As an ambitious founder, joining an accelerator program can be a major stepping stone to startup success. By joining an accelerator, startups can fast-track their progress, accessing resources and networks that would otherwise take years to build.

The impact of such programs is evident when we look at companies like Dropbox, Airbnb, and Reddit, each of which gained invaluable benefits from accelerator experiences with Y Combinator. By turbocharging their development, these companies leaped ahead, becoming industry leaders and household names.

In this article, we’ll delve deeper into the world of accelerators, helping you understand why such a program could be a game-changer for your startup and some startup Accelerators to consider from our Connect investment database.

Benefits of Joining an Accelerator

One of the most significant advantages of accelerator programs lies in the mentorship they provide. Founders are often p

aired with experienced entrepreneurs, investors, or industry experts who guide them through their growth trajectory. These mentors provide a wealth of industry insights, and strategic guidance that can open doors to significant networking opportunities.

Related resource: Should Your Startup Have Mentors? Key Benefits and Considerations

Alongside this, accelerators usually offer a certain amount of funding in exchange for equity. This early-stage capital injection can be crucial for startups to build their prototype, hire talent, or scale their operations. It also opens up a vast network of fellow founders, investors, and industry professionals, creating an ecosystem of collaboration and learning.

Additionally, founders gain access to resources and tools, such as workspaces, training sessions, and state-of-the-art technology. Accelerators ensure startups have what they need to succeed in today’s competitive market. These cumulative benefits can often be the catalyst that propels a young startup from stagnation to rapid growth.

Related resource: The Top 16 Accelerators Powering Startup Growth

“We surveyed 43 founders who attended these accelerators to better understand their biggest takeaways from each respective program. Founders highlighted many aspects of the accelerator programs, including access to quality advisers, mentors, and corporations, the strength of the program’s network, and the benefits of an environment that encourages deep thinking and iteration. They also appreciated education on fundraising and warm connections to investors and potential customers. On the other hand, founders expressed the need for more education on running a company.” – PitchBook Newsletter

Related resource: 12 Online Startup Communities for Founders

Selection Criteria and Application Process

Accelerators receive a plethora of applications, but only a handful make the cut. Therefore, understanding the selection criteria is crucial. Generally, these programs look for startups with high business potential, meaning your idea should solve a significant problem and have a sizable market. Team composition also plays a vital role; accelerators prefer diverse, dedicated, and capable teams that can withstand the rigors of startup life. Scalability is another crucial factor; your business should have the potential to grow rapidly and provide a return on investment.

As for the application process, it usually begins with an online application where you’ll provide information about your startup and why you believe it would benefit from the program. You’ll likely need to submit a pitch deck – a brief presentation outlining your business plan. If your application is shortlisted, the next stage is usually an interview with the accelerator’s selection committee. This is your opportunity to demonstrate your passion, knowledge, and commitment.

Related resource: Our Teaser Pitch Deck Template

Startup Growth Metrics and Benchmarks

For startups looking to attract accelerator interest and subsequent investment, monitoring and presenting the right growth metrics is critical. Key metrics include Monthly Recurring Revenue (MRR) and Year-over-Year (YoY) growth to showcase revenue consistency and scalability. Customer Acquisition Cost (CAC) and Lifetime Value (LTV) ratio provide insights into the efficiency of marketing strategies and customer value. Engagement metrics, like Daily Active Users (DAU) or Monthly Active Users (MAU), highlight product stickiness and user adoption. Tracking these metrics allows startups to demonstrate growth potential and operational efficiency to potential accelerators and investors.

Equity vs. Non-equity Programs

For founders, choosing between equity-based and non-equity accelerators is a crucial decision that impacts the future of your startup. Equity-based programs typically require you to give up a portion of your company's equity in exchange for capital, mentorship, and resources. This can be a good option if you're looking for substantial funding and are willing to share your company's ownership. On the other hand, non-equity accelerators offer support without taking any stake in your company, ideal for those who wish to retain full ownership. However, they might offer less capital. Consider your startup's funding needs, how much control you're willing to share, and the specific benefits each program offers to make an informed decision.

Related resource: Pros and Cons of Crowdfunding for Your Startup

Legal and IP Considerations for Startups in Accelerators

When joining an accelerator, it's crucial to carefully navigate legal and intellectual property (IP) considerations. Protecting your startup's IP is paramount, as it forms the core of your value proposition. Ensure you understand the terms of the accelerator agreement, especially concerning IP rights and confidentiality. Some accelerators may require disclosure of your IP, so it's essential to have clear agreements in place to protect your interests. Consulting with a legal expert specializing in startup and IP law can provide tailored advice, helping you safeguard your assets while benefiting from the accelerator's resources and network. Engaging in due diligence and obtaining professional legal guidance are key steps in this process.

What to Expect from an Accelerator

Most programs are highly structured and rigorous, designed to make the most of every minute. A typical day could include a blend of workshops, mentorship sessions, networking events, and ample amounts of time for product development. Accelerators push startups to evolve rapidly, so the schedule can be demanding. Expect long days and tight deadlines, but also a supportive, collaborative environment full of passionate people who share your entrepreneurial spirit. It’s a high-intensity period, but the pace is intentionally set to prepare you for the demanding nature of running a startup.

Preparing the Team

Preparing your team for an accelerator program is much like gearing up for a marathon. The program’s intensity means your team will need to be mentally prepared and resilient. Transparency is key – ensure your team understands the expectations and commitments of the program. Encourage open communication about concerns and questions. Prioritize team health and well-being to avoid burnout. Foster a culture of agility and quick decision-making, as accelerators move at a fast pace. Regular check-ins and debriefs can help the team navigate the experience collectively, learning and pivoting as needed.

Setting realistic and achievable goals before entering an accelerator is crucial. Having clear objectives will help you stay focused amidst the whirlwind of activities and opportunities. Your goals could range from product development milestones, market validation, and customer acquisition targets, to preparing for fundraising. Be ambitious, but also practical – consider your team’s capacity and the program’s duration. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Remember, these goals are not set in stone; they should evolve as you receive new information and feedback during the program. Regularly revisit and revise your goals to ensure they align with your startup’s growth and the invaluable feedback you’ll receive within the accelerator environment.

Related resource: Startup Metrics You Need to Monitor

Navigating Post-Accelerator Challenges

After completing an accelerator program, startups face the challenge of maintaining momentum. To sustain growth, focus on continuous learning and adaptability, leveraging the network and resources acquired during the program. Establish clear, achievable goals for short and long-term growth, and continuously measure performance against these objectives. Engage with the accelerator alumni community for support and potential collaboration opportunities. Prioritize building strong customer relationships and refining your value proposition based on feedback. Lastly, maintain fiscal discipline while seeking further investment opportunities to fuel growth.

Resources

- The most active startup accelerators and where they’re investing

- Accelerator connect profiles in our Fundraising CRM

- Seed-DB maintains a global list of accelerators and data on their funded startups.

- Barclays Eagle Labs: Our passion is innovation and growth so much so, that in 2015 when underused Barclays spaces became available we created Eagle Labs, a network made up of member businesses, partners, investors, corporates, mentors, banking expertise and so much more.

Startup Accelerators to Check Out

Buildit Accelerator

And Program Info Provided by Arta Beitāne, Associate and Accelerator Program Manager

About: Buildit is an accelerator that supports hardware and IoT startups in turning an idea into a tangible, market-worthy product.

Sweetspot check size: $ 300K

Traction metrics requirements: Must have an MVP or working prototype

Thesis: At Buildit you don’t just get a product accelerator. You get a partner in development that’s invested in seeing you succeed. Program Specifics: What does the curriculum include? What skills and knowledge areas does the program focus on?

“Curriculum topics: Smart prototyping, design for manufacturing, business modelling and pricing, efficient marketing with 0$ budget, pitch trainings, Fundraising & Legalese, IP protection, Sustainability and ESG reporting since Day 1…The program focuses on setting up the startup so that the team can raise their next investment rounds – clear plans and milestones, team competencies, IP rights, etc.”

Mentorship and Network: Who are the mentors and what are their backgrounds?

“Mentors are of various profiles, and the group constantly changes as we are on a constant lookout for fresh perspectives. Mentors usually are or have been founders themselves, some are investors and some are specialists in their own areas (lawyers, engineers, consultants). What networking opportunities exist within the program? What kinds of professionals will they have access to?

“Mentors (a long list of 300 experts, compiled over years) and investors mainly.”

Success Stories and Track Record: What notable companies have gone through the program?”

“We’re proud [amongst others] of STRIGA, Naco Technologies, Alternative Plants to name a few.”

Post-Program Support: What kind of support (if any) is offered to startups after they complete the program?

“In most cases, we invest in our program graduates. Participants are pre-selected in a way where we see high potential of a Buildit investment case. The network is quite widespread geographically and industry-wise, nevertheless, relatively closely knit, therefore, we see high likelihood in portfolio company founders helping each other + we try to host annual in-person events to facilitate relationship building and rekindling.”

Aviatra Accelerators

About: Aviatra Accelerators empowers women entrepreneurs to start and grow their businesses faster and with more confidence.

Thesis: We offer classes, coaching and community to women entrepreneurs. Our program “Capital-Ready Women” helps women get ready to successfully access capital from lenders and investors.

"Our newest program for women entrepreneurs is Capital-Ready Women. It’s designed to help women get ready to successfully access capital from lenders and investors. It begins with our Free Fundability Assessment, available at FreeFundabilityAssessment.com."

Union Kitchen

About: Union Kitchen is a Food Business Accelerator. We build successful food businesses by bringing together our Accelerator with access to our Kitchen, Distribution, and Stores. Since starting in 2012, we’ve worked with over 650 food businesses, including DC favorites Compass Coffee, Snacklins, Mas Panadas, Caribe and many more! Union Kitchen also launched an investment fund in 2022. Are you ready to build your successful food business? Apply here: https://unionkitchen.com/apply

Lair East Labs

About: Lair East Labs is an early-stage venture firm based in New York City that empowers founders to expand internationally. At the heart of Lair East Labs comes our founder-centric accelerator program. Each cohort intakes 10 startups to receive curriculum content, mentorship network, office space, and investments of up to $150K. Our 4-month program combines the best of two worlds: learning from alum founders and gaining access to a diverse mentor and investor network with extensive experience navigating the Asian markets. Our portfolio companies have raised $65 million of funding after completing the accelerator. For more information, please visit https://laireastlabs.com

Traction metrics requirements: Must have a MVP for software-centric startups or associated IP or research paper to validate the technology for DeepTech companies

Arkley Brinc

About: Arkley is an Accelerator VC that focuses on early-stage hardware startups to help them grow from prototype to IPO.

Thesis: We are the most individual acceleration program on earth. Representing the bespoke model: We do what’s necessary to make you do what’s impossible. We are working with startups as a team member in order to achieve agreed operational and financial goals by using Arkley’s ecosystem.

Accelerator Centre

About: Accelerator Centre is a network of facilities dedicated to developing and commercializing technology startups.

Thesis: The Accelerator Centre is an award-winning startup accelerator dedicated to building and scaling sustainable, globally competitive companies and giving startups the highest probability of long-term success.

Dreamit Ventures

About: Dreamit is a venture fund and growth-focused accelerator for Urbantech, Securetech, and Healthtech startups

Sweetspot check size: $ 1M Traction metrics requirements: Seek healthtech and securetech companies with early commercial traction and proven product market fit that are focused on scaling. Thesis: Dreamit Ventures is a fund and growth program focused on startups with revenue or pilots that are ready to scale.

Capital Innovators

About: Capital Innovators provides top-ranked accelerator programs, venture fund management, and corporate innovation. It manages private and corporate venture funds focused on technology, consumer products, and energy innovations. Capital Innovators has helped scale 188 companies and assisted them in raising over $600 MM in follow-on investment and creating over 2,900 jobs.

HARDS

About: The First Brazilian Software/Hardware Accelerator

Thesis: How do we acceerate your startup? It’s easy .. years of experience from our investors, partners, mentors, advisors and managers in hardware and software development, added to the experience of accelerating Darwin Startups!

Village Capital

About: Our mission is to reinvent the system to back the entrepreneurs of the future. Our vision is a future where business builds equity and long-term prosperity.

gener8tor

About: gener8tor is a nationally ranked, concierge accelerator that invests in high-growth startups.

Sweetspot check size: $ 100K

AngelPad

About: AngelPad is a seed-stage accelerator program that finds product market fit, defining a target market to get first validation for a company.

Sweetspot check size: $ 1M Thesis: Find awesome companies with founders we like to work with and spend three very intense months with them.

The Alchemist Accelerator

About: The Alchemist Accelerator is a venture-backed initiative focused on accelerating startups whose revenue comes from enterprises.

Sweetspot check size: $ 75K

Traction metrics requirements: Looking for companies from the idea stage to 15K+ in MRR

FounderFuel

About: FounderFuel is a mentor-driven venture accelerator that helps new startups make progress on the venture path.

Sweetspot check size: $ 120K Thesis: We ignite the global success of companies by developing the leaders behind them.

Amplify

About: Amplify is a pre-seed fund in Venice, CA dedicated to backing strong teams at the earliest stages and supporting from first check to exit.

Thesis: At Amplify, our vision is clear — help passionate technology entrepreneurs grow their startups into strong, scalable & successful companies.

Flashpoint

About: Flashpoint is an international tech investment manager with approx. $400 million AUM focused on international tech companies originating out of Europe and Israel. Flashpoint manages five venture funds: three VC funds, a Venture Debt Fund, and a Secondary Fund. The firm is headquartered in London and has offices in New York, Tel-Aviv, Budapest, Warsaw, Riga, and Nicosia.

Global Insurance Accelerator

About: The Global Insurance Accelerator is a mentor-driven business accelerator designed to foster innovation in the insurance industry through startups targeting the global insurance industry. We take in early-stage companies who are building solutions that support the insurance industry. We provide seed funding, networking with our mentors, a desk in our beautiful office in Des Moines, 100-days of on-site support and time on stage at the Global Insurance Symposium with hundreds industry executives in attendance. This is not your typical accelerator. Our investors are insurance carriers, our mentors are primarily insurance executives. Startups participating in our program find product-market fit and do customer discovery faster than they could ever do at any other accelerator. We are a strategic partner.

The Deal: Investment with founder-friendly terms: $50k in the form of a post-money SAFE that converts to 5% of the company; no board seat Curated meetings with 75+ insurance-focused mentors in program; dozens more after Final presentations @ Global Insurance Symposium (~600 attendees in 2019) Additional exposure at industry conferences One-bedroom, residential-style suite at the Staybridge Suites, with amenities including daily breakfast, nightly dinner, gym, pool, and laundry (in-person nights / 2-minute walk from GIA) Office space for your entire team Typical accelerator perks (deals on hosting, marketing tools, etc) Stocked fridge at the GIA office Founders need to be in Des Moines during the program, business-related travel is supported

Hardware.co

About: HARDWARE.co is a global community and accelerator for entrepreneurs, industry professionals and makers dedicated to the creation of innovative hardware products and companies. HARDWARE.co is made out of several interconnected components to serve, maintain, and grow our community. The HARDWARE.co Accelerator, Lab, Meetups, and Online Platform form a multichannel resource to give community members the opportunity to create leading products and companies. We support every stage of hardware development – from ideas, to prototypes, to investments, and beyond.

mHUB

About: mHUB is the nation’s leading hardtech and manufacturing innovation center. We offer membership options, run accelerator programs and provide research and development services to ensure the manufacturing industry continues to accelerate, grow and thrive.

Since launching in 2017, the mHUB community has generated more than $1B in revenue, launched more than 1,500 products, hired more than 5,100 employees, and raised over $1.5B in capital.

The mHUB facility, located in Chicago, is 80,000+ square feet and home to over 10 labs for prototyping and manufacturing. Labs include: 3D Printer Lab, Cold Metals Lab, Electronics Lab, Finishing Lab, Hot Metals Lab, Laser Cutting Lab, Plastics Lab, Testing Lab, Textiles Lab, Water Work Lab, and Woodworking Lab. There is more than $6 million of equipment and resources for members as well as over 5,000 square feet of event space.

Check size: $ 175K - $ 750K

Looking for Investors? Try Visible Today!

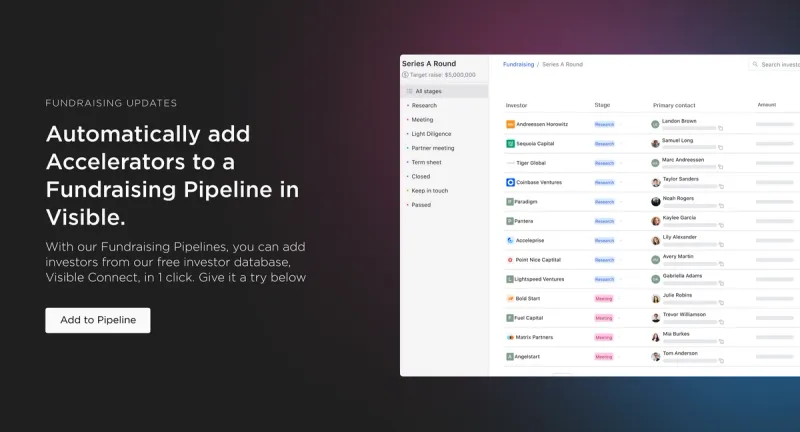

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related Resource: Accelerator connect profiles in our Fundraising CRM