A User-Friendly Guide to Startup Accounting

In a startup, there are a million things going on at all times. The last thing on a founder’s mind is most likely not balancing the books and managing the daily ins and outs of company finance – other than ensuring there is a cash runway to work with. But as your business grows, it’s critical to have a grasp on all elements of your company’s books to ensure your company can grow and scale in an effective way and avoid costly financial errors down the line.

Why Does Accounting Matter to Startups?

In a startup, typically cash is always tight and you’re operating on a short runway. This makes accounting even more critical for your business. Measuring, processing, and communicating the source and destination of every dollar is crucial to ensure smart business decisions can be made. After your startup raises a round of funding and takes on outside investors, accurate accounting is, even more, a crucial element to have under control in your startup. With outside eyes monitoring every way, you’re spending their investment, ensuring you have a tight grip on and understanding of your company’s accounting will make or break your business.

Related Resource: Building A Startup Financial Model That Works

What is Your Business Structure?

What is Your Business Structure?

Depending on how your organization is formally classified, the accounting required will be slightly different. All formal, for-profit businesses are classified as 1 of 5 different business entity types. The 5 different business entities are:

Business Entities Types

- Sole Proprietorship is an enterprise that is owned and run by a single person. Specifically, there is no legal distinction between the owner of the business and the business entity. A sole proprietorship does not always work alone as it is possible for the sole proprietorship to employ other people. Sole proprietorships are also known as sole tradership, individual entrepreneurship, or simply as a proprietorship.

- Partnership – When two or more individuals operate a business based on an oral or written agreement, that is legally considered a partnership. An agreement on the protocols and terms of the partnership is not required to consider a business entity to be considered a formal partnership, it’s best practice for one to be in place. Similar to a sole proprietorship, a partnership entity business has no legal distinction between the owners of said business.

- C Corporation – in the United States, under federal income tax law, a C Corporation is any business entity or enterprise corporation that is taxed separately from its owners. Unless the corporate elects otherwise, most for-profit corporate businesses in the United States are automatically considered a C Corporation.

- S Corporation – An S Corporation is a privately held company that makes the decision to be taxed under the Subchapter S of Chapter 1 of the Internal Revenue Code, or IRS, federal income tax law. By making a valid election, the S-corporation’s income and losses are divided among and passed through its shareholders. The individual shareholders must then report the income or loss on their own individual income tax returns.

- Limited Liability Company (LLC) – An LLC is a business that’s structure is allowed and dictated by individual state statutes. Each state can adjust and use different regulations to structure an LLC so it’s critical for business entities to check what different regulations are allowed for an LLC state to state. Owners of an LLC are referred to as members and typically, most states do not restrict ownership. So members could be individual owners, corporations, other LLCs, or in some cases even foreign entities. Most states also do not have a maximum number of members restriction in place on LLCs and most also permit “single-member” or sole owner LLCs. The main restriction on LLCs comes into play when considering the types of private businesses that do not qualify to be LLCs such as banks and insurance companies.

Understanding the Two Methods of Accounting

Now that the 5 primary business entities have been defined, the two methods of accounting need to be understood. Depending on the type of business entity, a different method may be used.

Accrual Basis Accounting

This specific accounting method allows a company to record its revenue before receiving the physical payment for the product or service that has been sold. Public companies are required to use accrual basis accounting. Most companies making above $5M a year in revenue use accrual basis accounting. This is typically the preferred method of accounting for private companies as it is generally more reflective of a company’s actual revenue.

Cash Basis Accounting

On the opposite end of the spectrum to accrual basis accounting, cash basis accounting only records the revenue in a company’s book of business when the cash transaction has physically occurred for the product or services sold. C Corporations and Partnerships are not allowed to use cash basis accounting unless they total under 5M a year in revenue for 3 tax years in a row.

Related resource: What is a Schedule K-1: A Comprehensive Guide

What Types of Financial Records Should Your Startup Keep?

Once you’ve determined the type of accounting most appropriate for your startup, it’s critical to have a clear understanding of the broad types of financial materials you should be keeping track of and recording for said accounting practice. A good rule of thumb is to keep everything related to the financial arm of your business, and when possible, make multiple copies as backups for key financial items and hold onto these items for at least 3 to 7 years after their existing date. An overview of the items that your startup should be holding onto and keeping in their financial records includes:

- Receipts from business expenses

- Bank statements

- Bills

- Tax Forms for both your business and employees

- Contracts that outline the services or products you are selling

- Contracts with vendors you are purchasing services from

- Receipts from any tax-deductible donations or contributions made by your business entity

Overall, it’s critical to establish a system early on for maintaining detailed records of every documented transaction or financial movement that occurs within or in relation to your business.

Related Resource: How to Calculate Runway & Burn Rate

The Relationship Between Recordkeeping and Accounting

A big part of the practice of measuring, processing, and communicating about financial information, aka accounting, is the process of recordkeeping. Recordkeeping is the process of keeping track of the history of an organization’s activities, or in some cases a person’s activities, by creating and storing these as consistent formal records.

What is Record-Keeping or Bookkeeping?

Recordkeeping relates to accounting as a form of recordkeeping specifically for financial activities. A clear recordkeeping process is the backbone and foundation of a good accounting process. Without it, accurate processing and measurement simply cannot occur.

Knowing recordkeeping, or bookkeeping as it’s sometimes known, is the backbone of the accounting process, it’s important to establish weekly and monthly recordkeeping tasks to ensure your process is rock solid from the early days of your business. We’ve got some recommendations to get you started.

Recommended Weekly Recordkeeping Tasks

1. Record all transactions into your books

Decide on a single source of truth to maintain ongoing documentation of your financial records. This single source of truth is often referred to as a “book”. We recommend a digital source of truth as well as a written source of truth or physical copies of each record as a backup barring any issue with the digital book. Set time for yourself every week at the same time to record all financial transactions from that week in your book and ensure the records are saved, backed up, and filed in an organized manner. Doing this on a weekly basis will prevent missed recordings of financial records as they get backed up week over week.

2. Segment Your Transactions

In addition to recording each transaction in your books on a weekly basis, take it a step further and segment your transactions into categories. This will provide an additional layer of organization and allow for extra audit and thoroughness on how your finances are flowing into and out of your business. Segments could include items like revenue, bills paid, taxes, etc.

3. Digitize Your Receipts

It can’t be emphasized enough – keep a digital record of your receipts. Just as we recommend keeping a physical copy of your books and digital transactions as backup, the same is true for physical receipts – digitize everything and make it a consistent practice to back up each digital record. The more risk you can mitigate in losing financial records, the more accurate your accounting will be in the long run.

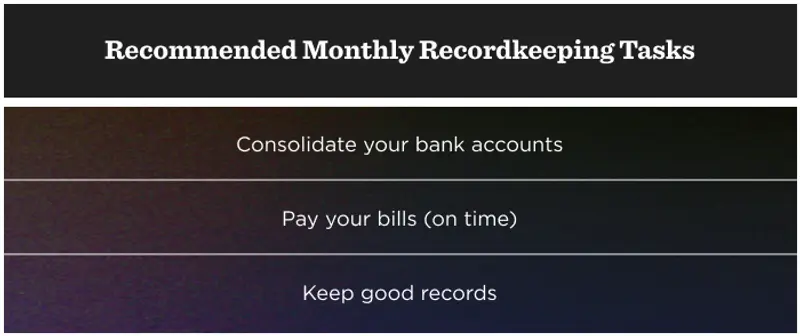

Recommended Monthly Recordkeeping Tasks

1. Consolidate your bank accounts

On a monthly basis, you should be taking a deeper look at your financial records. A big task to accomplish on a monthly basis is consolidation. Take a look at all accounts open and related to your business entity and consolidate said accounts into as few accounts as possible. This will ensure that no accounts get forgotten over time leading to missed transactions or balances in the accounting records. A monthly practice of consolidation is a foundational recordkeeping habit for your business.

2. Pay your bills (on time)

It’s a slippery slope when your business gets behind on its bills. Set monthly reminders for all recurring bills and pay them on time. It’s critical to keep an accurate record of all financial transactions and missed or late bills can throw off the overall financial accuracy of your accounting. Additionally, late bills often are additional fees, which for a startup strapped for cash, can be detrimental to your business.

3. Keep Good Records

Be as picky as possible. On a monthly basis, go through your records and clean up any sloppy entries. Reevaluate your system often to make sure the information your tracking is as accurate and efficient as possible. Good records are the foundation of your accounting process and ultimately the financial accuracy of your business.

Related Resource: 4 Types of Financial Statements Founders Need to Understand

The Benefits of a Good Accounting System

After you’ve established strong weekly, and monthly record-keeping tasks as the foundation of your accounting system, your measurement, and communication of the financial state of your business via accounting is underway. The benefits of a good accounting system have many ripple effects throughout your business.

Smoother Management of the Business

Most business decisions are made based on the financial state of the business. A good accounting system will ensure that the decisions being made are based on a clear and accurate process leading to an overall much smoother management of the business as a whole.

Reduced Time and Costs of Audits

Time is money in business and lost time going back through financial records that are not maintained correctly. Huge errors in your accounting system can even lead to fines from the IRS or expensive consultancy fees needed to bring in external auditors to fix said errors. Establishing a strong accounting system early in your business can prevent this.

Your Investors will Thank You

Investors are trusting you with their capital. If you have a smooth system in place to record, measure, and communicate all financial details aka an accounting system, you will always be prepared to answer and address all oversight and detailed questions from your investors. If they have a constant, clear picture of the status of their investment, they will be satisfied and can spend their time helping the business grow.

Should You Do Accounting In-House or Outsource?

Finally, you may be wondering if your accounting process should be something managed within your business or outsourced to a professional accounting firm. While your total revenue is under 100k, or even 500k, you can most likely manage that as a founder or with a singular financial hire in-house. As you start to climb in revenue and take on external investments, consider the cost of an in-house financial team; Under 5M dollars, it may make more sense to outsource to an accounting firm and spare the headcount.

However, if you have any special tax circumstances, it may make sense to invest in an in-house team if the cost of external services billed hourly ends up being more than the cost of headcount in-house. In-house accounting can also be beneficial because it ensures you have dedicated staff only working on your books, as opposed to an outside source managing multiple clients.

Related Resource: How to Choose the Right Law Firm for Your Startup

Related Resource: 7 Essential Business Startup Resources

Sign up For Visible Today - Your Startup Hub

Accounting is a critical practice all startups should establish early on in their business. When measuring and reporting out metrics to your stakeholders, consider Visible as a central reporting point of your startup hub. Create an account and get started now.