Building a startup is difficult. On top of building a fundable business, hiring top talent, and acquiring customers — founders need to secure funding for their business. For founders looking for equity financing, one of the first places to look is angel investors or venture capitalists.

Local angel investors can be a great source for kicking off a fundraise. While the typical angel check tends to be smaller than a vc fund, an angel check can be a great way to build momentum and start filling in your round.

If you’re a founder located in Los Angeles or Southern California, check out our list of 10 angel investors in the area below:

Where can I find angel investors in Los Angeles?

Angel investors can be anyone around you. While there are noteworthy angels (like the ones listed below), just about any high net worth individual can be an angel investor. Elizabeth Yin of Hustle Fund is a huge believer in small checks and pitched everyone around her — doctors, optometrists, dentists, etc.

Related Resource: 7 Tips for Raising a Friends & Family Round

Of course, if you’re looking for “traditional” angel investors you can use networking, events, social media, and online databases to find the right investors for your company. Learn more about finding and pitching angel investors for your startup below:

Related Resource: How to Effectively Find + Secure Angel Investors for Your Startup

Clark Landry

Clark Landry is an entrepreneur and investor based in Los Angeles and Nashville. Clark spent time as an entrepreneur and founded his own startups. Since then, he has started to invest in startups — 120+ investments to date.

- Industry – Agnostic with a focus on software businesses

- Notable Startups Funded – a few of Clark’s investment exits can be found below (check out the rest on his LinkedIn)

- The Trade Desk (in at $16M, NASDAQ IPO, ~$40B market cap)

- EdgeCast Networks (acquired by Verizon, $390M)

- Adconion (acquired by SingTel, $235M)

- Top Level Domain Holdings (IPO on the LSE AIM)

- Traffic Marketplace (acquired by Vivendi)

- Funding stage – seed stage

Jim Brandt

Jim Brandt is an angel investor based in Southern California. Jim is involved with Tech Coast Angels, an angel group in Southern California. Check out what TCA looks for in investments below:

- Industry: Software and life sciences are the most popular industries for TCA. Check out the industry breakdown for TCA below:

- Notable Startups Funded – TCA has made 450+ investments. Some of their recent exits can be found below:

- Procore Technologies (IPO at 368x)

- Doctible (8x)

- Findox (6x)

- Cognition Therapeutics (IPO at 6x)

- Discover Echo (5x)

Rosie O’Neill

Rosie O’Neill founded Sugarfina. Since founding Sugarfina, Rosie has turned to angel investing and launching her own fund, Pure Imagination Brands.

- Industry – Agnostic

- Notable Startups Funded – 50+ investments, check out a few recent investments below:

- Abbot’s Butcher

- The Bouqs Co

- Thrive Market

- Funding stage – early stage

Related Resource: VCs Investing In Food & Bev Startups

Mark Mullen

Mark Mullen is an angel investor and the founder of Bonfire Ventures. Prior to his career in angel and venture investing, Mark spent his career at RBC Capital Markets. Learn more about Mark and his investment criteria below:

- Industry – Agnostic

- Notable Startups Funded:

- ChowNow

- AdStage

- Bitium

- Funding stage – Early stage

Richard Wolpert

Richard Wolpert is a 4x startup founder and has since turned to angel investing. Currently, Richard is a venture partner at Acrew. Learn more about Richard and his investing criteria below:

- Industry – Agnostic

- Notable Startups Funded:

- Carta

- NestEgg

- Mob.ly

- Funding stage – Seed

Matt Mazzeo

Matthew Mazzeo is an angel investor and currently the General Partner at Coatue Management. Learn more about Matt and his investment criteria below:

- Industry – Technology, Media

- Notable Startups Funded:

- Airtable

- Loom

- Slack

- Funding stage – Seed and beyond

Anthony Saleh

Anthony Saleh is an angel investor and General Partner at WndrCo. At WndrCo, Anthony is responsible for their seed stage investments. Learn more about Anthony and his investment criteria below:

- Industry – Media and Entertainment, Future of Work, Cybersecurity

- Notable Startups Funded

- Robinhood

- OpenSea

- AirTable

- Funding stage – Seed

Tom McInerney

Tom McInerney is an active angel investor. Learn more about Tom and his angel investing criteria below:

- Industry – Agnostic

- Notable Startups Funded:

- Notion

- Segment

- Bird

- Funding stage – Seed/Series A

Ashton Kutcher

Ashton Kutcher (no introduction needed) has turned to angel investing. In addition to angel investing, Ashton has also started Sound Ventures. Learn more about Ashton and his investment criteria below:

- Industry – Technology

- Notable Startups Funded

- Airbnb

- Uber

- Airtable

- Funding stage – Seed/Series A

Related Resource: 15+ VCs Investing in the Future of Work

Connect with Angel Investors in Los Angeles with Visible

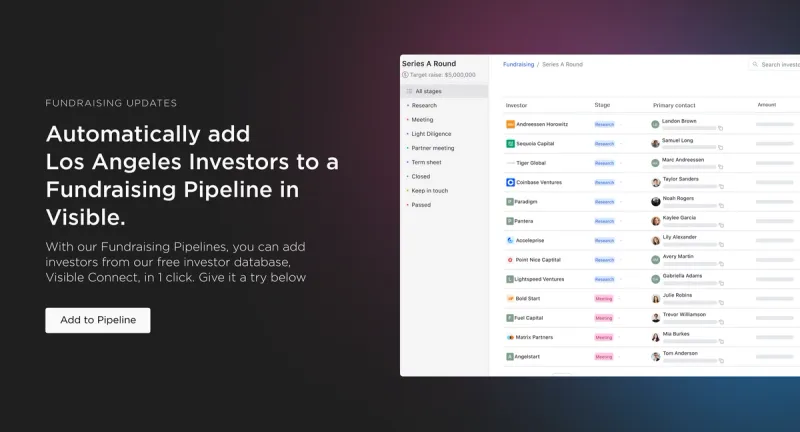

Finding the right investors for your business is only half the battle. With Visible, you can…

- Find the right investors for your startup with Visible Connect, our free investor database

- Manage and track the status of your raise with our Fundraising CRM

- Upload and share your pitch deck with investors in your pipeline

- Build and share your data room directly from Visible when working through due diligence and the final stages of your raise.

Manage every aspect of your raise all from one platform. Give Visible a free try for 14 days here.