helios

Cherry Ventures

- Location: Berlin, Germany

- About: Cherry Ventures is an early-stage venture capital firm led by a team of entrepreneurs with experience building fast-scaling companies such as Zalando and Spotify. The firm backs Europe’s boldest founders, usually as their first institutional investor, and supports them in everything from their go-to-market strategy and the scaling of their businesses. Cherry Ventures has previously invested in the seed stage of over 70 companies across Europe, including FlixBus, Auto1 Group, Flaschenpost, Infarm, Rows, Forto, SellerX, Juni, and Flink. Cherry Ventures is based in Berlin and invests across Europe with operations in London and Stockholm.

- Thesis: Founders first and investors second.

- Investment Stages: Pre-Seed, Seed

- Recent Investments:

- Klar

- Cosuno

- NUMA Group

EQT Ventures

- Location: Stockholm, Stockholms Lan, Sweden

- About: EQT Ventures is a sector agnostic, multi-stage VC fund, with just over €1.2 billion total capital raised. The fund’s team of former founders and operators from the likes of Spotify, Booking.com, Hotels.com and King have experienced the entrepreneurial journey firsthand and know how challenging it can be. They’re ready to support the next generation of entrepreneurs in Europe and the US with the expertise and advice needed to build global success stories.

- Investment Stages: Seed, Series A, Series B, Series C

- Recent Investments:

- Moralis

- Instabox

- Nothing

BlueYard Capital

- Location: Berlin, Germany

- About: BlueYard invests in founders with transforming ideas that decentralize markets and empower humanity. Typically $1-3m as an initial investment; active around the world. Most active in crypto/web 3 (e.g. Protocol Labs, Filecoin, Open Zeppelin, Radicle), technologies that help us overcome our largest planetary challenges (e.g. Marvel Fusion, Meatable, Dance), frontier biology to help us live long and prosper (e.g. BitBio, Biofidelity) and vertical software un-bundling monopolies (e.g. Pitch, Wonder).

- Thesis: BlueYard seeks to invest in founders with transforming ideas that decentralize markets.

- Investment Stages: Pre-seed, Seed, Series A

- Recent Investments:

- Privy

- Dance

- FreedomFi

Expedite Ventures

- Location: Berlin, Germany

- About: Expedite Ventures is a Business Angel group of CTOs and CPOs. We support tech founders hands-on with our know-how and capital. We offer a true hands-on mentoring approach, which we think is at least as important as capital. That’s why we provide both – plus a perspective that typical business-oriented angels and most VCs simply can’t provide.

- Investment Stages: Pre-seed, Seed

- Recent Investments:

- Superlist

- widgetbok

- supernova

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.