What is a 409a valuation?

Most founders aspire to take their companies public. Until that dream is achieved (or another is realized), it can be a bit tricky to understand the value of a startup along the way. Public companies value are set by the market. Private companies, however, depend on independent appraisals and private valuation.That is where a 409a valuation comes in. A 409a valuation is a critical term and concept founders need to know.

A 409a valuation is the fair market value (FMV) of a private company’s common stock. This FMV is determined by an independent appraisal. Common stock is the stock that has been reserved for founders and employees. A 409a valuation determines the cost to purchase a share.

Related resource: 8 Startup Valuation Techniques and Factors to ConsiderWhat Does the DCF Formula Tell You?

What are the benefits of a 409a valuation?

A 409a valuation is critical if you want to offer equity to your employees. While startups are getting up and running, matching benefits of large, established public companies can be difficult. A great option to offer new employees (and attract top talent) is to offer equity in the business. Offering stock options that will vest (or become accessible or earned) after a period of time promises high earning potential and promotes loyalty and employee investment in the vision and growth of the company. A 409a valuation is needed in order to accurately offer this benefit to your team.

In addition to providing attractive stock options for your employees and attracting top talent to your business, another benefit of a 409a valuation is that understanding and keeping this valuation up to date can help attract new investors and help a founder intelligently grow their business. We will cover when you should get this valuation done (and how often) but the insight provided by the valuation can be another metric to showcase success to investors and board members, especially if a startup is not cash-flow positive or growing revenue yet. Having a clear understanding of how much your business is worth by continuing to seek out an updated 409a valuation is critical for founders as they grow their business and get to the critical point of taking the company public or selling it for a profit.

When is a 409a valuation required?

To start, it’s important to highlight how long a 409a valuation stays valid. A 409a valuation is only valid for up to 12 months after its issuing date. The only exception to this timeline is if a material event occurs prior to the 12 month timeline.

Material Events

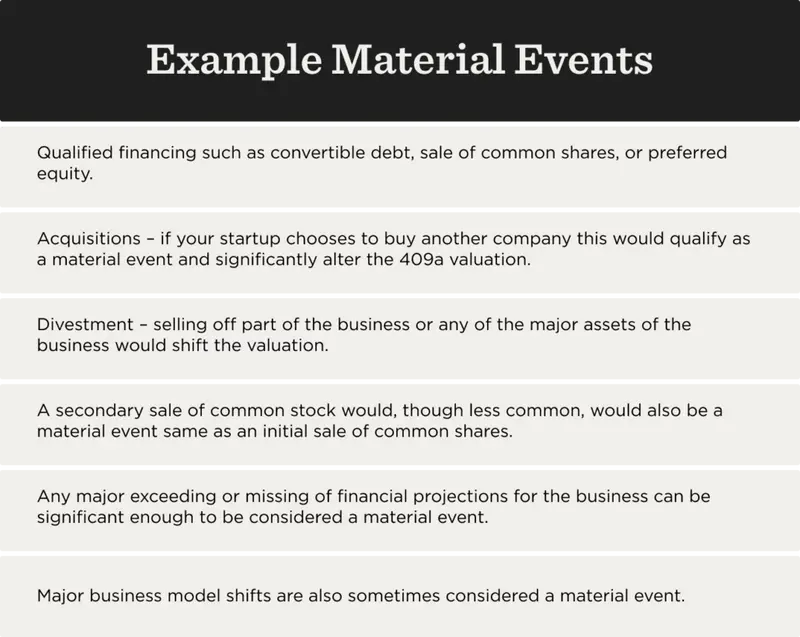

Material events are pivotal situations or changes to the business that would dramatically shift the valuation. Some examples of “material events” include:

- Financing such as convertible debt, sale of common shares, or preferred equity. Qualified financing is probably the most common material event startups will encounter.

- Acquisitions – if your startup chooses to buy another company this would qualify as a material event and significantly alter the 409a valuation.

- Divestment – selling off part of the business or any of the major assets of the business would shift the valuation.

- A secondary sale of common stock would, though less common, would also be a material event same as an initial sale of common shares.

- Any major exceeding or missing of financial projections for the business (annually or quarterly) can be significant enough to be considered a material event and trigger the need for a new valuation.

- Major business model shifts are also sometimes considered a material event. If, as a founder, you are ever unclear on what constitutes a material event, always consult a 409a valuation firm to be sure.

Technically speaking, a 409a valuation is required every 12 months or whenever a material event occurs. Beyond these requirements, there are critical times in the startup lifecycle where 409a is very much needed in order to continue growing and building your business in a smart, successful way.

Related Resource: A User-Friendly Guide on Convertible Debt

In order to receive a 409a valuation, you should be prepared to provide the following information to your independent assessor:

- Company overview including executives names and an overview of your startup’s industry

- A certificate of incorporation / corporate charter

- The most recent cap table

- A board presentation and recent pitch deck especially if you just completed a round of funding

- Historicals and 3-year profit and loss, cash balance, and any debt projections – essentially a complete financial picture

- Estimate of your hiring plan and options estimate you expect to issue over the next 12 months, the typical period that the 409a valuations are valid for.

- A list of publicly traded companies that are comparable to yours.

- Any info about expected timelines relating to IPOs, acquisitions, or mergers

- Any other significant events that have happened since you last had a 409a valuation created.

When do I need a 409a valuation for my startup?

Beyond the technical requirements of every 12 months and when a material event occurs, there are other circumstances where it is highly recommended that you get a new 309a valuation. Though not necessarily “required” these instances are critical to your success as a startup and as a founder because this new valuation will equip you with the most up-to-date information on the worth of your startup and provide another data point for growth.

Other instances where you need a 409a valuation outside of material events and the 12-month mark are:

Before issuing common stock for the first time

As stated, stock for your co-founders and employees can be a huge perk to offer in order to attract top talent and retain hard-working employees who will stay loyal and push the company forward. When common stock is available, all employees have a stake in the success of the business and want to push the company growth forward because they want to vest their stock when the company is on the verge of going public or getting acquired in order to walk away profitable from that common stock.

That being said, you need an initial 409a valuation to even have the opportunity to offer this stock to employees at all.

After raising a new round of venture financing

Raising a round of venture funding is extremely monumental for your business. Weather your startup is raising an initial seed round of just a few million or a 40M + round 3-4 years in, that type of capital injected into the business is extremely significant.

While a pre-money and post-money valuation will also be in play, it’s important to reassess your 409a valuation after this type of significant funding, too. After raising a new round of venture financing it is necessary to get a new 409a valuation because the new cash injection in the business will significantly change the speed at which you are able to scale. You will most likely be hiring more and offering more common stock so an updated valuation is crucial to do this accurately and intelligently.

If you are taking on a lot of new venture financing over a short amount of time, it is still recommended that you get a new 409a valuation after every round, even if that is close to your 12 year expiration of an existing 409a valuation or another material event. This is because venture funding is typically such a high-value injection for your company and there will be a new breakdown of ownership with the new investors at the table.

As you approach the “end” of your startup with an IPO, Merger, or Acquisition

If your company is on track to go public, or have an initial public offering (IPO) on the stock exchange, it is critical to get a final 409a valuation. A 409a valuation is only in existence when you have common stock and are a private company. So as you approach the time where your company is going to IPO and be publicly available for trade, those common stocks worth will convert at the public valuation. With that in mind, as your company approaches IPO, a new 409a valuation is necessary one final time. This final 409a valuation is going to be a factor in what the startup IPO’s at. That initial public offering will be influenced by your 409a valuation (among many other things). Its best to ensure your public offering is influenced by as many factors as you can control before the market takes hold of it. Having an accurate 409a valuation leading up to IPO sets up all your common stockholders for success by having the most realistic and up-to-date picture laid out.

The same goes for approaching a merger with another company in your company’s space or selling the company to be acquired by a larger company. Both instances can lead to a big payout for your common stockholders. However, in both cases, good due diligence on the part of the acquiring company leadership or leadership at the merging company should be to ask for a recent 409a valuation. It is necessary to invest in a new 409a valuation leading up to this major “end” event for your startup. An acquisition or merger will most likely change the primary owner of the business and shake up the valuation of the common stock. In some cases, if your private startup is acquired by a public company, your common stock will be absorbed by the public stock of the buying company. That being said, an updated 409a valuation is important to influence the market value of the stock that your employee’s common stock will be converting to. Let’s note, however, that this is dependent of course on the way the merger or acquisition deal is structured and if stock is at play for the existing startup employees.

How do 409a valuations work?

We’ve laid out when a founder should seek a 409a valuation for their startup, but now let’s dive deep into how a 409a valuation actually works. A 409a valuation is calculated by an independent appraiser with no affiliation to the startup at hand. This is done to ensure the valuation is fair and based on a defensible methodology.

An independent appraiser will approach a 409a valuation with one of three main methodologies. The three methodologies that might be used include:

Market Approach

A market approach is a methodology where the independent appraiser will look at comparable companies in the public market in order to reach the private 409a valuation. The market approach uses something typically known as an OPM backsolve. An OPM Backsolve is a methodology where the appraiser assumes the new investors or recent investors paid fair market value for their stock options and equity. Investors typically receive preferred stock, however, so the OPM backsolve is a special application for an option-based valuation method that takes into account the market value payment to calculate the preferred options into common stock options.

Asset Approach

The Asset Approach is typically the best approach for new startups that are pre-revenue and also have not raised any outside money. It is a very simple approach that consists of simply calculating a company’s net asset value and that number determines the proper valuation. These valuations are typically straightforward because it’s too early and there aren’t enough defining financial changes (positive or negative) to affect the valuation.

Income Approach

An income approach is a bit more straightforward than the Market Approach and basically the easy option for a company at the opposite end of the startup spectrum that would be using the asset approach. This is an approach that is typically used by independent appraisers when the startup receiving a new 409a valuation has a high amount of revenue and a positive cash flow. Using the income approach, a fair market value is determined by looking at a companies total earnings, or assets, and subtracting any outstanding liabilities or debts. Again, this approach is typically going to be the most effective and beneficial to a startup when they are in a positive earning position with high revenue.

Typically if these 409a appraisal methodologies are done within a 12-month valuation and done within these methodologies in the correct way as deemed by the IRS, they may be eligible for safe harbors to ensure extra security for that valuation. These are just extra protection for your business as long as the valuation isn’t extremely unreasonable.

To review, an asset approach is typically used at a startup’s inception and pre-revenue / pre-funding. An income approach is used to find a valuation when a company has high revenue and cash-positive. A market approach is used at every step in between asset and income stages or when there are more factors at play with investors or recent finding where an income approach is too simple. Independent appraisers may use any of these methodologies to find a 409a valuation so let’s dive into how much a 409a valuation costs.

How much does a 409a valuation cost?

Typically the cost of a 409a valuation can vary depending on the different aspects of a startups business and how complicated the valuation is going to be. The cost of a 409a valuation will also depend on how it is offered by your provider. Some providers offer it as a standalone service while others bundle it with other financial offerings which can alter the price.

The average cost of a typical 409a valuation will range from $1,000 to $10,000. The effects on cost include size of the startup and complexity of the company. Complexities could include significant material events, fundraising, cash position, investors involved, and timeline of the startups path to IPO.

An independent firm offering a valuation may offer a valuation with a flat rate of $1,000 but increase by $500+ as the state of the business becomes more complex / for each additional 409a valuation requested. Now that we’ve talked through what is needed to created a 409a valuation and the typical cost range of a 409a, lets outline who can help with a 409a valuation.

Who can help with my 409a valuation?

409a valuations can be provided by a variety of financial sources. They can be provided by independent financial firms and banks. Tax firms are also a key resource and provider that can give you a 409a valuation. If you believe your 409a valuation will be especially complicated, a tax firm may be your best bet to ensure all IRS requirements are fulfilled and any safe harbors that can be are taken.

409a valuations can also be calculated by software companies specializing in the practice (in addition to other financial services). Pulley is a great choice for startups to calculate their initial 409A valuation because you can also issue option grants using the 409A price directly on the platform.

FAQ

If you missed these pertinent pieces of info in the post or simply want a refresh, here are some frequently asked questions.

Is a 409a Valuation public?

No, a 409a valuation is not public as it is only available to privately held companies. In order to get a fair market value appraisal, a startup must look to publicly traded companies in their space for a comparison.

Is a 409a Valuation required?

Technically a 409a valuation is only required if you want to offer common stock to founders and employees. Investors technically take preferred stock, however, that relies on common stock valuation too. Typically the case to NOT have a 409a valuation will be the exception not the rule. 409a valuations are strongly encouraged if not typically required based on the nature of how you will most likely be financing your startup.

When does a 409 Valuation expire?

A 409a valuation expiries after 12 months or when a significant material event occurs before the expiration date.